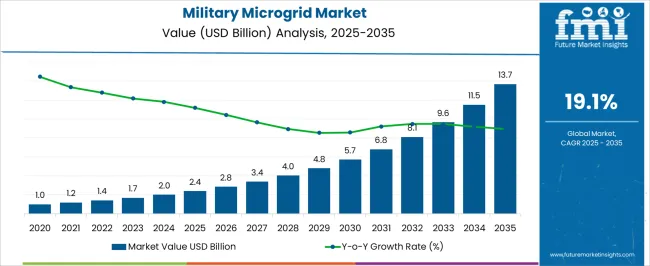

In 2025, the military microgrid market is valued at USD 2.4 billion and is projected to reach USD 13.7 billion by 2035, growing at a CAGR of 19.1%. The absolute dollar opportunity over this period is USD 11.3 billion, representing the additional revenue potential from 2025 to 2035. This sharp increase highlights the growing need for secure and reliable power systems in defense applications.

Companies can leverage this expansion by scaling production, enhancing system resilience, and offering tailored solutions for different military operations. The incremental growth presents a strong case for long-term investments and strategic positioning in the defense energy market. From a business standpoint, the USD 11.3 billion absolute dollar opportunity provides considerable prospects for established defense contractors and emerging players. With the market expanding from USD 2.4 billion in 2025 to USD 13.7 billion in 2035 at a CAGR of 19.1%, firms can target specific phases of growth to maximize revenue capture.

Strategic moves such as building partnerships with defense agencies, advancing modular systems, and optimizing logistics support will be crucial. This predictable growth path allows stakeholders to reinforce market share, broaden their client base, and achieve sustainable profitability within this decade of rapid expansion.

| Metric | Value |

|---|---|

| Military Microgrid Market Estimated Value in (2025 E) | USD 2.4 billion |

| Military Microgrid Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 19.1% |

A breakpoint analysis for the military microgrid market highlights critical thresholds where growth accelerates or strategic adjustments are required. With the market valued at USD 2.4 billion in 2025 and projected to reach USD 13.7 billion by 2035 at a CAGR of 19.1%, early breakpoints occur around USD 4.0–4.8 billion. These levels represent the initial phase of rapid adoption, driven by increased demand for secure and resilient power solutions in defense operations.

Recognizing these breakpoints allows companies to prioritize investments, scale production capacity, and strengthen service networks to capture incremental revenue during periods of accelerated growth. Later-stage breakpoints appear between USD 8.1–11.5 billion as the market approaches maturity and competition intensifies. Surpassing these thresholds may require firms to refine pricing strategies, enhance operational efficiency, and expand strategic partnerships with defense agencies to sustain growth momentum. Monitoring these breakpoints enables companies to anticipate shifts in procurement patterns and adjust production, logistics, and service strategies accordingly.

The market is experiencing strong growth driven by the increasing need for resilient and secure energy systems that can operate independently of conventional grids. The current market landscape reflects rising adoption across defense installations due to the growing importance of energy security, operational continuity, and mission readiness.

Military forces are prioritizing microgrid deployments to ensure an uninterrupted power supply during grid failures or cyber incidents, while also advancing sustainability goals through renewable energy integration. The flexibility of microgrid systems to combine multiple energy sources and advanced storage solutions is enabling enhanced operational efficiency and reduced dependence on fossil fuels.

With continued advancements in smart control systems, renewable energy generation, and high-capacity storage technologies, the market outlook remains positive. As geopolitical uncertainties and climate-related disruptions increase, military organizations are expected to expand investments in microgrids to enhance operational autonomy and energy resilience.

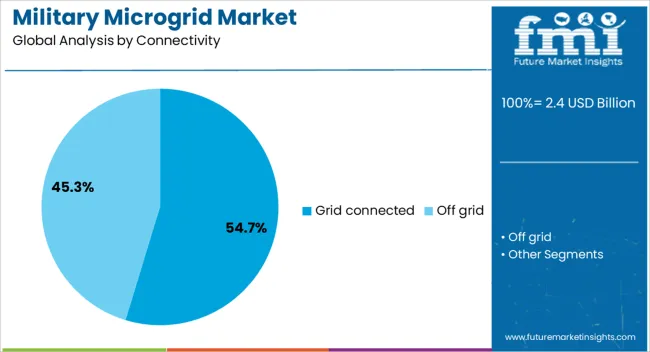

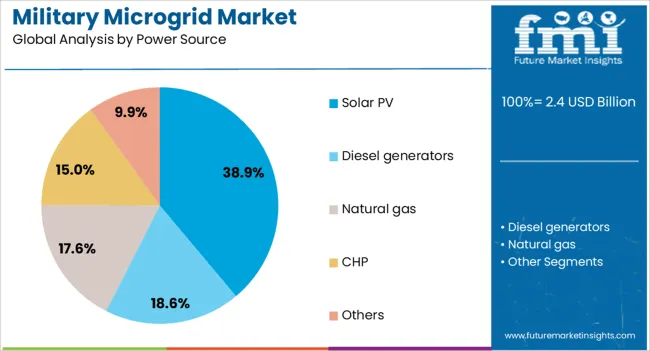

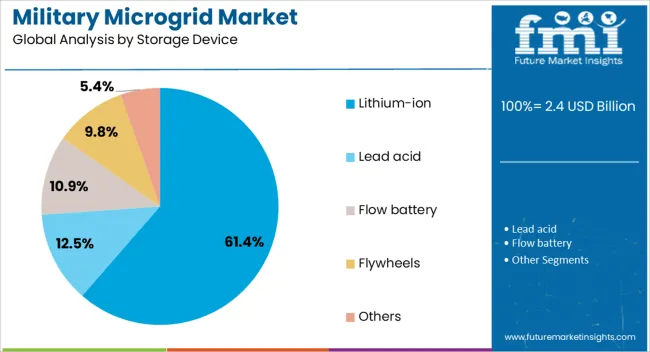

The military microgrid market is segmented by connectivity, power source, storage device, grid type, and geographic regions. By connectivity, the military microgrid market is divided into grid-connected and off-grid. In terms of power source, military microgrid market is classified into Solar PV, Diesel generators, Natural gas, CHP, and Others. Based on storage device, military microgrid market is segmented into Lithium-ion, Lead acid, Flow battery, Flywheels, and Others.

By grid type, military microgrid market is segmented into Hybrid, AC, and DC. Regionally, the military microgrid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The grid connected segment is projected to hold 54.7% of the Military Microgrid market revenue in 2025, making it the leading connectivity type. This dominance is being attributed to the ability of grid connected microgrids to offer both resilience and efficiency by operating in parallel with the main grid while seamlessly switching to islanded mode during outages.

The integration with existing grid infrastructure reduces operational costs and ensures a steady supply of power to military facilities without relying solely on onsite generation. Advanced control systems allow for optimized energy management, enabling better utilization of renewable resources while maintaining stability.

The segment’s growth is being supported by the increasing modernization of defense infrastructure, where grid connectivity provides a balance between reliability and cost efficiency Additionally, grid connected configurations are being favored for their capability to support larger loads and facilitate energy trading when surplus generation is available.

The solar PV segment is anticipated to account for 38.9% of the market revenue in 2025, positioning it as the leading power source. The segment’s prominence is being driven by the growing emphasis on renewable energy integration to reduce fuel dependency and improve operational sustainability.

Solar PV systems offer a predictable and low-maintenance source of power, making them highly suitable for deployment in both permanent and forward operating bases. The declining cost of photovoltaic modules, combined with advancements in efficiency and durability, has accelerated adoption in military applications.

The ability to pair solar PV with advanced storage technologies allows for a continuous energy supply even in the absence of sunlight, further increasing reliability. In addition, the strategic value of reducing reliance on fuel convoys and external supply chains is encouraging military organizations to scale up solar PV deployments within microgrids.

The lithium-ion segment is expected to command 61.4% of the market revenue in 2025, making it the dominant storage device type. This leadership is being supported by the superior energy density, rapid charging capability, and long lifecycle offered by lithium-ion batteries compared to other storage options.

These attributes are critical for military applications where reliability, quick response times, and space efficiency are paramount. The declining cost of lithium-ion technology has further encouraged large-scale adoption in defense energy systems.

The ability to deliver stable power output, integrate seamlessly with renewable generation, and provide high cycle performance under varying load conditions has strengthened its position in military microgrids. Lithium-ion storage enhances the operational flexibility of microgrids, enabling smoother transitions between power sources and ensuring a continuous energy supply during grid disruptions or peak demand periods.

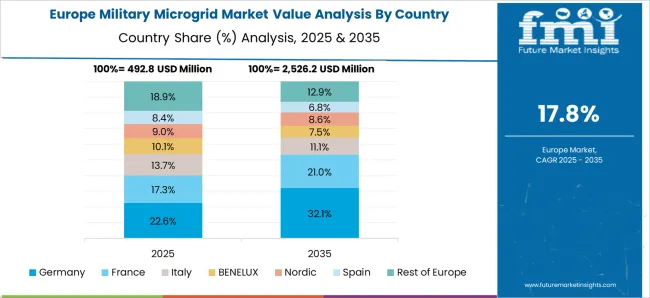

The military microgrid market is growing as defense organizations prioritize energy resilience, secure power supply, and integration of renewables for bases and forward operations. North America and Europe lead deployments with advanced hybrid systems ensuring mission continuity and cybersecurity. Asia-Pacific growth is supported by rising defense budgets, modernization programs, and strategic energy independence. Manufacturers differentiate through scalability, fuel flexibility, and control software. Regional variations in defense spending, infrastructure maturity, and operational requirements influence adoption, partnerships, and competitive positioning globally.

Military microgrids ensure reliable power for bases, command centers, and remote operations where outages or cyberattacks pose risks. North America emphasizes resilience against grid disruptions, investing in hybrid systems combining diesel, renewables, and storage. Europe prioritizes low-emission, renewable-powered systems aligning with NATO sustainability targets. Asia-Pacific adoption focuses on backup and rapid-deployment grids supporting expanding military infrastructure. Differences in resilience priorities shape system design, storage needs, and investment decisions. Suppliers offering robust, secure, and adaptable systems gain an edge in fulfilling mission-critical energy demands across diverse defense environments.

Cybersecurity is central to military microgrid procurement, as grid vulnerabilities could compromise operational readiness. North America and Europe demand advanced intrusion detection, encryption, and real-time monitoring in microgrid control software. Asia-Pacific markets increasingly integrate cybersecurity but often prioritize physical reliability and cost efficiency first. Differences in emphasis affect system architecture, supplier selection, and approval timelines. Companies offering military-grade cybersecurity features gain trust and higher-value contracts, while regional providers compete on affordability and deployment speed. Cybersecurity contrasts define adoption pace and long-term credibility in defense energy infrastructure projects.

Military microgrids serve both stationary bases and forward-deployed, mobile operations. North America invests in permanent, large-scale base microgrids integrating renewables and storage for long-term resilience. Europe emphasizes modular systems suitable for joint operations and rapid redeployment. Asia-Pacific favors mobile, containerized grids to support border operations and temporary sites. Differences in deployment models affect scalability, cost, and design priorities. Suppliers offering versatile platforms adaptable to both permanent and mobile use secure broader opportunities, while regional firms specialize in cost-effective mobile solutions. Deployment contrasts influence adoption strategies and supplier competitiveness globally.

Regional differences in defense spending directly influence microgrid adoption. The USA leads with large-scale funding for resilient infrastructure, while Europe integrates microgrids into modernization aligned with sustainability initiatives. Asia-Pacific shows significant growth as rising defense budgets drive investment in secure, efficient energy systems. Differences in funding levels affect project timelines, system sophistication, and procurement competition. Global suppliers gain advantages in high-budget contracts with advanced requirements, while regional players address smaller-scale, cost-sensitive projects. Spending contrasts determine adoption speed, supplier opportunities, and the long-term trajectory of military microgrid development worldwide.

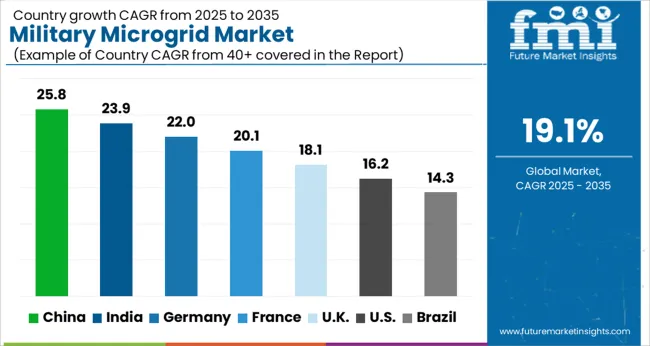

| Country | CAGR |

|---|---|

| China | 25.8% |

| India | 23.9% |

| Germany | 22.0% |

| France | 20.1% |

| UK | 18.1% |

| USA | 16.2% |

| Brazil | 14.3% |

The global military microgrid market was projected to grow at a 19.1% CAGR through 2035, driven by demand in defense energy systems, tactical operations, and secure power supply applications. Among BRICS nations, China recorded 25.8% growth as large-scale microgrid deployment and manufacturing facilities were commissioned and compliance with defense and energy regulations was enforced, while India at 23.9% growth saw expansion of production units to meet rising regional defense energy requirements. In the OECD region, Germany at 22.0% maintained substantial output under strict military and industrial standards, while the United Kingdom at 18.1% relied on moderate-scale operations for tactical and base energy solutions. The USA, expanding at 16.2%, remained a mature market with steady demand across defense and strategic energy segments, supported by adherence to federal and state-level safety and operational standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Military microgrid market in China is growing at a CAGR of 25.8%. Between 2020 and 2024, growth was driven by modernization of defense infrastructure, rising demand for secure and resilient energy systems, and increasing deployment of renewable energy technologies in military bases. Manufacturers focused on modular, scalable, and high-efficiency microgrid solutions capable of supporting critical military operations. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of smart, AI-enabled, and hybrid renewable-fossil microgrids integrated with energy storage solutions. Expansion of defense infrastructure, government initiatives for energy resilience, and focus on operational efficiency will further boost market growth. China remains a global leader due to strategic defense priorities, large-scale investments, and emphasis on self-reliant energy systems.

Military microgrid market in India is growing at a CAGR of 23.9%. Historical period 2020 to 2024 saw growth supported by government initiatives to enhance energy security for defense bases, modernization of military infrastructure, and renewable energy adoption. Manufacturers focused on compact, scalable, and reliable microgrids suitable for remote and critical defense installations. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of hybrid, AI-enabled, and energy storage-integrated microgrids. Expansion of military bases, renewable energy deployment, and government emphasis on operational energy resilience will further drive adoption. India is projected to remain a fast-growing market due to strategic defense priorities and increasing investment in self-sufficient energy systems.

Military microgrid market in Germany is growing at a CAGR of 22.0%. Between 2020 and 2024, growth was supported by modernization of military installations, focus on energy resilience, and integration of renewable energy technologies in defense infrastructure. Manufacturers focused on high-efficiency, modular, and secure microgrids suitable for military bases and critical operations. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of AI-driven, hybrid, and storage-integrated microgrid solutions. Expansion of defense infrastructure, government sustainability initiatives, and emphasis on operational reliability will further drive adoption. Germany remains a key European market due to strategic energy policies and advanced military technology.

Military microgrid market in the United Kingdom is growing at a CAGR of 18.1%. During 2020 to 2024, adoption was driven by modernization of defense installations, renewable energy integration, and focus on resilient energy infrastructure. Manufacturers focused on modular, reliable, and energy-efficient microgrids suitable for remote and critical military operations. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of AI-enabled, hybrid, and storage-integrated microgrid solutions. Expansion of military bases, government support for energy resilience, and sustainability initiatives will further support market development. The United Kingdom market demonstrates stable growth with emphasis on reliability, efficiency, and operational energy security.

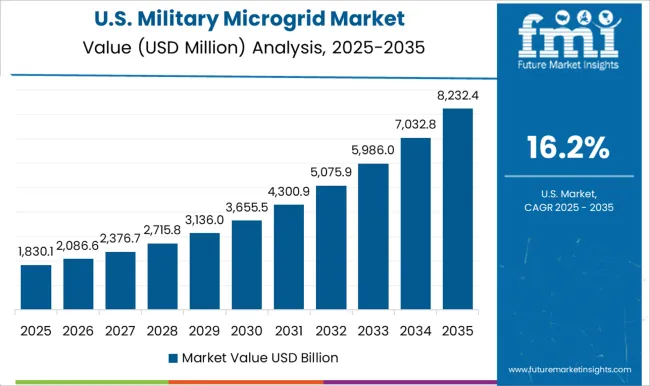

Military microgrid market in the United States is growing at a CAGR of 16.2%. Historical period 2020 to 2024 saw growth fueled by modernization of defense energy infrastructure, renewable integration, and demand for resilient microgrid solutions. Manufacturers focused on secure, high-efficiency, and scalable microgrids for military bases and critical operations. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of hybrid, AI-driven, and storage-integrated microgrids capable of operating independently of the main grid. Expansion of defense infrastructure, federal initiatives for energy resilience, and strategic investments in renewable energy will further drive adoption. The United States market demonstrates consistent growth with emphasis on reliability, security, and operational efficiency.

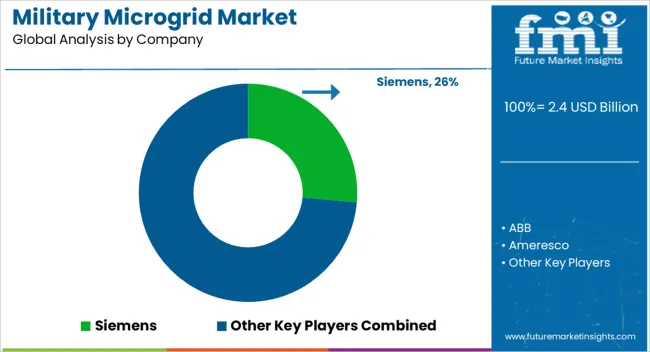

The military microgrid market is supplied by Siemens, ABB, Ameresco, Caterpillar, FlexGen Power Systems, General Electric, Piller Power Systems, PG&E, Saft, Stellar Energy, and Schneider Electric. Products focus on secure, reliable, and scalable power solutions for forward operating bases, naval vessels, and mission-critical installations. Brochures highlight microgrid controllers, energy storage systems, integrated renewable sources, and hybrid diesel-generator setups, emphasizing redundancy, rapid deployment, and operational resilience under extreme conditions.

Competition is driven by system reliability, modularity, and integration capabilities. Siemens and ABB emphasize advanced control software and automated load management, while Caterpillar and FlexGen Power Systems focus on ruggedized energy storage and generator combinations. General Electric and Schneider Electric offer integrated solutions combining energy storage with real-time monitoring and predictive maintenance. Piller Power Systems and Saft provide high-capacity battery systems tailored for rapid-response military deployments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Connectivity | Grid connected and Off grid |

| Power Source | Solar PV, Diesel generators, Natural gas, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Grid Type | Hybrid, AC, and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Ameresco, Caterpillar, FlexGen Power Systems, General Electric, Piller Power Systems, PG&E, Saft, Stellar Energy, and Schneider Electric |

| Additional Attributes | Dollar sales vary by grid type, including grid-connected, off-grid, and hybrid microgrids; by power source, spanning renewable energy, fossil fuels, and energy storage systems; by application, such as forward operating bases, homeland defense, and remote military installations; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by energy resilience needs, decarbonization efforts, and secure power supply for defense operations. |

The global military microgrid market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the military microgrid market is projected to reach USD 13.7 billion by 2035.

The military microgrid market is expected to grow at a 19.1% CAGR between 2025 and 2035.

The key product types in military microgrid market are grid connected and off grid.

In terms of power source, solar pv segment to command 38.9% share in the military microgrid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Military Communications Market Analysis by Component, Application, End User & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA