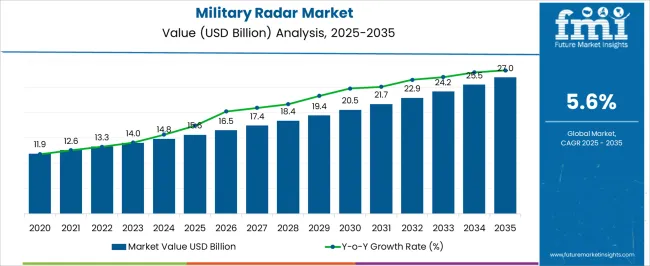

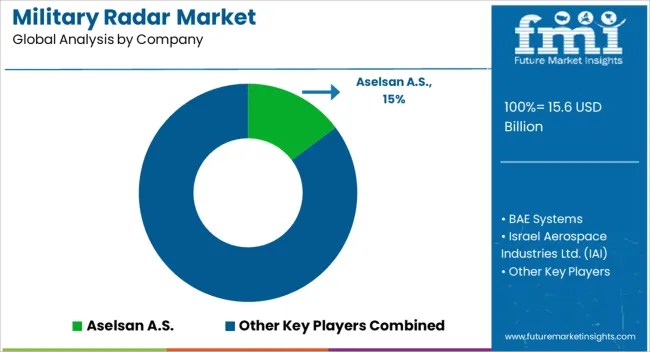

The military radar market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 27.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The military radar market is projected to reach 15.6 USD billion in 2025 and expand to 27.0 USD billion by 2035, registering a CAGR of 5.6%. Analysis of the growth rate volatility index indicates steady and consistent expansion with moderate annual fluctuations driven by defense budgets, modernization programs, and geopolitical tensions. Investment in advanced radar technologies, including phased array, active electronically scanned array (AESA), and multi-function systems, is expected to drive incremental adoption across land, air, and naval platforms.

Regional defense modernization initiatives, particularly in Asia-Pacific, North America, and Europe, are contributing to demand for surveillance, early warning, and missile defense systems. Strategic procurement, long-term defense contracts, and upgrades of legacy radar networks support stable growth. Furthermore, technological enhancements that reduce size, weight, and power requirements, alongside integration with command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) platforms, enhance operational efficiency and battlefield situational awareness.

Defense contractors and radar manufacturers are increasingly focusing on modular, scalable solutions to cater to diverse military applications and export opportunities, while simulation and testing services provide additional revenue streams. Overall, the market demonstrates a resilient trajectory with predictable volatility, reflecting sustained investment in defense capabilities and emerging operational requirements globally.

| Metric | Value |

|---|---|

| Military Radar Market Estimated Value in (2025 E) | USD 15.6 billion |

| Military Radar Market Forecast Value in (2035 F) | USD 27.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The military radar market is strongly shaped by interrelated parent markets, each contributing distinctively to overall demand and growth. The defense and defense procurement market holds the largest share at 40%, driven by government spending on surveillance, early warning, missile defense, and electronic warfare systems. The aerospace and aviation sector contributes 25%, with fighter jets, transport aircraft, and unmanned aerial vehicles increasingly integrating advanced radar systems for navigation, threat detection, and situational awareness. The naval and maritime defense segment accounts for 15%, where warships, submarines, and coastal defense units rely on radar for threat monitoring, target tracking, and communication support.

The homeland security and border monitoring market holds 10%, emphasizing radar deployment for perimeter security, critical infrastructure protection, and anti-intrusion systems. Finally, the export and international defense cooperation market represents 10%, driven by cross-border defense contracts, modernization programs, and regional security collaborations. Collectively, the defense, aerospace, and naval segments account for 80% of overall demand, highlighting that modernization programs, operational readiness, and national security priorities remain the primary growth drivers, while homeland security and international contracts provide complementary demand across global regions.

The military radar market is experiencing consistent growth due to rising defense modernization programs, the need for enhanced surveillance capabilities, and increased geopolitical tensions driving investments in advanced radar systems. Technological advancements in signal processing, phased array systems, and integration with artificial intelligence are enabling faster target detection, improved tracking accuracy, and multi-mission operational capability.

The growing adoption of radar systems across land, naval, and airborne platforms is further accelerating demand. Additionally, the focus on network-centric warfare and interoperability across allied forces is pushing defense agencies to procure radars with higher flexibility and upgrade potential.

The future outlook remains strong as countries continue to prioritize radar modernization to counter evolving threats, including stealth technologies, unmanned systems, and hypersonic weapons.

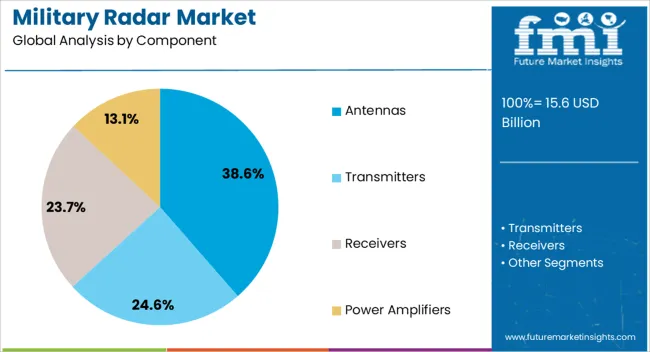

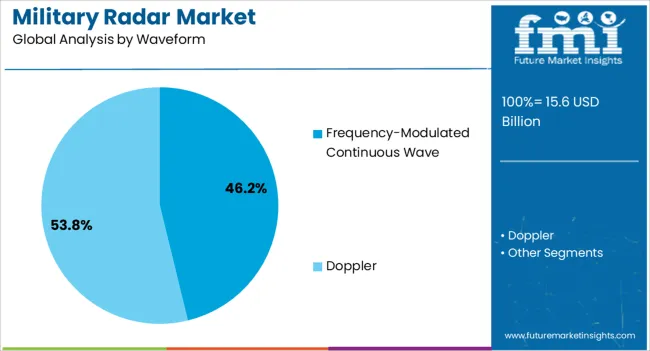

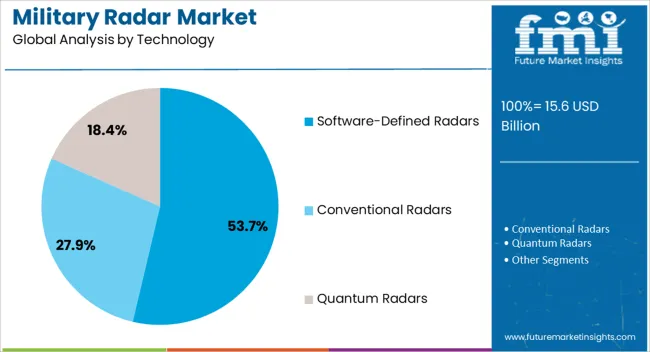

The military radar market is segmented by component, waveform, technology, range, platform, application, and geographic regions. By component, military radar market is divided into antennas, transmitters, receivers, power amplifiers, duplexers, digital signal processors, stabilization systems, graphical user interfaces, and others. In terms of waveform, military radar market is classified into frequency-modulated continuous wave and doppler. Based on technology, military radar market is segmented into software-defined radars, conventional radars, and quantum radars. By range, military radar market is segmented into short (50 Kms), medium (50-200 Kms), and long (>200 Kms). By platform, military radar market is segmented into ground-based, naval, airborne, and space. By application, military radar market is segmented into airspace monitoring & traffic management, air & missile defense, weapon guidance, ground surveillance & intruder detection, vessel traffic security & surveillance, airborne mapping, navigation, mine detection & underground mapping, ground force protection & counter-mapping, weather monitoring, ground penetration, maritime patrolling, search, & rescue, border security, space situational awareness, and others. Regionally, the military radar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antennas segment is projected to account for 38.6% of the total market revenue by 2025 within the component category, making it the leading segment. Its dominance is attributed to its critical role in determining radar range, accuracy, and beamforming capability.

Ongoing advancements in electronically scanned array antennas have improved operational reliability, reduced maintenance requirements, and enhanced performance in complex environments. Increased demand for lightweight and compact designs suitable for multiple platforms has further strengthened its position.

The strategic importance of antennas in enabling multi-band operation and integrating with advanced waveform technologies ensures their continued market leadership.

The doppler waveform segment is expected to hold 53.8% of total market revenue by 2025, positioning it as the dominant waveform type. This preference stems from its proven ability to deliver precise velocity detection, superior target discrimination, and reliable tracking of moving objects in complex operational environments.

Its strong performance in long-range surveillance, airborne applications, and missile guidance systems has significantly driven adoption across defense platforms.

Furthermore, advancements in Doppler processing algorithms and the integration of digital signal enhancements have improved real-time threat detection, solidifying its role as the leading waveform choice in next-generation military radar systems.

The software-defined radars segment is anticipated to capture 53.7% of the total market revenue by 2025, emerging as the dominant technology category. This leadership is driven by the flexibility of software-based architectures, which allow rapid upgrades, multi-mission capability, and adaptability to emerging threats without requiring hardware replacement.

The ability to reconfigure operational parameters in real time, integrate advanced algorithms, and support multiple waveforms has positioned software-defined radars as a future-ready solution.

Defense agencies are increasingly adopting this technology to ensure long-term system relevance and reduce lifecycle costs, solidifying its dominance in the technology segment.

Military radar demand is driven by enhanced threat detection, regional modernization, and cross-domain integration. Export programs and global collaborations further expand market opportunities, ensuring sustained growth across defense sectors worldwide.

Military radar systems are increasingly adopted to provide enhanced threat detection, long-range surveillance, and early warning across land, air, and sea domains. Governments prioritize high-resolution and multi-function radar technologies for situational awareness, missile defense, and electronic countermeasure capabilities. Integration with command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) networks enables real-time data sharing and operational coordination.

Modern radars offer scalable and modular designs to meet diverse operational requirements while minimizing size, weight, and power consumption. Defense forces deploy phased array and active electronically scanned array (AESA) systems to track multiple targets simultaneously, improving responsiveness and decision-making. Investments in training, simulation, and maintenance services support system reliability and effective lifecycle management, ensuring readiness during missions and tactical operations globally.

The growth of the military radar market is fueled by regional defense modernization initiatives and procurement programs. Asia-Pacific, North America, and Europe are leading in investments due to geopolitical tensions and rising defense budgets. Military forces are upgrading legacy radar systems and expanding coverage for land, naval, and airborne platforms. Long-term defense contracts with domestic and international suppliers provide consistent revenue streams, while government tenders encourage competition and technological differentiation.

Countries are prioritizing interoperable radar systems that can integrate with existing military networks for joint operations. Funding allocations emphasize capability enhancement, fleet modernization, and border security. These programs also encourage domestic manufacturing, local supplier engagement, and strategic collaborations between defense contractors to secure long-term operational efficiency.

Military radar systems are increasingly integrated with multi-domain defense operations to enhance operational effectiveness and real-time decision-making. Radars are connected with missile defense, electronic warfare, air defense, and surveillance platforms to provide a comprehensive operational picture. Integration with unmanned aerial vehicles (UAVs), ships, and armored vehicles ensures coordinated targeting and reconnaissance. Interoperable systems allow multiple branches of the armed forces to share information securely and execute joint missions effectively.

Advanced radar solutions include modular architectures for scalability, remote monitoring, and predictive maintenance. This cross-platform integration improves response times, reduces operational risks, and strengthens defense readiness. Manufacturers focus on delivering adaptable systems compatible with evolving tactical requirements across global defense sectors.

Export opportunities and international defense collaborations are shaping growth dynamics in the military radar market. Countries with advanced radar capabilities are supplying systems to allied nations under modernization programs, defense partnerships, and offset agreements. Joint ventures, technology sharing, and co-development projects enhance global adoption while meeting regional defense standards and interoperability requirements.

Export demand is particularly high in emerging economies investing in border security, coastal surveillance, and aerial defense infrastructure. Defense contractors leverage these partnerships to expand geographic reach, diversify revenue streams, and demonstrate reliability in operational scenarios. Regulatory compliance, local content requirements, and lifecycle support services are emphasized to secure contracts and sustain long-term market presence internationally.

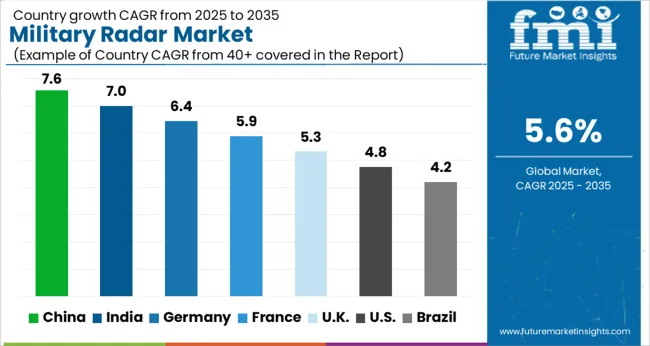

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

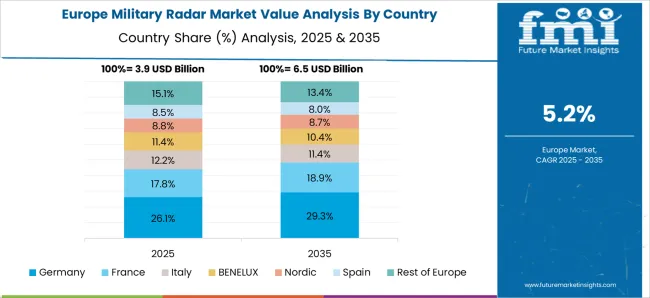

The global military radar market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads at 7.6%, followed by India at 7.0%, Germany at 6.4%, the UK at 5.3%, and the USA at 4.8%. Growth is driven by defense modernization programs, increased defense budgets, and the need for advanced surveillance, threat detection, and missile defense capabilities. Asia, particularly China and India, demonstrates rapid expansion due to regional security challenges, naval and air defense initiatives, and investment in indigenous radar technologies. Europe emphasizes upgrading legacy systems, integrating multi-domain networks, and enhancing interoperability. North America focuses on high-precision, multi-function radar solutions for strategic and tactical operations. Procurement contracts, defense collaborations, and long-term modernization plans further accelerate adoption globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The military radar market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by extensive defense modernization programs, regional security challenges, and investments in indigenous radar technologies. The People’s Liberation Army is prioritizing upgrades to airborne, naval, and ground-based radar systems, focusing on phased array, active electronically scanned array (AESA), and multi-function capabilities.

Domestic manufacturers are collaborating with international defense suppliers for knowledge transfer, system integration, and advanced component development. High-resolution surveillance, early threat detection, and missile defense applications are key adoption drivers. Government-backed funding and long-term procurement contracts ensure sustained market growth, while training, simulation, and maintenance services enhance operational readiness and lifecycle support.

The military radar market in India is anticipated to expand at a CAGR of 7.0% from 2025 to 2035, fueled by rising defense budgets, border security needs, and modernization of air, land, and naval platforms. India is focusing on integrating multi-function AESA radars, long-range surveillance systems, and electronic countermeasure capabilities. Strategic partnerships with global radar manufacturers facilitate technology transfer, system customization, and indigenous production.

Programs such as Project Seabird and Air Force modernization support demand for advanced maritime and airborne radar networks. Government procurement policies, offset requirements, and indigenous defense initiatives further encourage growth. Institutional training, simulation programs, and lifecycle management services enhance reliability and operational efficiency for deployed radar systems.

The military radar market in Germany is expected to grow at a CAGR of 6.4% from 2025 to 2035, supported by defense modernization initiatives, NATO commitments, and upgrades of legacy radar systems. Germany is adopting multi-function, high-resolution radars for air defense, missile tracking, and coastal surveillance. Integration with command and control networks enhances situational awareness and operational coordination.

Collaboration with European defense consortia allows shared R&D efforts and joint production of advanced radar components. Investments in radar simulation, predictive maintenance, and lifecycle management ensure system reliability and performance. The focus on interoperability across European defense forces encourages standardized systems, reducing operational risk and enhancing joint mission effectiveness.

The military radar market in the UK is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by investments in air, naval, and ground radar systems for defense readiness. The UK Ministry of Defence is modernizing legacy systems with multi-function AESA radars, integrated electronic warfare sensors, and long-range surveillance capabilities.

Partnerships with European and North American manufacturers support technology integration, R&D, and supply chain optimization. Radar adoption focuses on fleet protection, border monitoring, and early threat detection. Funding programs, long-term defense contracts, and export collaborations ensure steady market expansion. Training, simulation, and maintenance services further enhance operational efficiency and readiness across all deployed systems.

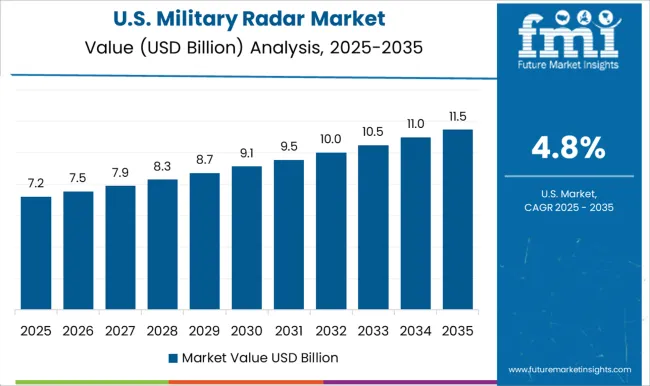

The military radar market in the USA is anticipated to expand at a CAGR of 4.8% from 2025 to 2035, fueled by defense modernization, homeland security, and aerospace applications. The Department of Defense emphasizes multi-domain radar deployment for air defense, missile tracking, electronic warfare, and border security. Advanced AESA radars, phased array systems, and portable radar units are being integrated across naval, airborne, and ground platforms.

Collaborations with defense contractors such as Raytheon, Lockheed Martin, and Northrop Grumman facilitate R&D, system upgrades, and modular solutions. Funding for simulation, predictive maintenance, and operational support ensures reliability and readiness. Export opportunities and strategic defense alliances contribute to global influence and market growth for USA-manufactured radar systems.

Competition in the military radar market is defined by detection range, target tracking accuracy, and multi-domain integration. Aselsan A.S. leads with advanced AESA and phased-array radars optimized for air, naval, and ground applications, emphasizing modular designs, reliability, and interoperability. BAE Systems competes with multi-function radar systems tailored for electronic warfare, missile defense, and situational awareness across allied defense networks. Israel Aerospace Industries (IAI) differentiates through long-range surveillance, airborne early warning, and coastal monitoring radars, integrating cutting-edge signal processing and threat detection algorithms.

L3Harris Technologies offers mobile, compact, and versatile radar solutions for tactical operations and battlefield intelligence, focusing on ease of deployment and operational resilience. Leonardo S.p.A. provides high-precision radar systems for air defense, naval, and homeland security applications, integrating AESA technology, electronic countermeasure capabilities, and interoperability across NATO and European defense platforms. Lockheed Martin Corporation emphasizes multi-domain radar solutions with high-resolution imaging, missile tracking, and system modularity, often bundled with missile defense and aerospace platforms.

Northrop Grumman Corporation competes through scalable radar architectures, long-range surveillance, and electronic warfare compatibility for air, maritime, and ground-based operations. Raytheon Technologies Corporation delivers long-range, multi-function radar systems, prioritizing threat detection, missile guidance support, and defense network integration. Thales Group focuses on high-performance naval and land radars, leveraging advanced signal processing, AESA arrays, and interoperability to meet multi-mission requirements. Strategies in the market revolve around modular designs, multi-domain compatibility, and system integration for air, sea, and land platforms.

Collaborations with government defense agencies, international partnerships, and technology transfer agreements enhance competitiveness. Product brochures emphasize detection range, target tracking, radar cross-section, signal processing capabilities, and multi-mission applications. Maintenance, software upgrades, simulation support, and lifecycle services are highlighted. Specialized radar systems for air surveillance, missile defense, coastal monitoring, and electronic warfare are marketed alongside deployment flexibility, operator training programs, and system interoperability, reflecting a highly competitive and technology-intensive global radar landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.6 billion |

| Component | Antennas, Transmitters, Receivers, Power Amplifiers, Duplexers, Digital Signal Processors, Stabilization Systems, Graphical User Interfaces, and Others |

| Waveform | Frequency-Modulated Continuous Wave and Doppler |

| Technology | Software-Defined Radars, Conventional Radars, and Quantum Radars |

| Range | Short (50 Kms), Medium (50-200 Kms), and Long (>200 Kms) |

| Platform | Ground-Based, Naval, Airborne, and Space |

| Application | Airspace Monitoring & Traffic Management, Air & Missile Defense, Weapon Guidance, Ground Surveillance & Intruder Detection, Vessel Traffic Security & Surveillance, Airborne Mapping, Navigation, Mine Detection & Underground Mapping, Ground Force Protection & Counter-Mapping, Weather Monitoring, Ground Penetration, Maritime Patrolling, Search, & Rescue, Border Security, Space Situational Awareness, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aselsan A.S., BAE Systems, Israel Aerospace Industries Ltd. (IAI), L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, and Thales Group |

| Additional Attributes | Dollar sales, share, CAGR, defense segment adoption (air, naval, ground), radar type demand (AESAs, phased-array, multi-function), regional procurement trends, modernization programs, integration with electronic warfare, and export opportunities. |

The global military radar market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the military radar market is projected to reach USD 27.0 billion by 2035.

The military radar market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in military radar market are antennas, parabolic reflector antennas, slotted waveguide antennas, phased array antennas, and others.

In terms of waveform, frequency-modulated continuous wave segment to command 46.2% share in the military radar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA