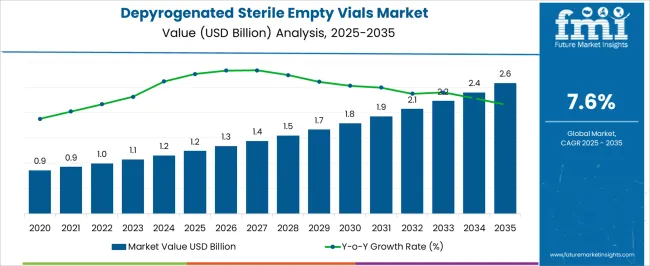

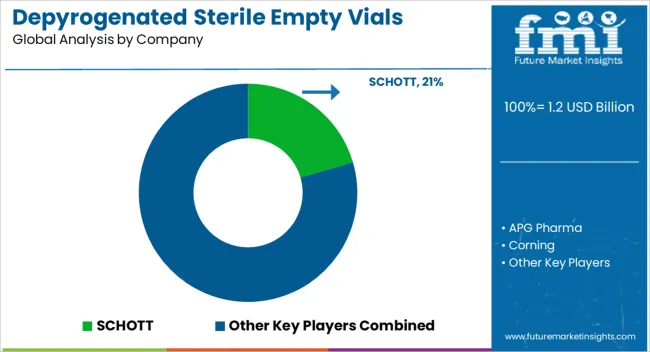

The depyrogenated sterile empty vials market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

Between 2025 and 2030, the market will rise from USD 1.2 billion to approximately USD 1.7 billion, reflecting a steady upward trend. This phase of growth is driven by rising demand from the pharmaceutical and biotech industries, where sterile vials play a critical role in drug storage and vaccine delivery. The emphasis on aseptic packaging and prevention of endotoxin contamination has strengthened reliance on depyrogenated vials, particularly in injectable formulations. The consistent year-on-year increase indicates a robust adoption curve, supported by expanding biologics pipelines and contract manufacturing services. From 2030 to 2035, the market is forecast to grow further from USD 1.7 billion to USD 2.6 billion, sustaining its smooth upward trajectory.

This period will be shaped by greater utilization of sterile vials in advanced therapies, including cell and gene treatments, where precision and sterility remain non-negotiable. The rise in large-scale vaccine programs and injectable biologics will continue to fuel demand, with manufacturers investing in enhanced depyrogenation processes and higher-capacity sterile packaging lines. The growth pattern highlights an industry that is not only expanding but also maturing, as regulatory requirements and quality standards tighten across global markets. This trajectory signals strong long-term opportunities for suppliers, particularly those offering scalability, quality assurance, and integration with advanced pharmaceutical packaging systems.

| Metric | Value |

|---|---|

| Depyrogenated Sterile Empty Vials Market Estimated Value in (2025 E) | USD 1.2 billion |

| Depyrogenated Sterile Empty Vials Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The depyrogenated sterile empty vials market holds a specialized but essential share across several broader healthcare and packaging markets, with its contribution reflecting the growing importance of sterile and contamination-free packaging. Within the pharmaceutical packaging market, depyrogenated vials represent about 6%, as they serve a focused role compared to blister packs, bottles, and flexible formats. In the sterile packaging market, their share is higher at nearly 12%, since these vials are integral in applications requiring endotoxin-free conditions for parenteral drugs. Within the injectable drug delivery market, depyrogenated sterile empty vials account for close to 10%, given their widespread use in lyophilized drugs, vaccines, and biologics requiring aseptic containment. In the biologics and vaccines packaging market, the share rises to around 14%, underscoring their importance in safeguarding high-value biologics where sterility is critical for product efficacy and regulatory compliance.

Finally, in the laboratory and diagnostic packaging market, depyrogenated vials contribute about 8%, supporting reagent storage and diagnostic sample handling where endotoxin-free conditions are mandatory. Collectively, these percentages show that depyrogenated sterile empty vials are particularly strong in vaccine and biologics applications, while maintaining steady but smaller shares in broader pharmaceutical and diagnostic packaging. Their role as a sterile containment solution positions them as an indispensable element within the healthcare packaging ecosystem, balancing niche relevance in general packaging with central importance in advanced drug and biologic delivery.

The depyrogenated sterile empty vials market is witnessing robust demand driven by increasing pharmaceutical R&D, stricter sterility standards, and growth in injectable drug formulations. Regulatory mandates for endotoxin-free packaging, particularly in parenteral drug delivery, have pushed manufacturers to adopt advanced depyrogenation techniques and controlled filling environments.

Rising biologics production and expansion in contract manufacturing also contribute to higher consumption of sterile vials. Furthermore, technological improvements in vial surface treatment and integrity testing have expanded the application scope of depyrogenated vials.

As pharma pipelines diversify and injectable therapies rise, the market is expected to maintain upward momentum globally.

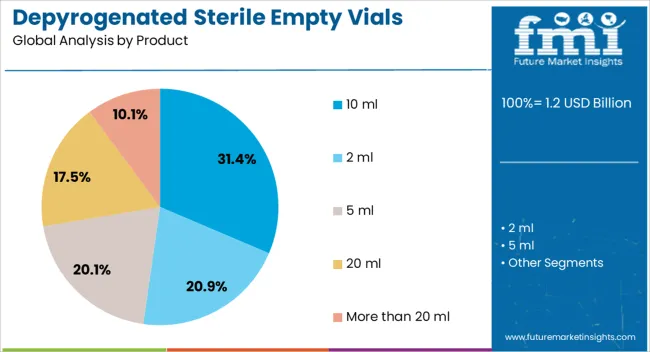

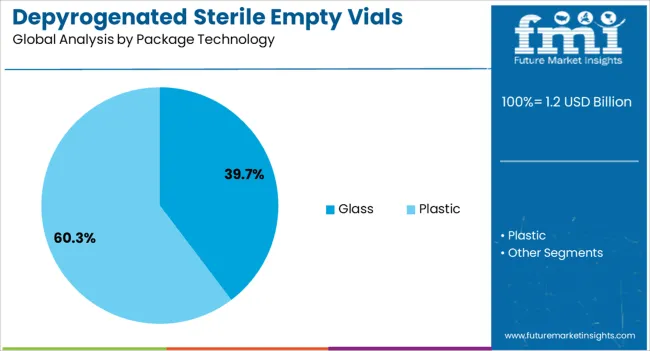

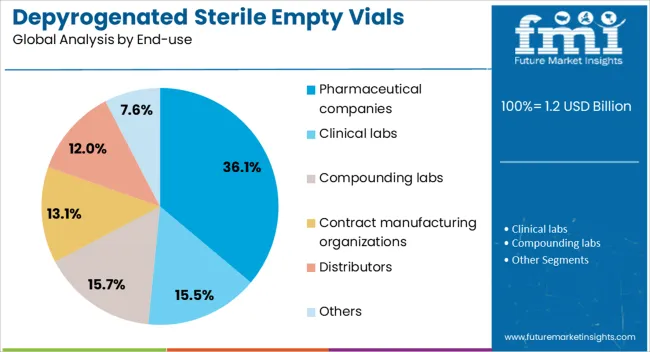

The depyrogenated sterile empty vials market is segmented by product, package technology, end-use, and geographic regions. By product, depyrogenated sterile empty vials market is divided into 10 ml, 2 ml, 5 ml, 20 ml, and More than 20 ml. In terms of package technology, depyrogenated sterile empty vials market is classified into glass and plastic. Based on end-use, depyrogenated sterile empty vials market is segmented into pharmaceutical companies, clinical labs, compounding labs, contract manufacturing organizations, distributors, and others. Regionally, the depyrogenated sterile empty vials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10 ml product segment is projected to lead the market with a 31.40% share in 2025. Its dominance stems from its ideal compatibility with small-dose injectable therapies, biologics, and vaccines, which require precision and minimal contamination risk. The 10 ml format provides optimal volume for unit-dose and multi-dose applications, especially in clinical settings where space and waste are constrained. Standardization in machinery for filling and labeling further supports widespread adoption. The segment also benefits from ongoing demand in ophthalmology, oncology, and pediatric care where smaller, controlled dosages are critical for patient safety and therapeutic efficacy.

Glass packaging technology is expected to command 39.70% of the market by 2025, making it the most utilized material type. Its supremacy is linked to superior barrier properties, thermal resistance during depyrogenation, and regulatory acceptance in sterile pharma packaging. Glass vials maintain integrity during high-temperature sterilization processes, making them ideal for ensuring pyrogen-free status. Additionally, borosilicate and aluminosilicate variants provide chemical durability and reduce interaction risks with sensitive drug molecules. Growing confidence in break-resistant and low-leachability glass compositions continues to reinforce its use across both branded and generic formulations.

Pharmaceutical companies are set to dominate end-use with a 36.10% share in 2025, driven by expanding production of parenteral formulations and sterile injectables. These firms require strict compliance with cGMP and FDA regulations, necessitating reliable sterile primary packaging. Depyrogenated vials offer consistency in sterility assurance levels and streamline validation protocols for critical drugs. The segment's growth is also linked to global vaccine distribution, oncology drugs, and specialty treatments that demand stringent packaging. In-house vial processing and direct procurement from specialized suppliers are common practices, reinforcing the central role of pharmaceutical firms in shaping demand.

The depyrogenated sterile empty vials market is expanding as demand for safe, contamination-free containers rises in pharmaceutical and biotech manufacturing. Opportunities are strengthening in contract manufacturing and international compliance-driven supply chains, while trends emphasize ready-to-use formats, borosilicate glass, and automation compatibility. Challenges persist in high production costs, supply chain risks, and regulatory compliance barriers. In my opinion, companies that invest in quality assurance, scalable production, and strategic partnerships with global drug manufacturers will secure stronger positions in this critical pharmaceutical packaging segment.

Demand for depyrogenated sterile empty vials has been driven by their crucial role in aseptic drug manufacturing, vaccines, and biologics. These vials undergo depyrogenation to eliminate endotoxins, ensuring sterility and safety for parenteral formulations. The growing reliance on injectable therapies across chronic disease treatment and vaccine production has accelerated their usage in global pharmaceutical supply chains. In my opinion, demand will remain strong as drug makers continue to expand sterile fill-finish operations, making these vials indispensable in regulated pharmaceutical and biotechnology industries.

Opportunities are growing in contract manufacturing and outsourcing, where depyrogenated sterile vials are essential to efficient large-scale production. CMOs and CDMOs are increasingly partnering with pharmaceutical firms to meet rising global demand for biologics and injectable formulations, driving procurement of high-quality sterile containers. Export markets are also opening for suppliers meeting stringent FDA and EMA compliance. I believe companies that align with outsourcing partners and offer scalable, regulatory-compliant solutions will capture significant opportunities, as drug developers prioritize efficiency, safety, and global distribution capabilities.

Trends indicate rising adoption of ready-to-use (RTU) and pre-sterilized vials, which reduce contamination risks and streamline pharmaceutical filling operations. Manufacturers are offering packaging formats that integrate seamlessly with automated filling lines, improving efficiency and reducing downtime. Another trend is the shift toward higher-quality borosilicate glass and polymer alternatives for improved strength and compatibility with sensitive formulations. In my opinion, these trends highlight a decisive shift toward convenience and safety-driven solutions, with RTU vials setting the standard for the next phase of sterile pharmaceutical packaging.

Challenges include high production costs, as depyrogenation requires advanced sterilization equipment and stringent quality assurance processes. Supply chain vulnerabilities, particularly shortages of medical-grade glass and disruptions in logistics, create risks for pharmaceutical producers dependent on timely vial availability. Smaller players struggle with regulatory compliance, limiting their ability to compete globally. In my assessment, overcoming these challenges will require strong supplier networks, capacity expansion, and investments in quality control to ensure consistent supply of sterile vials for critical pharmaceutical applications worldwide.

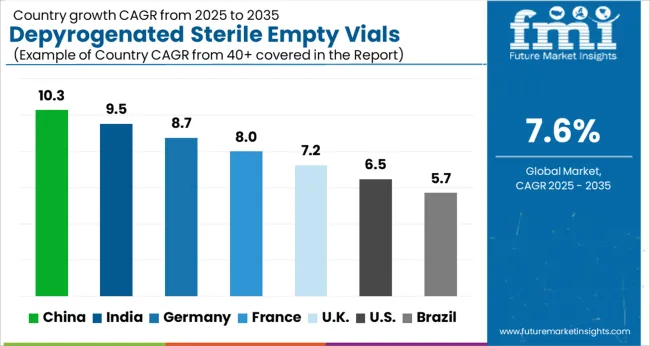

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

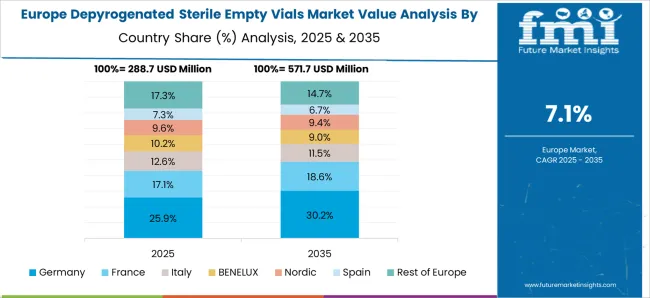

The global depyrogenated sterile empty vials market is projected to grow at a CAGR of 7.6% from 2025 to 2035. China leads with a growth rate of 10.3%, followed by India at 9.5%, and Germany at 8.7%. The United Kingdom records a growth rate of 7.2%, while the United States shows the slowest growth at 6.5%. Growth is driven by expanding pharmaceutical and biotech manufacturing, stringent regulatory requirements for sterile packaging, and increasing demand for injectable drugs and vaccines. Emerging markets such as China and India are accelerating due to domestic drug production and export opportunities, while developed economies like the USA, UK, and Germany emphasize advanced quality control, automation in vial processing, and strong regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The depyrogenated sterile empty vials market in China is projected to grow at a CAGR of 10.3%. Growth is fueled by rapid expansion of the pharmaceutical industry, increased production of biologics, and rising demand for injectable therapies. Chinese manufacturers are investing in advanced depyrogenation processes to meet international quality standards. The country is also strengthening its export capacity for sterile vials to support global drug companies. Government support for healthcare expansion and compliance with GMP standards is further boosting market adoption, positioning China as a leading hub for sterile vial production.

The depyrogenated sterile empty vials market in India is expected to grow at a CAGR of 9.5%. Strong domestic demand for injectables, vaccines, and generics is fueling growth. Indian pharmaceutical manufacturers are increasingly investing in sterile packaging facilities that comply with international standards such as US FDA and EU GMP. The growing role of India as a global supplier of vaccines and biosimilars is further increasing demand for sterile vials. With government support for pharmaceutical exports and rising private investments in biopharmaceutical infrastructure, India continues to strengthen its position in global sterile vial production.

The depyrogenated sterile empty vials market in Germany is projected to grow at a CAGR of 8.7%. Germany’s advanced pharmaceutical and biotech industries are key drivers of demand. Strict regulatory requirements for aseptic packaging and depyrogenation processes ensure high product standards. Manufacturers are adopting automated depyrogenation systems and advanced inspection technologies to meet growing needs. Germany also plays a central role in supplying sterile packaging for Europe’s vaccine production and clinical trials. Emphasis on precision manufacturing and quality assurance continues to strengthen the country’s position.

The depyrogenated sterile empty vials market in the UK is projected to grow at a CAGR of 7.2%. Rising biopharmaceutical production and growing demand for contract manufacturing services are fueling demand for sterile vials. Regulatory compliance with MHRA and EU standards drives higher adoption of advanced depyrogenation equipment. Innovation in packaging design and integration of automation in vial production are enhancing efficiency. The UK’s role as a hub for clinical trials and drug development is further boosting demand for high-quality sterile vials in both research and commercial applications.

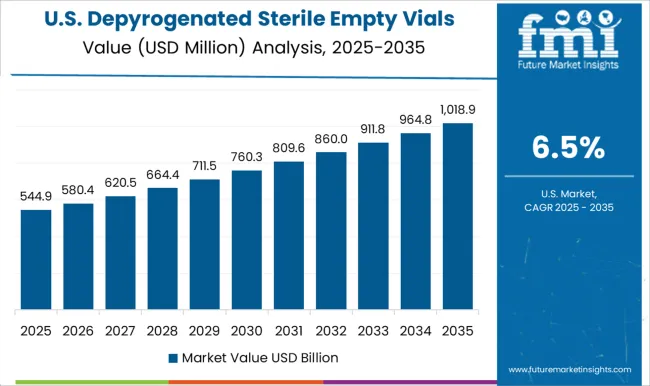

The depyrogenated sterile empty vials market in the USA is projected to grow at a CAGR of 6.5%. While slower than emerging economies, demand remains strong due to the country’s leadership in biologics, vaccines, and specialty pharmaceuticals. Regulatory frameworks from the FDA enforce strict requirements for sterile packaging and depyrogenation. Manufacturers are investing in advanced vial washing, sterilization, and inspection technologies to maintain compliance. The presence of major pharmaceutical companies and CDMOs ensures steady consumption of sterile vials, while innovation in automation and quality assurance sustains long-term growth.

Competition in depyrogenated sterile empty vials is anchored in precision manufacturing, pharma partnerships, and regulatory compliance. SCHOTT and Corning leverage glass science expertise, supplying borosilicate vials with proven resistance to thermal and chemical stress. SGD Pharma and DWK Life Sciences emphasize sterile packaging solutions and regional production footprints that secure supply for critical drug formulations. Nipro PharmaPackaging builds on integrated pharma packaging systems, focusing on Asia’s high-volume generics market. APG Pharma positions itself as a specialized provider with tailored sterile vial offerings, while Thermo Fisher Scientific integrates vials into its broader laboratory and bioprocessing ecosystem. The result is a market shaped by global leaders with material strength, regional manufacturers with agile capacity, and diversified life science firms extending their consumables portfolios.

Strategies center on cleanroom-certified production, regulatory adherence to USP and Ph. Eur. standards, and capacity expansion to address biologics and injectable demand. SCHOTT and Corning drive innovation in lightweight, high-strength vials that withstand depyrogenation cycles without compromising clarity. SGD Pharma and DWK Life Sciences highlight supply security through multi-continent facilities and fast turnaround on small batches. Nipro and APG Pharma pursue cost-effective sterile solutions, targeting contract manufacturers and generics producers. Thermo Fisher differentiates by bundling vials with analytical tools, creating cross-selling advantages. Product brochures emphasize low endotoxin levels, dimensional consistency, and ready-to-fill compatibility, supported by images of sterilization lines and cleanroom packaging. Clear messaging underscores reliability for vaccine filling, biologics storage, and clinical trial readiness. By combining technical validation with assurances of sterility and scalability, brochures position these vials as essential enablers in regulated pharmaceutical supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Product | 10 ml, 2 ml, 5 ml, 20 ml, and More than 20 ml |

| Package Technology | Glass and Plastic |

| End-use | Pharmaceutical companies, Clinical labs, Compounding labs, Contract manufacturing organizations, Distributors, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SCHOTT, APG Pharma, Corning, DWK Life Sciences, Nipro PharmaPackaging, SGD Pharma, and Thermo Fisher Scientific |

| Additional Attributes | Dollar sales by product type (glass vs plastic vials), Dollar sales by capacity range (2ml–10ml, 10ml–50ml, above 50ml), Trends in injectable biologics and vaccine fill-finish, Use in pharmaceutical R&D and commercial manufacturing, Growth of CDMO and biotech partnerships, Regional demand variations across North America, Europe, and Asia-Pacific. |

The global depyrogenated sterile empty vials market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the depyrogenated sterile empty vials market is projected to reach USD 2.6 billion by 2035.

The depyrogenated sterile empty vials market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in depyrogenated sterile empty vials market are 10 ml, 2 ml, 5 ml, 20 ml and more than 20 ml.

In terms of package technology, glass segment to command 39.7% share in the depyrogenated sterile empty vials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Sterile and Antiviral Packaging Market Forecast and Outlook 2025 to 2035

Sterile Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sterile Tubing Welders Market Size and Share Forecast Outlook 2025 to 2035

Sterile Dosage Form Market Size and Share Forecast Outlook 2025 to 2035

Sterile Prep-Pack Workstations Market Size and Share Forecast Outlook 2025 to 2035

Sterile Barrier Packaging Market Growth - Demand & Forecast 2025 to 2035

Analyzing Sterile Packaging Market Share & Industry Leaders

Global Sterile Injectable CDMO Market Analysis – Size, Share & Forecast 2024-2034

Sterile Wraps Market

Sterile Medical Packaging Market

Sterile IV Containers Market

Sterile Container Market

Sterile Lids Market

Sterile Oncology Injectable Market

Non-Sterile Liquids Suspensions Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Mobile Sterile Units Market Analysis – Growth, Applications & Outlook 2025–2035

UK Mobile Sterile Units Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Mobile Sterile Units Market Analysis – Size & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA