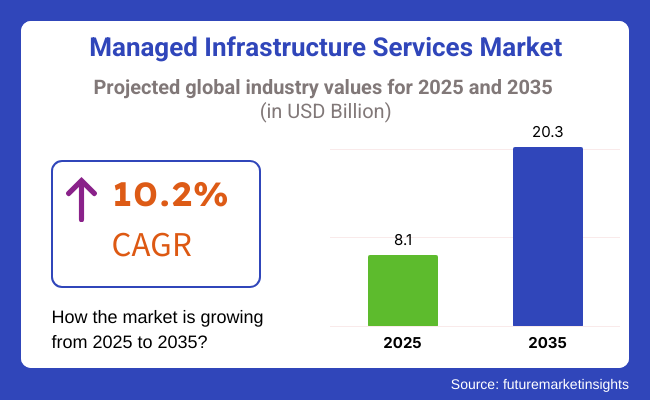

The managed infrastructure services market is projected to reach USD 8.1 billion in 2025 and expand to USD 20.3 billion by 2035, reflecting a CAGR of 10.2% during the forecast period. The increasing demand for cloud-based IT infrastructure, growing digital transformation across industries, and advancements in automation and cybersecurity solutions are driving growth.

Advancements in AI-driven IT operations, predictive maintenance, and real-time network monitoring are further expanding opportunities. Additionally, the integration of these services in hybrid cloud environments, edge computing, and enterprise IT ecosystems is enhancing the scope. Strategic investments in R&D, regulatory compliance measures, and collaborations among IT service providers, technology firms, and enterprises are fueling industry expansion.

The managed infrastructure services market experiences rapid growth as enterprises, cloud service providers, and government organizations increasingly adopt outsourced IT management solutions. Companies integrate AI-powered infrastructure automation, cloud-based service orchestration, and real-time network monitoring to enhance performance, improve security, and optimize IT operations.

Manufacturers, telecom operators, and smart city developers implement managed infrastructure services to optimize digital infrastructure, improve operational efficiency, and enhance network performance. AI-powered analytics enable automated network monitoring, real-time asset management, and cloud-native infrastructure scalability.

The increasing reliance on AI-driven network automation, IoT-enabled IT infrastructure, and smart data center management accelerates demand for the services that provide predictive fault detection, AI-enhanced traffic optimization, and automated cloud workload balancing. Companies integrate AI-powered IT resilience frameworks, cloud-native DevOps automation, and real-time security posture management to improve IT agility and service continuity.

The integration of AI-driven IT analytics, software-defined storage solutions, and blockchain-backed cybersecurity strengthens IT resilience, regulatory compliance, and cloud infrastructure performance. Businesses invest in AI-powered cloud cost management, intelligent IT resource provisioning, and automated endpoint protection to enhance IT security and efficiency.

Despite its importance, managed infrastructure service adoption in manufacturing, telecom, and smart cities faces challenges such as data privacy concerns, multi-cloud governance issues, and skill gaps in IT automation. However, advancements in AI-powered network policy enforcement, edge computing IT management, and quantum-safe cybersecurity frameworks improve scalability and effectiveness in digital infrastructure modernization.

| Company | Contract Value |

|---|---|

| IBM Corporation | Approximately USD 1.2 billon |

| Accenture plc | Approximately USD 850 million |

| Fujitsu Ltd. | Approximately USD 500 million |

Between 2020 and 2024, the Managed Infrastructure Services market grew rapidly as enterprises sought scalable, cost-efficient solutions to manage IT infrastructure. Businesses migrated to cloud-based platforms, enhancing operational agility and reducing capital expenditures. Service providers leveraged automation, AI-driven analytics, and hybrid cloud management to improve infrastructure performance, security, and compliance.

Organizations prioritized digital transformation, adopting the services to streamline IT operations, optimize network performance, and ensure business continuity. AI-powered monitoring tools enabled predictive maintenance, while edge computing and IoT integration improved real-time data processing.

Despite these advancements, companies faced challenges such as cybersecurity threats, compliance complexity, and vendor lock-in. By 2024, service providers implemented AI-driven automation, multi-cloud strategies, and enhanced cybersecurity frameworks to address these concerns and improve service delivery.

Looking ahead to 2025 to 2035, the Managed Infrastructure Services market will experience transformative innovations, including AI-powered self-healing infrastructure, blockchain-enhanced security, and autonomous IT operations. Organizations will increasingly adopt zero-trust security models and decentralized network architectures to safeguard infrastructure against cyber risks.

Quantum computing will revolutionize infrastructure services by enabling real-time data processing at unprecedented speeds, optimizing IT workloads, and reducing downtime. AI-driven network orchestration will enhance automation, ensuring intelligent workload distribution and minimizing infrastructure inefficiencies.

With the rise of edge AI and decentralized cloud frameworks, the infrastructure services will evolve into hyper-intelligent ecosystems capable of autonomously managing IT resources. Businesses will leverage digital twins for real-time IT simulations, optimizing infrastructure performance, and predicting failures before they occur.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Enterprises adopted AI-based monitoring tools for predictive maintenance and issue detection. | AI-native infrastructure autonomously self-heals, optimizes resource allocation, and eliminates downtime. |

| Companies leveraged multi-cloud strategies to enhance IT flexibility and resilience. | AI-enhanced multi-cloud orchestration automates workload balancing, optimizing infrastructure costs and efficiency. |

| Businesses implemented advanced security measures to mitigate cyber risks. | AI-powered, zero-trust security models autonomously detect threats, enforce compliance, and minimize attack surfaces. |

| Enterprises integrated edge computing to reduce latency and enhance real-time data analysis. | AI-optimized edge infrastructure autonomously processes workloads, ensuring ultra-low latency and improved scalability. |

| Early blockchain applications improved data integrity and access control. | Decentralized blockchain networks ensure tamper-proof security, securing cloud and on-premises IT infrastructure. |

| High-performance computing addressed data-intensive workloads. | Quantum-powered IT management revolutionizes infrastructure scalability, predictive analysis, and resource efficiency. |

| Businesses utilized AI for network monitoring and operational improvements. | Fully autonomous AI-driven network orchestration dynamically adapts to workload demands, ensuring optimal performance. |

| Companies optimized IT infrastructure to reduce energy consumption. | AI-driven energy-efficient data centers and carbon-neutral cloud frameworks redefine sustainability in IT operations. |

| Enterprises explored decentralized computing models to enhance resilience. | AI-driven, decentralized cloud architectures support self-managed IT ecosystems, reducing dependency on central providers. |

| Organizations experimented with digital twin models for IT simulations. | Fully integrated digital twins optimize IT infrastructure, predict failures, and improve system performance. |

The Managed Infrastructure Services Market in the United States grows rapidly as enterprises adopt cloud-based solutions, AI-driven automation, and cybersecurity frameworks to enhance IT operations. Companies develop advanced services to optimize network performance, reduce downtime, and improve scalability.

The demand for hybrid cloud solutions, real-time monitoring, and predictive maintenance fuels expansion. Businesses focus on integrating AI-driven security solutions, IoT-based infrastructure monitoring, and automated workload management to enhance operational efficiency and cost-effectiveness. The rising adoption of edge computing and 5G further strengthens the industry landscape.

The USA technology, banking, and healthcare sectors integrate these services to ensure operational resilience and regulatory compliance. Additionally, government policies encourage businesses to invest in secure, scalable, and automated IT infrastructure management solutions.

The increasing adoption of software-defined networking (SDN) and AI-driven analytics further propels growth. Companies also implement DevOps automation to streamline IT infrastructure processes and improve service delivery.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

The Managed Infrastructure Services Market in the United Kingdom expands as businesses implement AI-powered IT management platforms to improve network security, automate infrastructure monitoring, and enhance system reliability. Companies integrate managed infrastructure solutions to reduce operational costs, increase IT agility, and optimize cloud migration strategies. The adoption of cloud-native applications, real-time analytics, and automated patch management drives growth.

The increasing adoption of cybersecurity-as-a-service, AI-driven IT analytics, and multi-cloud management accelerates expansion. Additionally, regulatory frameworks supporting digital transformation promote the adoption of these services across industries.

Businesses increasingly deploy zero-trust security models and cloud-based disaster recovery solutions to mitigate risks and enhance resilience. The market sees a surge in demand for remote infrastructure management (RIM) due to the rise of remote workforces.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.2% |

The Managed Infrastructure Services Market in the European Union grows as enterprises implement AI-enhanced automation, real-time IT monitoring, and cloud-native solutions. Countries like Germany, France, and Italy lead by integrating these services into finance, manufacturing, and public sector IT environments. Businesses invest in hybrid cloud solutions, containerized workloads, and AI-driven IT orchestration to optimize infrastructure performance.

The EU enforces strict data security and IT governance regulations, prompting companies to invest in GDPR-compliant managed infrastructure solutions. Additionally, advancements in AI-powered automation and IoT-driven infrastructure management accelerate the adoption of managed IT services across industries.

The integration of blockchain for secure data transactions and AI-based predictive maintenance further enhances market potential. The growing implementation of robotic process automation (RPA) streamlines infrastructure management and reduces human error.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.3% |

The Managed Infrastructure Services Market in Japan expands as enterprises integrate AI-driven IT automation, hybrid cloud solutions, and cybersecurity frameworks. Companies develop innovative services to improve data center efficiency, enhance IT security, and reduce operational complexity. The market benefits from advancements in quantum computing, AI-powered predictive maintenance, and software-defined IT infrastructure.

Japan’s focus on digital transformation, smart infrastructure, and AI-powered IT management drives the adoption of managed infrastructure solutions. Additionally, industries such as telecommunications, financial services, and manufacturing invest in cloud-based IT infrastructure to improve system resilience and operational agility.

The rise of AI-powered network optimization and IoT-enabled infrastructure monitoring further accelerates growth. Companies implement digital twin technology to simulate and optimize infrastructure performance in real time.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.4% |

The Managed Infrastructure Services Market in South Korea grows rapidly as enterprises implement AI-powered network monitoring, cloud-based IT operations, and automated system management. The government supports smart IT infrastructure initiatives, accelerating the adoption of managed IT services across industries. Businesses invest in AI-driven IT service management (ITSM) platforms, cybersecurity solutions, and edge computing for real-time infrastructure optimization.

Companies integrate real-time system analytics, proactive cybersecurity measures, and AI-driven IT automation to optimize infrastructure performance and enhance reliability. Additionally, advancements in 5G connectivity, digital twin infrastructure, and blockchain-driven security further propel growth. The expansion of hyper-converged infrastructure (HCI) and AI-driven workflow automation enhances scalability and cost efficiency across industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

Organizations rely on these services to ensure seamless IT operations, reduce downtime, and improve network resilience. Businesses deploy AI-driven predictive maintenance, automated workload balancing, and cloud-native infrastructure monitoring to enhance scalability and operational efficiency.

The increasing need for IT agility, digital transformation, and hybrid cloud solutions accelerates the adoption of these services with AI-powered network diagnostics, automated compliance enforcement, and real-time service optimization. Companies implement software-defined networking (SDN), infrastructure-as-code (IaC), and AI-enhanced threat detection to strengthen IT governance and cybersecurity resilience.

Managed infrastructure service providers enhance capabilities with multi-cloud management platforms, AI-powered service automation, and real-time system performance analytics to ensure proactive maintenance and risk mitigation. The integration of zero-trust security frameworks, blockchain-based data protection, and AI-driven workload orchestration strengthens IT infrastructure reliability and efficiency.

Despite their advantages, managed infrastructure services face challenges such as integration complexity, legacy system dependencies, and evolving cybersecurity threats. However, advancements in AI-powered network observability, real-time incident response, and automated IT governance address these concerns, ensuring sustained growth.

Banks, healthcare institutions, and retail enterprises use managed infrastructure services to improve IT reliability, ensure regulatory compliance, and enhance customer experiences. Unlike traditional IT management, modern managed services utilize AI-powered proactive monitoring, cloud-based disaster recovery, and real-time IT performance optimization to reduce operational disruptions and security risks.

The push for cloud-first IT strategies and cybersecurity enhancement fuels the adoption of these services for AI-driven network monitoring, automated cloud resource allocation, and IT service continuity. Companies integrate AI-enhanced ITSM (IT Service Management), real-time endpoint protection, and automated compliance reporting to streamline IT workflows and regulatory adherence.

The deployment of AI-powered threat intelligence, cloud security automation, and predictive IT maintenance strengthens system resilience and operational efficiency. Industry leaders invest in hybrid cloud infrastructure management, AI-driven helpdesk automation, and software-defined data centers (SDDC) to enhance IT service performance and scalability.

Despite its advantages, managed infrastructure service adoption faces challenges such as evolving IT compliance requirements, vendor lock-in concerns, and cost management complexities. However, innovations in AI-powered service orchestration, autonomous IT troubleshooting, and real-time IT performance analytics continue to improve adoption and scalability.

The managed infrastructure services sector is transforming at a fast pace as businesses increasingly move towards cloud-based offerings, automation by AI, and cybersecurity-focused IT operations management. Businesses focus on hybrid cloud, outsourcing of IT, and smart infrastructure monitoring to maximize performance and minimize cost of operations. This change is fueled by increased digital transformation projects, multi-cloud environment adoption, and the requirement for secure, scalable IT environments.

International IT service providers, cloud computing companies, and specialized managed service providers are key influencers in the market. The key capabilities of these players include automation-driven infrastructure management, AI-enabled IT operations, and cybersecurity solutions to provide buffer-free IT performance. Businesses are looking for managed service providers (MSPs) that provide end-to-end solutions involving cloud computing as well as AI-based predictive analytics to provide IT resilience.

Market expansion is happening because of a growing demand for hybrid and multi-cloud architectures, real-time monitoring of infrastructure, and increase in automation because of AI. Proactive IT support, predictive maintenance, and end-to-end security solutions need to be delivered, and MSPs must be able to do this if they want to stay in the competition. As businesses continue to expand their IT environments, managed infrastructure services will be a key enabler of smooth digital transformation in the long term.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IBM | 20-25% |

| Accenture | 15-20% |

| HCL Technologies | 12-17% |

| TCS | 8-12% |

| DXC Technology | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| IBM | Develops AI-driven infrastructure automation, hybrid cloud management, and cybersecurity solutions. |

| Accenture | Provides IT outsourcing, multi-cloud strategy consulting, and infrastructure modernization services. |

| HCL Technologies | Specializes in hybrid cloud infrastructure, AI-powered IT operations, and managed network services. |

| TCS | Focuses on digital transformation, IT infrastructure automation, and enterprise cloud solutions. |

| DXC Technology | Offers end-to-end managed IT services, cybersecurity frameworks, and AI-driven infrastructure analytics. |

Key Company Insights

Other Key Players (20-30% Combined)

The market covers Remote System Management & Monitoring, Disaster Recovery & Business Continuity Service, Information Security Audits & Assessment, and Others.

The market includes Telecom & IT, BFSI, Consumer Goods & Retail, Manufacturing, Healthcare & Life Sciences, Education, and Energy.

The market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

The Global Managed Infrastructure Services industry is projected to witness a CAGR of 10.2% between 2025 and 2035.

The Global Managed Infrastructure Services industry stood at USD 8.1 billion in 2025.

The Global Managed Infrastructure Services industry is anticipated to reach USD 20.3 billion by 2035 end.

North America is expected to record the highest CAGR, driven by increasing cloud adoption, cybersecurity concerns, and demand for scalable IT solutions.

The key players operating in the Global Managed Infrastructure Services industry include IBM, Fujitsu, Cisco, Accenture, Atos, DXC Technology, AT&T, Ericsson, Cognizant, Dell Technologies Inc., and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 13: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Industry, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 28: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Industry, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Managed File Transfer (MFT) Market Size and Share Forecast Outlook 2025 to 2035

Managed Travel Distribution Market Size and Share Forecast Outlook 2025 to 2035

Managed DDoS Protection Market Report - Growth & Forecast 2025 to 2035

Managed Detection and Response Market

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Managed Print Services Market by Type by Industry & Region Forecast till 2035

Managed SD-WAN Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Network Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Database Services Market Report - Growth & Forecast 2025 to 2035

Managed Workplace Services Market Analysis – Growth & Forecast through 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Cloud Managed Services Market

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA