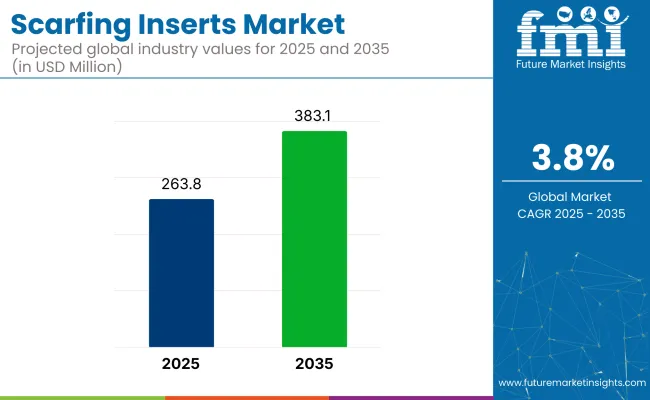

The scarfing inserts market is projected to grow from USD 263.8 million in 2025 to USD 383.1 million by 2035, registering a CAGR of 3.8% during the forecast period. This moderate growth is expected to be driven by consistent demand from the steel manufacturing and metal processing industries.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 263.8 million |

| Market Size (2035) | USD 383.1 million |

| CAGR (2025 to 2035) | 3.8% |

As of 2025, the market accounts for a small but essential share across several industrial equipment sectors. Within the global metal cutting tools market, it contributes around 2-3%, as these inserts are used in specialized surface machining processes during steel production. In the steel manufacturing equipment market, the share is higher at approximately 4-6%, since scarfing is a routine part of defect removal in billets and slabs.

Within the industrial tooling market, scarfing inserts represent about 1-2%, owing to their limited use outside the metallurgical segment. In the surface preparation equipment market, the contribution is close to 2-3%, given their role in achieving defect-free finishes. In the metallurgical equipment market, scarfing inserts account for roughly 3-4%, supporting continuous casting and finishing operations.

The market is a critical segment within the steel and metal processing industry, enabling high-precision surface defect removal during hot and cold rolling operations. Demand is tightly correlated with global steel production, particularly in automotive, construction, and pipeline manufacturing. The value chain begins with carbide powder suppliers and extends through precision tooling manufacturers, OEMs, and industrial distributors.

Key growth drivers include rising investments in high-grade steel infrastructure and increased adoption of automated scarfing systems in integrated steel mills. Market dynamics are shifting as end-users demand longer tool life, higher heat resistance, and reduced downtime.

Innovation is centered around multi-edge geometries and advanced coatings, enhancing productivity and material yield. Strategic partnerships between insert manufacturers and steel producers are accelerating, with Asia Pacific emerging as both the largest production hub and fastest-growing consumption market.

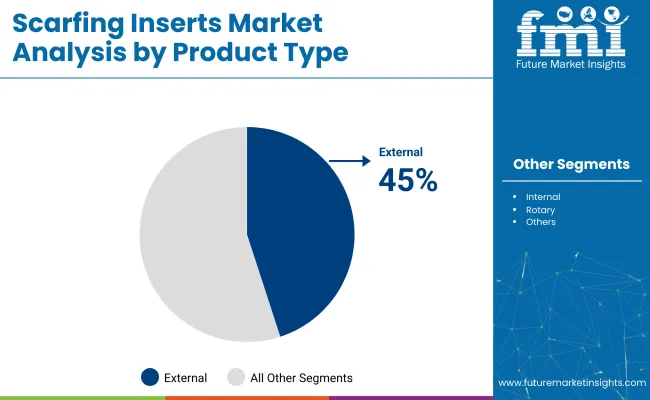

Tungsten carbide is projected to dominate the material segment with an 80% share in 2025, driven by its superior hardness and durability. External scarfing inserts are set to lead the product type segment with a 45% share.

Tungsten carbide is projected to account for 80% of the material segment by 2025, thanks to its exceptional wear resistance and longevity in high-temperature environments.

External scarfing inserts are anticipated to lead the product type segment, capturing 45% of the market by 2025. These tools have been preferred for their ability to cleanly remove weld beads from the outer surface of pipes and tubes.

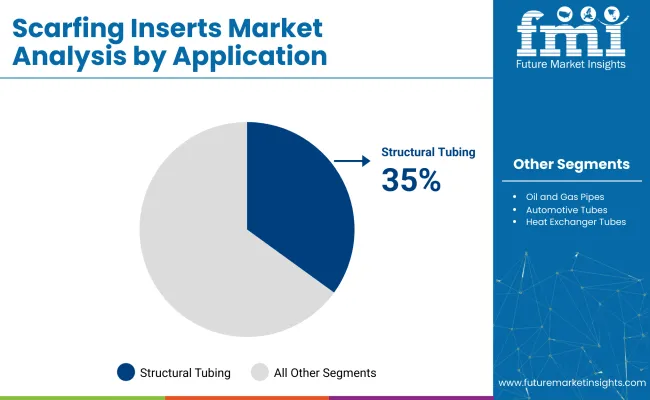

Structural tubing applications are expected to hold 35% of the scarfing inserts market in 2025, driven by steady demand from the infrastructure and transportation sectors.

Standard fit scarfing inserts are projected to dominate the category segment, accounting for 50% of the market by 2025. These inserts are designed for compatibility with a wide range of scarfing heads and tool holders.

The market is expanding due to rising demand in the steel and metal processing industries. These inserts are essential for surface defect removal during hot and cold rolling processes. As steelmakers aim to improve product quality and reduce scrap rates, there is growing adoption of advanced insert materials and geometries tailored for high-speed scarfing operations.

High Demand from Steel Mills and Pipe Manufacturing Units

Scarfing inserts are widely used in continuous casting lines, tube mills, and strip processing facilities to remove surface defects such as cracks, scales, and inclusions. They help ensure a clean, uniform surface finish before further rolling or welding operations. Steel producers rely on these inserts to maintain product quality and meet customer specifications.

Increasing Use of Carbide and Ceramic-Based Insert Materials

Manufacturers are offering inserts made from tungsten carbide, ceramic composites, and coated alloys to withstand high temperatures and abrasive conditions. These materials deliver better wear resistance, longer tool life, and improved heat dissipation. Inserts with precision-ground edges and enhanced chip evacuation are being developed for cleaner cuts and faster operation.

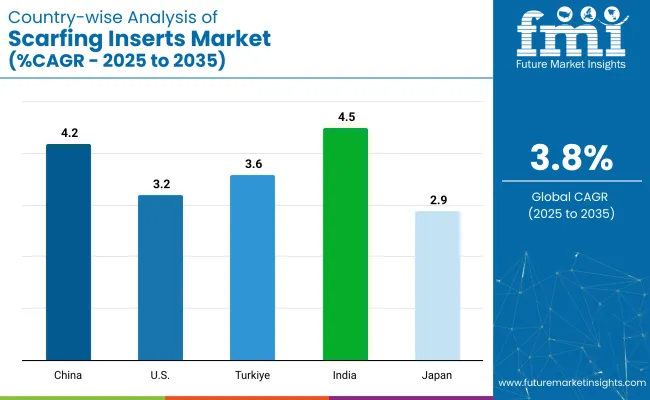

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.2% |

| USA | 3.2% |

| India | 4.5% |

| Turkiye | 3.6% |

| Japan | 2.9% |

India’s momentum is being driven by rising steel production, the growth of integrated steel plants, and increasing demand for billet and slab surface conditioning. China is scaling scarfing insert use through continuous casting optimization and domestic manufacturing automation. In contrast, developed economies such as the United States (3.2%), Türkiye (3.6%), and Japan (2.9%) are expanding steadily at 0.76-0.95x rates.

The USA focuses on high-durability inserts for specialty alloy production and value-added steel. Türkiye emphasizes cost efficiency and import substitution in regional mills. Japan prioritizes clean surface finish and thermal resistance in electric arc furnace operations. As global infrastructure and industrial output grow, both high-volume and high-precision markets are reshaping the scarfing inserts landscape.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 4.5% through 2035. Growth is fueled by the rapid expansion of long product manufacturing, including rebar, wire rod, and structural sections. Integrated steel plants are adopting scarfing systems to meet export-grade quality standards.

Surface defect control in billet and bloom production is a primary driver. Domestic toolmakers are scaling up insert manufacturing to reduce dependence on imports. Usage in thermal cutting applications across public-sector mills is also increasing. India’s position as a BRICS nation supports internal tooling demand and regional export potential.

China is expected to grow at a CAGR of 4.2% between 2025 and 2035. Continuous casting efficiency and high-speed steel output are driving the adoption of advanced insert designs. State-owned enterprises are upgrading scarfing lines to reduce surface rejection rates.

Local tool producers are investing in hard carbide formulations with long heat resistance. Large mills in Hebei and Jiangsu provinces are leading in high-temperature billet processing. Market expansion is supported by both internal infrastructure projects and overseas billet exports.

The USA market is projected to grow at a CAGR of 3.2% through 2035. Demand is concentrated in electric arc furnace (EAF) facilities and mini-mills producing specialty alloys. Inserts are used in scarfing carbon and stainless steel slabs for automotive and aerospace applications.

USA-based suppliers are offering precision-engineered inserts with extended wear life and thermal resistance. Retrofitting of scarfing equipment in Midwest and Southeast facilities is underway. Growth is supported by the reshoring of metals production and federal infrastructure stimulus plans.

Türkiye’s market is forecast to expand at a CAGR of 3.6% during the forecast period. Regional steel mills are adopting scarfing operations to enhance product uniformity and reduce downstream surface defects. Demand is rising in flat and long product lines, especially in export-oriented mills.

Local importers are offering cost-competitive carbide inserts sourced from East Asia. Turkish producers are focusing on entry-level surface preparation to meet international quality benchmarks. Growth is shaped by regional steel consolidation and trade-driven production goals.

Japan is projected to grow at a CAGR of 2.9% from 2025 to 2035. High-quality output requirements from the automotive and electronics sectors are driving precision in billet surface processing. Inserts are used in slab conditioning within electric arc furnace (EAF) facilities.

Domestic toolmakers are focused on thermal stability, reduced chipping, and longer operating cycles. Usage is concentrated in coastal steel plants serving specialty downstream sectors. Japan’s market remains steady, driven by value-added applications rather than volume expansion.

The industry is moderately consolidated, led by a few dominant players with global manufacturing and distribution capabilities. Kent Corporation is a prominent name offering high-performance scarfing solutions for steel tube and pipe production lines. CERATIZIT Group provides premium-grade carbide scarfing inserts known for their durability and precision in hot-rolled steel applications.

Widia specializes in technologically advanced wear-resistant inserts, widely adopted in heavy industrial sectors. Hunan Estool Co., Ltd. and OMCD Group are emerging as significant contributors, focusing on cost-effective alternatives and expanding presence in Asian and European markets. Innovation in insert geometry and coatings continues to enhance cutting speed, reduce downtime, and increase overall efficiency in metalworking operations.

Recent Scarfing Inserts Industry News

In February 2025, Norton Abrasives India unveiled a new sustainable approach to abrasive tooling for scarfing operations, spotlighting diamond and CBN abrasives that enhance surface finish quality while reducing material waste and improving carbon efficiency in steel, automotive, and foundry applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 263.8 million |

| Projected Market Size (2035) | USD 383.1 million |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Material Types Analyzed (Segment 1) | Tungsten Carbide, Ceramic, Coated Carbide, Other Specialized Materials |

| Product Types Analyzed (Segment 2) | External, Internal, Rotary, Stationary, Chamfer, Others |

| Applications Analyzed (Segment 3) | Oil & Gas Pipes, Automotive Tubes, Construction Tubes, Heat Exchanger Tubes, Structural Tubing, Appliance Tubes |

| Categories Analyzed (Segment 4) | Standard Fit, Custom Fit, Universal Fit |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Kent Corporation, CERATIZIT Group, Hunan Estool Co., Ltd., OMCD Group, Widia |

| Additional Attributes | Dollar sales by product and application, rising demand in the automotive and pipe industries, shift toward coated materials, and advancements in high-durability insert design. |

The market is segmented by material type into tungsten carbide, ceramic, coated carbide, and other specialized materials.

Based on product type, scarfing inserts are categorized as external, internal, rotary, stationary, chamfer, and others.

Key applications include oil and gas pipes, automotive tubes, construction tubes, heat exchanger tubes, structural tubing and appliance tubes.

By category, the market includes standard fit, custom fit, and universal fit scarfing inserts.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 263.8 million in 2025.

It is projected to reach USD 383.1 million by 2035.

The market is anticipated to grow at a CAGR of 3.8% during the forecast period.

Structural tubing applications are expected to dominate the market with a 35% share in 2025.

External scarfing inserts are expected to command a 45% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Inserts Market

Vaginal Inserts Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Indexable Tool Inserts Market

Aircraft Galley Inserts Market

Japan Valve Seat Inserts Market Trend Analysis Based on Sales Channel, Material, Engine, End-Use and Provinces 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA