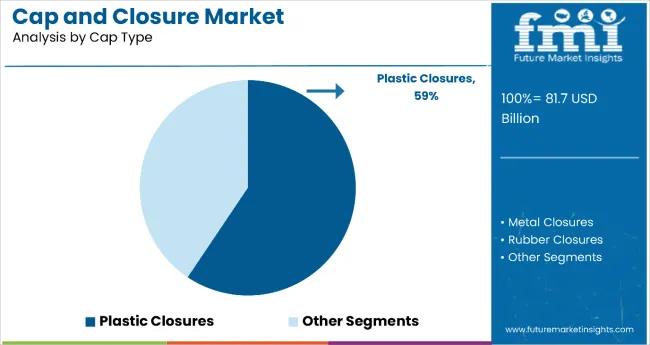

The global caps and closures market is projected to reach USD 81.7 billion by 2025 and expand to USD 125.7 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.4% over the forecast period. In 2024, the market revenue was recorded at USD 79.2 billion. Plastic closures are anticipated to dominate the market, accounting for over 59% of the total market share by 2035.

This dominance is attributed to advanced manufacturing techniques like injection molding, which allow for complex designs and precise fits. Additionally, plastic closures offer safety features such as tamper evidence and child-resistant mechanisms.

The beverage industry is expected to be the primary end-use segment, capturing more than 34% of the market share during the forecast period. Caps and closures in this sector ensure product freshness, prevent contamination, and provide convenience to consumers. They are extensively used in packaging water, juices, soft drinks, and alcoholic beverages.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 81.7 Billion |

| Industry Value (2035F) | USD 125.7 Billion |

| CAGR (2025 to 2035) | 4.4% |

In a statement, Rich Riley, Co-CEO of Origin Materials, emphasized the company's focus on sustainable solutions: "Today we foresee rapid near-term growth in the caps and closures market, where we offer a powerful solution for product performance and recycling circularity." The market is also witnessing a shift towards sustainable and recyclable packaging solutions.

Manufacturers are focusing on developing eco-friendly materials and designs to meet consumer preferences and regulatory requirements. For instance, companies are investing in post-consumer recycled (PCR) materials for closures, aligning with global sustainability goals.

Geographically, the Asia-Pacific region is emerging as a significant market for caps and closures, driven by the expanding food and beverage industry and increasing consumer awareness of sustainable packaging options. The region's growing e-commerce sector and changing consumer lifestyles are further propelling the demand for convenient and eco-friendly packaging solutions.

Key players in the caps and closures market include Amcor, AptarGroup, Crown Holdings, Berry Global, and Silgan Holdings are investing in research and development to introduce innovative packaging solutions that meet the evolving needs of consumers and industries.

The industry is poised for significant growth over the next decade, driven by its advantages in cost, sustainability, and convenience, particularly within the beverage industry. Continued innovation and adaptation to consumer preferences and regulatory standards will be crucial for companies aiming to capitalize on this expanding market.

Raw material innovation is rapidly reshaping the cap & closure market across leading global economies, with sustainability, regulatory compliance, and cost-efficiency at the core of national strategies. From plant-based alternatives in Asia to lightweight engineering in Europe, each economy is driving advances that reflect both regional policy priorities and evolving consumer expectations.

Environmental compliance is becoming a defining force in the cap & closure market, with top economies aligning their packaging policies to reduce waste, promote recyclability, and encourage material innovation. Regulatory shifts are accelerating investments in lightweight designs, tethered caps, biodegradable alternatives, and closed-loop systems that align with circular economy goals.

The below table presents the expected CAGR for the global cap & closure market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 2.0% (2023 to 2034) |

| H2 | 3.2% (2023 to 2034) |

| H1 | 2.9% (2024 to 2035) |

| H2 | 4.3% (2024 to 2035) |

In the first half (H1) of the decade from 2023 to 2033, the business is predicted to surge at a CAGR of 2.0%, followed by a slightly higher growth rate of 3.2% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 2.9% in the first half and remain relatively moderate at 4.3% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 110 BPS.

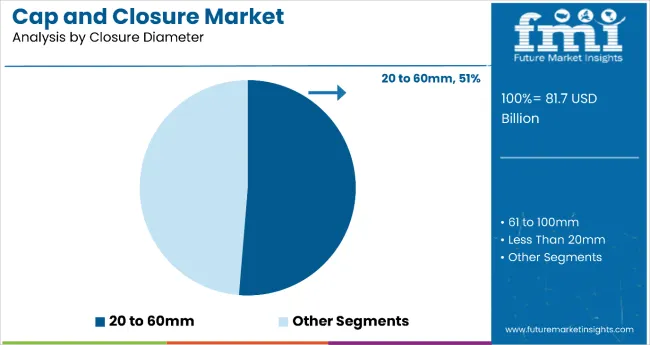

The 20 to 60 mm closure diameter segment is projected to lead the market, capturing a significant 51% market share by 2025. This diameter range is highly preferred across multiple industries due to its optimal balance between functionality and consumer convenience. Closures within this range effectively seal beverage bottles, including water, soft drinks, juices, and other liquid consumables, ensuring both product integrity and ease of use.

In the food sector, closures sized between 20 and 60 mm are extensively employed for jars and containers, providing efficient tamper-evident and resealable solutions. Additionally, household products such as cleaning solutions and personal care items heavily utilize these closures because they are easy to grip and reseal. The widespread adoption of automation in packaging lines further enhances operational efficiency with closures in this range, making it a preferred choice for manufacturers like Coca-Cola, PepsiCo, and Unilever.

Plastic closures are anticipated to dominate the caps & closures market, commanding a notable 59% market share by 2025. These closures are widely favored due to their cost-effectiveness, lightweight nature, and superior resealable properties. Plastic closures provide significant advantages over metal alternatives, including corrosion resistance, making them highly suitable for beverages, pharmaceuticals, and household products.

Manufacturers increasingly rely on plastic closures because they are economical to produce at scale and demonstrate remarkable durability and flexibility. Additionally, plastic closures are compatible with automated production processes, thus enhancing efficiency. Companies such as Nestlé, Procter & Gamble, and Johnson & Johnson extensively utilize plastic closures due to their excellent sealing capability, consumer convenience, and sustainability potential through recyclable materials.

Tamper evident and child-resistant closures are primarily driving the global cap and closure market in the pharmaceutical, food, and chemical fields. Such features like the breakable seal on the closures provide tamper-evident proof to hold integrity by offering the user visibly whether the package has been opened or was tampered, thus preventing cases such as contamination and fraud.

Pharmaceutical and chemical products require child-resistant closures as they save the product from accidental ingestion by children; it is safe and provides conformity with regulatory measures. As the awareness among consumers regarding safety increases, the demand for these closures builds up, forcing manufacturers to innovate and implement more appropriate security across almost all industries.

Brand focuses on unique and functional closures that will improve its market presence and capture attention from consumers. Custom caps with embossed logos, vibrant colors, and distinctive shapes make the products stand out in shelves. Innovative designs, such as easy-pour and ergonomic closures, capture the demand from the consumer for convenience and comfort. These designs improve the user experience with regard to ease of use, safety, and reliability.

Companies also have other features like child-resistant closures or tamper-evident seals to achieve compliance with the standards and secure consumer safety. As the competitive packaging landscape continues to evolve, companies continue investing in these customized and innovative closures to strengthen brand identity and differentiate their products in the global market.

The caps and closures industry depends on petroleum-based polymers like polypropylene (PP) and polyethylene (PE). These are based on crude oil. The crude oil price has been volatile with geopolitical tensions, supply chain disruption, and varying global demand, and hence these raw materials might increase in price unexpectedly.

This directly affects production costs, thereby making it difficult for manufacturers to maintain stable prices. Further, alternative materials are often expensive, which also affects the profit margin. Abrupt price hikes of resin materials will force companies to look for ways to reduce cost, possibly compromising quality or efficiency in production. Such raw material price volatility might deter market growth.

The global market for cap & closure grew at a CAGR of 3.1% during the historical period between 2020 and 2024. The cap & closure market globally was observed to be positively growing as it reached a value of USD 79.2 billion in 2024 from USD 69.8 billion in 2020.

Between 2020 and 2024, the global sales of caps and closures continuously expanded due to the increased demand in food, beverage, and pharmaceutical sectors. Moreover, the growth in e-commerce expansion and the preference of consumers for convenience-oriented packaging further propelled the sales growth where innovative designs catered for individual industry needs.

From 2025 to 2035, cap and closure demand is expected to increase as concern for sustainability escalates. Because of the growth in the usage of eco-friendly materials and the recyclable packing of industries, the market would shift towards the biodegradable and reusable closings. Demand for premium and functional packaging for consumers will lead to further development in this domain.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Berry Global Group, Inc., Amcor plc, Silgan Holdings and AptarGroup.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include BERICAP Holding GmbH, Crown Holdings, Inc., Guala Closures Group, C.L. Smith, Tecnocap S.p.A, UNITED CAPS, Nippon Closures Co., Ltd., PELLICONI & C. SPA, The Massilly Group, Tetra Pak International S.A and Phoenix Closures, Inc.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach.

Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

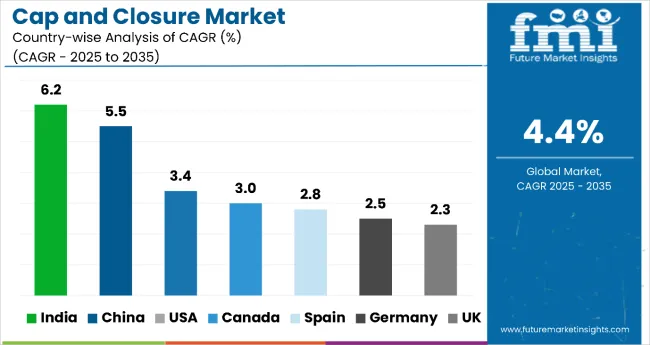

The section below covers the future forecast for the cap & closure market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.4% through 2035. In Europe, Germany is projected to witness a CAGR of 2.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

| Germany | 2.5% |

| China | 5.5% |

| UK | 2.3% |

| Spain | 2.8% |

| India | 6.2% |

| Canada | 3.0% |

On-the-go packaging has been in huge demand in the USA market since consumer lifestyles continue to hasten. This shift has brought about great demand for user-friendly closures like flip-top lids and resealable caps, which can provide ease and portability convenience for customers. Such closures enable consumers to open and close packages easily, ensuring that products constantly stay fresh and easy to consume when on the go.

For example, beverage brands like Coca-Cola designed bottles with screw caps to prevent leakage and easy use for multiple times. This trend represents the need for packaging that accommodates the modern, mobile lifestyle, enhancing convenience and user experience.

Wide geographies and extreme climatic conditions in Canada demand closures that can withstand significant temperature fluctuations, especially in remote or northern regions. Closures will have to ensure integrity in transport across long distances under cold or very hot temperatures in most cases.

For instance, in the beverages industry, closures for bottled drinks are engineered to prevent cracking or warping under freezing temperatures, thus being able to function without malfunction during transport and storage. Some beverage packaging companies are using induction seals, which create a strong, airtight seal. They are designed to be resistant to extreme cold conditions and will not leak or allow contamination. Therefore, the freshness of the product is preserved even across Canada's diverse climates.

Key players of global cap & closure industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

In terms of cap type, the industry is segmented into plastic closures, metal closures, rubber closures and cellulose screw caps and seals.

In terms of closure diameter, the industry is segmented into less than 20 mm, 20 to 60 mm, 61 to 100 mm and more than 100 mm.

End users of cap & closure include food, beverages, pharmaceuticals, cosmetics & personal care, household & toiletries, chemical & petrochemical and others.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The global cap & closure industry is projected to witness CAGR of 4.4% between 2025 and 2035.

The global cap & closure industry stood at 79.2 billion in 2024.

Global cap & closure industry is anticipated to reach USD 125.7 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.1% in assessment period.

The key players operating in the global cap & closure industry include Berry Global Group, Inc., Amcor plc, Silgan Holdings and AptarGroup.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Material, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Material, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Cap Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Cap Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Closure Diameter, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by Closure Diameter, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 26: Global Market Attractiveness by Cap Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Material, 2024 to 2034

Figure 28: Global Market Attractiveness by End Use, 2024 to 2034

Figure 29: Global Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 56: North America Market Attractiveness by Cap Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Material, 2024 to 2034

Figure 58: North America Market Attractiveness by End Use, 2024 to 2034

Figure 59: North America Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Cap Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 88: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Cap Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Cap Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Cap Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Cap Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 208: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Cap Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Closure Diameter, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Cap Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Cap Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Cap Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Cap Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Closure Diameter, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Closure Diameter, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Closure Diameter, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Closure Diameter, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Cap Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Closure Diameter, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Cap & Closure Market Trends & Forecast 2024-2034

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capacitance Meter Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capryloyl Glycine Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Caprylic Capric Triglyceride Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Capnography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Market Share Breakdown of Capsule Filling Machine Manufacturers

Examining Market Share Trends in the Cap Liner Industry

Competitive Breakdown of Capsaicin Manufacturers

Capacitive Touchscreen Market Insights – Growth & Forecast through 2034

Global Caprolactam Market Analysis - Size, Share & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA