The sterile rubber stopper market is experiencing consistent growth driven by rising demand from the pharmaceutical and biotechnology sectors. Increasing production of injectable drugs, biologics, and vaccines has intensified the need for high-quality sealing components that maintain sterility and product integrity. Market expansion is being supported by strict regulatory standards governing packaging safety and material performance.

Manufacturers are investing in advanced molding technologies and contamination-free production environments to meet these evolving requirements. The market outlook remains positive as global healthcare systems continue to expand and the adoption of prefilled syringes and vials gains traction. Technological advancements in elastomer formulation and coating technologies are further enhancing chemical resistance and reducing interaction with drug formulations.

Growth rationale is centered on the role of sterile rubber stoppers in ensuring contamination prevention, maintaining shelf stability, and supporting the integrity of sensitive pharmaceutical products These drivers collectively reinforce long-term demand stability and position the market for steady expansion across therapeutic and industrial applications.

| Metric | Value |

|---|---|

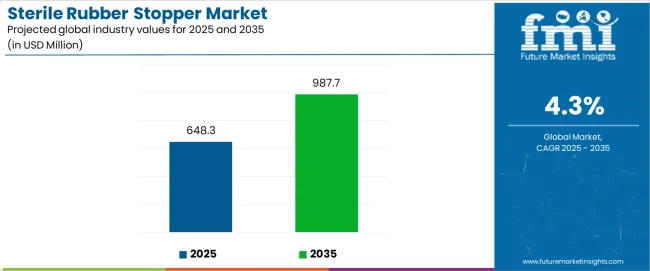

| Sterile Rubber Stopper Market Estimated Value in (2025 E) | USD 648.3 million |

| Sterile Rubber Stopper Market Forecast Value in (2035 F) | USD 987.7 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

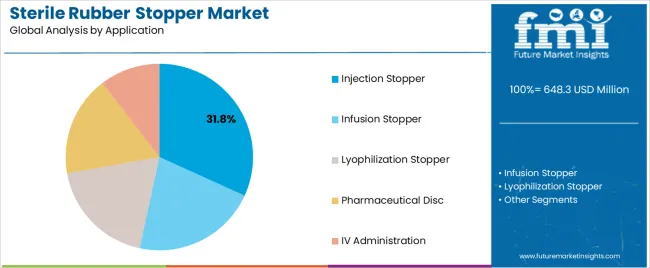

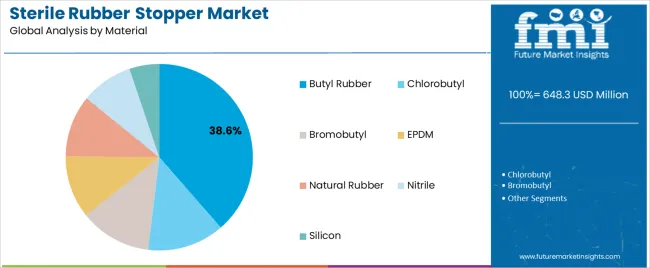

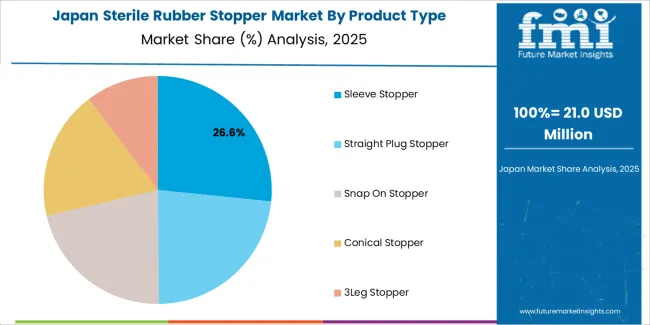

The market is segmented by Product Type, Application, Material, Coating, Sterilization Technology, Diameter Size, and End Use and region. By Product Type, the market is divided into Sleeve Stopper, Straight Plug Stopper, Snap On Stopper, Conical Stopper, and 3Leg Stopper. In terms of Application, the market is classified into Injection Stopper, Infusion Stopper, Lyophilization Stopper, Pharmaceutical Disc, and IV Administration. Based on Material, the market is segmented into Butyl Rubber, Chlorobutyl, Bromobutyl, EPDM, Natural Rubber, Nitrile, and Silicon. By Coating, the market is divided into Flurotech & Teflon Coating and B2 Coating. By Sterilization Technology, the market is segmented into Autoclavable and Gamma Irradiation. By Diameter Size, the market is segmented into 20mm, 13mm, 28mm, and 32mm. By End Use, the market is segmented into Pharmaceutical, Medical & Healthcare, Chemical, and Research & Development. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

sterile-rubber-stopper-market-analysis-by-product-type

The sleeve stopper segment, accounting for 27.40% of the product type category, has emerged as a leading type due to its superior sealing performance and suitability for multi-dose vials and liquid formulations. Its widespread use in pharmaceutical packaging has been supported by enhanced design precision and compatibility with automated filling systems.

Demand growth has been driven by the rise in biologics and vaccines requiring reliable containment solutions. The segment benefits from advancements in elastomer processing and sterilization techniques that ensure consistent performance under stringent storage conditions.

Adoption is being reinforced by regulatory compliance and the need for cost-efficient, high-barrier stoppers that minimize contamination risks Continuous innovation in sleeve stopper geometry and surface treatment is expected to sustain its market share and strengthen its application in critical drug packaging systems.

The injection stopper segment, holding 31.80% of the application category, dominates due to its vital role in maintaining sterility and ensuring safe drug administration. It is preferred in high-volume injectable formulations and prefilled syringes, where leak prevention and compatibility are essential.

Growth has been supported by increased production of vaccines and parenteral drugs, coupled with higher adoption in hospital and clinical settings. Manufacturing improvements in rubber compounding and sterilization processes have enhanced dimensional stability and chemical inertness.

Consistent demand from pharmaceutical companies and contract manufacturers has stabilized supply chains and encouraged further capacity expansion The segment’s leadership is expected to continue as the shift toward injectable therapies grows and packaging requirements for biologics become more demanding.

The butyl rubber segment, representing 38.60% of the material category, has maintained dominance due to its excellent gas impermeability, flexibility, and chemical resistance. Its use ensures effective preservation of drug potency and prevents contamination from external elements.

The material’s performance under a wide temperature range makes it ideal for both liquid and lyophilized drug applications. Manufacturers prefer butyl rubber for its proven compatibility with a wide range of pharmaceutical formulations and sterilization methods.

The segment’s strong position is supported by continuous improvements in synthetic butyl formulations that enhance purity and reduce extractables With the growing emphasis on high-performance, low-reactivity closure systems, butyl rubber is expected to remain the preferred choice, reinforcing its market leadership and contributing significantly to long-term industry growth.

Sterile Rubber Stoppers Revolutionize Industry Safety! Sterile rubber stoppers have become indispensable across diverse sectors such as pharmaceuticals, medicine, and chemicals.

Governments Tighten Grip with Pharma Sterilization Rules! Governments and regulatory bodies, including the International Organization for Standardization and the Food and Drug Administration, are implementing stringent sterilization protocols to safeguard the delivery of pharmaceuticals.

Advanced Sterilization Drives Safety in Rubber Stopper Manufacturing! The implementation of new sterilization protocols is poised to fuel growth in the sterile rubber stopper industry.

Fluctuating raw material prices and more options for closures are making it tough for the market to grow. Additionally, strict regulations against using Teflon coatings on sterile rubber stoppers, because of their environmental impact, are expected to slow down sales.

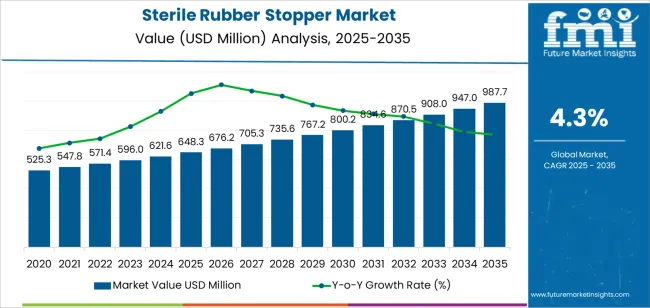

From 2020 to 2025, the sterile rubber stopper market showed steady growth, boasting a 5.2% CAGR. During this period, the market faced various challenges, including supply chain disruptions, increasing raw material costs, and stringent regulatory requirements. Additionally, competition intensified with the entry of new players and advancements in alternative packaging technologies.

Despite these obstacles, the market continued to expand due to rising demand from the pharmaceutical and healthcare industries for reliable and contamination-free packaging solutions. This trend has contributed to the positive outlook of the Sterile Rubber Stopper industry.

| Attributes | Quantitative Outlook |

|---|---|

| Sterile Rubber Stopper Market Size (2025) | USD 591.5 million |

| Historical CAGR (2020 to 2025) | 5.2% |

Short-term Sterile Rubber Stopper Market Analysis

The sterile rubber stopper market global forecast suggests considerable growth owing to the increasing demand for sterile packaging solutions in the healthcare industry.

As advancements in medical technologies continue to rise, the need for reliable and aseptic packaging of pharmaceuticals and medical devices becomes paramount. The market is poised to capitalize on this trend, offering a crucial component in ensuring the integrity and safety of medical products.

Long-term Sterile Rubber Stopper Market Analysis

Global trends in the sterile rubber stopper industry spotlight a dynamic landscape. One notable trend is the increasing demand for specialized medical vial stoppers tailored to specific drug formulations and delivery systems. This trend shows that pharmaceutical companies want packaging that fits their drugs perfectly.

They need it to work well and be safe for patients. Also, new manufacturing technologies like automation and precision molding are making rubber stopper production faster and better. This is expected to have a highly positive impact on the global demand for sterile rubber stoppers in the long run.

Sterile rubber stopper makers are in a good spot as the demand for cleaner packaging is booming. They can benefit from the rise of pharmaceutical and biotech industries. The push for better quality and safety in delivering drugs creates opportunities for using new technologies and materials.

Manufacturers can adapt to changing industry needs. Also, as more people care about the environment, there is a chance for a market for eco-friendly rubber stoppers. This lets manufacturers support environmental concerns and meet the needs of conscious customers.

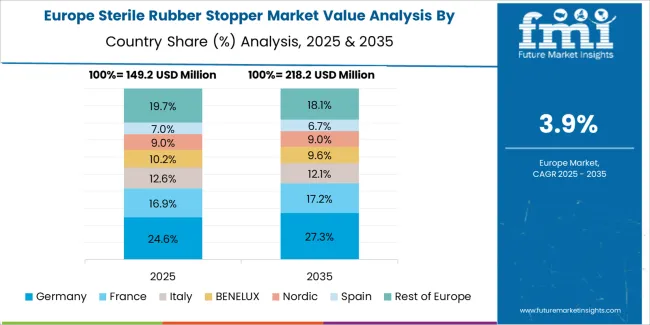

The North America sterile rubber stopper market is expected to grow well. This is because of the increasing demand for pharmaceutical products. Europe is witnessing continuous and steady growth in demand for sterile rubber stoppers. This is due to the growing emphasis on healthcare quality and safety

The Asia Pacific sterile rubber stopper industry is likely to make big progress. One reason is the region's growing pharmaceutical sector. Also, increasing healthcare investments contribute to this growth.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

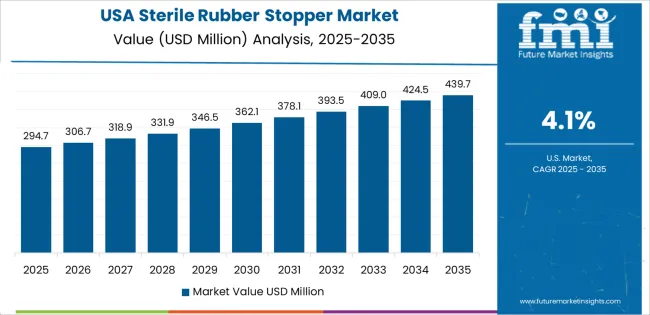

| United States | 3.5% |

| Germany | 3.1% |

| Japan | 4.5% |

| China | 5.1% |

| India | 5.9% |

Demand for sterile rubber stoppers in the United States is set to rise with an anticipated CAGR of 3.5% through 2035. Key factors influencing the sterile rubber stopper market include:

The market in Germany is likely to exhibit a CAGR of 3.1% through 2035. Reasons supporting the growth of the sterile rubber stopper market in the country include:

The Japan sterile rubber stopper market is expected to surge at a CAGR of 4.5% through 2035. The topmost dynamic forces supporting the sterile rubber stopper adoption in the country include:

The adoption of sterile rubber stoppers in China is forecasted to inflate at a CAGR of 5.1% through 2035. Prominent factors backing up the pharmaceutical rubber stopper market growth are:

Sales of sterile rubber stoppers in India are estimated to record a CAGR of 5.9% through 2035. The primary factors bolstering the sterile rubber stopper market size are:

As far as the material of sterile rubber stopper is concerned, the silicone segment is likely to generate significant profit in 2025, holding 32.1% sterile rubber stopper market share. Similarly, the IV administration segment is expected to perform better in terms of application, possessing a 37.3% revenue share of the sterile rubber stopper industry in 2025.

| Segment | Estimated Market Share in 2025 |

|---|---|

| Silicone | 32.1% |

| IV Administration | 37.3% |

The silicone segment is poised to become the primary revenue generator within the market. Several key factors contribute to the growing acceptance of silicone, including:

The chief position in the market is held by the IV administration segment, a trend substantiated by factors such as:

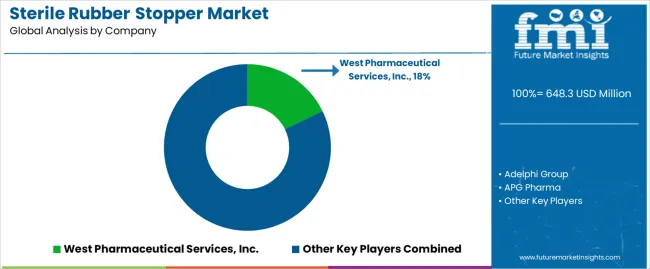

Sterile rubber stopper market players employ diverse strategies to gain a competitive edge. Some focus on technological innovation, introducing advanced materials and manufacturing processes.

Others prioritize cost leadership, optimizing production efficiency to offer competitive pricing. Customer-centric approaches emphasize tailored solutions and responsive customer service. Market entrants often carve niches by specializing in specific applications.

Key Players and their Top Developments

Adelphi Group: Adelphi Group manufactures big batches of sterile rubber stoppers. They have various types, like the West FluroTec injection stoppers. These are good to go and certified sterile and endotoxin-free. Adelphi's stoppers are crafted from bromobutyl latex-free rubber and are suitable for sterilization as per VIA1130 standards.

APG Pharma: APG Pharma serves as a B2B partner offering various sterile rubber stoppers for pharmaceutical use. It provides a wide selection of rubber stoppers, all meeting high-quality standards and manufactured under secure and certified processes following guidelines. Within their standard range, one can find common models for injection vials, infusion vials, and freeze-drying stoppers. These products come in 'ready to sterilize' or 'ready to use' options, ensuring top quality.

West Pharmaceutical Services (WPS): West Pharmaceutical Services provides different rubber stoppers for pharmaceutical vials. These stoppers play a crucial role in shielding drugs from the environment, ensuring their quality and safety. An example is the 4040 LyoTec® ready-to-sterilize stoppers, offering a secure closure for lyophilized drug products. These stoppers have an igloo design to stay stable on the vial when vented.

The global sterile rubber stopper market is estimated to be valued at USD 648.3 million in 2025.

The market size for the sterile rubber stopper market is projected to reach USD 987.7 million by 2035.

The sterile rubber stopper market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in sterile rubber stopper market are sleeve stopper, straight plug stopper, snap on stopper, conical stopper and 3leg stopper.

In terms of application, injection stopper segment to command 31.8% share in the sterile rubber stopper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sterile and Antiviral Packaging Market Forecast and Outlook 2025 to 2035

Sterile Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sterile Tubing Welders Market Size and Share Forecast Outlook 2025 to 2035

Sterile Dosage Form Market Size and Share Forecast Outlook 2025 to 2035

Sterile Prep-Pack Workstations Market Size and Share Forecast Outlook 2025 to 2035

Sterile Barrier Packaging Market Growth - Demand & Forecast 2025 to 2035

Analyzing Sterile Packaging Market Share & Industry Leaders

Global Sterile Injectable CDMO Market Analysis – Size, Share & Forecast 2024-2034

Sterile Wraps Market

Sterile Medical Packaging Market

Sterile IV Containers Market

Sterile Container Market

Sterile Lids Market

Sterile Oncology Injectable Market

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Mobile Sterile Units Market Analysis – Growth, Applications & Outlook 2025–2035

UK Mobile Sterile Units Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Mobile Sterile Units Market Analysis – Size & Industry Trends 2025-2035

Depyrogenated Sterile Empty Vials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA