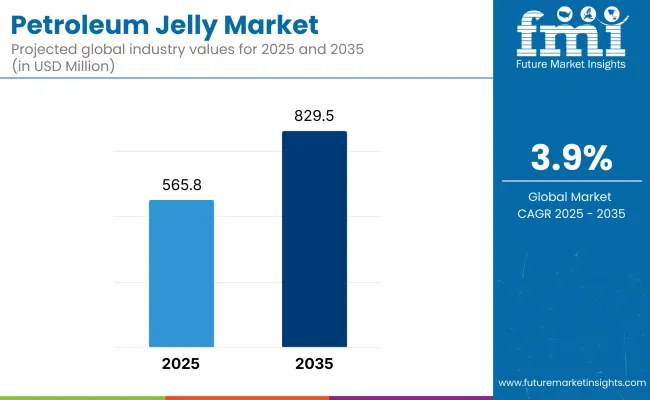

The demand for petroleum jelly worldwide will remain constant as the use of petroleum jelly in pharmaceuticals, personal and cosmetics, continue to grow. The GDP for the forecast period is expected to be USD 565.8 million in 2025, USD 829.5 million in 2035, representing a CAGR of 3.9% for the market during the predicted period.

Petroleum jelly is filled with moisturizers, lubricants, protective and healing agents, and they have widespread use their industries. This is owing to the rising demand for medical grade and skincare petroleum jelly its rising usages in coatings, other applications includes rust prevention and also for industrial processing acts as a growth factor for the market. However, market growth is constrained by problems associated with petroleum-based formulations, regulations and competition from the other natural alternatives.

North America remains a leading marketplace for petroleum jelly, supported by stable demand from the personal care, medical and pharmaceutical industries. Medicinal-grade and dermatological Petroleum Jelly has gained significant traction in the United States and Canada, used primarily in moisturizing lotions, lip care, and wound healing products.

The growing demand for hypoallergenic and fragrance-free formulations and the presence of major cosmetics and skincare brands are contributing to market growth. Moreover, petroleum jelly-based industrial lubricants and protective coatings further witnesses demand across manufacturing and automotive segments.

In Europe, the growth in petroleum jelly consumption is moderate, mostly in premium skincare and baby care, followed by pharmaceutical applications. Countries including Germany, France, the UK, and Italy are at the forefront of market growth of high-purity petroleum jelly for dermatological and medical formulations.

Stringent EU regulations on hydrocarbon-based skincare products have prompted a move toward purified, low-toxicity, and natural-derived alternatives. Moreover, growing utilization in mechanical lubrication, anti-corrosion coatings, and food-grade processing applications are creating industrial demand.

It is projected that the Asia-Pacific region will witness the fastest growth during the forecast period, owing to the increasing disposable income, growing beauty and personal care industry, and increasing pharmaceutical manufacturing in countries such as China, India, Japan, and South Korea. Being the largest producer and consumer of petroleum-based derivatives, China has a considerable domestic and export demand for cosmetic and industrial petroleum jelly.

As for India, the growth of traditional healing and Ayurveda skincare is contributing to the inclusion of petroleum jelly in herbal and therapeutic ointments. Japan and South Korea’s innovation of high-end beauty and skincare formulations is also further fuelling market growth.

Challenges: Crude Oil Dependency and Regulatory Concerns

Petroleum jelly production is highly dependent on crude oil refining, making it susceptible to price fluctuations and environmental concerns. Additionally, strict regulations on hydrocarbon-based skincare ingredients in certain regions are encouraging the development of plant-based alternatives.

Opportunities: Organic and Dermatological Innovations

This trend of natural, organic, and hypoallergenic formulations offers new avenues for growth in the skincare and pharmaceutical sectors. To appeal to these consumers, companies are devising ultra-purified, fragrance-free, therapeutic-grade petroleum jelly suitable for sensitive skin and medical applications. Innovations regarding food-grade, biodegradable, and eco-friendly variants are also extending product industrial capabilities.

Petroleum jelly market is witnessing moderate growth between 2020 and 2024 owing to increasing demand from personal care, pharmaceuticals, and industrial. High-purity, fragrance-free, and medicated petroleum jelly just kept moving its way up the ranks, leading the charge on global scales through skincare, wound care and cosmetic formulations.

Refinement Processes, Hypoallergenic Ingredient formulations and Eco-friendly Packaging made the products a more appealing and compliant to safety regulation globally. But barriers to growing the market have included tightening regulatory scrutiny of petroleum-based products, sustainability concerns, and competition from plant-based alternatives.

From 2025 to 2035, expect a transitioning market to fuel bioengineered petroleum-free solutions, improved formulation with AI, and convolution with smart-packaging. This will involve the integration of AI-driven skin hydration analytics, eco-friendly packaging solutions, and lab-engineered hydrocarbon jelly substitutes for increased efficiency and cost-effectiveness.

Breakthroughs in self-healing skin barrier formulations, automated dermatological personalization through machine learning, and blockchain-based supply chain transparency will continue to revolutionize our industry. Market trends will also evolve through the introduction of carbon-neutral petroleum jelly manufacturing processes, AI-driven efficacy-based optimization of product formulations, and of course environmental sourcing of ingredients responsible for the product.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EU cosmetic safety regulations, and pharmaceutical-grade petroleum jelly standards. |

| Formulation Innovation | Use of triple-purified petroleum jelly, hypoallergenic variants, and scented/medicated formulations. |

| Industry Adoption | Growth in personal care, pharmaceutical, and industrial lubrication applications. |

| Smart & AI-Enabled Solutions | Early adoption of moisturizing sensors in skincare, recyclable packaging, and enhanced purity testing. |

| Market Competition | Dominated by legacy petroleum jelly manufacturers, skincare brands, and pharmaceutical suppliers. |

| Market Growth Drivers | Demand fueled by rising skincare awareness, increasing demand for wound healing solutions, and expansion of cosmetic-grade petroleum jelly. |

| Sustainability and Environmental Impact | Early adoption of recyclable packaging, sustainable refining processes, and reduced petroleum-based waste. |

| Integration of AI & Digitalization | Limited AI use in basic dermatological research and refining quality control. |

| Advancements in Manufacturing | Use of traditional refining, manual quality testing, and batch-based purification techniques. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance monitoring, blockchain-backed ingredient traceability, and carbon-neutral petrochemical sourcing mandates. |

| Formulation Innovation | Adoption of bioengineered petroleum-free jelly, AI-optimized hydration formulas, and dermatology-driven smart skincare applications. |

| Industry Adoption | Expansion into AI-driven personalized skincare, eco-friendly alternatives, and smart-packaging-integrated petroleum jelly solutions. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-powered real-time skin hydration tracking, biodegradable smart packaging, and adaptive skincare formulations. |

| Market Competition | Increased competition from AI-integrated skincare companies, plant-based petroleum jelly alternatives, and biotech-driven dermatology firms. |

| Market Growth Drivers | Growth driven by AI-powered personalized skincare, lab-grown petroleum-free alternatives, and zero-waste product lifecycle strategies. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral production, AI-driven material efficiency, and fully biodegradable petroleum jelly alternatives. |

| Integration of AI & Digitalization | AI-powered real-time hydration analytics, blockchain-backed supply chain sustainability, and AI-assisted dermatological product customization. |

| Advancements in Manufacturing | Evolution of lab-engineered hydrocarbon alternatives, AI-assisted skincare formulation balancing, and 3D-printed personalized skincare products. |

North America, specifically the United States, is the biggest regional market for petroleum jelly, followed by Europe. The rise in consumer preference for multipurpose moisturizing products and the growth of medical and personal care applications are among the factors boosting the market growth.

Increasing adoption of petroleum jelly as a base ingredient in cosmetic formulations is another factor playing in favour of market developments. Moreover, the continuous advancement in refining methods for high-purity, fragrance-free, and hypoallergenic variants adds to the product appeal. Moreover, the market is gaining from the growing utilization of e-commerce in the distribution of personal care products.

| Country | CAGR (2025 to 2035) |

|---|---|

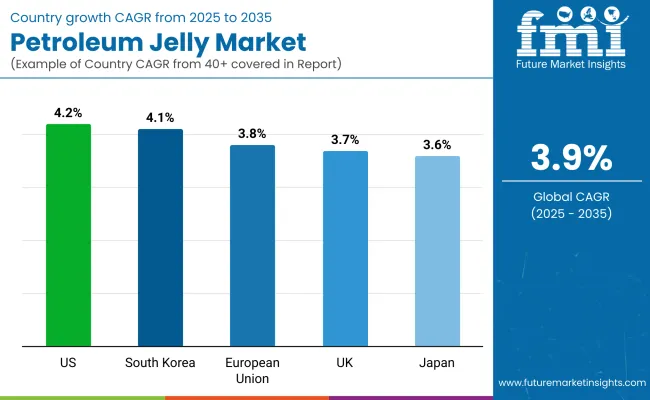

| United States | 4.2% |

In the UK, the petroleum jelly market is seeing positive momentum driven by an increase in awareness and demand for skincare products, the introduction of pharmaceutical-grade petroleum jelly, and an increase in applications in industrial lubricants and rust prevention. The widening scope of organic and hypoallergenic product lines, especially in the beauty and personal care sectors, is also shaping market trajectories.

The emerging sustainable packaging trend and green formulations are also influencing product development. Growing use of petroleum jelly in tattoo aftercare followed by wound healing applications is expected to continue to drive its consumption among various consumer demographics.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

The petroleum jelly market in the European Union has been dominated by Germany, France, and Italy which benefit from strict regulations in cosmetics, wider use in pharmaceutical and medical ointments, and increasing applications in the industrial sector. Demand for high-quality, dermatologically tested petroleum jelly formulations is growing, as the EU places a strong emphasis on product safety and purity standards.

Moreover, the exponent of sustainable beauty trends and the rise of vegan-friendly alternatives are combining with industry aspirations. Moreover, the growing incorporation of petroleum jelly in baby care, lip care, and high-end skincare products is anticipated to boost market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.8% |

The growth in Japan's petroleum jelly market is influenced by various factors like rising availability of high-purity cosmetic ingredients, increasing demand for multi-functional skincare products, and widening applications in medical treatments and pharmaceutical formulations.

This drives recently process developments in petroleum jelly have more used in special dermatologic and hypoallergenic skin care products due to its innovation in different countries. Consumer preferences are also being influenced by the growth of minimalist skincare trends and functional beauty products. Increased eco-friendly packaging and ethical sourcing of ingredients are also impacting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

South Korea is projected to be an essential market for petroleum jelly, fueled by the growing demand from K-beauty formulations, a strong presence of skincare and cosmetic brands, and rising demand for therapeutic skincare and wound healing products.

The country’s early adoption of savvy beauty trends is driving demand for high-quality, dermatologically tested variants of petroleum jelly. Product development is also impacted by new approaches in cosmetics science, such as nano-encapsulation to improve absorption. AI-powered skincare solutions and personalized formulations are also driving growth in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

The petroleum jelly market dynamics typically represent the usp grade and technical grade segments as major players, as industries prefer these high-quality formulations for pharmaceutical, cosmetic, and industrial applications. These grades are vital to guarantee that a product is safe, effective, and meets worldwide regulatory requirements. The market trends enabled by this distinction manifest as the demand of petroleum jelly keeps riding high on different market scales.

USP Grade Petroleum Jelly Dominates the Market as Pharmaceutical and Cosmetic Demand Surges

The USP (United States Pharmacopeia) grade segment is projected to be the fastest-growing segment of the petroleum jelly market owing to its high purity, followed by the stringent requirements of the pharmaceutical and personal care industries. USP-grade petroleum jelly is distinct from technical-grade variants, as it undergoes extensive refining and quality control processes to guarantee its safety for medical and cosmetic use.

The growing demand for USP-grade petroleum jelly in the preparation of ointments, wound care products, & dermatological formulations is anticipated to drive the market adoption. More than 60% of pharmaceutical and skincare formulations include USP-grade petroleum jelly due to its hypoallergenic and non-comedogenic nature, studies suggest.

The market is further driven by the expansion of USP-grade petroleum jelly (that is medically certified) due to its moisturizing, anti-inflammatory, and healing properties, which has been well accepted in the pharmaceutical and skincare applications.

Adoption has been further accelerated by the adoption of AI-powered quality control in the refining process of petroleum jelly, allowing for automated purity analysis, real time contamination detection systems and blockchain-based traceability, ensuring that products are consistent and meet the requirements of the regulatory landscape.

Even with its benefits like higher purity, safety and compatibility with industry standards, USP-grade petroleum jelly segment is experiencing key challenges like high production costs, stringent regulatory approvals and competition from plant-based substitutes.

But new technologies like greener refining processes, self-learning proprietary Islamic and AI-derived formulations, and higher medical grade applications are driving down costs, improving throughput, and paving the way for deeper penetration into the global USP-grade petroleum jelly market.

Technical Grade Petroleum Jelly Gains Traction as Industrial and Lubrication Applications Expand

As a cost-efficient lubricant and reliable protective coating in many machines and systems used for various mechanical applications, technical-grade petroleum jelly is also gaining significant market traction. Technical-grade petroleum jelly is less refined than USP-grade variants, making it an excellent option for non-medical applications.

The rising application of technical-grade petroleum jelly in manufacturing, machinery maintenance, and industrial coatings has driven its adoption. The booming market for high performance technical-grade petroleum jelly with corrosion prevention, thermal stability and waterproofing properties, is driving market demand to ensure durability and longevity in industrial applications.

The rising integration of automated quality evaluation inclusive of AI-based viscosity analysis, real-time impurity monitoring, as well as predictive performance analytics have further propelled adoption, enabling technical-grade formulations to maintain consistency and efficiency.

Multipurpose technical-grade petroleum jelly enriched with weather shields, compatibility with high-temperature processes, and improved sealing characteristics has been introduced, aiding the market progress with multiple application benefits across automotive, construction, and mechanical verticals.

While it is certainly what in many cases is desirable for its lesser price point, industrial performance, and versatility on the industrial use, the technical-grade petroleum jelly segment present drawbacks like purity level, potential environmental issues, and lack of popularity in health industries.

But new developments in bio-based alternatives, artificial intelligence-driven formulation testing and high-efficiency refining technologies and continue to upgrade product quality, sustainability and wide-market reach of technical-grade petroleum jelly, leaving room for growth globally.

Based on application, the petroleum jelly market is bifurcated into pharmaceutical, cosmetics & personal care, which is the leading segment due to the growing demand of skin care, wound healing & beauty-enhancing formulations. These industries being highly innovative ensure the evolution of petroleum jelly based products.

Demand for Dermatological and Wound Healing Applications Drives Growth in Pharmaceutical Industry

Petroleum jelly is widely used in the pharmaceutical industry because of its moisturizing, protective, and healing properties. Unlike general skincare applications, pharmaceutical-grade petroleum jelly needs to pass strict regulatory and medical safety guidelines.

Adoption has also been driven by the rising demand for topical medications formulated using petroleum jelly, including burn ointments, wound dressings, and scar treatments. In fact, studies indicate that more than 65% of its use is grounded in first-aid and skin recovery treatments.

The market demand has been further bolstered by the introduction of advanced pharmaceutical petroleum jelly formulations that incorporate antibacterial properties, pain-relief additives, and hypoallergenic ingredients for improved therapeutic benefits.

The proliferation of smart pharmaceutical packages with AI-enabled dosage monitoring, tamper-proof seals, and recyclable containers has helped boost the adoption while ensuring the consumer safety and the environmental responsibility.

The advent of organic and plant-infused petroleum jelly like botanical extracts, CBD-infused balms, and vitamin-enriched alae has further created optimal market growth, in which the products attract health-conscious consumers.

While pharmaceutical petroleum jelly has its benefits in wound care, drug delivery, and dermatological applications, challenges such as stringent regulatory approval processes, increasing demand for synthetic alternatives, and competition in the market by plant-based emollients could hinder growth of this segment.

Yet new technology innovations, including sweeping advancements in AI-driven era production of drugs, biodegradable types of pharmaceutical packaging, and advancements in purity refining, work to stimulate efficiency, safety, and consumer trust, offering for uninterrupted expansion of pharmaceutical petroleum jelly on the global front.

Cosmetics & Personal Care Sector Grows as Skincare and Beauty Formulations Incorporate Petroleum Jelly

The demand for petroleum jelly is primarily driven by the cosmetics and personal care industry. Industrial-grade petroleum jelly is not suitable for many cosmetic applications, as those need to be free of any contaminants and suited for prolonged contact with the skin.

There has been a rise in adoption owing to its extensive application in beauty products such as hydrating creams, lip protectants, and hair conditioning treatments. Luxury petroleum jelly-hybridized skin care products, as well as petroleum jelly with added organic extracts, SPF protection, and collagen-boosting properties, have been able to drive the demand in the market, strengthening its position as a more functional product in beauty care.

More specifically, the incorporation of AI-enhanced beauty product design, including personalized skincare suggestions, intelligent ingredient mixing, and automated quality analysis, has propelled adoption even more, increasing product efficiency and customer satisfaction.

Market growth has been maximized by manufacturers developing personalized petroleum jelly products, including scented products, tinted balms and other skin treatments narrowing down to different flag preferences.

While the cosmetics & personal care petroleum jelly segment benefits from the properties of miniaturization and skin and hair protection, there are certain challenges such as rising demand for plant-based ingredients and products along with concerns surrounding the formulation and approval of associated products containing mineral oils in clean beauty.

Nevertheless, from advances in green chemistry to AI-boosted ingredient formulation to biodegradable skincare packaging, new developments are making brands more sustainable, safer, and better able to accommodate international markets keeping increasing demand for cosmetic-grade petroleum jelly growing all across the globe.

Growing need for individual care items and rise in the use of petroleum jelly in pharmaceutical and industrial applications are the Driving factors for the Petroleum Jelly Market. The market is growing steadily with the widening scope of their applications in cosmetics, personal care, and medical ointments. The industry is also carving a niche for fragrance- and hypoallergenic formulations, sustainable packaging and inclusion of natural and organic ingredients, among others.

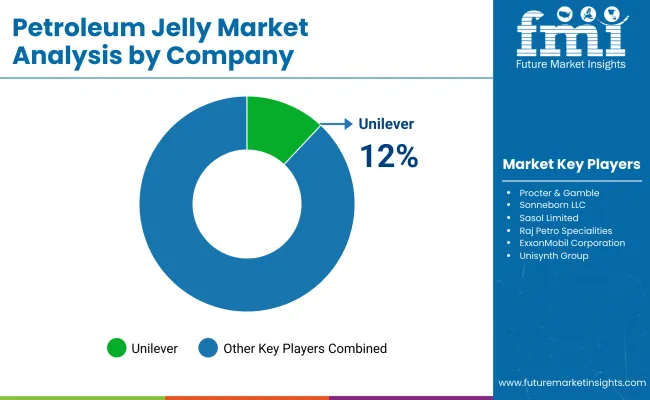

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Unilever | 12-16% |

| Procter & Gamble (P&G) | 10-14% |

| Sonneborn LLC | 8-12% |

| Sasol Limited | 6-10% |

| Raj Petro Specialities | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Unilever | Develops dermatologically tested petroleum jelly under the Vaseline brand for skincare and medical applications. |

| Procter & Gamble (P&G) | Specializes in multipurpose petroleum jelly with advanced moisturizing properties. |

| Sonneborn LLC | Offers high-purity white petroleum jelly for pharmaceutical and industrial applications. |

| Sasol Limited | Focuses on petroleum jelly solutions for personal care, lubricants, and industrial use. |

| Raj Petro Specialities | Provides custom formulations of petroleum jelly for medical, cosmetic, and industrial sectors. |

Key Company Insights

Other Key Players (45-55% Combined)

Several petroleum product manufacturers contribute to the expanding Petroleum Jelly Market. These include:

The overall market size for the petroleum jelly market was USD 565.8 million in 2025.

The petroleum jelly market is expected to reach USD 829.5 million in 2035.

The demand for petroleum jelly will be driven by increasing applications in the pharmaceutical and cosmetic industries, rising demand for skincare and personal care products, growing use in industrial lubricants and coatings, and advancements in refining processes for high-purity grades.

The top 5 countries driving the development of the petroleum jelly market are the USA, China, Germany, India, and Brazil.

The pharmaceutical-grade petroleum Jelly segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End User, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by End User, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by End User, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Grade, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Grade, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Europe Market Attractiveness by Grade, 2023 to 2033

Figure 71: Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by End User, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: MEA Market Attractiveness by Grade, 2023 to 2033

Figure 107: MEA Market Attractiveness by End User, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Jelly Mist Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Royal Jelly Market Analysis by Type, Form, Application, and Region Forecast Through 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Demand for Petroleum Liquid Feedstock in USA Size and Share Forecast Outlook 2025 to 2035

Low-Calorie Jelly Market Growth - Innovations & Market Expansion 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA