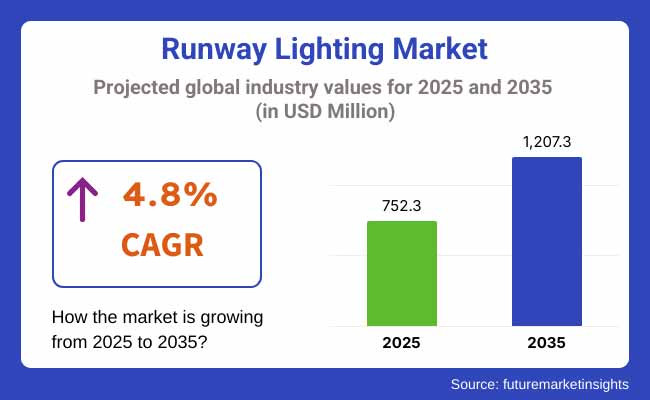

Runway lighting market will grow in the forecast period of 2025 to 2035 due to rising airport infrastructure spending, retrofits for existing runways, and energy-efficient high light system requirements. The market would be worth approximately USD 752.3 million in 2025 and to USD 1207.3 million by 2035 with a 4.8% compound annual growth rate in the forecast period.

There are certain very strong reasons for the market situation. The main reason behind the growth is the rise in civilian and military air traffic. Airports across the globe are upgrading their runway lighting systems with higher version systems with better safety specification standards and newer technologies.

Major hubs like London Heathrow and Los Angeles International Airport, for example, are choosing LED-based systems in a bid to provide better visibility as well as electricity cost savings. However, high initial investment and requirement of tight control are serving as a barrier of entry into the market. Manufacturers are thus shifting focus towards importation of higher performance flexible lighting systems with International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA) standards compliance to the aviation level to counteract this.

Runway lighting may be categorized into various types under various categories based on the function and technology. Approach light installations (ALS), threshold lights, edge lights, and touchdown zone lights are indicators of increased visual acuity during landing or take-off. LED-based runway light installations are gaining popularity as they consist of ruggedness, low power consumption, and lower maintenance cost.

For instance, large airport owners across the entire Middle East region are placing orders for LED-based precision approach path indicators (PAPI) to offer pilots more accuracy under poor weather conditions. Solar-runway lighting is also in demand, especially by regional and rural airports where grid penetration is minimal.

North America's largest runway lighting market has a massive share of the world and regional airports eager to upgrade. The USA, home to busiest airports like Hartsfield-Jackson Atlanta International Airport and Chicago O'Hare International Airport, is a league leader in implementing the LED and smart lighting technology.

The need for going green without losing the green colour while operating the airports efficiently too is promoting investment in high-quality efficient runway lighting systems. Besides, the demand for night flight and takeoff and landing under low visibility conditions is also propelling airport authorities towards the use of high-intensity LED lights.

Europe leads the runways lighting market, especially in Germany, France, and the UK. The regulatory guidelines of European Aviation Safety Agency (EASA) are forcing airports to replace their existing lighting systems with more efficient configurations for energy conservation and safety.

For instance, Frankfurt Airport recently installed a novel approach lighting system using LEDs that facilitates navigation for pilots and reduces operational expenses. Major European airport operators are even using intelligent light control systems to control intensity dynamically according to weather conditions and flight scenarios.

The Asia-Pacific region will be the largest to grow in the market for runway lighting through improved aviation expansion and growing spending on airport facilities. China, India, and Indonesia are building new airports and expanding others to meet rising passenger traffic.

India's UDAN (Ude Desh Ka Aam Nagrik) regional airport expansion program has generated demand for affordable solar-powered runway lighting. Beijing Daxing International Airport utilizes intelligent runway lighting systems that dynamically adjust luminance according to volume of aircraft.

Challenge: Prohibitive Upfront Investment and Regulated Compliance

Installation of sophisticated lighting technology, smart and sophisticated runway lighting systems, demands huge capital investment, a huge economic burden for small and medium airports. Approvals by bodies like ICAO, FAA, and EASA also contribute to the work and cost of compliance. Airport infrastructure in developing countries also never receives a proper budget, and installation of sophisticated lighting technology is thus postponed.

Opportunity: Technological Innovations in Smart and Sustainable Lighting

Increasing sustainability awareness is driving innovation in solar-powered and LED-based runway lighting systems. Adaptive lightning technology, intensity changing with weather and traffic conditions, is also being developed by companies. Honeywell and ADB SAFEGATE, for instance, are leading innovation in adaptive runway light systems for providing best visibility and reducing power consumption. Remote monitoring and forecast maintenance capabilities are also rationalizing airport lights systems.

Between 2020 to 2024, airport runway lighting experienced never-before-seen demand owing to airport expansion and rigorous safety protocols. The shift to replace long-standing halogen bulbs with power-efficient LEDs accelerated, particularly from advanced economies. The unforeseen COVID-19 pandemic incidentally destroyed airport infrastructure expenditures for a period but post-pandemic recuperation happened in the blink of an eye boosting next-gen runway lighting system demand once again.

Through to 2025 to 2035, the market will continue to advance with technologies in smart light, sustainability, and automation. Internet of Things (IoT) control of lighting systems, auto-diagnosis, and adaptive brightness control will define the future of runway lighting. Solar-powered solutions will rise to prominence in airports for reducing costs and operating on a carbon-neutral basis. As more global air travel is on the increase, financing sophisticated runway lighting systems will be one way of maintaining airport operations to be safe and efficient.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Aviation authorities issued basic LED lighting overhauls to increase visibility on runways. ICAO and FAA standards emphasized energy efficiency but didn't call for across-the-board changes. |

| Technological Advancements | Replacement of halogen and incandescent with LED-based systems increased energy efficiency and lifespan. Wireless control systems achieved limited success. |

| Smart Airport Infrastructure | Early adoption of automated lighting systems and remote monitoring at principal airports, prioritizing energy efficiency. |

| Resilience & Sustainability | Partial LED installations were employed to reduce carbon footprints. Reserve power systems were primarily diesel-powered. |

| Safety & Operational Efficiency | Basic lighting upgrades improved runway safety, but severe weather conditions were still an issue. |

| Cost & Lifecycle Management | Initial costs of LED lighting installations were high, limiting take-up, despite long-term cost benefits. Lifecycle cost savings remained the key selling point. |

| Market Growth Drivers | Airport modernization schemes, growing air traffic, and regulatory encouragement for LED take-up drove expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter safety and sustainability laws prompt widespread adoption of adaptive energy-saving LED lighting systems. Weather-smart intelligent lighting systems with automated brightness adjustment become regulatory norms. |

| Technological Advancements | AI-based runway lighting with prognostic maintenance assists in lowering downtime. Solar-powered LED light integration and smart IoT-based intelligent lighting control systems revolutionize airfield lighting. |

| Smart Airport Infrastructure | Mass adoption of real-time data analytics-facilitated integrated airfield ground lighting (AGL) systems for enhanced safety and visibility. Efficiency and human mistake are avoided by AI-facilitated automation. |

| Resilience & Sustainability | Widespread deployment of green light technologies like grid-independent and solar-powered lighting. Battery storage devices with renewable power sources ensure perpetual runway lighting during outages. |

| Safety & Operational Efficiency | Smart weather-responsive adaptive lighting systems enhance visibility and decrease flight delays. Automated fault detection also reduces maintenance-related downtime. |

| Cost & Lifecycle Management | Reduce costs by mass adoption and technology advancements. Enhanced materials and maintenance-free LED-based solutions extend the life cycle even further, enhancing return on investment. |

| Market Growth Drivers | Accelerated growth driven by the development of smart airports, growing demand for robust and energy-efficient infrastructure, and governmental incentives towards carbon-neutral flying operations. |

The United States runway lighting industry has been growing step by step since the airports keep getting upgraded, air traffic keeps rising, and policy regulation is now moving towards efficient energy technology. The FAA policy required the conversion from halogen to LED systems, and the bigger airports started using automated lighting systems as a method of attaining better visibility and security.

During the following two years, growth in smart airport developments and installations of state-of-the-art airfield lighting systems will drive the market. Rising repeated instances of weather-related accidents drive demand for robust lighting systems with instant reaction to changes. Solar-powered runway lights and IoT-regulated smart control systems will be the main trends in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

UK airport runway lighting is driven by the intense security regulation, green initiative, and continuous airport infrastructure development. CAA regulatory compliance has resulted in the development of humongous replacement programs for LEDs, and demand for smart light technology increases by the day. Sustainability legislation driving airports towards hybrid and solar lighting will power future development.

The UK government's carbon-neutral airport infrastructure policy is driving smart airfield lighting system investment. Expansion in nighttime flights further highlights the necessity of next-generation light solutions, like AI-based adaptive ones.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union aviation lighting industry has been dominated by strict environmental policies and green aviation objectives. Dutch, French, and German airport lighting has already been replaced with LED airport lighting technology, and additional emphasis is being put on incorporating smart automation capability.

The EU Green Deal net-zero carbon objective is also propelling the use of energy-efficient lighting technology increasingly. Airport development schemes and growing air traffic are going to fuel more investments in intelligent lighting technology. Deployment of AI-based solutions for intelligent brightness levels and predictive maintenance is now becoming the new standard for all European airports.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan's air transport lighting market is witnessing high demand with the country's investment in smart airport technology and airport security. LED lighting at large airports such as Narita and Haneda with high-precision-controlled technology improved night operations and power efficiency.

Future development is being initiated with innovation in AI-controlled lighting systems that will be performing live realignments based on changing weather patterns. Japanese leadership in the uptake of renewable energy is also initiating investment in solar-powered runway lights solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

South Korea airport runway market is expanding with the enhanced use of technology and infrastructure development at strategic airports like Incheon and Gimpo. Smart airport strategy of the country is promoting end-to-end automation, IoT-based lighting enhancing business and security.

Government policies toward green aviation operations and expansion of infrastructure for improving resiliency are pushing the adoption of adaptive light solutions. Predictive maintenance offerings and solar-powered runway lighting will propel the market to grow in the future.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

LED lighting is the norm in runway lighting with its enhanced energy efficiency, increased lifespan, and lower maintenance. Airports across the world are converting runways to LED lighting to achieve maximum lighting at reduced expenditure. LEDs consume much less power compared to incandescent and halogen lighting, a feature that is making them the new standard in big commercial airports such as Hartsfield-Jackson Atlanta International Airport and Heathrow Airport, where light is ever needed to enhance security and efficiency.

LED technology also offers better resistance to extreme weather, thus decreasing chances of failure in demanding applications. Growing concern for sustainability and reduction of carbon footprints has also grown LED usage, particularly in countries with strict energy policies, i.e., North America and Europe. The growth of smart lighting networks, e.g., automatic control and monitoring of LED lights, is also poised to propel the segment forward.

In spite of the quick transition to LEDs, incandescent runway lighting remains on the table, especially in legacy-infrastructure airports. Incandescent lighting is used in low-scale and mid-scale airports, especially in developing countries, because it has a lower capital cost. Latin American and African regional airports like Peru's Jorge Chávez International Airport and Ghana's Kotoka International Airport remain to use incandescent lighting systems where financial constraints cannot be met right away for LED replacement.

Halogen lamps are capable of adequate fog visibility but their climatic application range as an economical alternative is limited. Their energy-starved need and lessened life span are disadvantageously contrasted to the situation in an LED solution, and the motive for extensive usage is unattractive. As modernization schemes pick up steam, the share of the incandescent lighting market will be impacted because alternatives will lean towards green options.

Halogen light continues to be utilized in specialty applications, mostly special flight and military operations. Military bases like Nellis Air Force Base in the USA continue to use halogen runway lights because they are heat-resistant and offer quality light. Halogen light is also capable of offering full brightness instantly without warm-up time, which is advantageous in emergency and tactical applications.

Although the halogen lamp delivers higher color quality than does the incandescent light, the additional heat and shorter lifetime render them inappropriate for major airport installations. Halogen gear still sees service on military installations and in some remote private airstrips, such as those used for Arctic exploration or scientific research stations, where robustness in challenging conditions is of more importance than conserving energy.

Commercial airports remain the largest end-use application market for runway lights, driven by strong air traffic demand and stringent aviation safety regulations. Large international hub airports such as Dubai International Airport and Los Angeles International Airport are massive spenders on advanced lighting infrastructure to provide safe night and low-visibility operations. More passengers flying and more expansion plans such as the construction of new terminals for Istanbul Airport are also accountable for demanding more advanced runway lighting solutions.

Regulatory standards by aviation authorities like the Federal Aviation Administration (FAA) and the International Civil Aviation Organization (ICAO) make commercial airports implement quality lighting systems, and therefore they need LED upgrades. Expansion of public-private partnerships (PPPs) and airport privatization in the Middle East and Asia-Pacific is also driving investment to upgrade runway lights.

Military airfields account for most of the runway lighting industry because reliability in lighting is crucial to military bases, combat operations, and take-off and landing in case of emergency. Military airfields such as Ramstein Air Base in Germany and Edwards Air Force Base in the USA place a lot of emphasis on strong and bright lighting systems, even incorporating infrared light in the event of night vision compatibility.

Governments are increasing military expenditures, particularly in the USA, China, and India, and are thus opting to fit upgraded light equipment on airbases. Airfield light systems for military use are extremely robust, and they will operate even on rescue or combat missions. Their use in military and intelligent lighting is gradually gaining momentum, whereas conventional incandescent and halogen systems are being installed since they are recognized to possess a tested record of operating under tough conditions.

Private airports, such as business jets, charter aircraft, and private flying terminals, are a niche but expanding sector of the runway lighting industry. Airports such as Teterboro Airport in the USA and Farnborough Airport in the UK need custom-designed lighting systems that are economically effective, visually appealing, and operationally efficient.

Private airstrips have greater leeway in embracing frequency-based lighting technologies by operational frequency and cost than military and commercial airports. While most private airports have already switched to LED lights for long-term profitability and sustainability, small airports still hold inventories of incandescent and halogen bulbs because of their initial cost advantage. Increased demand for private air transport driven by business air travel and high-net-worth individuals will underpin further investment in runway lighting infrastructure in this segment.

The runway lighting market is competitive, driven by aggressive foreign competitors and local manufacturers satisfying aviation infrastructure demand. It is driven by advancements in LED, smart lighting, and international levels of aviation conformity. Successful market competitors focus on energy saving, high resistivity, and increased visibility in varying atmospheric conditions. The market comprises a combination of strong corporate giants and new upstarts, each driving innovation and market expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ADB Safegate | 18-23% |

| Honeywell International Inc. | 14-18% |

| Eaton Corporation | 10-14% |

| OCEM Airfield Technology | 6-10% |

| ATG Airports Ltd | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ADB Safegate | Specializes in advanced airfield lighting systems, LED runway lights, and intelligent airfield solutions. Focuses on automation and real-time monitoring for enhanced safety and efficiency. |

| Honeywell International Inc. | Provides precision approach path indicators (PAPI), taxiway lighting, and obstruction lights. Invests in energy-efficient LED lighting solutions to reduce operational costs. |

| Eaton Corporation | Manufactures FAA- and ICAO-compliant runway and taxiway lighting systems. Develops smart lighting control solutions for optimized airport operations. |

| OCEM Airfield Technology | Offers customized airfield lighting solutions, including high-intensity runway edge lights and inset lights. Known for its durable and low-maintenance lighting products. |

| ATG Airports Ltd | Supplies runway, taxiway, and approach lighting solutions with a focus on LED-based systems. Provides modular airfield lighting infrastructure to facilitate rapid deployment. |

Key Company Insights

ADB Safegate (18-23%)

ADB Safegate leads the way in runway lighting with its state-of-the-art airfield illumination and intelligent automation technologies. ADB Safegate provides high-brightness LED runway lighting, intelligent control systems, and real-time monitoring solutions for maximum airport safety and operating efficiency. Its new light technologies have widespread installations in major global airports with ICAO and FAA approval guarantees.

Honeywell International Inc. (14-18%)

Honeywell International Inc. is a world leader in airfield lighting products and solutions like runway approach lighting, obstruction lighting, and taxiway edge lighting. Honeywell is interested in energy-efficient lighting solutions and smart monitoring solutions to allow airports to transition to efficient and cost-effective lighting systems. Honeywell's global presence allows for uninterrupted supply of high-performance lighting systems to military and commercial airfields.

Eaton Corporation (10-14%)

Eaton Corporation maintains FAA- and ICAO-certified runway lighting gear focusing on intelligent control systems. Eaton provides heavy-duty energy-saving LED taxiway lights and runway lights for increased light and safety improvement. Eaton delivers centralized lighting control systems with remotely adjustable functions on a real-time basis to enhance more adaptive airfield lighting towards changing weather and flight timetables.

OCEM Airfield Technology (6-10%)

OCEM Airfield Technology is a reliable airfield lighting company with high-performance capabilities. It provides custom-made high-intensity runway edge lighting, inset light systems, and solar airfield light systems. Its product is widely used in commercial airports as well as defense airports where reliability and low maintenance are of paramount concern.

ATG Airports Ltd (4-8%)

ATG Airports Ltd provides extensive ranges of airfield light systems ranging from approach lights to taxiway lights. ATG's emphasis on LED-based systems is in line with energy conservation and maintenance cost savings. ATG's modular light system is simple to install and retrofit, and this places this firm in a leading position in airport modernization.

Other Key Players (40-50%)

Along with these market-share leaders, several other companies hold substantial market share, which impacts airfield lighting technology development, sustainability, and cost. These include:

The global runway lighting market was valued at approximately USD 752.3 million in 2025.

The runway lighting market is projected to reach approximately USD 1207.3 million by 2035, growing at a CAGR of 4.8% from 2025 to 2035.

The demand for runway lighting is expected to be driven by factors such as the increasing number of airports worldwide, the growing use of LED lights, and the need for energy-efficient and cost-effective lighting solutions amidst the growth in air traffic and aviation infrastructure modernization.

The top 5 countries contributing to the runway lighting market include the United States, the United Kingdom, India, Germany, and China.

Based on product type, LED lighting is expected to dominate the runway lighting market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Runway Lighting System Market

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Marine Lighting Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Wireless Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA