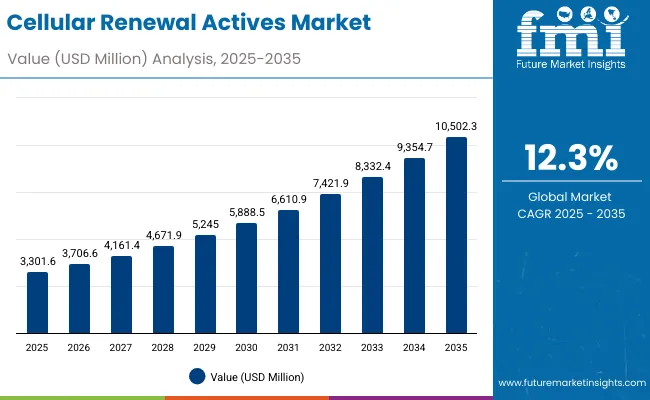

The Cellular Renewal Actives Market is expected to record a valuation of USD 3,301.6 million in 2025 and USD 10,502.3 million in 2035, with an increase of USD 7,200.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.3% and more than a 3X increase in market size.

Cellular Renewal Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Cellular Renewal Actives Market Estimated Value in (2025E) | USD 3,301.6 million |

| Cellular Renewal Actives Market Forecast Value in (2035F) | USD 10,502.3 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,301.6 million to USD 5,888.5 million, adding USD 2,586.9 million, which accounts for 35.9% of the total decade growth. This phase records steady adoption of retinoids, AHAs, and peptides across skincare serums, creams, and peeling solutions. The rise is driven by consumer demand for visible cell renewal, texture refinement, and dermatologist-tested actives. Serums dominate this period as they cater to over 51% of consumer demand, being lightweight, fast-absorbing, and suitable for daily routines.

The second half from 2030 to 2035 contributes USD 4,613.8 million, equal to 64.1% of total growth, as the market jumps from USD 5,888.5 million to USD 10,502.3 million. This acceleration is powered by the mainstreaming of clean-label claims, premium dermatology clinic partnerships, and consumer shift toward clinical-grade formulations. Beyond serums, masks/pads and advanced creams/lotions gain traction as multifunctional formats. The radiance and anti-aging & firmness functions accelerate, while peptides and growth factors rise in prominence as next-generation actives. Distribution expands across pharmacies, e-commerce, and premium beauty retail, reinforcing the omnichannel approach of leading brands.

From 2020 to 2024, the Cellular Renewal Actives Market grew steadily from USD 2,100 million to USD 3,000 million, driven by strong consumer adoption of serum-based AHAs, retinoids, and peptide-infused formulations. During this period, the competitive landscape was dominated by mass-premium brands like The Ordinary, Paula’s Choice, and La Roche-Posay, which controlled over 20% of combined revenue in key online channels. Competitive differentiation relied on clinical validation, visible performance in 4-8 weeks, and affordability, while luxury clinical-grade solutions remained niche but growing. Service-based models such as dermatologist-led subscription skincare contributed less than 8% of total market value.

Demand for cellular renewal actives will expand to USD 3,301.6 million in 2025, and the revenue mix will shift as dermatologist-tested and clean-label claims grow beyond 50% share. Traditional active-led players face rising competition from clinical-grade innovators offering enzyme-based resurfacing, peptide-growth factor blends, and PHA-based sensitive skin exfoliants. Major serum and clinical skincare vendors are pivoting toward hybrid models that combine e-commerce subscription, dermatology clinic endorsements, and premium retail partnerships. Emerging entrants focusing on bio-fermented actives, microbiome-safe exfoliants, and peptide innovations are gaining share. The competitive advantage is moving away from just product strength to holistic efficacy, safety perception, and claim credibility.

Advances in active class innovation have significantly improved performance and consumer safety. Retinoids and retinols, long considered gold-standard for renewal, are now offered in encapsulated and stabilized forms to reduce irritation, expanding adoption among sensitive skin consumers. The popularity of AHAs, BHAs, and PHAs reflects growing consumer awareness of chemical exfoliation for texture smoothing, while enzyme-based actives like papain and bromelain are carving out a niche for gentler exfoliation.

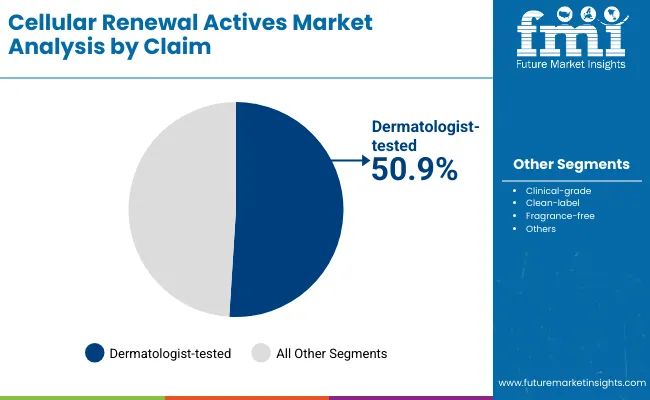

The market is also driven by peptides and growth factors, which not only stimulate cellular renewal but also support firmness and anti-aging outcomes, aligning with premium skincare positioning. Industries such as dermatology clinics, pharmacies, and premium beauty retail are reinforcing credibility through dermatologist-tested claims, which now account for over 50% of global market share.

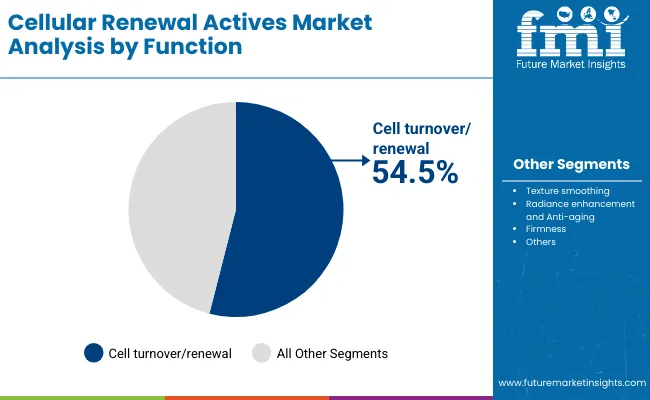

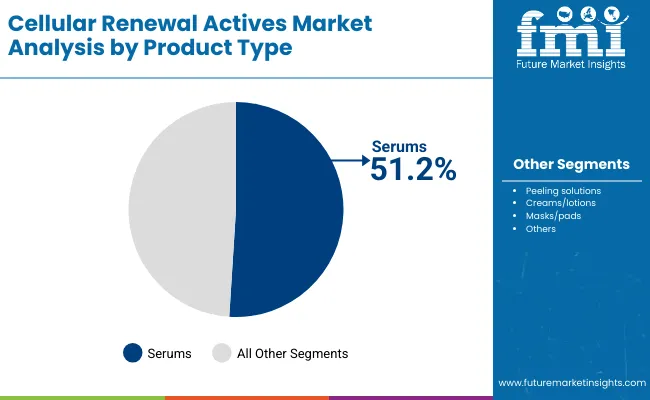

The expansion of e-commerce and subscription-based sales models has fueled rapid access to renewal actives. Innovations in serum textures, peeling solutions, and multifunctional creams are expected to open new application areas. Segment growth is expected to be led by cell turnover/renewal in functions, serums in product types, and dermatologist-tested claims in consumer preference, given their clinical backing and growing visibility through KOL dermatologists and social media amplification.

The Cellular Renewal Actives Market is segmented by active class, function, product type, channel, and claim. Active classes include retinoids/retinals, AHAs/BHAs/PHAs, enzymes (papain, bromelain), and peptides/growth factors, highlighting the core actives driving adoption. Functions are categorized into cell turnover/renewal, texture smoothing, radiance enhancement, and anti-aging & firmness, representing distinct consumer needs.

Product types encompass serums, peeling solutions, creams/lotions, and masks/pads, reflecting multiple skincare routines. Channels of purchase include e-commerce, pharmacies, dermatology clinics, and premium beauty retail, covering both direct-to-consumer and professional distribution. Claims span dermatologist-tested, clinical-grade, clean-label, and fragrance-free, underscoring how credibility, safety, and sustainability drive consumer choice.

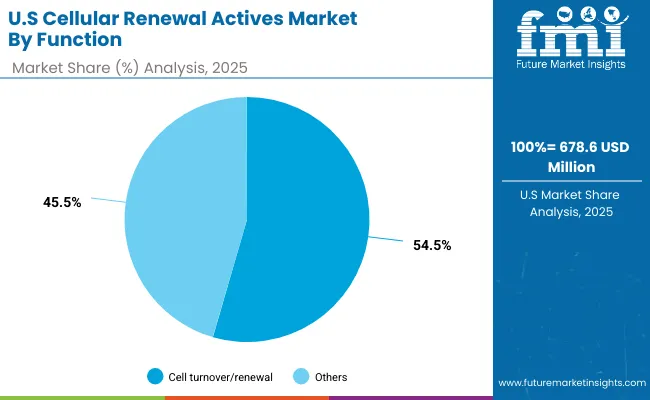

| Function | Value Share% 2025 |

|---|---|

| Cell turnover/renewal | 54.5% |

| Others | 45.5% |

The cell turnover/renewal function is projected to contribute 54.5% of the global market revenue in 2025, maintaining its lead as the dominant category. This is driven by the widespread use of retinoids and AHAs, which accelerate the natural shedding of dead skin cells and encourage healthier renewal. Consumers increasingly seek products that deliver visible changes in smoothness, brightness, and fine line reduction, positioning this function as the backbone of the category.

The segment’s growth is also supported by the mainstream acceptance of dermatologist-recommended retinoids and the innovation of gentler alternatives like retinaldehyde and PHAs for sensitive users. As clinical validation and digital dermatology consultations rise, cell turnover remains the central claim for renewal actives, ensuring its leadership over the decade.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 51.2% |

| Others | 48.8% |

The serums segment is forecasted to hold 51.2% of the market share in 2025, led by its lightweight, fast-absorbing format suited for high concentration delivery. These products are favored for their ability to penetrate deeper layers and offer targeted results, making them the most trusted format for renewal-focused consumers.

Their compact design, versatility across AHAs, retinoids, peptides, and enzymes, and strong alignment with dermatologist-tested claims have facilitated their dominance in e-commerce, pharmacies, and clinical settings. As consumers increasingly adopt layered skincare routines, serums are expected to remain the flagship delivery system for cellular renewal actives well into 2035.

| Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 50.9% |

| Others | 49.1% |

The dermatologist-tested segment is projected to account for 50.9% of global market revenue in 2025, underscoring the importance of clinical credibility in consumer decision-making. With rising sensitivity concerns and growing regulatory scrutiny, dermatologist-tested positioning assures consumers of safety and efficacy.

This claim resonates strongly in markets like the USA, Germany, and UK, where regulatory frameworks and professional endorsements heavily influence purchasing decisions. In Asia, particularly China and India, the claim boosts consumer trust in relatively new brands entering the renewal actives space. As clinical-grade and clean-label trends converge, dermatologist-tested validation will remain the most influential claim, reinforcing consumer loyalty and premium pricing.

Rising Consumer Shift Toward Clinical-Grade and Dermatologist-Tested Claims

One of the strongest drivers in the Cellular Renewal Actives Market is the growing consumer reliance on clinical-grade and dermatologist-tested formulations. With over 50.9% of market value in 2025 attributed to dermatologist-tested claims, it is evident that consumer trust is anchored in clinical validation. This demand is particularly strong in mature markets such as the USA and Germany, where regulatory oversight and consumer skepticism of “beauty-only” positioning push brands to secure dermatological endorsements, publish trial data, and highlight safety testing.

For example, brands like SkinCeuticals and La Roche-Posay have leveraged their clinical-grade heritage to dominate pharmacy and dermatology clinic channels, effectively blurring the line between skincare and treatment. This driver is amplified by social media dermatologists (DermTok, YouTube KOLs) who frequently recommend clinically tested actives, accelerating adoption across both premium beauty retail and e-commerce. As consumer awareness of long-term safety increases, clinical validation will not only sustain demand but also justify premium pricing and expand the clinic-pharmacy channel.

Rapid Growth in Emerging Asian Markets with Younger Demographics

Markets such as India (CAGR 22.2%) and China (CAGR 18.7%) are accelerating demand for cellular renewal actives, driven by demographic and lifestyle-specific factors. These countries have a relatively younger consumer base, which is increasingly exposed to preventive skincare concepts through K-beauty, J-beauty, and influencer-led education. Unlike Western markets, where cellular renewal is often associated with anti-aging, in Asia it is framed as glow, radiance, and preventive skin health.

Serums and peeling solutions dominate in these regions because younger consumers prefer affordable, fast-acting, and lightweight products that can integrate into multi-step routines. E-commerce platforms like Tmall, Nykaa, and Lazada are accelerating access, while local players are launching PHA-based and enzyme-led actives to differentiate from harsher Western AHA/BHA formulas. This driver is crucial because these regions are not only growing faster than global averages but also influencing global product development encouraging brands to develop sensitive-skin safe and multifunctional actives tailored to Gen Z and millennials.

Irritation and Tolerance Barriers in Active Classes

While retinoids and AHAs dominate renewal claims, their high irritation potential remains a major restraint. Consumers with sensitive skin or specific conditions (eczema, rosacea) often experience redness, dryness, and purging, which limits repeat purchase rates. This barrier is evident in Western markets, where demand for gentler alternatives such as retinaldehyde, PHAs, and enzyme actives is rising. The irritation issue also restricts penetration into dermatology clinics for sensitive patients and into broader mainstream retail where tolerance-friendly formulations are prioritized.

Brands are investing in encapsulation, micro-dosing, and time-release formulations to overcome this restraint, but the negative perception of “harsh exfoliants” still slows growth in consumer adoption. This is particularly challenging in pharmacy channels, where consumers expect safety-first skincare. As a result, innovation must focus on stability + tolerability alongside efficacy, or risk losing long-term consumer loyalty.

Regulatory Complexity and Ingredient Scrutiny Across Regions

The global market is restrained by regulatory fragmentation around active classes such as retinoids, peptides, and growth factors. In the EU, strict guidelines around concentration levels and permissible claims restrict how brands market their products compared to more lenient regions like the USA or Asia. Similarly, China’s National Medical Products Administration (NMPA) has introduced stringent filing and testing requirements for functional cosmetics, making clinical claims (anti-aging, renewal) harder to substantiate without extensive data.

This complexity not only slows time-to-market for global brands but also increases compliance costs, particularly for smaller entrants. Companies must often reformulate products for different regions, creating inefficiencies. Regulatory caution around stem-cell derived peptides or growth factors is another bottleneck, as these high-potential actives are under heavy scrutiny for safety and ethical concerns. As claims become more aggressive (“clinically proven to reverse aging”), compliance pressures will intensify, restraining free market expansion.

Bio-Fermented and Enzyme-Based Renewal Actives as Gentle Alternatives

A key trend reshaping the global market is the shift toward bio-fermented and enzyme-led actives (e.g., papain, bromelain). Unlike traditional AHAs and retinoids, these actives offer gentler exfoliation and renewal by breaking down proteins on the skin surface, making them highly suitable for sensitive skin and daily use. Their popularity is rising in Asia and Europe, where demand for clean-label and low-irritation solutions is higher.

Fermentation technologies are further introducing postbiotic and microbiome-balancing renewal actives, which combine cell turnover with barrier protection an angle that directly addresses consumer concerns about over-exfoliation. Global brands like Drunk Elephant and Sunday Riley are experimenting with enzyme blends in masks/pads and peeling solutions, positioning them as “modern exfoliation” alternatives. This trend represents not only product innovation but also a shift in consumer education, emphasizing gentleness and skin health over aggressive resurfacing.

Integration of Peptides and Growth Factors into Anti-Aging Renewal

While retinoids and AHAs remain strong, the fastest-growing innovation trend is the integration of peptides and growth factors into renewal products. These actives move beyond simple exfoliation, targeting cell signaling, collagen production, and firmness restoration. Their role in anti-aging & firmness aligns with rising consumer interest in multi-benefit skincare.

Premium brands like SkinCeuticals and Neostrata are leading in this space, combining peptides with established actives (retinoids, AHAs) to create hybrid formulations that deliver renewal plus structural repair. In Asia, bioengineered growth factors are being marketed as next-generation solutions for skin regeneration, appealing to both younger preventive users and older anti-aging consumers. This trend marks a shift from single-active hero formulations to synergistic blends, creating competitive differentiation while also raising barriers for smaller players due to R&D intensity.

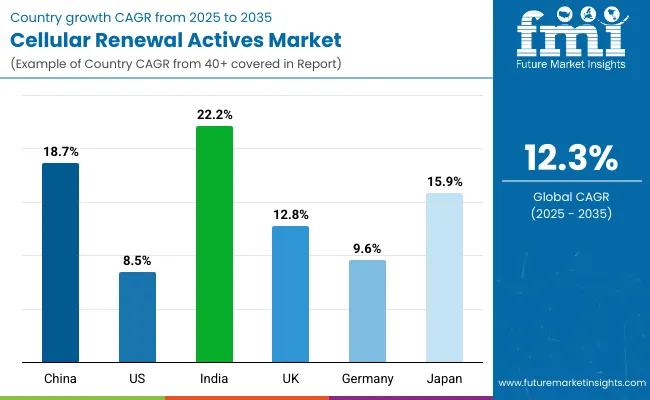

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.7% |

| USA | 8.5% |

| India | 22.2% |

| UK | 12.8% |

| Germany | 9.6% |

| Japan | 15.9% |

The Cellular Renewal Actives Market is witnessing highly uneven growth across countries, shaped by demographic profiles, consumer preferences, and channel dynamics. India leads with a CAGR of 22.2%, driven by a young and urbanizing population increasingly educated about preventive skincare and active-based routines. Affordable serums and peeling solutions dominate, distributed heavily through e-commerce and pharmacy chains.

China follows with a CAGR of 18.7%, where the appetite for premium serums and clinical-grade claims is accelerating. The market here benefits from strong K-beauty and J-beauty influences, a rising middle class, and regulatory reforms encouraging product innovation. Japan, at 15.9% CAGR, reflects mature yet dynamic demand where renewal actives are positioned more toward gentle, enzyme-based and PHA formulations, aligning with the country’s preference for subtle, long-term skin health rather than aggressive exfoliation.

On the other hand, growth in Western markets is steady but more moderate. The USA at 8.5% CAGR shows resilience, anchored by high adoption of dermatologist-tested formulations and a strong clinical-grade positioning in dermatology clinics and pharmacies. Germany (9.6% CAGR) is shaped by pharmacy-led trust, where regulatory rigor ensures dermatologist-backed claims dominate.

The UK, at 12.8% CAGR, shows a stronger tilt toward premium beauty retail and e-commerce adoption, with consumers responding well to influencer-driven education on retinoids and peptides. Collectively, this regional divergence indicates that Asia-Pacific will serve as the growth engine, particularly India, China, and Japan, while the USA and Europe will continue to represent strong value pools where clinical validation and safety claims remain the decisive purchase factors.

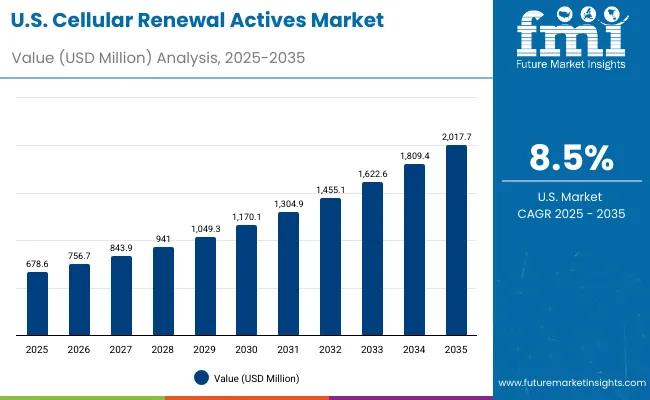

| Year | USA Cellular Renewal Actives Market (USD Million) |

|---|---|

| 2025 | 678.6 |

| 2026 | 756.7 |

| 2027 | 843.9 |

| 2028 | 941.0 |

| 2029 | 1,049.3 |

| 2030 | 1,170.1 |

| 2031 | 1,304.9 |

| 2032 | 1,455.1 |

| 2033 | 1,622.6 |

| 2034 | 1,809.4 |

| 2035 | 2,017.7 |

The Cellular Renewal Actives Market in the United States is projected to grow at a CAGR of 8.5%, led by consumer preference for dermatologist-tested and clinical-grade formulations. Demand is particularly strong in pharmacies and dermatology clinics, where cell turnover/renewal products account for over 54% share. Serums dominate the USA landscape due to their efficacy-driven perception and ability to integrate into multi-step routines, while creams/lotions expand adoption among mature consumers seeking anti-aging benefits. Rising consumer awareness of peptides and growth factors is diversifying demand away from just retinoids and AHAs. Regulatory scrutiny and emphasis on safety claims create opportunities for premium brands to differentiate through clinical studies and endorsements from dermatology KOLs.

The Cellular Renewal Actives Market in the United Kingdom is expected to grow at a CAGR of 12.8%, supported by applications in premium beauty retail, dermatology clinics, and online subscription services. British consumers are highly responsive to influencer-driven education on actives such as retinoids and AHAs, which has accelerated serum adoption. At the same time, clinical-grade and clean-label claims are boosting credibility, especially in pharmacy-driven purchases. Masks and pads are increasingly popular in the UK, positioned as convenient “at-home clinic” solutions for exfoliation and radiance enhancement. Partnerships between premium retailers and dermocosmetic brands are further fueling market penetration.

India is witnessing rapid growth in the Cellular Renewal Actives Market, forecast to expand at a CAGR of 22.2% through 2035, the highest globally. A sharp increase in serum and peeling solution demand is driven by urban Gen Z and millennial consumers, who adopt preventive skincare routines early. Tier-2 and tier-3 cities are showing rising penetration through cost-effective e-commerce platforms and pharmacy chains. Affordable PHA-based and enzyme-led actives are gaining popularity as gentler alternatives to stronger retinoids and AHAs, helping overcome sensitivity barriers. Educational outreach by dermatologists and beauty influencers is accelerating awareness, while international brands entering India are partnering with local online-first retailers for rapid scale-up.

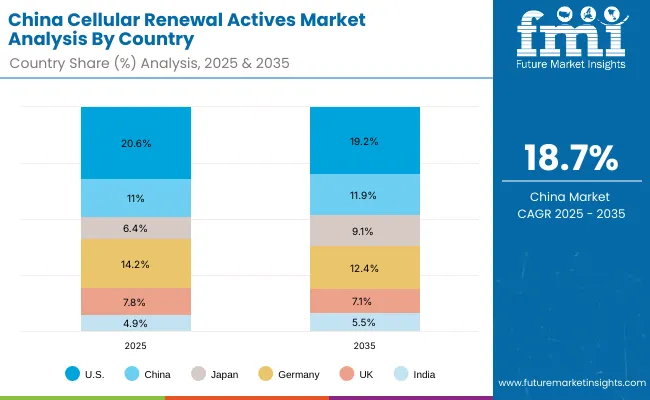

The Cellular Renewal Actives Market in China is expected to grow at a CAGR of 18.7%, among the highest of leading economies. This momentum is driven by premium serum adoption, clinical-grade positioning, and K-beauty/J-beauty influences that emphasize exfoliation and radiance. E-commerce platforms such as Tmall and JD.com are critical growth enablers, while local C-beauty brands are competing through enzyme and peptide innovation. Demand for masks/pads is accelerating, as consumers embrace weekly at-home exfoliation as part of multi-step routines. Regulatory reforms are tightening claim requirements, but they also create trust and opportunity for brands that can prove clinical efficacy and dermatologist-tested safety.

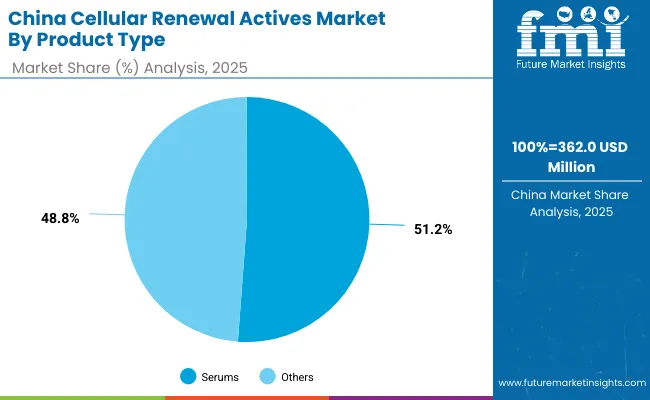

| China by Product Type | Value Share% 2025 |

|---|---|

| Serums | 51.2% |

| Others | 48.8% |

The Cellular Renewal Actives Market in China is valued at USD 362.0 million in 2025, with serums leading at 51.2%. The dominance of serums is a direct outcome of China’s multi-step skincare routines, influenced heavily by K-beauty and J-beauty traditions, where lightweight, high-potency formats are preferred for layering. Chinese consumers increasingly demand visible radiance and texture improvements, which has accelerated the adoption of serum-based AHAs, retinoids, and peptides. Portability, versatility, and compatibility with both daily and weekly routines enhance adoption, allowing serums to integrate into both mass-market e-commerce brands and clinical-grade dermatology offerings.

This advantage positions serums as the essential format for exfoliation, renewal, and preventive anti-aging, while masks/pads remain popular for episodic radiance boosts. Clean-label and clinical-grade claims are gaining traction among China’s rising middle-class consumers, with peptides and enzyme-based renewal actives increasingly marketed as gentler, science-backed alternatives. As the country continues its digital-first retail expansion, AI-driven personalization tools on platforms such as Tmall and JD.com will strengthen serum penetration and fuel mass-market accessibility.

| USA by Function | Value Share% 2025 |

|---|---|

| Cell turnover/renewal | 54.5% |

| Others | 45.5% |

The Cellular Renewal Actives Market in the United States is valued at USD 678.6 million in 2025, with cell turnover/renewal leading at 54.5%. This dominance reflects the USA consumer preference for scientifically validated, performance-driven formulations, especially those backed by dermatologist endorsements. Products focusing on cell renewal, such as retinoids and exfoliating acids, are heavily adopted in pharmacies and dermatology clinics, where safety and clinical claims hold significant weight. Anti-aging and firmness benefits are often communicated as secondary outcomes of renewal-focused products, strengthening this segment’s lead.

The USA market also benefits from a strong ecosystem of dermatology KOLs, subscription skincare platforms, and premium pharmacy chains, which amplify demand for dermatologist-tested renewal actives. While serums dominate in channel versatility, creams and lotions are also popular among older demographics for anti-aging. As regulatory oversight and consumer awareness intensify, clinical-backed renewal actives will continue to expand across both professional and consumer skincare spaces, making this segment the backbone of USA adoption.

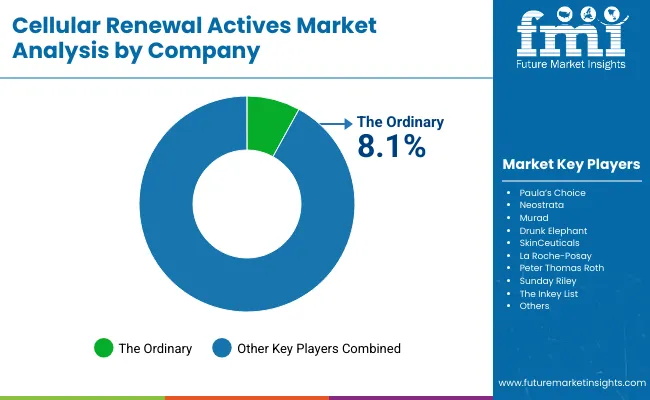

The Cellular Renewal Actives Market is moderately fragmented, with mass-premium brands, clinical-grade dermocosmetic leaders, and niche innovators competing across diverse channels. Leading players such as The Ordinary, Paula’s Choice, and La Roche-Posay hold significant share, driven by their serum-first strategies, affordability, and dermatologist-tested claims. Their strategies increasingly emphasize online distribution, clinical trial validation, and clean-label formulations to retain trust among sensitive-skin consumers. Premium players including SkinCeuticals, Neostrata, and Murad are expanding clinical-grade positioning through pharmacy and dermatology clinics, where dermatologist endorsements accelerate credibility. These brands are accelerating adoption through peptide- and growth factor-based actives, making them highly relevant for anti-aging and firmness solutions.

Niche-focused providers such as Peter Thomas Roth, Sunday Riley, and The Inkey List drive differentiation with innovative textures, influencer partnerships, and hybrid enzyme/acid blends that appeal to early adopters and Gen Z. Their strength lies in customization, agility, and trend-led product launches rather than global scale.

Competitive differentiation is shifting away from single active hero formulas toward integrated product ecosystems that include multi-active blends, clinical claims, subscription-based retail models, and dermatologist collaborations. This reflects a broader market transition from affordable, efficacy-driven mass serums toward ecosystem-based skincare portfolios that combine scientific validation, omnichannel retail, and consumer education.

Key Developments in Cellular Renewal Actives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,301.6 million |

| Active Class | Retinoids / retinals, AHAs/BHAs/PHAs, Enzymes (papain, bromelain), and Peptides/growth factors |

| Function | Cell turnover/renewal, Texture smoothing, Radiance enhancement, and Anti-aging & firmness |

| Product Type | Serums, Peeling solutions, Creams/lotions, and Masks/pads |

| Channel | E-commerce, Pharmacies, Dermatology clinics, and Premium beauty retail |

| Claim | Dermatologist-tested, Clinical-grade, Clean-label, and Fragrance-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, Paula’s Choice, Neostrata, Murad, Drunk Elephant, SkinCeuticals, La Roche- Posay, Peter Thomas Roth, Sunday Riley, The Inkey List |

| Additional Attributes | Dollar sales by product type and function, adoption trends in dermatology clinics and e-commerce, rising demand for serums as the leading delivery format, sector-specific growth in anti-aging and radiance-enhancement functions, segmentation of sales by clinical-grade and dermatologist-tested claims, integration of AI-based personalization in e-commerce platforms, regional trends influenced by consumer demographics and skincare culture, and innovations in encapsulated retinoids, PHAs, a nd peptide-growth factor blends. |

The Cellular Renewal Actives Market is estimated to be valued at USD 3,301.6 million in 2025.

The market size for the Cellular Renewal Actives Market is projected to reach USD 10,502.3 million by 2035.

The Cellular Renewal Actives Market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in the Cellular Renewal Actives Market are serums, peeling solutions, creams/lotions, and masks/pads.

In terms of function, the cell turnover/renewal segment will command a 54.5% share in the Cellular Renewal Actives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Cellular Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cellular Rubber Market Growth - Trends & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA