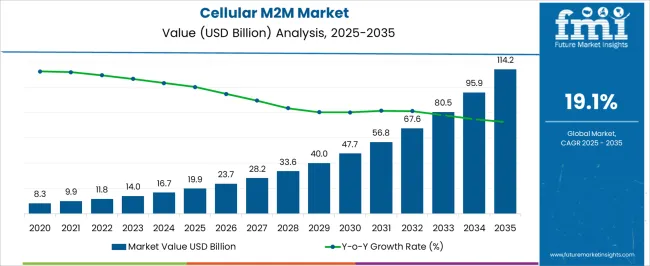

The Cellular M2M Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 114.2 billion by 2035, registering a compound annual growth rate (CAGR) of 19.1% over the forecast period.

| Metric | Value |

|---|---|

| Cellular M2M Market Estimated Value in (2025 E) | USD 19.9 billion |

| Cellular M2M Market Forecast Value in (2035 F) | USD 114.2 billion |

| Forecast CAGR (2025 to 2035) | 19.1% |

The cellular M2M market is expanding rapidly due to the increasing adoption of IoT solutions, rising demand for real time monitoring, and the growing need for seamless connectivity across industries. Enterprises are investing in advanced cellular communication technologies to support automation, predictive maintenance, and operational efficiency.

Enhanced network reliability through 4G LTE and the rollout of 5G are accelerating the deployment of M2M applications by ensuring low latency and high bandwidth. Healthcare, transportation, and logistics sectors are increasingly integrating cellular M2M solutions to improve asset utilization, patient monitoring, and supply chain visibility.

The market outlook remains strong as industries continue to leverage cellular M2M for cost reduction, productivity improvement, and strategic digital transformation initiatives.

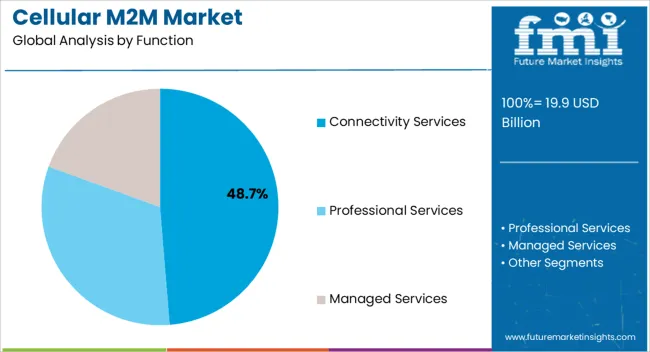

The connectivity services segment is expected to account for 48.70% of the total revenue by 2025 within the function category, making it the leading segment. This growth is being driven by rising demand for reliable mobile network services that enable seamless machine to machine communication across global networks.

Enterprises rely on cellular connectivity for uninterrupted device integration, efficient remote monitoring, and data exchange. The growth of smart infrastructure and the expansion of IoT ecosystems have further increased reliance on connectivity services.

As industries adopt cloud based platforms and data driven decision making, the role of connectivity services is being reinforced, establishing their dominance in the market.

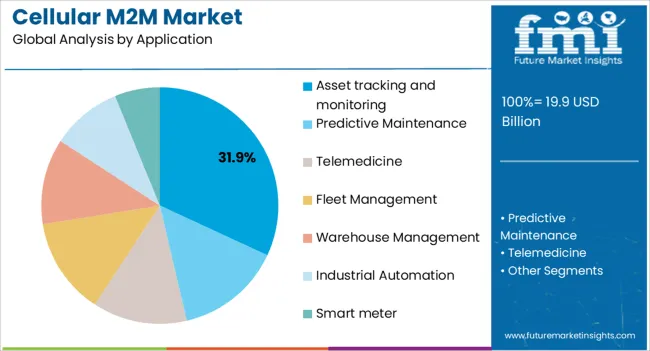

The asset tracking and monitoring segment is projected to hold 31.90% of total market revenue by 2025 under the application category, making it the most prominent area of adoption. The segment’s leadership is attributed to the rising need for real time visibility, theft prevention, and predictive asset management across logistics, transportation, and industrial sectors.

Cellular M2M enables organizations to monitor the location, condition, and performance of critical assets in real time, thereby improving operational efficiency and reducing downtime. Increased focus on supply chain optimization and compliance requirements has further accelerated the deployment of asset tracking solutions.

As enterprises seek enhanced transparency and accountability, asset tracking and monitoring remain central to M2M adoption.

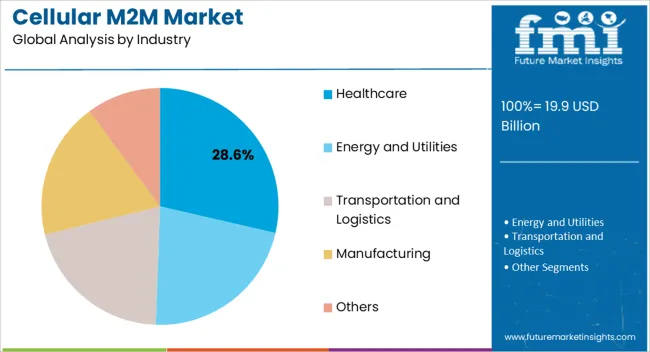

The healthcare segment is anticipated to contribute 28.60% of market revenue by 2025 within the industry category, positioning it as the leading vertical. The dominance of this segment is attributed to the growing application of cellular M2M in patient monitoring, medical device connectivity, and emergency response systems.

Cellular enabled M2M solutions allow healthcare providers to deliver remote patient care, track medical assets, and ensure compliance with regulatory frameworks. The rising demand for telemedicine, chronic disease management, and real time patient data exchange is further driving adoption.

As healthcare systems globally invest in connected care infrastructure, the role of cellular M2M technologies is being reinforced, solidifying healthcare’s leadership in the industry category.

Access to wireless communication technologies and internet networks are the precursors for the M2M cellular gateway methods. With the growth in telecommunication infrastructure, the global cellular M2M industry is anticipated to expand its area of operation further strengthening in terms of customer base.

The market operation of many industries and service-providing companies is getting complicated by the assimilation of real-time data management and dissemination. Integration of cellular M2M connection is the most preferred way for enhancing the efficiency of such systems which offers a great opportunity for market growth.

In recent times, many regional business entities are entering into the global competition by establishing their subsidiaries in different parts of the world. So, the M2M cellular networks are expected to play a key role in this endeavor of business expansion. Invariably, it brings in a lot of opportunities for the cellular M2M industry on an international level.

For the success of cellular M2M networks, a huge amount of data needs to be recorded and managed at control units. So, data privacy and security can pose a key challenge for the great adoption of cellular M2M communication by the end users.

Strong data protection laws formulated by different national governments are anticipated to turn out to be particular restraints against America cellular market. The high sensitivity and security associated with customer data are projected to be a serious constraint for the growth of the IoT security market size in various countries. It is further expected to have some negative impacts on the cellular M2M industry as well.

The unavailability of sufficient appliances such as M2M cellular amplifiers or other parts for the maintenance and repairmen of existing systems has limited the growth of the global cellular industry share to some extent.

| Attributes | Details |

|---|---|

| Cellular M2M Industry Value (2020) | USD 6,355.7 million |

| Cellular M2M Industry Value (2025) | USD 11,930.2 million |

| Cellular M2M Industry Value (2025) | USD 14,018.0 million |

| Cellular M2M Market Value (2035) | USD 80,726.9 million |

| Cellular M2M Market Growth Rate (2025 to 2035) | 19.1% |

| Cellular M2M Industry Growth Rate (2020 to 2025) | 17% |

The market, in the preceding years, has observed a market valuation of USD 6,355.7 million in 2020. By the end of 2025, the market gained revenue of USD 11,930.2 million, expanding at 17% CAGR.

With the introduction of disruptive technologies such as machine learning (ML) and the Internet of Things (IoT), the usefulness of cellular M2M connections has increased manifold. The significant growth in the information technology (IT) sector has also boosted the performance of cellular M2M communication devices by integrating them with powerful software solutions.

Other areas of digital technology like big data analytics, cloud computing, and intelligent systems are anticipated to further augment the global cellular M2M industry size in the coming days. Furthermore, the integration of such advanced technologies has also increased the traffic through the M2M cellular gateways installed at any facility. For this reason, the demand for M2M cellular booster is observed to be growing in the market. This is anticipated to further boost the cellular M2M industry size during the forecast years as well.

The market is estimated to reach USD 14,018.0 million in 2025, and by the end of 2035, the market valuation is projected to be USD 80,726.9 million. From 2025 to 2035, the market is projected to expand at a CAGR of 19.1%.

The evolution of the industrial Internet of Things or IIoT by the implementation of Industry 4.0 is suggested to raise the demand for cellular M2M boosters dominating other segments of the global cellular M2M industry.

| Segment | Connectivity Services |

|---|---|

| Market Share (2025) | 59.5% |

| Market Size (2025) | USD 8,340.71 million |

| Market Size (2035) | USD 48,031.97 million |

As per the previous market analysis report by FMI, the connectivity services dominated the global cellular M2M industry by volume and revenue. This segment is predicted to maintain its dominance for some years with a CAGR of 19.3% over the forecast years from 2025 to 2035. In 2025, the connectivity services accounted for 59.5% value share.

Integration of cellular M2M communication in some of the key sectors such as transportation and healthcare sector is predicted to be a crucial factor for the top performance of the connectivity services segment.

The performance of the other two segments of professional services and managed services has remained marginal over the past years. But, with the increase in demand for personalized cellular M2M solutions, there is an anticipation of a significant growth surge in these two segments in the future.

| Segment | Asset tracking and monitoring |

|---|---|

| Market Share (2025) | 38.4% |

| Market Size (2025) | USD 5,382.91 million |

| Market Size (2035) | USD 30,998.78 million |

Installation of cellular M2M connections is high in large-scale industries and business units. This has rendered the application of cellular M2M for asset tracking and monitoring the maximum-grossing segment of the global cellular M2M industry. It is expected to witness a CAGR of 18.6% over the forecast years.

In 2025, the segment represented 38.4% market share. Such an impressive growth of the asset tracking and monitoring segment can be attributed to the fact that it increases the productivity of assets by checking the wasteful and poor operations.

The other applications of cellular M2M networks for predictive maintenance and industrial automation are also predicted to be an attractive segment for the market players during the forecast years.

Cellular M2M technologies have been prominently used in the transportation and logistics sectors. This sector still holds the position of the top user of M2M cellular gateways for payment of charges and wages in remote areas. With the growth of the transportation and logistics industry, the segment is expected to remain the leading end user of the global cellular M2M industry.

The use of M2M cellular modems has also been observed to gain traction in the manufacturing segment in the recent past. The expansion of e-commerce websites has created a huge requirement for funds transfer facilities in far-flung areas. This rise in demand is anticipated to create a huge demand for cellular M2M networks in the manufacturing segment as well.

| Region | Value Share (2025) |

|---|---|

| North America | 28.6% |

| Europe | 23.4% |

| The United States | 20.2% |

| Germany | 8.9% |

| Japan | 7.1% |

| Australia | 2.7% |

Geographically, North America has a significant cellular M2M network across the world. The presence of a robust infrastructure for early adoption of any type of connectivity technology has made this region extremely responsive toward the latest technological integrations. Also, due to the presence of some global leaders of telecommunication companies like AT&T, Verizon, and T-Mobile in the United States, a lot of innovations in M2M cellular modems are achieved in this region.

The United States alone contributes about 20.2% to the revenue share of the global market with its regional cellular M2M industry estimated to be valued at USD 16,306.65 million by the end of the forecast period. The other global leaders providing cellular M2M solutions are mostly present in nations of South East Asia such as China, Japan, and South Korea. Asia Pacific follows North America in the growth rate by the contribution of these 3 countries which is more than 16% of the global cellular M2M industry share.

dDiverting from the large end users of M2M cellular gateways, most of the key players are now focusing on providing devices for daily transactions such as:

This shift in customer base is emerging to be a powerful strategy for the key players to remain competitive in the market. Acquisition and partnership with software companies are some of the other strategies adopted by the key players of the global cellular M2M market to increase the brand value of their products.

Key Players in the Cellular M2M Industry are as follows:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million/ billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; the Middle East & Africa; and Oceania |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, Italy, France, the United Kingdom, Spain, Russia, GCC Countries, China, India, Australia & New Zealand, and ASEAN |

| Key Segments Covered | Function, Application, Industry, and Region |

| Key Companies Profiled |

AT&T; Verizon; T-Mobile; Vodafone; Telefonica; Ericsson; Arm Holdings; KPN |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global cellular M2M market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the cellular M2M market is projected to reach USD 114.2 billion by 2035.

The cellular M2M market is expected to grow at a 19.1% CAGR between 2025 and 2035.

The key product types in cellular M2M market are connectivity services, professional services and managed services.

In terms of application, asset tracking and monitoring segment to command 31.9% share in the cellular M2M market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Cellular Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cellular Rubber Market Growth - Trends & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA