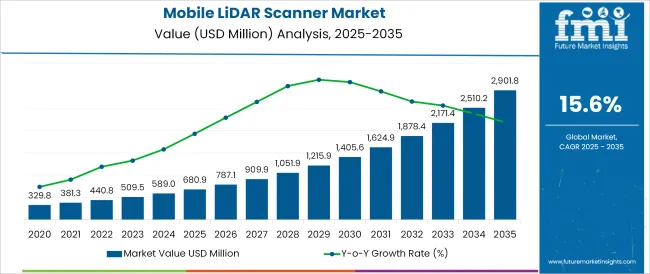

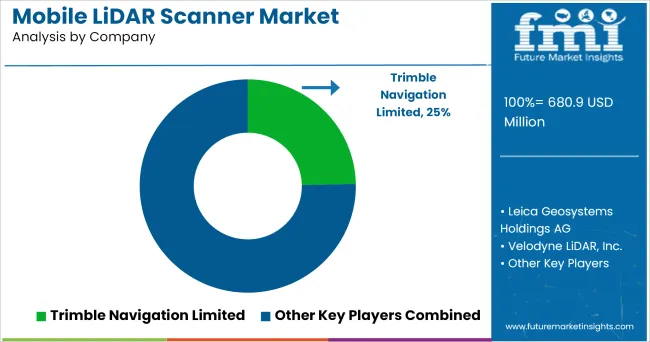

The Mobile LiDAR Scanner Market is estimated to be valued at USD 680.9 million in 2025 and is projected to reach USD 2901.8 million by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period.

The mobile LiDAR scanner market is undergoing significant transformation due to rapid advancements in autonomous navigation, smart infrastructure development, and 3D mapping technologies. Increasing adoption across sectors such as transportation, construction, forestry, and defense has elevated the demand for mobile, high-resolution scanning systems. As cities expand their smart infrastructure initiatives and private enterprises explore automation in surveying and inspection, mobile LiDAR systems have become essential tools for real-time, on-the-move data capture.

Market dynamics are being influenced by the convergence of LiDAR with AI-enabled analytics, GNSS-based precision positioning, and cloud data processing, which together reduce operational complexity and turnaround times. Regulatory emphasis on safety and mapping accuracy-particularly in transport and environmental monitoring-is further accelerating demand.

As miniaturization, cost-efficiency, and sensor accuracy continue to improve, the mobile LiDAR scanner market is expected to maintain strong growth across applications requiring detailed terrain and object profiling.

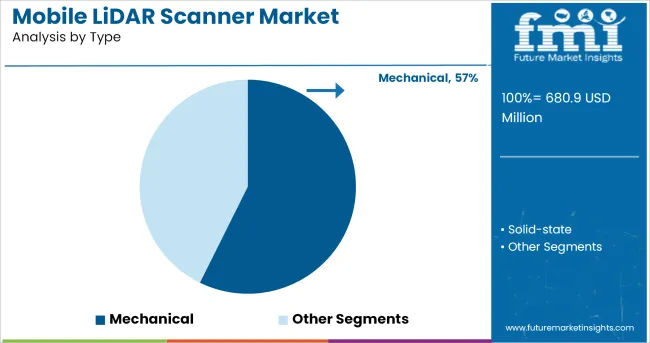

The market is segmented by Type, Component, and Application and region. By Type, the market is divided into Mechanical and Solid-state. In terms of Component, the market is classified into Navigation and positioning systems, Laser scanners, and Others.

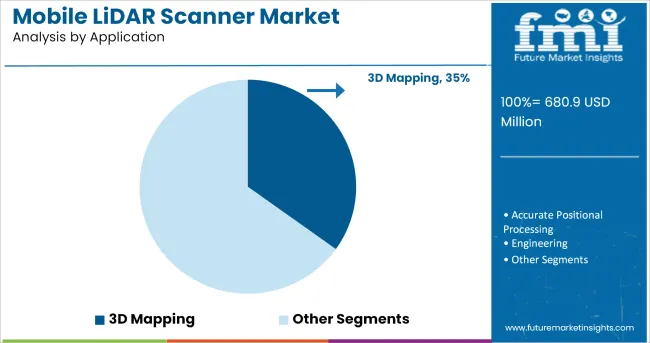

Based on Application, the market is segmented into 3D Mapping, Accurate Positional Processing, Engineering, Urban planning, Meteorology, Environment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical segment is projected to contribute 57.30% of total market revenue in 2025 under the type category, reinforcing its position as the dominant configuration. This dominance is underpinned by its proven reliability in dynamic environments, robust range capabilities, and compatibility with varied terrains and mobile platforms. Mechanical LiDAR systems have been favoured for their ability to deliver high-resolution data at competitive costs, particularly for applications in urban planning, infrastructure inspection, and autonomous vehicle navigation.

Their rotating mirrors and wider field of view enable comprehensive 3D capture, supporting consistent performance in real-time mapping tasks. Additionally, established manufacturing ecosystems and field-tested deployment histories have solidified confidence in mechanical systems.

These factors collectively contribute to the sustained leadership of mechanical LiDAR solutions within mobile deployments.

It is estimated that navigation and positioning systems will account for 48.60% of total revenue within the component category in 2025. Their critical role in enabling accurate geospatial referencing and trajectory correction during data acquisition has positioned them as indispensable within mobile LiDAR configurations. These systems integrate GPS, IMUs, and SLAM-based enhancements, ensuring seamless data synchronization and real-time positional awareness.

The growing emphasis on centimeter-level accuracy in surveying and 3D reconstruction has driven adoption. Furthermore, enhanced system integration with cloud-based platforms and GIS software has increased demand for advanced positioning modules.

The segment's contribution reflects its foundational role in reducing drift, improving mapping fidelity, and ensuring operational consistency across dynamic environments.

The 3D mapping segment is projected to generate 34.90% of total application revenue in 2025, marking it as the leading use case in the mobile LiDAR scanner market. The growing need for real-time topographic and structural data across sectors like urban development, mining, and disaster assessment has spurred demand for high-resolution 3D outputs.

Mobile LiDAR systems used in 3D mapping have enabled rapid, on-the-go data collection, reducing the time and manpower required for conventional surveys. Their ability to deliver dense point clouds and detailed visualizations has improved accuracy in spatial modeling and planning workflows.

Additionally, the increasing availability of mobile mapping vehicles and drone-integrated platforms has expanded access to previously difficult terrains. The reliability and precision offered by mobile LiDAR for 3D mapping have thus reinforced its dominance within the application segment.

The increasing adoption of mobile laser scanning for reaching and collecting data from unsafe building sites, restricted locations and areas overrun with vegetation, are creating growth opportunities. It also addition of static scanning systems in the mobile LiDAR scanner to produce more detailed point clouds.

It also offers various features such as collection efficiency, accurate positional processing, 3D visualization excellence, cost and schedule effective, and others. The reliability of such features drives the growth of the mobile LiDAR scanner market.

Growing demand for advanced mobile mapping system and technological advancements, emergence of the mobile light detection and ranging (LiDAR) systems with a sensor technology, such major factors fueling demand for mobile LiDAR scanner across regions.

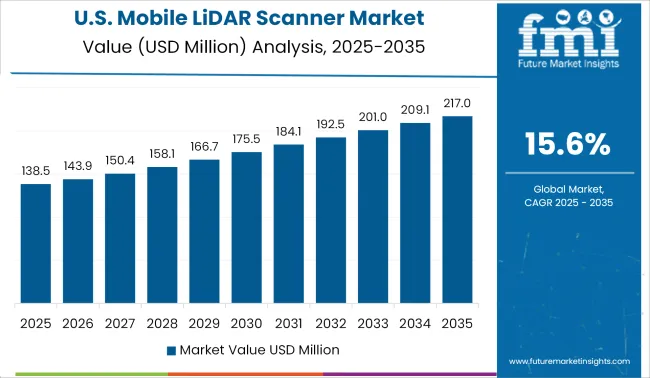

North America region will be the largest market share for mobile LiDAR scanner, due to the strong presence of mobile LiDAR scanner providers and manufacturer in the region.

This is attributed to the high increase in demand for mobile LiDAR scanner for various end user application such as rising safety of field crews along deeply traveled corridors, and quicker data collection than both terrestrial scanning and conventional surveying, among others.

The North American regional market has been accounted for strong share in the global mobile LiDAR scanner market, owing to growing adoption of LiDAR systems in UAVs, and LiDAR in engineering and construction applications in the region.

It also offers various benefits such as delivering for 3D mapping, measuring of interior spaces, and object identification and classification. Hence, the demand for mobile LiDAR scanner is increasing across the North America region during the forecast period.

South Asia & Pacific is expected to dominate the mobile LiDAR scanner market. The region is expected to offer lucrative opportunities for leading market players owing to rising demand for greater density of scanned data along with improved data compression and storage.

South Asia & Pacific has accounted for a mobile LiDAR scanner market share in 2024 and is expected to enhance at a CAGR of over 27.5% in the near future. The presence of key market players such as Hexagon AB, Sick AG, Teledyne Optech, and Trimble Inc., such major players contributing to the growth.

Some of the leading manufacturer and providers of mobile LiDAR scanner include

The key providers of mobile LiDAR scanner is continuously focusing on investing in new and emerging technologies/ service lines in order to leverage the experience and maturity of a very broad product line to offer customers a range of options. For instance, in 2024, Trimble has introduced the Trimble MX50 mobile mapping system for asset management and mapping.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global mobile LiDAR scanner market is estimated to be valued at USD 680.9 million in 2025.

The market size for the mobile LiDAR scanner market is projected to reach USD 2,901.8 million by 2035.

The mobile LiDAR scanner market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in mobile LiDAR scanner market are mechanical and solid-state.

In terms of component, navigation and positioning systems segment to command 48.6% share in the mobile LiDAR scanner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Computed Tomography Scanners Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

LiDAR Pulsed Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA