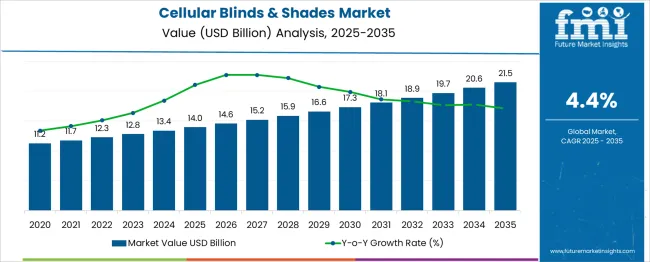

The cellular blinds & shades market is estimated to be valued at USD 14.0 billion in 2025 and is projected to reach USD 21.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. The consumer electronics high voltage electric capacitor segment represents 100% of its specific sub-market, focused on capacitors rated above 100 V used in compact, high-density electronic products.

Within the broader high-voltage electric capacitor market, this category accounts for approximately 3% to 5%, as the highest voltage applications exist in power transmission and industrial settings. In the overall consumer electronics components market, their share remains modest at around 1% to 2%, due to the dominance of low-voltage capacitors and integrated components.

For portable power and energy storage devices such as smartwatches and compact devices, these capacitors contribute roughly 5% to 7% of component usage. In printed circuit board and signal conditioning applications, the share is estimated at 2% to 3%, primarily for decoupling and filtering functions. The sector is expanding as devices demand rapid charge-discharge cycles and compact energy storage solutions. Key innovators include Murata Manufacturing, Panasonic Electronic Devices, AVX, Kemet, and TDK.

These companies develop multilayer ceramic capacitors and thin film capacitors that support high voltage pulses in smartphones, wearables, and electric vehicle charging peripherals. Major technical trends include miniaturization, advanced dielectric materials, and hybrid capacitor arrays that offer high energy density and reliable performance. Manufacturers focus on scalable production near consumer technology hubs and collaboration with mobile chipset makers. Growth is driven by rising use of fast charging, compact power electronics and IoT-enabled devices.

| Metric | Value |

|---|---|

| Cellular Blinds & Shades Market Estimated Value in (2025 E) | USD 14.0 billion |

| Cellular Blinds & Shades Market Forecast Value in (2035 F) | USD 21.5 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The global cellular blinds & shades market is forecast to expand from USD 14.0 billion in 2025 to USD 21.5 billion in 2035, driven by a CAGR of 4.4%. This trajectory suggests a relatively inelastic growth pattern, with the market continuing to expand even during periods historically correlated with volatility in residential construction and discretionary home spending. Between 2025 and 2030, the market adds USD 3.3 billion, while 2030 to 2035 adds USD 4.2 billion, showing gradual acceleration despite global cyclical risks.

The year-on-year growth is expected to correlate weakly with GDP fluctuations and housing completions, reflecting the influence of mid-cycle renovation activity, retrofit demand from aging structures, and energy-conscious interior upgrades. Cellular shades, with their thermal insulation properties, tend to attract steady interest regardless of short-term interest rate changes or consumer sentiment dips.

Peer-reviewed housing and interior design studies from journals such as Energy and Buildings confirm that window treatment purchases are often motivated by long-term utility cost reduction rather than immediate economic outlooks. The market’s elasticity is further tempered by low replacement frequency, modest average unit costs, and broad availability across mass-market and premium retail channels. As such, the product category behaves closer to semi-essential home infrastructure than to fully discretionary décor.

The current market landscape is shaped by growing awareness of energy conservation in residential and commercial spaces, as reflected in investor presentations and sustainability-focused corporate reports.

Future growth is expected to be influenced by advancements in fabric technology, expanding design options, and increasing adoption of smart home solutions that integrate with existing interiors. Industry news and annual reports indicate that manufacturers are focusing on eco-friendly materials and improved insulation capabilities, addressing consumer concerns about energy costs and carbon footprint.

Additionally, heightened investments in the construction sector and growing preferences for customizable shading solutions have reinforced the market’s trajectory. These factors collectively provide a strong foundation for continued growth, with opportunities driven by evolving consumer preferences and innovations in design and materials.

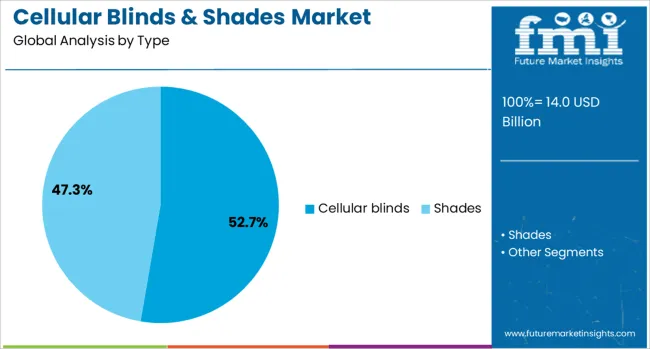

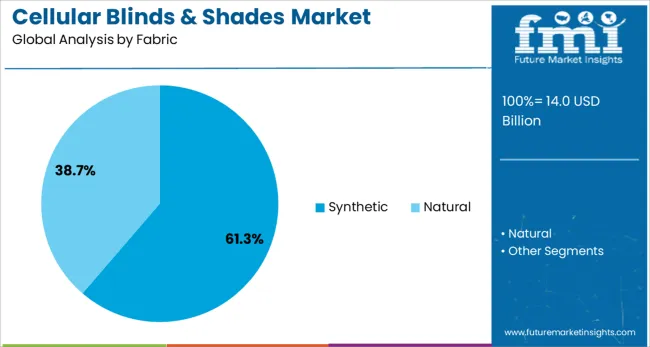

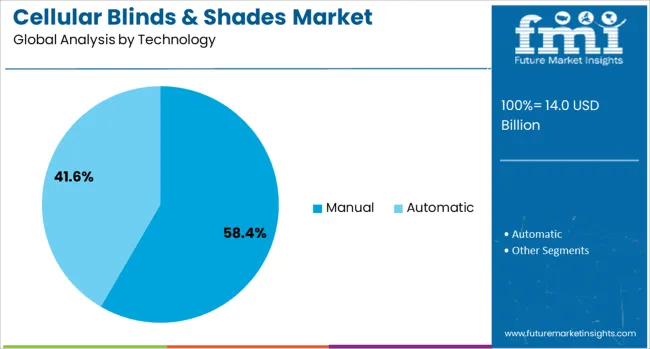

The cellular blinds & shades market is segmented by type, fabric, technology, installation, application, distribution channel, and geographic regions. The cellular blinds & shades market is divided into Cellular blinds and Shades. In terms of the fabric of the cellular blinds & shades market, it is classified into Synthetic and Natural. The technology of the cellular blinds & shades market is segmented into Manual and Automatic.

The cellular blinds & shades market is segmented into Retrofit and New construction. The cellular blinds & shades market is segmented into Residential, Commercial, Healthcare, Institution, Spa & beauty centres, Hotel and resorts, and Others (shopping malls, stores). The distribution channel of the cellular blinds & shades market is segmented into Offline and Online. Regionally, the cellular blinds & shades industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cellular blinds type segment is projected to account for 52.7% of the Cellular Blinds & Shades market revenue share in 2025, maintaining its leadership position. This prominence is attributed to its superior insulation properties, ability to enhance indoor comfort, and contribution to energy savings as highlighted in corporate product briefings and sustainability statements.

Cellular blinds have been widely adopted in both residential and commercial spaces due to their distinctive honeycomb structure, which traps air and improves thermal efficiency. The segment’s growth has also been supported by its availability in various colors and textures, offering consumers significant flexibility in interior design choices.

Technical papers and product launches indicate that these blinds are favored for their lightweight construction and ease of installation, which appeal to cost-conscious and environmentally aware customers. Furthermore, the emphasis on sustainable building practices and the rising popularity of green certifications have solidified cellular blinds’ position as the preferred type in the market.

The synthetic fabric segment is expected to capture 61.3% of the Cellular Blinds & Shades market revenue share in 2025, emerging as the dominant fabric choice. This leadership has been fostered by its durability, resistance to moisture and fading, and ease of maintenance, as outlined in fabric manufacturers’ press releases and industry journals.

Synthetic fabrics have been preferred for their ability to deliver long-lasting performance and withstand varying environmental conditions, making them suitable for diverse climates and applications. The segment’s growth has also been supported by advancements in textile technology, which have enhanced the appearance and tactile qualities of synthetic materials while retaining their functional benefits.

According to investor updates, synthetic options have gained acceptance due to their affordability and compatibility with advanced printing and finishing techniques, enabling a broader range of designs and textures. These characteristics have established synthetic fabrics as the material of choice, aligning with consumer demand for both practicality and aesthetic appeal.

The manual technology segment is anticipated to hold 58.4% of the Cellular Blinds & Shades market revenue share in 2025, sustaining its lead among technology options. This dominance has been driven by its cost-effectiveness, simplicity of operation, and low maintenance requirements, as observed in manufacturer communications and product announcements.

Manual blinds have continued to attract consumers who prioritize affordability and straightforward functionality over automation. The segment’s growth has been reinforced by the widespread availability of manual mechanisms that are easy to use and install without the need for electrical connections or smart home integrations.

Trade publications have noted that manual systems are particularly appealing in markets where electricity costs or infrastructure limit the adoption of motorized solutions. Additionally, the enduring preference for tactile control and reliability in operation has maintained manual technology’s relevance, ensuring its strong market position amid growing competition from automated alternatives.

Adoption of cellular blinds and shades has increased across residential, commercial, and institutional buildings due to their role in moderating indoor temperature and enhancing energy efficiency. These coverings are being integrated into retrofit programs where glare control and insulation are required without mechanical cooling systems. Cordless and motorized models are gaining preference in childcare, healthcare, and rental housing, where durability and ease of use are prioritized. Honeycomb structures with air-trapping pockets have enabled better temperature retention across varying climates.

Thermal insulation and passive heat control have guided product preference in energy-conscious projects. The honeycomb design used in cellular shades has been validated for reducing seasonal energy loss and improving occupant comfort. In offices and residential units exposed to fluctuating sunlight, motorized variants have been integrated with smart hubs for automated operation. Light-filtering and blackout configurations are now specified based on room function, especially in home offices and hybrid-use spaces. Growing demand for non-mechanical solutions to reduce interior temperature swings has led to the use of cellular shades in zoning strategies and architectural planning workflows.

The initial cost of advanced variants, especially dual-cell and motorized formats, has limited adoption in budget-constrained segments. Installation complexity for irregular window frames and the need for exact alignment have added to labor time and material wastage. Variation in quality among imported products has resulted in inconsistent performance in moisture-heavy environments. Replacement difficulties in customized systems have slowed adoption in rental housing. Property managers have cited limited interoperability between brands and insufficient after-sales support as additional challenges, particularly in institutional buildings where maintenance cycles require standardization and inventory consistency.

Integration with smart home ecosystems and building automation systems has created opportunities in both new construction and retrofits. Timed shading, voice control, and sensor-based responsiveness have supported the adoption of digitally enhanced cellular blinds in office buildings and luxury residences. Custom fabrication for narrow, angled, or floor-to-ceiling windows has enabled greater architectural compatibility. Battery-powered modules are being used where wired connections are not feasible. Lightweight panels with branding capabilities are being deployed in retail spaces, while reversible dual-fabric designs have entered the hospitality segment, offering thermal and aesthetic versatility in compact formats.

Shift toward modular, pre-measured kits has reduced installation time and simplified inventory planning. Multi-layered configurations with acoustic-dampening materials are increasingly specified in shared work environments and residential units near transport corridors. Voice-activated blinds compatible with smart assistants are gaining share among consumers with accessibility requirements. Hybrid materials that balance light diffusion and thermal insulation are selected for coworking hubs, conference centers, and flexible living spaces. The market is also seeing a rise in customer preference for neutral-toned fabrics that align with minimalist interior styles while maintaining effective light control and energy retention properties.

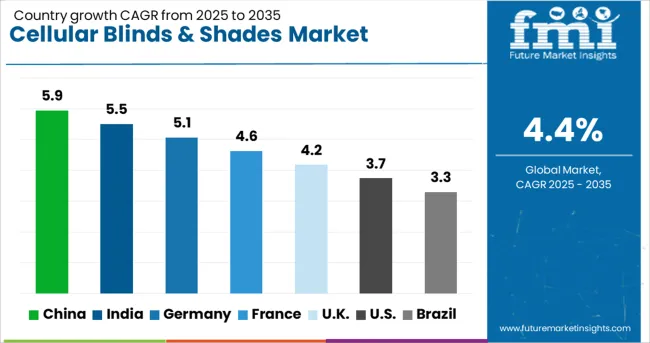

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

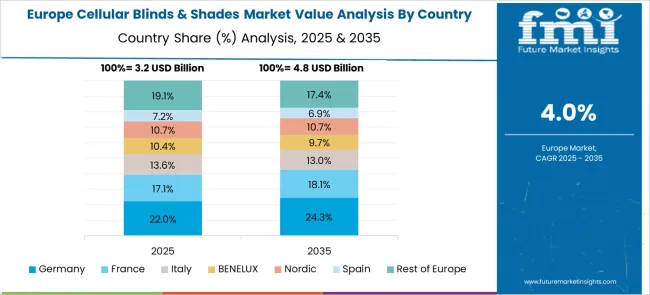

The global cellular blinds and shades market is estimated to grow at a CAGR of 4.4% from 2025 to 2035. China leads with 5.9%, exceeding the global average by 1.5%, supported by increased residential renovation activity and rising consumer preference for thermal-insulating interiors. India follows at 5.5%, where mid-income housing and hotel chains drive adoption of cost-efficient energy-saving solutions. Germany (OECD) records 5.1%, 0.7% above the global rate, with demand centered around energy performance upgrades in existing homes. The United Kingdom (OECD) posts 4.2%, slightly below the global benchmark due to lagging retrofit rates. The United States (OECD) trails at 3.7%, underperforming by 0.7%, attributed to the slow transition from traditional window coverings. The report includes detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 5.9% of global demand in 2025. Manufacturers prioritized thermal insulation performance, especially for urban mid-rise residential and hospitality projects. Multi-layer honeycomb constructions with UV-reflective linings were favored in southern regions due to high solar load. Large-format cordless systems with embedded motors gained adoption for high-window installations across commercial office buildings.

India held 5.5% of the global market in 2025. Growth has been shaped by the availability of affordable modular blind systems that target mid-income housing and co-working interiors. Thermal insulation benefits have supported market penetration in northern states. Local assembly firms have offered customizable widths and fabric grades, influencing direct-to-consumer online sales models.

Germany accounted for 5.1% of global consumption in 2025. High adoption rates were seen in building renovations where energy efficiency retrofits were mandated under national building performance standards. Side-channel mounted cellular blinds with controlled fabric tensioning were installed in both commercial and residential buildings. Motorization trends continued with increased compatibility with building automation systems.

The United Kingdom held 4.2% of the global market in 2025. Product integration has focused on heritage and low-energy housing retrofits where external window treatments were restricted. Cellular blinds with neutral-toned textiles and concealed operating mechanisms aligned with minimalistic interior preferences. Day-night variants allowed for light control without external shading.

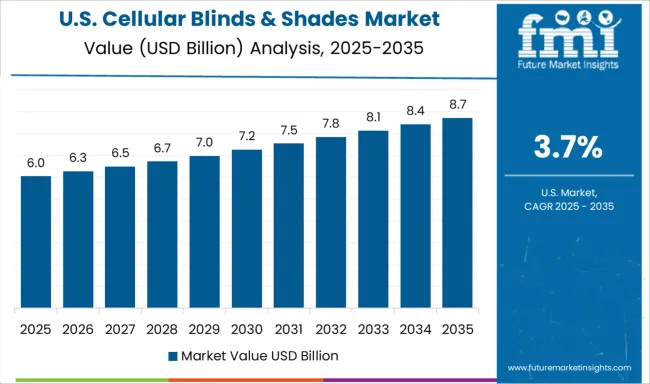

The United States accounted for 3.7% of global share in 2025. Growth was driven by consumer demand for DIY-installable cellular blinds that combine privacy, insulation, and aesthetic flexibility. Custom-sized double and single-cell constructions were increasingly chosen in suburban homes. Online platforms with visual fit guides and measurement tools accelerated direct-to-consumer sales.

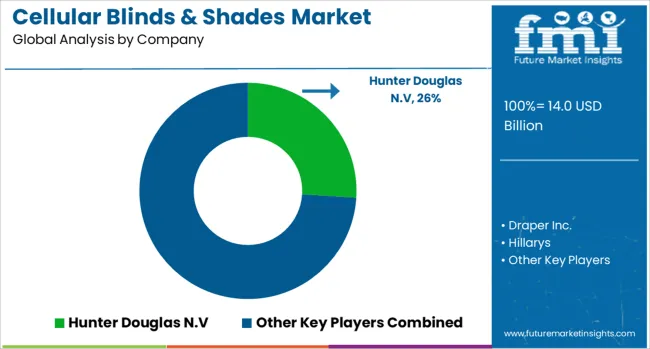

The competitive landscape of the cellular blinds and shades segment is shaped by a mix of global manufacturers, regional specialists, online direct-to-consumer brands, and private-label programs tied to major retailers. Global players maintain an advantage through large-scale operations, consistent quality, and diversified product portfolios, while regional specialists compete by offering quick, made-to-measure solutions and personalized service.

Online-native brands are carving market share with transparent pricing, simplified configuration tools, and fast delivery, whereas private-label offerings target entry-level price points and high-volume sales through retail and builder partnerships. Differentiation is achieved through factors such as cell depth and count for insulation, light-control versatility from sheer to blackout, child-safe cordless systems, top-down/bottom-up operation, and acoustic comfort.

Motorization and integration with app- or voice-controlled systems enhance long-term consumer engagement, while diverse fabric libraries, color palettes, and hardware finishes cater to design-focused buyers. Distribution strategies span specialty dealers, window-covering showrooms, home improvement chains, and e-commerce platforms, each serving distinct customer segments.

Pricing tiers range from value lines with standard sizes to premium offerings featuring dual-cell constructions, advanced motors, and designer textiles. Operational efficiency, reliable sourcing, shorter lead times, and precise measurement capabilities are critical to profitability. Partnerships with home automation ecosystems, interior designers, and builders, alongside compliance with child safety and flame resistance standards, strengthen market positioning.

Regionally, OECD markets show strong replacement demand and high adoption of smart features, BRICs focus on affordability with selective premium uptake in urban centers, and GCC markets lean toward high-end finishes and motorized installations for residential and hospitality projects. Brands that can combine rapid custom fulfillment, credible insulation performance, seamless smart integration, and installer-friendly programs are best positioned for share gains.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.0 Billion |

| Type | Cellular blinds and Shades |

| Fabric | Synthetic and Natural |

| Technology | Manual and Automatic |

| Installation | Retrofit and New construction |

| Application | Residential, Commercial, Healthcare, Institution, Spa & beauty centres, Hotel and resorts, and Others (shopping malls, stores) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hunter Douglas N.V, Draper Inc., Hillarys, Kresta, AWB - Advanced Window Blinds, Vertilux Corporation, Next Day Blinds Corporation, Springs Window Fashions LLC, Aluvert Blinds, Legrand Group, Royal Blinds LLC, Lafayette Venetian Blind Inc., Blinds.com, Bed Bath & Beyond Inc., and Elite Window Fashions |

| Additional Attributes | Dollar sales by product type (cellular blinds, honeycomb shades) and application (residential, commercial), demand driven by energy-saving and smart home trends, led by Asia‑Pacific with North America catching up, innovation in motorization, smart controls, and eco fabrics. |

The global cellular blinds & shades market is estimated to be valued at USD 14.0 billion in 2025.

The market size for the cellular blinds & shades market is projected to reach USD 21.5 billion by 2035.

The cellular blinds & shades market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in cellular blinds & shades market are cellular blinds, _bottom up, _top-down bottom up, _day and night, _vertical, _skylight, shades, _roller, _venetian, _vertical, _roman, _pleated, _solar and _zebra/layered shade.

In terms of fabric, synthetic segment to command 61.3% share in the cellular blinds & shades market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cellular Rubber Market Growth - Trends & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Blinds and Shades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA