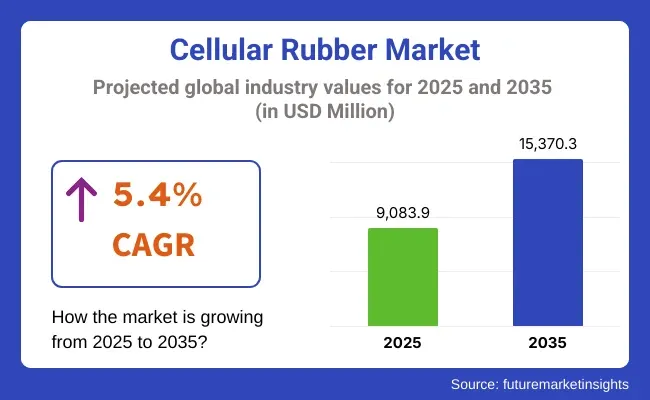

The global cellular rubber market is estimated at USD 9,083.9 million in 2025 and is further projected to reach USD 15,370.3 million by 2035, representing a CAGR of 5.4% over the forecast period.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 9,083.9 million |

| Industry Value (2035) | USD 15,370.3 million |

| CAGR (2025 to 2035) | 5.4% |

Cellular rubber, encompassing both open-cell and closed-cell structures, is widely adopted for sealing, insulation, cushioning, and vibration dampening applications across automotive, construction, electronics, marine, and industrial sectors due to its superior compressibility, weather resistance, and thermal insulation properties.

In 2024, A growing focus on environmental sustainability is driving demand for bio-based and recyclable cellular rubber materials. Manufacturers are increasingly introducing halogen-free, low-VOC, and recyclable rubber foams to meet strict environmental regulations such as REACH, RoHS, and LEED.

These eco-friendly variants are especially gaining traction in Europe and North America across construction, automotive, and electronics sectors. Companies like Armacell and Zotefoams are expanding their portfolios to include eco-conscious materials derived from renewable sources. This trend aligns with circular economy goals and offers improved market positioning among OEMs focused on sustainability and green certifications.

strong demand for cellular rubber was observed in Asia Pacific, led by rising automotive production in China and India, coupled with increasing insulation needs in the construction sector. According to the International Organization of Motor Vehicle Manufacturers (OICA), China produced over 27 million vehicles in 2023, which significantly boosted the use of cellular rubber components in weatherstrips, NVH materials, and battery insulation.

The rapid adoption of electric vehicles (EVs) is creating new opportunities for cellular rubber in battery protection and thermal insulation systems. Closed-cell EPDM and silicone foams are being used to safeguard EV battery packs from shocks, vibrations, moisture ingress, and heat build-up.

These materials offer flame retardancy, chemical resistance, and long-term durability, which are critical for battery safety and performance. As EV platforms become more advanced, the demand for precision die-cut, lightweight, and thermally stable rubber components is increasing, particularly in Asia-Pacific and Europe, where automotive electrification is accelerating under government mandates and OEM investment.

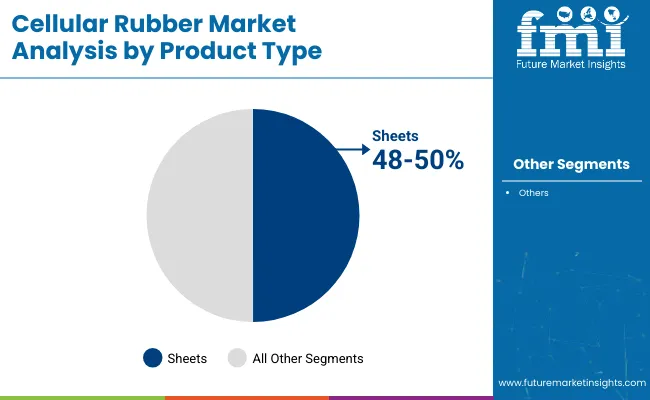

Sheets are projected to hold the largest share in the global cellular rubber market by product type, accounting for approximately 48-50% of the total market in 2025, and are expected to grow at a CAGR of 5.4% through 2035.

Cellular rubber sheets offer high versatility and are widely used for gasketing, insulation, vibration dampening, and sealing across industries such as automotive, electronics, HVAC, and construction. Their ease of fabrication, consistent thickness, and compatibility with die-cutting and lamination processes make them a preferred choice in OEM applications. Demand for flame-retardant and weather-resistant cellular rubber sheets is increasing, particularly in sectors adhering to strict safety and environmental standards across Europe, North America, and Asia-Pacific.

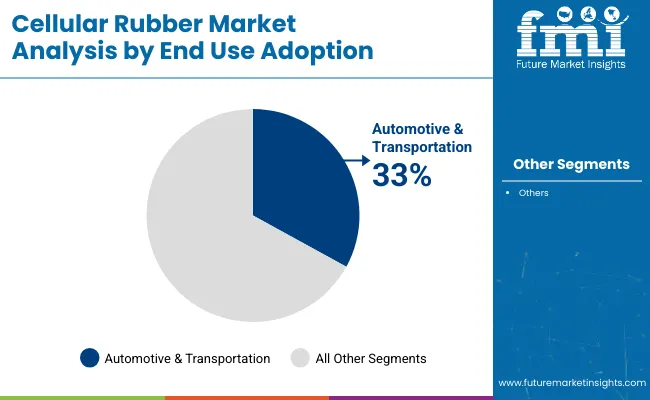

The automotive and transportation sector is projected to account for over 33% of the global cellular rubber market share in 2025, growing at a CAGR of 5.8% through 2035. Cellular rubber is widely used in gaskets, seals, battery insulation, weatherstrips, and acoustic insulation in electric vehicles (EVs), commercial vehicles, and rail systems.

The global shift toward e-mobility, along with stricter regulations on noise, emissions, and thermal efficiency, is accelerating the demand for lightweight, high-performance foam materials. Asia-Pacific and Europe are leading this transformation with high EV production and adoption rates, while North American OEMs increasingly use closed-cell rubber solutions for thermal and environmental sealing in electric and hybrid vehicle platforms.

Volatile Raw Material Costs and Environmental Compliance

Instability of prices for raw materials, especially synthetic rubbers from petrochemical sources such as EPDM, SBR and neoprene are hindering growth for the cellular rubber industry. As prices for oil fluctuate the pressures on manufacturers costs increase which could hit margins. Furthermore, increased environmental concerns and legislations associated with the usage of VOC-emitting chemicals and halogenated compounds are driving manufacturers to redesign their product portfolio.

Expansion in Electric Vehicles and Sustainable Building Materials

The shift to electric and hybrid cars is surely a huge growth area. Cellular rubber plays a vital role in the thermal management, noise insulation and cushioning of batteries and electronic modules. The introduction of lightweight and fire-retardant foam materials aids in enhancing vehicle efficiency and passenger safety.

Likewise, green building trends privilege materials that provide better thermal conductivity, moisture conservation, and energy efficiency. With government policies to support sustainable architecture and carbon-neutral infrastructure, the adoption of cellular rubber in HVAC insulation and soundproofing will see sharply increasing trends. Manufacturers who will invest in bio-based, recyclable or low-emission rubber foams will be strongly positioned to capture that future demand.

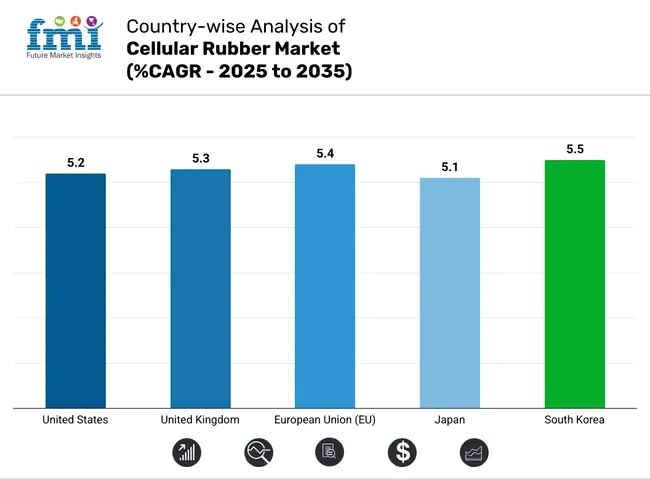

The United States Cellular Rubber market is focused on expansion, with an expected CAGR of 5.2% between 2025 and 2035. The value is being fuelled by the rise of the material's use across automotive, construction and electronics industries. Cellular rubber plays a crucial role in ensuring durability and acoustic insulation through gasketing, sealing and vibration control in automotive manufacturing.

Lower energy architecture tends to also fuel demand in building and HVAC systems, which are essential to creating such facilities. Moreover, product integration is being increasingly fostered as lightweight material adoption continues to trend across USA industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The United Kingdom cellular rubber market is anticipated to grow at a CAGR of 5.3% during the forecast period. SriP's proprietary space-saving technology allows for the design of lighter vehicles while not compromising on operational functions. Cellular rubber is becoming more common in the construction industry as sound deadening and thermal insulation products. In addition, the resistance of polyethylene to UV, weather, and chemical also contributes to its use in outdoor applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

Europe is estimated to grow with a GDP of approximately 5.4% throughout the forecast period in the cellular rubber market. The top countries are as follows driving this growth, the reason is high demand in automotive and transportation: Germany, France, and Italy. Due to the strict environmental regulations in the area, manufacturers have also been working with cellular rubber to seek light weight energy efficient solutions. Increasing emphasis on noise reduction and improvement of passenger comfort levels in rail and public transport systems further drives consumption of performance rubber materials.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

From 2025 to 2035, Japan's cellular rubber market is estimated to grow at a CAGR of 5.1%. Drive demand is in core from the country precursor industries in automotive and electronics. As manufacturers strive toward product miniaturization and achieve better insulation in electronic devices, cellular rubber makes it possible with its flexibility, thermal resistance, and cushioning. The material's performance in sealing and weather-stripping applications, which are vital parts of Japan’s typhoon-heavy region, contributes to further growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

In South Korea, the cellular rubber market is expected to register a CAGR of 5.5% during the period of 2025 to 2035. Ongoing demand for high-performance, multifunctional rubber materials is being driven by the country's technological progress in the fields of consumer electronics and automotive business.

Growth is also spurred by government investments in sustainable urban development and eco-friendly construction materials. In addition, indigenous manufacturers have also developed their own closed cell foam technologies here, making this country one of the major exporters in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The global cellular rubber market is highly competitive and innovation-driven, with manufacturers focusing on sustainability, product customization, and thermal/acoustic performance.Key players are investing in bio-based, halogen-free, and low-emission rubber formulations to comply with evolving environmental mandates such as LEED, REACH, and RoHS.Vertical integration, automated foam processing, and expansion into developing markets are being adopted to strengthen global supply chains and meet growing demand.

Product development strategies are increasingly centered around energy-efficient insulation, low-VOC adhesives, and precision-cut foam gaskets for OEM applications in electronics, healthcare, and mobility sectors. Emerging markets in Asia Pacific, Latin America, and Africa are projected to offer high-growth opportunities over the next decade due to expanding urbanization, infrastructure build-outs, and growing manufacturing bases.

The overall market size for the Cellular Rubber Market was USD 9,083.9 Million in 2025.

The Cellular Rubber Market is expected to reach USD 15,370.3 Million in 2035.

Rising requirement of lightweight, shock-absorbing, and insulation materials among various sectors including automotive, electronics, construction and aerospace will drive the demand for the Cellular Rubber Market.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Cellular nitrile butadiene rubber (NBR) segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Cellular Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Rubber Molding Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA