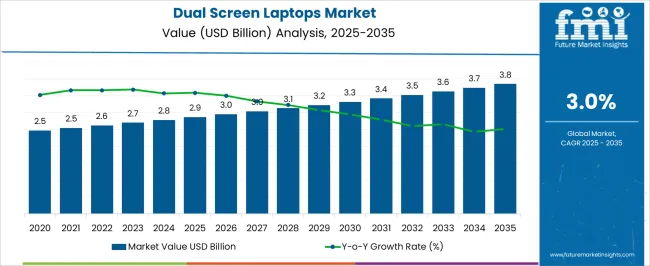

The dual screen laptops market is valued at USD 2.9 billion in 2025 and will reach USD 3.8 billion by 2035, growing at a CAGR of 3.0%. A growth contribution index analysis examines the relative impact of key drivers on overall market expansion, separating the influence of unit sales, pricing trends, and technological advancements.

Rising interest in enhanced multitasking capabilities and productivity-focused designs supports steady adoption across North America, Europe, and parts of the Asia Pacific. Price contribution becomes more prominent in the later phase, as premium dual-screen models with higher-end displays, improved touch interfaces, and extended battery life command higher margins. Upgrades and specialized features, such as haptic feedback and stylus integration, further strengthen value-based growth.

Technological innovation also enhances the growth contribution index, as improvements in hinge design, display durability, and thermal management increase usability and appeal. By 2035, both volume and value contributions are balanced, reflecting broader adoption alongside incremental feature-driven price gains. The growth contribution index highlights that sustainable expansion in the Dual Screen Laptops Marketdepends on combining increased unit sales with continuous product enhancements and differentiated offerings, allowing manufacturers to capture maximum value from both mainstream and premium segments.

| Metric | Value |

|---|---|

| Dual Screen Laptops Market Estimated Value in (2025 E) | USD 2.9 billion |

| Dual Screen Laptops Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

Display panel manufacturers contribute around 28%, supplying secondary touchscreen panels and high-resolution LCD or OLED modules. Semiconductor and chipset providers represent roughly 15%, delivering processors, GPUs, and controllers optimized for dual-screen operation. Software and UI/UX developers hold close to 10%, creating applications and operating system adaptations for multi-screen workflows. Peripheral and accessory suppliers make up the remaining 7%, providing stylus pens, docking solutions, and protective components.

The market is growing due to demand for enhanced multitasking, creative workflows, and portable productivity solutions. Adoption of OLED secondary displays has risen by over 25% year-on-year, offering better color accuracy and touch responsiveness. Innovative hinge and foldable designs are improving ergonomics, while energy-efficient panels reduce battery consumption by 10–12%. Collaboration between OEMs and software developers has increased, with dual-screen-optimized apps now accounting for ~30% of preloaded productivity suites. Gaming and content creation segments are driving hardware upgrades, with higher RAM and GPU integration to manage multi-display workflows.

The dual screen laptops market is gaining traction as device manufacturers respond to rising consumer demand for multitasking efficiency, enhanced productivity, and immersive computing experiences. Industry announcements and technology showcase events have underlined rapid innovation in display engineering, hinge mechanisms, and software optimization for dual-screen functionality.

Increasing adoption among creative professionals, gamers, and business users has broadened the market base, with operating system updates and application integrations enhancing usability. Hardware advancements, including lightweight materials, extended battery life, and higher refresh rate panels, have improved portability without compromising performance.

The competitive landscape is also evolving, with collaborations between hardware makers and software developers driving feature-rich ecosystems. Future market growth is expected to be sustained by wider adoption of dual-screen devices in educational and remote work environments, as well as expanding affordability through diversified pricing strategies. Segment leadership is currently shaped by mid-range pricing for broader accessibility and by screen sizes that balance portability and productivity.

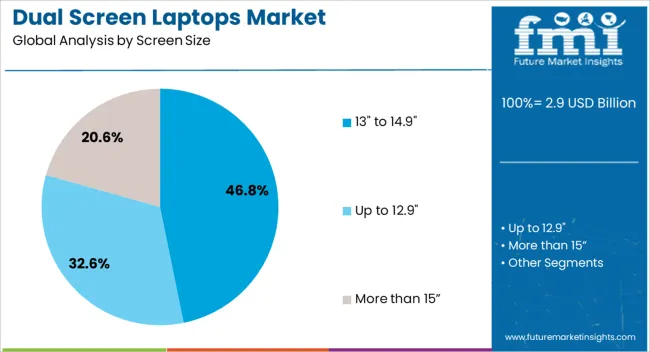

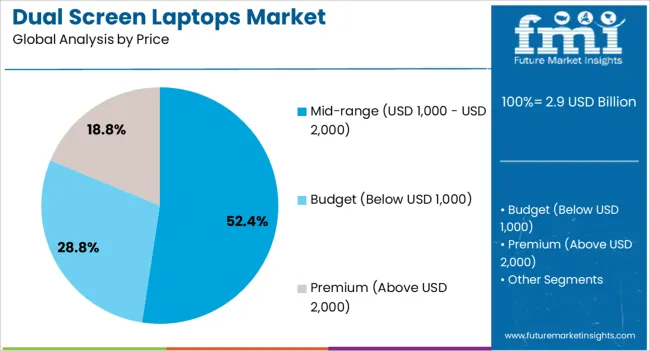

The dual screen laptops market is segmented by screen size, price, and geographic regions. By screen size, dual screen laptops market is divided into 13" to 14.9", Up to 12.9", and More than 15”. In terms of price, dual screen laptops market is classified into Mid-range (USD 1,000 - USD 2,000), Budget (Below USD 1,000), and Premium (Above USD 2,000). Regionally, the dual screen laptops industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 13" to 14.9" screen size segment is projected to account for 46.8% of the dual screen laptops market revenue in 2025, making it the largest contributor in terms of form factor preference. Growth in this segment has been influenced by the need for a balanced combination of portability and workspace, which appeals to both mobile professionals and students.

This size range offers an optimal footprint for dual-display integration while maintaining manageable weight and battery efficiency. Manufacturers have targeted this category with designs that provide high-resolution displays, thin bezels, and touch-enabled secondary screens without significantly increasing device bulk.

Additionally, the segment has benefited from strong adoption in the premium ultrabook category, where mobility is a primary purchasing factor. As hybrid work arrangements and mobile computing requirements continue to expand, the 13" to 14.9" segment is expected to remain a preferred choice, offering a practical compromise between compactness and productivity-enhancing screen real estate.

The mid-range price segment, spanning USD 1,000 to USD 2,000, is projected to hold 52.4% of the dual screen laptops market revenue in 2025, maintaining its lead due to its balance of affordability and high-performance specifications. This range has been attractive to a broad consumer base, offering advanced features such as high-resolution displays, powerful processors, and dedicated graphics while remaining accessible to professionals, students, and tech-savvy consumers.

Market data from electronics retail trends indicates that consumers in this range seek devices that provide premium design and functionality without entering the ultra-premium price bracket. Manufacturers have strategically introduced models in this segment to capture both first-time buyers of dual-screen devices and those upgrading from conventional laptops.

Additionally, competitive pricing strategies, seasonal promotions, and bundled software offerings have enhanced value perception. As component costs gradually stabilize and economies of scale improve, the mid-range segment is expected to continue leading adoption, serving as the entry point for mainstream dual-screen laptop ownership.

The dual screen laptops market is expanding due to increasing demand for high-performance computing in professional, creative, and gaming segments. Multi-display configurations enhance productivity, facilitate multitasking, and enable seamless content creation. Asia Pacific is emerging as a major adopter due to growing consumer electronics manufacturing and technology integration. North America and Europe continue to focus on premium and enterprise-level dual screen laptops for corporate and creative use.

Increased requirements for multitasking, video editing, programming, and professional design are driving dual screen laptop adoption. The ability to operate multiple applications simultaneously without switching windows enhances workflow efficiency. Gaming and streaming applications benefit from additional screens for improved interaction and monitoring. Enterprise users leverage dual screens to access data, run software tools, and conduct virtual meetings concurrently. The combination of enhanced screen real estate and portability is a key factor supporting market expansion. Manufacturers are introducing ergonomic designs and software enhancements to improve user experience. Rising corporate and creative sector adoption is projected to continue supporting strong demand for dual screen laptops globally.

Integration of touch-sensitive displays, foldable panels, and enhanced resolution screens is creating growth opportunities. Dual screen laptops with energy-efficient panels allow extended battery life while providing advanced functionality. Software optimization for multi-display usage enhances productivity in design, programming, and professional workflows. Corporate, educational, and creative sectors are increasingly adopting laptops with dual displays for flexible use. Manufacturers focusing on ergonomics, portability, and optimized software ecosystems are expected to capture a larger share of the expanding market. Technological innovation in display technology and interactive functionality continues to drive product differentiation and long-term adoption.

Corporate and educational institutions are emerging as significant adopters of dual screen laptops. These devices facilitate collaborative work, multitasking, and enhanced learning experiences. Software platforms are increasingly optimized to leverage dual display functionality for productivity applications, virtual classrooms, and remote work environments. Enhanced screen resolution and touch capability improve user engagement and reduce workflow interruptions. Rising digitalization in corporate training, creative studios, and educational programs drives demand. Integration of dual screens in mobile workstations supports professionals and students in managing complex tasks efficiently while improving output quality.

High manufacturing costs and premium pricing of dual screen laptops limit adoption among price-sensitive segments. Limited awareness of productivity benefits and the need for software optimization creates hesitation in enterprise and consumer markets. Retrofitting existing software to fully utilize dual displays also presents operational challenges. Manufacturers investing in cost-effective designs, user training, and software compatibility solutions are better positioned to expand market penetration. Optimizing production processes, reducing component costs, and educating consumers and enterprises on functional advantages are critical to overcoming adoption barriers in the dual screen laptop market.

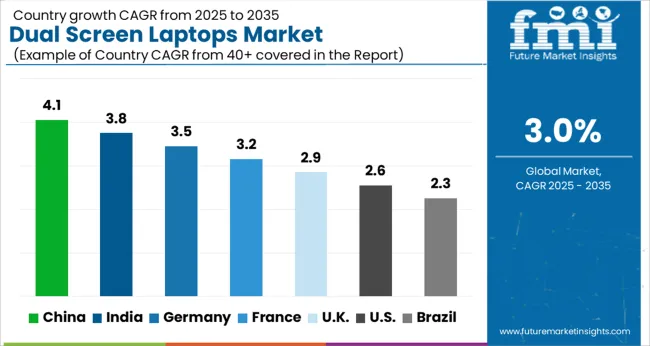

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

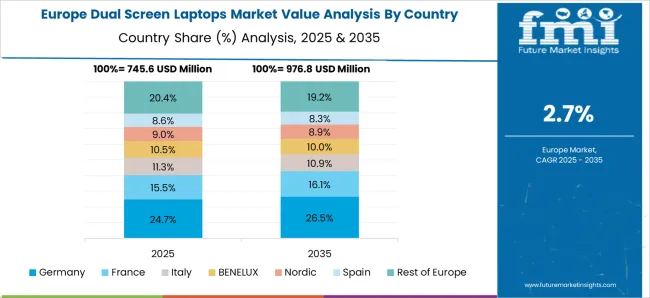

The dual screen laptops market is growing at a global CAGR of 3% from 2025 to 2035, driven by increasing demand for productivity-enhancing devices, remote work solutions, and innovative computing experiences. China leads with a CAGR of 4.1%, +37% above the global benchmark, supported by BRICS-driven consumer electronics manufacturing, strong domestic demand, and adoption in corporate and educational sectors. India follows at 3.8%, +27% above the global average, reflecting growing tech adoption, startup growth, and rising remote work requirements. Germany records 3.5%, +17% over the global rate, influenced by OECD-supported innovation in hardware design and premium laptop markets. The United Kingdom posts 2.9%, slightly below the global CAGR, shaped by moderate adoption among business users. The United States stands at 2.6%, −13% under the global benchmark, constrained by mature laptop penetration and slower uptake of dual-screen devices. BRICS markets are driving scale, while OECD economies emphasize innovation, ergonomics, and high-quality designs.

China is leading growth in the dual screen laptops market with a CAGR of 4.1%, driven by rising demand in technology-savvy urban centers and increasing adoption in IT, education, and creative industries. Major laptop manufacturers are launching innovative dual screen models to cater to productivity-focused consumers and gaming enthusiasts. Expansion of e-commerce platforms and strong distribution networks are supporting market penetration. Collaborations between hardware manufacturers and software developers are enhancing user experience and multitasking capabilities. Domestic production advantages and rapid adoption of new display technologies further strengthen China’s position in the global dual screen laptops market.

India is recording a CAGR of 3.8% in the dual screen laptops market, supported by growing remote work, IT sector expansion, and increasing interest from students and professionals. Manufacturers are targeting the premium segment with high-performance dual screen devices optimized for multitasking and content creation. Rising online retail and technology awareness are accelerating adoption across urban and semi-urban areas. Educational institutions are also incorporating dual screen laptops for enhanced learning experiences. Strategic collaborations with software developers and distributors are helping streamline supply and enhance market availability.

Germany is progressing at a CAGR of 3.5% in the dual screen laptops market, driven by IT enterprises, research institutes, and creative agencies. Demand for productivity-focused dual screen laptops is rising due to increasing remote collaboration and advanced software requirements. German consumers are opting for high-end devices with enhanced display quality and multitasking features. Local distributors and resellers are promoting dual screen solutions for enterprise and professional use. Industrial and academic adoption of dual screen technology is contributing to steady growth in the market.

The United Kingdom is expanding at a CAGR of 2.9% in the dual screen laptops market, supported by growing remote work, digital content creation, and enterprise adoption. Imports remain the primary supply source, with Europe and Asia providing most devices. Adoption in creative industries and professional environments is driving demand for dual screen laptops with productivity-focused features. Retail partnerships and online marketplaces are improving accessibility and distribution. Strategic marketing campaigns by brands are increasing awareness and encouraging early adoption among professionals and students.

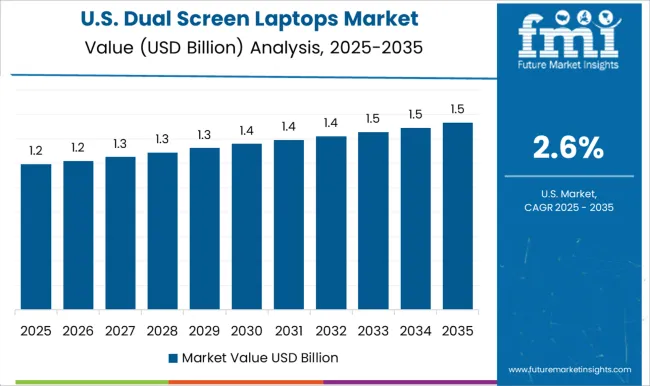

The United States is recording a CAGR of 2.6% in the dual screen laptops market, driven by enterprise, educational, and professional users. Demand is concentrated in technology companies and digital media sectors, where productivity and multitasking are critical. High-end dual screen laptops with enhanced display and software integration are preferred by consumers. Imports from Asia dominate supply, supplemented by domestic assembly and distribution. Increasing remote work adoption and enterprise IT upgrades are supporting steady market growth.

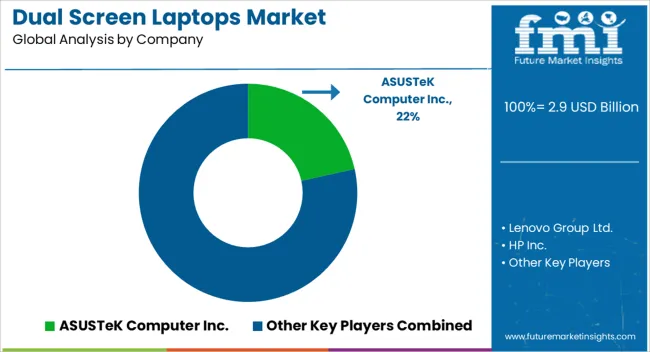

The dual screen laptops market is shaped by leading technology companies delivering portable computing solutions with enhanced multitasking capabilities, productivity features, and immersive user experiences. Lenovo Group Ltd. is assumed to be the leading player, supported by its ThinkPad X1 Fold and Yoga Book series, which integrate dual-screen designs with flexible display technologies and optimized software for business and creative workflows. ASUSTeK Computer Inc. and HP Inc. maintain strong market positions through their ZenBook Duo and Spectre Fold models, focusing on slim designs, touch responsiveness, and productivity-oriented enhancements. Microsoft Corporation and Dell Inc. compete with Surface Duo and Concept laptops, offering innovative dual-display operating systems and app integration to support multitasking and professional applications. Acer Inc. and Razer Inc. contribute through high-performance models tailored for gaming, content creation, and mobile workstation applications, emphasizing durability, display quality, and user interface innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Screen Size | 13" to 14.9", Up to 12.9", and More than 15” |

| Price | Mid-range (USD 1,000 - USD 2,000), Budget (Below USD 1,000), and Premium (Above USD 2,000) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASUSTeK Computer Inc., Lenovo Group Ltd., HP Inc., Microsoft Corporation, Dell Inc., Acer Inc., and Razer Inc. |

| Additional Attributes | Dollar sales by screen type and laptop segment, demand dynamics across consumer, business, and gaming laptops, regional trends across North America, Europe, and Asia-Pacific, innovation in foldable displays, touch-enabled secondary screens, and energy-efficient panels, environmental impact of material sourcing and electronic waste, and emerging use cases in multitasking, creative workflows, and hybrid work setups. |

The global dual screen laptops market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the dual screen laptops market is projected to reach USD 3.8 billion by 2035.

The dual screen laptops market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in dual screen laptops market are 13" to 14.9", up to 12.9" and more than 15”.

In terms of price, mid-range (usd 1,000 - usd 2,000) segment to command 52.4% share in the dual screen laptops market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA