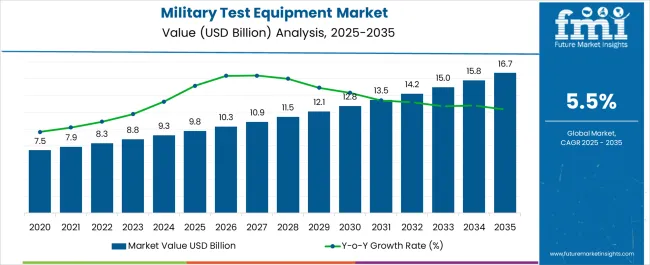

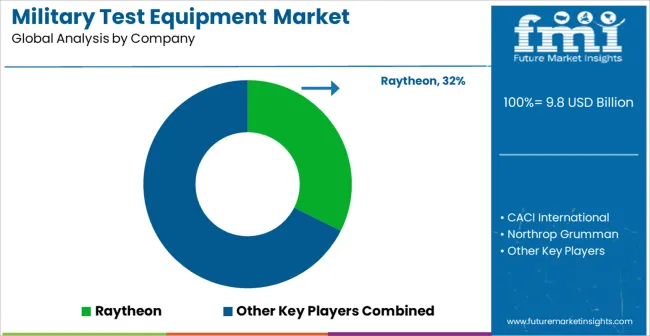

The Military Test Equipment Market is estimated to be valued at USD 9.8 billion in 2025 and is projected to reach USD 16.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Military Test Equipment Market Estimated Value in (2025 E) | USD 9.8 billion |

| Military Test Equipment Market Forecast Value in (2035 F) | USD 16.7 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Military Test Equipment market is witnessing steady growth as defense agencies and armed forces globally continue to upgrade their testing capabilities to support advanced weapon systems and electronic warfare platforms. The current scenario reflects increased investment in simulation, automated testing, and integrated verification solutions aimed at improving readiness and reducing downtime. As defense budgets are being optimized for modern warfare requirements, test equipment that ensures accuracy, reliability, and fast deployment is increasingly preferred.

Emerging threats and sophisticated communication systems are creating a need for robust testing solutions, which has driven adoption across land, air, and naval forces. Furthermore, the growing emphasis on predictive maintenance and automated diagnostics is encouraging the use of advanced testing platforms.

The outlook for the market remains positive, with further growth expected in areas where defense systems are being modernized and upgraded Enhanced collaboration between equipment providers and defense agencies is also fostering innovation, allowing customized solutions that cater to mission-specific requirements.

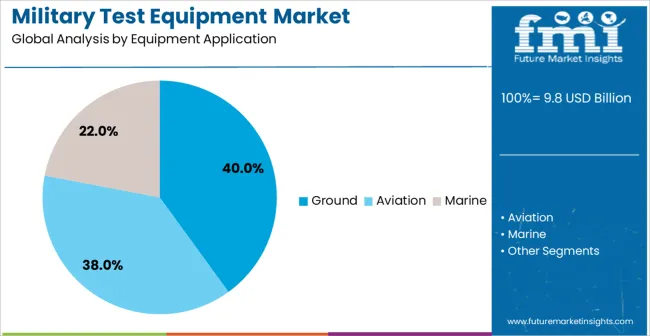

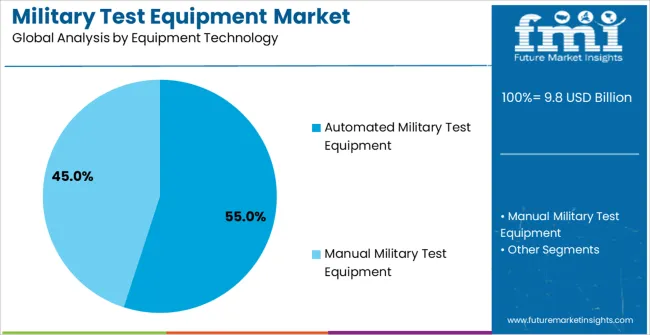

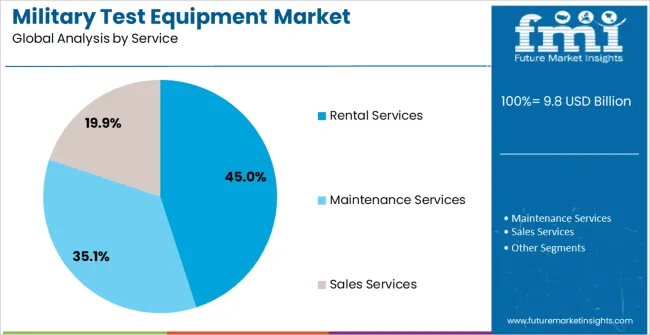

The military test equipment market is segmented by equipment application, equipment technology, service, and geographic regions. By equipment application, military test equipment market is divided into Ground, Aviation, and Marine. In terms of equipment technology, military test equipment market is classified into Automated Military Test Equipment and Manual Military Test Equipment. Based on service, military test equipment market is segmented into Rental Services, Maintenance Services, and Sales Services. Regionally, the military test equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ground equipment application segment is projected to hold 40.00% of the Military Test Equipment market revenue share in 2025, making it the leading segment in terms of application. This prominence is being attributed to the increasing deployment of testing systems for armored vehicles, communication setups, and artillery systems that are critical for ground operations. The requirement for durable and high-precision equipment capable of operating in harsh terrains has supported the expansion of this segment.

The preference for testing solutions that enable fast fault detection and maintenance in the field has further reinforced its growth. Equipment that supports rugged environments while ensuring operational safety and system reliability has been increasingly adopted by military units.

Additionally, modernization programs focused on improving ground mobility and tactical readiness have contributed to the growing demand As the complexity of ground-based systems continues to rise, investment in reliable test equipment has been prioritized to ensure seamless operational performance under diverse field conditions.

The automated military test equipment technology segment is expected to account for 55.00% of the Military Test Equipment market’s revenue share in 2025, establishing it as the dominant technology segment. This leadership has been driven by the growing need for precision and repeatability in testing complex defense systems. Automation has enabled quicker turnaround times and higher throughput in test processes, reducing the need for manual interventions and minimizing human error.

The adoption of automated systems has been accelerated by advancements in artificial intelligence and machine learning, which are helping predict system failures and optimize maintenance schedules. The ability to conduct simulations and replicate real-world scenarios with minimal human involvement has made automated platforms highly desirable across defense programs.

Moreover, automated solutions have been valued for their cost efficiency and ability to scale operations in alignment with mission demands As defense organizations seek to reduce lifecycle costs and enhance system availability, automated testing technologies have been increasingly integrated into procurement strategies and maintenance operations.

The rental services segment is expected to account for 45.00% of the Military Test Equipment market’s revenue share in 2025, making it a leading service category. The popularity of rental services is being driven by defense organizations’ growing need for cost-effective solutions that allow rapid deployment of test equipment without the long-term commitments associated with ownership. Renting provides flexibility in accessing advanced equipment for specific mission requirements or temporary deployments.

The ability to upgrade to the latest testing systems without incurring the full cost of procurement has been particularly attractive to military units operating under tight budget constraints. Furthermore, rental agreements have facilitated faster field readiness by ensuring that mission-critical equipment is available when required, without the logistical delays of procurement cycles.

The availability of rental services has also supported smaller defense units and allied forces by enabling shared access to advanced systems, thus promoting interoperability As defense priorities shift toward agile operations and mission-specific deployments, rental services are expected to maintain strong demand, offering a practical solution for optimizing operational efficiency.

Complex and vital military-grade electronic systems demand more capabilities and efficiency in the military test equipment used to inspect those systems. These military-grade electronic systems can range from electrical items to military vehicles and aircraft. Different military test equipment are required to carry out different tests.

Electronic military test equipment creates or emits signals and captures responses from the electronic military devices under test. This ensures proper functioning of the device under test (DUT) as the faults in the device can be rectified.

Military test equipment that evaluate the microwave/radio frequency performance levels cover a wide range of functions and frequencies owing to the diversified nature of military-grade electronic systems. Military test equipment may be inexpensive and simple or extremely expensive and complicated.

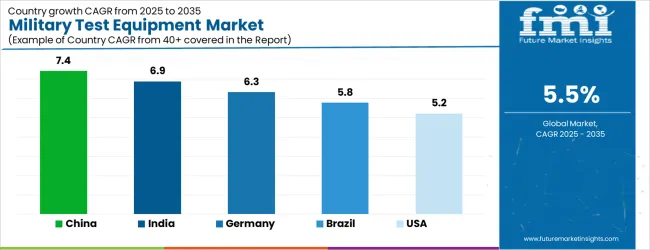

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| U.K. | 4.7% |

| Japan | 4.1% |

The Military Test Equipment Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Military Test Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The U.S. Military Test Equipment Market is estimated to be valued at USD 3.5 billion in 2025 and is anticipated to reach a valuation of USD 3.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 475.1 million and USD 255.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.8 Billion |

| Equipment Application | Ground, Aviation, and Marine |

| Equipment Technology | Automated Military Test Equipment and Manual Military Test Equipment |

| Service | Rental Services, Maintenance Services, and Sales Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon, CACI International, Northrop Grumman, United Technologies, OSHKOSH, HITACHI, Custom Manufacturing & Engineering, AMETEK, ALL-TEST Pro, Mil-Spec Industries, PrimeTest Automation, and Trilion Quality Systems |

The global military test equipment market is estimated to be valued at USD 9.8 billion in 2025.

The market size for the military test equipment market is projected to reach USD 16.7 billion by 2035.

The military test equipment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in military test equipment market are ground, aviation and marine.

In terms of equipment technology, automated military test equipment segment to command 55.0% share in the military test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wi-Fi Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA