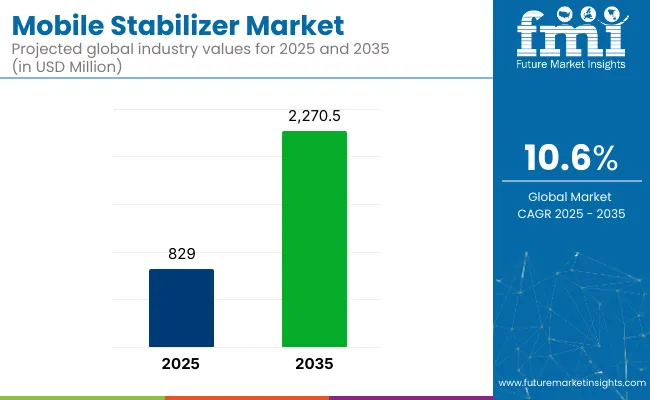

The global mobile stabilizer market is valued at USD 829 million in 2025 and is poised to be worth USD 2,270.5 million by 2035, reflecting a CAGR of 10.6% over the forecast period. Growth is expected to be driven by rising demand for cinematic video capture, increasing popularity of social media content creation, and ongoing improvements in gimbal-based stabilization technologies.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 829 million |

| Market Size (2035) | USD 2,270.5 million |

| CAGR (2025 to 2035) | 10.6% |

Advancements in AI-assisted tracking, gesture controls, and wireless connectivity are being integrated into newer models, making them suitable for solo creators and professional videographers alike.

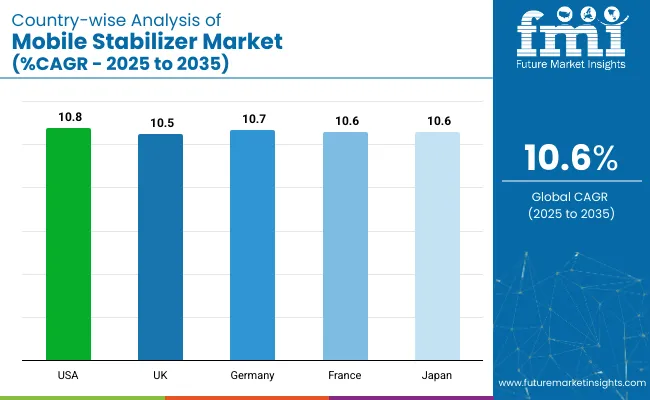

The USA market is projected to grow at a CAGR of 10.8%, with its position expected to be maintained as the leading revenue contributor throughout the forecast period. Japan is anticipated to expand at a CAGR of 10.6%, supported by increasing demand for live streaming.

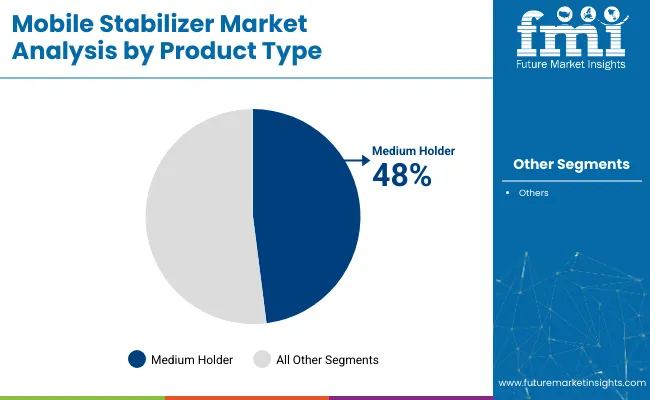

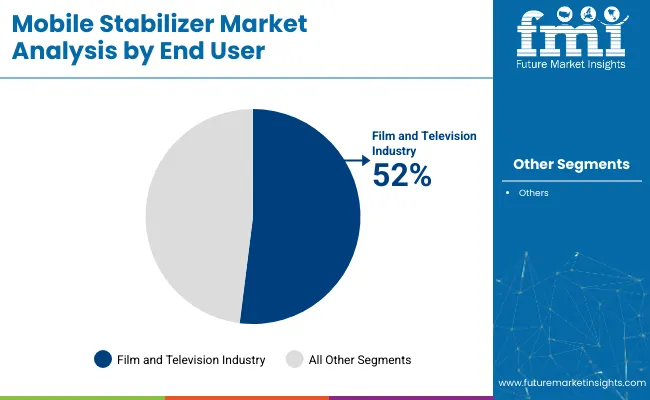

In terms of product type, medium holders are expected to account for 48% of the market share in 2025. Simultaneously, by end user, the film and television industry is projected to capture around 52% share, with stabilizers being extensively used in high-definition media production, branded visual content, and professional digital storytelling.

Recent innovations in the mobile stabilizer market have been marked by the integration of AI-powered stabilization algorithms, gesture-based controls, and LiDAR-assisted motion tracking. Stabilizers are now being equipped with real-time subject recognition, autonomous horizon leveling, and voice-command functionality, enabling hands-free operation.

Foldable carbon-fiber frames are being introduced for enhanced portability without compromising stability. Additionally, modular add-ons such as detachable LED lights, microphones, and battery packs are being offered for flexible shooting setups. AR overlay features and 5G-enabled cloud sync for live video editing are also being embedded, allowing professional-quality content to be produced and shared instantly from mobile devices.

The mobile stabilizer market is segmented by product type into light holder, medium holder, and heavy holder. By end user, it is classified into industrial, film and television industry, and civilian use. By sales channel, it is divided into supermarket/hypermarket, specialty stores, wholesalers/distributors, online retailers, and convenient stores. By region, the market has been analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Among product types, medium holder stabilizers are expected to dominate the segment, accounting for approximately 48% market share in 2025, as strong demand is being witnessed from independent filmmakers, vloggers, and digital content creators.

The film and television Industry segment is projected to lead, with a share of around 52% in 2025, owing to the increased use of advanced mobile stabilizers in broadcast-quality video production, commercial advertising, and scripted content.

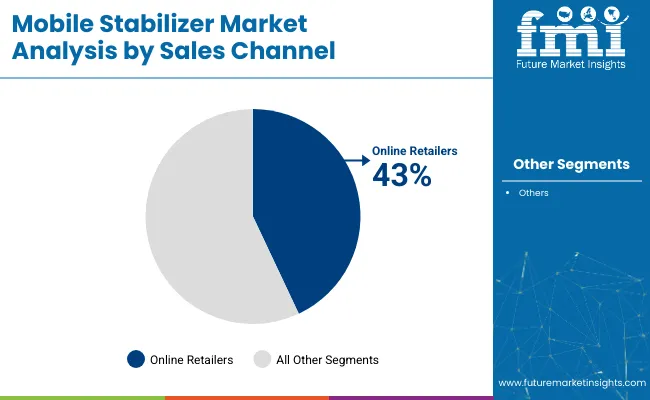

The online retailers segment is expected to be the most lucrative in the sales channel category, projected to account for approximately 43% of the market share in 2035.

The mobile stabilizer market is witnessing robust growth, driven by increasing demand for high-quality video content, rising adoption of AI-enabled filming accessories, and advancements in compact, portable stabilization technologies.

Recent Trends in the Mobile Stabilizer Market

Key Challenges in the Mobile Stabilizer Market

The mobile stabilizer market in the USA is expected to grow at a CAGR of 10.8% from 2025 to 2035. This growth is being driven by the country’s dominant presence in professional video production, increasing content creation trends, and strong integration of smartphone videography into commercial and personal use. Demand is being supported by well-established tech infrastructure and advanced user expectations.

Sales of mobile stabilizer in UK is projected to expand at a CAGR of 10.5% through 2035. Adoption is being boosted by the rise of digital storytelling, remote content creation, and educational video production. With more professionals and small studios turning to compact equipment, the market continues to evolve in both consumer and enterprise segments.

Germany’s mobile stabilizer industry is forecast to grow at a CAGR of 10.7%, with demand being shaped by the rising popularity of independent filmmaking, YouTube production, and e-commerce-driven video content. Tech-savvy consumers are favoring eco-designed stabilizers and modular systems, leading to broader product adoption across age groups and industries.

France mobile stabilizer market is witnessing steady growth with a projected CAGR of 10.6%, backed by the country’s creative industry boom, social media expansion, and professional video production in fashion and advertising. Local users are drawn to stabilizers that offer both style and functionality, especially for urban content creators and marketing professionals.

Japan mobile stabilizer revenues are anticipated to expand at a CAGR of 10.6%, supported by its leadership in imaging technology, growing base of solo creators, and wide application of mobile stabilizers in entertainment and esports. Local brands are innovating rapidly, combining precision hardware with AI-driven software to appeal to advanced users.

The mobile stabilizer market is moderately consolidated, with dominant players like DJI and Zhiyun leading in global market share, while companies such as Freefly, Filmpower, and Varavon cater to specialized segments. The competitive landscape is characterized by rapid innovation, strategic partnerships, and product diversification to meet evolving consumer demands.

Top companies are competing through aggressive pricing strategies, continuous technological advancements, and expanding their product lines to cater to both amateur and professional content creators. For instance, DJI has focused on enhancing user experience with features like improved motor torque and OLED touchscreens in their RS 4 series, while Zhiyun integrates AI capabilities for advanced tracking and control.

Freefly targets high-end cinematography with products like the Ember S2.5K, emphasizing high-speed imaging. Filmpower and Varavon focus on ergonomic designs and affordability to attract independent filmmakers and vloggers.

Recent Mobile Stabilizer Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 829 million |

| Projected Market Size (2035) | USD 2,270.5 million |

| CAGR (2025 to 2035) | 10.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in Thousand Units |

| By Product Type | Light Holder, Medium Holder, Heavy Holder |

| By End User | Industrial, Film and Television Industry, Civilian Use |

| By Sales Channel | Supermarket/Hypermarket, Specialty Stores, Wholesalers/Distributors, Online Retailers, Convenient Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Big Balance Tech., WENPOD, Comodo, Freefly, Filmpower, Varavon, DEFY, Lanparte, Zhiyun, and DJI Tech |

| Additional Attributes | Dollar sales by value, market share by country and region, competitive landscape |

The mobile stabilizer market is valued at USD 829 million in 2025.

It is projected to grow at a CAGR of 10.6% between 2025 and 2035.

Medium holder stabilizers lead with an estimated 48% market share in 2025.

Key players include DJI, Zhiyun, Freefly Systems, Filmpower, and Varavon.

The USA is expected to grow at the highest CAGR of 10.8% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Mobile Messaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Command and Control Solutions Market Size and Share Forecast Outlook 2025 to 2035

Mobile Tracking Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA