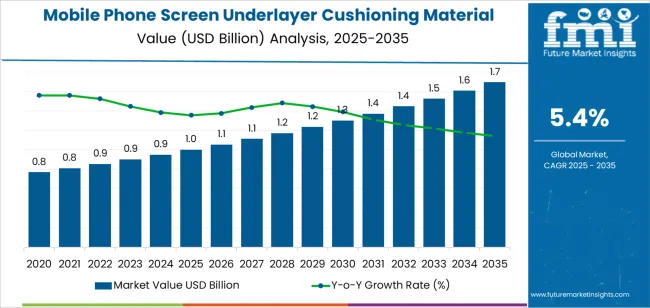

The global mobile phone screen underlayer cushioning material market is valued at USD 1.0 billion in 2025 and is projected to reach USD 1.9 billion by 2035, expanding at a CAGR of 5.4%. The market is estimated to generate an absolute dollar opportunity of USD 0.9 billion across the forecast period. Rolling CAGR analysis indicates consistent mid-term growth driven by the rapid evolution of smartphone design, where thinner profiles and flexible displays demand improved impact absorption and structural reinforcement materials.

Manufacturers are developing advanced cushioning layers composed of thermoplastic polyurethane, silicone elastomers, and hybrid polymer composites that provide balanced elasticity and compression recovery. These materials play a critical role in enhancing drop resistance, improving display adhesion, and minimizing damage from mechanical stress. Ongoing innovation in flexible and foldable smartphone architectures continues to open new opportunities for high-performance cushioning films with micro structured surfaces and optical clarity.

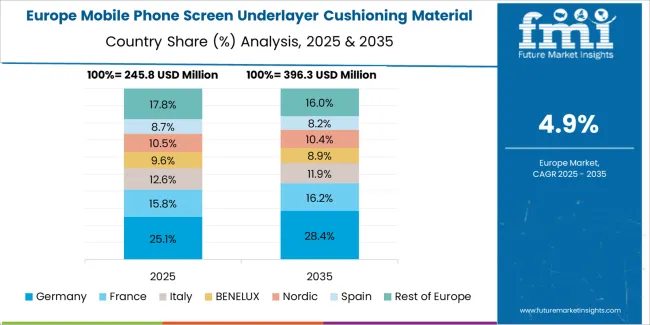

Asia Pacific remains the principal manufacturing and consumption hub, supported by concentrated smartphone production facilities in China, South Korea, and Japan. North America and Europe maintain steady demand linked to component supply networks for premium smartphone assembly. Through 2035, technological refinement, material sustainability, and precise thickness calibration will remain key factors influencing competitiveness and reliability in the cushioning material market.

Between 2025 and 2030, the Mobile Phone Screen Underlayer Cushioning Material Market will progress through the rapid growth and early maturity phases of its adoption cycle. The market is expected to increase from USD 1.0 billion to USD 1.4 billion, reflecting a 40.0% expansion as smartphone manufacturers increasingly adopt advanced cushioning materials to enhance screen durability and impact resistance. Growth will be driven by rising global smartphone shipments, the trend toward thinner and foldable displays, and the demand for improved drop protection in premium devices. During this phase, product innovation will focus on high-elasticity polymers, nano-foam composites, and flexible silicone substrates that provide superior shock absorption and optical clarity.

From 2030 to 2035, the market will transition into the maturity and optimization stage, expanding from USD 1.4 billion to USD 1.9 billion a 35.7% increase over five years. At this stage, adoption rates will stabilize as cushioning materials become a standardized feature across both flagship and mid-range devices. Manufacturers will focus on material recyclability, cost optimization, and integration with automated screen lamination systems. The introduction of AI-driven quality control and precision coating technologies will further enhance production efficiency. Replacement and upgrade demand from the circular economy and refurbished device sectors will sustain steady market performance into the mid-2030s.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The mobile phone screen underlayer cushioning material market is expanding as device manufacturers pursue improved shock absorption and structural integrity for increasingly thin and flexible displays. These materials typically composed of silicone, polyurethane, or microcellular polymer composites act as protective buffers between the display module and frame, mitigating damage from impact, pressure, and thermal expansion. The shift toward foldable and edge-to-edge screen architectures intensifies the need for ultra-thin, high-resilience cushioning layers that preserve optical clarity while maintaining mechanical support. Manufacturers prioritize precision lamination processes and advanced adhesive compatibility to ensure seamless integration during assembly and long-term performance stability.

Market momentum is also influenced by rising global smartphone production and shorter product replacement cycles, which drive continuous material innovation. Suppliers develop multi-functional cushioning films that combine vibration damping, dust resistance, and heat dispersion to meet the evolving performance standards of premium devices. The expansion of 5G-enabled and high-refresh-rate smartphones, which generate greater internal heat, further boosts demand for thermally adaptive underlayer materials. However, complex bonding requirements and high production costs challenge smaller suppliers entering the market. Ongoing collaboration between material science companies and original equipment manufacturers continues to refine durability, thinness, and recyclability, ensuring sustained growth across consumer electronics manufacturing ecosystems.

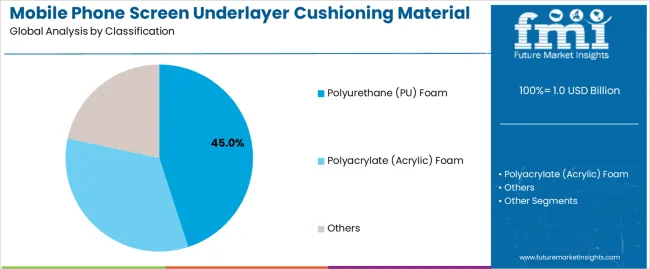

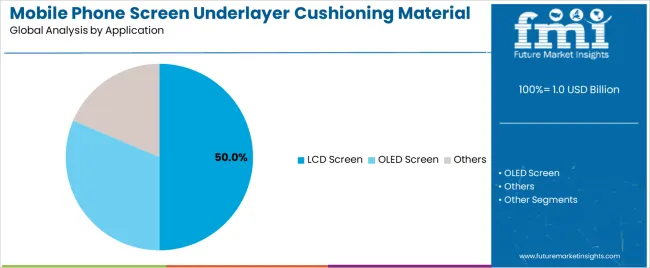

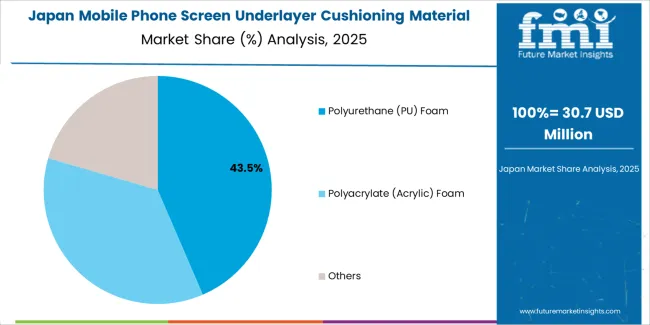

The mobile phone screen underlayer cushioning material market is segmented by classification, application, and region. By classification, the market is divided into polyurethane (PU) foam, polyacrylate (acrylic) foam, and others. Based on application, it is categorized into LCD screen, OLED screen, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define material composition, application alignment, and regional production trends within the global mobile device manufacturing supply chain.

The polyurethane (PU) foam segment accounts for approximately 45.0% of the global mobile phone screen underlayer cushioning material market in 2025, representing the leading classification category. This dominance is attributed to PU foam’s superior cushioning properties, elasticity, and resistance to compression fatigue, which ensure screen stability and impact absorption in compact device assemblies. PU foam provides uniform stress distribution beneath display modules, reducing the risk of delamination and pixel deformation during thermal or mechanical stress.

The segment’s leadership is supported by extensive use in high-volume smartphone production, particularly for LCD-based devices where consistent optical alignment and vibration resistance are essential. PU foams are also valued for their adhesive compatibility and dimensional precision in automated assembly processes. Manufacturers continue to develop formulations with enhanced resilience, thermal stability, and moisture resistance to support thinner, lighter device designs. The material’s balance of flexibility, durability, and cost efficiency ensures broad adoption among electronic component suppliers. The PU foam segment remains the preferred cushioning material for display underlayers, reflecting its adaptability to large-scale manufacturing and its proven performance within global mobile electronics production frameworks.

The LCD screen segment represents about 50.0% of the total mobile phone screen underlayer cushioning material market in 2025, making it the largest application category. This leadership reflects the sustained production volume of LCD-based smartphones, tablets, and display panels, particularly in cost-sensitive consumer markets. Cushioning materials are used in LCD modules to protect delicate glass layers and maintain uniform optical alignment under assembly and operational stress conditions.

The segment’s strength is driven by widespread adoption of mid-range devices utilizing LCD technology, supported by well-established manufacturing infrastructure in East Asia. PU and acrylic foams are applied beneath LCD modules to absorb impact, mitigate pressure variations, and stabilize contact interfaces between screen layers. The need for consistent performance during thermal cycling and repeated handling reinforces demand for high-quality cushioning materials in this category. Despite the rapid expansion of OLED production, LCD screens continue to dominate volume shipments due to their affordability and durability advantages. The LCD screen segment’s continued dominance is supported by its compatibility with established material technologies, stable manufacturing economics, and persistent demand across mainstream mobile device production lines worldwide.

The mobile phone screen underlayer cushioning material market addresses the need for protecting delicate display panels against impact, vibration, and mechanical stress by placing a cushioning layer beneath the screen surface. Growth is supported by rising smartphone adoption, increasing use of large-format and foldable displays, and demand for improved durability in handsets. The market faces challenges in the form of raw material cost fluctuations, manufacturing precision requirements, and tight integration constraints in ultra-thin devices. A key trend is the development of advanced cushioning foams and adhesive systems that combine shock absorption, thermal management, and minimal thickness to meet compact smartphone designs.

Demand is primarily driven by the proliferation of high-end smartphone displays such as OLED, foldables and flexible panels, which require reliable support to maintain structural integrity. As device makers push for thinner bezels and lighter form factors, the need for effective cushioning materials beneath the screen becomes more critical. For display module suppliers, a standout USP is “ultra-thin, high-energy absorption cushioning foams custom-tuned for specific handset models,” enabling OEMs to adopt larger or foldable screens without sacrificing durability. Such tailor-made solutions support manufacturers seeking both aesthetics and performance in next-generation smartphones.

Market expansion is limited by several factors including the cost and complexity of producing high-performance cushioning materials compatible with ultra-thin device profiles, and the need for precise alignment and lamination processes in mobile manufacturing environments. Some manufacturers may opt for lower-cost alternatives or omit cushioning layers when budgets are tight, especially in entry-level devices. Additionally, as handset designs reduce thickness and weight, the allowable cushioning layer volume shrinks, placing tighter demands on material innovation. For cushioning-material suppliers targeting OEM segments, a valuable USP is “quick-turn prototyping and supply ramp-up support for tight device integration schedules,” which helps overcome integration bottlenecks and supports rapid model iteration.

A major trend in the market is the move toward multifunctional cushioning layers that not only absorb shock but also aid thermal dissipation, acoustic damping, and adhesive bonding, all within minimal thickness. Materials such as micro-cellular foams, polymeric gels and engineered tapes are being improved to offer higher resilience per unit thickness. Integration of automated inspection and lamination with double-sided adhesive backing is becoming more common in complex handset manufacturing. For material providers, a compelling USP is “modular cushioning platforms with interchangeable core materials and adhesive systems that streamline integration across multiple device platforms,” enabling component standardisation while meeting varied design needs.

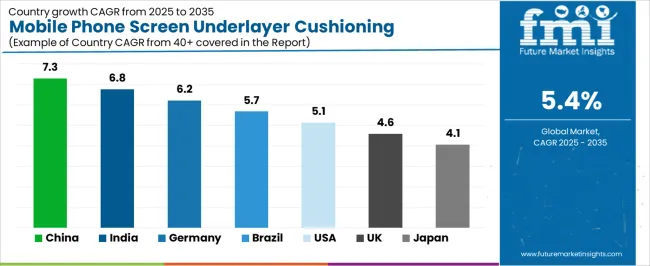

| Country | CAGR (%) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| USA | 5.1% |

| UK | 4.6% |

| Japan | 4.1% |

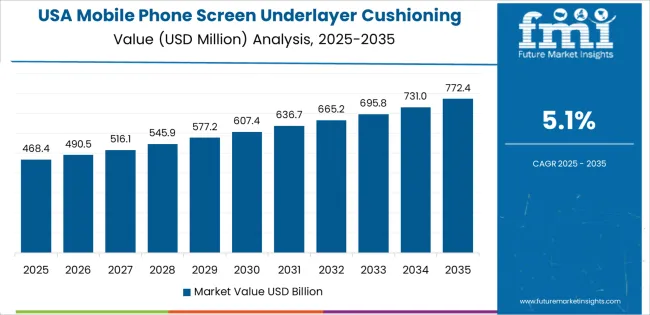

The mobile phone screen underlayer cushioning material market is expanding strongly across global economies, with China leading at a 7.3% CAGR through 2035, driven by high smartphone manufacturing output, material innovation, and the integration of impact-resistant layers. India follows at 6.8%, supported by growing electronics production, government initiatives promoting local manufacturing, and increasing smartphone adoption. Germany records 6.2%, emphasizing precision engineering, advanced polymers, and sustainable material development. Brazil grows at 5.7%, reflecting the expansion of mobile device assembly and rising consumer electronics demand. The USA, at 5.1%, remains innovation-focused with strong R&D in flexible materials, while the UK (4.6%) and Japan (4.1%) continue advancing miniaturized cushioning technologies and high-durability solutions for premium smartphone components.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is demonstrating strong momentum in the mobile phone screen underlayer cushioning material market, projected to grow at a CAGR of 7.3% through 2035. Expanding domestic smartphone production and rapid component innovation are strengthening demand for high-performance cushioning films and foams. Manufacturers are investing in precision coating, lamination, and polymer processing technologies to improve impact resistance and optical clarity. Growth in flexible display and foldable phone segments is further promoting adoption of advanced cushioning materials optimized for thin and durable screen assemblies.

India is witnessing consistent growth in the mobile phone screen underlayer cushioning material market, advancing at a CAGR of 6.8%, supported by local component manufacturing and assembly expansion. Rising investments in electronics production under national incentive programs are driving adoption of cushioning materials with high shock resistance and heat stability. Domestic suppliers are partnering with global material producers to ensure quality consistency and technology transfer. The rapid increase in mid-range smartphone assembly operations continues to reinforce long-term consumption of screen protection layers.

Across Germany, the mobile phone screen underlayer cushioning material market is advancing at a CAGR of 6.2%, supported by strong material science expertise and advanced polymer engineering. Local manufacturers are developing high-precision elastomer and microcellular foam solutions tailored for durable and foldable screen structures. Continuous innovation in surface uniformity, compression resilience, and bonding performance ensures compatibility with next-generation display designs. Collaboration between research institutes and electronics producers continues to foster specialized material development.

Brazil is recording steady progress in the mobile phone screen underlayer cushioning material market, forecast to expand at a CAGR of 5.7% through 2035. Recovery in consumer electronics manufacturing and import substitution policies are strengthening local demand. Producers are introducing shock-absorbing foams and adhesive films designed for improved surface protection. Growth in domestic smartphone refurbishment and repair industries further supports aftermarket demand. Local partnerships with international firms are enabling access to advanced production and testing technologies.

In the United States, the mobile phone screen underlayer cushioning material market is growing at a CAGR of 5.1%, supported by rapid innovation in material composition and digital device protection. Manufacturers emphasize nano-layer coatings, silicone-based films, and precision adhesives optimized for ultra-thin displays. Demand from foldable and rugged smartphone categories continues to stimulate product development. The strong presence of R&D facilities and collaboration with leading device brands ensures consistent technological advancement and market reliability.

Across the United Kingdom, the mobile phone screen underlayer cushioning material market is advancing at a CAGR of 4.6%, supported by increasing collaboration between material research institutes and electronic component manufacturers. Development of impact-absorbing, transparent polymer films is addressing the requirements of high-end mobile device producers. Manufacturers focus on sustainability by using recyclable, non-toxic substrates. Expansion of online retail and device repair sectors also contributes to steady aftermarket material consumption across domestic markets.

Japan is growing steadily in the mobile phone screen underlayer cushioning material market, projected to rise at a CAGR of 4.1% through 2035. Domestic producers emphasize ultra-precision polymer processing and micro-layered adhesive formulations to improve shock absorption and flexibility. Development of materials suitable for OLED and curved displays reinforces Japan’s position in high-end electronics manufacturing. Continuous refinement of transparent, high-durability cushioning layers ensures performance consistency across premium mobile device applications.

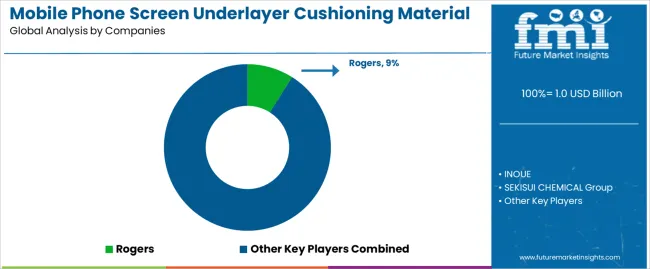

The global mobile phone screen underlayer cushioning material market demonstrates moderate concentration, shaped by leading polymer manufacturers and precision materials suppliers serving smartphone assembly lines. Rogers holds a leading position through advanced polyurethane and elastomeric materials engineered for impact absorption, dimensional stability, and reliable adhesion in display module assembly. INOUE and SEKISUI CHEMICAL Group maintain strong positions through consistent innovation in polymer foams and adhesive films supporting high-performance touch display integration. Nitto and Saint-Gobain Norseal provide high-quality cushioning materials emphasizing compression recovery, heat resistance, and dielectric strength, ensuring structural protection of fragile display layers under thermal and mechanical stress conditions during manufacturing and device operation.

TORAY INDUSTRIES and CROWN GROUP contribute technological expertise in polymer formulation and microcellular foam technology, delivering precision-engineered materials for flexible and foldable display structures. Dongguan TAIYALUCK Electronic Technology and Suzhou Shihua New Material Technology represent the growing Chinese production base, supplying cost-efficient cushioning films optimized for large-scale assembly. Competition in this market is influenced by mechanical resilience, adhesive stability, and optical transparency requirements. Strategic differentiation depends on miniaturization compatibility, consistent compression response, and long-term reliability under repeated loading cycles. As smartphone designs evolve toward thinner and more durable profiles, suppliers are investing in advanced cushioning materials that balance protection, flexibility, and heat management for next-generation display technologies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Polyurethane (PU) Foam, Polyacrylate (Acrylic) Foam, Others |

| Application | LCD Screen, OLED Screen, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Rogers, INOUE, SEKISUI CHEMICAL Group, Nitto, Saint-Gobain Norseal, TORAY INDUSTRIES, CROWN GROUP, Dongguan TAIYALUCK Electronic Technology, Suzhou Shihua New Material Technology |

| Additional Attributes | Dollar sales by material type and application; analysis of cushioning efficiency across polyurethane and acrylic segments; regional adoption across smartphone manufacturing hubs; market share by OEM utilization; innovation trends in microcellular foams, flexible adhesives, and thermally stable substrates; benchmarking of lamination and impact resistance technologies; evaluation of recyclability and thin-layer durability; competitive landscape among polymer producers and display material suppliers; and integration analysis of cushioning layers within flexible and foldable display architectures. |

The global mobile phone screen underlayer cushioning material market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the mobile phone screen underlayer cushioning material market is projected to reach USD 1.7 billion by 2035.

The mobile phone screen underlayer cushioning material market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in mobile phone screen underlayer cushioning material market are polyurethane (pu) foam, polyacrylate (acrylic) foam and others.

In terms of application, lcd screen segment to command 50.0% share in the mobile phone screen underlayer cushioning material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA