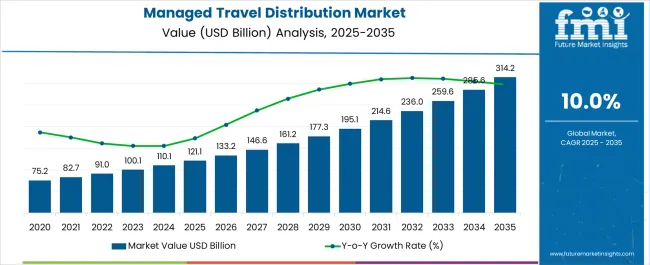

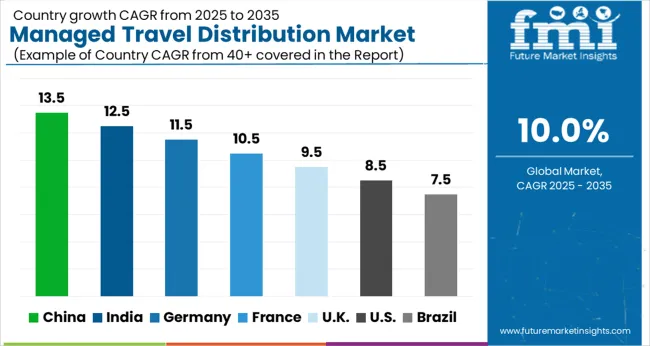

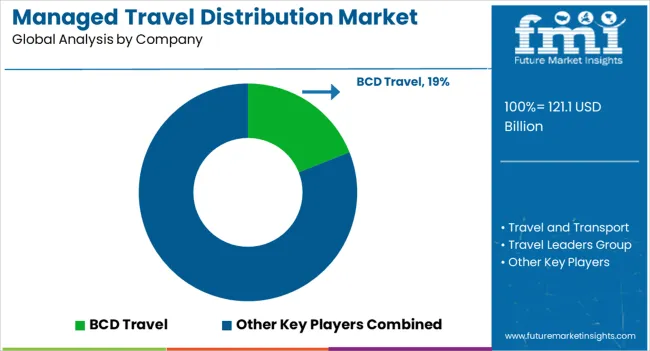

The Managed Travel Distribution Market is estimated to be valued at USD 121.1 billion in 2025 and is projected to reach USD 314.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Managed Travel Distribution Market Estimated Value in (2025 E) | USD 121.1 billion |

| Managed Travel Distribution Market Forecast Value in (2035 F) | USD 314.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The managed travel distribution market is evolving rapidly, driven by the convergence of digital platforms, rising enterprise travel volumes, and demand for cost-optimized corporate mobility solutions. Businesses are increasingly focusing on centralizing travel procurement and automating policy compliance through integrated travel management systems.

Enhanced demand forecasting, real-time expense tracking, and policy-driven booking workflows are influencing the adoption of structured distribution models. The rise of hybrid work models and the return of business travel post-pandemic have accelerated the deployment of scalable, tech-driven platforms.

Strategic partnerships between travel management companies and aggregators are improving transparency and efficiency in itinerary planning and approvals. Looking forward, the market is expected to benefit from AI-enabled personalization, dynamic content delivery, and growing emphasis on traveler well-being and sustainability as key pillars of managed travel strategies.

The market is segmented by Type, Booking Channel, Tourist Type, Tour Type, and Age Group and region. By Type, the market is divided into Customer Meetings, Clients’ Office Visit, Internal Meetings, Conferences, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourist Type, the market is segmented into Domestic and International. By Tour Type, the market is divided into Independent Traveler, Tour Group, and Package Traveller. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

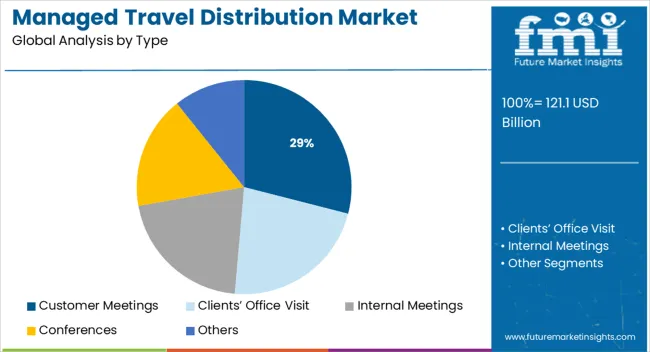

Customer meetings are projected to account for 29.0% of total revenue in the managed travel distribution market in 2025, establishing this category as the leading travel type. This segment's dominance is being influenced by the return of in-person engagements, client servicing needs, and strategic relationship building that require physical presence.

Organizations across sectors are reinstating travel for high-value client interactions, particularly where negotiation, onboarding, or technical support is involved. As virtual formats reach their limitations in complex or high-touch scenarios, business travel for customer meetings is regaining momentum.

Additionally, travel budgets are being prioritized for client-facing personnel, while internal travel is being consolidated or virtualized. This shift has strengthened the segment's revenue position within managed travel ecosystems.

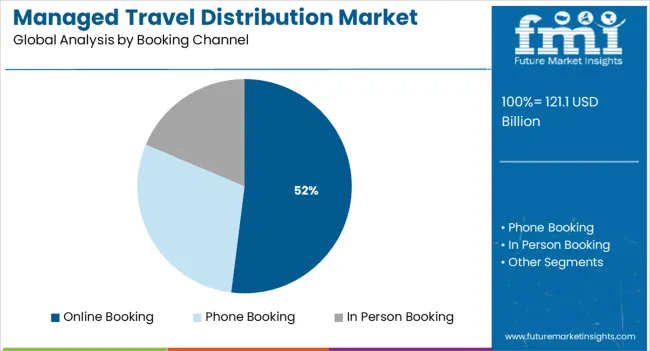

Online booking is expected to contribute 52.0% of the managed travel distribution market revenue in 2025, making it the leading booking channel. This leadership is driven by the integration of self-service portals, mobile applications, and AI-based itinerary optimization tools.

Travel managers are favoring platforms that centralize vendor content, enable traveler tracking, and enforce policy compliance seamlessly. The ability to deliver real-time pricing, dynamic bundling, and in-policy suggestions has significantly enhanced booking efficiency.

Additionally, employees are increasingly demanding consumer-grade user experiences in corporate tools, further accelerating online adoption. As travel ecosystems expand to include sustainability tracking and wellness integrations, online booking tools are being positioned as end-to-end platforms for enterprise mobility management.

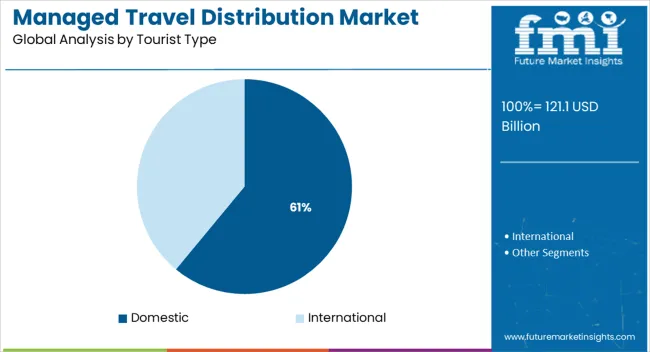

Domestic travel is expected to generate 61.0% of the total market revenue in 2025, making it the most dominant tourist type in the managed travel distribution sector. This trend is being driven by shorter planning cycles, reduced cost exposure, and risk mitigation policies that favor travel within national borders.

Corporates are increasingly optimizing regional sales visits, inter-city team meetings, and client demos through structured domestic travel programs. Government advisories, visa complexities, and operational uncertainties associated with international travel have further reinforced the domestic segment.

Moreover, enhanced regional connectivity, growing tier-2 business hubs, and increased service coverage by travel management companies have contributed to the segment’s sustained leadership. With enterprises aiming to reduce carbon footprints and operational expenses, domestic travel continues to form the core of managed distribution strategies.

The popularity of systems like managed travel distribution is gradually increasing. The need for organised and custom travel planning is growing as the number of new business travellers increases globally. The development of controlled travel distribution has been impacted by technological development and digitalisation. There are many luxury travel options, and they are expanding over time. The managed travel distribution market is steadily growing. Today's business travellers favour organised tours offered through managed travel distribution. The managed travel distribution industry is quickly evolving because of the prevalence of smartphones.

Systems like managed travel distribution are becoming more and more prevalent. As the number of new business travellers increases globally, there is an increasing need for organised and personalised travel planning. Technology advancement and digitalization have had an impact on the development of controlled travel distribution. There are numerous possibilities for luxurious travel, and they are growing each time. The market for managed travel distribution is expanding consistently. Business travellers of today prefer the organised tours provided by managed travel distribution. Due to the widespread usage of smart gadgets, the managed travel distribution sector is rapidly evolving.

One of the most notable effects of the transformation in corporate travel is the increase in leisure travel, and this trend is predicted to continue with more people getting vaccinated. More workers are seeking activities other than work during their period away from the office as the majority of the workforce is consisting younger generations. Despite the fact that 92% of businesses halted business travel in the early pandemic months, pre-pandemic statistics indicate that 90% of millennial business travellers included leisure activities in their travel plans. Given that COVID-19 vaccinations are already accessible, this may very likely happen by 2024.

Once every two to three months, travellers take these excursions. More than half of business travellers visiting overseas intend to stay longer so they may fit in recreational activities at their travel locations. Players in the tourism sector can benefit from this opportunity by utilizing new marketing strategies for local events and attractions for tourists.

The new generation of corporate travelers is responsible for the rising popularity of unusual lodgings in business travel. Travelers on business are more likely to investigate alternatives to typical chain hotels. More people are choosing to stay in apartments and other types of more comfortable lodging. Today's business visitors are becoming more and more accustomed to staying in smaller boutique hotels and lodgings that resemble homes, such as those provided by Airbnb.

These unconventional lodgings offer chances to discover the location in novel ways. Additionally, when the comfort and convenience of recreational opportunities are favored, more tourists tend to stay outside of the city core.

The majority of employees now view corporate travel as a perk, which is a significant factor in the Managed Travelling forecast. International business travellers also value travel for its benefits to their personal and professional development. Millennials, who make up the majority of the workforce, are also more open to travelling since they view it as an educational experience. Employees who travel frequently report feeling more empowered and engaged. Managed travel can even aid in boosting social skills and self-confidence.

More businesses are recognising these consequences and the connection between Managed Travel. An effective, creative corporate travel programme can be utilised as a strategy to boost retention rates, promote employee engagement, and promote organisational growth.

European travel management companies are offering huge discounts to attract more tourists

While the current coronavirus problem is undoubtedly a concern for travel management companies in Europe, it is almost equally difficult to find qualified workers. The war in Ukraine and other major geopolitical events are causing concern among European TMCs.

Since many people were forced to continue working despite the pandemic's low levels of business travel, remuneration has received a lot of attention. In 87 per cent of situations, transaction fees are still the most common form of payment. Some European TMCs claim that a tiny amount of their business is handled through subscription fees or a hybrid model with other elements of management fees and some elements of transaction fees, signalling the beginning of the emergence of other kinds of compensation.

Dubai is providing Visas that are valid for 5 years

An application for a multiple-entry tourist visa valid for five years is now available to those who want to travel to the United Arab Emirates. Dubai is presently regarded as one of the world's most technologically advanced cities. The location draws tens of thousands of tourists from all over the world due to its astounding infrastructure and thriving economy. The choice to enact a five-year, multiple-entry visa will result in an even greater influx of tourists. It is anticipated that the visa will be essential for the influx of companies and employees from around the world. As a result, there will be a rise in managed travellers visiting United Arab Emirates (UAE) from the corporate sector throughout the globe.

India is the fastest-developing business market

India is one of the fastest-growing economies in the world. There are a lot of companies in the country that are doing business at international levels. As a result, there has been a rise in the number of corporate travellers visiting the country, and also corporate travellers that are crossing the country's border to expand their reach internationally.

More corporate travellers are flying to India showing an 11.3% increase in market growth. Beating South Korea in spending for business travel, India is set to be part of the top 5 Managed Travel Distribution Markets. This will provide a concrete foundation for the sector which is expected to grow rapidly in the country.

Corporate companies are very cautious about their relationship with clients

The most preferred type of Managed Travel Distribution Market is Customer Meetings. Major changes are seen in the travel policies of the corporate sector post-pandemic. Businesses are adopting policies that aim towards less travel due to the damaged economic status of most companies. Hence, they are focusing on traveling just for factors important to their business.

Online Booking is More Preferred by Tourists

Online mode of booking is preferred by most of the managed travelers which majorly includes people from the corporate sector. More business travelers choose to make their own travel and lodging arrangements. It's possible that the self-booking tendency is a further effect of the demographic shift in business travelers. Millennials, after all, prefer self-booking when they travel so they can choose lodgings and flights that suit their interests.

Group Tour Type is More Preferred by Corporate Tourists

As the majority of managed travelers are traveling for the purpose of business, they tend to travel in groups or teams working on a specific project. Hence, the people opting for managed tours opt for the tour group packages which are specially designed as per the traveler's needs.

Globalization is evidently increasing in every part of the world

International tourists are more likely to take managed travel distribution tours as these are the people who are traveling for business and have to travel overseas for their related work. This trend is suspected to continue in the upcoming years.

Under the direction of a skilled manager, managed travel distribution can make business trips more luxurious while also saving money and time. Corporate travel is changing as a result of technology and scheduled travel working together properly. Managed travel is becoming more popular, and the majority of travel agents are using smart gadgets to offer their clients cutting-edge options. The managed travel distribution industry is being impacted by the rigorous corporate standards for internal travel and the massive domination of technology.

For instance:

As the corporate sector is something that functions 24/7. BCD travels offer its customer services at any time throughout the day. They provide assistance via phone calls, in offline and online modes as well. Moreover, they provide their clients with the information in quick time by their policy of 90 minutes delivery.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Colombia Germany, United Kingdom, France, Italy, Russia, South Africa, Turkey, United Arab Emirates (UAE), Egypt, Jordan China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Philippines, Cambodia, Vietnam, Australia & New Zealand. |

| Key Segments Covered | Type, Booking channel, tourist type, tour type, and Region. |

| Key Companies Profiled | Travel Leaders Group; Travel and Transport; BCD Travel; Expedia Inc.; Global Business Travel; HRG Travel; Travel perk; Agencia |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global managed travel distribution market is estimated to be valued at USD 121.1 billion in 2025.

The market size for the managed travel distribution market is projected to reach USD 314.2 billion by 2035.

The managed travel distribution market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in managed travel distribution market are customer meetings, clients’ office visit, internal meetings, conferences and others.

In terms of booking channel, online booking segment to command 52.0% share in the managed travel distribution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Managed File Transfer (MFT) Market Size and Share Forecast Outlook 2025 to 2035

Managed SD-WAN Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Workplace Services Market Analysis – Growth & Forecast through 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Network Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Managed Database Services Market Report - Growth & Forecast 2025 to 2035

Managed DDoS Protection Market Report - Growth & Forecast 2025 to 2035

Managed Print Services Market by Type by Industry & Region Forecast till 2035

Managed Infrastructure Services Market Analysis by Solution, Application, and Region Through 2035

Managed Detection and Response Market

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Cloud Managed Services Market

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Travel Advertising Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA