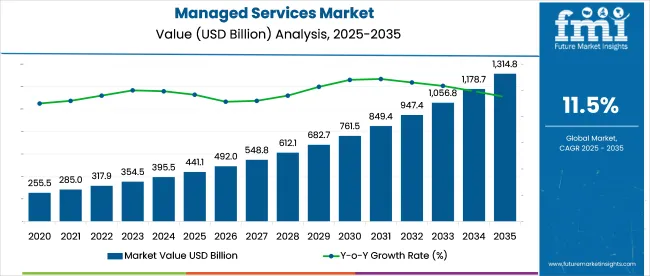

The managed services market is estimated at USD 441.1 billion in 2025. Demand is projected to reach USD 1,314.9 billion by 2035, growing at a CAGR of 11.5%. This growth is being fueled by rising demand for scalable IT infrastructure, cost-effective outsourcing models, and proactive threat mitigation.

Organizations across sectors are transitioning from traditional IT models to fully or partially outsourced services to optimize resources and ensure continuous system performance. Managed services providers (MSPs) are increasingly relied upon for everything from infrastructure management and network monitoring to cloud operations and data security. Companies like IBM, Accenture, and DXC Technology are expanding their global delivery capabilities with automation-first and AI-integrated offerings.

As of 2025, the managed services market accounts for approximately 25-30% of the overall IT services market, reflecting its role in ongoing infrastructure and application management. Within the cloud computing market, managed services contribute around 15-20%, driven by the need for support across multi-cloud and hybrid environments. In the broader outsourcing services market, the segment holds a 20-25% share, indicating a move from transactional outsourcing to long-term service partnerships.

For enterprise IT infrastructure, managed services represent 10-15%, particularly in network, storage, and data center operations. In cybersecurity services, managed offerings make up 30-35%, as organizations increasingly rely on external providers for threat detection, monitoring, and compliance. These shares demonstrate managed services’ integration across major IT domains.

In February 2025, IBM finalized its USD 6.4 billion acquisition of HashiCorp, completing integration of HashiCorp’s Terraform and Vault tools into IBM’s hybrid cloud platform. Rob Thomas, IBM’s SVP & chief commercial officer, commented: “With this acquisition, IBM is committed to continuing to invest in and grow the HashiCorp capabilities.” These moves underscore IBM’s strategy to build out managed and automated infrastructure services amidst growing enterprise demand.

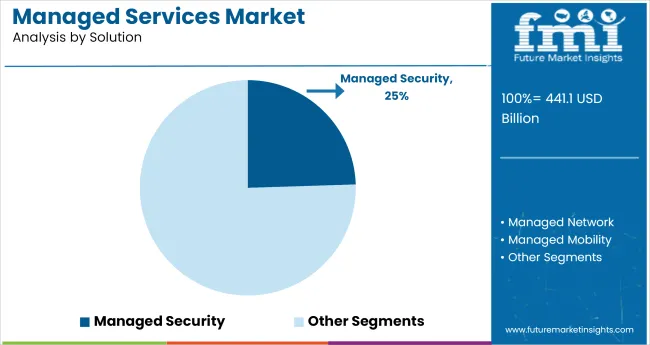

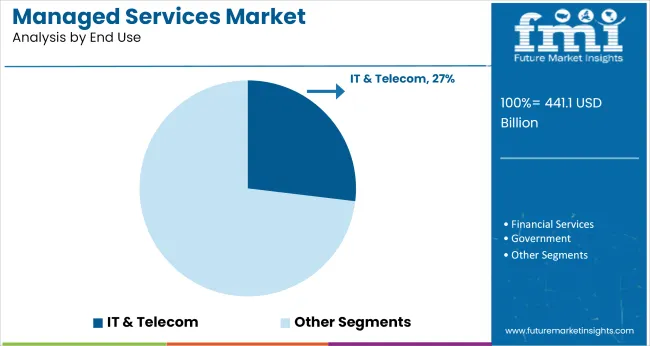

Managed services adoption remains strong across IT-heavy industries. In 2025, managed security services lead with 24.5% share by solution, reflecting increasing cybersecurity incidents. IT and telecom hold the top position among end-use sectors with 26.9%, driven by high infrastructure dependency.

Managed security commands 24.5% of the total market, driven by the rise in ransomware, zero-day attacks, and endpoint vulnerabilities. Enterprises allocate 15-18% of their IT budgets to managed security outsourcing. Vendors like IBM, AT&T Cybersecurity, and Palo Alto Networks offer threat intelligence, SIEM integration, and managed detection & response (MDR) through 24/7 SOCs. Regulatory compliance frameworks such as ISO/IEC 27001 and NIST 800-53 make continuous monitoring essential.

The IT and telecom sector accounts for 26.9% of total end-use demand, reflecting heavy reliance on uptime, network redundancy, and data center performance. Providers such as NTT Ltd., Cognizant, and HCLTech offer managed infrastructure, network, and BSS platforms to telcos and IT firms across hybrid environments. These enterprises face high volume SLAs, necessitating proactive monitoring and zero-downtime architecture.

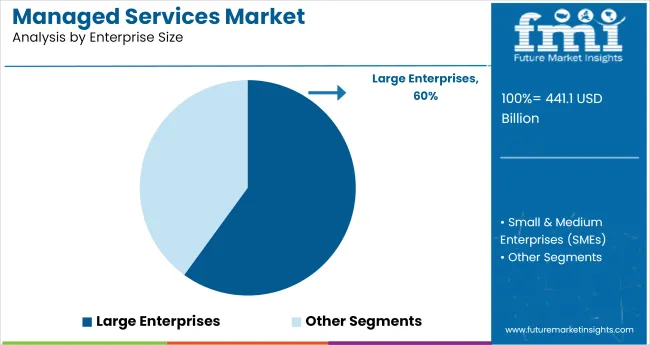

Large enterprises remain the dominant customer segment, accounting for over 60% of total managed services usage. These organizations operate across multi-region environments and rely on third-party providers to support cloud migration, disaster recovery, and service continuity. They typically have over 1,000 endpoints under management and integrate MSPs for cost control and specialist expertise. Companies like Capgemini, TCS, and DXC Technology service complex hybrid environments involving on-premises and hosted assets.

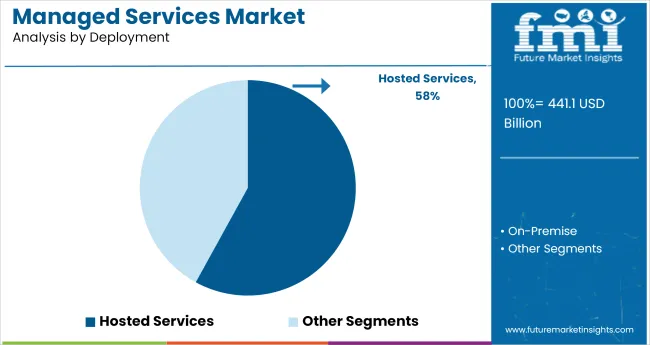

Hosted services are gaining traction across SMEs and large enterprises due to faster deployment, lower CAPEX, and built-in scalability. Hosted solutions now comprise 58% of total managed services contracts. Key adoption areas include email security, backup-as-a-service, and network monitoring. Vendors provide integrated dashboards and SLA-based escalation models through the cloud.

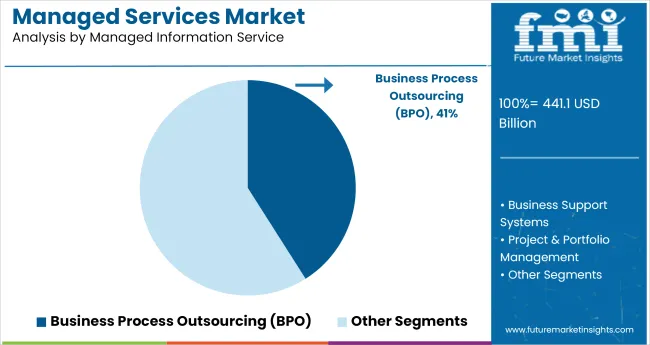

Business Process Outsourcing (BPO) remains the top contributor, accounting for over 41% of the managed information services segment. Enterprises are outsourcing functions like customer service, finance, and HR to reduce fixed overheads and improve scalability. Vendors such as Genpact, TCS, and Infosys BPM handle over 300 million global customer interactions annually, offering multilingual, omnichannel capabilities. Automation has reduced average processing time by 22-27% in F&A BPO services. Industry-specific BPO-especially in healthcare and BFSI-drives deal size and duration.

The managed services market is gaining momentum as businesses seek agile infrastructure and cost-efficient IT solutions. Growth is being driven by rising cyber threats, demand for 24/7 IT support, and the need for scalable service models.

Shift to Outcome-Based Contracts Alters Engagement Models

Mid-size enterprises and large corporations are adjusting procurement toward service-level agreements linked to uptime, response times, and cost-per-ticket metrics. MSPs are phasing out fixed-capacity retainers in favor of hybrid models combining remote infrastructure management with consumption-based billing. In North America, 41% of managed service deals signed in H1 2025 incorporated variable billing elements tied to cloud resource usage.

Across Europe, MSPs supporting industrial clients have integrated predictive maintenance and edge analytics into standard packages, shortening incident resolution windows by 19% on average. Asian providers are adopting modular contracts where clients selectively activate components like endpoint protection, database patching, or API monitoring, allowing finer cost control and service flexibility.

Cloud-Native Integration Redefines Service Delivery Scope

Managed service portfolios now extend beyond infrastructure to encompass workload optimization across multi-cloud environments. By Q2 2025, over 54% of contracts involving AWS, Azure, or GCP support included active cost governance tools, workload migration schedules, and container orchestration.

Clients are favoring providers with proprietary automation IP, reducing manual ticket volume by 27% year-over-year across Tier 2 markets. In financial services and retail, MSPs are embedding CI/CD pipeline management, enabling concurrent DevOps alignment and compliance reporting. Support teams are increasingly co-located with client developer squads, maintaining continuous visibility into code-level performance and rollback dependencies.

Margin Compression Linked to Talent Shortages and Contract Churn

Labor supply constraints, especially for certified cloud engineers and security analysts, are driving up baseline delivery costs. Average fully loaded compensation for AWS-certified architects rose 11% YoY in Southeast Asia by June 2025. Simultaneously, pricing pressure from client re-bidding cycles has compressed gross margins by 250-380 basis points across mid-tier MSPs. Vendors facing margin erosion have begun automating service desk tiers and decommissioning low-margin L1 support.

Some firms have exited legacy infrastructure support entirely, redirecting teams to manage Kubernetes clusters and zero-trust frameworks. While high-value contracts tied to regulated sectors offer pricing stability, low-differentiation support services continue to experience rate erosion and elevated churn risk.

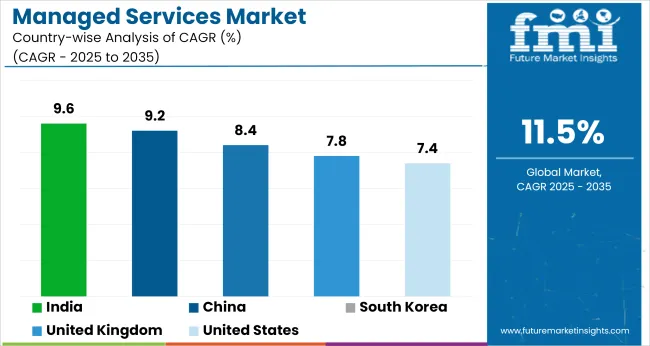

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 9.6% |

| China | 9.2% |

| South Korea | 8.4% |

| United Kingdom | 7.8% |

| United States | 7.4% |

Global demand for managed services is projected to increase at an 11.5% CAGR from 2025 to 2035. Among the five profiled countries, India and China, both BRICS members, post the highest national growth at 9.6% and 9.2%, respectively-trailing the global average by -17% and to 20%. South Korea records 8.4% (-27%), while OECD economies such as the United Kingdom (7.8%) and United States (7.4%) show gaps of -32% and -36%, respectively.

The divergence stems from a combination of digital transformation intensity, availability of skilled outsourcing talent, and IT infrastructure maturity. BRICS economies benefit from scalable service ecosystems and increase domestic enterprise IT spend, while OECD markets are limited by cost structures and legacy system inertia. The widening performance gap suggests an evolving shift in managed services leadership toward emerging markets with flexible capacity and rapid cloud adoption models.

The managed services industry in the United States is experiencing steady advancement, with growth anticipated at an annualized pace of 7.4% from 2025 to 2035. This trajectory reflects a deeper enterprise shift toward integrated IT ecosystems blending AI, zero-trust architecture, and container-based orchestration. Innovation in service delivery, particularly around DevSecOps, software-defined networking, and infrastructure observability, is redefining contract terms and lifecycle value.

Over the forecast period, the United Kingdom is projected to maintain a compound annual growth rate of 7.8%, driven by regulatory stringency and increased scrutiny around data governance. With cybersecurity obligations under GDPR and FCA guidelines intensifying, managed detection and response (MDR) tools and endpoint resilience systems are being widely outsourced. Local providers are capitalizing on demand for infrastructure built on sovereign principles-localized data centers, zero egress fees, and audit-friendly architectures.

China is positioned for rapid managed services adoption, registering an expected CAGR of 9.2% through 2035. This robust expansion is linked to national digital policy frameworks that encourage enterprises and SMEs to shift core IT functions to government-compliant platforms. Domestic vendors dominate the space, offering AI-integrated platforms and localized SLAs tailored to regional compliance thresholds. Demand is particularly pronounced in industrial hubs where automation, latency-reduction, and city-level digital governance are prioritized.

The managed services industry in India is forecasted to expand at a robust 9.6% CAGR over the next decade, reflecting increasing demand from SMEs, startups, and public cloud integrators. The shift is marked by a move away from traditional IT outsourcing toward full-stack platform services ranging from AI-assisted dashboards to infrastructure-as-code deployments. Digital India’s initiatives and favorable data policies continue to stimulate demand across Tier-II and Tier-III urban centers.

South Korea is anticipated to record a yearly average growth rate of 8.4% between 2025 and 2035, with market demand driven by convergence of edge computing, AI orchestration, and public-private infrastructure upgrades. Large enterprises and municipal bodies are embracing AIOps, centralized control layers, and predictive analytics to ensure business continuity. Sectoral uptake remains particularly strong across healthcare, logistics, and smart manufacturing segments.

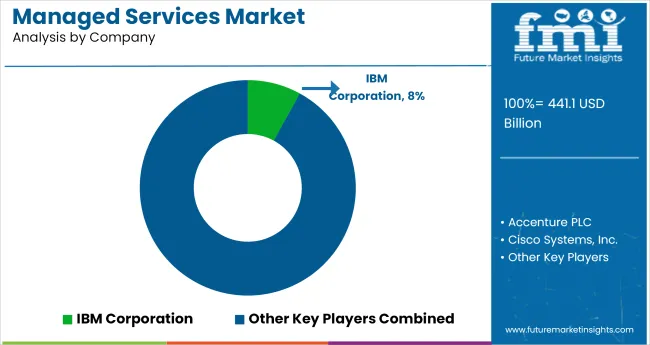

Leading Players - IBM Corporation holding 8% share

The managed services market is structured around complex integration needs and long-duration contracts, with firms like IBM Corporation, Accenture PLC, and Cisco Systems, Inc. maintaining strong client retention through global service delivery and portfolio depth. Accenture expands its capabilities through targeted acquisitions, while IBM aligns manage offerings with enterprise cloud migration. Cisco focuses on network performance and endpoint control to strengthen client lock-in. HPE and DXC Technology build recurring engagement by embedding services into operational workflows, limiting vendor replacement.

New entrants face structural barriers such as high infrastructure requirements, extended client onboarding cycles, and regulatory compliance constraints. Large vendors benefit from multi-year contracts, proprietary platforms, and operational scale. Emerging participants like Alcatel-Lucent Enterprise, Avaya Inc., and BMC Software pursue narrow service models tailored to regional or sector-specific gaps, often relying on internal development or strategic collaborations. Scaling remains difficult without established delivery ecosystems or embedded client relationships.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 441.1 billion |

| Projected Market Size (2035) | USD 1,314.9 billion |

| CAGR (2025 to 2035) | 11.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Segments Analyzed - By Solution | Managed Data Center, Managed Network, Managed Mobility, Managed Infrastructure, Managed Backup and Recovery, Managed Communication, Managed Information, Managed Security |

| Segments Analyzed - By Enterprise Size | Small & Medium Enterprises (SMEs), Large Enterprises |

| Segments Analyzed - By End-Use | Financial Services, Government, Healthcare, IT & Telecom, Manufacturing, Media & Entertainment, Retail, Others |

| Segments Analyzed - By Managed Information Service | Business Process Outsourcing (BPO), Business Support Systems, Project & Portfolio Management, Others |

| Segments Analyzed - By Deployment | On-premises, Hosted |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players | Accenture PLC, Alcatel-Lucent Enterprise, AT&T Inc., Avaya Inc., Ericsson, Fujitsu Limited, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Lenovo Group Limited, BMC Software, Inc., CA Technologies, Cisco Systems, Inc., DXC Technology Company |

| Additional Attributes | Dollar sales by solution type, enterprise size, and end-use, growing demand for IT infrastructure outsourcing, shift toward cloud-based deployment, increasing need for managed security services, trends in automation and digital transformation driving managed services adoption, regional differences in managed services uptake. |

The industry is segmented by solution into managed data center, managed network, managed mobility, managed infrastructure, managed backup and recovery, managed communication, managed information, and managed security.

Based on enterprise size, the market is classified into small & medium enterprises (SMEs) and large enterprises.

By end use, the managed services market is categorized into financial services, government, healthcare, IT & telecom, manufacturing, media & entertainment, retail, and others.

This segment includes business process outsourcing (BPO), business support systems, project & portfolio management, and others.

Deployment models include on-premises and hosted services.

Geographic segmentation includes North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa.

The global managed services industry is estimated at USD 441.1 billion in 2025.

The market is projected to reach USD 1,314.9 billion by 2035, growing at a CAGR of 11.5%.

Managed security leads the market in 2025 with a 24.5% share.

The IT & telecom segment dominates with a 26.9% market share in 2025.

Top player is IBM Corporation holding 8% Industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Managed Print Services Market by Type by Industry & Region Forecast till 2035

Managed SD-WAN Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Network Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Database Services Market Report - Growth & Forecast 2025 to 2035

Managed Workplace Services Market Analysis – Growth & Forecast through 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Managed Services Market

Managed Infrastructure Services Market Analysis by Solution, Application, and Region Through 2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Managed File Transfer (MFT) Market Size and Share Forecast Outlook 2025 to 2035

Managed Travel Distribution Market Size and Share Forecast Outlook 2025 to 2035

Managed DDoS Protection Market Report - Growth & Forecast 2025 to 2035

Managed Detection and Response Market

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA