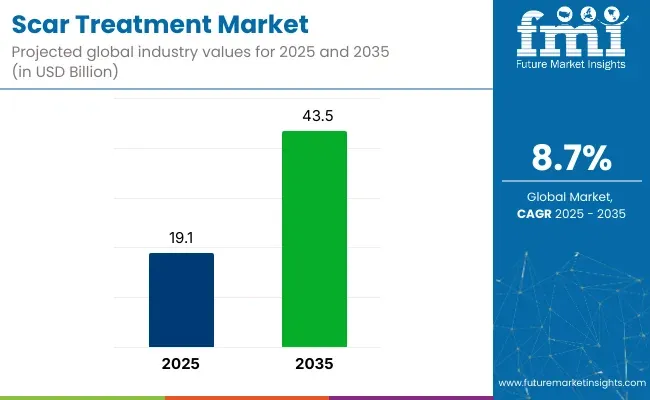

The global scar treatment market is projected to be valued at USD 19.1 Billion in 2025 and is expected to reach USD 43.5 Billion by 2035, registering a CAGR of 8.7% during the forecast period. The global scar treatment market is undergoing a significant transformation, driven by technological advancements and evolving consumer preferences.

The market is projected to expand substantially, fuelled by a growing demand for personalized and effective scar management solutions. Key factors contributing to this growth include the rising incidence of skin injuries, increased awareness of aesthetic treatments, and the integration of innovative therapies such as laser treatments and regenerative medicine.

Moreover, the shift from basic over-the-counter products to advanced, scientifically backed therapies indicates a paradigm shift in consumer expectations and treatment efficacy. The market's evolution is further supported by the increasing adoption of telemedicine and e-commerce platforms, enhancing accessibility to scar treatment products and services. As the industry continues to innovate and cater to diverse patient needs, the scar treatment market is poised for sustained growth and development in the coming decade.

Prominent players in the scar treatment market include Smith & Nephew, Bausch Health, Merz Pharmaceuticals, LLC, Mölnlycke Health Care, Alliance Pharma, HRA Pharma, and Rejuvaskin. These companies are actively engaged in research and development, strategic partnerships, and product innovations to enhance their market presence.

In 2024, Crown Aesthetics, a division of Crown Laboratories, announced the official launch of the SkinPen® Precision Elite, a revolutionary FDA-cleared device that sets a new benchmark in microneedling. SkinPen Precision Elite features significant upgrades, including an innovative, one-time use, easy-to-install cartridge minimizing risk for accidental lockouts with active retraction technology powered by the all-new ActiSine™ technology.

“The time and dedication poured into these advancements for our flagship product, SkinPen, reflect the passion of our entire team,” said Jeff Bedard, Founder and CEO of Crown Laboratories.

Global Scar Treatment Industry Analysis

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 19.1 Billion |

| Projected Size, 2035 | USD 43.5 Billion |

| Value-based CAGR (2025 to 2035) | 8.7% |

In North America, the scar treatment market is characterized by a high prevalence of skin injuries due to surgeries, burns, and accidents, driving the demand for effective scar management solutions. The region benefits from advanced healthcare infrastructure, increased consumer awareness, and a strong presence of key market players.

The adoption of innovative treatments, such as laser therapy and regenerative medicine, is facilitated by supportive regulatory frameworks and significant investment in research and development. Additionally, the growing trend of aesthetic procedures and the influence of social media contribute to the market's growth. The integration of telemedicine and e-commerce platforms further enhances accessibility to scar treatment products, catering to the evolving consumer preferences in the region.

Europe's scar treatment market is driven by a combination of factors, including a high incidence of surgical procedures, increased awareness of aesthetic treatments, and a strong emphasis on research and innovation. The region's stringent regulatory standards ensure the availability of safe and effective scar management products. Key players in the market are actively engaged in developing advanced therapies, such as laser treatments and topical applications, to meet the diverse needs of consumers.

The growing demand for minimally invasive procedures and the influence of beauty trends contribute to the market's expansion. Furthermore, the integration of digital health solutions and the rise of e-commerce platforms enhance the accessibility and convenience of scar treatment options for consumers across Europe.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the Scar Treatment Industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global Scar Treatment Market from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 9.4%, followed by a slightly lower growth rate of 9.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.4% |

| H2 (2024 to 2034) | 9.1% |

| H1 (2025 to 2035) | 8.7% |

| H2 (2025 to 2035) | 8.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 8.7% in the first half and projected to lower at 8.2% in the second half. In the first half (H1) the market witnessed a decrease of -70 BPS while in the second half (H2), the market witnessed a decrease of -90 BPS.

Topical treatments have been observed to hold the leading revenue share of 57.0% in the global scar treatment market in 2025, primarily attributed to their widespread accessibility, affordability, and ease of application. Demand for non-invasive solutions has consistently increased, with consumers preferring over-the-counter creams, silicone gels, and ointments that are dermatologist-recommended for managing post-surgical and acne-related scars.

Enhanced formulations incorporating active ingredients like silicone, onion extract, and retinoid have been developed, improving efficacy in scar fading and skin regeneration. Moreover, topical products have been marketed extensively through e-commerce platforms and retail pharmacy chains, making them available to a broader consumer base without requiring clinical intervention.

Adoption has also been supported by the growing aesthetic consciousness among consumers and the minimal risk profile associated with these treatments.

Atrophic scars have been estimated to hold a dominant 48.9% share of the global scar treatment market by indication in 2025, driven by the increasing incidence of acne-related skin conditions. This segment’s leadership has been reinforced by a rising number of adolescents and adults affected by severe acne, often resulting in long-term facial scarring.

Greater dermatological consultations and early diagnosis have led to increased demand for cosmetic and therapeutic solutions tailored specifically for atrophic scars. Treatment regimens typically include a combination of micro needling, topical retinoid, chemical peels, and laser resurfacing, thereby creating a continuous cycle of product and service consumption.

Furthermore, growing social awareness and digital influence have heightened concern around facial aesthetics, prompting consumers to seek advanced treatment options. The segment’s expansion has been supported by the availability of targeted, clinically tested treatments marketed with high efficacy claims.

High Adoption of Combination Therapies fueling Market Growth

The rising demand for combination therapies, which combines laser treatments with biologics, is a game-changer in the scar treatment space. Laser therapies are excellent for targeting the structural irregularities of scars by stimulating collagen production and resurfacing the skin. When combined with biologics, such as stem cell treatments or platelet-rich plasma (PRP), the regenerative process is further amplified, resulting in enhanced scar healing and improved skin texture.

Such synergy is very effective for the treatment of severe and complex scars that remain unresponsive to single modality treatments. The demand for such combined treatments is increasing because they can provide better and longer-lasting results that could satisfy both function and aesthetic needs.

As more and more healthcare providers incorporate such integrated solutions, satisfaction levels among patients are increasing and the market is becoming increasingly confident. Further, this domain is probably going to ensure combination therapies are firmly placed at the center of scar management strategies with continued research and innovation.

Advanced Silicone-Based Formulations Redefining Topical Scar Treatments

Advanced formulations of silicone-based products are changing topical scar management with improved efficacy and ease of use. Silicone sheets and gels, engineered to have good adhesive properties and high durability, offer an easy, non-invasive form of minimizing the appearance of scarring and improving texture on the skin. They work by creating a kind of protective barrier hydrating the scar tissue, minimizing collagen overproduction, and promoting a balanced healing process.

Such an established ability to flatten and soften scars, accompanied by minimal side effects making silicone-based treatments as the most preferred treatment for health professionals. This innovation is growing the market due to increased access and affordability for people looking for effective solutions that do not involve invasive procedures.

The ability of silicone products to address a broad range of scars, from surgical to acne, adds to their popularity. As science further refines these formulations, the role these products will play in comprehensive scar management strategies which is driving the growth of this market.

Nanotechnology Revolutionizing the Efficacy of Scar Treatment

Emergence of nanotechnology in scar treatment formulations is a transforming advancement: better delivery and hence better efficacy of the active ingredient. Nanotechnology allows the preparation of nanoscale carriers, including liposomes, nanoparticles, and nanogels, to encapsulate therapeutic agents. Targeted delivery of active compounds in scar tissue improves penetration into the deeper layers of the skin with fewer side effects.

This accurate delivery mechanism significantly improves the efficacy of treatments since the therapeutic agents are delivered at the right concentration to the target site. Furthermore, nanotechnology is also used along with high-end ingredients like growth factors, antioxidants, and peptides that stimulates the collagen and accelerate healing of the scars.

This ability to formulate drugs for different types of scars further speaks to its versatility. Consequently, nanotechnology-based products are becoming increasingly accepted in different dermatology drugs, which is further driving innovation and market growth in scar management.

Inconsistent Treatment Result Posing as a Market Barrier

The heterogeneity of the outcome remains a major challenge despite advances in scar treatment. The success of different scar treatment modalities depends on various factors such as the type of scar, severity of the scar, patient skin types, age, as well as general health.

For example, hypertrophic scars and keloids scars may react differently to the same modality of treatment. This inconsistency may result in patient dissatisfaction because the expectations for improvement are not always met. Besides this, varying expertise among professionals intensifies the problem.

Laser and microneedling treatments have specificity and sensitivity. Any mishandling affects the results, as there are different protocols that have not yet been standardized. Due to the non-uniform protocols in these clinics, a level of patient trust in new technology is minimized. This unreliability lowers the chances for interested patients who seek expensive solutions and directly slows the growth rate. To curb this restraint, improved training must be provided with enhanced clinical practice guidelines and awareness in patients.

The market structure is moderately fragment with many niche and regional players dominating the specific countries. The global market for scar treatment is characterized by a concentration of key players, with Tier 1 companies holding a dominant share of 39.7%. These industry leaders, Mederma (Perrigo Company Plc), Smith+Nephew, Alliance Pharmaceuticals Limited, Mölnlycke Health Care AB and Bausch Health Inc., invest heavily in product innovation, R&D, and technological advancements.

They excel in offering comprehensive product portfolios that cater to complex treatment of scars, which are more severe in nature. These companies benefit from strong global market presence, fast regulatory approvals, and strategic collaborations for market growth.

On the other hand, Tier 2 companies account for 22% of the market share. Although having strong R&D capabilities and dominant product portfolios, these players focus on regional market penetration and cost-effective solutions. Their approach emphasizes balancing quality with affordability, targeting emerging markets, and addressing niche treatment needs.

While Tier 2 companies invest in incremental innovations, they focus on expanding market reach through competitive pricing strategies and strategic alliances, contributing to their market presence. Key players in is market includes Cynosure Inc, Avita Medical Limited, Lumenis, Syneron Medical Ltd, Shanghai Fosun Pharmaceuticals Ltd, Bio‑Oil®, BenQ Materials, Enaltus LLC and Laboratoires Expanscience.

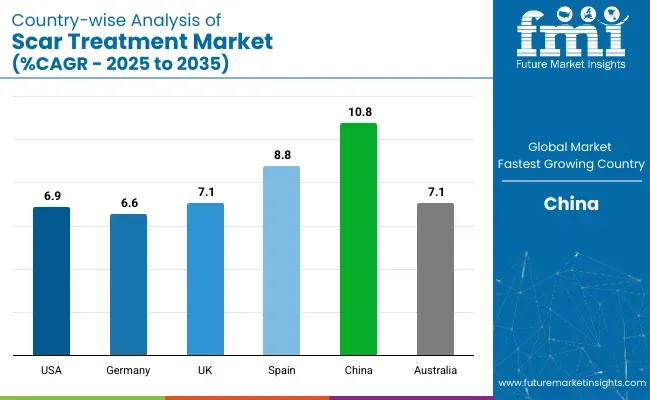

The section below covers the Scar Treatment Industry analysis for the sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 6.9% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 12.3% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

| Germany | 6.6% |

| UK | 7.1% |

| Spain | 8.8% |

| China | 10.8% |

| Australia | 7.1% |

The United States dominates the North America market with high share in 2024. The United States is expected to exhibit a CAGR of 6.9% throughout the forecast period (2025 to 2035).

The United States is the holds the leading market share in the North America scar treatment space. The market growth is characterized by considering a combination of factors which includes per-capita healthcare spending, rising disposable income and advanced therapeutic options. The rising awareness among patients regarding available treatment options combined with a high incidence of acne scars, burn injuries, surgical scars will drive demand for scar treatment solutions.

The presence of top companies investing highly in research and development and easy regulations for new products propels the market's growth. Growth in disposable income and an ageing population looking to get cosmetic and reconstructive treatments also supports the growth of the market.

Also, advanced treatments such as laser therapy, silicone gels, and dermal fillers are also the ones that have caused revenue growth in the market. The growth of the market is thus creating revenue for these treatments as the world continues to expand with the united states at the helm of innovation, technological advancement, and consumer spending on healthcare solutions.

In 2024, China held a dominant revenue in the East Asia market and is expected to grow with a CAGR of 10.8%.

China is the biggest market for scar treatment in East Asia, considering its large population, increasing urbanization, and rising healthcare awareness. The incidence of surgical procedures, burn injuries, and skin-related conditions is rising in the country, and there is a huge demand for cosmetic and reconstructive treatments, which has been fueling the growth of the market. The rising disposable incomes and an increased focus on aesthetic and personal care also drive growth.

With its developed healthcare system, China ensures a strong, state-of-the-art medical structure which supports further improvements in medicine, and its healthcare infrastructure supports advanced scar treatment products, including silicone gels, laser treatments, and topical applications.

This country has accelerated technology improvements and includes not only domestic companies but also overseas players within its market to stimulate competition and innovations. With affordability and increasing access to high-quality treatments, China is likely to continue dominating the market for scar treatment in East Asia, making it a key player in the growth trajectory of the global market.

Germany occupies a leading value share in Western Europe market in 2024 and is expected to grow with a CAGR of 6.6% during the forecasted period.

The country leads the market share in European scar treatment. It is primarily driven by an advanced healthcare system and high demand for medical aesthetics with a strong presence of leading pharmaceutical and medical device companies. Established healthcare infrastructure coupled with wide accessibility ensures advanced scar treatment options which includes laser therapy, silicone-based products, and topical treatments.

The aging population across Germany, coupled with increased interest in aesthetic surgery and cosmetic procedures encourages the demand for effective scar treatment solutions. There are also significant presence of market players in Germany who invest in research and innovation and hence, it is a forerunner for the European market. High disposable income and rising awareness of aesthetic treatments in the country are additional factors that grow the market.

The global scar treatment market is highly fragmented in nature, comprising both established industry majors and emerging players. The leading companies in the market are Mederma, Smith+Nephew, Alliance Pharmaceuticals, Lumenis, Syneron Medical Ltd and Cynosure Inc, which rely on their large product portfolio, strong R&D capabilities, and extensive distribution networks to sustain their market share.

Strong innovation and intense emphasis on improvements in topical treatments, laser therapies, and advanced silicone-based products give a thrust towards this category. At the same time, niche markets are finding market shares by cheaper solutions provided by smaller regional companies.

Non-invasive treatments, as well as personalized skincare, add fuel to the fire in terms of rising demand for competitive offerings. Strategic partnerships, mergers, and acquisitions are expanding their geographic reach and enhancing product offerings, fostering a dynamic environment in the scar treatment market.

Recent Industry Developments in Scar Treatment Market

In terms of Treatment, the industry is divided into Drug Therapy, Topical Treatment, Injectable Filler, Laser Therapy Treatment, Dermabrasion, Chemical Peels, Micro Needling, Cryotherapy, Skin Grafting, Autologous Fat Grafting, Natural and Alternative Remedies

In terms of indication, the industry is divided into Keloid scar, Atrophic scar, Hypertrophic Scar, Contractures, Adhesions, Stretch Marks and others.

In terms of sales channel, the industry is segregated into Hospitals, Dermatology Clinics, Plastic Surgery and Cosmetic Clinics, Retail Pharmacy Chains, Drug Stores and online sales & e-commerce sales.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global Scar Treatment Industry is projected to witness CAGR of 9.4% between 2025 and 2035.

The global Scar Treatment Industry stood at USD 17.4 Billion in 2024.

The global Scar Treatment Industry is anticipated to reach USD 43.5 Billion by 2035 end.

The UK is expected to show a CAGR of 7.1% in the assessment period.

Alliance Pharmaceuticals Limited, Avita Medical Limited, BenQ Materials, Bio‑Oil®, Blackbird Skincare, Cimeosil, Cynosure Inc, Enaltus LLC, Laboratoires Expanscience, Lumenis, Mederma (Perrigo Company Plc), Mölnlycke Health Care AB, Shanghai Fosun Pharmaceuticals Ltd, Smith+Nephew and Syneron Medical Ltd and others.

Figure 1: Global Market Value (USD Million) by Product Type, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by End-use, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 8: Global Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 11: Global Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 12: Global Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 13: Global Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 14: Global Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 17: Global Market Attractiveness by Product Type, 2025 to 2035

Figure 18: Global Market Attractiveness by Scar Type, 2025 to 2035

Figure 19: Global Market Attractiveness by End-use, 2025 to 2035

Figure 20: Global Market Attractiveness by Region, 2025 to 2035

Figure 21: North America Market Value (USD Million) by Product Type, 2025 to 2035

Figure 22: North America Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 23: North America Market Value (USD Million) by End-use, 2025 to 2035

Figure 24: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 25: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 28: North America Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 31: North America Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 32: North America Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 33: North America Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 34: North America Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 37: North America Market Attractiveness by Product Type, 2025 to 2035

Figure 38: North America Market Attractiveness by Scar Type, 2025 to 2035

Figure 39: North America Market Attractiveness by End-use, 2025 to 2035

Figure 40: North America Market Attractiveness by Country, 2025 to 2035

Figure 41: Latin America Market Value (USD Million) by Product Type, 2025 to 2035

Figure 42: Latin America Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 43: Latin America Market Value (USD Million) by End-use, 2025 to 2035

Figure 44: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 45: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 48: Latin America Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 54: Latin America Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 57: Latin America Market Attractiveness by Product Type, 2025 to 2035

Figure 58: Latin America Market Attractiveness by Scar Type, 2025 to 2035

Figure 59: Latin America Market Attractiveness by End-use, 2025 to 2035

Figure 60: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 61: Europe Market Value (USD Million) by Product Type, 2025 to 2035

Figure 62: Europe Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 63: Europe Market Value (USD Million) by End-use, 2025 to 2035

Figure 64: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 65: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 68: Europe Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 71: Europe Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 72: Europe Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 74: Europe Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 77: Europe Market Attractiveness by Product Type, 2025 to 2035

Figure 78: Europe Market Attractiveness by Scar Type, 2025 to 2035

Figure 79: Europe Market Attractiveness by End-use, 2025 to 2035

Figure 80: Europe Market Attractiveness by Country, 2025 to 2035

Figure 81: East Asia Market Value (USD Million) by Product Type, 2025 to 2035

Figure 82: East Asia Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 83: East Asia Market Value (USD Million) by End-use, 2025 to 2035

Figure 84: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 85: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 88: East Asia Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 89: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 90: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 91: East Asia Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 92: East Asia Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 93: East Asia Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 94: East Asia Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 95: East Asia Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 97: East Asia Market Attractiveness by Product Type, 2025 to 2035

Figure 98: East Asia Market Attractiveness by Scar Type, 2025 to 2035

Figure 99: East Asia Market Attractiveness by End-use, 2025 to 2035

Figure 100: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 101: South Asia Market Value (USD Million) by Product Type, 2025 to 2035

Figure 102: South Asia Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 103: South Asia Market Value (USD Million) by End-use, 2025 to 2035

Figure 104: South Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 105: South Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 106: South Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 107: South Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 108: South Asia Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 109: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 110: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 111: South Asia Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 112: South Asia Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 113: South Asia Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 114: South Asia Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 115: South Asia Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 116: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 117: South Asia Market Attractiveness by Product Type, 2025 to 2035

Figure 118: South Asia Market Attractiveness by Scar Type, 2025 to 2035

Figure 119: South Asia Market Attractiveness by End-use, 2025 to 2035

Figure 120: South Asia Market Attractiveness by Country, 2025 to 2035

Figure 121: Oceania Market Value (USD Million) by Product Type, 2025 to 2035

Figure 122: Oceania Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 123: Oceania Market Value (USD Million) by End-use, 2025 to 2035

Figure 124: Oceania Market Value (USD Million) by Country, 2025 to 2035

Figure 125: Oceania Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 128: Oceania Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 131: Oceania Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 134: Oceania Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 137: Oceania Market Attractiveness by Product Type, 2025 to 2035

Figure 138: Oceania Market Attractiveness by Scar Type, 2025 to 2035

Figure 139: Oceania Market Attractiveness by End-use, 2025 to 2035

Figure 140: Oceania Market Attractiveness by Country, 2025 to 2035

Figure 141: MEA Market Value (USD Million) by Product Type, 2025 to 2035

Figure 142: MEA Market Value (USD Million) by Scar Type, 2025 to 2035

Figure 143: MEA Market Value (USD Million) by End-use, 2025 to 2035

Figure 144: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 145: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 148: MEA Market Value (USD Million) Analysis by Product Type, 2020 to 2035

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product Type, 2025 to 2035

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2025 to 2035

Figure 151: MEA Market Value (USD Million) Analysis by Scar Type, 2020 to 2035

Figure 152: MEA Market Value Share (%) and BPS Analysis by Scar Type, 2025 to 2035

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Scar Type, 2025 to 2035

Figure 154: MEA Market Value (USD Million) Analysis by End-use, 2020 to 2035

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-use, 2025 to 2035

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-use, 2025 to 2035

Figure 157: MEA Market Attractiveness by Product Type, 2025 to 2035

Figure 158: MEA Market Attractiveness by Scar Type, 2025 to 2035

Figure 159: MEA Market Attractiveness by End-use, 2025 to 2035

Figure 160: MEA Market Attractiveness by Country, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Scar and Stretch Mark Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Scarfing Inserts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Mascara Applicators Market Size and Share Forecast Outlook 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Croscarmellose Sodium Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA