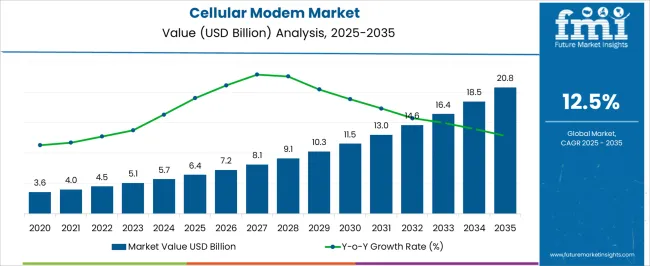

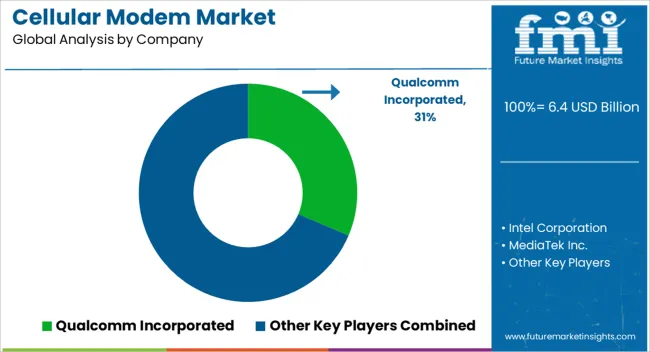

The cellular modem market is expected to grow from USD 6.4 billion in 2025 to USD 20.8 billion by 2035, registering a 12.5% CAGR and generating an absolute dollar opportunity of USD 14.4 billion. Growth is driven by rising demand for reliable wireless connectivity across industrial IoT, automotive, smart cities, healthcare, and consumer electronics applications. Advancements in 4G, 5G, and emerging 6G technologies, along with increased adoption of machine-to-machine (M2M) communication, enhance modem performance, speed, and coverage, further driving market expansion globally.

Market share erosion or gain analysis highlights shifts in competitive positioning and adoption across regions, product types, and applications. North America currently holds a significant market share due to early adoption of 5G infrastructure, industrial IoT deployment, and high smartphone penetration; however, some share is expected to erode slightly as the Asia Pacific, led by China, India, and Southeast Asia, expands rapidly with new industrial, automotive, and smart city projects.

Product-wise, high-speed 5G modems are gaining share from legacy 4G modems due to better performance and reliability. Application-wise, industrial IoT and automotive sectors are expected to capture additional share, while consumer electronics growth remains steady but slower. Overall, the USD 14.4 billion opportunity reflects both regional expansion and product innovation, with gains in emerging markets offsetting moderate share erosion in mature regions between 2025 and 2035.

| Metric | Value |

|---|---|

| Cellular Modem Market Estimated Value in (2025 E) | USD 6.4 billion |

| Cellular Modem Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The cellular modem market is primarily driven by the telecommunications and IoT sector, which accounts for approximately 46% of the market share, as modems enable wireless connectivity for smart devices, M2M communication, and industrial automation. The automotive and transportation segment contributes around 24%, leveraging cellular modems for connected vehicles, fleet management, and telematics applications. The consumer electronics sector represents close to 15%, integrating modems into smart appliances, wearables, and home networking devices. The industrial and energy sector accounts for roughly 10%, using modems for remote monitoring, predictive maintenance, and process control. The remaining 5% comes from healthcare, retail, and logistics applications requiring reliable wireless data transmission for critical operations. The cellular modem market is evolving with innovations in high-speed connectivity, multi-band support, and compact design. 5G-enabled modems are increasingly deployed to support ultra-fast data transmission and low-latency IoT applications. Multi-network and global roaming capabilities are improving reliability for automotive, logistics, and remote monitoring applications. Edge computing integration allows real-time data processing and enhanced device performance. Energy-efficient designs are being adopted for battery-powered devices. Manufacturers are focusing on modular solutions, ruggedized modems for harsh environments, and secure communication protocols. Rising IoT adoption, connected vehicles, and expanding smart device networks are driving global market growth.

The Cellular Modem market is experiencing steady expansion, driven by the increasing adoption of mobile connectivity and data-intensive applications across consumer and industrial sectors. The current market growth is being influenced by the proliferation of smartphones, IoT devices, and connected infrastructure that rely on high-speed and reliable cellular networks.

Advancements in wireless communication technologies, particularly 4G LTE and the ongoing shift toward 5G, have enabled enhanced data throughput, low latency, and scalable connectivity solutions. Investments in digital infrastructure, coupled with rising demand for remote monitoring, telematics, and smart consumer electronics, are shaping the market outlook.

Future growth is expected to be supported by the deployment of next-generation communication standards, growing adoption of embedded solutions in devices, and increasing integration of cellular modems with IoT platforms As connectivity becomes a critical requirement across both personal and commercial devices, cellular modems are anticipated to remain a core enabling technology, with manufacturers focusing on compact, energy-efficient, and software-upgradable designs to meet evolving market needs.

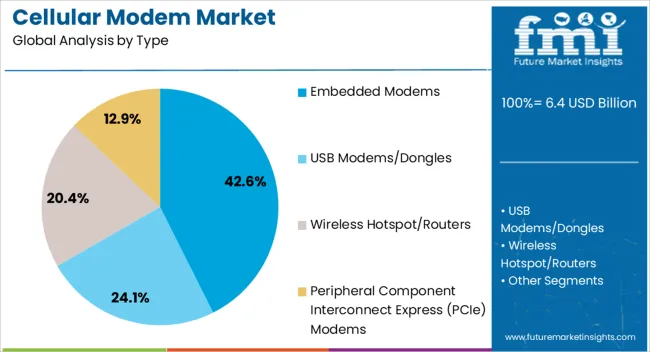

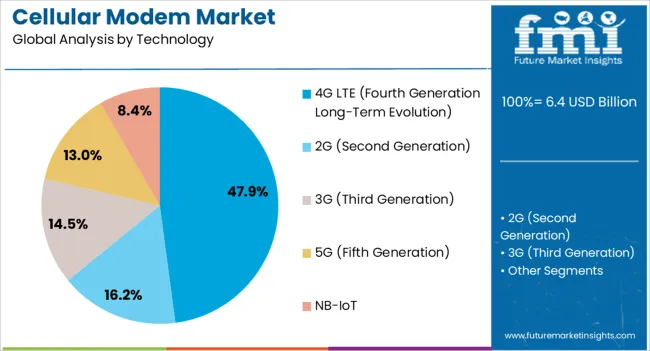

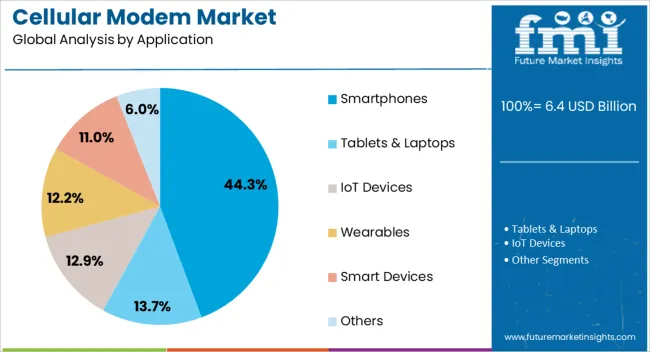

The cellular modem market is segmented by type, technology, application, vertical, and geographic regions. By type, cellular modem market is divided into Embedded Modems, USB Modems/Dongles, Wireless Hotspot/Routers, and Peripheral Component Interconnect Express (PCIe) Modems. In terms of technology, cellular modem market is classified into 4G LTE (Fourth Generation Long-Term Evolution), 2G (Second Generation), 3G (Third Generation), 5G (Fifth Generation), and NB-IoT. Based on application, cellular modem market is segmented into Smartphones, Tablets & Laptops, IoT Devices, Wearables, Smart Devices, and Others. By vertical, cellular modem market is segmented into Telecommunications, Agriculture, Automotive & Transportation, Building Automation, Consumer Electronics, Energy & Utilities, Healthcare, Industrial & Manufacturing, Retail, and Others. Regionally, the cellular modem industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Embedded Modems type is projected to hold 42.6% of the Cellular Modem market revenue share in 2025, establishing it as the leading segment. This growth is being attributed to the high demand for integrated connectivity solutions in smartphones, automotive telematics, industrial IoT devices, and consumer electronics. Embedded modems offer seamless integration with device hardware and software, enabling smaller form factors, lower power consumption, and optimized performance.

The widespread adoption of embedded solutions has been further supported by the need for continuous connectivity without compromising device design or functionality. As devices increasingly require over-the-air updates, remote diagnostics, and secure data transmission, embedded modems provide the flexibility and reliability needed to support these functions.

Future growth is expected to be reinforced by ongoing advancements in miniaturization, enhanced compatibility with evolving network standards, and the expansion of connected devices across consumer and industrial applications The combination of operational efficiency, ease of integration, and long-term reliability has positioned embedded modems as the preferred solution across multiple sectors.

The 4G LTE technology segment is expected to capture 47.9% of the total Cellular Modem market revenue in 2025, making it the dominant technology. This leadership is being driven by the widespread deployment of 4G networks, which provide high-speed data transfer, low latency, and reliable connectivity essential for smartphones, IoT devices, and telematics applications.

The growth of 4G LTE has been supported by its proven global infrastructure, broad device compatibility, and continued expansion in both urban and semi-urban regions. The ability of 4G LTE to support high-bandwidth applications such as video streaming, cloud computing, and remote monitoring has further reinforced its adoption.

With many devices still relying on 4G as the primary connectivity standard, manufacturers continue to embed 4G modems in smartphones and industrial devices, ensuring consistent performance and long-term reliability The segment is expected to sustain growth in the near term, driven by incremental improvements in network coverage, energy-efficient modems, and the ongoing demand for high-speed, mobile broadband connectivity.

The Smartphones application segment is anticipated to account for 44.3% of the Cellular Modem market revenue in 2025, positioning it as the largest end-use application. This leadership is being attributed to the rapid proliferation of smartphones globally, coupled with rising consumer demand for high-speed mobile data, video streaming, online gaming, and social networking applications.

Cellular modems embedded in smartphones enable reliable connectivity, improved signal processing, and seamless integration with device operating systems, enhancing user experience. The growth of this segment has been accelerated by the adoption of compact, power-efficient modems that support high data throughput and multiple network standards.

As smartphones continue to evolve with enhanced capabilities such as augmented reality, AI-based applications, and real-time communication services, the embedded modem component remains critical for device performance Future expansion is expected to be supported by increasing smartphone penetration in emerging markets, upgrades to higher-speed network standards, and growing demand for connected consumer devices requiring continuous and secure mobile connectivity.

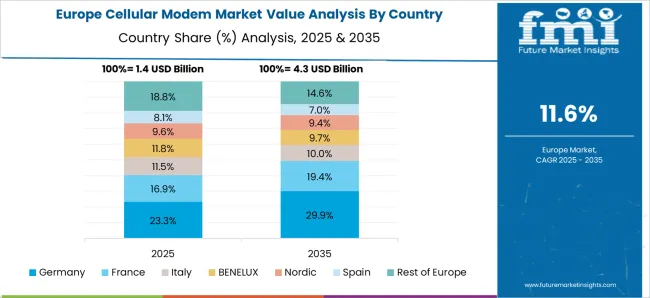

The cellular modem market is expanding due to increasing demand for IoT connectivity, smart devices, and industrial automation. Asia Pacific leads with 38% adoption, driven by China (20%), Japan (10%), and India (8%). Europe contributes 32%, led by Germany (12%), France (10%), and UK (10%). North America holds 27%, primarily the USA, while the rest of the world represents 3%. Key applications include industrial IoT (35%), automotive (25%), consumer electronics (20%), healthcare devices (10%), and energy management systems (10%). Growing adoption of 5G-enabled modems and remote monitoring solutions is driving global market growth.

Market growth is fueled by the rise of IoT devices, connected automotive solutions, and industrial automation. Industrial IoT contributes 35% of adoption, automotive 25%, consumer electronics 20%, healthcare devices 10%, and energy management 10%. Asia Pacific adoption is 38%, Europe 32%, and North America 27%. 5G-enabled modems enhance data transfer speeds and network reliability, enabling real-time monitoring and predictive maintenance in manufacturing and smart infrastructure. Rising deployment of connected cars and telematics solutions further increases demand. Governments in China, Japan, Germany, and USA are investing in smart city and connected infrastructure initiatives, creating additional growth avenues.

Key trends include 5G integration, embedded modems, and compact form factors. 5G-enabled modems are increasingly adopted in industrial IoT and automotive applications, representing around 30% of total deployments. Embedded cellular modules are gaining traction in consumer electronics and healthcare devices, accounting for 20% of adoption. Multi-network and global roaming features are standard in 25% of new deployments. Low-power wide-area network (LPWAN) modems are growing in smart metering and energy management applications, particularly in Europe and North America. Remote firmware updates, cloud connectivity, and real-time analytics are emerging features driving adoption in industrial, automotive, and smart city applications worldwide.

Opportunities exist in industrial IoT, automotive telematics, consumer electronics, healthcare devices, and energy management systems. Industrial IoT accounts for 35% adoption, automotive 25%, consumer electronics 20%, healthcare 10%, and energy management 10%. Asia Pacific contributes 38%, Europe 32%, and North America 27%. Expansion of smart factories, connected vehicles, and telehealth solutions is driving adoption. Integration with cloud platforms enables predictive maintenance and real-time data monitoring. Adoption in smart energy grids and building automation is increasing. Partnerships with telecom operators and device manufacturers are creating new revenue channels. Growing 5G deployments in China, Japan, Germany, and the USA further enhance market potential.

Challenges include high integration costs, network compatibility issues, and cybersecurity risks. Implementation costs are 15–20% higher for 5G-enabled solutions compared to 4G LTE modems. Legacy network compatibility can limit deployment in certain regions, affecting adoption. Regulatory standards for automotive, industrial, and healthcare devices vary across regions, increasing compliance requirements. Cybersecurity concerns, including data breaches and device hacking, require robust security protocols. Power consumption and heat management in compact modems pose design challenges. Smaller enterprises and emerging markets face cost constraints, limiting adoption. Supply chain constraints for semiconductors and network modules may delay production and deployment in Asia Pacific and North America.

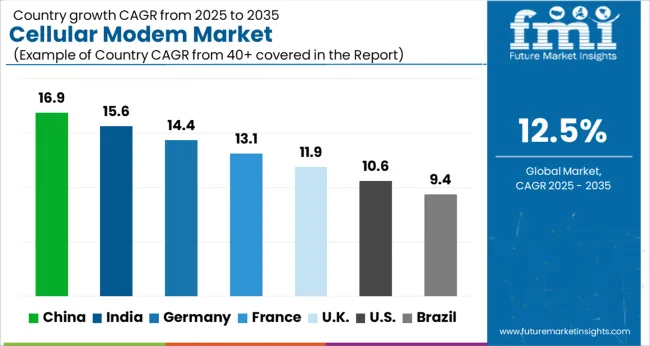

| Country | CAGR |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| UK | 11.9% |

| USA | 10.6% |

| Brazil | 9.4% |

The cellular modem market is projected to grow at a global CAGR of 12.5% through 2035, driven by increasing demand for IoT connectivity, mobile data applications, and industrial automation. China leads at 16.9%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in telecommunications infrastructure, IoT deployment, and domestic manufacturing of modems. India follows at 15.6%, a 1.25× multiple of the global rate, reflecting growth in smart devices, industrial IoT, and mobile connectivity adoption. Germany records 14.4%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in high-speed connectivity, industrial automation, and enterprise communication solutions. The United Kingdom posts 11.9%, 0.95× the global rate, with demand focused on commercial IoT, enterprise networks, and connectivity services. The United States stands at 10.6%, 0.85× the benchmark, with steady uptake in mobile communications, industrial applications, and IoT ecosystems. BRICS economies drive most of the market volume, OECD countries emphasize technological advancement and high-speed connectivity, while ASEAN nations contribute through expanding IoT adoption and mobile connectivity infrastructure.

The cellular modem market in China is projected to grow at a CAGR of 16.9%, driven by the expansion of IoT networks, smart devices, and industrial automation. Domestic suppliers such as Huawei, ZTE, and Quectel provide 4G and 5G-enabled modems for smart homes, automotive, and industrial applications. Technological developments emphasize high-speed connectivity, low power consumption, and compact designs. Growth is supported by government initiatives promoting digital infrastructure, urban smart city projects, and the increasing deployment of connected devices across commercial and industrial sectors.

The cellular modem market in India is expected to grow at a CAGR of 15.6%, supported by the proliferation of IoT, smart metering, and connected automotive applications. Key suppliers such as Tata Communications and Sierra Wireless provide high-performance modems for 4G and emerging 5G networks. Adoption is driven by digitalization initiatives, expanding telecom infrastructure, and demand for low-latency, high-speed connectivity. Technological innovation focuses on compact designs, energy efficiency, and multi-network compatibility for industrial, consumer, and automotive applications.

Germany digital multimeter market is increasing at 5.2% CAGR, above the global 4.5%, driven by automotive, electronics, and industrial automation applications. In 2024, about 210,000 units were deployed, with Bavaria, Baden-Württemberg, and North Rhine-Westphalia representing 38% of installations. Companies such as Fluke, HIOKI, and Gossen Metrawatt focused on integrating wireless connectivity, smart interfaces, and automated calibration features. Industrial adoption contributed 46% of installations, while laboratory and R&D applications accounted for 29%. Emphasis on precision measurement and regulatory compliance encouraged adoption of high-accuracy digital multimeters. Calibration services and remote monitoring capabilities improved operational efficiency in industrial facilities.

The cellular modem market in the United Kingdom is expected to grow at a CAGR of 11.9%, supported by smart city projects, industrial IoT adoption, and connected transport initiatives. Suppliers focus on compact 4G and 5G-enabled modems with low power consumption and enhanced connectivity reliability. Adoption is concentrated in industrial, automotive, and smart home applications. Technological development emphasizes embedded solutions, multi-band compatibility, and secure connectivity for commercial and consumer applications.

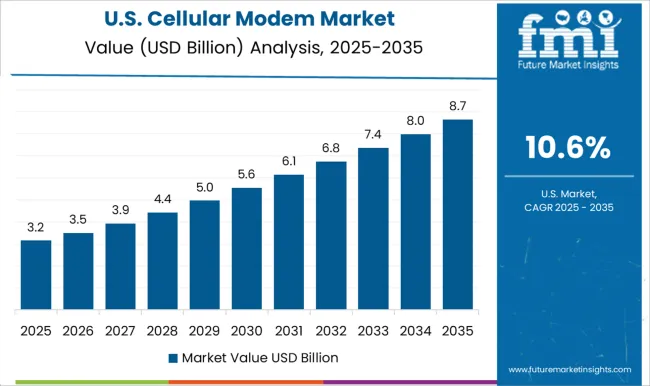

The cellular modem market in the United States is projected to grow at a CAGR of 10.6%, driven by IoT adoption, industrial automation, and connected automotive applications. Major suppliers such as Sierra Wireless, Qualcomm, and Verizon provide high-speed 4G and 5G modems for smart devices, automotive telematics, and industrial systems. Growth is supported by increasing demand for low-latency, high-reliability connectivity and integration with cloud and edge computing systems. Technological improvements include compact form factors, low power consumption, and secure connectivity protocols.

Competition in the cellular modem market is being shaped by connectivity reliability, data speed, and multi-network compatibility across verticals such as telecommunications, agriculture, automotive, building automation, and consumer electronics. Market positions are being reinforced through high-performance hardware, firmware flexibility, and global support networks that ensure uninterrupted wireless communication. Modems are being applied in energy and utilities for smart metering, remote monitoring, and grid automation, ensuring consistent data transfer and operational efficiency. In healthcare, cellular modems are being utilized for patient monitoring devices, telemedicine applications, and real-time data reporting, enhancing accessibility and service reliability. Industrial and manufacturing sectors are being served with ruggedized modems engineered for machine-to-machine communication, predictive maintenance, and industrial IoT integration. Retail verticals are being represented with solutions optimized for point-of-sale systems, inventory tracking, and digital signage connectivity. Automotive and transportation are being advanced with modems designed for fleet management, navigation, and vehicle telematics, ensuring continuous network coverage and data security. Strategies in the market are being centered on multi-band support, low-latency communication, and secure network integration. Research and development are being allocated to improve data throughput, environmental durability, firmware upgrades, and compatibility with evolving cellular standards such as 5G and LTE-M. Product brochures are being structured with specifications covering network frequency bands, power consumption, interface options, environmental tolerances, and data protocols. Features such as remote management, secure data transmission, low-power operation, and multi-network compatibility are being emphasized to guide procurement and deployment decisions. Each brochure is being arranged to present technical performance, regulatory compliance, and integration guidelines. Information is being provided in a clear, evaluation-ready format to assist system integrators, technology providers, and procurement teams in selecting cellular modems that meet connectivity, reliability, and operational efficiency requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.4 Billion |

| Type | Embedded Modems, USB Modems/Dongles, Wireless Hotspot/Routers, and Peripheral Component Interconnect Express (PCIe) Modems |

| Technology | 4G LTE (Fourth Generation Long-Term Evolution), 2G (Second Generation), 3G (Third Generation), 5G (Fifth Generation), and NB-IoT |

| Application | Smartphones, Tablets & Laptops, IoT Devices, Wearables, Smart Devices, and Others |

| Vertical | Telecommunications, Agriculture, Automotive & Transportation, Building Automation, Consumer Electronics, Energy & Utilities, Healthcare, Industrial & Manufacturing, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qualcomm Incorporated, Intel Corporation, MediaTek Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Sierra Wireless, Inc., and Fibocom Wireless Inc. |

| Additional Attributes | Dollar sales by modem type and end use, demand dynamics across IoT, industrial, and consumer applications, regional trends in wireless connectivity adoption, innovation in 5G/4G integration, low-power design, and security features, environmental impact of electronic waste, and emerging use cases in smart cities, connected vehicles, and remote monitoring. |

The global cellular modem market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the cellular modem market is projected to reach USD 20.8 billion by 2035.

The cellular modem market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in cellular modem market are embedded modems, usb modems/dongles, wireless hotspot/routers and peripheral component interconnect express (pcie) modems.

In terms of technology, 4g lte (fourth generation long-term evolution) segment to command 47.9% share in the cellular modem market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Cellular Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cellular Rubber Market Growth - Trends & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

LTE Modem Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA