Between 2025 and 2035, the global rubber testing equipment market is expected to flourish due to the high demand for quality rubber products from industries such as automotive, aerospace, construction, and healthcare. Physical, mechanical, and chemical properties of rubber materials are determined using rubber testing equipmentmaintaining longevity, functionality, and the worldwide quality standards. With a focus on product safety and innovation, manufacturers are increasingly looking to use precise testing instruments (hardness testers, rheometers, tensile testing machine, aging oven, etc.

Moreover, technological developments in digital testing, automation, and precision analytics are optimizing the efficacy and dependability of testing processes, thereby driving the expansion of the global rubber value chain.

Key Market Metrics

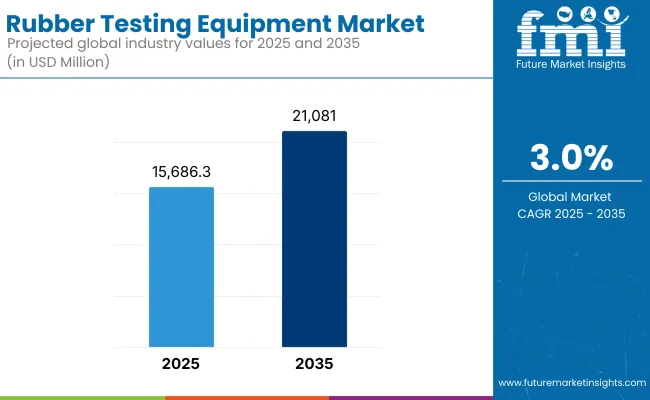

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 15,686.3 Million |

| Projected Market Size in 2035 | USD 21,081.0 Million |

| CAGR (2025 to 2035) | 3.0% |

In 2025, the rubber testing equipment market is projected to be valued at approximately USD 15,686.3 million. By 2035, the market size is expected to reach around USD 21,081.0 million, expanding at a steady compound annual growth rate (CAGR) of 3.0%.

Technological advancements in digital testing, automation, and precision analytics are further enhancing the efficiency and reliability of testing processes, supporting the expansion of the global rubber value chain.

North America is another lucrative region for the rubber testing equipment market owing to the strict quality regulations in the region, as well as the presence of a large automotive and aerospace manufacturing base. USA remains at the forefront of regional demand, as proved by investments towards R&D and quality assurance in the manufacture of rubber goods including tires, seals and industrial components.

The case of Europe, which is a more mature and uniform market, market; countries such as Germany, France and Italy also highlight variables such as precision and quality control characteristics rubber. The region’s focus on the use of durable and sustainable materials, especially in automotive and building and construction industries, is driving demand for advanced rubber testing solutions.

The Asia-Pacific region is the most attractive and fastest-growing market for these products, as the rapid industrialization of emerging economies, the growth of tire manufacturing hubs in Asia, and the increasing exports of rubber products are driving market growth. Government support for quality certification and industrial modernization further accelerates market growth in this region.

Challenge

Capital Investment, Technical Skill Requirements, and Data Standardization

High initial investments in contemporary lab and inline testing equipment, including dynamic mechanical analysis (DMA), tensile machines, and rheometers, serve as major hurdles for the Rubber Testing Equipment Market. Litigation is often an ineffective weapon against such large corporations, and small and medium manufacturers are too often forced to outsource testing services because they can't afford the expertise needed.

Furthermore, such equipment requires technically trained personnel in order to calibrate, measure and interpret the results accurately personnel often not easily accessible in any given rubber-processing plant. In addition, without standardization of the data compared to legacy systems, the test results could not be immediately integrated into wider quality assurance (QA) and digital manufacturing systems, resulting in delayed decision-making for real-time issues.

Opportunity

Automation, Digital QA Integration, and Sustainable Material Testing

However, the high costs associated with these materials have limited its growth, making it a lucrative space for potential developments, and as a result, the market is expected to grow at a significant pace due to surging demand globally for high-performance, safety-compliant rubber products used in automotive, aerospace, construction, and medical devices.

This trend prompts investment in high-throughput automated testing platforms that rely less on operators and shorten testing cycles. The transition towards Industry 4.0 is also increasing the adoption of smart, sensor-based rubber testing apparatus that have capabilities to upload real-time information to one centralized monitoring system. Moreover, the increasing use of bio-based and recycled rubber materials increasingly demands flexible and adaptive testing solutions which can assess novel compounds under various thermal and mechanical stress conditions to boost innovation.

From 2020 to 2024, market penetration was primarily centered on basic mechanical property testing, with automotive tire testing, industrial rubber quality control, and physical performance benchmarking continuing to prevail. Integration with digital QA systems, however, remained sparse, and equipment refreshesif they happenedtended to be driven by the emergence of new regulations or product recall events.

By 2025 to 2035, the market will evolve toward Modular, Digital Integrated and Remote Operable systems for Predictive Maintenance, AI-Based Material characterization, Eco-certification testing, and the like. Innovation will focusing on non-destructive testing (NDT), micro-sample rheology and AI-enhanced fatigue and crack growth simulations, particularly as next-gen elastomers become more complex.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO, ASTM, and DIN standards for mechanical testing |

| Technology Innovations | Widespread use of durometers, tensile testers, and Mooney viscometers |

| Market Adoption | Common in automotive, industrial rubber goods, footwear, and hoses |

| Sustainability Trends | Limited to recyclability testing and aging studies |

| Market Competition | Dominated by Alpha Technologies, U-CAN Dynatex, TA Instruments, ZwickRoell |

| Consumer Trends | Demand for compliance testing and batch-level quality assurance |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Emergence of ESG-focused testing protocols, green material traceability, and automated reporting for audit trails |

| Technology Innovations | Growth of AI-integrated DMA, automated robotic testing arms, and cloud-linked fatigue analyzers |

| Market Adoption | Expansion into medical elastomers, e-mobility tires, wearable devices, and 3D-printed rubber parts |

| Sustainability Trends | Increased focus on biodegradable rubber performance, energy-efficient testing systems, and VOC emission testing |

| Market Competition | Entry of IoT-connected equipment firms, modular lab equipment startups, and AI-based testing software vendors |

| Consumer Trends | Rising need for in-line, real-time defect detection, traceability, and automated data analysis dashboards |

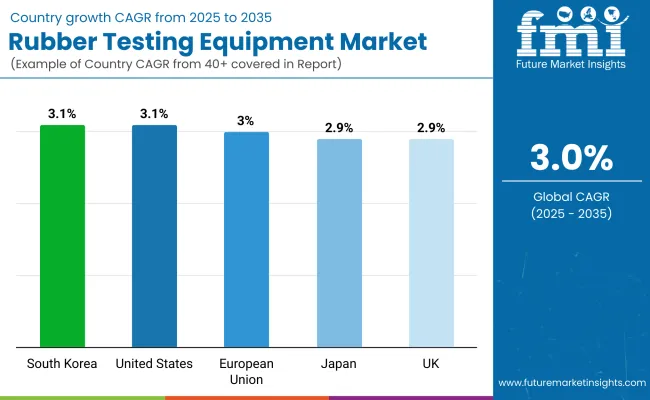

The rubber testing equipment in the USA is witnessing stable growth as a result of strict quality assurance standards observed in automotive, aerospace, and industrial rubber components. Rising demand for testing the durability, tensile strength, and resistance to aging in tires, seals, and gaskets is propelling sales of this equipment. ASTM and ISO standard compliance is an essential driver for a continuous test in the production lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

The market in the United Kingdom is growing at a steady rate since the usage of rubber testing as a part of quality control has become common practice in various manufacturing sectors including construction materials, medical devices, and transport components. With increasing investments in laboratory automation and digital material analysis tools, the demand for new testing machines is expected to grow in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

The rubber testing equipment market is expanding as its automotive industry is strong, targeting the compliance of REACH regulations and exploring sustainable rubber formulation R&D across European nations. Rheometers, tensile testers, and aging ovens are heavily utilized for validating synthetic and natural rubber products in countries such as Germany, France, and Italy.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.0% |

Japan's market is developing slowly, with high standards of precision manufacturing driven by the automotive, electronics and healthcare industries. Small, high-precision rubber testing instruments are popularly utilized in both R&D labs and QC departments focusing on micro-components and elastomeric materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

In South Korea the market is growing with a strong focus from the country on material science innovation and export-oriented manufacturing. Rubber testing is a crucial part of semiconductor manufacturing (for seals), as well as in tire manufacturing and consumer electronics, where elastomer performance must be consistent and precise.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

The global Rubber Testing Equipment Market is expanding as it provides industries with reliable, consistent, and efficient methods to analyze the mechanistic and physical properties of the rubber products. These testers are used to find out about durability, elasticity, density, hardness, viscosity, and aging properties, which ensures the reliability of the product and whether it meets international quality standards.

The market spans a wide variety of the test equipment, servicing the automotive, construction, industrial goods, and consumer products industries. It is segmented based on Testing Type and End Use.

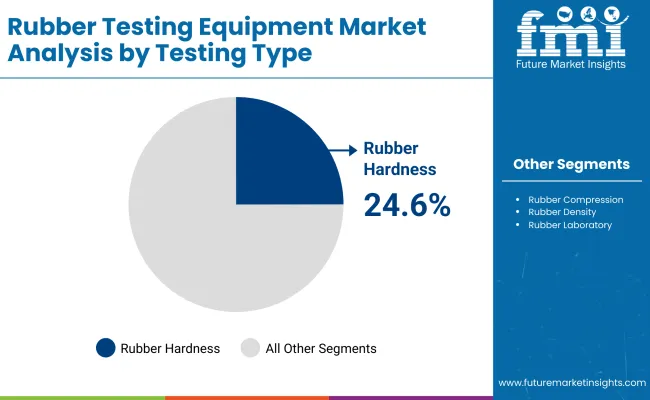

| Testing Type | Market Share (2025) |

|---|---|

| Rubber Hardness Testing Equipment | 24.6% |

Rubber hardness testing equipment is likely to experience the largest share of the market globally equating, to 24.6% of overall market share by 2025. It is essential for R&D laboratories and production quality control and is critical in the testing of Shore A or Shore D hardness of vulcanized rubber, elastomers, and synthetic materials.

Because hardness is a critical performance attribute in applications including tires, gaskets, and seals, this apparatus is widely used in automotive, industrial, and medical sectors. The demand for this segment is also being driven by growing regulation, and consumer demands for product safety and uniformity.

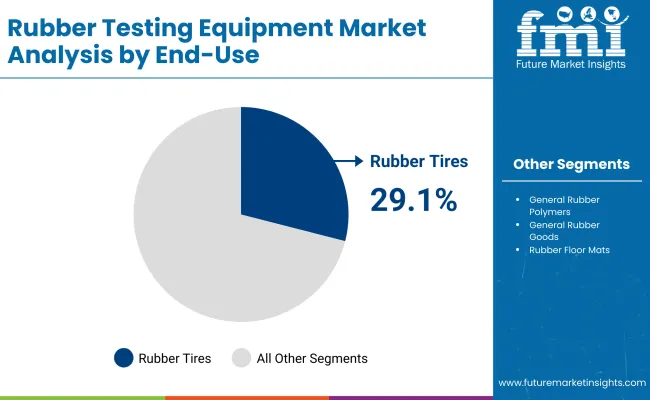

| End Use | Market Share (2025) |

|---|---|

| Rubber Tires Testing Equipment | 29.1% |

The end user segment in rubber tires testing equipment classifies the market into the following categories: rubber tires testing equipment (ETR, ESR, and ITR) and others. Tire manufacturers extensively use test apparatus for determining tensile strength, abrasion resistance, heat aging, elasticity, and dimensional stability to meet safety and performance specifications.

As the world auto industry is increasingly concerned about durability, on-road safety and fuel efficiency, tire testing is of supreme importance to product development and lifecycle assessment. As the popularity of EVs and sportier cars grow, the demand for rigorous tire testing and procedures using high-tech machinery continues to grow.

With greater need for quality assurance, R&D and conformity testing in the automotive, aerospace, industrial manufacturing, footwear and construction industries, and the rubber testing equipment market is gradually growing. They measure tensile strength, hardness, compression set, abrasion resistance, rheological behavior and dynamic mechanical properties of elastomeric compounds and rubber. Companies, on their part, also focusing on digital automation, strong multi-parameter testing as well as ASTM, ISO and DIN standard compliance.

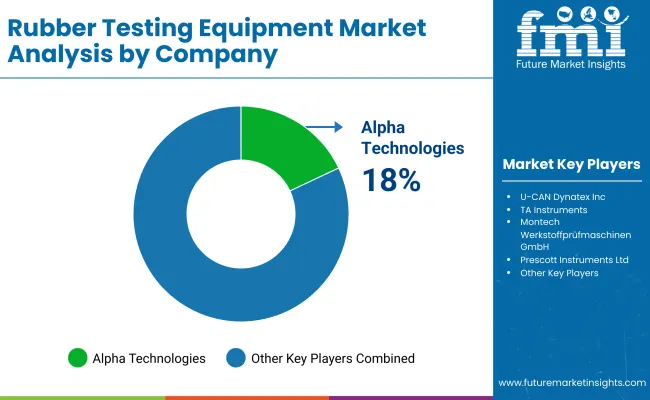

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Alpha Technologies (Ametek Inc.) | 18-22% |

| U-CAN Dynatex Inc. | 14-18% |

| TA Instruments (Waters Corporation) | 10-14% |

| Montech Werkstoffprüfmaschinen GmbH | 8-12% |

| Prescott Instruments Ltd. | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alpha Technologies | In 2024, launched Premier RPA Ultra rheometer with real-time automation and data analytics. In 2025, introduced AI-enabled rubber process analyzers with multi-point precision mapping. |

| U-CAN Dynatex Inc. | In 2024, expanded Mooney viscometer and tensile testers for vulcanization studies. In 2025, released integrated software platforms for lab automation and global data compliance. |

| TA Instruments | In 2024, upgraded DMA and TGA series with high-resolution thermal analysis for rubber polymers. In 2025, introduced modular rheology solutions tailored for elastomer R&D. |

| Montech GmbH | In 2024, unveiled fully automatic hardness and abrasion testers for inline quality control. In 2025, developed closed-loop, cloud-based lab management software for smart factories. |

| Prescott Instruments Ltd. | In 2024, introduced next-gen dynamic mechanical testers with touchscreen interface. In 2025, focused on comprehensive rubber compound testing systems for small and mid-sized labs. |

Key Company Insights

Alpha Technologies (18-22%)

Alpha Technologies leads globally in rubber rheology and viscoelastic analysis, offering high-performance instruments designed for process control, R&D, and regulatory compliance, supported by strong global service networks.

U-CAN Dynatex Inc. (14-18%)

U-CAN offers durable, cost-effective rubber testing machines widely used across Asia and emerging markets, with a focus on Mooney viscosity, tensile strength, and elongation monitoring.

TA Instruments (10-14%)

Part of Waters Corporation, TA Instruments delivers advanced thermal and mechanical analysis tools, suited for high-end elastomeric research, polymer behavior tracking, and compound development.

Montech GmbH (8-12%)

Montech specializes in automated rubber testing solutions with a strong emphasis on speed, data accuracy, and low operator dependence, ideal for high-throughput production labs.

Prescott Instruments Ltd. (6-9%)

Prescott focuses on flexible testing solutions for both production environments and academic institutions, with a growing footprint in Europe and the Middle East, and expertise in MDR, RPA, and DMA instruments.

Other Key Players (25-30% Combined)

The overall market size for the rubber testing equipment market was USD 15,686.3 Million in 2025

The rubber testing equipment market is expected to reach USD 21,081.0 Million in 2035.

Growth is driven by the increasing demand for high-performance rubber in automotive, aerospace, and industrial sectors.

The top 5 countries driving the development of the rubber testing equipment market are China, the USA, Germany, Japan, and India.

Tensile strength testers and rheometers are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Molding Market Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Rubber Anti-Tack Agents Market Size and Share Forecast Outlook 2025 to 2035

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber choppers Market

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Plastic-Rubber Composite Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Snap on Rubber Stopper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA