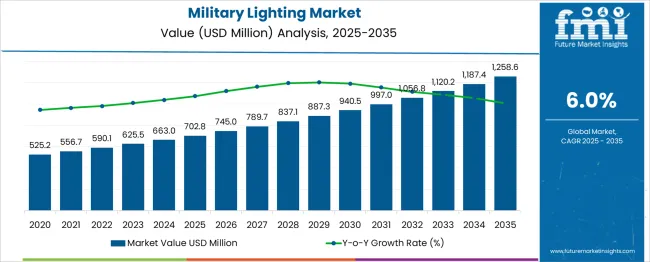

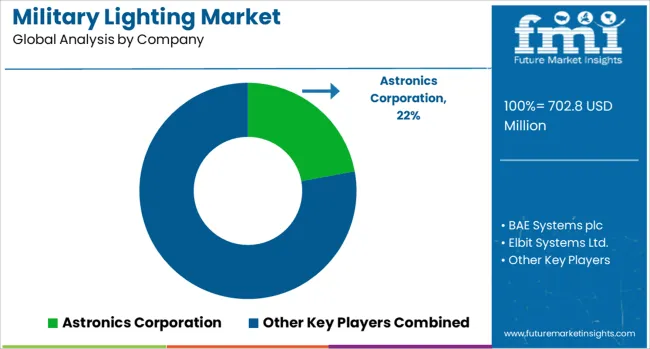

The Military Lighting Market is estimated to be valued at USD 702.8 million in 2025 and is projected to reach USD 1258.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The Military Lighting Market demonstrates steady expansion from USD 525.2 billion in 2021 to USD 887.3 billion by 2030, representing an absolute dollar opportunity of USD 362.1 billion over the decade. This progression reflects a CAGR of approximately 6.2%, indicating consistent but moderate growth across all segments. Year-on-year (YOY) analysis reveals incremental gains rising from USD 31.5 billion (2022) to nearly USD 50 billion by 2030, showcasing an accelerating growth curve toward the latter years. The first five-year phase (2021–2025) adds USD 137.8 billion, accounting for roughly 38% of the next few years expansion, while the second half (2026–2030) contributes USD 224.3 billion, nearly 62% of total growth, indicating stronger momentum as modernization programs intensify.

Mid-phase years (2026–2028) reflect sustained investments in advanced LED systems, night-vision-compatible solutions, and intelligent lighting integrated into combat and naval platforms. Growth is strongly aligned with defense budget allocations for energy-efficient technologies, enhancing operational capability under extreme conditions. This trajectory highlights increasing adoption of connected lighting technologies and resilient systems for ground vehicles, aircraft, and naval vessels. The trend reinforces opportunities for suppliers focusing on smart illumination, thermal signature reduction, and modular retrofitting to meet evolving defense requirements.

| Metric | Value |

|---|---|

| Military Lighting Market Estimated Value in (2025 E) | USD 702.8 million |

| Military Lighting Market Forecast Value in (2035 F) | USD 1258.6 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The military lighting market constitutes a specialized segment within larger defense and aerospace ecosystems, including land vehicle systems, naval vessels, aircraft platforms, command infrastructure, and electronic systems integration. Its contribution within these sectors varies based on application intensity and technology adoption. In armored land vehicle systems, military lighting solutions hold an estimated 14% share due to requirements for ruggedized and night-vision-compatible illumination. For naval vessels, the share is approximately 11%, reflecting demand for corrosion-resistant and low-signature lighting in mission-critical environments. Within military aircraft platforms, the segment accounts for around 9%, supported by the need for cockpit, cargo, and formation lighting systems.

Command and control infrastructure sees an estimated 7% share, as lighting plays a role in operational safety and tactical readiness. The lowest contribution, about 5%, is observed in broader electronic systems integration, where lighting components are a minor portion of complex assemblies. This multi-domain presence highlights the strategic significance of lighting technologies in modern defense systems. Growing emphasis on energy efficiency, thermal performance, and infrared compliance is expected to reinforce adoption trends. Manufacturers offering LED-based solutions with advanced dimming, electromagnetic shielding, and modular configurations are well-positioned to capture incremental opportunities as defense modernization and multi-theater operations expand globally.

Armed forces across the globe are focusing on enhancing situational awareness, mobility, and operational readiness, which has led to the adoption of advanced lighting systems with embedded control and dimming functionalities.

Advancements in solid-state lighting, combined with rising procurement budgets for land, naval, and air-based platforms, are significantly influencing the demand for ruggedized and adaptive lighting technologies. Emphasis on stealth operations and energy optimization is further driving the replacement of legacy lighting systems with programmable, low-heat, and vibration-resistant lighting solutions.

The integration of intelligent lighting with command-and-control networks and the focus on standardizing lighting across platforms are paving the way for long-term adoption. As global military operations expand in complexity and scale, the need for reliable, versatile lighting systems is expected to remain critical in future defense strategies.

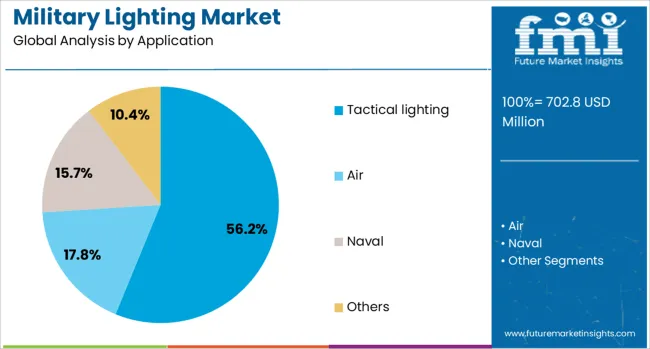

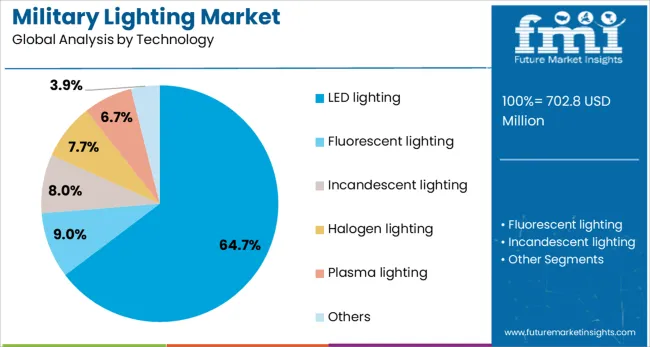

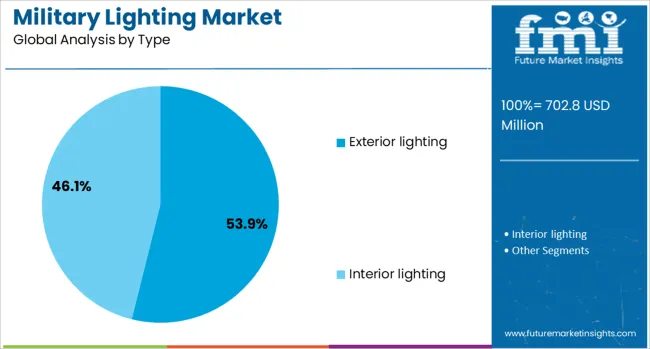

The military lighting market is segmented by application, technology, type, and geographic regions. By application of the military lighting market is divided into Tactical lighting, Air, Naval, and Others. In terms of technology of the military lighting market is classified into LED lighting, Fluorescent lighting, Incandescent lighting, Halogen lighting, Plasma lighting, and Others. Based on type of the military lighting market is segmented into Exterior lighting and Interior lighting.

Regionally, the military lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tactical lighting segment is projected to account for 56.2% of the military lighting market’s revenue share in 2025, making it the leading application category. This dominance is being influenced by the operational necessity for compact, high-lumen, and mission-specific illumination across ground-based troop deployments. Tactical lighting systems are being widely integrated into helmets, weapons, and wearable equipment to support mobility, communication, and target identification in low-visibility and night-time operations.

The segment has gained momentum due to growing adoption of modular and multi-functional lighting tools that can be rapidly configured in the field. Increased focus on soldier survivability, dismounted situational awareness, and advanced battlefield coordination has resulted in continuous innovations in infrared, strobe, and color-coded tactical lights.

Enhanced energy efficiency, durability under harsh environments, and ease of mounting on various gear types have further supported their deployment. As militaries increasingly prioritize flexibility and mission adaptability, tactical lighting systems are expected to maintain their strategic importance across global defense forces.

The LED lighting segment is anticipated to capture 64.7% of the total market share in the military lighting market in 2025, emerging as the dominant technology. This leadership is being driven by the superior energy efficiency, extended lifespan, and low thermal signature of LED systems, which are crucial in both combat and non-combat operations.

Defense agencies are transitioning from conventional halogen or incandescent lighting to LED solutions to reduce maintenance costs and improve operational uptime in high-demand environments. LED lighting provides enhanced brightness control, faster response time, and better resistance to shock, vibration, and extreme temperatures, making it highly suitable for military vehicles, airfields, and marine platforms.

Integration of LED lighting into smart power systems and control networks has further expanded their utility in advanced defense applications. As global military modernization initiatives prioritize sustainability, power optimization, and reduced logistics burden, LED technology is expected to remain the preferred standard in military lighting infrastructure.

The exterior lighting segment is forecast to represent 53.9% of the military lighting market’s revenue share in 2025, making it the leading type. The dominance of this segment is supported by its critical role in enhancing the visibility, safety, and functionality of military vehicles, aircraft, and naval assets during night-time operations and adverse weather conditions. Exterior lighting systems are being increasingly installed on armored vehicles, unmanned systems, and tactical transport platforms to ensure navigation, convoy protection, and identification in combat zones.

Innovations in directional beam control, multi-mode lighting, and corrosion-resistant housings have improved operational performance and durability. The ability to integrate with infrared sensors, communication systems, and stealth functionalities has further enhanced the strategic utility of exterior lighting.

Rising demand for mission-configurable lighting that adapts to terrain and threat levels is also contributing to the segment’s growth. With ongoing upgrades in vehicle fleets and tactical mobility platforms, exterior lighting is poised to remain a mission-critical component of defense lighting systems.

The military lighting market is prioritizing tactical-grade, energy-efficient systems with LED technology, night-vision compatibility, and durability for extended operations. A strong focus on mobile and modular configurations ensures rapid deployment, adaptability, and mission continuity in challenging environments.

The military lighting market has been influenced by an increased preference for tactical-grade systems designed for harsh environments. Adoption of LED-based units with enhanced brightness and longer operational life has been prioritized to reduce maintenance cycles during critical missions. These lighting systems have been configured for compatibility with night-vision devices, enabling seamless operations in low-light conditions. Command units have emphasized the need for energy-efficient illumination that maintains high reliability during extended deployments. Advanced optics and dimming control features have been considered essential in field applications. This transition demonstrates that durability and operational adaptability are being viewed as indispensable factors in modern defense infrastructure upgrades.

A noticeable shift has occurred toward mobile lighting units for rapid deployment in conflict zones and disaster relief operations. Portable and vehicle-mounted lighting systems have been incorporated to ensure mission continuity in remote terrains. Forces have evaluated modular lighting structures as critical for establishing temporary command centers and field hospitals without delays. Manufacturers have invested in developing shock-resistant designs to withstand extreme vibration and unpredictable conditions. Smart control mechanisms integrated into military lighting solutions have provided operational flexibility, especially in coordinated missions. The emphasis on mobility and adaptability highlights the market’s progression toward solutions that reduce setup complexity and improve tactical readiness.

The military lighting market is experiencing a major shift toward energy-efficient systems as armed forces seek reduced power consumption without compromising illumination standards. LED technology has become the preferred choice because of its lower heat output and superior operational life, making it suitable for extreme environments. Demand for lighting systems compatible with night vision equipment and infrared operations is gaining momentum, driven by enhanced tactical requirements. Energy-efficient solutions also contribute to reduced maintenance frequency, improving mission readiness in remote and combat settings. Defense programs worldwide are prioritizing upgrades to LED-based configurations in armored vehicles, naval fleets, and aircraft platforms, supporting performance, reliability, and operational endurance under challenging field conditions.

The adoption of military lighting systems is strongly influenced by the need for compliance with rigorous standards such as MIL-STD and IP-rated certifications. Equipment is designed to withstand shocks, vibrations, corrosion, and electromagnetic interference, ensuring uninterrupted performance during critical missions. Ruggedized lighting for armored vehicles, naval decks, and aerospace interiors is a key requirement for procurement authorities. Manufacturers are focusing on modular designs for ease of integration across multiple platforms, while offering advanced sealing to protect against dust and water ingress. Lighting systems that ensure operational safety, electromagnetic compatibility, and low detectability are increasingly viewed as essential assets in defense modernization projects worldwide.

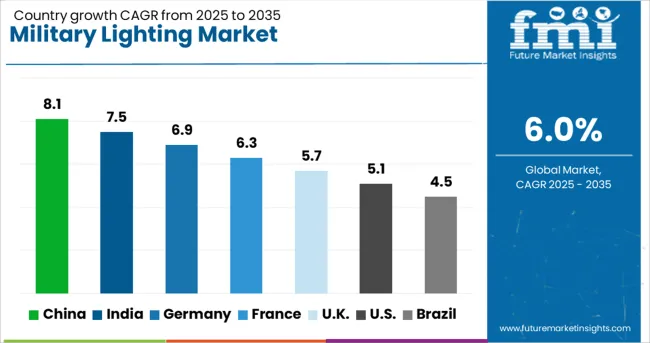

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

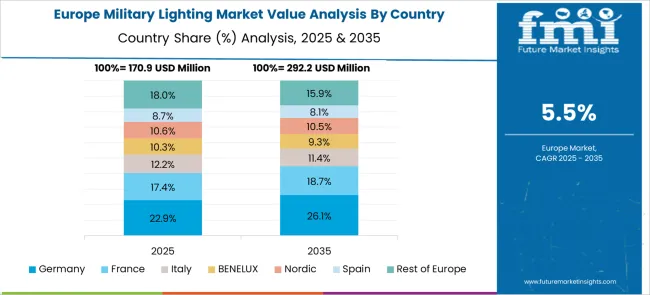

The military lighting industry, expected to grow at a global CAGR of 6.0% from 2025 to 2035, is showing diverse performance among key nations. China, a BRICS member, is leading with an 8.1% CAGR, supported by large-scale defense modernization programs and investments in tactical infrastructure. India, another BRICS economy, is recording a 7.5% CAGR, driven by the rapid procurement of portable and vehicle-mounted lighting systems for its armed forces. Germany, an OECD member, is exhibiting a 6.9% CAGR, as integrated LED-based solutions become essential in NATO defense projects and field applications. The United Kingdom, an OECD member, is experiencing a 5.7% CAGR with adoption concentrated in mobile configurations for overseas operations. The United States, an OECD leader, is showing a 5.1% CAGR, attributed to gradual upgrades of existing systems within established military bases. High-growth potential is being presented by BRICS economies, particularly China and India, where modernization programs are reshaping defense procurement strategies. The report includes an in-depth review of 40+ nations, with the top five referenced here for strategic insight.

China recorded a CAGR of 7.4% from 2020 to 2024, which has escalated to 8.1% for the period from 2025 to 2035. The rise in CAGR indicates significant progress in large-scale defense modernization projects, emphasizing advanced tactical lighting solutions for armored vehicles and naval applications. Enhanced budget allocation has resulted in widespread adoption of LED-based illumination with advanced optics for mission-critical zones. High-level integration with night-vision systems has been prioritized to ensure operational superiority. Rapid procurement programs for portable lighting units and vehicle-mounted systems have been accelerated to support mobility in rugged terrains. Continuous investment in research centers and collaborations with domestic technology firms has contributed to China's leadership position in this segment.

India exhibited a CAGR of 6.8% during 2020 to 2024, which increased to 7.5% for the forecast period between 2025 and 2035. This rise demonstrates strategic investment in portable illumination units for fast-response teams and battlefield adaptability. Expansion of defense budgets has supported the procurement of vehicle-mounted and modular systems suitable for harsh climatic conditions. Tactical-grade lighting with advanced dimming control features is being adopted to work with mission safety protocols. Emerging collaborations with domestic electronics manufacturers have strengthened supply capabilities. Increasing demand for integrated lighting systems in naval ships and combat aircraft underlines the scope for further development in this sector.

Germany maintained a CAGR of 6.3% from 2020 to 2024, which advanced to 6.9% between 2025 and 2035. This growth is attributed to Germany's consistent investment in NATO-driven modernization programs requiring advanced lighting technologies. Tactical lighting integrated with infrared filters for night vision compatibility has been deployed extensively. Upgrades in armored vehicles and mobile command centers have emphasized durability and power efficiency. Domestic manufacturers have increased their role in providing LED-based solutions designed for heavy-duty applications. This progress has ensured a competitive position for Germany within the European defense supply chain while strengthening procurement strategies for future missions.

The United Kingdom posted a CAGR of 4.9% between 2020 and 2024, which improved to 5.7% between 2025 to 2035. This increase is associated with the modernization of overseas deployment units and the integration of smart control features in lighting systems. Greater emphasis has been placed on mobility through vehicle-mounted configurations and modular designs for temporary bases. LED-based lighting with extended operational life is becoming a procurement priority to minimize downtime in combat environments. Strategic partnerships with defense contractors have driven innovation in compact, shock-resistant designs. Despite slower adoption compared to BRICS economies, the United Kingdom remains a vital player in supplying advanced lighting solutions for specialized missions.

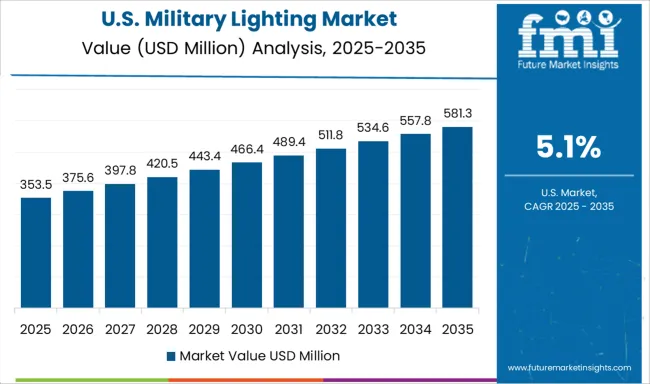

The United States reported a CAGR of 4.6% from 2020 to 2024, rising to 5.1% from 2025 to 2035. The improvement indicates steady demand driven by the modernization of established military bases and naval vessels. Tactical-grade lighting with smart dimming controls has been integrated to enhance energy optimization during prolonged missions. Replacement cycles for outdated fluorescent systems have accelerated, favoring LED adoption across Army, Air Force, and Navy units. Research collaborations with defense technology firms have advanced the development of resilient lighting structures designed for extreme environments. This transition demonstrates a measured but sustained focus on operational readiness through improved illumination systems.

In the military lighting sector, leading companies are advancing solutions that address stringent performance requirements across multiple defense applications. Astronics Corporation and BAE Systems plc are recognized for tactical-grade lighting systems featuring LED technology and modular architecture, enabling compatibility with night-vision equipment and optimized power consumption for combat vehicles, naval vessels, and aerospace platforms.

Elbit Systems Ltd. and General Dynamics Corporation emphasize vehicle-mounted and portable lighting units designed for rapid deployment in rugged terrains, integrating adaptive brightness and dimming controls for operational flexibility in dynamic mission conditions. Hella KGaA Hueck & Co. combines automotive and defense expertise to deliver high-durability lighting systems tailored for armored vehicles, while Honeywell International Inc. capitalizes on aerospace-grade engineering to provide advanced illumination for military aircraft and ground systems, prioritizing electromagnetic shielding and environmental resilience.

Astronics continues to lead innovation in smart cockpit and cargo lighting, while BAE Systems integrates intelligent power management into its defense lighting portfolio. Elbit focuses on miniaturized solutions to support unmanned systems and field-deployable units, whereas General Dynamics develops integrated lighting networks for modern tactical vehicles. Both Hella and Honeywell are investing heavily in rugged optics, impact resistance, and modular upgrades to meet evolving defense procurement standards, positioning these firms as key enablers of next-generation military lighting capabilities worldwide.

In May 2025, the Israeli MoD announced the acquisition of $55 million worth of helicopter protection systems from Elbit.

| Item | Value |

|---|---|

| Quantitative Units | USD 702.8 Million |

| Application | Tactical lighting, Air, Naval, and Others |

| Technology | LED lighting, Fluorescent lighting, Incandescent lighting, Halogen lighting, Plasma lighting, and Others |

| Type | Exterior lighting and Interior lighting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astronics Corporation, BAE Systems plc, Elbit Systems Ltd., General Dynamics Corporation, Hella KGaA Hueck & Co., and Honeywell International Inc. |

| Additional Attributes | Dollar sales, share by region and product type, defense procurement trends, technology adoption in LED and NV-compatible systems, competitive landscape, upcoming contracts, and regulatory compliance for tactical applications. |

The global military lighting market is estimated to be valued at USD 702.8 million in 2025.

The market size for the military lighting market is projected to reach USD 1,258.6 million by 2035.

The military lighting market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in military lighting market are tactical lighting, _ground, _vehicle lighting, _base and infrastructure lighting, air, _aircraft lighting, _airport and airfield lighting, naval, _shipboard lighting, _dock and harbor lighting, others, _special operations and _training and simulation.

In terms of technology, led lighting segment to command 64.7% share in the military lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA