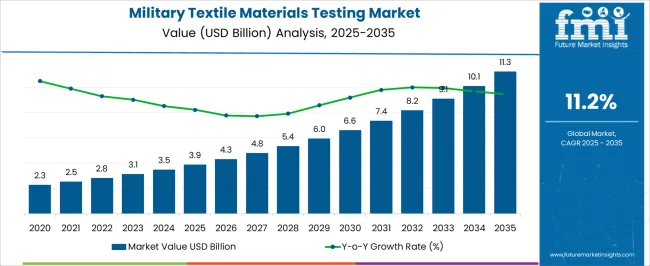

The Military Textile Materials Testing Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Military Textile Materials Testing Market Estimated Value in (2025 E) | USD 3.9 billion |

| Military Textile Materials Testing Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The Military Textile Materials Testing market is witnessing robust growth, driven by the increasing demand for high-performance fabrics that can ensure protection, comfort, and durability for armed forces personnel in diverse operational conditions. Rising focus on advanced textile technologies for combat uniforms, protective gear, and extreme-environment clothing is reinforcing the need for stringent testing protocols. Military organizations are placing greater emphasis on textile performance standards to enhance soldier efficiency, mobility, and survivability during missions.

Innovations in textile engineering, including moisture-wicking fabrics, flame-retardant materials, and ballistic-resistant textiles, are creating significant opportunities for testing services. Compliance with international military standards and regulatory benchmarks is further driving adoption of specialized testing solutions. Growing geopolitical tensions, modernization of defense forces, and increasing investments in military research and development are expanding the scope of textile testing requirements.

As armies worldwide prioritize functional performance alongside comfort and safety, the demand for sophisticated material testing methods is expected to rise steadily The market’s expansion is also being supported by advancements in laboratory technologies, sensor-based assessments, and simulation-driven testing approaches.

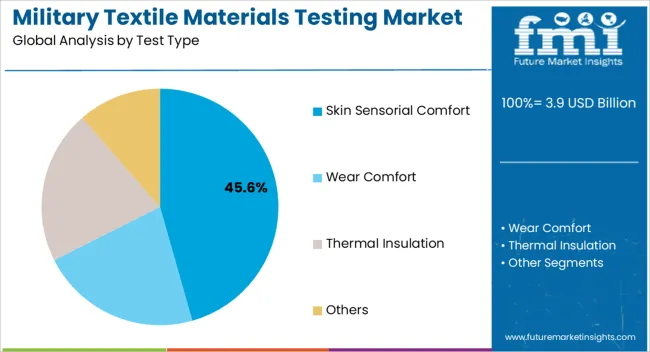

The military textile materials testing market is segmented by test type, and geographic regions. By test type, military textile materials testing market is divided into Skin Sensorial Comfort, Wear Comfort, Thermal Insulation, and Others. Regionally, the military textile materials testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The skin sensorial comfort test type segment is projected to account for 45.6% of the market revenue in 2025, making it the leading test type. This dominance is being driven by the growing need to evaluate fabric comfort in terms of breathability, moisture management, softness, and skin compatibility, all of which directly impact soldier performance and endurance. Fabrics used in military clothing undergo rigorous environmental exposure, including high temperatures, humidity, and extended wear, making comfort testing critical to prevent fatigue and skin-related issues.

Advances in textile science are enabling precision testing of tactile sensations, ensuring that fabrics balance comfort with durability and protection. Military procurement agencies are increasingly prioritizing fabrics that not only meet ballistic and flame resistance requirements but also offer high comfort levels to improve soldier morale and effectiveness in field operations.

Sensor-based testing methods and objective measurement techniques are strengthening the credibility of results, driving greater adoption of comfort testing protocols As the importance of combining protective performance with enhanced wearability continues to grow, the skin sensorial comfort segment is expected to maintain its leadership in the coming years.

Developments in the missiles and surveillance technologies are encouraging innovations in individual protection equipment such as military textiles and field related structures and systems. Textiles for military outfits face a multiple challenges. There must be a provision for durability, comfort and protection and also should withstand a wide range of hostile environments.

A soldier’s mobility, survivability and stamina are closely linked with comfort and fit of their outfit. Military textile materials testing is the technique offered in checking and confirming the quality of military textiles, which adds invaluable benefits to the military sector. Soldiers must dress in such a way that they must feel comfortable; it is therefore of utmost importance that the clothing and associated equipment are compact, durable and of high importance.

The major criterion, which the fabrics for military purpose should meet are the physical and camouflage requirements, resistance to various environmental conditions wind, water, heat, fire, battlefield threats and economic conditions.

The military textile materials testing market include various tests for thermal insulation, wear comfort and skin sensorial comfort. One of the most prominent features of comfort for military textile materials is the property of thermal comfort, i.e. comfort or discomfort associated with how hot or cold one feels.

The military textile materials testing have various properties, which are achieved by various processes in chemical finishing, i.e. certain substances are applied to the surface of the textile fabric where they are retained, not penetrating into the yarn.

In the wear comfort test of textiles, there is a difference between thermo-physiological aspects of the material i.e. maintaining the moisture and warmth, and the way textile looks on skin.

The thermal insulation test for combat uniforms, sleeping bags and cold protective clothing and immersion suits can be measured by using the thermal manikins. Skin sensorial comfort test is done for the sensitivity of skin, which is a significant aspect that influences wear comfort.

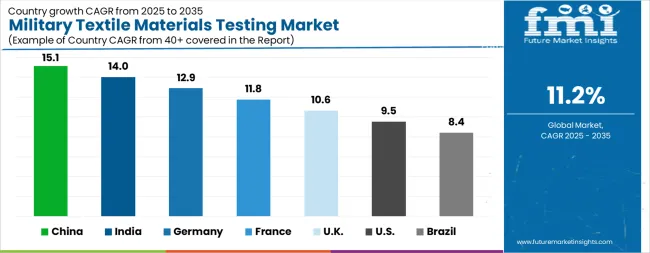

| Country | CAGR |

|---|---|

| China | 15.1% |

| India | 14.0% |

| Germany | 12.9% |

| France | 11.8% |

| UK | 10.6% |

| USA | 9.5% |

| Brazil | 8.4% |

The Military Textile Materials Testing Market is expected to register a CAGR of 11.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.1%, followed by India at 14.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.4%, yet still underscores a broadly positive trajectory for the global Military Textile Materials Testing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.9%. The USA Military Textile Materials Testing Market is estimated to be valued at USD 1.4 billion in 2025 and is anticipated to reach a valuation of USD 3.5 billion by 2035. Sales are projected to rise at a CAGR of 9.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 200.6 million and USD 115.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Test Type | Skin Sensorial Comfort, Wear Comfort, Thermal Insulation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

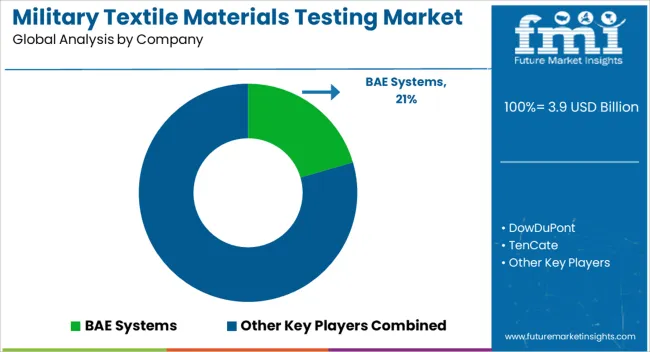

| Key Companies Profiled | BAE Systems, DowDuPont, TenCate, Outlast, W. L. Gore & Associates, Mide Technology, Ohmatex ApS, and AFT |

The global military textile materials testing market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the military textile materials testing market is projected to reach USD 11.3 billion by 2035.

The military textile materials testing market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in military textile materials testing market are skin sensorial comfort, wear comfort, thermal insulation and others.

In terms of , segment to command 0.0% share in the military textile materials testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA