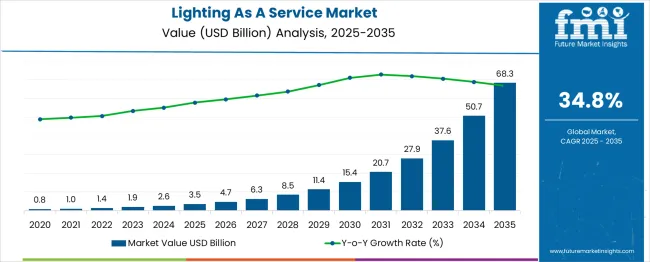

The global lighting as a service market is anticipated to grow from USD 3.5 billion in 2025 to approximately USD 68.3 billion by 2035, recording an absolute increase of USD 64.8 billion over the forecast period. This translates into a total growth of 1,881.0%, with the market forecast to expand at a CAGR of 34.8% between 2025 and 2035. The market size is expected to grow by nearly 19.81X during the same period, supported by increasing adoption of LED technology, growing focus on energy efficiency and rising demand for smart lighting solutions integrated with IoT and building management systems.

Between 2025 and 2030, the lighting as a service market is projected to expand from USD 3.5 billion to USD 20.6 billion, resulting in a value increase of USD 17.1 billion, which represents 26.4% of the total forecast growth for the decade. This phase of development will be shaped by accelerating digital transformation in buildings, increasing focus on operational cost reduction, and growing adoption of outcome-based lighting solutions. Service providers are expanding their LaaS offerings to address the growing demand for comprehensive lighting solutions that include financing, installation, maintenance, and energy management services.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.5 billion |

| Forecast Value in (2035F) | USD 68.3 billion |

| Forecast CAGR (2025 to 2035) | 34.8% |

The lighting as a service (laas) market demonstrates a recurring growth pattern with noticeable cyclical trends. Over a span of 3–4 years, significant bursts of growth occur, particularly as new technologies emerge and adoption rates increase. The market steadily expands from 1.4 billion USD to 6.3 billion USD, with adoption accelerating as the concept of lighting as a service gains traction. This early phase is characterized by innovation and a gradual increase in consumer awareness, leading to steady yet moderate growth during the initial years.

Between 2025 and 2030, the market's growth trajectory sharply accelerates. It jumps from 6.3 billion USD to 20.7 billion USD, reflecting the rapid scaling of laas solutions across commercial and residential sectors. This 3–4 year cycle is influenced by factors such as economic shifts, regulatory incentives, and technological advancements. After this surge, the market continues its upward trend, reaching 50.7 billion USD by 2035. These recurring growth cycles highlight the market's responsiveness to external factors, such as energy efficiency regulations and cost reductions, providing stakeholders with insights into future periods of accelerated growth and the strategic planning required to capitalize on these opportunities.

Market expansion is being supported by the increasing focus on energy efficiency and the corresponding demand for lighting solutions that can deliver immediate energy savings without significant upfront capital investment. Modern organizations are increasingly focused on reducing operational costs while meeting environmental consciousness commitments and improving workplace comfort and productivity. Lighting as a service's proven ability to deliver energy savings, reduce maintenance costs, and provide predictable monthly expenses makes it an attractive alternative to traditional lighting procurement and management approaches.

The growing focus on smart buildings and IoT integration is driving demand for LaaS solutions that can provide data analytics, occupancy sensing, and integration with building management systems. Organization preference for outcome-based service models that transfer performance risk to service providers is creating opportunities for comprehensive lighting service offerings. The rising influence of circular economy principles and equipment-as-a-service business models is also contributing to increased adoption of LaaS across various building types and industry sectors.

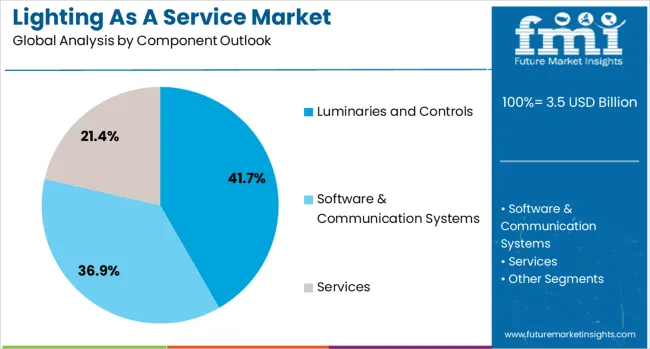

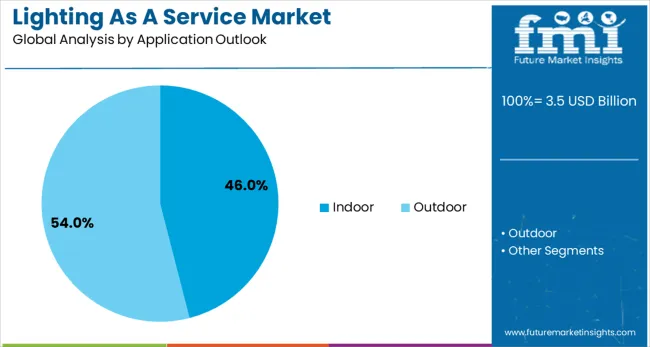

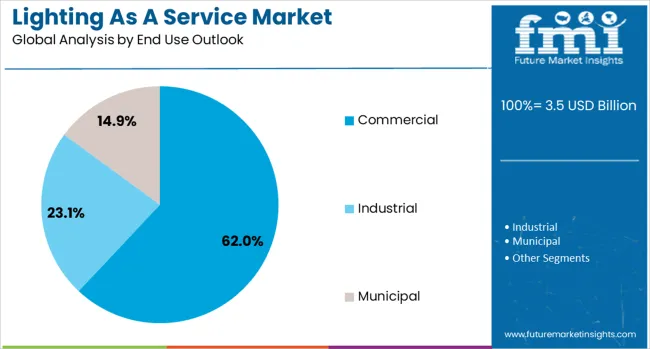

The market is segmented by component, application, end use, and region. By component, the market is divided into luminaries and controls, software & communication systems, and services. Based on the application, the market is categorized into indoor and outdoor. In terms of end use, the market is segmented into commercial, industrial, and municipal. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The luminaries and controls segment is projected to account for 42% of the lighting as a service market in 2025, reaffirming its position as the dominant component category. Service providers and customers increasingly recognize luminaries and controls as the core hardware components that deliver energy savings and lighting performance improvements. Advanced LED luminaires and intelligent control systems directly address customer needs for energy efficiency, lighting quality, and operational flexibility while forming the foundation of comprehensive LaaS solutions.

This component category represents the essential hardware infrastructure required for effective lighting service delivery, including LED fixtures, sensors, controllers, and networking equipment that enable smart lighting functionality. Service provider investments in high-quality luminaires and advanced control technologies continue to strengthen value propositions and customer satisfaction. With customers prioritizing energy savings and lighting performance, luminaries and controls align with both cost reduction objectives and comfort requirements, making them the central component of LaaS value delivery.

Indoor applications are projected to represent 46% of lighting as a service demand in 2025, underscoring their critical role in commercial and industrial building operations. Building owners and facility managers prefer indoor LaaS solutions for their ability to deliver immediate energy savings, improve occupant comfort, and provide detailed usage analytics for space optimization. Positioned as essential services for modern building operations, indoor LaaS offers both cost reduction benefits and operational intelligence advantages.

The segment is supported by increasing focus on workplace productivity and employee satisfaction, which require high-quality indoor lighting environments. Indoor lighting systems provide opportunities for integration with building management systems and IoT platforms that enable comprehensive facility optimization. As building operations become more data-driven and efficiency-focused, indoor LaaS will continue to dominate applications while supporting comprehensive smart building strategies.

The commercial end-use segment is forecasted to contribute 62% of the lighting as a service market in 2025, reflecting the primary adoption of LaaS models in office buildings, retail facilities, and hospitality properties. Commercial building owners increasingly prefer LaaS for its ability to reduce operational expenses while improving tenant satisfaction and building attractiveness. This aligns with commercial real estate trends that emphasize cost efficiency as key competitive differentiators.

The segment benefits from established commercial building management practices and a growing focus on ESG performance that requires measurable energy and cost savings. With significant lighting infrastructure requirements and operational cost pressures, commercial buildings serve as the primary market for LaaS solutions, making them a critical foundation for market growth and service provider business models.

The lighting as a service market is advancing rapidly due to increasing focus on operational cost reduction and growing adoption of subscription-based business models that transfer capital risk to service providers. The market faces challenges, including contract complexity and long-term commitment requirements, performance guarantee risks for service providers, and customer concerns about vendor lock-in and service dependencies. Innovation in IoT integration and predictive analytics continues to influence service development and market expansion patterns.

The growing adoption of smart city initiatives is enabling municipalities to deploy comprehensive LED lighting systems through LaaS models that eliminate upfront capital requirements while delivering immediate energy savings and maintenance cost reductions. Municipal LaaS provides cities with modern lighting infrastructure while transferring performance and technology risks to experienced service providers. Local governments are increasingly recognizing the benefits of outcome-based lighting services for achieving goals and budget optimization.

Modern LaaS providers are incorporating IoT sensors, data analytics, and machine learning capabilities to deliver autonomous lighting optimization that adapts to occupancy patterns, daylight conditions, and energy costs in real-time. These technologies enhance energy savings while providing valuable insights about space utilization and building performance that customers can use for operational optimization. Advanced analytics also enable predictive maintenance and proactive service delivery that improves system reliability and customer satisfaction.

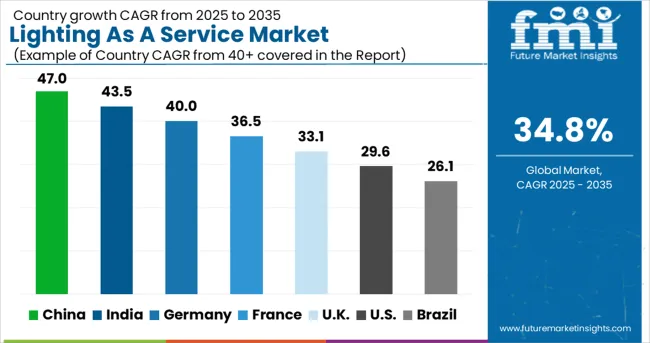

| Countries | CAGR (2025-2035) |

|---|---|

| China | 47% |

| India | 43.5% |

| Germany | 40% |

| France | 36.5% |

| UK | 33.1% |

| USA | 29.6% |

| Brazil | 26.1% |

The lighting as a service market is experiencing exceptional growth globally, with China leading at a 47% CAGR through 2035, driven by massive smart city development initiatives, rapid commercial construction, and strong government support for energy efficiency programs. India follows closely at 43.5%, supported by expanding commercial infrastructure, growing awareness about energy costs, and increasing adoption of green business models. Germany shows strong growth at 40%, emphasizing industrial energy efficiency and smart building integration. France records 36.5%, focusing on energy service innovations and commitments. The UK shows 33.1% growth, prioritizing ESG performance and operational cost optimization.

The report covers an in-depth analysis of 40+ countries with top-performing markets highlighted below.

Revenue from lighting as a service (LaaS) in China is anticipated to experience exceptional growth, with a CAGR of 47% through 2035. This surge is driven by the country’s massive smart city development programs and the increasing demand for energy-efficient solutions across commercial and industrial sectors. The government’s strong push for energy-saving initiatives, alongside the adoption of smart infrastructure, creates a significant opportunity for LaaS providers. As commercial and industrial construction activities continue to rise, major domestic and international players are expanding their service capabilities to cater to these markets. The rapidly developing urban areas, especially in tier-1 and tier-2 cities, are a key focus for large-scale LaaS deployments. The demand for operational cost reduction and energy savings is pushing the adoption of LaaS among industrial operators and building owners. • Government-backed smart city and energy efficiency projects. • Commercial construction and industrial development fueling demand. • Focus on operational cost reduction and energy efficiency.

The lighting as a service (LaaS) market in India is expanding at a CAGR of 43.5% through 2035, driven by the rapid growth of commercial infrastructure, manufacturing, and rising energy awareness. With the country’s growing urbanization and expanding real estate market, demand for cost-effective and energy-efficient lighting solutions is increasing. The Indian commercial real estate market, along with the manufacturing sector, is driving the rapid adoption of LaaS solutions. Both international providers and domestic companies are setting up extensive service capabilities to meet this demand. The growing need for energy cost management and efficient lighting solutions is particularly evident in office buildings, retail facilities, and manufacturing plants in major cities. The rise in energy-consciousness is pushing more commercial property owners to opt for services that promise energy savings and improved operational efficiency. • Rapid growth of commercial infrastructure and manufacturing sector. • Rising energy cost awareness among facility managers and building owners. • Demand for operational cost optimization across industries.

Demand for lighting as a service in Germany is projected to grow at a CAGR of 40%. Leadership in industrial energy efficiency and smart building technologies is fueling the demand for advanced LaaS solutions. The country’s industrial and commercial customers seek high-performance lighting solutions that integrate seamlessly with advanced building management systems. With a focus on guaranteed energy savings, German companies are increasingly investing in LaaS, which combines LED technology with advanced control and analytics for performance optimization. The demand for cost-effective, outcome-based lighting services is also rising as companies strive to meet environmental goals and energy cost management priorities. The adoption of these technologies is supported by the country’s strict regulations on energy efficiency and cost management. • Focus on energy efficiency and smart building technology adoption. • High demand for LED-based lighting solutions with advanced controls. • Increasing importance of cost-effectiveness in lighting solutions.

In France, the lighting as a service (LaaS) market is growing at a CAGR of 36.5% through 2035, supported by the country’s commitment to energy efficiency and innovative commercial practices. French organizations are increasingly demanding comprehensive LaaS solutions that provide measurable energy savings while contributing to carbon reduction goals. The emphasis on advanced building technologies and resource management is driving the need for innovative LaaS offerings. The country’s collaboration between energy service companies and lighting technology providers enhances the development of next-generation lighting solutions. The focus on innovation is paving the way for LaaS applications that combine lighting with advanced building optimization and energy management systems, ensuring enhanced performance and cost savings.

The lighting as a service (LaaS) market in the UK is experiencing a CAGR of 33.1% through 2035, driven by a strong focus on environmental, social, and governance (ESG) performance and cost management across commercial and public sectors. With increasing pressure on organizations to meet environmental targets and reduce their carbon footprint, LaaS is gaining traction as a cost-effective, environmentally friendly lighting solution. UK-based commercial buildings, retail facilities, and public sector organizations are seeking guaranteed performance and budget predictability from LaaS providers. The integration of intelligent lighting systems and data-driven solutions is fueling the demand for advanced LaaS platforms. These platforms not only provide energy savings but also offer real-time monitoring and analytics to optimize energy usage. • ESG performance and environmental impact driving adoption. • Demand for guaranteed performance and budget predictability. • Integration of intelligent systems and data-driven solutions in LaaS platforms.

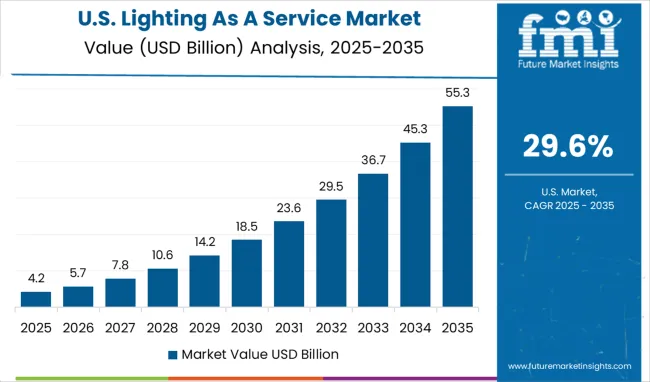

The lighting as a service (LaaS) market in the USA is forecasted to grow at a CAGR of 29.6% through 2035, supported by innovations in commercial real estate, smart building technologies, and preference for outcome-based service models. American commercial building owners are prioritizing energy efficiency and operational savings, making LaaS a preferred solution. The increasing need for building optimization solutions and the integration of advanced lighting controls is propelling LaaS adoption. The USA market is characterized by strong demand for scalable, flexible solutions that integrate seamlessly with building management systems. Financing innovations are also making LaaS an attractive option, removing the upfront costs typically associated with traditional lighting infrastructure.

Revenue from lighting as a service in Brazil is projected to grow at a CAGR of 26.1% through 2035, supported by expanding commercial infrastructure, raising awareness about energy cost management, and increasing adoption of green business practices. The country’s developing commercial real estate and industrial markets are key drivers for LaaS adoption, as building owners and facility managers seek energy-efficient solutions to reduce operational costs. Government initiatives that promote energy efficiency and environmental goals are also accelerating the adoption of LaaS. International and domestic lighting service providers are expanding their presence in Brazil to meet the growing demand for energy-efficient lighting solutions. This demand is expected to continue rising as Brazil’s energy consciousness and focus on cost-effective solutions increase.

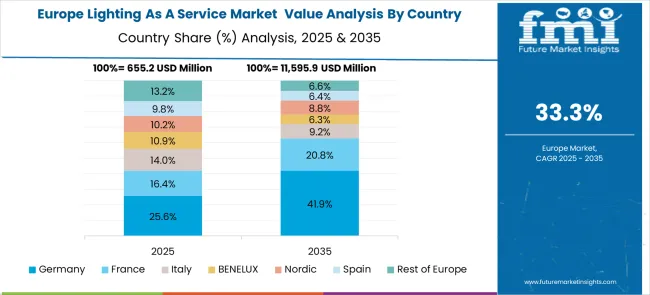

The lighting as a service market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its focus on energy efficiency and industrial eco-responsibility, supported by companies leveraging engineering expertise to implement comprehensive LaaS solutions that emphasize performance guarantees, energy savings, and integration with Industry 4.0 initiatives across manufacturing and commercial applications.

France represents a significant market driven by its green development commitments and sophisticated understanding of energy service company (ESCO) models, with organizations focusing on comprehensive LaaS solutions that combine French energy expertise with advanced LED technologies for enhanced building efficiency and carbon footprint reduction in commercial and public sector applications.

The UK exhibits considerable growth through its focus on ESG performance and energy cost management, with strong adoption of LaaS across commercial buildings, public sector facilities, and industrial sites. Germany and France show expanding interest in smart lighting applications, particularly in municipal infrastructure and industrial facilities requiring advanced control and data analytics capabilities. BENELUX countries contribute through their focus on circular economy principles and innovative financing models. At the same time, Eastern Europe and Nordic regions display growing potential driven by EU eco-conscious regulations and expanding smart city initiatives.

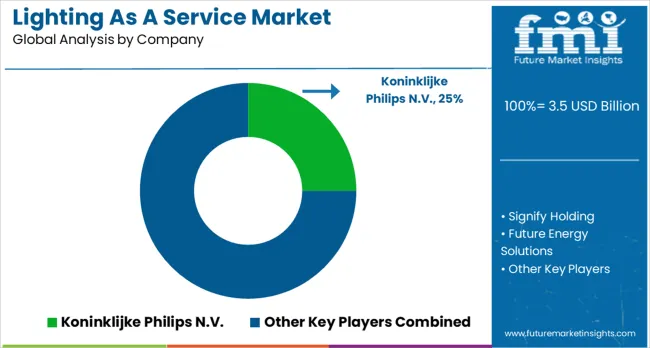

The lighting as a service (LaaS) market is highly competitive, with a diverse mix of established lighting manufacturers, specialized energy service providers, and emerging smart lighting solution companies. These companies are investing significantly in service model development, financing capabilities, IoT platform integration, and comprehensive customer support to provide reliable, cost-effective, and performance-guaranteed lighting services. The focus on innovation, particularly in smart lighting technologies, data analytics, and outcome-based service delivery, is crucial to enhancing customer value and securing a strong market position.

Koninklijke Philips N.V. leads the market with a significant share, offering comprehensive LaaS solutions that focus on smart lighting integration and energy management capabilities. The company’s advanced solutions enable businesses to optimize energy use, reduce costs, and enhance the overall performance of lighting systems. Signify Holding, another leading player, offers an extensive lighting service portfolio with a strong emphasis on IoT connectivity and data analytics. These capabilities allow for better energy control, predictive maintenance, and real-time data-driven insights. Future Energy Solutions specializes in energy service delivery, offering performance contracting and energy efficiency solutions to businesses and municipalities. Stouch Lighting focuses on providing commercial and industrial lighting services, delivering tailored solutions that meet the specific needs of large-scale facilities.

ESB provides utility-scale energy services, including integrated lighting solutions, designed to improve efficiency on a large scale. Airis Energy Solutions USA delivers comprehensive energy efficiency services, with a strong focus on reducing operational costs through advanced lighting solutions. Facility Solutions Group integrates facility management with lighting services, ensuring energy savings across multiple industries. Other notable companies, including LED SOLUTIONS, Firefly Group, Lusety US LED Ltd., TRILUX Lighting Ltd., LumenStream, TellCo Europe Sagl, ARQUILED, and Urbanvolt, offer specialized lighting services that focus on smart technology integration, energy savings, and custom service models across various market segments and geographic regions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.5 billion |

| Component | Luminaries and Controls, Software & Communication Systems, Services |

| Application | Indoor, Outdoor |

| End Use | Commercial, Industrial, Municipal |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Koninklijke Philips N.V., Signify Holding, Future Energy Solutions, Stouch Lighting, ESB, Airis Energy Solutions USA, Facility Solutions Group, LED SOLUTIONS, Firefly Group, Lusety US LED Ltd., TRILUX Lighting Ltd., LumenStream, TellCo Europe Sagl, ARQUILED, and Urbanvolt |

| Additional Attributes | Dollar sales by component and end-use category, regional demand trends, competitive landscape, buyer preferences for indoor versus outdoor applications, integration with smart building systems, innovations in IoT connectivity, data analytics advancement, and outcome-based service model development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global lighting as a service market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the lighting as a service market is projected to reach USD 68.3 billion by 2035.

The lighting as a service market is expected to grow at a 34.8% CAGR between 2025 and 2035.

The key product types in lighting as a service market are luminaries and controls, software & communication systems and services.

In terms of application outlook, indoor segment to command 46.0% share in the lighting as a service market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA