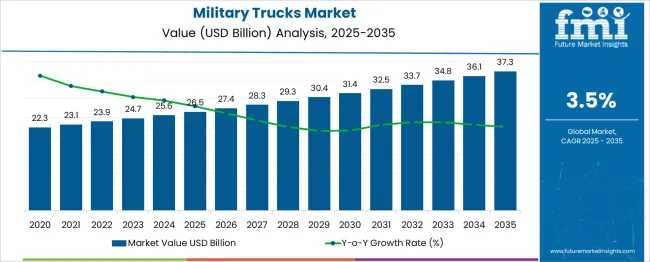

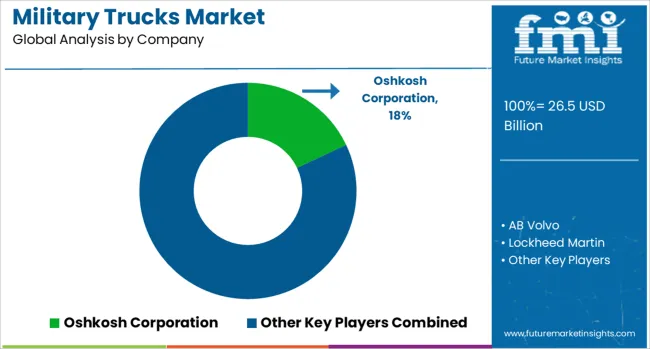

The Military Trucks Market is estimated to be valued at USD 26.5 billion in 2025 and is projected to reach USD 37.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. From 2020 to 2025, the market increases from USD 22.3 billion to USD 26.5 billion, generating an absolute dollar opportunity of USD 4.2 billion. This growth is driven by the ongoing modernization of military fleets, increasing demand for versatile and rugged transport vehicles, and rising defense budgets worldwide. Additionally, the focus on upgrading tactical and logistical capabilities supports steady demand for advanced military trucks during this period. Between 2025 and 2035, the market is expected to add USD 10.8 billion in absolute dollar opportunity, reaching USD 37.3 billion by 2035. This phase benefits from the replacement of aging vehicles, the development of fuel-efficient and armored trucks, and the expansion of military operations in emerging regions.

By 2030, the market is forecast to surpass USD 31.4 billion, indicating healthy mid-term growth. Overall, the period from 2020 to 2035 presents a cumulative absolute dollar opportunity of USD 15 billion, providing manufacturers and defense contractors significant prospects to innovate and capture increasing demand in the military trucks sector.

| Metric | Value |

|---|---|

| Military Trucks Market Estimated Value in (2025 E) | USD 26.5 billion |

| Military Trucks Market Forecast Value in (2035 F) | USD 37.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The Military Trucks market is experiencing significant growth, propelled by increasing defense budgets and rising geopolitical tensions worldwide. The current landscape is characterized by heightened demand for advanced logistics and troop mobility solutions that enhance operational readiness and adaptability. According to defense industry news, investor presentations, and government procurement updates, modernization programs and replacement of aging fleets are key priorities for armed forces, creating strong momentum for military truck adoption.

Future growth is expected to be supported by the integration of advanced drivetrains, improved survivability, and digital command systems in vehicles. Sustainability objectives within defense procurement strategies, as noted in corporate disclosures and press releases, are also encouraging investments in efficient and adaptable vehicle platforms.

Additionally, evolving battlefield requirements and the focus on rapid deployment are fostering innovation in vehicle design and functionality. These dynamics collectively indicate robust and sustained growth potential for the Military Trucks market across developed and emerging regions.

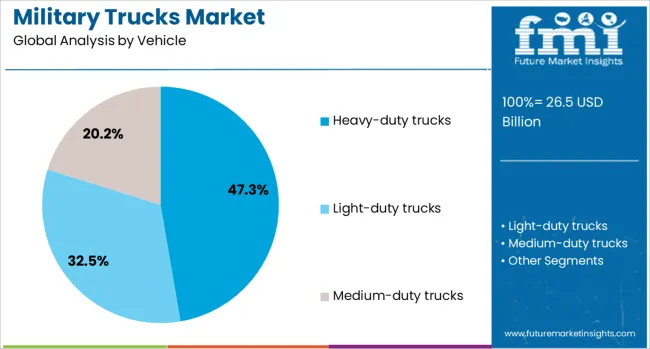

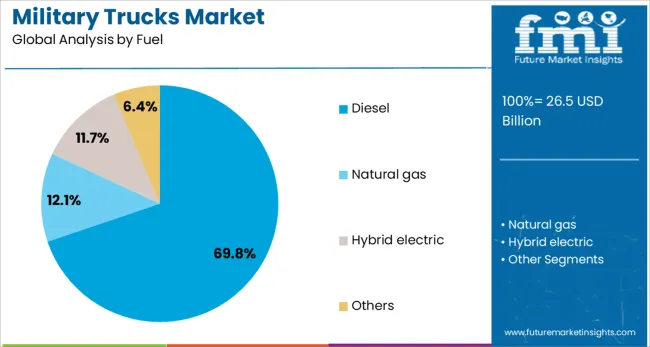

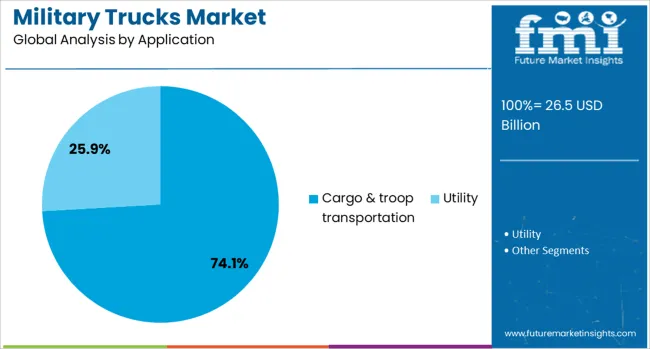

The military trucks market is segmented by vehicle, fuel application, and geographic regions. By vehicle of the military trucks market is divided into Heavy-duty trucks, Light-duty trucks Medium-duty trucks. In terms of fuel of the military trucks market is classified into Diesel, Natural gas, Hybrid electric Others. Based on application of the military trucks market is segmented into Cargo & troop transportation Utility. Regionally, the military trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The heavy-duty trucks segment is anticipated to contribute 47.3% of the Military Trucks market revenue share in 2025, making it the dominant vehicle segment. This position has been reinforced by the segment’s capacity to transport larger payloads, including heavy equipment and large numbers of personnel, as highlighted in defense contract announcements and military logistics reports.

Preference for heavy-duty configurations is being driven by their superior off-road capabilities and durability under harsh conditions, meeting rigorous operational demands. Industry journals and technical bulletins have noted that these trucks provide enhanced protection and payload flexibility while supporting integration with advanced communication and surveillance equipment.

Their robust engineering and adaptability to modular upgrades have positioned them as a reliable choice for critical missions. Furthermore, procurement programs often prioritize heavy-duty trucks to ensure readiness for diverse battlefield scenarios, securing their leading market share.

The diesel segment is projected to command 69.8% of the Military Trucks market revenue share in 2025, maintaining its leadership in the fuel category. This dominance has been attributed to diesel engines’ ability to deliver high torque and better fuel efficiency over extended operational periods, as reported in defense technology publications and manufacturer press statements.

The logistical advantage of a well-established global diesel supply chain has supported its preference in military operations. Diesel-powered trucks have also been recognized in investor communications for their ruggedness and reliability, particularly in remote and challenging environments where maintenance support is limited.

Their compatibility with existing military fueling infrastructure and compliance with evolving efficiency standards have further cemented their prominence. These factors, alongside the ease of refueling and operational familiarity among defense personnel, have ensured diesel’s continued dominance in powering military trucks.

The cargo and troop transportation segment is expected to account for 74.1% of the Military Trucks market revenue share in 2025, underscoring its critical role in military operations. Growth in this segment has been supported by its centrality to mission readiness and logistics efficiency, as reflected in government procurement notices and defense industry updates.

This application is being prioritized for its ability to provide rapid, reliable movement of soldiers and essential supplies across varied terrains. Corporate strategy presentations have highlighted that investments in this segment enable armed forces to maintain mobility and operational flexibility under combat and peacetime conditions alike.

Enhanced safety features, larger payload capacities, and ability to adapt to multi-mission requirements have strengthened the appeal of these trucks in this role. Furthermore, modernization initiatives focusing on quick deployment and battlefield support have reinforced the segment’s leading share in the market.

The military trucks market is expanding steadily as armed forces worldwide upgrade and expand their logistics, troop transport, and tactical vehicle fleets. These trucks are critical for mobility, cargo transport, and mission support across diverse terrains and operational scenarios. Demand is driven by modernization programs, increasing military budgets, and the need to replace aging fleets with vehicles that offer enhanced protection, payload capacity, and off-road capability. The rise of asymmetric warfare and disaster response missions also boosts demand for versatile and rapidly deployable trucks. North America and Asia-Pacific dominate the market due to high defense spending and ongoing military modernization efforts. The integration of advanced communication systems, improved drivetrains, and survivability features supports operational efficiency and crew safety. Manufacturers focus on modular designs that can be adapted for multiple roles, including troop carriers, fuel tankers, and mobile command units.

Military trucks range from light tactical vehicles to heavy-duty transport trucks designed to carry large payloads. Light tactical trucks are used for reconnaissance and rapid troop movement, while medium and heavy trucks support logistics, artillery towing, and fuel or ammunition transport. These vehicles are engineered for ruggedness, high ground clearance, all-wheel drive, and adaptability to extreme weather and terrain conditions. Enhanced suspension systems, reinforced chassis, and armored cabins increase durability and crew protection. Modern trucks often feature diesel engines optimized for fuel efficiency and reliability under heavy loads. Performance specifications such as payload capacity, maximum speed, range, and fording capability are tailored to mission requirements. Interoperability with military logistics and communication systems enhances coordination during deployments.

Military trucks form the backbone of ground mobility and logistics, enabling timely delivery of troops, equipment, and supplies to forward areas. Their reliability directly affects mission success, especially in hostile or remote environments where infrastructure is limited. Enhanced payload capacities and off-road capabilities reduce the need for multiple vehicle types, streamlining fleet management and operational planning. Trucks equipped with integrated communications and GPS facilitate real-time tracking, route optimization, and convoy security. In disaster relief and humanitarian missions, these vehicles enable rapid response and supply distribution. The ability to customize trucks for specialized roles—such as mobile workshops, medical units, or missile carriers—increases tactical flexibility. Efficient and robust military truck fleets are essential for maintaining operational readiness and force projection in modern armed forces.

Military trucks must comply with stringent defense standards governing durability, safety, and environmental performance. Regulations related to emissions, noise, and fuel efficiency are influencing design improvements, especially in developed markets. Maintenance and lifecycle management are critical factors affecting operational availability and total cost of ownership. Manufacturers often provide training, spare parts logistics, and technical support to ensure fleet readiness. Supply chain reliability for critical components—engines, transmissions, tires, and electronic systems—is essential to meet delivery schedules and maintain after-sales service. Geopolitical factors and trade restrictions can impact procurement and production timelines. To mitigate risks, some producers invest in localized assembly and partnerships with domestic suppliers. Increasingly, defense agencies favor vehicles with modular designs to simplify upgrades and repairs, enhancing fleet sustainability over extended service periods.

Rising geopolitical tensions and ongoing military modernization worldwide are driving demand for sophisticated military trucks. Armed forces seek vehicles that perform reliably across rugged terrains, extreme weather conditions, and active combat zones. There is a growing focus on crew protection, prompting the integration of ballistic armor, mine-resistant structures, and enhanced survivability features in new models. Logistics and tactical support missions depend on trucks with high payload capacity and extended operational range to sustain prolonged deployments. The increasing need for multi-role vehicles that can be swiftly reconfigured for various missions supports operational flexibility. Emerging regions in Asia-Pacific, the Middle East, and Africa are investing significantly to modernize their fleets, while mature markets prioritize replacing aging trucks with more fuel-efficient, low-maintenance alternatives. Additionally, adoption of hybrid and alternative fuel technologies is gradually shaping truck design to lower operating costs and reduce dependence on traditional fuels.

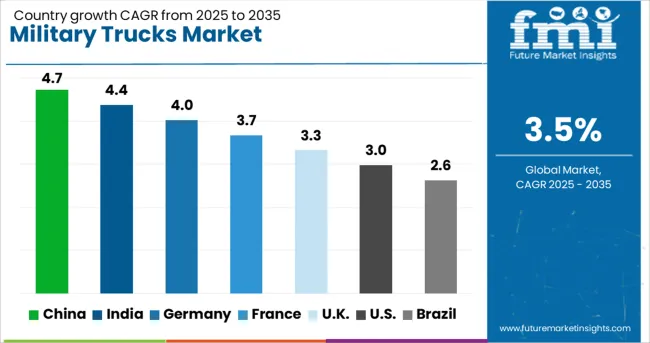

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The military trucks market is progressing at a moderate CAGR of 3.5%, driven by ongoing modernization and logistical enhancements in armed forces worldwide. Among BRICS nations, China leads with a 4.7% growth rate, supported by expanding defense manufacturing capabilities and increasing domestic demand. India follows at 4.4%, reflecting its focus on upgrading military transport fleets and boosting indigenous production. In the OECD region, Germany records 4.0% growth, leveraging its engineering expertise and export-oriented defense industry. The United Kingdom shows steady growth at 3.3%, backed by defense procurement programs and logistical needs. The United States, with a mature market, registers 3.0% growth, influenced by replacement cycles and tactical vehicle upgrades. These countries influence the global military trucks market through their manufacturing output, regulatory frameworks, and deployment strategies. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the military trucks market with a 4.7% growth rate. Strong government investment in defense modernization and expanding military logistics capabilities drive this growth. Compared to India, China benefits from a large-scale domestic manufacturing industry and advanced supply chain networks. Increased focus on mobility and rapid deployment capabilities encourages demand for specialized military trucks. Integration of advanced communication and navigation systems adds to the trucks’ operational efficiency. Partnerships between defense firms and technology companies foster continuous improvements.

Military trucks market in India grows at 4.4%, fueled by efforts to upgrade transportation fleets and improve battlefield logistics. Compared to Germany, India focuses on locally manufactured vehicles to support self-reliance goals. The Indian government’s emphasis on indigenous defense production supports market expansion. Increased border security challenges highlight the need for durable, all-terrain military trucks. Collaboration with foreign manufacturers helps improve technology and quality standards. Rising defense budgets further support procurement.

Germany maintains steady growth at 4.0% in the military trucks market. The country emphasizes engineering precision and reliability in truck design. Compared to the United Kingdom, Germany focuses on multifunctional trucks suitable for various military operations. Demand from NATO and European allies supports the export market. Strong research and development efforts aim to enhance fuel efficiency and durability. Government contracts ensure steady demand for advanced military vehicles.

The United Kingdom’s military trucks market grows at 3.3%, driven by modernization programs and logistical upgrades. Compared to the United States, the UK places emphasis on lightweight, versatile trucks capable of rapid deployment. Government initiatives focus on upgrading aging fleets and improving operational flexibility. Investment in hybrid and electric vehicle technologies is increasing. Collaboration with allied nations supports technology exchange and joint development projects.

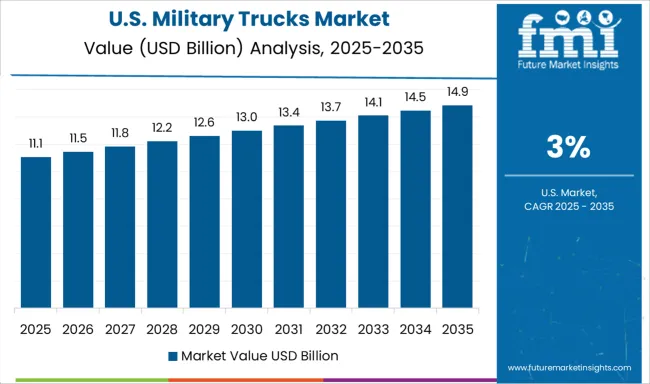

The United States advances the military trucks market at 3.0%, supported by high defense spending and technological innovation. Compared to China, the US market prioritizes advanced communication systems and autonomous vehicle features. Ongoing fleet upgrades focus on improving mobility and survivability. Strong partnerships with defense contractors drive development of specialized vehicles. Demand from multiple military branches ensures consistent market growth.

The military trucks market is dominated by global defense and automotive manufacturers delivering rugged, versatile, and mission-ready vehicles for troop transport, logistics, and tactical operations. Oshkosh Corporation leads with advanced mobility platforms, including all-terrain and armored vehicles, emphasizing survivability and payload flexibility for modern military forces. AB Volvo and Daimler AG provide heavy-duty tactical trucks with proven reliability, integrating state-of-the-art drivetrains and off-road capabilities suitable for multinational defense contracts. Lockheed Martin and General Dynamics Land Systems combine vehicle platforms with integrated defense technologies, offering armored and mission-configurable trucks for high-risk operational theaters.

Navistar Defense and Iveco S.p.A. focus on medium- and heavy-duty tactical trucks with modular designs, allowing rapid adaptation for troop transport, logistics, and specialized support roles. Mitsubishi Heavy Industries, Ltd., Mahindra Emirates Vehicle Armouring, and Renault Trucks Defense cater to regional defense requirements, providing cost-effective, armored, and adaptable military trucks. Market competition is increasingly shaped by innovations in fuel efficiency, vehicle survivability, autonomous mobility, and modular payload capabilities, with suppliers striving to meet evolving defense logistics and tactical mobility needs in diverse global terrains.

AM General began producing the JLTV A2 in early 2025, with initial deliveries to the USA Army expected in Q2 2025. The vehicle debuted publicly at IDEX 2025 in Abu Dhabi, featuring over 250 upgrades, including improved corrosion protection, fuel efficiency, reduced noise, upgraded powertrain, and optional Hornet RCWS for added operational capability.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 Billion |

| Vehicle | Heavy-duty trucks, Light-duty trucks, and Medium-duty trucks |

| Fuel | Diesel, Natural gas, Hybrid electric, and Others |

| Application | Cargo & troop transportation and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oshkosh Corporation, AB Volvo, Lockheed Martin, Dailmer AG, Navistar Defense, Iveco S.p.A., General Dynamics Land Systems, Mitsubishi Heavy Industries, Ltd., Mahindra Emirates Vehicle Armouring, and Renault Trucks Defense |

| Additional Attributes | Dollar sales in the Military Trucks Market vary by vehicle type including light, medium, and heavy trucks, application across troop transport, logistics, and combat support, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing defense budgets, modernization programs, and demand for versatile, durable military vehicles. |

The global military trucks market is estimated to be valued at USD 26.5 billion in 2025.

The market size for the military trucks market is projected to reach USD 37.3 billion by 2035.

The military trucks market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in military trucks market are heavy-duty trucks, light-duty trucks and medium-duty trucks.

In terms of fuel, diesel segment to command 69.8% share in the military trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA