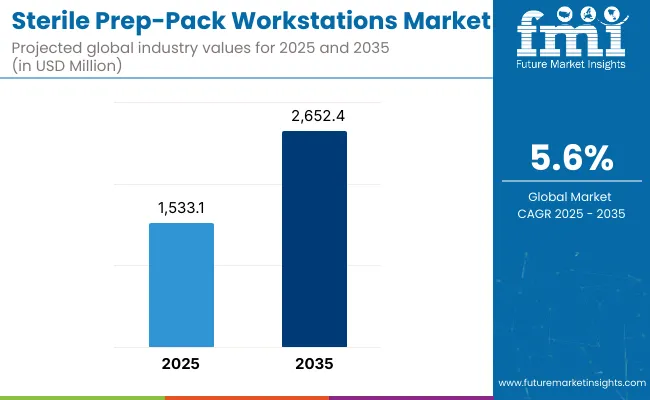

The sterile pre-pack workstations market is expected to grow to a valuation of USD 1,533.1 million in 2025. By 2035, demand is anticipated to grow to USD 2,652.4 million, at a CAGR of 5.6% during the forecast period.

| Metric | Value |

|---|---|

| Sterile Prep Pack Workstations Estimated Value in (2025) | USD 1,533.1 million |

| Sterile Prep Pack Workstations Estimated Value in (2035) | USD 2,652.4 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Compounding Aseptic Isolators (CAIs) segment will rise to 24.5% by 2030, while Automated Sterile Prep-Pack Stations will remain niche at under 15% share. The second half from 2030 to 2035 contributes USD 635.9 million which is equal to 56.8% of the total growth as the market jumps from USD 2016.5 million to USD 2652.4 million.

This acceleration is powered by widespread adoption of these devices in end user settings. Laminar Flow Workstations and Compounding Aseptic Isolators (CAIs) together capture a large share of above 54.5% by the end of the decade. Biological Safety Cabinets (BSCs) is likely to hold around 23.0% surpassing traditional ergonomic tables.

From 2020 to 2024, the overall Sterile Prep‑Pack Workstation grew from USD 1212.7 million to USD 1449.0 million. Leading manufacturers such as Getinge, Steris and Skytron, LLC together account for nearly 52.5% of global revenue through bundled instruments and ergonomic workstation sales. Key strategies deployed by these players include advances in ergonomics, integration of modular storage packagesand partnerships with sterile processing departments to pilot new workflows.

In 2025, the Sterile Prep-Pack Workstations market is expected to reach a value of approximately USD 1533.1 million, driven by a shift from basic ergonomic worktables to digitally integrated sterile workspace ecosystems. Growth will be propelled by hospital investments in workflow optimization, infection prevention, and compliance with USP <797> and <800> standards. Sterile processing departments (SPDs) are increasingly adopting modular and height-adjustable systems equipped with task lighting, instrument tracking modules, and HEPA-filtered airflow controls to improve staff productivity and reduce contamination risks.

Sterile Prep‑Pack Workstations are seeing strong growth because healthcare facilities worldwide face mounting pressure to reduce surgical site infections, improve process efficiency, and support staff ergonomics. Major drivers include stricter sterilization compliance and infection control regulations, increasing surgical volumes, and labor shortage in sterile processing departments.

Innovations such as height‑adjustable stainless‑steel workstations with integrated storage, along with sensor‑based workflow monitoring, reduce assembly time and human errorand generate measurable ROI for hospitals. The pandemic amplified demand for reliable sterile workflows, accelerating adoption of high‑performance prep‑pack stations.

As hospital budgets prioritize operator safety and throughput, manufacturers who deliver hygienic surfaces, efficient layouts, and traceability modules are achieving robust sales. In countries with expanding healthcare infrastructureparticularly in North America and Asia Pacific, these new facilities and upgrades is further boosting demand.

The market is segmented by product, application, end-user, and region. Product include Laminar Flow Workstations, Compounding Aseptic Isolators (CAIs), Biological Safety Cabinets (BSCs), Automated Sterile Prep-Pack Stations and Modular Cleanroom Workstations highlighting the core elements driving adoption.

Application classification covers Hospital Sterile Compounding, Pharmaceutical Manufacturing, Clinical Trial Packaging, Biotech & Research Aseptic Use, Veterinary and Specialty Use and Others. Based on End User, the segmentation includes Hospitals, Compounding Pharmacies (503A/503B), Biopharmaceutical Manufacturing, Research Institutes & CROs, Veterinary Clinics & Labs. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

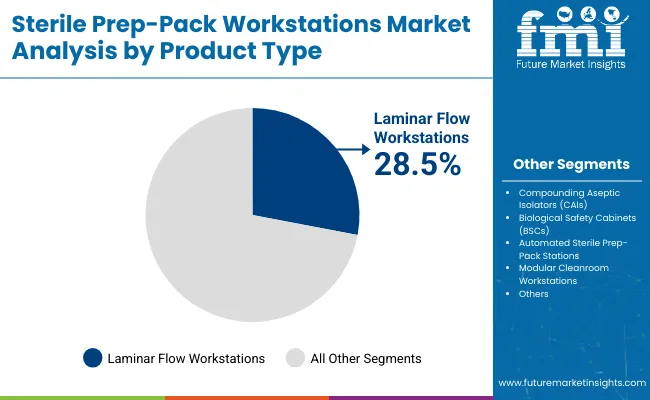

Laminar flow workstations are expected to retain a dominant position and is expected to contribute 28.5% in 2025 owing to their ability to ensure ISO-classified clean air environments. Their adoption has been driven by the rising global emphasis on contamination control and aseptic workflows in sterile processing departments.

Preference has been increasingly shown for these units due to their ability to direct airflow uniformly, minimizing particulate spread during packaging and labeling. Product installations have also been incentivized by regulatory agencies recommending controlled environments for surgical instrument prep and packaging. These factors have collectively contributed to the sustained demand for laminar flow models over conventional worktables in high-throughput hospital and central sterile supply settings.

| Product | Market Share (%) |

|---|---|

| Laminar Flow Workstations | 28.5% |

| Compounding Aseptic Isolators (CAIs) | 24.0% |

| Biological Safety Cabinets (BSCs) | 22.5% |

| Automated Sterile Prep-Pack Stations | 15.0% |

| Modular Cleanroom Workstations | 10.0% |

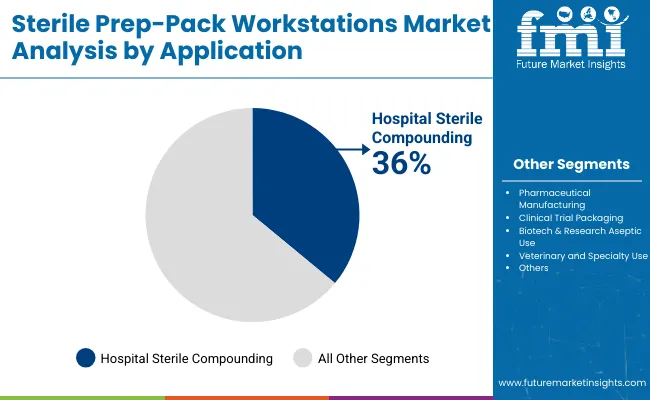

Hospital sterile compounding has emerged as the leading application area and is projected to hold around 36.0% in 2025 due to increased regulatory oversight and the rising complexity of parenteral drug preparations. Regulatory bodies such as USP and FDA have mandated stricter environmental controls and quality assurance in compounding spaces.

As a result, sterile prep-pack workstations tailored for compounding tasks especially in chemotherapy, TPN, and IV admixture preparations have been more widely installed. Additionally, the growth in personalized medicine and biologics has increased the volume of high-risk compounded medications, necessitating dedicated sterile workspaces that comply with cleanroom-grade standards.

| Application | Market Share (%) |

|---|---|

| Hospital Sterile Compounding | 36.0% |

| Pharmaceutical Manufacturing | 30.0% |

| Clinical Trial Packaging | 10.0% |

| Biotech & Research Aseptic Use | 12.0% |

| Veterinary and Specialty Use | 7.0% |

| Others | 5.0% |

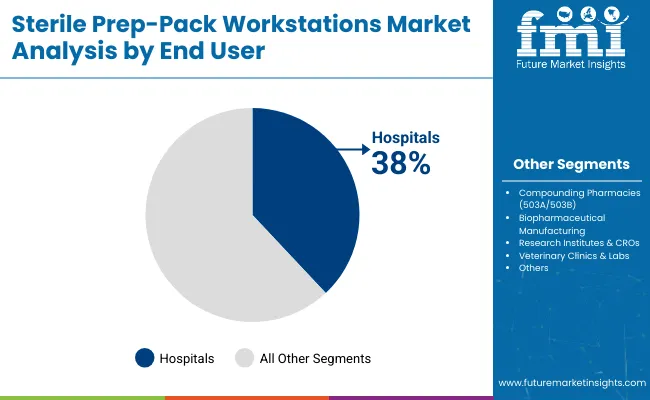

Hospitals are expected to remain the largest end user segment contributing around 38.0% in 2025 due to their need for streamlined, scalable, and regulation-compliant sterile processing units. Most of the surgical interventions and high-risk medical procedures are performed in hospital settings, necessitating advanced sterile packaging infrastructure. Demand has been reinforced by mandates for infection control and standardized reprocessing workflows.

Investments in hospital infrastructure modernization, especially in surgical departments and CSSDs (Central Sterile Supply Departments) have resulted in widespread adoption of high-efficiency, modular prep-pack workstations. Procurement has also been influenced by favorable health policy frameworks supporting capital equipment upgrades and operational efficiency in large tertiary and academic hospitals.

| End User | Market Share (%) |

|---|---|

| Hospitals | 38.0% |

| Compounding Pharmacies (503A/503B) | 26.0% |

| Biopharmaceutical Manufacturing | 20.0% |

| Research Institutes & CROs | 10.0% |

| Veterinary Clinics & Labs | 6.0% |

Growing surgical volumes and increased audits are reinforcing demand. However, high capital costs, infrastructure dependencies, and retrofitting challenges hinder adoption, especially in budget-constrained or rural facilities. A key trend is the integration of these workstations into modular CSSD infrastructures, with vendors offering them as part of end-to-end sterile reprocessing solutions. Customizable designs for lean layouts and sterile zone separation are shaping procurement strategies in hospital modernization and sterile processing upgrades.

Regulatory Push for Sterile Workflow Standardization

The most significant growth driver in the Sterile Prep-Pack Workstations market is the tightening of regulatory compliance standards, particularly USP <797> and <800>, which mandate stringent environmental controls and ergonomic conditions for sterile compounding and reprocessing. Hospitals and ambulatory surgical centers are compelled to invest in cleanroom-compatible prep-pack tables with built-in HEPA filtration, stainless-steel surfaces and ergonomic adjustability.

Accreditation bodies such as The Joint Commission have intensified audits of sterile processing departments (SPDs), further encouraging adoption. As surgical case volumes increase, the need for repeatable, contamination-free instrument handling workflows is reinforcing procurement of advanced workstations.

High Capital Cost and Infrastructure Dependencies

Despite increasing awareness, the high capital expenditure associated with advanced sterile prep-pack systems, especially laminar flow-integrated or smart sensor-equipped units continues to be a major barrier. Facilities with limited budgets, particularly in mid-tier or rural healthcare settings, often delay upgrades due to infrastructure limitations, such as HVAC compatibility and cleanroom zoning. Retrofitting existing SPDs to meet new standards adds to implementation hurdles.

Convergence of Sterile Prep-Pack Workstations with Modular CSSD Infrastructure

An alternative but rapidly accelerating trend is the integration of sterile prep-pack workstations into modular Central Sterile Supply Department (CSSD) design frameworks. Rather than sourcing prep-pack tables as standalone units, large hospitals and health systems are now bundling them as part of comprehensive CSSD modernization projects.

Vendors like STERIS and Belimed are aligning their workstation offerings with end-to-end sterile reprocessing solutions, which include automated washers, pass-through sterilizers, and digital workflow software. This convergence is driving procurement decisions based on system-level interoperability, not just workstation features.

Additionally, modular CSSDs designed for lean layouts and zone separation require customizable prep-pack workstations. As new hospitals facilities undergo sterile zone retrofits, prep-pack workstations are being co-designed alongside HVAC, lighting, and sterile storage systems positioning them as strategic components within a broader sterile processing ecosystem.

| Country | CAGR |

|---|---|

| USA | 4.2% |

| Brazil | 6.3% |

| China | 7.5% |

| India | 7.8% |

| Europe | 5.1% |

| Germany | 4.8% |

| France | 5.0% |

| UK. | 5.4% |

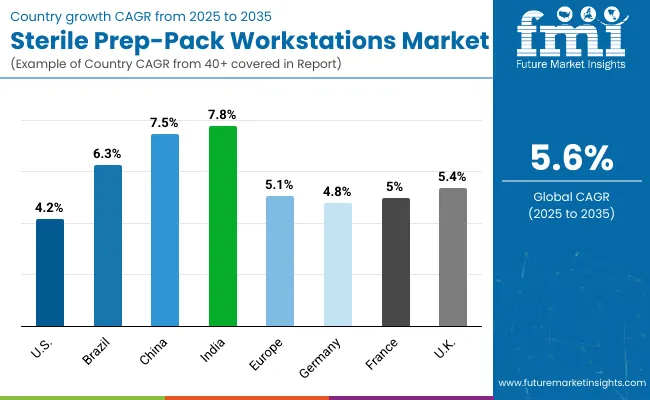

Asia Pacific is emerging as the fastest-growing region in the Sterile Prep-Pack Workstations market, projected to grow at a CAGR of 7.2% between 2025 and 2030. Among its key markets, India is forecast to expand at a CAGR of 7.8%, driven by the aggressive expansion of tertiary hospitals and increased adherence to NABH-accredited CSSD protocols.

Simultaneously, China is projected to grow at 7.5% CAGR, supported by large-scale investments in surgical infrastructure, rising procedural volumes, and public sector procurement of advanced sterilization technologies.

The region’s dominance stems from a surge in healthcare infrastructure development across Tier 1 and Tier 2 cities, as well as regulatory shifts emphasizing infection control post-COVID. Furthermore, government-funded hospital modernization programsespecially in India and Southeast Asiaare prioritizing compliant sterile processing departments (SPDs), where sterile prep-pack workstations are a core capital component.

Europe is expected to grow steadily at 5.1% CAGR through 2035. Germany is projected to grow at 4.8% CAGR, benefiting from automation initiatives in SPD layouts. France is estimated at 5.0% CAGR, backed by public hospital investments under the “Ségur de la santé” reform.

The UK. will see growth of 5.4% CAGR, largely driven by NHS modernization projects targeting surgical site infection (SSI) reduction. The European market is supported by harmonized infection control standards, continuous staff training programs, and a growing shift from manual to ergonomic and compliant sterile reprocessing stations.

North America remains a mature but innovation-led market, with the USA projected to grow at a CAGR of 4.2% between 2025 to 2035. Growth in the USA is driven by the replacement of legacy sterile workstations with smart, modular systems aligned with USP <800> compliance.

The rising demand for closed-loop sterilization documentation, coupled with increasing surgical volume in outpatient and ASC settings, is fueling adoption. Additionally, federal funding for hospital infrastructure upgrades and the focus on staff safety in sterile reprocessing environments are accelerating investment in prep-pack workstation modernization.

The sterile prep-pack workstation market in the USA is forecasted to grow at a 4.2% CAGR, primarily driven by increasing federal and state mandates for compliance with USP <797>/<800> regulations in sterile compounding and instrument reprocessing workflows.

Hospitals and ambulatory surgical centers (ASCs) are upgrading legacy prep stations with HEPA-filtered, laminar flow units equipped with digital traceability systems, enabling real-time logging and audit readiness. Demand is being further fueled by SPD capacity constraints and initiatives to optimize throughput and reduce hospital-acquired infections-a trend underscored in USA-specific data on sterilization service expansions.

The Sterile Prep-Pack Workstation market in the United Kingdom is projected to grow at a CAGR of 5.4% through 2035, supported by NHS England’s ongoing investment in infection control and surgical infrastructure upgrades. The “New Hospital Programme” and increased funding under Health Infrastructure Plans (HIPs) are catalyzing the modernization of sterile reprocessing zones.

Adoption is also being driven by the rising volume of elective surgical procedures and pressure to reduce surgical site infections (SSIs). Trusts are prioritizing procurement of prep-pack tables that offer space optimization, built-in task lighting, and manual handling safety features. There is a clear shift toward modular sterile zones in new-build hospitals, where prep-pack units are designed into the CSSD blueprint from the outset.

The Sterile Prep-Pack Workstation market in Germany is forecast to grow at a CAGR of 4.8%, led by increased automation in hospital sterile supply workflows. Under Germany’s Krankenhauszukunftsgesetz (Hospital Future Act), federal funding has been allocated for digital and physical upgrades, including CSSDs.

German hospitals are known for high procedural volume and stringent hygiene protocols, which are accelerating the transition from static stainless-steel tables to height-adjustable, laminar flow-integrated prep stations with real-time monitoring. Additionally, Germany’s labor laws emphasize ergonomic safety standards, prompting demand for prep stations with reduced physical strain on sterile processing staff.

| Europe Country | 2025 |

|---|---|

| Germany | 22.50% |

| UK | 18.20% |

| France | 16.70% |

| Italy | 10.40% |

| Spain | 9.50% |

| Benelux | 7.10% |

| Nordics | 8.40% |

| Rest of Europe | 7.20% |

| Europe Country | 2035 |

|---|---|

| Germany | 20.70% |

| UK | 19.10% |

| France | 17.20% |

| Italy | 9.10% |

| Spain | 10.90% |

| Benelux | 8.20% |

| Nordics | 9.20% |

| Rest of Europe | 5.60% |

The Sterile Prep-Pack Workstation market in India is expected to grow at a CAGR of 7.8%, making it one of the fastest-growing markets globally. Growth is fueled by massive expansion in tertiary hospitals, medical colleges, and private surgical centers across Tier 1 and Tier 2 cities. Rising incidence of hospital-acquired infections (HAIs), along with NABH accreditation standards, has led to increased adoption of sterile prep infrastructure in newly built hospitals.

Indian hospital groups are increasingly integrating modular CSSDs, with sterile prep-pack tables positioned as critical components. Additionally, local OEMs and international suppliers are offering cost-effective, customizable solutions suited for Indian layouts and budgets.

The Sterile Prep-Pack Workstation market in China is projected to grow at a CAGR of 7.5% through 2035, supported by aggressive hospital infrastructure investments under the Healthy China 2030 policy. China's Ministry of Health has issued stricter regulations for surgical instrument sterilization, accelerating deployment of laminar airflow prep systems and digitally tracked sterile workspaces in Class A hospitals.

Urban hospitals are moving toward fully modular CSSDs, while district hospitals are adopting prep-pack stations that support high-throughput, multi-shift operations. Domestic medical equipment manufacturers are scaling production to meet surging demand and are increasingly integrating workflow management software into prep environments.

The Sterile Prep-Pack Workstations market in Japan is projected to reach USD 125.5 million in 2025, with Laminar Flow Workstations accounting for 22.0% of installations, reflecting Japan’s dual focus on precision and worker safety. The near-equal distribution stems from Japan’s high labor standards and compliance with JSHP (Japan Society of Healthcare Policy) sterilization protocols, where ergonomic efficiency is prioritized alongside airflow controls in hospital CSSDs.

Japan’s push for automation in hospital infrastructure, especially under aging workforce scenarios, is a major driver. The Ministry of Health, Labour and Welfare has also mandated infection control upgrades in long-term care hospitals and surgical centers, reinforcing demand for traceable, customizable prep-pack stations. Additionally, local manufacturers are enhancing domestic supply chains by offering integrated workstation modules for smart sterile zones.

The Sterile Prep-Pack Workstations market in South Korea is estimated at USD 57.3 million in 2025, with Sterile Drug Compounding accounting for the largest revenue share at 30.0%. This dominance is driven by government-enforced upgrades under MOHW (Ministry of Health and Welfare) mandates that require enhanced contamination control during sterile preparations in both public and private hospitals. Hospitals are investing in HEPA-filtered, ISO-classified prep zones to comply with standards outlined in the Korean Pharmacopoeia.

Chemotherapy Drug Preparation follows with 22.0%, supported by Korea’s nationwide cancer care programs and centralized oncology compounding centers. These facilities are deploying closed-system workstations to ensure operator safety during cytotoxic drug handling.

The Sterile Prep-Pack Workstations market is moderately fragmented, with global leaders, established mid-sized firms, and emerging players competing across sterile reprocessing and pharmacy compounding applications. Industry leaders such as Getinge AB and STERIS plc hold substantial market share, driven by their end-to-end sterile processing ecosystems.

These companies are expanding through strategic acquisitions (e.g., Healthmark by Getinge, and surgical container systems by STERIS) and offer bundled solutions that integrate prep-pack workstations with T-DOC traceability software, HEPA-filtered airflow controls, and modular CSSD infrastructure. Their strategies increasingly focus on infection control compliance, ergonomic safety, and full-suite integration with sterilization and reprocessing workflows.

Established mid-sized manufacturers like Belimed Inc. (Steelco S.p.A), Skytron LLC, and MAC Medical Inc. cater to facilities seeking scalable and modular workstation setups. These players are innovating through digital planning tools, ergonomic customization, and enhanced storage solutions, making them highly relevant for hospitals undergoing phased sterile department upgrades.

Emerging players such as Pure Processing LLC, Coulmed Products, BOSTONtec, and Reos Medical focus on niche applications like outpatient centers, compact CSSDs, and education-focused sterile setups. Their strength lies in product customization, competitive pricing, and value-added services such as technician training, workflow optimization, and mobile configurations.

As the market matures, competitive differentiation is shifting from basic stainless-steel fabrication toward modular connectivity, IoT-enabled workflow tracking, and integration with sterilization analytics platforms.

Key Developments:

| Item | Value |

|---|---|

| Quantitative Units | USD 1533.1 million |

| Product type | Laminar Flow Workstations, Compounding Aseptic Isolators (CAIs), Biological Safety Cabinets (BSCs), Automated Sterile Prep-Pack Stations, Modular Cleanroom Workstations |

| Application | Hospital Sterile Compounding , Pharmaceutical Manufacturing, Clinical Trial Packaging, Biotech & Research Aseptic Use, Veterinary and Specialty Use and Others |

| End User | Hospitals, Compounding Pharmacies (503A/503B), Biopharmaceutical Manufacturing, Research Institutes & CROs and Veterinary Clinics & Labs |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK. etc. |

| Key Companies Profiled | Getinge AB, STERIS, Skytron , LLC, MAC MEDICAL INC, Coulmed Products, Belimed INC. (Steelco S.p.A), Pure Processing LLC, BOSTONtec and Reos Medical |

| Additional Attributes | Dollar sales by application and regions, adoption trends of Automated Sterile Prep-Pack Stations, Rising demand in Biotech & Research Aseptic Use, Growing demand across Compounding Pharmacies and Biopharmaceutical Manufacturing |

The global Sterile Pre-Pack Workstation market is estimated to be valued at USD 1533.1 billion in 2025.

The market size for Sterile Pre-Pack Workstation is projected to reach USD 2652.4 billion by 2035.

The Sterile Pre-Pack Workstation market is expected to grow at a CAGR of 5.6% during this period.

Key product types include Laminar Flow Workstations, Compounding Aseptic Isolators (CAIs), Biological Safety Cabinets (BSCs), Automated Sterile Prep-Pack Stations and Modular Cleanroom Workstations.

The Hospital Sterile Compounding segment is projected to command 36.0% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sterile Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Sterile and Antiviral Packaging Market Forecast and Outlook 2025 to 2035

Sterile Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sterile Tubing Welders Market Size and Share Forecast Outlook 2025 to 2035

Sterile Dosage Form Market Size and Share Forecast Outlook 2025 to 2035

Sterile Barrier Packaging Market Growth - Demand & Forecast 2025 to 2035

Analyzing Sterile Packaging Market Share & Industry Leaders

Global Sterile Injectable CDMO Market Analysis – Size, Share & Forecast 2024-2034

Sterile Medical Packaging Market

Sterile Wraps Market

Sterile IV Containers Market

Sterile Container Market

Sterile Lids Market

Sterile Oncology Injectable Market

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Mobile Sterile Units Market Analysis – Growth, Applications & Outlook 2025–2035

UK Mobile Sterile Units Market Growth – Innovations, Trends & Forecast 2025-2035

Demand for Sterile Water Treatment System in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA