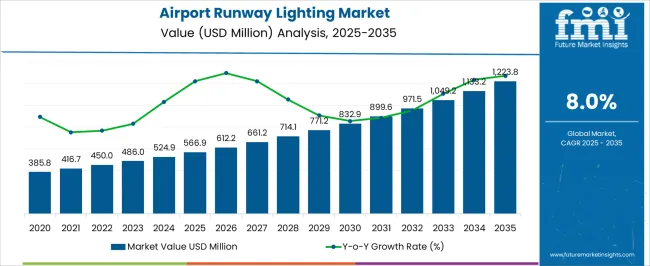

The airport runway lighting market is projected to reach 566.9 USD million in 2025 and expand to 1,223.8 USD million by 2035, growing at a CAGR of 8.0%. Growth elasticity is closely linked to macroeconomic indicators such as global air passenger traffic, airport infrastructure spending, and government aviation budgets. Expansion in emerging markets with rising middle-class populations and increasing disposable incomes drives higher air travel demand, which in turn stimulates investments in airport modernization projects, including advanced lighting systems.

Additionally, global GDP growth, industrial output, and trade volumes influence cargo traffic, indirectly affecting runway lighting requirements for commercial and logistics airports. Currency fluctuations, import-export policies, and fiscal incentives also affect procurement costs for high-quality LED, solar-powered, and smart lighting solutions. Technological standardization, safety regulations, and compliance with ICAO and FAA standards further shape adoption timing and project feasibility. The elasticity of the market indicates that a 1% rise in aviation infrastructure expenditure or air traffic correlates to approximately a 0.7–0.8% increase in runway lighting demand. Moreover, shifts in government priorities toward modernization, renewable energy integration, and climate resilience can either accelerate or moderate growth.

Regional economic recovery trends, post-pandemic air traffic resurgence, and strategic airport expansions in Asia-Pacific and the Middle East are expected to contribute disproportionately to the overall market trajectory, while established markets in North America and Europe focus on retrofitting, efficiency, and automation.

| Metric | Value |

|---|---|

| Airport Runway Lighting Market Estimated Value in (2025 E) | USD 566.9 million |

| Airport Runway Lighting Market Forecast Value in (2035 F) | USD 1223.8 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The airport runway lighting market is strongly influenced by five interconnected parent markets, each contributing distinctly to overall demand and growth. The commercial aviation infrastructure market holds the largest share at 40%, driven by airports upgrading lighting systems to enhance safety, accommodate increasing passenger traffic, and comply with ICAO and FAA standards.

The cargo and logistics airport segment contributes 25%, with demand tied to efficient night operations, air freight handling, and compliance with operational safety regulations. Military and defense aviation accounts for 15%, as runway lighting is critical for night sorties, training operations, and rapid deployment missions. Airport modernization and renovation projects hold a 10% share, fueled by initiatives to retrofit aging lighting systems, implement energy-efficient LEDs, and integrate smart controls for reduced operational costs. Finally, the general aviation and private airports market represents 10%, supporting business jets, regional airstrips, and smaller airfields requiring compliant lighting solutions for safe take-offs and landings.

Commercial, cargo, and military segments account for 80% of overall demand, highlighting that passenger traffic growth, cargo operations, and defense requirements remain the primary growth drivers, while modernization projects and private aviation provide additional opportunities for global market expansion.

The airport runway lighting market is expanding steadily, driven by rising global air traffic, modernization initiatives, and increased focus on safety compliance. Growing investments in airport infrastructure, particularly in developing economies, are creating strong demand for efficient and reliable runway lighting systems.

Technological advancements in energy efficiency, durability, and smart control systems are supporting widespread adoption, while stringent aviation regulations are mandating the use of high-quality lighting solutions. The integration of advanced lighting technologies is enabling improved visibility, operational efficiency, and cost savings for airport operators.

With ongoing expansion projects and airport upgrades worldwide, the outlook remains positive as stakeholders prioritize sustainable solutions that enhance both safety and operational performance.

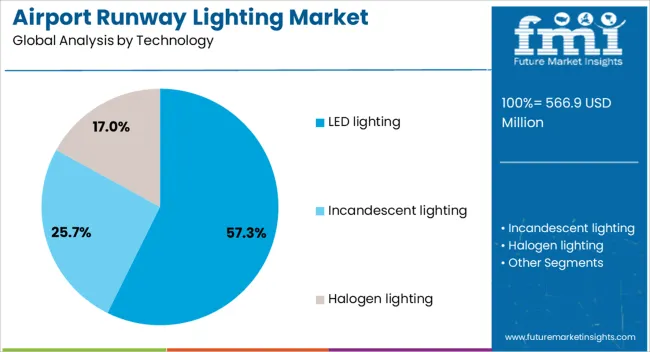

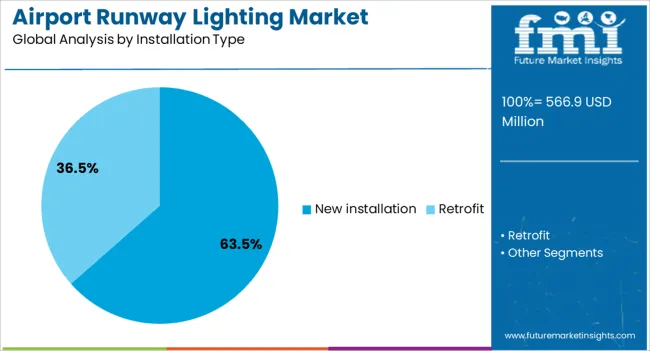

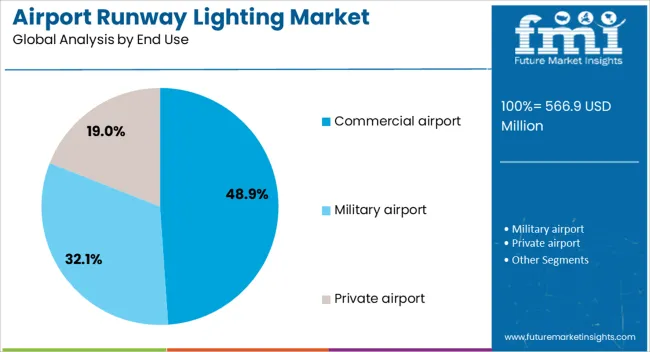

The airport runway lighting market is segmented by technology, installation type, end use, and geographic regions. By technology, airport runway lighting market is divided into LED lighting, Incandescent lighting, and Halogen lighting. In terms of installation type, airport runway lighting market is classified into New installation and Retrofit. Based on end use, airport runway lighting market is segmented into Commercial airport, Military airport, and Private airport. Regionally, the airport runway lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED lighting segment is projected to account for 57.30% of the total market revenue by 2025 within the technology category, positioning it as the dominant choice. This growth is supported by the superior energy efficiency, extended lifespan, and low maintenance requirements of LED systems compared to traditional lighting options.

The ability of LED lighting to deliver consistent illumination under varying weather conditions has enhanced its reliability in critical runway applications. Additionally, environmental benefits such as reduced carbon emissions and compatibility with smart control systems have further driven adoption.

Airports seeking to minimize operational costs while meeting sustainability goals are increasingly turning to LED technology, solidifying its leadership in the market.

The new installation segment is expected to contribute 63.50% of total revenue by 2025, making it the leading installation type. This dominance is driven by the rise in greenfield airport projects, expansions, and modernization efforts worldwide.

Governments and private operators are investing in advanced runway lighting systems to meet international aviation standards and improve passenger safety. The ability to integrate the latest energy-efficient technologies and smart monitoring systems during new construction provides long-term operational and maintenance benefits.

As global air travel continues to recover and expand, the demand for new installations is anticipated to remain strong.

The commercial airport segment is projected to hold 48.90% of total market revenue by 2025 under the end use category, making it the most significant contributor. This growth is driven by the continuous increase in passenger and cargo traffic, necessitating enhanced runway safety measures.

Commercial airports require reliable, high-performance lighting to support operations during varying visibility conditions and extended operational hours. Additionally, competitive pressures and service quality benchmarks are prompting operators to invest in advanced lighting systems that improve both safety and efficiency.

The consistent flow of air traffic and ongoing infrastructure upgrades ensure that commercial airports remain the largest end user in the runway lighting market.

The airport runway lighting market is primarily driven by commercial traffic growth, cargo operations, military requirements, and modernization initiatives. Safety, reliability, and operational efficiency remain key adoption factors across all airport segments.

The airport runway lighting market is witnessing growth due to rising passenger traffic and expansion of commercial aviation infrastructure. Airports are upgrading lighting systems to comply with ICAO and FAA safety standards while supporting night and low-visibility operations. LED and energy-efficient solutions are preferred for lower maintenance costs, improved visibility, and durability under varying weather conditions. Large international airports are leading adoption due to stringent operational requirements and higher air traffic volumes. Expansion of regional airports also contributes to market growth as operators seek standardized lighting solutions to handle increasing flights. Operational efficiency, safety compliance, and reduced downtime are critical factors shaping procurement decisions for both public and private airport authorities.

The cargo and logistics aviation sector is a key driver for runway lighting deployment. Night-time operations, rapid aircraft turnaround, and large-scale freight handling require reliable and high-intensity lighting solutions. Air cargo hubs prioritize systems that enhance visibility during peak operational hours and minimize delays. Automated control systems are being integrated to allow dynamic lighting adjustments based on aircraft movement and weather conditions. Regional freight-focused airports are investing in runway and taxiway lighting to meet growing demand for e-commerce and express delivery services. Maintenance efficiency, durability, and operational reliability of lighting fixtures influence purchasing decisions, while integration with air traffic control and airport operations management enhances overall functionality.

Runway lighting is critical for military and defense airports supporting night sorties, rapid deployment, and training exercises. Air force bases require robust, high-intensity lighting capable of withstanding harsh environmental conditions. Portable and temporary lighting solutions are increasingly used for tactical operations and emergency runways. Systems are selected based on precision, durability, and ability to integrate with navigation aids for secure operations. Military standards often exceed civil aviation specifications, driving innovation in fixture performance and control mechanisms. Long lifecycle, resistance to damage, and low-maintenance designs are essential considerations for defense authorities. Investments in runway lighting enhance readiness, operational flexibility, and safety during complex and high-tempo flight operations.

A significant portion of airport runway lighting demand comes from modernization and retrofit initiatives. Aging infrastructure is being upgraded to LED systems, reducing energy consumption, maintenance costs, and downtime. Retrofit projects also aim to improve visibility for pilots, enhance airport compliance, and integrate intelligent control systems for automated operations. Both small regional airports and major international hubs are undertaking phased replacement strategies to minimize operational disruptions. Vendors are focusing on providing modular solutions, standardized components, and long-lasting fixtures that simplify installation and service. Government and private investments in airport expansion, renovation, and safety enhancement programs are driving consistent market growth globally.

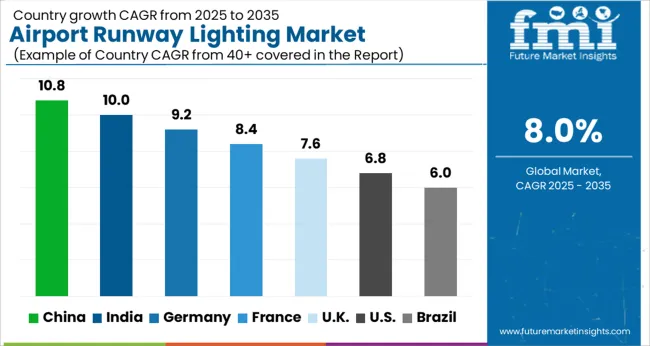

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global airport runway lighting market is projected to grow at a CAGR of 8.0% from 2025 to 2035. China leads with 10.8%, followed by India (10.0%), Germany (9.2%), the UK (7.6%), and the USA (6.8%). Growth is driven by increasing air traffic, airport expansions, modernization projects, and regulatory compliance for safe night and low-visibility operations. BRICS nations, especially China and India, are witnessing rapid adoption due to growing passenger and cargo flights, while Europe and North America emphasize energy-efficient, durable, and automated lighting solutions. Demand for LED-based systems, intelligent control integration, and retrofit of aging infrastructure is shaping market expansion globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The airport runway lighting market in China is projected to grow at a CAGR of 10.8% from 2025 to 2035, driven by rapid expansion of commercial airports, increasing passenger traffic, and modernization of existing infrastructure. New airport projects across tier-1 and tier-2 cities are investing in LED, solar-powered, and energy-efficient lighting systems to enhance operational safety and comply with international aviation standards. Air navigation service providers are integrating intelligent lighting control systems for better visibility, reduced energy consumption, and automated monitoring. Domestic manufacturers are scaling production of high-durability, corrosion-resistant lighting fixtures tailored for harsh weather conditions. Partnerships with global aviation technology firms are enabling faster adoption of advanced lighting solutions, while government investment in airport infrastructure continues to boost demand.

The airport runway lighting market in India is expected to grow at a CAGR of 10.0% from 2025 to 2035, fueled by increasing air passenger traffic, new airport projects, and expansion of regional aviation hubs. Airports are upgrading to LED and energy-efficient lighting systems that comply with ICAO standards for night and low-visibility operations. Runway and taxiway lighting installations are being integrated with centralized control systems for better monitoring and maintenance efficiency. Domestic manufacturers are collaborating with global aviation technology providers to supply high-durability and weather-resistant fixtures suitable for diverse climatic conditions. Investment by the Airports Authority of India and private players in smart airport infrastructure is further driving market adoption.

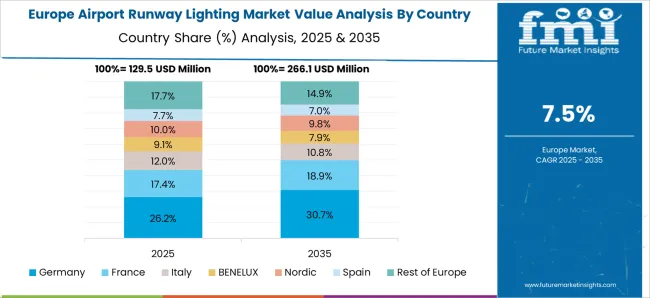

The airport runway lighting market in Germany is projected to grow at a CAGR of 9.2% from 2025 to 2035, supported by airport modernization projects and strict adherence to EU and ICAO safety standards. Major airports such as Frankfurt, Munich, and Berlin are upgrading to LED, intelligent control, and energy-efficient lighting systems. Focus on operational safety, reduced energy consumption, and predictive maintenance is driving the replacement of aging infrastructure. Local manufacturers emphasize high-quality, corrosion-resistant lighting solutions with long lifespans and minimal maintenance requirements. Collaborations with international aviation technology firms are facilitating the integration of automated monitoring systems, while retrofit projects at regional airports are contributing to market expansion.

The airport runway lighting market in the UK is expected to grow at a CAGR of 7.6% from 2025 to 2035, driven by modernization of major airports and compliance with ICAO and CAA regulations. London Heathrow, Manchester, and other international airports are adopting energy-efficient LED runway and taxiway lighting, along with intelligent control systems for automated monitoring and maintenance. Airport authorities are prioritizing durability, corrosion resistance, and reduced energy consumption in lighting fixtures. Domestic and international manufacturers are collaborating to offer turnkey solutions, including installation, maintenance, and control system integration. Investments in regional airports and refurbishment of older airports further contribute to market expansion.

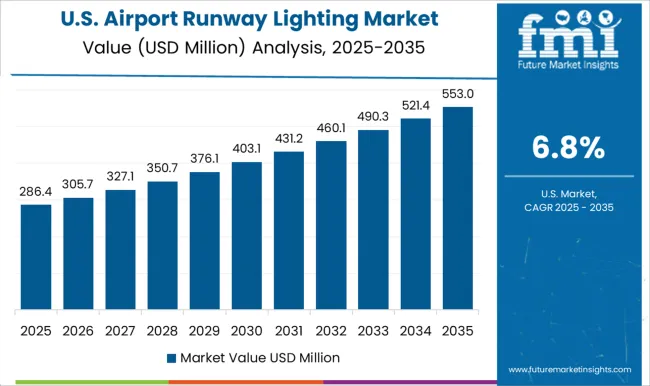

The airport runway lighting market in the USA is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by ongoing airport modernization projects, safety compliance, and energy-efficient upgrades. Major hubs such as Atlanta, Los Angeles, and Chicago are replacing conventional lighting with LED and solar-powered runway systems integrated with automated control and monitoring solutions. Focus on long-life, low-maintenance, and weather-resistant fixtures is influencing procurement decisions. Federal Aviation Administration (FAA) programs and funding for airport infrastructure improvements support adoption. Domestic manufacturers and global suppliers collaborate to provide high-performance, compliant lighting systems, while retrofit projects at regional airports contribute to steady market growth across the country.

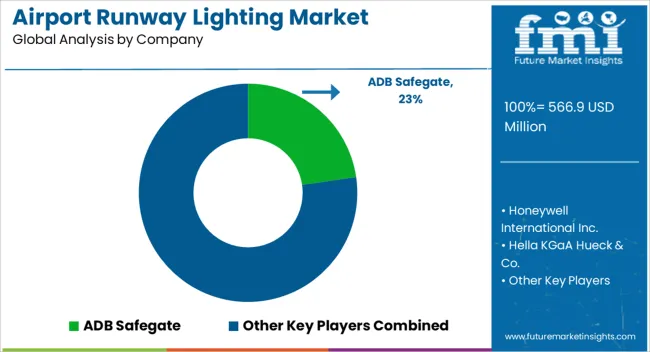

Competition in the airport runway lighting market is defined by energy efficiency, operational reliability, and regulatory compliance with ICAO and national aviation standards. ADB Safegate leads with integrated airfield lighting solutions, offering LED runway, taxiway, and apron lighting systems coupled with intelligent control and monitoring platforms to enhance airport safety and operational efficiency. Honeywell International Inc. competes with turnkey airport lighting solutions, emphasizing automation, durability, and integration with air traffic management systems, supporting both new constructions and retrofit projects. Hella KGaA Hueck & Co. differentiates through high-performance, weather-resistant lighting fixtures designed for low-maintenance and long service life, suitable for extreme climatic conditions. OSRAM Licht AG focuses on energy-efficient LED lighting with high luminous intensity, low power consumption, and precision optics, serving both civil and military airports. ABB Ltd. offers smart airport infrastructure solutions, combining lighting, control systems, and predictive maintenance technologies to reduce operational downtime and enhance energy efficiency.

Eaton Corporation PLC provides modular and scalable runway lighting solutions, emphasizing ease of installation, compliance with safety standards, and lifecycle support for airports of all sizes. Market strategies across competitors highlight regulatory alignment, energy optimization, and integration with automated airfield control systems. Collaborations with airport authorities, engineering contractors, and technology providers enable tailored solutions for major hubs and regional airports.

| Item | Value |

|---|---|

| Quantitative Units | USD 566.9 Million |

| Technology | LED lighting, Incandescent lighting, and Halogen lighting |

| Installation Type | New installation and Retrofit |

| End Use | Commercial airport, Military airport, and Private airport |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADB Safegate, Honeywell International Inc., Hella KGaA Hueck & Co., OSRAM Licht AG, ABB Ltd., and Eaton Corporation PLC |

| Additional Attributes | Dollar sales, share by LED vs conventional systems, adoption in commercial vs regional airports, retrofit vs new construction demand, regional growth patterns, regulatory trends, and energy-efficient technology uptake. |

The global airport runway lighting market is estimated to be valued at USD 566.9 million in 2025.

The market size for the airport runway lighting market is projected to reach USD 1,223.8 million by 2035.

The airport runway lighting market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in airport runway lighting market are led lighting, incandescent lighting and halogen lighting.

In terms of installation type, new installation segment to command 63.5% share in the airport runway lighting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Information Display System Market

Airport Lighting Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Runway Lighting System Market

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA