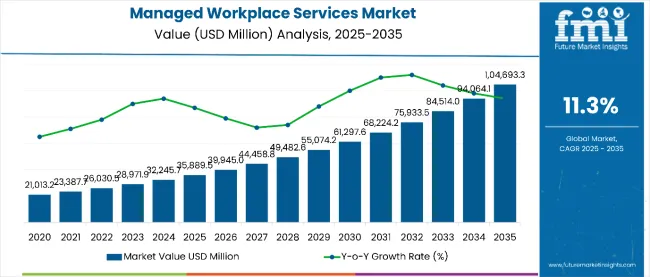

The global demand for managed workplace services is estimated to be worth USD 35889.5 million in 2025 and anticipated to reach a value of USD 1,04,693.3 million by 2035. Sales are projected to rise at a CAGR of 11.3% over the forecast period between 2025 and 2035. The revenue generated by Managed Workplace Services in 2024 was USD 32260.2 million. The market is anticipated to exhibit a Y-o-Y growth of 7.3% in 2025.

MWS market includes IT solutions designed to optimize and support workplace operations. Managed workplace services enable the proper functioning of end-user computing environments with an undisturbed level of functionality. MWS consists of the management of devices, application support, virtual desktop infrastructure, helpdesk solutions, and collaboration tools suited for different kinds of industries.

Managed workplace services aim to drive productivity in end-users while aligning IT activities with streamlined practices and scalable solutions for a hybrid and remote work environment. MWS enables businesses to improve user experience through automation, cloud computing, advanced analytics, as well as a reduction in overall costs and change in workplace demand.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 32260.2 million |

| Estimated Size, 2025 | USD 35889.5 million |

| Projected Size, 2035 | USD 1,04,693.3 million |

| Value-based CAGR (2025 to 2035) | 11.30% |

The MWS market is a rapidly growing entity, mainly driven by gradual adoption of hybrid work models, rapid digitalization, and emerging demand for scale-up IT infrastructure. Organizations from all major industries are adopting MWS to boost worker productivity, modernize infrastructure, and successfully operate diverse types of workplaces. Advanced technologies such as AI, automation, and cloud computing are transforming the market and allow providers to deliver more personalized and efficient solutions.

Increased investments in workplace modernization, especially in emerging economies, and focus on enhancing employee experience further fuel market growth, positioning MWS as a critical component of modern business strategies.

The managed workplace services market requires a clear understanding of Total Cost of Ownership (TCO) and Return on Investment (ROI) to deliver maximum business value. TCO covers all costs of acquiring and managing IT assets, while ROI reflects the benefits gained relative to these costs. Companies worldwide prioritize boosting productivity, cutting costs, and strengthening security through managed services. Regional factors like labor costs, regulations, and digital transformation shape these outcomes.

The Managed Workplace Services Market is rapidly evolving through the adoption of emerging technologies such as generative AI, AR/VR, wearables, and blockchain across leading economies. These innovations are driving enhanced productivity, improved security, and more immersive collaboration in diverse workplace environments. Businesses are focusing on leveraging these technologies to optimize operations, support hybrid workforces, and accelerate digital transformation initiatives.

The below table presents the expected CAGR for the global managed workplace services market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 10.3%, followed by a slightly higher growth rate of 10.7% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 10.3% (2024 to 2034) |

| H2, 2024 | 10.7% (2024 to 2034) |

| H1, 2025 | 11.3%(2025 to 2035) |

| H2, 2025 | 11.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 11.3% in the first half and remain relatively moderate at 11.5% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

The primary driver for the MWS market is the growing prevalence of hybrid work models, as organizations look for solutions that support employees working from diverse locations. With the norm now set by a mix of remote and on-site work, businesses need scalable and secure IT support to ensure seamless collaboration and productivity.

It responds to the requirement of remote work and provides VDI, cloud-based collaboration tools, and real-time remote troubleshooting for these employees. Not only are they enhancing the experience of the employee but are unburdening in-house IT teams, so being an important aspect of the strategy of a modern workplace along with MWS.

The rapid digital transformation across industries is driving the demand for managed workplace services because businesses are trying to modernize their IT infrastructure and enhance operational efficiency. Companies are increasingly adopting cloud-based platforms, automation, and advanced analytics to streamline workplace operations.

In this transformation, MWS providers play an important role by providing end-to-end solutions related to device management, application support, and employee onboarding, specifically designed for specific sectors. The driving forces of modernization at the workplace, especially in the health care, finance, and retail sectors, further boost the market potential.

It has been noticed that enterprise houses are giving more emphasis to the betterment of employee experience, which is regarded as an essential ingredient to be promoted for productivity and talent retention. Managed workplace services help provide employees with smooth, seamless access to IT, personalized tools, and applications so that daily activities are hardly disrupted.

Employees can be directed toward core business tasks, such as work assignments, by ensuring that self-service portals, AI-driven issue resolution, and proactive maintenance of technology are all deployed. Such solutions that benefit end-users, driving workplace satisfaction, also serve larger organizational purposes around efficiency and innovation.

Despite the many benefits, MANAGED WORKPLACE SERVICES software-based systems have high deployment costs that are a disincentive to entering the market, especially to SMEs. The cost of obtaining a software system and the time required to train staff to understand how to engage with it are deterrents to potential adopters; this is compounded in price-sensitive markets.

Again, the apprehension on the part of traditional operators, coupled with a lack of proper technical know-how in roll-out of such sophisticated systems, makes their deployment rather less widespread. This restraint is more dominant in an area where the infrastructure is thin and, thus, an impediment to market penetration and growth.

The global Managed Workplace Services industry recorded a CAGR of 11.3% during the historical period between 2020 and 2024. The growth of managed workplace services industry was positive as it reached a value of USD 32260.2 million in 2024 from USD 21060.4 million in 2020.

From 2020 to 2024, the MWS market experienced a steady growth pattern, primarily influenced by the massive shift to remote work that began with the COVID-19 pandemic and continued in the form of hybrid work models. Organizations needed scalable and secure IT solutions to support distributed teams and, thus, increased demand for services such as VDI, cloud-based collaboration tools, and proactive IT support. This period also witnessed accelerated digital transformation as businesses are now responding to the changing workplace dynamics.

It will fuel MWS adoption in no small measure and lead to a far more rapid growth rate in the market during 2025-2035 when improved automation, artificial intelligence, and analytics strengthen workplace efficiency and user experience.

Emerging markets in Asia-Pacific, Latin America, and the Middle East will form the core for this growth because companies in these regions will continue to modernize their workplaces to remain at the forefront in the market. Smart technologies will further cement MWS as an integral part of future workplace strategies, and thus the market is likely to experience growth over the next decade based on employee experience and sustainability.

Tier 1 comprises IBM Corporation, Hewlett Packard Enterprise (HPE), Accenture plc, Tata Consultancy Services (TCS), and Capgemini SE. It is the largest segment with end-to-end managed workplace solutions offered across industries and geographies using advanced technologies such as AI, automation, and analytics to provide innovative and scalable services like VDI, cloud-based collaboration tools, and device management.

Companies such as these - with high brand equity, deep global reach, and heavy investments in R&D- have the largest share of the market, providing complex solutions for large enterprises and spearheading the agenda of workplace modernization at scale.

Tier 2 includes players like DXC Technology, Wipro Limited, Cognizant Technology Solutions, Atos SE, and HCL Technologies, which have become well-established within niche regions and sectors. These companies offer a blend of holistic and niche services, primarily looking to enhance operational performance and employee experience for mid-sized and large businesses. They might not be as prominent globally as Tier 1 vendors, but in regional markets and specific offerings, these players are crucial participants in the MWS market. They also target industries such as healthcare, finance, and manufacturing by leveraging domain-specific know-how.

A Tier 3 firm includes companies such as Unisys Corporation, NTT Data Corporation, Fujitsu Limited, Infosys Limited, and Tech Mahindra Limited. This Tier 3 segments target managed workplace solutions, specialized in specific service offerings like IT helpdesk support, end-user device management, and workplace security. They target mainly SMEs or niche markets, exploiting their flexibility and cost advantages. The market share might be a bit smaller for Tier 1 and Tier 2 players. Innovative approaches and local expertise help set them apart, however, making them the game-changers to drive growth within the larger market.

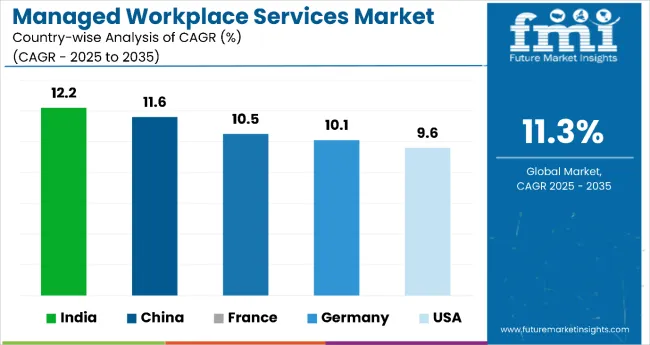

The section below covers the industry analysis for the managed workplace services market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, Italy, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 58.6% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 8.6% during the forecasted period.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 9.6% |

| Germany | 10.1% |

| France | 10.5% |

| China | 11.6% |

| India | 12.2% |

The USA market leads in this managed workplace services market because it is moving digitally at an unparalleled pace, integrating hybrid work across different sectors in the economy. Advanced workplace solutions are driven by strong IT infrastructure in the country, along with early adoption of technologies such as cloud computing, AI, and automation.

Enterprises of the USA focus much more on employee productivity and experience, thus propelling investment into scalable and highly secure MWS products like VDI and cloud collaboration, while this leading global service provider in this region, supplemented by a more than competitive environment, will build up continuous innovations, and accordingly adoption of MWS in various healthcare, financial and retail lines to catapult up market growth much more.

The managed workplace services market is developing rapidly in India, mainly driven by the boom of the Indian IT sector and India as a global hub for outsourcing services. Businesses worldwide come to India for managed workplace services that feature highly skilled professionals and low costs, including the outsourcing of services like IT helpdesk support, device management, and cloud-based operations.

Government initiatives promote digitalization and support hybrid work models, increasing demand for MWS in the domestic markets. Indian companies are also investing in automation and AI technologies to improve services, while startups and SMEs adopting modern workplace solutions contribute enormously to the growth of the market.

China’s managed workplace services market is experiencing robust growth, driven by the country’s rapid industrial digitalization, urbanization, and the increasing adoption of smart workplace technologies. As China continues to modernize its infrastructure and industries, businesses are leveraging MWS to enhance operational efficiency and support a growing workforce.

The government’s push for digital transformation under initiatives like “Made in China 2025” and smart city development further accelerates market demand. Hybrid work models combined with the rampant rise of IoT and cloud computing, have added opportunities for the MSPs to penetrate into newer heights. China also emerges in the manufacturing line with rapid strides in its IT investments which form a backbone of the new-age MWS environment.

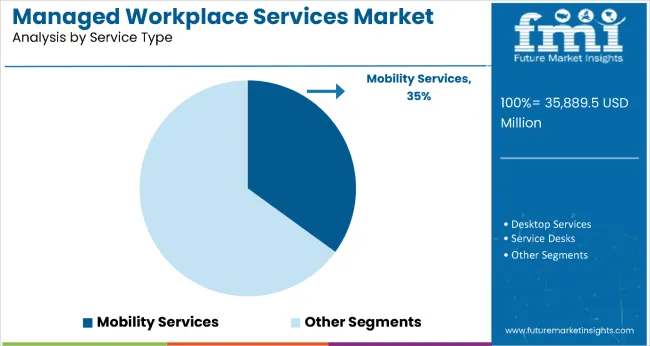

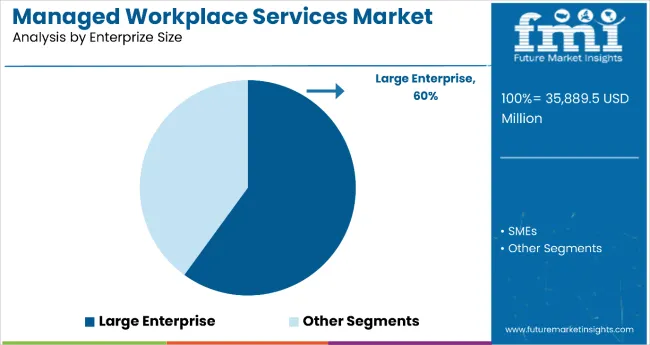

The section contains information about the leading segments in the managed workplace services industry. By Enterprise Size, the SMEs segment is estimated to grow at a CAGR of 12.4% during the forecasted period. moreover, by end user, the IT and Telecom segment has holding the share of 63.1% in 2024.

| End User | Share (2025) |

|---|---|

| Mobility services | 35% |

Mobility managed services provide end-to-end support for mobile devices, including configuration, security management, application deployment, and technical support. These services help businesses maintain productivity while ensuring data security, compliance, and seamless connectivity.

Additionally, they reduce the internal IT burden by outsourcing device lifecycle management and support tasks. With the rise in mobile workforce expectations, companies rely on these services to deliver consistent user experiences and operational efficiency across all endpoints. This segment accounts for 35% share.

| Enterprise Size | Share (2025) |

|---|---|

| Large Enterprise | 60% |

The large enterprise segment accounts for 60% share. Managed workplace services are popular in large enterprises because they offer a comprehensive and cost-effective way to streamline IT operations, enhance employee productivity, and support digital transformation.

These services include end-to-end management of devices, applications, service desks, and user support, allowing enterprises to focus on core business functions. By outsourcing workplace IT management, companies gain access to the latest technologies, proactive maintenance, and scalable solutions without the burden of in-house infrastructure and staffing.

The established global IT service providers have been in the managed workplace services (MWS) market with regional and emerging competitors. Because of the highly innovative offerings and customized solutions offered by them, competition in the market is sharp. The leaders of the market include large companies like IBM, HPE, Accenture, and TCS. These service portfolios are designed as complete solutions in a scalable, efficient, and agile manner based on advanced technologies like AI, automation, and cloud computing.

Regional players and niche providers, such as Unisys and Tech Mahindra, focus on cost-effective services, industry-specific, and targeted towards SMEs and mid-sized enterprises. Intense competition with continuous innovation compels the providers to invest in advanced analytics, employee-centric tools, and strategic collaborations, which will help to deliver better service quality and reach more international customers. Increased emphasis on hybrid work models and digital transformation further highlights the competitive dynamics in the MWS market.

In terms of Service Type is segregated Mobility Services, Desktop Services, Service Desks, Collaboration Services, Management Services and Other Service Types.

In terms of Enterprise Size, is distributed into Small and Medium Enterprises and Large Enterprises.

In terms of End User is segregated BSFI, Government, IT and Telecom, Healthcare and Life Sciences, Manufacturing and Automotive, Transportation and Logistics, Retail, Media and Entertainment and Others

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Managed Workplace Services industry is projected to witness CAGR of 11.3% between 2025 and 2035.

The global Managed Workplace Services industry stood at USD 32260.2 million in 2024.

The global Managed Workplace Services industry is anticipated to reach USD 104224.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.8% in the assessment period.

The key players operating in the global Managed Workplace Services industry include IBM Corporation, Hewlett Packard Enterprise (HPE), DXC Technology, Tata Consultancy Services (TCS), Wipro Limited and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Managed File Transfer (MFT) Market Size and Share Forecast Outlook 2025 to 2035

Managed Travel Distribution Market Size and Share Forecast Outlook 2025 to 2035

Managed DDoS Protection Market Report - Growth & Forecast 2025 to 2035

Managed Detection and Response Market

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Managed Print Services Market by Type by Industry & Region Forecast till 2035

Managed SD-WAN Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Network Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Database Services Market Report - Growth & Forecast 2025 to 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Infrastructure Services Market Analysis by Solution, Application, and Region Through 2035

Cloud Managed Services Market

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Workplace Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA