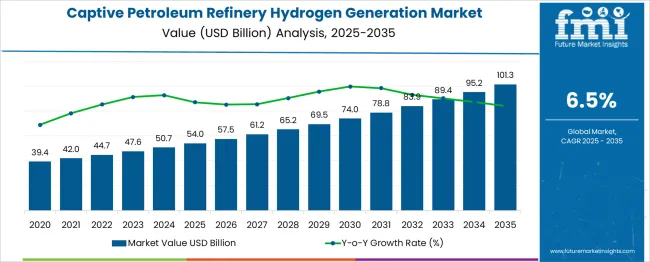

The captive petroleum refinery hydrogen generation market is estimated to be valued at USD 54.0 billion in 2025 and is projected to reach USD 101.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The 10-year growth trajectory shows a steady upward trend, with values reaching USD 42.0 billion in 2021, USD 44.7 billion in 2022, USD 47.6 billion in 2023, USD 50.7 billion in 2024, and USD 54.0 billion in 2025, contributing USD 14.6 billion in the first half, which accounts for about 24% of total growth. The second half (2025–2030) delivers USD 26.7 billion, or 43% of the overall increase, as the market advances through USD 57.5 billion in 2026, USD 61.2 billion in 2027, USD 65.2 billion in 2028, USD 69.5 billion in 2029, and USD 74.0 billion in 2030, confirming a moderately back-weighted growth pattern.

The decade multiplier stands at 2.57x, with the first half registering around 1.37x and the latter half showing a multiplier of approximately 1.36x, indicating consistent momentum across the forecast period. This growth is driven by rising demand for hydrogen as a clean fuel alternative, increasing refinery capacity expansions, and regulatory pressures to reduce carbon emissions. Companies focusing on advanced hydrogen generation technologies, process efficiency improvements, and integration with petrochemical operations are expected to capture a competitive advantage in this expanding market segment.

| Metric | Value |

|---|---|

| Captive Petroleum Refinery Hydrogen Generation Market Estimated Value in (2025 E) | USD 54.0 billion |

| Captive Petroleum Refinery Hydrogen Generation Market Forecast Value in (2035 F) | USD 101.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The captive petroleum refinery hydrogen generation market occupies a specialized but crucial role within the energy and refining sector. In the overall hydrogen production market, captive refinery hydrogen generation accounts for approximately 35–38%, reflecting its integration into refining processes for desulfurization and hydrocracking operations. Within the petroleum refining operations market, its share stands at nearly 28–30%, driven by the mandatory compliance with ultra-low sulfur fuel regulations and increasing reliance on hydrogen for cleaner fuel output.

In the broader industrial hydrogen consumption landscape, this segment contributes around 20–22%, as refinery-based hydrogen generation continues to serve internal operational needs over external merchant supply. For the refining gas processing and treatment ecosystem, captive hydrogen systems represent roughly 18–20%, influenced by technological upgrades in steam methane reforming (SMR) units and partial oxidation technologies. Growth is driven by stringent fuel standards, rising demand for middle distillates, and investments in residue upgradation projects across refineries worldwide. Key developments include the deployment of energy-efficient hydrogen generation units, integration of carbon capture solutions, and digitization of plant operations for optimized gas output. With increasing regulatory pressure on emissions, captive hydrogen systems remain pivotal for refinery modernization initiatives, ensuring compliance and operational flexibility while reducing reliance on third-party hydrogen suppliers. This positions captive refinery hydrogen generation as a strategic enabler for future-ready refining operations across global markets.

The captive petroleum refinery hydrogen generation market is undergoing a significant transformation driven by the rising emphasis on cleaner fuel production and refinery efficiency optimization. As global environmental regulations continue to tighten, refineries are increasingly focused on reducing sulfur content in fuels, which has expanded the demand for high-purity hydrogen generation solutions.

A growing preference for on-site hydrogen production over merchant supply is being observed due to the flexibility, cost advantages, and consistent availability it offers. Technological advancements in process efficiency, integration of energy recovery systems, and pressure to meet hydrogen intensity targets under emerging energy transition frameworks are contributing to future market potential.

Furthermore, investments in modernization of aging refining infrastructure, especially in Asia and the Middle East, are reinforcing the role of hydrogen in desulfurization and hydrocracking applications. The ability to reduce carbon intensity within traditional refining processes through controlled, captive hydrogen generation is expected to shape the trajectory of this market in the coming years..

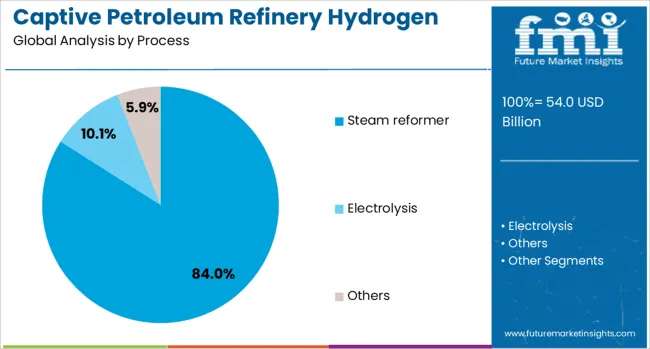

The captive petroleum refinery hydrogen generation market is segmented by process and geographic regions. The captive petroleum refinery hydrogen generation market is divided into Steam reformer, Electrolysis, and Others. Regionally, the captive petroleum refinery hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reformer subsegment within the process segment is projected to account for 84% of the Captive Petroleum Refinery Hydrogen Generation market revenue share in 2025, making it the leading process technology. This dominance has been driven by the process's proven reliability, scalability, and cost-effectiveness in generating high-purity hydrogen required for refinery operations.

Steam reforming has been widely adopted due to its ability to integrate seamlessly with existing refining infrastructure and its compatibility with natural gas, which remains a relatively abundant and economically viable feedstock in several regions. The thermal efficiency and established engineering design standards of steam reforming units have enabled refiners to optimize operations and ensure a steady hydrogen supply for hydroprocessing applications.

Furthermore, the widespread expertise and operational familiarity with this process have minimized risks during deployment and maintenance, contributing to its sustained preference. As refineries increasingly seek to align with low-emission targets while maintaining economic efficiency, steam reforming continues to be the cornerstone of captive hydrogen generation strategies..

Captive hydrogen generation in refineries is expanding due to cost benefits, compliance needs, and operational reliability, supported by SMR advancements and CCS integration. However, high capital costs, gas price volatility, and competitive supply options remain key challenges.

Captive hydrogen generation has become indispensable in petroleum refineries as desulfurization and hydrocracking requirements intensify. Refineries increasingly rely on in-house hydrogen production to comply with stringent fuel quality standards, particularly for ultra-low sulfur diesel and gasoline. Rising global demand for cleaner-burning fuels has amplified the adoption of steam methane reforming (SMR) and partial oxidation technologies for hydrogen generation within refineries. Dependence on captive systems enables cost control and reduces exposure to price volatility in the merchant hydrogen market. This shift is particularly evident in Asia-Pacific and Middle Eastern markets, where refining capacity expansions are actively incorporating hydrogen generation units to enhance operational flexibility and meet emission compliance requirements.

Captive hydrogen generation provides significant cost benefits for refineries compared to sourcing hydrogen externally. With crude oil processing complexity rising, hydrogen-intensive processes such as hydrocracking and residue upgrading are becoming essential for maximizing product yields. This has prompted refineries to prioritize investment in dedicated hydrogen generation units to optimize long-term operating margins. Energy efficiency improvements in SMR units and heat recovery systems further lower hydrogen production costs. Additionally, growing emphasis on operational reliability encourages refiners to adopt self-sufficiency strategies, reducing supply chain disruptions. Such economic factors strengthen the business case for captive hydrogen generation, especially in regions with volatile natural gas prices influencing hydrogen production economics.

While conventional SMR continues to dominate, refiners are adopting process optimizations such as enhanced heat integration and oxygen-blown gasification to boost hydrogen yield and efficiency. Integration of carbon capture and storage (CCS) systems within hydrogen units is gaining importance for meeting emission reduction targets, particularly in regions with strict regulatory frameworks. Digital process control solutions, predictive analytics, and automation are also being introduced to monitor hydrogen purity and ensure stable supply to hydrotreating units. These improvements are not only lowering operational costs but also enhancing equipment reliability and uptime. As refineries move toward energy-efficient processes, the optimization of captive hydrogen generation remains a critical operational priority.

Despite its strategic importance, the captive hydrogen generation market faces challenges such as high capital expenditure for SMR installations and fluctuating natural gas prices, which significantly affect hydrogen production economics. Regulatory uncertainty and growing competition from alternative hydrogen supply models, including merchant and pipeline-based services, add to complexity. Additionally, integrating CCS systems to address emission concerns increases initial investment requirements for refineries. The competitive landscape is shaped by technology providers offering turnkey hydrogen units with advanced control systems and flexible capacity options. Overcoming these hurdles requires refiners to balance investment strategies with long-term compliance objectives, ensuring steady operational performance amid shifting energy and environmental policies.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

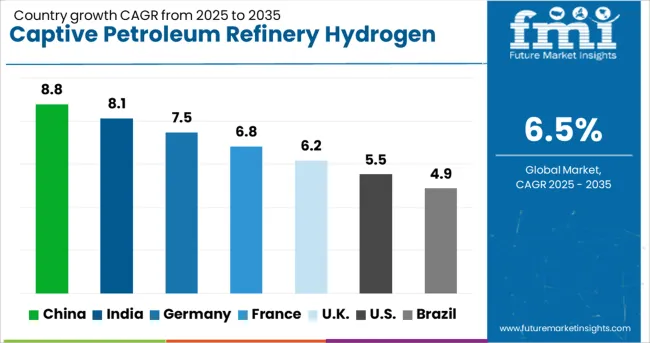

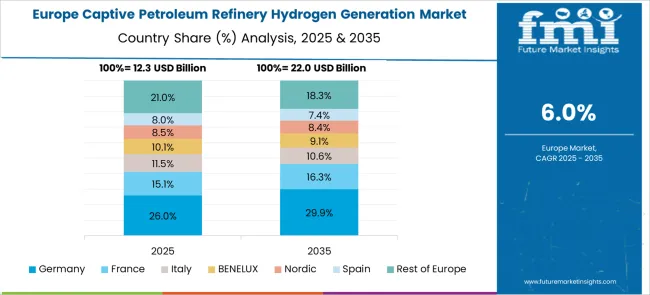

The captive petroleum refinery hydrogen generation market is forecasted to expand globally at a CAGR of 6.5% from 2025 to 2035, driven by the increasing integration of hydrogen in desulfurization, hydrocracking, and fuel quality improvement processes. China leads with a CAGR of 8.8%, supported by expanding refining capacity, stringent fuel standards, and large-scale adoption of steam methane reforming (SMR) units. India follows at 8.1%, benefiting from rising investments in refinery upgrades, growing demand for ultra-low sulfur fuels, and government-backed modernization programs. France achieves 6.8%, propelled by enhanced refinery integration projects and focus on high-purity hydrogen for clean fuel output. The United Kingdom grows at 6.2%, supported by refinery reliability programs and integration of CCS-enabled hydrogen systems, while the United States records 5.5%, driven by steady downstream investments and adoption of low-emission hydrogen generation technologies. The report includes insights from more than 40 countries, with these six representing key strategic benchmarks for global hydrogen generation growth.

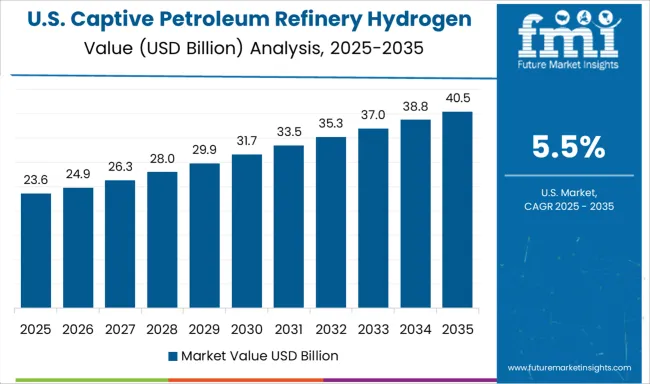

The CAGR for the captive petroleum refinery hydrogen generation market in the United States moved from nearly 4.6% during 2020–2024 to 5.5% in the 2025–2035 period, as refiners accelerated investments to meet low-sulfur fuel standards. The earlier phase saw moderate growth due to limited refinery expansions and dependence on merchant hydrogen supply. A sharper increase in the next decade is attributed to optimization of existing SMR units, higher adoption of CCS-enabled hydrogen systems, and modernization programs in large Gulf Coast refineries. Strategic partnerships with technology providers and growing integration of predictive monitoring tools improved operational efficiency and reduced energy costs, strengthening captive hydrogen adoption in U.S. refineries.

The CAGR in the United Kingdom moved from approximately 4.4% in 2020–2024 to 5.4% for 2025–2035, reflecting accelerated investments in small animal clinics and specialized veterinary care centers. The adoption of technologically integrated examination tables and foldable treatment units became widespread during this period. Rising demand for compact and functional furniture solutions in urban practices and growing preference for adjustable-height treatment tables supported expansion. Additionally, the trend toward incorporating stainless steel and antimicrobial surfaces in furniture design contributed to higher procurement volumes. Retail chains are expanding veterinary service sections, boosting demand for standardized and cost-efficient furniture packages.

India’s CAGR rose from 6.5% during 2020–2024 to 8.1% between 2025 and 2035, driven by growing investments in refinery modernization and demand for ultra-clean fuels. Early growth was influenced by partial upgrades in major refineries like Jamnagar and Paradip, focusing on integrated hydrogen production units. A stronger rise in the later period resulted from greenfield refinery projects, increased government mandates on fuel quality, and improved economics of captive generation over merchant supply. Adoption of automation and integration of energy recovery systems has further enhanced cost efficiency for Indian refiners.

The CAGR for China moved upward from 7.2% during 2020–2024 to 8.8% for 2025–2035, supported by massive refinery expansions and government-backed programs for ultra-low sulfur fuel adoption. The initial growth phase was dominated by large-scale installations in coastal refining hubs, with refiners prioritizing energy security through self-sufficient hydrogen production. The next decade is expected to see accelerated integration of high-capacity SMR units, carbon capture facilities, and enhanced thermal recovery systems for improved hydrogen yield. State-owned enterprises are entering long-term agreements with global technology providers to build energy-efficient hydrogen plants.

France experienced an improvement in CAGR from 5.4% in 2020–2024 to 6.8% during 2025–2035, reflecting growing emphasis on fuel quality and refinery integration initiatives. Earlier growth remained conservative due to regulatory delays and slow capital allocation toward hydrogen projects. In the following decade, capacity additions in key refining clusters, integration of CCS with SMR systems, and energy optimization measures accelerated adoption. Increased investments in R&D for low-emission refining and digitization of plant operations further contributed to the momentum, ensuring hydrogen reliability for hydrocracking and desulfurization units.

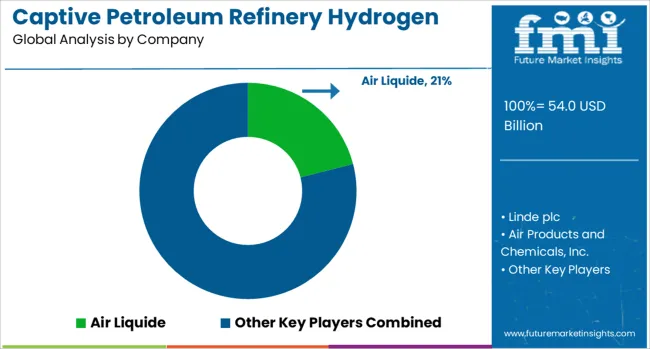

The captive petroleum refinery hydrogen generation market is shaped by a strong network of global engineering and industrial gas companies offering integrated hydrogen production solutions. Air Liquide is a leading player, recognized for deploying advanced SMR and CCS-enabled hydrogen systems that ensure operational efficiency for refineries. Linde plc focuses on customized hydrogen generation units, emphasizing energy recovery and digital monitoring to help refiners meet stringent emission compliance requirements. Air Products and Chemicals, Inc. maintains a dominant role in supplying turnkey hydrogen plants, leveraging expertise in partial oxidation technologies for large-scale refinery applications. Cummins Inc. has expanded its hydrogen portfolio by introducing advanced electrolyzer systems, supporting hybrid strategies for refineries seeking both conventional and low-carbon hydrogen solutions.

Technip Energies is a key technology integrator, delivering engineering, procurement, and construction (EPC) services for SMR-based hydrogen generation units with an increasing focus on decarbonization frameworks. Competitive dynamics center on efficiency, integration of carbon capture technologies, and cost-optimized solutions that balance regulatory compliance with long-term profitability. These companies are also prioritizing strategic partnerships, refinery modernization projects, and regional capacity expansions to capitalize on rising hydrogen demand in Asia-Pacific and Middle Eastern refining hubs. Growth opportunities are being driven by the global shift toward clean fuels, adoption of advanced thermal recovery systems, and integration of predictive maintenance technologies in hydrogen units to ensure reliability and operational continuity for refinery operators.

In November 2024, Air Liquide launched a major green hydrogen project with Total Energies in Southern France, a European flagship involving large‑scale electrolyser deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 54.0 Billion |

| Process | Steam reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde plc, Air Products and Chemicals, Inc., Cummins Inc., and Technip Energies |

| Additional Attributes |

The global captive petroleum refinery hydrogen generation market is estimated to be valued at USD 54.0 billion in 2025.

The market size for the captive petroleum refinery hydrogen generation market is projected to reach USD 101.3 billion by 2035.

The captive petroleum refinery hydrogen generation market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in captive petroleum refinery hydrogen generation market are steam reformer, electrolysis and others.

In terms of , segment to command 0.0% share in the captive petroleum refinery hydrogen generation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Electrolysis Captive Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA