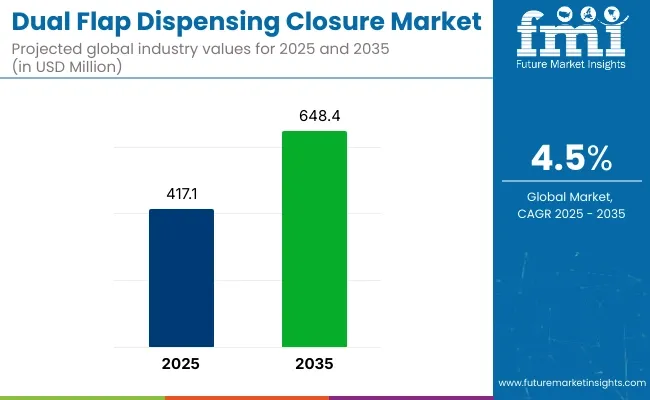

The dual flap dispensing closure market is projected to grow from USD 417.1 million in 2025 to USD 648.4 million by 2035, registering a CAGR of 4.5% during the forecast period. Sales in 2024 reached USD 399.1 million, reflecting a steady increase in demand across various industries.

This growth has been attributed to the rising need for convenient and user-friendly packaging solutions in sectors such as food and beverage, personal care, and household products. The increasing adoption of dual flap dispensing closures for products like spices, condiments, and seasonings has further propelled the market's expansion. Additionally, the surge in e-commerce and the demand for secure packaging have led to a higher utilization of advanced closure technologies globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 417.1 million |

| Industry Value (2035F) | USD 648.4 million |

| CAGR (2025 to 2035) | 4.5% |

In April 2025, Guala Closures, a world leader in the production of closures for the spirits, wine, water, beer, non-alcoholic beverage, and edible oil markets, inaugurated its new Greenfield manufacturing facility in West Africa, strategically located in the Lagos Free Zone.

“This investment underscores our commitment to advancing in the African market and creating value for our partners,” said Andrea Lodetti, CEO of Guala Closures. “Indeed, our global presence and in-depth knowledge of local markets allow us to stay close to our global customers, addressing their specific needs in every region of the world with customized solutions and outstanding service. By leveraging cutting-edge technologies and maintaining a strong focus on product quality and safety, we aim to enhance brand identity while offering robust protection against counterfeiting - an increasingly critical issue in the industry.”

The shift towards sustainable and environmentally friendly solutions has significantly influenced the dual flap dispensing closure market. Manufacturers have been focusing on developing closures that are recyclable, biodegradable, and made from renewable resources.

Innovations include the integration of biodegradable materials, modular designs, and the use of recycled components to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making dual flap dispensing closures an attractive option for environmentally conscious industries. Additionally, the development of automated manufacturing processes has enhanced efficiency and consistency in production, further driving market growth.

The dual flap dispensing closure market is poised for significant growth, driven by increasing demand in food and beverage, personal care, and household products industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of dual flap dispensing closures is anticipated to rise, offering cost-effective and eco-friendly solutions for product packaging and dispensing.

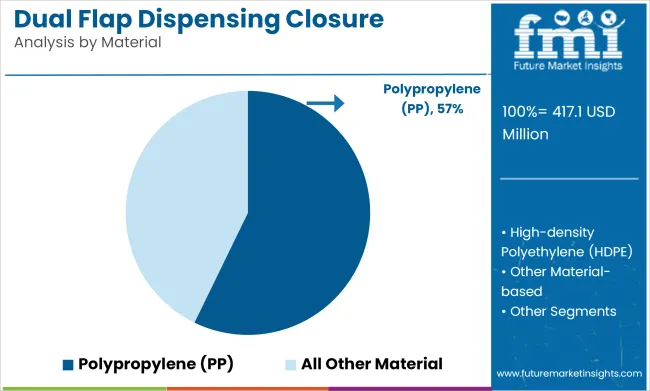

Polypropylene (PP) is projected to account for approximately 57.2% of the global dual flap dispensing closure market by 2025, as its adoption has been supported by high process ability, chemical resistance, and durability under repeated use. PP-based closures have been extensively utilized in dispensing applications that require precision flow control, hinge flexibility, and structural integrity under consumer handling.

Injection-molded PP closures have been manufactured to deliver tight sealing, repeated opening and closing without stress cracking, and a balance of stiffness and impact resistance. Food-grade PP has been particularly favored in condiment, seasoning, and dry food packaging where product hygiene and moisture protection are required.

Its compatibility with colorants, embossing, and custom mold designs has also enabled branding opportunities, while its recyclability has supported sustainability goals across packaging portfolios. Lightweight yet sturdy, PP closures have demonstrated an ability to reduce material consumption and shipping weight without compromising functionality.

As manufacturers aim to provide consumer-friendly, tamper-evident, and reusable packaging solutions, polypropylene is expected to remain the preferred material for dual flap dispensing closures across multiple end-use segments.

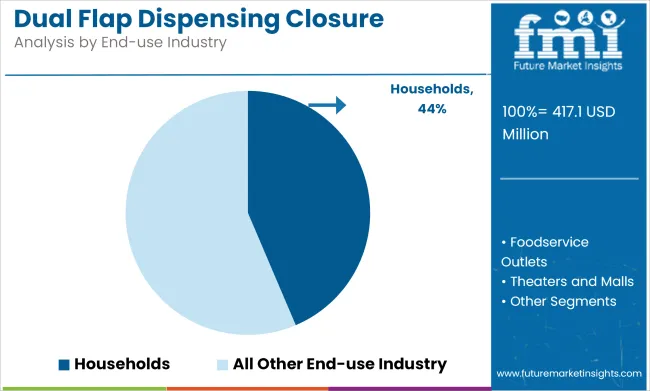

The households segment is anticipated to dominate the dual flap dispensing closure market by 2025, holding an estimated 43.6% market share, as these closures have been widely utilized in everyday packaging for pantry staples, cleaning agents, and personal care products. Their use has been driven by consumer expectations for convenience, portion control, and clean dispensing.

Dual flap closures have been integrated into bottles, jars, and pouches used for salt, spices, powdered detergents, sugar, and bath salts-enabling both wide and narrow openings for controlled dispensing. These closures have facilitated multi-functional use by offering options for pouring, sprinkling, or scooping from a single container.

Reusable packaging with dual flap closures has been adopted in households seeking to reduce plastic waste and reliance on disposable containers. Enhanced user control, ergonomic design, and moisture resistance have made such closures a standard in family-size and refillable packaging formats. As lifestyle trends continue to favor clutter-free organization, product reusability, and efficient kitchen and cleaning routines, the demand for dual flap dispensing closures in household applications is expected to grow steadily, sustaining its lead as the primary end-use segment in the market.

The Environmental Effect of Plastic Packaging

The biggest challenge for the dual flap dispensing closure market is likely the environmental effect of plastic packaging. Closures are fundamentally petroleum-derived polymers, and they contribute to the problem of plastic waste. As governments around the globe demand less plastic, business will be asked more and more to provide environmentally sustainable solutions that do not compromise product performance. Material science and recycling technology will be the solution to this issue.

Sustainable Materials Innovation

Increased focus on sustainability is a sound business opportunity. Firms are putting investments in manufacturing biodegradable and recyclable plastic lids to fulfill regulatory and customer acceptability standards. Bioplastics such as PLA (polylactic acid) and PHA (polyhydroxyalkanoates) also have good alternatives since they are as strong and handy as plastic but can be composted. Big packagers are also opting for reusable and refillable closure systems to reduce plastic waste and lengthen product life cycles.

USA dual flap dispensing closure market is increasing because of increased demand from personal care and the food industry. Demand by house meal and fast service restaurants for condiment squeeze bottle whiplash has also spurred innovation with controlled-dispensing and spill-proofing. Personal care is also a compelling driver, with companies using dual flap closure on shampoos, soap, and lotion to ensure hassle-free use in a hygienic way.

Sustainability requirements will be one of the key driving forces for the industry in the future. Use by the USA government of recyclable and compostable packaging will cause manufacturers to use bio-based polymers. Demand for refill and bespoke dispensing systems will be fueled by growth of subscription personal care and beauty businesses.

| Country | CAGR (2025 to 2035) |

|---|---|

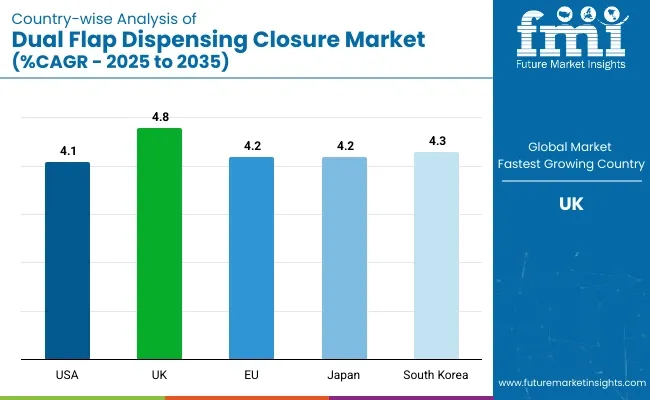

| USA | 4.1% |

UK's dual flap dispensing closure industry is growing due to the green packaging requirements under the Extended Producer Responsibility (EPR) policy. Light-weight mono-material dispensing closures are increasingly in demand, especially for packaging sauce, spread, and honey. The rise in plastic-free beauty and personal care packaging trends is also propelling companies towards switching to bio-based dispensing closures.

The British grocery market is still eager to purchase dual flap closures for high-end organic, healthy foods and others. Growth in application by retailers of refill stations is also driving demand for closure compatible with reusable and fillable pack formats.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

European Union dual flap dispensing closure industry is recording ongoing growth in conformity with superior sustainability standards pursuant to the EU Packaging and Packaging Waste Directive (PPWD). France, Germany, and Italy are the forerunner markets pursuing bio-based and compostable dispensing closures due to prioritizing plastic uptake diminution coupled with compliance with circular economy strategy.

The EU beverage and food industry still requires precision-dispensing solutions, such as for milk, sauces, and specialty beverages. The personal care industry is shifting toward metal-free hinges and fully recyclable dispensing caps to promote sustainability.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

Japanese dual flap dispensing closures market is also transforming in the aftermath of technology advancement and precision engineering of the packaging industry. Growing demand for on-the-go, travel-sized personal care and hygiene products is encouraging demand for new-generation dispensing closures. Additionally, country regulations regarding recycling waste are driving consumption of recyclable and reusable dispensing closures for application in consumer goods packaging.

Japan's food market, encompassing specialty drinks, condiments, and sauces, is utilizing advanced oxygen-barrier dispensing closures to protect product freshness. Electronic packaging integration is on the rise, with closures having QR codes to enable interactive consumer engagement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Market growth is fueled for South Korea dual flap dispensing closure by e-packaging and e-commerce growth. South Korea's growing cosmetics and beauty market is one of the main consumers of high-end dispensing closure, especially personal care and skin care cosmetics.

Food product packaging such as instant noodle spices, sauces, and condiments are moving towards precision-dispensing pack solutions in the name of convenience and reduction in product waste. Environmentally friendly packaging alternatives backed by state policies are pressurizing companies to adopt PCR-based materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

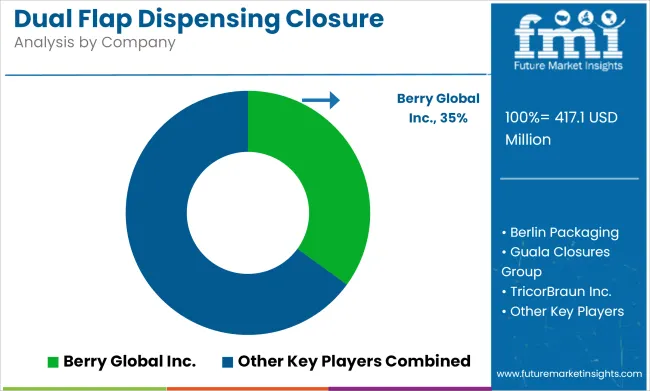

The dual flap dispensing closure market is a competitive market, with the market dominated by large international manufacturers and regional players with product innovation and growth markets combinations. Market leaders focus on convenience development, spill-proof functionality, and reducing material unsustainability.

The market has developed dominant industry players with strong distribution networks and new entrants with innovative designs and low-cost manufacturing processes. Growth of food and beverage, personal care, and home and household products businesses continues to fuel demand for new dispensing solutions.

The overall market size for the dual flap dispensing closure market was USD 417.1 million in 2025.

The dual flap dispensing closure market is expected to reach USD 648.4 million in 2035.

The increasing adoption of convenient packaging solutions in the food, personal care, and household product industries fuels the dual flap dispensing closure market during the forecast period.

The top 5 countries driving the development of the dual flap dispensing closure market are the USA, Germany, China, India, and Brazil.

On the basis of end-use, the food packaging segment is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Dual-Ovenable Cook Trays Market

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA