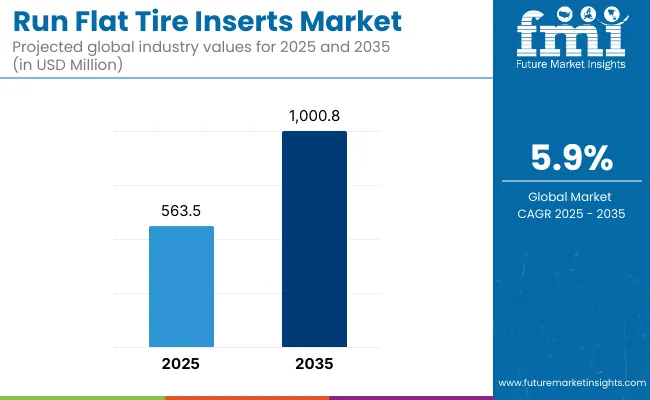

The global run flat tire inserts market is positioned for sustained growth over the coming decade. There is an increased demand for enhanced vehicle safety, military-grade mobility solutions, and growing adoption in off-road and high-risk environments. Estimated at USD 563.5 million in 2025, the run flat tire inserts market is anticipated to grow to about USD 1,000.8 million by 2035 with a consistent compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Attribute | Detail |

|---|---|

| Market Size (2025E) | USD 563.5 million |

| Market Size (2035F) | USD 1,000.8 million |

| Value CAGR (2025 to 2035) | 5.9% |

Run flat tire inserts are becoming a standard requirement in defense, law enforcement, armored cars, and commercial fleets. Their ability to allow continued vehicle mobility after tire damage or deflation is a safety asset of the utmost importance, especially in hostile terrain or combat situations. With increased geopolitical tensions and defense modernization initiatives worldwide, demand for trusted run flat systems will most likely increase drastically.

In the consumer marketplace outside of the military, burgeoning concerns for safety and consumer focus on vehicle performance are compelling automobile makers to look at sophisticated tire technology. Run flat inserts minimize the chances of being stranded in case of a tire blowout, particularly in isolated locations or heavy traffic conditions.

Their increasing use in luxury SUVs, sports cars, and luxury vehicles is propelling the growth. Technological changes are also revolutionizing product design throughout the industry. Material innovation like composites that weigh less and polymers that have greater strength-improves run flat insert durability, heat resistance, and performance. In addition, the incorporation of smart tire systems that provide real-time tire conditions is expected to complement the demand for more tire safety solutions.

Government regulations requiring vehicle safety features and the growing trend of armored civilian vehicles in some regions are also driving industry adoption. Nevertheless, high upfront costs, limited end-user awareness, and compatibility challenges with some vehicle types may moderately hinder growth in price-sensitive industries.

However, as vehicular safety receives more attention and defense expenditure keeps rising, the industry is poised to show a promising direction. Companies and suppliers that focus on innovation, cost-saving, and strategic collaboration will be well-placed to benefit from the changing demands of commercial and defense vehicle industries up to 2035.

The run flat tire inserts market is gaining momentum across the automotive industry, particularly due to increasing safety needs and technological advancements in tire technology. Safety, reliability, and compatibility with vehicle systems are greatly appreciated by automobile OEMs as well as tire manufacturers to enhance performance and passenger safety.

Innovation continues to be a driving force as they look to innovate products in the competitive industry. Distribution is about cost-effectiveness and access to products with stable supply that can help deliver increased demand, particularly on the aftermarket front.

Commercial fleet customers and end-use customers, as well as individual drivers, appreciate reliability, price, and durability as they attempt to save on downtime and maintenance. Compliance is most important to OEMs but becomes progressively less important to end-users, depending on manufacturers for conformance.

Under a trend of heightened demand for long-lasting and puncture-resistant tire solutions, simultaneous production in accordance with stakeholder-defined priorities will be critical to achieving a good industry share as well as acquiring long-term adoption of run-flat technologies.

During the period 2020 to 2024, the industry served mainly niche areas, like military vehicles, armored transport, and high-security convoys. These inserts were appreciated for their capability to keep vehicles operational even after punctures or blowouts and were normally restricted to defense and high-value logistics operations. But full consumer takeup was retarded by cost, non-standardization, and low awareness. Technological advancement here centered on the improvement of durability and load-carrying ability by employing rubber and polymer composites.

In the future, from 2025 to 2035, there is expected to be a transformation through the intersection of smart mobility, improved materials, and predictive maintenance systems. There is a significant trend towards the integration of sensors within tire inserts for live feedback and prognostic analysis in the civilian and defense industries.

Consumer vehicles, electric cars (EVs), and autonomous platforms will also increasingly feature run flat technology as manufacturers respond to increasing demand for vehicle safety and readiness. Emerging industries in Southeast Asia, Latin America, and parts of Africa are predicted to gain good momentum with growth in infrastructure and road safety programs implemented by the government. Green concerns will also undergo a shift toward sustainable, recyclable insert materials.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Armored military cars, military vehicles, VIP and high-security transport | Greater consumer car, commercial vehicle uptake, electric and autonomous vehicle takeup |

| Basic run flat performance with rubber/polymer-type architecture | Smart inserts with sensors, condition-based maintenance, and high-performance materials |

| Niche industrie s with low mainstream penetration | Mainstream driven by safety regulations and auto technology |

| Traditional composites with low emphasis on recyclability | Lightweight, recyclable, and sustainable composites |

| Leaders in North America and Europe | Double-digit growth in Asia-Pacific, Latin America, and the Middle East |

| OEM alliances and aftermarket suppliers | Introduction of e-commerce, direct-to-consumer, and digital marketplaces |

| Premium pricing, largely focused on defense and specialty vehicles | Competitive pricing schemes for consumer access and fleet adoption |

| Low, with limited environmental integration | High, with emphasis on green production and circular economy strategies |

| Few configurations and sizes | Extremely customizable solutions based on vehicle type and application |

The global run flat tire inserts market is predicted to develop steadily, with increased application in military vehicles, high-end cars, and off-road use owing to their capacity for mobility following punctures. Technological advancements and growing demand for improved vehicle safety are driving growth. However, some risks can affect the projected growth trajectory.

One of the largest risks is the expense of run-flat tire systems, including the inserts and spare tires. Run-flat systems are more expensive than traditional tire systems, and that may deter price-sensitive customers, especially in emerging economies. This price difference restricts mass-market adoption, maintaining the niche and inhibiting growth into mass-industry vehicles.

There are also compatibility risks. Run-flat inserts are typically designed specifically for specific tires and vehicles and must be properly installed. Hence, limited flexibility increases dependence on OEM relationships or specialty aftermarket vendors. The marketplace could struggle to grow quickly enough without broad compatibility or standardization.

In addition, lack of availability and consciousness can be growth inhibitors. Latin American, Asia-Pacific and African sales penetration could be lagging, despite the growing motor population of the region, due to an absence of marketing or coverage. Few consumers are also unaware of the benefits provided by run-flat technology.

Competition also poses a technological threat in the form of self-sealing or airless tires that are gaining interest in offering puncture resistance with fewer compromises in ride quality. With these technologies developing, they would be able to compete head-on with run-flat inserts, forcing price and innovation competition in the industry.

Economic recessions and price fluctuations of raw materials (e.g., rubber and polyurethane) might affect manufacturing costs and profitability. The manufacturers may be forced to absorb a loss or lose their share to lower-priced equivalents, especially in the aftermarket environment.

To mitigate such risks, the manufacturers should invest in cost-saving efforts, sensitize stakeholders through targeted education campaigns, enhance collaborations with the OEMs, and investigate diversification into complementary tire safety technology.

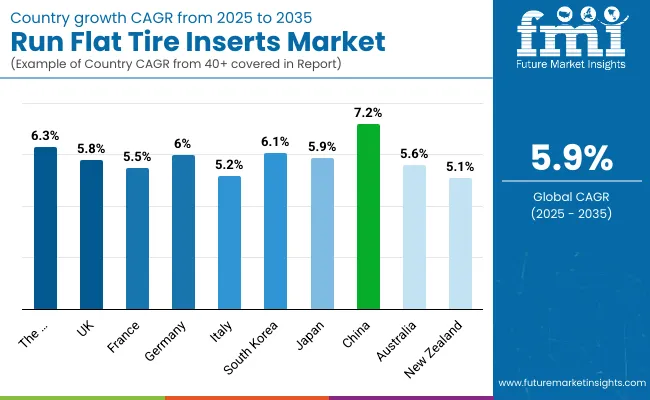

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.3% |

| UK | 5.8% |

| France | 5.5% |

| Germany | 6.0% |

| Italy | 5.2% |

| South Korea | 6.1% |

| Japan | 5.9% |

| China | 7.2% |

| Australia | 5.6% |

| New Zealand | 5.1% |

The USA is expected to grow strongly at a CAGR of 6.3% from the forecast period of 2025 to 2035. Industry growth is augmented by increasing demand for vehicle safety systems and constant innovation in tire technology. A strong luxury automotive player presence and a high level of investment in mobility solutions also drive growth.

Demand is the strongest in both passenger and military vehicle industries based on favorable regulatory environments and technological adaptability. Leading players in the USA include Hutchinson Industries, Michelin North America, and Goodyear Tire & Rubber Company, all of which are expanding product offerings to meet the increase in consumer demands for safety and performance. Competition is continuously increasing, triggering investments in new material technology and structural design innovation in insert structures.

The UKis expected to grow at a CAGR of 5.8% between 2025 and 2035. Industry growth is primarily led by high-end automobile production expansion and enhanced use of run flat technology in security and luxury vehicles. Government initiatives promoting advanced vehicle safety capabilities also propel growth, particularly in urban areas where tire failures represent significant operational hazards.

The industry is dominated by major players such as Pirelli, Continental AG, and Sumitomo Rubber Industries, which are all vying on the basis of technology upgrades unique to the UK's diverse driving conditions. Technological advancements in thermoplastic elastomers and structural composites will aid in increasing durability and drive growth throughout the forecast period.

The flat tire inserts market in France is expected to witness a CAGR of 5.5% through the forecast period until 2035. France's established automotive sector and strong research and development environment help achieve consistent growth. Advanced tire systems growth is impacted by the increased vehicle safety regulations and the increasing share of electric and hybrid vehicles, where weight optimization and safety are crucial considerations.

Key leaders such as Michelin, Bridgestone, and Trelleborg are competing fiercely to create insert solutions with enhanced thermal stability and loading potential. Continuous investment in smart tire solutions and integration with vehicle electronic systems also drive advancements.

Germany is forecasted to have a CAGR of 6.0% within the flat run tire inserts industry between 2025 and 2035. The country, as a vehicle manufacturing hub around the globe, aids in fostering demand while leading OEMs to increasingly implement run flat solutions as a way of enhancing car security and reducing time spent inoperative. Penetration is high for performance vehicles as well as for defense mobility solutions.

Top manufacturers such as Continental AG, Rheinmetall, andKraiburg Austria contribute to dominating by providing innovative solutions catering to extreme driving situations. Polyurethane and reinforced polymer material technologies are making extended lifespan and better ride performance possible, with consumers embracing these in various industries.

Italy's flat run tire inserts market will register a CAGR of 5.2% between the years 2025 and 2035. Demand is fueled by increasing demand in luxury and armor vehicle segments along with growing aftermarket potential. The rich heritage of automotive design in Italy underlines continued innovation in lightweight and adaptable tire technology.

Key players such as Pirelli, Hutchinson, and Marangoni are innovating product offerings through collaborative development and customization. Structural foam and hybrid material insert innovation is improving performance under extreme temperature and loading conditions, creating more reliable products and more extensive adoption in civilian and defense applications.

South Korea is anticipated to progress at a CAGR of 6.1% between 2025 and 2035. Rising domestic automotive production and high emphasis on vehicle safety improvements fuel growth. The adoption of electric vehicles and autonomous mobility platforms also fuels the demand for low-maintenance and durable tire technologies.

Major contributors such as Hankook Tire, Nexen Tire Corporation, and Kumho Tire are focusing on developing next-generation insert systems with integrated pressure management and long-duration run-flat capabilities. Partnerships with local OEMs and overseas defense contractors also increase competitiveness and product deployment.

Japan is expected to grow with a CAGR of 5.9% in the run flat tire inserts market during the forecast period. Emphasis on technological leadership and vehicle safety regulations strongly support the growth. The adoption of innovative materials and structure designs aligns with Japan's broader mobility innovation strategy.

Key leaders like Bridgestone Corporation, Toyo Tire Corporation, and Sumitomo Rubber Industries are stepping up R&D investment to develop performance and compatibility with new vehicle platforms. Usage is growing in high-performance passenger cars, disaster-response vehicles, and defense units, reflecting a diverse demand scenario.

China's run flat tire insert sales are forecast to exhibit the fastest development of major countries at a 7.2% CAGR from 2025 to 2035. Expediting urbanization, mounting vehicle ownership levels in the rising middle class, and regulatory imperative on auto safety by the government keep fueling demand. Indigenous EV manufacturing facility expansion also spurs the development of ancillary tire tech innovation.

Key players such as ZC Rubber, Sailun Group, and Linglong Tire are spending heavily on cost-efficient and scalable run flat insert solutions. Export-oriented production initiatives and local OEM platform integration expand extensive industry presence across vehicle categories such as passenger, military, and commercial utilization.

The Australian run flat tire inserts market is anticipated to register a CAGR of 5.6% during 2025 to 2035. Demand is prompted by mobility needs in extreme and hostile environments, along with military and emergency services vehicle uptake. Niche development is driven by local knowledge of vehicle safety and off-road reliability.

Customers such as Michelin, Goodyear, and Federal Corporation both serve the OEM and the aftermarket by means of strategic alliances and product placement. Peak performance in austere environments, plus regulatory compliance, will continue to drive product formulation and acceptance.

In New Zealand, the sales of run flat tire inserts will grow at a rate of 5.1% CAGR through the forecast period. Enhanced use in niche vehicle segments such as rural emergency response vehicles, defense, and high-end SUVs will contribute to growth. The value-heavy but minuscule nature of this segment results in attention to product reliability and safety standards.

Local producers include Bridgestone, Continental, and regional distributors who collaborate with overseas tire brands. Products are trending towards lighter, more energy-efficient insert designs to support applications in varied geographic and climatic conditions characteristic of New Zealand's transport infrastructure.

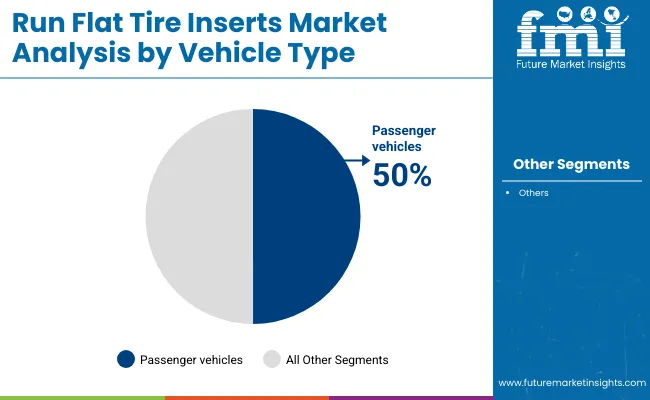

In 2025, the Run Flat Tire Inserts Market is mainly segmented into two vehicle types: passenger vehicles and commercial vehicles. Passenger vehicles lead with a 50% share, while commercial vehicles account for 25%.

The consumer demand for ease of access, safety, and mobility drives the growth of passenger vehicles in the Run Flat Tire Inserts Market. By supporting the vehicle to move with tire damage due to a slight puncture, automobile run-flat inserts eliminate the need for tire changing and repair.

Furthermore, the integration of run-flat tires into vehicle models by original equipment manufacturers (OEMs) such as BMW, Mercedes-Benz, and Audi has created a situation where they have become standard in most models. The high-performance and luxury segments have especially been the way run-flat tires shine. With more car manufacturers accepting run-flat technology, the demand for passenger vehicle run flat tire inserts continues to rise.

Commercial vehicles account for 25% of the industry, which is additionally benefitted from the convenience and safety offered by run flat tire inserts. In commercial scenarios such as heavy-duty transport and long-haul trucking, considering the convenience of changing these tires, real-life scenarios include logistics firms and freight drivers who, due to associated telematics or construction firms, sometimes cannot afford to have a tires-on-tow setup.

Run flat tire inserts then allow for continued onward mobility at no damaging cost in terms of tires, thus reducing downtimes, which is vital for any viable business. These options provided by the run-flat systems for commercial vehicles are offered by companies such as Bridgestone and Michelin, providing a tire that can bear a more significant load while satisfying the stringent conditions of commercial use. With the expansion of e-commerce and increased reliance on freight transport, the burgeoning sector for run flat tire inserts for commercial vehicles is being boosted.

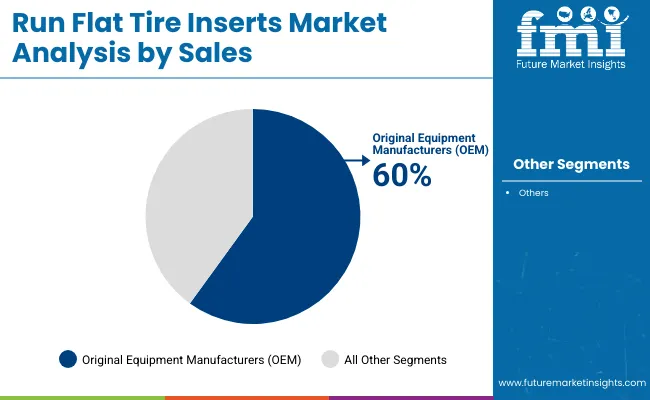

By sales channel, theindustryis segmented into Original Equipment Manufacturers (OEM) and aftermarket. The first dominates with its approximately 60% share, while the latter holds the remaining 40%.

The OEM segment dominates because of the growing penetration of run-flat tire technology into newly manufactured vehicles, mainly in the premium and luxury segments. Most models from automakers such as BMW, Mercedes-Benz, and Audi have run-flat tires, either standard or optional, in their lineup, pointing toward recognition of added safety and convenience in use by consumers.

As a result, this surge in demand for run-flat tire inserts through OEMs is being generated because consumers prefer such technology for their vehicles. Another contribution to this sales channel is the joint efforts among tire manufacturers like Bridgestone, Michelin, and Continental with the automaker's adoption of run-flat tires.

The aftermarket segment holds 40% of the share. More vehicles are loaded with run-flat tires; hence, the sales for replacement inserts have expanded within the aftermarket segment. Vehicle owners who incur damage or wear on their tires turn to the aftermarket for a cost-effective way to replace or upgrade their run-flat tires.

Varied offers of different tire inserts drive the segment adapted to several vehicle models and the convenience this brings of not having to spare tires when it comes to replacing run-flat tires. Tire Rack, Discount Tire, and TireBuyer are some of the major players in the aftermarket.

The industryhas tough competition among dominant manufacturers based on performance enhancement, military-grade applications, and integration with safety technologies in vehicles. Running flat solutions by way of patents, allowing mobility after the damage of a tire, keeps the top-ranking companies, namely, Bridgestone Corporation, Michelin, and Continental AG, at the forefront. Strategies adopted by the respective players include collaboration with OEM partners, exclusive supply contracts for luxury and armored vehicles, and investments in smart tire technology.

Leading players such as Goodyear and Pirelli emphasize specialized tread patterns as well as strengthened sidewall technologies to deliver extraordinary durability and adaptability to run-flat tires in sports, commercial, and high-security applications. These companies engage in material innovations, heat-dissipating solutions, and AI-driven predictive maintenance technologies to further strengthen their presence.

Newcomers such as Hutchinson Industries and RunFlat International Ltd. target military, law enforcement, and off-road avenues by providing lightweight, high-strength polymer-based insert systems. Asian manufacturers, including Sumitomo Rubber Industries and Toyo Tire Corporation, are rapidly expanding their territory on lower-cost run-flat technologies aimed at mass-market vehicles and commercial fleets.

The innovations in the industry are lightweight composites, sensor-based monitoring systems, and self-sealing run-flat solutions, which have been improved by their manufacturing processes, supply chain efficacy, and aftermarket service model. Strategic investments in AI-powered tire analytics, sustainable materials, and high-performance rubber compounds are increasingly shaping the competitive landscape.

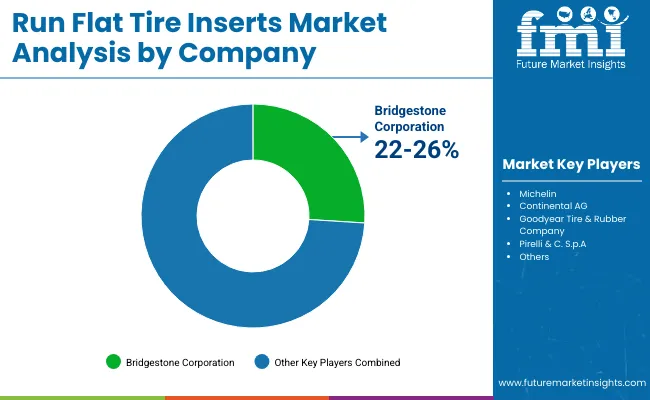

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bridgestone Corporation | 22-26% |

| Michelin | 18-22% |

| Continental AG | 14-18% |

| Goodyear Tire & Rubber Company | 10-14% |

| Pirelli & C. S.p.A | 8-12% |

| Combined Others | 15-25% |

| Company Name | Offerings & Activities |

|---|---|

| Bridgestone Corporation | High-durability run-flat tires for luxury, military, and high-performance vehicles. |

| Michelin | Self-sealing and run-flat tire technologies integrated with smart sensor solutions. |

| Continental AG | Lightweight, heat-resistant , run-flat inserts for commercial and emergency response fleets. |

| Goodyear Tire & Rubber Company | AI-driven tire monitoring with reinforced run-flat sidewall designs. |

| Pirelli & C. S.p.A | Sports-performance run-flat tire solutions with specialized rubber compounds. |

Key Company Insights

Bridgestone Corporation (22-26%)

Bridgestone dominates the sector with reinforced polymer-based run-flat solutions catering to luxury, military, and performance automotive segments.

Michelin (18-22%)

Michelin’s self-sealing run-flat technology integrates real-time tire pressure monitoring for enhanced safety and extended mobility.

Continental AG (14-18%)

Continental leads in heat-resistant, lightweight, run flat tire inserts optimized for high-speed and emergency vehicle applications.

Goodyear Tire & Rubber Company (10-14%)

Goodyear pioneers AI-driven tire monitoring systems combined with run-flat reinforcement for improved durability and efficiency.

Pirelli & C. S.p.A (8-12%)

Pirelli specializes in ultra-high-performance run-flat tires engineered with innovative tread compounds for superior handling.

Other Key Players

The industry is segmented into Rooftop and Ground-mounted.

The industry is segmented into Fixed and Tracking.

The industry is segmented into Residential, Commercial, and Civic Utilities.

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry valuation is estimated to be USD 563.5 million in 2025.

Sales are projected to grow to USD 1,000.8 million by 2035, indicating a robust expansion.

China is expected to grow at a rate of 7.2%, reflecting rising demand for advanced automotive safety technologies.

Passenger vehicles remain the primary application segment.

Leading companies include Bridgestone Corporation, Michelin, Continental AG, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A, Hutchinson Industries, Sumitomo Rubber Industries, Toyo Tire Corporation, RunFlat International Ltd., and Michelin Tweel Technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Running Shoes Market Growth - Trends & Demand Forecast 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Runway Lighting System Market

Crunch‑textured Snacks in Spain Analysis - Size, Share & Forecast 2025 to 2035

Trunks Market

Corundum Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hirschsprung Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Refurbished Running Shoes Market Growth - Trends & Forecast 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Terrestrial Trunked Radio (TETRA) Market Analysis - Size, Share, and Forecast 2025 to 2035

Session Initiation Protocol (SIP) Trunk Market

Flat Rack Containers Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Pouch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA