The mobile endoscopic workstations market is expected to reach USD 330.1 Million by 2025 and is expected to steadily grow at a CAGR of 4.4% to reach USD 507.8 Million by 2035. In 2024, mobile endoscopic workstations market have generated roughly USD 316.2 Million in revenues.

Mobile endoscopic workstations are portable, self-sufficient units housing within them a complete range of endoscopy equipment-light sources, monitors, insufflators, camera control units, and data recording devices-embedded in easy-to-pull-trollies or carts. Increasing flexibility in mobility between hospital units while decreasing infrastructure-related capital expenditure along with improved workflow has brought about a rising demand in clinics and hospitals.

The rising demand for point-of-care endoscopy in outpatient surgery centers and rural healthcare facilities has also contributed to the growth. The innovations, alongside high definition imaging, wireless connectivity, and the ever-reducing modular designs, further bolster the case for a critical possession by healthcare facilities in that they enhance diagnostic accuracy while ensuring that documentation becomes digital and data are shared in real-time

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 330.1 Million |

| Industry Value (2035F) | USD 507.8 Million |

| CAGR (2025 to 2035) | 4.4% |

Various historical factors contributing to the accelerated adoption of mobile endoscopic workstations between 2020 and 2024 include the COVID-19 pandemic wherein hospitals sought mobile equipment that can be disinfected easily to minimize patient transfers and cross-contamination risks. As the backlog of elective procedures worsened post-pandemic, there arose a strong demand for efficient, mobile endoscopy solutions that could be swiftly deployed across various settings such as outpatient and ambulatory surgical centers.

At that time, there was also a faster pace of miniaturization and integration of technological elements, thereby enabling high-quality imaging and digital connectivity in compact packages. The health systems, particularly those in developing nations, invested in low-cost, scalable endoscopic diagnostic solutions, hence mobile workstations were an attractive alternative. Increased emphasis on telemedicine and remote diagnostics further facilitated the adoption of mobile units.

Mobile endoscopic workstations in North America got a huge boost due to minimally invasive surgical procedures, increased frequency of surgeries, and need of adaptive diagnostics. Most outpatient surgery centers and hospitals are after a mobile design that increases workflow efficiency and reduced equipment downtime.

Rising incidences and growing populations of elderly people further fuel the demand for endoscopy with cases of gastrointestinal, respiratory, and urology disorders. Advanced technologies in endoscopy have ensured additional improvement in diagnostic quality and technique ease with high-definition imaging, built-in artificial intelligence software, and wireless connectivity.

With increasing geriatric population figures coupled with a high percentage of older individuals suffering from chronic diseases, especially gastrointestinal or pulmonary disorders, healthcare systems have begun focusing efforts on minimizing use of invasive and point-of-care diagnostics.

This includes day-case surgery and outpatient-like care facilities, thus requiring movable and workspace-efficient facilities like mobile workstations. In addition, major investments in digital health infrastructure and initiatives from the EU to roll out interoperable medical devices are geared towards the rapid integration of sophisticated, mobile endoscopy platforms.

increasing prevalence of chronic ailments like gastric, colorectal, and respiratory disorders drive demand for mobile endoscopic workstations in the Asia-Pacific region.In terms of affordability and flexibility for healthcare settings on a budget or in remote rural areas, mobile workstations offer a viable alternative.

Government incentives for the modernization of public hospitals and the promotion of medical tourism in Thailand and South Korea have been another stimulant for demand. AI imaging and light HD monitors have increased the acceptance rate within established and emerging healthcare markets spread across the region.

Integration of advanced technologies within space-constrained Hinders the Adoption of Mobile Endoscopic Workstations

One of the prime challenges in developing mobile endoscopic workstations is to house high-level technology in space-limited, mobile platforms while ensuring no compromise on image quality or device compatibility. Though mobility brings varying values of flexibility, it restricts the amount of space and ability for heavy-duty production items, such as high processing, dual imaging modules, and large displays.

Advanced connectivity with hospital information systems (HIS), picture archiving, and communication systems (PACS), as well as real-time video streaming, proved to be technically challenging obstacles as well. Providing cybersecurity for mobile devices that are connected should also become a clearly identifiable emerging trend, since these systems are undergoing continual evolution to prioritize wireless data transmission and remote access features within the medical environment.

Decentralized and remote healthcare environments, especially in underserved and rural regions

The opportunities for mobile endoscopic workstations lies in their potential for decentralized and remote health care, especially for underserved populations and rural settings. In the quest for equitable access to advanced diagnosis the world over, mobile workstation provides a credible approach for getting to patients outside the tertiary centers.

Being compact and self-contained, it allows clinicians to carry out endoscopic procedures within community health centers, field hospitals, and even home-care programs, thus fostering outreach and early detection of disease. With the growing usage of tele-endoscopy and remote collaboration, the mobile units could also be integrated with live data sharing and AI-based decision support, enhancing diagnostic accuracy.

The emerging markets in Asia, Africa, and Latin America present tremendous potential, especially where governments are investing in portable diagnostics infrastructure to counter healthcare inequities. This expands the reach of endoscopy clinically, by not demanding dedicated operating rooms or fixed installations.

Demand for Space-Efficient and Integrated Diagnostic Solutions anticipates the Growth of the Market

Endoscopic workstations are found replacing fixed endoscopes in the space-strapped workflow-optimized specialty clinics and hospitals. These devices integrate light sources, monitors, insufflators, and recording units into a single, compact trolley-based system, thus relieving the need for multiple fixed installations. Thus, it suits their use in multi-disciplinary endoscopy suites, emergency rooms, and small to medium-sized hospitals.

Their design allows for movement from one department to the other with minimal downtime, maximizing usage time of high-cost endoscopic equipment, and is flexible toward affordability; physicians are more searching for flexibility and scalability, while mobile workstations offer this-in that angles such as bronchoscopy, laparoscopy, and cystoscopy can all be configured quickly and set up less time.

Emphasis on Infection Control and Equipment Standardization demonstrates the Growth of the Market

The post-outbreak world has made healthcare systems globally stricter infection control measures like closed-loop water system mobile endoscopic workstations, antimicrobial-coated surfaces, and sealed cable management. These are the main considerations newly introduced clinics and hospitals use to highlight sterilization convenience and organization of equipment, reducing the chances of cross-contamination during procedures.

Furthermore, tray workstations, modular design, for instance, with compartments for scopes and accessories minimize procedural delay and promote streamlined workflows. In overhead standardization, education and training, maintenance, and inventory become easier. This means that mobile endoscopy units are increasingly viewed as an evolving necessity with respect to infrastructure, at once driving regulatory compliance and improving safety for patients, especially in high-throughput settings such as surgical centers and emergency care departments.

Increasing Use in Multi-Site and Satellite Facilities is an Ongoing Trend in the Market

The installation of mobile endoscopic workstations in satellite centers, outreach clinics, and mobile diagnostic vans. It allows a hospital to extend diagnostic and minor surgical capabilities to patients, particularly in rural or underserved communities. Moveable units are more preferred because they are quick to move, assemble, and deploy.

Their affordability, as well as ergonomics today, also makes them apt for frequent high-frequency usage in different environments. This trend coincides with the big-picture strategic direction moving toward local delivery of healthcare, where health systems try to improve access and lessen the load on hospitals, and introduce less to-day-care interventions by bringing care closer to the home without these patients needing to report to tertiary institutions.

Surge in Demand from Minimally Invasive Procedure Markets

Mobile endoscopy workstations increase popularity in minimally invasive procedures (MIS, e.g., gastroenterology, urology, and ENT). Such units provide ease and swift inter-case procedure switching, particularly for outpatient and ambulatory surgery applications. Standard care is now being shifted toward MIS as far as diagnosis and therapy are concerned; mobility isn't enough; practitioners need workstations that have the ability to support various scopes, high-definition visibility, and innovative access to instruments.

In addition, their compatibility with different endoscopic instruments and capacity to sustain extended use without disruption make them suitable for high-volume surgical calendars. The trend toward faster patient recovery, shorter hospital stays, and lower procedure costs continues to drive momentum for them in international markets.

The market for mobile endoscopy workstations maintained a constant growth trend in 2020 to 2024 as the surgical backlog of the patient increased due to COVID-19, coupled with rising minimally invasive surgeries being performed and developing infrastructural upgrades for outpatient as well as ambulatory facilities. Their adoption was further propelled by additional infection control measures and the requirements for flexible combinations of diagnosis configurations.

Growth in the market on the horizon 2025 to 2035 will be from the decentralization of healthcare service delivery, continued advancement of technologies in mobility and imaging, and continued investments into rural and point-of-care centers for medical care. More so, increased procedural volumes in gastroenterology and urology, as well as ENT, as well as an increase in demand for space-efficient and multifunctional use equipment, is anticipated to contribute to the growth in emerging and developed economies.

Shifts in the Mobile Endoscopic Workstations Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory bodies like the FDA and CE-marking authorities were inclined towards equipment portability, compliance with sterilization, and safety standards of surgical mobile units |

| Technological Advancements | Increasing uptake of high-definition imaging platforms, built-in insufflation and suction modules, and enhanced battery-powered mobility functions. |

| Consumer Demand | Increasing use of mobile units in outpatient facilities, older demographics requiring GI and ENT diagnostic testing, and backlog of procedures due to post-COVID. |

| Market Growth Drivers | Increase in endoscopy procedures, greater appeal of decentralized diagnosis, and development of hospital infrastructure in mid-income nations. |

| Sustainability | Early emphasis on modular parts to minimize waste and facilitate repairability ; green packaging for devices. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Next-generation regulations will reduce mobile platform certifications, promote interoperability with hospital IT systems, and expand coverage of endoscopic solutions under national health plans. |

| Technological Advancements | Anticipated integration of cutting-edge imaging modalities (NBI, fluorescence), energy-efficient elements, minimalist design optimization, and native EMR connectivity for intraoperative processes. |

| Consumer Demand | Increased need for multifunctional, space-efficient systems to serve growing ambulatory networks, preventive screenings, and point-of-care endoscopy services in underserved areas. |

| Market Growth Drivers | Enhanced rural outreach activity programs, volume increases in day-care surgery volumes, and heightened demand for adaptable deployment across operating department and specialist clinic settings. |

| Sustainability | Increased move toward recyclable materials, diminished energy usage for procedures, and green-certified production facilities supportive of international-level sustainability objectives. |

Market Outlook

Increasing popularity of ambulatory surgical centers and the tilt towards minimally invasive diagnostics have created demand in the USA Equally important are supports for reimbursement of outpatient procedures and high rates of screening for GI cancers. There is great logistical and operational flexibility with mobile endoscopic workstations, making them a preferred option in multisite healthcare networks.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The market is characterized by an advanced hospital infrastructure, emphasis on outpatient endoscopy, and strict hygiene regulations. More mobile units are being taken up by secondary care centers to limit waiting times for procedures. Government investments in digitalized healthcare and increasing institutional volume in ENT and GI procedures provide a sound outlook for mobile endoscopy solutions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

India's market is bullish owing to rising rural diagnostic access, public-private healthcare initiatives, and the heavy burden of GI disorders. Workstations endoscopic on wheels, enable them to be able to deploy into resource-limited hospitals and mobile medical camps. Decentralized delivery of healthcare encouraged by government also aids the market's long-term sustainability in tier two and three cities.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

China's uptake is fueled by increasing surgical volumes, hospital upgrades, and a growing middle class demanding early diagnosis. Strong manufacturing capacities and healthcare reform backed by the government are fueling demand for compact, scalable endoscopic platforms. Local innovation and cross-border partnerships are further advancing mobile endoscopy suitable for urban as well as provincial healthcare settings.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

With its aging population and high screening rates for colorectal cancer, demand for endoscopic procedures is sustained in Japan. Mobile miniaturized workstations fit the design of space-limited hospitals. The Japanese commitment to high-tech precision care and infection control means steady uptake within both private and public sector outpatient and specialty clinics.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Laparoscopes segment dominates the market due to the adoption of minimally invasive surgical procedures in gynecology, and general surgery

The laparoscopes segment takes precedence in mobile systems for endoscopic workstations owing to the increasing popularity of minimally invasive surgical techniques across gynecology, general surgery, and urology. With improved surgical benefits, speed in equipment mobility, real-time imaging, and integrated device management, mobile endoscopic workstations enrich the surgical process. Their joined effort with next-generation laparoscopic instruments and their versatile multi-disciplinary workflows is also added to their intrinsic value in the market.

Gastrointestinal endoscopes account for a substantial share of the market due to the growing prevalence of digestive disorders

Increasing population of patients undergoing routine screening procedures tends to huddle around colorectal cancer. These work stations tend to facilitate endoscopic procedures, such as colonoscopy and gastroscopy, as they provide HD high-definition visualization, good manageability of devices, and easy incorporation with documentation systems.

The mobile advantage ensures possible operations between high-volume hospitals and outpatient clinics within departments. Necessitated by a growing need for early diagnosis and immediate care of GI diseases, mobile, flexible systems are required to support rapid turnover of patients and improve efficiency of the procedures.

The hospitals segment dominates the market due to their ability to conduct high procedural volume

An important factor attributing to the leadership of the hospitals segment in the mobile endoscopic workstations market is the high procedural volume and comprehensive infrastructure with capital resources. A wide array of diagnostic and surgical endoscopic procedures are performed by hospitals over various departments like gastroenterology, pulmonology, and urology. Mobile endoscopies promote workflow efficiency by allowing timely movement of the workstation between departments, centralized data access, and real-time imaging.

Complex and emergency cases that require sophisticated, multi-functional mobile setups are mostly seen in hospitals. High-resolution imaging capability and integration with hospital IT infrastructure create dependencies on hospital mobile workstations as valuable investments in improving procedural results and patient management for large hospitals.

Ambulatory surgery centres (ASCs) and clinics account for a substantial share due to the rising preference for outpatient and minimally invasive procedures

Ambulatory surgery centers and clinics pose to contribute in a major way due to a growing demand for outpatient and minimally invasive procedures. Extensively reliant on mobile endoscopic workstations, these facilities have proved their worth with a design that minimizes space, offers flexibility, and delivers high-performance imaging and data storage in an economical configuration.

There has been a respectable rise in demand for portable and nimble equipment as more elective procedures are being transferred to ASCs for better convenience for patients and less burden on the hospitals. Clinics, in particular, benefit from these workstations with respect to their ability to easily relocate these pieces of equipment from one room to another, in order to best optimize space while still maximizing procedural volume and quality patient care.

Mobile endoscopic workstations is fighting hard in the competitive market evoked by technology migration in terms of portability, high-definition imaging, and connectivity to digital healthcare infrastructure. The general leaders in this space are busy developing systems that are multi-specialty and modular in order to support fast turnover of patients. On top of that, suppliers are busy improving the ergonomics in which these systems operate with real time connectivity of data to the hospital network.

In as much as system standardization and safety feature regulatory approvals are speeding time to market for new products, firms are seeking to grow through strategic alliances with hospitals, vendors for endoscopic suites, and software companies. An increase in demand for smaller, efficient, and mobile diagnostic devices globally urges companies to expand product ranges and territories to become greater players in outpatient markets and surgical or emergency care.

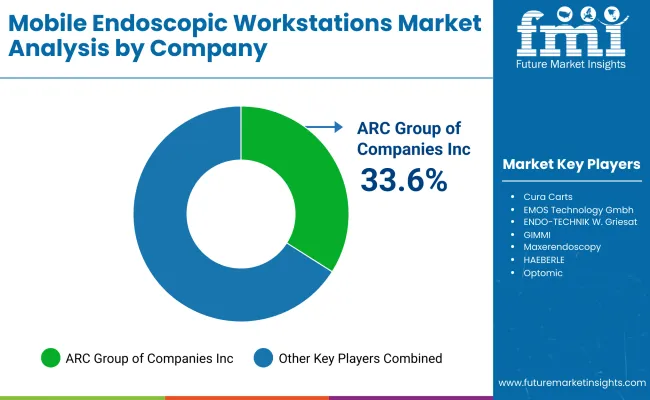

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ARC Group of Companies Inc. | 33.6%-38.5% |

| Cura Carts | 20.4%-22.6% |

| EMOS Technology Gmbh | 15.1%-17.2% |

| ENDO-TECHNIK W. Griesat | 4.6%-6.8% |

| Other Companies (combined) | 12.1%-15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| ARC Group of Companies Inc. | ARC has the modular mobile endoscopy cart solutions for surgical, diagnostic and outpatient settings. They are concentrating very heavily on wireless image integration and multi-scope docking capabilities in support of the gastroenterology and urology specialties |

| Cura Carts | Cura Carts creates mobile endoscopy workstations tailored to specific end-user needs with emphasis on ergonomics, cable management, and equipment surfaces that possess antimicrobial properties. The design of these systems allows them to be plugged and played for extensive use in ambulatory and hospital settings. |

| EMOS Technology Gmbh | EMOS Technology provides endoscopic high-performance mobile platforms. Their equipment well matched with HD and 4K video systems. Their stations have intelligent storage of endoscopic accessories, built-in suction and insufflation facilities. The company concentrates on integration towards hospital PACS and OR systems |

| ENDO-TECHNIK W. Griesat | ENDO-TECHNIK centers its developments on premium mobile endoscopy workstations that feature superior cooling, adjustable height, as well as endoscope reprocessing support. The latest models are meant to serve the less invasive procedures in gynecology and laparoscopy with mobility and workflow enhancement. |

Key Company Insights

Colonoscopes, Gastrointestinal endoscopes, Enteroscopes, Bronchoscopes, Cystoscopes, Laparoscopes and Others

Bronchoscopy, Arthroscopy, Laparoscopy, Urology Endoscopy, Neuroendoscopy, Gastrointestinal Endoscopy, Gynecology Endoscopy, ENT Endoscopy and Others

Single-use, Reprocessing and Sterilization

Hospitals, Ambulatory Surgery Centres & Clinic, Specialized Endoscopy Clinics, Diagnostic Imaging Centres and Others

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The overall market size for mobile endoscopic workstations market was USD 330.1 Million in 2025.

The mobile endoscopic workstations market is expected to reach USD 507.8 Million in 2035.

The global shift towards minimally invasive surgeries and increasing prevalence of gastrointestinal, urological, and respiratory conditions anticipates the growth of the mobile endoscopic workstations market.

The top key players that drives the development of mobile endoscopic workstations market are ARC Group of Companies Inc., Cura Carts, EMOS Technology Gmbh, ENDO-TECHNIK W. Griesat and Ecleris S.R.L.

Laparoscopes segment by type is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Hygiene, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Hygiene, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by End User, 2023 to 2033

Figure 29: Global Market Attractiveness by Hygiene, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by End User, 2023 to 2033

Figure 59: North America Market Attractiveness by Hygiene, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Hygiene, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Hygiene, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Hygiene, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Hygiene, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Hygiene, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Hygiene, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Hygiene, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Hygiene, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Hygiene, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Hygiene, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Hygiene, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA