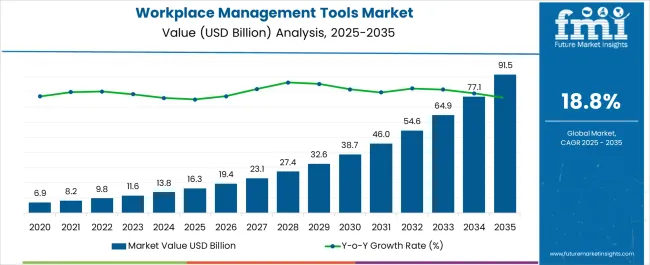

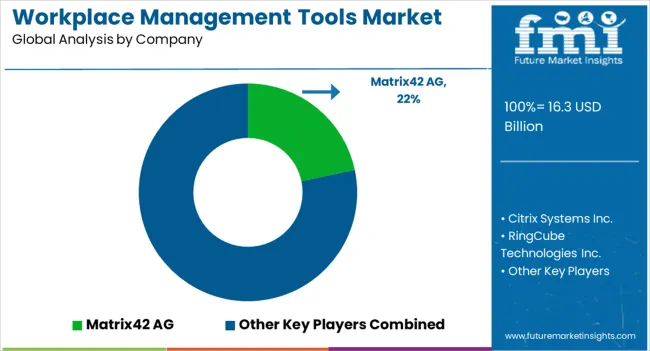

The Workplace Management Tools Market is estimated to be valued at USD 16.3 billion in 2025 and is projected to reach USD 91.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.8% over the forecast period.

| Metric | Value |

|---|---|

| Workplace Management Tools Market Estimated Value in (2025 E) | USD 16.3 billion |

| Workplace Management Tools Market Forecast Value in (2035 F) | USD 91.5 billion |

| Forecast CAGR (2025 to 2035) | 18.8% |

The workplace management tools market is witnessing strong growth as enterprises increasingly adopt digital platforms to optimize workforce efficiency, resource utilization, and compliance requirements. Rising demand for seamless integration of employee scheduling, performance monitoring, and workflow automation is driving widespread adoption across industries.

The growing emphasis on hybrid and remote work models has intensified the need for centralized platforms that ensure collaboration, productivity tracking, and resource planning. Technological advancements such as AI enabled analytics, cloud integration, and mobile accessibility are further strengthening the adoption of workplace management solutions.

Regulatory focus on workplace safety, employee well being, and operational transparency is also contributing to market expansion. With enterprises prioritizing efficiency, cost optimization, and adaptability to dynamic work environments, the market outlook remains highly positive.

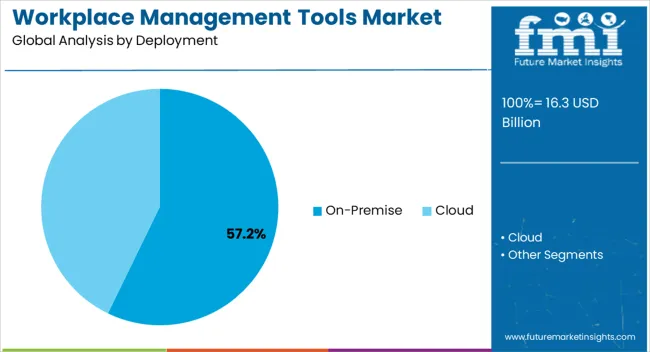

The on premise deployment segment is expected to account for 57.20% of the total revenue by 2025, making it the leading deployment mode. This dominance is attributed to the ability of on premise solutions to offer higher data security, full control over infrastructure, and compliance with internal governance policies.

Industries handling sensitive employee and organizational data have favored this deployment type due to its reliability and reduced dependence on third party hosting environments. The continued preference in sectors with stringent regulatory and privacy requirements has further strengthened its share.

As organizations balance digital transformation with security considerations, on premise deployment continues to hold significant relevance.

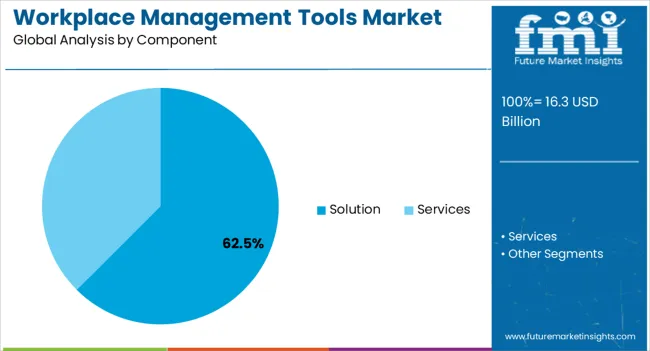

The solution segment is projected to capture 62.50% of total revenue by 2025 within the component category, positioning it as the most prominent segment. This growth is being driven by the demand for integrated platforms that combine scheduling, analytics, communication, and performance tracking in a unified interface.

Solutions have been increasingly deployed to reduce operational inefficiencies, improve decision making, and enhance employee engagement. Enterprises have recognized the value of scalable platforms that can adapt to diverse workforce models and changing business needs.

The segment’s leadership is further supported by advancements in customization, automation, and integration capabilities, enabling organizations to streamline processes and achieve measurable outcomes.

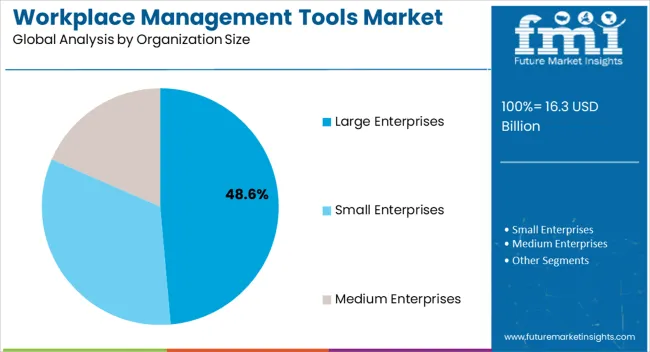

The large enterprises segment is estimated to contribute 48.60% of the overall market revenue by 2025, making it the leading organization size category. This leadership is explained by the extensive need for large scale workforce management across geographically distributed teams and complex operational structures.

Large enterprises have demonstrated the capacity to invest in advanced workplace management solutions that support scalability, data driven insights, and real time decision making. Strategic focus on employee productivity, cost reduction, and compliance has further reinforced adoption.

With greater resources and digital maturity, large enterprises have continued to lead the market in setting benchmarks for efficiency and workplace innovation.

Drivers

North America is experiencing a rapid increase in the workspace management tools market. In 2025, North America held a market share of 28.1% due to higher adoption and installation of workspace tools on virtual desktops by enterprises.

Currently, the United States holds a massive share due to increasing developments in smart building projects in the region. Most leading market players, such as Oracle, IBM, Trimble, Accruent, and Archibus, have headquarters in this region.

Also, advanced developments and establishments in the real estate and infrastructure sector increase the demand for workplace management tools in North America. Hence, North America is expected to dominate the market in the coming years.

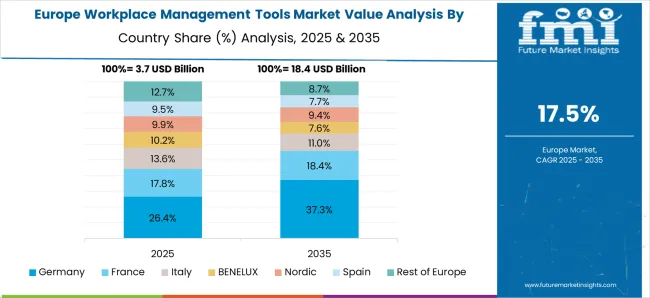

In 2025, a significant share of 25.1% was occupied by the workplace management tools market in Europe due to a decrease in the total ownership costs of workspace management tools in the region.

Within the European Union, continuous technological advancements are occurring throughout the region, such as in Norway, Finland, Sweden, Denmark, the Netherlands, Switzerland, and the United Kingdom, which holds a strong position in national technological strength.

How is the Start-up Ecosystem in the Workplace Management Tools Market?

The workplace management tools market survey explains that various business models are emerging all the time, sometimes due to market changes and sometimes due to technological advancements, culminating in brand-new and exciting trends. It is becoming increasingly common for start-ups to focus on innovation, merge and acquire, and develop the appropriate frameworks and architectures.

Workplace Management Tools Market: Key Contracts/ Agreements/ Acquisitions

Most workplace management tools market competitors adopted partnerships as a key strategy to expand their geographical footprint and upgrade their product technologies.

Recent Developments in the Workplace Management Tools Market

Due to the competitive environment, organizations increasingly require workplace management tools to keep their workers motivated and organized. This ensures optimal productivity to stay abreast of the changing times. Companies like SISQUAL, Oracle, NICE Systems, and Infor are introducing a wide range of innovative workplace management tools with advanced capabilities and features. These solutions address the traditional needs of contact centers, back offices, and branches.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Deployment, Component, Organization Size, Industry Vertical, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global workplace management tools market is estimated to be valued at USD 16.3 billion in 2025.

The market size for the workplace management tools market is projected to reach USD 91.5 billion by 2035.

The workplace management tools market is expected to grow at a 18.8% CAGR between 2025 and 2035.

The key product types in workplace management tools market are on-premise and cloud.

In terms of component, solution segment to command 62.5% share in the workplace management tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Workplace Wellness Market Size and Share Forecast Outlook 2025 to 2035

Smart Workplace Market Size and Share Forecast Outlook 2025 to 2035

Managed Workplace Services Market Analysis – Growth & Forecast through 2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Employer and Workplace Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Industrial and Workplace Safety Market Growth – Trends & Forecast 2025 to 2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA