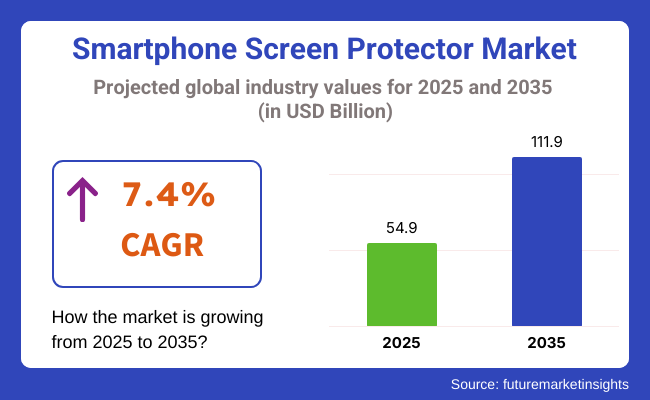

The global smartphone screen protector market is estimated to be worth USD 54.9 billion in 2025. In 2024, the revenue was estimated to be worth USD 51.25 billion. There will be strong and consistent growth between the period 2025 and 2035 at a compound annual growth rate (CAGR) of 7.4%. By 2035, the valuation is anticipated to expand significantly to USD 111.94 billion.

It is one of the primary factors for the growth forecast that the demand for top-notch smartphones with cutting-edge displays continues to rise, making compatible and durable screen protection solutions in demand. Screen protector technologies are advancing at the same rate as the advancement of smartphone screens currently.

Some trends in the industry include edge-to-edge tempered glass, blue light filter films, privacy films, and oleophobic coatings. These not only protect against damage but also boost user experience and device lifespan, thereby becoming an indispensable accessory for many consumers across the world. Emerging regions across Asia Pacific, Latin America, and the Middle East are fuelling global expansion.

The penetration of smartphones in these regions is growing very quickly, and users are becoming more inclined to protect their investments by using quality screen protectors. Meanwhile, North America and Europe are shifting to high-end, multi-feature protectors that both perform well and look stylish.

eCommerce websites and internet selling channels offer an immense range of products, easy compatibility verification, and individualized recommendations, increasing customer ease of use. Additionally, partnerships among OEMs and accessory players are streamlining bundled sales, thereby making screen protectors part of the initial smartphone purchasing process.

Innovation will remain center stage for competitive positioning. As increasingly discerning and eco-aware customers, screen protector brands will have to drive technical performance higher while capturing sustainability trends. Those that offer better-performing, recyclable, and functionally enhanced products will be most likely to capture a rising share in the years to come.

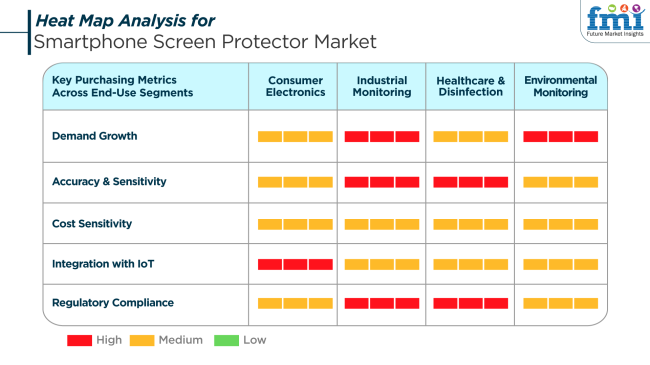

Distinct requirements across key end-use segments shape the smartphone screen protector industry. In the consumer electronics space, users prioritize features like clarity, thinness, anti-fingerprint coatings, and edge-to-edge fit. High-frequency smartphone users, particularly in urban regions, are more inclined toward premium glass protectors offering multiple layers of protection and enhanced screen interaction.

Industrial monitoring environments demand rugged, highly sensitive protectors capable of withstanding temperature fluctuations, mechanical stress, and high-touch use. In parallel, healthcare applications require antimicrobial coatings and compatibility with frequent sanitization protocols, making hygiene and regulatory compliance critical evaluation factors.

Cost sensitivity plays a more decisive role in industrial and environmental monitoring use cases where large-scale deployments are common. Nonetheless, even in price-sensitive segments, there is increasing recognition of the long-term cost savings achieved through durable and high-performance protectors, reinforcing the trend toward more reliable and multifunctional solutions.

The smartphone screen protector industryis poised for strong growth, but it must navigate several emerging risks. Foremost among these is the continual advancement in native screen durability technologies. With manufacturers developing increasingly resilient glass materials-such as Gorilla Glass Victus and similar innovations-the need for additional protective layers could be perceived as redundant by consumers, particularly those using high-end devices.

Competitive saturation also poses a significant challenge. The industry has several low-cost and distinguishable products, particularly in unregulated online marketplaces. Brand value and compresses margins, especially for established players that invest in R&D and quality assurance. Without clear differentiation, many providers risk commoditization.

Regulatory and environmental pressures are escalating. Screen protectors composed of non-recyclable plastics are increasingly under scrutiny, particularly in regions adopting stringent sustainability standards. Companies that fail to adopt biodegradable materials or recyclable packaging may encounter regulatory barriers or consumer backlash, impacting long-term access and brand equity.

From 2020 to 2024, the smartphone screen protector industry saw steady growth with growing penetration of smartphones and growing awareness among consumers about protecting devices. With flagship smartphones with higher screen replacement prices becoming increasingly prevalent, consumers turned to screen protectors in droves as a low-cost preventive measure.

Tempered glass products dominated the industry while offering more resilience and transparency than plastic alternatives. Online stores and smartphone retail outlets became primary sales channels. Meanwhile, users began to exhibit increasing demand for anti-glare, privacy, and antimicrobial coatings as a manifestation of altered use cases and pandemic-post hygiene consciousness.

Through the period 2025 to 2035, there will be innovations in screen protector technology. Technologies like self-healing coating, ultra-thin hybrid film, and embedding biometric sensors will redefine product expectations. Folding and curved phones will stimulate new form-fit and flexible case demand. Sustainability will also affect materials, as recyclable and eco-friendly protectors will come into the limelight. Custom-fit and easy application to smartphones will be a driver for purchases.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Affordability, basic protection, anti-glare and scratch resistance | High-performance, multifunctional protection with a focus on sustainability |

| Use of tempered glass and PET films | Self-healing, ultra-thin hybrids, sensor-friendly and flexible materials |

| Anti-fingerprint, privacy, antimicrobial coatings | Smart coatings, recyclable materials, and customizable designs |

| Aimed at standard flat and slightly curved screens | Growing need for foldable, wrap-around, and edge-to-edge compatibility |

| Retail outlets, digital channels, bundled with accessories | Embedded in phone sales, replacement subscriptions, AR try-ons |

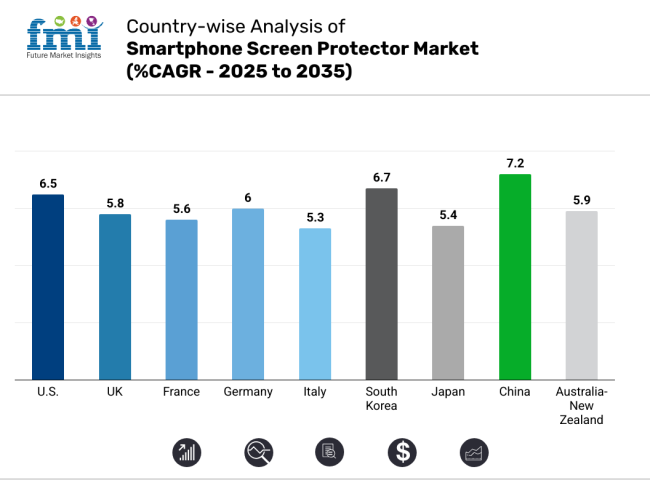

The USA would develop at a 6.5% CAGR over the study period. The growth is spurred by the consistent demand for premium smartphones and growing consumer thinking towards safeguarding their phones. A technologically advanced consumer base coupled with strong smartphone penetration supports screen protectors to be more than basic devices today.

Screen technology innovations, such as edge-to-edge screens and foldable designs, are driving demand for more advanced protective technologies like liquid screen protectors and privacy screens. Retail distribution channels and online sales platforms have further widened product availability, with end-users increasingly looking for value-added features like anti-glare, anti-scratch, and antimicrobial coatings. Personalization needs have also spurred increased demand for screen protectors that are individually tailored and compatible with specific model devices.

Both foreign brands and local suppliers dominate the USA, which makes the environment conducive to product innovation. Corporate demand for the protection of smartphones in industries like logistics and healthcare is further driving sales. In addition, expansion in premium phones has prompted people to invest in quality accessories that prolong the life of devices and enhance usability.

The UK will grow at 5.8% CAGR during the study period. Expansion is fueled by a technologically sophisticated population and an ongoing replacement cycle of smartphones. Growing device consciousness towards maintenance and beauty is prompting consumers to choose screen protectors that are not only robust but also deliver clarity and touch sensitivity.

Consumption of flagship smartphones, especially in urban cities, is continuing to influence demand for premium protective solutions. Deep e-commerce penetration in the UK has made the availability of various screen protector solutions like tempered glass, hybrid films, and flexible TPU-based ones possible.

Segmentation through enhanced features like blue light blocking, privacy screens, and oleophobic treatments is gaining popularity. Consumer expectations are moving towards thin, stealthy protectors that do not take away from screen functionality. Additionally, environmental consciousness is propelling demand for recyclable and biodegradable packaging from UK consumers, pushing companies to innovate in terms of sustainability factors. At the same time, the growing dominance of online reviews and social media, visibility and product quality remain key determinants of success within the industry.

France will expand by 5.6% CAGR during the study period. Industry performance is sustained by steady smartphone ownership, growing disposable income, and a mounting tendency among customers to protect electronic investments. Good looks and the necessity for scratch and smudge-resistant screens are fueling steady demand for tempered glass and multilayered film protectors.

Retail availability and growth in direct-to-consumer models are key characteristics of the industry. Urban consumers are increasingly looking for screen protectors that support high-resolution screens and provide advanced touch functionality.

Slim, minimalist designs are favored among French consumers, and they often seek out products that complement the device's appearance. Partnerships between accessory companies and telecom retailers are driving wider availability of packaged screen protection offerings. Regional brands are also emphasizing antimicrobial and anti-reflective qualities in response to increased awareness about comfort and hygiene. Additionally, new e-waste challenges are encouraging reusable screen protectors and eco-friendly packaging.

Germany will expand at a 6.0% CAGR over the study period. A strong engineering tradition dominates and focuses on product quality, with a strong focus on durable and high-performance accessories. German smartphone buyers are early adopters of new products like screen protectors with sophisticated coatings and privacy-integrated technology.

Rising sales of high-end smartphones from leading global brands have consolidated demand for protectors that are curvature screen match and high refresh rate sensitive. The retail landscape is diverse, from technology-focused stores, carrier stores, and web-based marketplaces selling a wide variety of protection products.

Besides, consumers are shifting towards screen protectors that offer mechanical protection and functional benefits such as fingerprint resistance and shock absorption. Sustainability is also a concern, with an increasing segment of users choosing accessories that demonstrate environmental stewardship. German importers and accessory manufacturers are responding to these new trends by investing in product certification and quality to position their products to meet consumer and regulatory standards.

Italy is expected to achieve a 5.3% CAGR during the study period. The steady uptake of mid-range and flagship mobile phones is fueling commensurate demand for screen protectors with ruggedness and visual integrity. Italian consumers tend to be brand-loyal and appreciate both the utility and visual consonance of mobile phone accessories.

Distribution through electronics retail chains and e-commerce platforms is on the rise, particularly in metropolitan areas. The growing demand for aesthetics and device protection is propelling the use of ultra-clear and edge-to-edge protectors. The rising action of travel among consumers has further boosted demand for anti-glare and shatterproof protectors.

Local retailers are also focusing on the customer experience through on-site screen protector installation, particularly at mobile repair and retail stores. Additionally, younger generations are embracing digitally propelled trends, like matte finish guards for gaming and anti-spy coatings for public privacy. There is a gradual shift towards more advanced products that combine aesthetics with robust protection features.

South Korea is expected to grow at 6.7% CAGR during the study period. With a large number of top smartphone vendors, the country has an industry offering high value. South Korean consumers tend to upgrade smartphones frequently and are among the first in line to buy smartphones with curved and foldable displays, necessitating high-performance screen protection solutions.

The domestic industry is characterized by universal knowledge of smartphone accessories, and material and feature innovation has the greatest impact on choice. Self-healing, touch sensitivity-enhancing, and full-body screen protectors are becoming increasingly favored.Local brands and OEM partnerships dominate the supply chain and often bundle screen protectors into new smartphone models. Quality and aesthetics dictate consumer preference, and the best-sellers are high optical clarity and slim-profile screen protectors.

Japan is forecasted to grow at 5.4% CAGR during the study period. Dynamics are influenced by consumer trends favoring quality, precision, and convenience in smartphone usage. The demand for screens in Japan is stimulated by minimalist design focus and seamless user experience. High-demand solutions that improve upon the original screen viewing without cutting back on color accuracy or touch sensitivity are favored highly.

Retail channels, particularly electronics specialty shops and mobile operator stores, offer a variety of screen protection items. Consumers are highly accepting of new materials and technologies like high-hardness glass and multi-layer PET films with antibacterial functions. Expanding demand for dust-proof and anti-fingerprint solutions also boosts growth.

Apart from personal purchases, users mostly opt for bundled services comprising screen protector applications during device installation. Japanese accessory businesses prefer customer-centered packaging and ease-of-use application kits to ensure customer satisfaction. Technological development in oleophobic and hydrophobic coatings also enjoys high demand from technology-inclined consumers who desire durability and cleanliness during the use of devices.

China is expected to grow at a 7.2% CAGR during the study period. A robust smartphone manufacturing ecosystem and vast user base are driving sales growth at a very rapid rate. With the continuous upgradation of smartphones and widespread adoption of both flagship and mid-range smartphones, there is a high demand for affordable and high-performance screen protection products.

China's position as the global factory for goods makes it possible for economies of scale and rapid innovation, creating a wide variety of options at a huge number of price points. Domestic brands regularly launch products with high hardness scores, blue light filtering, and edge-to-edge compatibility. Internet marketplaces and e-commerce giants make significant contributions to distribution with large catalogs and low prices.

Increased adoption of large-screen and foldable devices is also driving demand for flexible and adaptable screen protector material. Furthermore, heightened consumer awareness of eye health and screen cleanliness is contributing to the popularity of UV protection and antibacterial coatings. Fast-paced innovation and growing export demand make China a key driver in the worldwide smartphone screen protector market.

The Australia-New Zealand region is expected to grow at 5.9% CAGR during the study period. Consumers in both nations are increasingly conscious of the protection of smartphones, especially with the rising price of flagship devices. The demand for screen protectors comes from a need to maintain device longevity and appearance. Online and in-store platforms provide widespread access to screen protectors across various device brands and screen sizes.

Product adoption by urban users, who frequently apply mobile devices in work, play, and social activity, is high. Features that are the most in-demand include anti-glare, scratch resistance, and high transparency coating. Australian and New Zealand consumers are increasingly generating interest in the use of environmental and biodegradable protective items.

Furthermore, carrier partnership impacts and bundled plan service impacts are helping to support premium screen protector sales. Product customization, including branding and personalization, is more in demand among young consumers. With smartphones becoming a bigger part of daily life, screen protection investment is regarded as a functional and aesthetic necessity.

By type, tempered glasswill hold an 87.9% share. Polyethylene Terephthalate (PET) will have 7.5% of the share.

Alongside the foregoing, the protection offered by tempered glass, because of its excellent durability against scratches and its ability to absorb impact energy, arises as the best protection over other types of materials. This material has increased transparency, which means that the quality of the display will not be affected, but it is also by far the other types when it comes to shatter resistance. Even so, customer demand dictates the reasons for its popular usage, such as wanting protection with an uncompromised way to view content.

Leading brands such as Apple, Samsung, and Google have high retail availability and bundling of products. There are developments in quality, such as anti-fingerprint coatings and edge-to-edge protection, which have enlivened the glory of tempered glass among consumers seeking high-performance and durable screen protection.

While PET screen protectors are not as popular as tempered glass, they still hold a good share, amounting to 7.5% of the overall industry. Generally, PET protectors are lighter, thinner, and more flexible than tempered glass, and they provide a low level of protection against scratch abuse and minor impacts but no shatterproof quality.

PET protectors are usually the choice among those customers who want a lightweight, low-cost solution for their precious smartphone. Manufacturing costs are cheaper as well, which makes it a good option for budget-conscious consumers or ones choosing minimalist options. Lower price and ease of installation are some of the key benefits of PET screen protectors.

The Mid-Range price segment will dominate the smartphone screen protector industry in 2025, making up 61.7% of the share, followed by the Economy with 23.8%.

The largest percentage of the revenue share is in the mid-range price segment, which blends both cost and output performance. This price range typically incorporates well-engineered, high-quality tempered-glass screen protectors and high-quality PET materials, giving a strong level of protection against scratches, impacts, and any form of damage at a very reasonable price.

Mid-range options usually come with unique features like anti-fingerprint coating or blue light filter and edge-to-edge, which gives extra value to consumers. The mid-range price range is attractive to many categories, such as budget buyers who seek to protect their devices but are not too expensive and slightly upgrade feature lovers who do not want to go premium. Major brands such as ZAGG, Belkin, and OtterBox manufacture this range, promoting the cause of middle-tier screen protectors.

The Economy category commands a lesser share than the Mid-Range, yet it owns a substantial revenue share component of 23.8% of the overall equity. Screen protectors in this price range are made of basic PET material or very low-grade tempered glass, which gives very good protection against scratches and some very light impacts.

These products are mostly targeted toward cost-sensitive customers looking for very basic protection without any extra features or extra premium quality. Most likely, economy protectors would be sold in bulk or packaged together, attracting interest from consumers looking for a cheap and disposable option for their devices. Retailers and online marketplaces often provide low-priced screen protectors at entry-level pricing for customers who are less interested in price than features.

The smartphone screen protector industry is characterized by fierce contestation and fast-paced product innovations, spurred on by the increasing subscription of expensive smartphones to consumers and the growing customer cognizance of the effectiveness and resale value of their devices.

Thanks to the explosion in the size of high-resolution OLED and AMOLED displays, protection manufacturers are devoted to ultra-clear, amply durable, easy-installation screen protectors that support touch sensitivity and optimum visibility while offering better aesthetics. There is a mélange of large accessory brands, material science companies, and regional players that compete across technology, compatibility, and aesthetics.

ZAGG Inc., Belkin International, Corning Inc., IntelliARMOR, and AZ Infolink Private Ltd., to mention a few, are all part of the top players. ZAGG leads the way in providing a wide variety of tempered glass and hybrid polymer solutions that come bundled mostly with lifetime warranties and installations in retail stores. Belkin sells protectors that are carefully cut, designed in collaboration with Apple and other OEMs, marketed by retail partnerships, and epoxied to product displays.

Corning brings innovations based on material science leadership to its menu with its Gorilla Glass adaptations in ultra-thin screen protectors. At the same time, IntelliARMOR markets an edge-to-edge solution with an antimicrobial coating to tech-savvy customers. Finally, AZ Infolink has been creating good traction in emerging markets with cheap products and private-label partnerships.

Strategic foci include anti-glare and blue light filtering technologies, self-healing films, antimicrobial coatings, privacy filters, and biodegradable products. While their distribution strategy varies through e-commerce supremacy, retail electronics stores, telecom partnerships, and bundled purchases with phones, they all pay homage to the same source of e-commerce kingship. Premiumization, sustainability, and integration with protective cases continue to influence product development and brand differentiation in this rather commoditized yet innovation-driven market.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| ZAGG Inc. | 18-22% |

| Belkin International, Inc. | 14-18% |

| Corning Inc. | 12-15% |

| IntelliARMOR | 8-11% |

| AZ Infolink Private Ltd. | 6-9% |

| Other Key Players (Combined) | 30-38% |

Key Company Insights

ZAGG Inc. leads the global smartphone screen protector industry with an estimated 18-22% share, driven by its innovation-focused Invisible Shield product line. The brand’s premium offerings feature edge-to-edge protection, military-grade durability, antimicrobial coatings, and advanced functionalities like privacy filtering and blue light reduction.

ZAGG's broad retail distribution and strong brand recognition, particularly in North America and Europe, solidify its leadership. Belkin International, with a 14-18% share, capitalizes on its close alignment with Apple to deliver co-branded, high-performance protectors through Apple Stores and premium retail channels. Its InvisiGlass Ultra series resonates strongly with iOS users, reinforcing its niche in the premium tier.

Corning Inc. holds a 12-15% share by leveraging its materials science expertise to deliver ultra-durable, high-clarity screen protectors, extending its reputation beyond OEM glass supply. IntelliARMOR, with 8-11%, targets the mid-range segment through e-commerce, offering value-focused products with features like anti-glare and self-healing capabilities.

AZ Infolink Private Ltd captures a 6-9% share by catering to mid-tier and budget smartphone brands in emerging regions like South Asia and the Middle East, often operating as an OEM supplier. Together, these players focus on innovation, strategic alliances, and channel diversification, which are key to maintaining competitive advantage.

The segmentation is into tempered glass, polyethylene terephthalate, and thermoplastic polyurethane.

The segmentation is into economy, mid-range, and premium categories.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 54.9 billion in 2025.

The industry valuation is projected to grow to USD 111.9 billion by 2035.

The industry valuation is expected to grow at a CAGR of 7.2% during the forecast period.

Tempered glass is the leading segment in the smartphone screen protector market.

Key players include ZAGG Inc., Belkin International, Inc., Corning Inc., IntelliARMOR, AZ Infolink Private Ltd., NuShield Inc., Halloa Enterprise Co. Ltd., Clarivue, Ryan Technology Co. Ltd., and Jiizii Glass.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Material, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Material, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Material, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 16: Global Market Attractiveness by Material, 2024 to 2034

Figure 17: Global Market Attractiveness by Price Range, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 34: North America Market Attractiveness by Material, 2024 to 2034

Figure 35: North America Market Attractiveness by Price Range, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Price Range, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Price Range, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Price Range, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Price Range, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Price Range, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Price Range, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smartphone 3D Camera Market Size and Share Forecast Outlook 2025 to 2035

Smartphone System-on-Chip Market Insights - Trends & Forecast 2025 to 2035

Refurbished Smartphone Market Trends – Growth & Forecast 2024-2034

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Screen Printing Mesh Market Size and Share Forecast Outlook 2025 to 2035

Screen Cleaner Market Analysis by Type, Application and Region from 2025 to 2035

Screenless Display Market

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Lab Screening Test Kit Market

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Touchscreen Controller Market Growth - Trends & Outlook 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Touchscreen Gloves Market

Oral Screening Systems Market

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Touch Screen Film Market Size and Share Forecast Outlook 2025 to 2035

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Touch Screen Module Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA