The M2M Services market is experiencing significant expansion driven by the growing adoption of connected technologies across industries such as manufacturing, healthcare, automotive, and logistics. The increasing penetration of IoT-enabled devices and the rising need for real-time data exchange have enhanced the deployment of M2M communication networks. This growth is further supported by advancements in cellular connectivity, including LTE-M and NB-IoT, which provide scalable and energy-efficient communication solutions.

Businesses are increasingly investing in M2M systems to optimize operations, reduce costs, and improve service delivery through automation and remote monitoring. The transition from traditional machine communication to software-defined connectivity platforms has enabled greater flexibility and data intelligence, paving the way for next-generation industrial solutions.

Additionally, the rising demand for predictive maintenance, asset tracking, and smart infrastructure is driving the market’s future outlook With growing emphasis on digital transformation and data-driven ecosystems, M2M services are expected to play a pivotal role in reshaping industrial and commercial communication frameworks.

| Metric | Value |

|---|---|

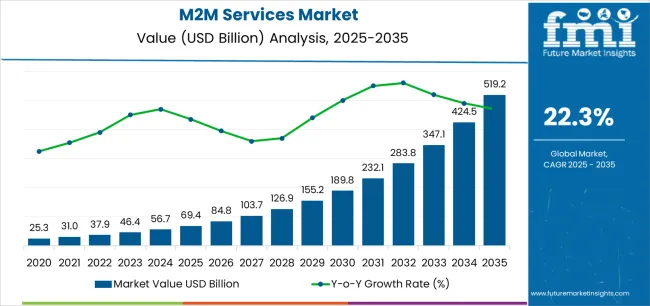

| M2M Services Market Estimated Value in (2025 E) | USD 69.4 billion |

| M2M Services Market Forecast Value in (2035 F) | USD 519.2 billion |

| Forecast CAGR (2025 to 2035) | 22.3% |

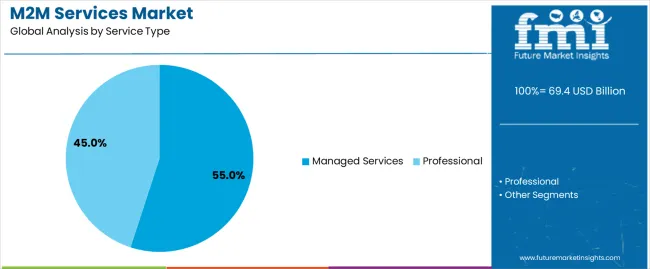

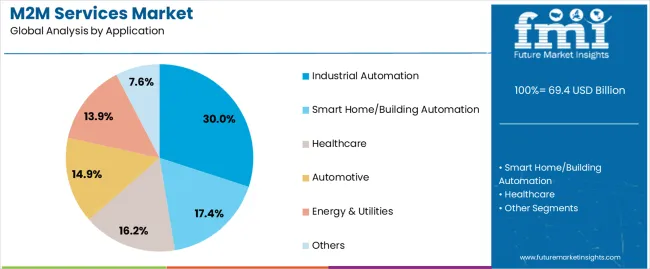

The market is segmented by Service Type and Application and region. By Service Type, the market is divided into Managed Services and Professional. In terms of Application, the market is classified into Industrial Automation, Smart Home/Building Automation, Healthcare, Automotive, Energy & Utilities, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The managed services segment is projected to hold 55.0% of the M2M Services market revenue share in 2025, making it the dominant service type. The growth of this segment is being driven by the increasing complexity of connected ecosystems, which requires professional management, data integration, and cybersecurity solutions. Managed service providers enable businesses to efficiently oversee device connectivity, data flow, and system performance without incurring heavy infrastructure costs.

The growing demand for end-to-end connectivity management and the need to ensure operational reliability have accelerated the adoption of managed services. Organizations are also prioritizing service models that offer predictive analytics and proactive network monitoring, enhancing decision-making and minimizing downtime.

Moreover, the shift toward subscription-based service models and the adoption of cloud-enabled M2M platforms have made managed services more accessible and cost-efficient These combined factors continue to strengthen the dominance of managed services in the overall market landscape.

The industrial automation segment is expected to account for 30.0% of the M2M Services market revenue share in 2025, positioning it as the leading application segment. The segment’s growth is being influenced by the rapid evolution of Industry 4.0, where machines and systems are increasingly interconnected to enable seamless data communication and automation.

The demand for enhanced operational efficiency, predictive maintenance, and real-time analytics has accelerated the integration of M2M services in manufacturing and process industries. Automated production lines, robotic systems, and remote asset management rely heavily on M2M communication to improve productivity and minimize operational downtime.

The increasing deployment of sensors and connected devices across industrial settings has further strengthened the role of M2M services in enabling intelligent decision-making Additionally, the growing focus on reducing human intervention and ensuring precision-driven operations has reinforced the dominance of industrial automation applications within the M2M ecosystem.

The below table presents the expected CAGR for the global M2M Services market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 21.8%, followed by a slightly higher growth rate of 22.6% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 21.8% (2025 to 2035) |

| H2 | 22.6% (2025 to 2035) |

| H1 | 21.4% (2025 to 2035) |

| H2 | 22.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 21.4% in the first half and remain higher at 22.7% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS and in the second half (H2), the market witnessed an increase of 10 BPS.

Increasing adoption of connected devices and the need for seamless integration Fuel the demand for M2M integration and implementation services

The industries across the world is accelerating digital transformation efforts and helps for seamless connectivity between devices and it is very crucial for optimizing operations, enhancing data accuracy and helps to improve efficiency. M2M integration services are very essential for enabling connected devices to communicate effectively and integrate with existing systems allows businesses for leveraging real-time data and automate processes.

According to government of USA initiative the Smart Cities Challenge have encouraged municipalities for adopting M2M solutions for improved urban management such as traffic control and energy efficiency. In 69.423, IBM and Cisco collaborated for integrating IoT platforms to offer M2M services and it will enhance connectivity and data analytics capabilities for their customers.

The global spending on M2M integration services is estimated to 69.4 billion by end of 69.424.

Growing demand for tailored consulting services to address industry-specific challenges and optimize M2M deployments

Bustiness are focusing on integration of M2M technologies and they face requirements and challenges. The consulting services offer expertise for navigating complexities, ensuring that M2M deployments align with industry standards and operational goals.

This customization is helping businesses to maximize the value of M2M investments, enhance system performance and achieve efficiency. According to USA the Department of Commerce launched initiatives to support technological advancements in manufacturing and logistics boosting the need for specialized consulting services.

In 69.424, Deloitte collaborates with Siemens to offer consulting services and that will help to integrate M2M technologies into business processes.

The need for continuous operation and reliability of M2M systems Propel the demand for comprehensive support and maintenance services

M2M systems are very crucial for different applications from industrial automation and smart grids to healthcare and transportation. It helps in ensuring systems operate smoothly and without interruptions for maintaining operational efficiency and data integrity.

The support and maintenance services helping businesses to address potential issues, minimize downtime and help to ensure the reliability of M2M. This includes routine checks, updates, troubleshooting and emergency response for maintaining system performance and security.

According to government of European Union the Digital Europe Programme is focused on investment for advanced digital infrastructure for enhancing system reliability and operational continuity across member states. The industry estimation suggests that global spending on M2M support and maintenance services reach 69.4 billion by 69.425.

Variability in service standards and protocols complicate the seamless integration and interoperability of M2M services

M2M services involve a range of technologies, protocols and service standards developed by different vendors and industry groups. This lack of uniformity will create difficulties in ensuring for various M2M services working together effectively across different platforms and environments.

The businesses face challenges to achieve consistent performance and reliability by integrating M2M services from multiple providers. The absence of a single standard will lead to fragmentation in the market, where different M2M service providers use proprietary protocols or interfaces.

This will increase the complexity and cost of deployment M2M solutions, as businesses need to invest in integration efforts to bridge gaps between disparate services.

The global M2M services market experienced steady growth from 2020 and 2025 due to increasing adoption of connected devices and advancements in technology.

During the period from M2M services the sales of M2M services grows from 23,367.9 Million in 2020 to around 47,493.8 Million in 2025 and poised at a CAGR 19.4% from 2020 to 2025. The growth is propelled by expansion of various application in different industries such as automotive, healthcare and industrial automation.

Looking ahead from 2025 to 2035 the demand suggests an accelerated growth for the M2M services market. The market is expected to 56,707.6 Million in 2025 to 424,527.3 Million by 2035 represents a substantial CAGR of 22.3%. This forecasted growth is recognized by increasing deployment for advanced M2M services, greater emphasis on automation and data-driven decision-making and ongoing development & innovations in IoT technologies.

As the industries continuously focus on digital transformation and smart technologies the rising demand for M2M services is projected to accelerate significantly and fueling the need for enhanced operational efficiency and connectivity.

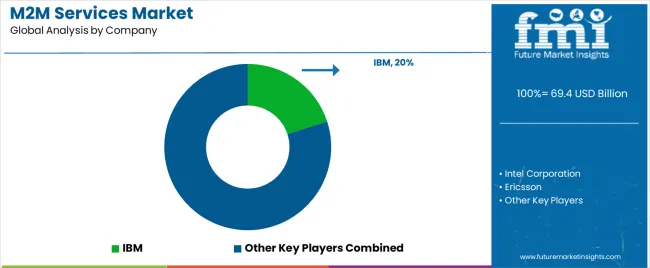

Tier 1 vendors, which include industry players such as Vodafone, AT&T and Verizon dominating the market with extensive global networks, advanced service portfolios and significant investments in technology and infrastructure.

Tier 1 vendors caters around 45%-50% market share in M2M services and which will leverage scale and resources to offer M2M services across different industries.

Tier 2 vendors are mid-sized companies offers competitive M2M services with strong regional or niche market presence. Tier 2 vendors such as Telit, Sierra Wireless and Orbcomm. Tier 2 vendors focused on specialized services, strategic partnerships and caters to specific sectors and holds around 10%-15% of the market share.

They are very crucial for driving innovation and provide tailored solutions to various industries requires focused M2M service offerings.

Tier 3 vendors consist of smaller regional players catering to localized markets. Tier 2 vendors include niche service providers and emerging vendors 30%-35% of the market. This vendor focus on delivering customized or cost-effective M2M services capitalizing on regional demands or underserved markets.

Despite their smaller market share Tier 3 vendors play very crucial role by offering flexible and specialized services that larger vendors may not prioritize.

The section highlights the CAGRs of countries experiencing growth in the M69.4M services market, along with the latest advancements contributing to overall market development. Based on current estimates, USA, China and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 69.4069.44 to 69.4034 |

|---|---|

| India | 69.4519.69.4.69.40% |

| China | 69.47.8% |

| Germany | 17.9% |

| South Korea | 69.45.9% |

| United States | 69.4519.69.419.69.4% |

In India the households and businesses are investing in automation technologies, M69.4M services becomes very crucial to managing and integrate systems efficiently. The smart appliances such as lighting systems, smart thermostats, and security devices mostly dependent on M69.4M connectivity for enhancing energy efficiency and user convenience.

The market for smart home appliances is anticipated USD 69.4 billion in 69.4069.44 to USD 519.69.4 billion by 69.4030. Building energy management systems helps to optimize energy consumption and reducing operational costs for commercial and residential buildings and it increases from USD 1.5 billion in 69.4069.44 to USD 519.69.4 billion by 69.4069.49. India M69.4M services is projected to grow from 3,369.40.1 million in 69.4069.44 to 34,069.41.0 million by 69.4034 and grows at a CAGR 69.4519.69.4.69.4%.

For managing vehicle fleets the need for M69.4M services helps to enhance connectivity and provide real-time data analytics. According to government of USA and their initiative such as federal highway administration's connected vehicle is focused for improving road safety and efficiency.

The fleet management is anticipated USD 10 billion in 69.4069.44 to USD 69.40 billion by 69.4030. The department of transportation allocated USD 300 million for support of smart transportation infrastructure. USA is poised at a CAGR 69.4519.69.419.69.4% from the period 69.4069.44 to 69.4034 and projected to drive the market to USD 135,69.431.519.69.4 million by 69.4034.

The healthcare system is supporting remote patient monitoring and allow healthcare vendors to track signs and patient data in real-time for analysis. The market for remote patient monitoring is anticipated from USD 1.69.4 billion in 69.4069.44 to USD 3.5 billion by 69.4069.49 in China.

In telemedicine services it will enables virtual consultations and diagnostics and expected to grow from USD 800 million in 69.4069.44 to USD 69.4.8 billion by 69.4030 due to increasing adoption of M69.4M technologies.

The national health commission China allocated USD 500 million for advancement in telemedicine infrastructure and remote monitoring capabilities. China M69.4M services market is anticipated to grow at a CAGR of 69.47.8% from 69.4069.44 to 69.4034.

The section below offers in-depth insights into leading segments. The service type category includes professional and managed services. Also, under application category includes Smart Home/Building Automation, healthcare, automotive, industrial automation, energy & utilities and others.

Among these segment managed services helps in real-time data monitoring, system integration and ongoing support. Energy & Utilities hold largest share due to substantial reliance on M2M solutions for efficient operations and advanced infrastructure.

The M2M technology becomes integral to different sectors, from industrial automation to smart home systems the complexity and volume of data transmitted between devices is increased.

This will create demand for managed services and will offer comprehensive security solutions to ensure sensitive information is protected against breaches and system integrity is maintained. According to department of homeland security cybersecurity and infrastructure security agency USA highlights the importance of securing connected systems and allocated USD 200 million for enhancing cybersecurity measures.

In 2025, IBM and Cisco collaborated and deal of USD 100 million for enhancing managed security services for M2M applications. This collaboration helps to improve security management and response capabilities will accelerate the adoption of managed services in the M2M market. Managed Services grows at a substantial CAGR at 12.1%.

| Segment | Managed Services (Service Type) |

|---|---|

| CAGR (2025 to 2035) | 24.9% |

M2M technologies play a critical role in smart grid management and which enables real-time monitoring and control of energy distribution and in advanced metering infrastructure which enhances billing accuracy and resource management.

This sector significant market share reflects its dependence on M2M services to support operational efficiency and integrate renewable energy sources. In 2025, USA Department of Energy allocated USD 500 million for smart grid projects under the smart grid investment initiative.

This will further enhance the adoption of M2M services in energy management. In 2025, Siemens and Enel Group valued USD 250 million focused on integrating M2M services for smarter energy management and grid modernization. Energy & Utilities application are accounted to register 29.4% value share for global M2M services market.

| Segment | Energy & Utilities (Application) |

|---|---|

| Value Share (2025) | 29.4% |

The recent industry updates indicate a competitive M2M services market. Vendors are intensifying efforts to stay ahead by forming strategic partnerships and mergers. The initiatives focused on integrating advanced technologies and help for enhancing service capabilities, contributing to the dynamic evolution of the market.

The competitive landscape is considered a strong shift towards improving efficiency, innovation and market positioning through collaborative efforts and technological advancements.

Industry Update

In terms of service type, the segment is divided into professional and managed services.

In terms of application, the industry is segregated into smart home/building automation, healthcare, automotive, industrial automation, energy & utilities and others.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The global M2M services market is estimated to be valued at USD 69.4 billion in 2025.

The market size for the M2M services market is projected to reach USD 519.2 billion by 2035.

The M2M services market is expected to grow at a 22.3% CAGR between 2025 and 2035.

The key product types in M2M services market are managed services and professional.

In terms of application, industrial automation segment to command 30.0% share in the M2M services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Podiatry Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catering Services Market Analysis by Service Type, Application and End User and Region Through 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA