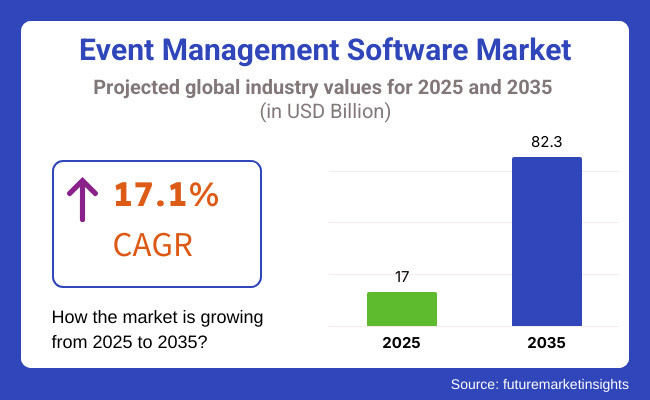

The global event management software market is set to reach USD 82.3 billion, a significant increase from the 2025 valuation of USD 17 billion. The CAGR is estimated to be around 17.1%. As more and more organizations adopt digital solutions for event planning and staging, the demand for sophisticated event management software continues to grow at a remarkable speed.

Event management software is a computer program used to simplify event planning, organization and staging. These solutions come in cloud and on-premise software formats that allow for core capabilities like registration/ticketing, venue management, marketing automation and attendee interaction.

These tools are used by businesses, governments and non-profits in order to make logistics more efficient, do real-time monitoring of the event, and raise their ROI. As more and more people turn their attention to hybrid and virtual events, Event Management platforms are incorporating artificial intelligence (AI), data analytics, and automation to give better service. As digitalization shapes the future of events, software companies are always coming up to meet new customer demands with scalable, ready-to-use solutions.

It develops in a number of factors that are driving upward the Event management software industry. The rapid rise of frictionless event experiences, automation (or 'real-time marketing'), and data-driven decision-making have forced many organizations into investing in AI-driven event management tools. Companies rely on cloud-based platforms for seamless cooperation, remote access and real-time data tracking.

Furthermore, the surge in hybrid and virtual events has also boosted demand for solutions that can do everything from live broadcasting to audience engagement, remote networking and more. Analytics-based insights are becoming a priority for companies. These insights are used to measure the level of attendee engagement, optimize events, and improve marketing results. The rise of digital payment networks and block chain ticketing helps also to protect security and operational efficiency in business areas.

While growing rapidly, the event management software industry faces problems such as cybersecurity threats, data privacy and demanding implementation costs Enterprises dealing with large-scale events must comply with stringent data protection regulations in order to keep the information of attendees secure.

Integrating event management software with existing enterprise systems can present a technical challenge for some businesses. Competition among the providers of software is fierce, so they must continue to innovate and differentiate their products if they want to hang on to customers.

New trends and technological advances may give the industry a welcome boost. AI-powered chat bots and virtual agents enhance the interaction between attendees, delivering automatic service information in response to customer requests with targeted recommendations.

Event planners can use predictive analytics to view historical data traces for clues about how prospective audience members will behave this year. Block chain technology makes event ticketing more secure, reduces fraud and brings transparency to the event. As businesses come to regard digital solutions for events as essential, the event management software market will take shape with new technologies that improve efficiency and change worldwide events at every level.

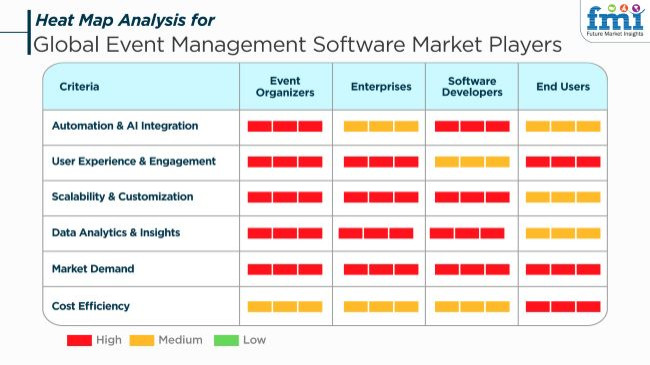

The rapid expansion of the industry is mainly due to the digitalization of events, hybrid event formats, and the data-driven insights need of the companies. Event organizers value automation by featuring AI, easy registration systems, and real-time engagement tools at the top of their priority list to provide a comfortable and enjoyable attendee experience. The features of event ROI measurement, lead generation, and easy integrability with CRM tools bound them.

The software vendors are leading the way to develop cloud-based, AI, and mobile-focused solutions for event management appropriate to virtual as well as live events. End users' demands include the simplicity of use, individualization of the event, and networking without problems. Criteria for the main buyers' decision include the ability to scale operations, access on multiple devices, AI analytical features, integration options, and affordability. The increase of automation and engagement tools in corporate conferences, expos, and virtual summits makes the event management software industry expand extensively in the near future.

Event Management Software Market Contract Analysis:

| Company | Development Details |

|---|---|

| Cvent | Launched an AI-powered event planning tool to enhance attendee engagement and streamline event management processes. |

| Eventbrite | Partnered with a major virtual reality platform to offer immersive event experiences, expanding their digital event offerings. |

| Bizzabo | Acquired a leading event marketing firm to integrate advanced marketing automation features into their platform. |

In 2024, the industry witnessed significant advancements, with companies like Cvent introducing AI-driven tools to enhance event planning and attendee engagement. Eventbrite expanded its digital footprint by partnering with virtual reality platforms, offering immersive event experiences. Bizzabo's acquisition of an event marketing firm underscores the trend of integrating marketing automation to provide comprehensive event solutions.

The industry is prone to several risks such as data security, technological obstacles, industry competition, and economic downturns.

Regulatory compliance is not uniform globally; that is, it has an impact on how event software providers find it necessary to collect, store, and process the customer's information. The companies are obliged to comply with privacy, accessibility, financial regulatory laws so that they avert penalties.

Disruptive technologies such as AI, VR, and blockchain have been moving the industry in a different direction. Companies that do not adopt automation, AI-based data insights, and hybrid event formats are flirting with extinction. Deploying cloud-based, scalable, and AI-enabled event technology guarantees a competitive edge in the long haul.

Industry competition is very fierce as a result of the presence of firms such as Cvent, Eventbrite, and Bizzabo which command the bandwagon. The primary way to gain additional industry share is differentiation through personalization, user experience, and demand-driven solutions.

The impact of economic downturns on the corporate sector can sometimes be seen in the events' budgets. During periods of financial hardships, flexible pricing strategies, cost-effective solutions, and freemium models are the tools to sustain the demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

| Germany | 15.4% |

| UK | 16.7% |

| China | 17.6% |

| India | 18.3% |

The USA has a tight hold on the industry due to its well-developed digital infrastructure and corporate event culture. Large corporations, SMEs, and non-profit organizations gladly spend money on event technology to automate planning, attendance, and insights. Organizations are increasingly embracing AI-powered automation, hybrid event solutions, and real-time data insights to streamline operations and engage the audience more effectively. Industry growth is fueled by the dominance of large software vendors and ongoing technological advancements.

The integration of event management software with CRM and marketing automation tools makes efficiency even greater. Virtual and hybrid events continue to grow, causing the industry to transform by offering scalable solutions to different business needs. FMI is of the opinion that the American industry is going to experience a 16.2% CAGR throughout the research.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| High Digital Connectivity | Enables efficient event management through cloud platforms and AI technology for the American economy. |

| Strong Corporate Event Culture | Large businesses, SMEs, and charities spend on event technology for more participant interaction, easier planning, and greater maximum analysis. |

| Increased Demand for Virtual and Hybrid Events | Early integration into event software enables companies to achieve the greatest audience reach, integrating real-time data with automated processes for delivering improved experiences. |

| Availability of Key Industry Players | The USA has key event management software players that offer innovation through the development of new products and strategic acquisition of companies. |

| Increased Use of AI and Automation | Artificial intelligence-based solutions maximize efficiency, delivering personalized experiences and minimizing event processes. |

China's event management software industry continues to expand with digitalization, transforming the way business is done. Companies increasingly adopt complex platforms to stage spectacular conferences, business summits, and exhibitions. Mobile-enabled solutions, artificial intelligence-powered automation, and real-time analytics radically boost event planning productivity.

Organizations use virtual and hybrid event formats to bridge global bases, maximizing reach and interaction. Government programs for smart cities and the digital economy enable local and international suppliers with AI-driven, scalable solutions to gain momentum. Economic development and technological advancement continue to drive China forward. FMI is of the opinion that China's industry will grow at 17.6% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Rapid Digitalization | China’s industry expands as businesses embrace technology for large events, corporate events, and exhibitions. |

| Government-Sponsored Initiatives | Smart city initiatives and digital economy initiatives enhance the use of software. |

| Increased Mobile Penetration | Mobile event solutions continue to be popular, with functional features and real-time interaction. |

| AI-Powered Event Automation | Companies utilize AI-powered solutions to automate event processes and maximize audience interactions. |

| Competitive Market Environment | Local and international vendors introduce scalable, customized, and AI-powered solutions. |

India's industry is growing rapidly with increasing digital adoption across industries. Mobile phone and cloud technology penetration stimulates the need for economical and scalable solutions. Organizers prefer virtual and hybrid model events to make them easy to organize and accessible for a large group of targets.

Digital development initiatives by the public sector and startup ecosystems create opportunities for wider utilization of software. AI-powered automation, network usefulness, and inspection are propulsive forces to ease event planning operations and their organization. The affordability of software products because of the cost-effectiveness of solutions makes event management technology reachable to mid-size organizations. Thus, India stands as the leading emerging industry for the industry. FMI has confidence that the Indian industry will register an 18.3% CAGR through the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growing SME Segment | Mid-sized and small business organizations embrace budget-friendly event software platforms. |

| Boosted Digital Uptake | Increased use of cloud and mobile-friendly platforms supports business growth. |

| Virtual and Hybrid Events Growth | Organizations depend on hybrid models to encourage more flexibility and participation. |

| Government Incentives for Digitalization | The use of software grows through digitalization and startup business development strategies. |

| More AI Adoption in Event Organization | AI-powered automation, network software, and analytics enhance events. |

Germany’s industry expands as businesses use technology to organize events. Corporate event culture dominates in the nation, guaranteeing that demand for AI-driven platforms, cloud-driven platforms, and data analytics will be in place. Virtual and hybrid model events get traction as companies look for efficient means to optimize audience interaction.

Companies choose secure and compliant software options that support EU data protection standards. Increased consciousness of conferences, trade shows, and corporate forums further fuels the expansion of the industry.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong Corporate Event Market | Germany’s corporate landscape fosters the necessity for effective event management solutions. |

| Technological Innovation | Sophisticated analysis, AI-powered automation, and seamless integrations make event planning more effective. |

| Hybrid and Virtual Event Adoption | Organizations leverage technology to ensure maximum event reach and engagement. |

| Data Security and Compliance Focus | Organizations focus on secure event management solutions against EU regulations. |

| Emerging MICE Industry | Conferences, exhibitions, and corporate events are fueling greater software needs. |

The UK industry is experiencing constant growth, and firms are adopting digital media to spearhead event planning and staging. Firms focus on hybrid and virtual event platforms to increase coverage and engagement among the audience. AI-based analytics and automation requirements also increase, ensuring maximum efficiency across different roles of event management.

Firms require cloud-based scalable solutions to address other events. Marketing and CRM integration with unified software enhances maximum decision-making capabilities, enhancing vertical take-up even further.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Maturing Business Climate | The UK boasts a matured event management sector, leading to steady software demand. |

| Hybrid and Virtual Event Focus | Quests leverage computer technology to enrich event experiences. |

| High AI and Data Analytics Penetration | Artificial intelligence-driven tools simplify planning, participant interaction, and event production. |

| Increasing Demand for Scalable Solutions | Companies require scalable, cloud-based platforms to host diverse event types. |

| Seamless Integration with Marketing and CRM Tools | Easy software integration improves efficiency and data-driven decision-making. |

The event management software market features a dynamic blend of Tier 1 giants and agile mid-market players, with moderate consolidation shaping the competitive landscape. Leading suppliers such as Cvent and Eventbrite dominate due to their end-to-end event planning ecosystems and global scalability.

Cvent continues to invest heavily in AI-driven personalization and integrations with CRM tools, while Eventbrite focuses on intuitive ticketing solutions for public and mid-sized events. Companies like Bizzabo and Whova are gaining ground through innovation in attendee engagement, mobile accessibility, and real-time analytics. These firms prioritize R&D to enhance hybrid event experiences and streamline user workflows.

Meanwhile, emerging players such as Eventdex, Sched, and Eventzilla are disrupting with cost-effective, niche solutions tailored to specific event types like conferences or expos. Despite this growth, high entry barriers persist due to data security standards, integration challenges, and customer loyalty toward established platforms. The market shows signs of consolidation, though room remains for differentiated offerings and regional expansion.

Recent Event Management Software Industry News

The event management software industry has seen a flurry of activity in mergers, acquisitions, and product development over the past year. Cvent has been particularly aggressive, acquiring tools focused on AI-powered vendor sourcing, event marketing, and in-person lead capture to strengthen its trade show and hybrid event capabilities. EventMobi also expanded its portfolio by acquiring a virtual event platform to enhance its hybrid event offering. Eventbrite introduced instant payout and mobile payment features to support organizers with faster revenue access.

Bizzabo rolled out new features in its Event Experience OS, including enhanced analytics and wearable smart badges for attendee tracking. Meanwhile, players like Whova, Aventri, Eventzilla, and Eventdex have focused on upgrading hybrid and mobile engagement tools to serve both corporate and mid-size events. The space continues to evolve rapidly, with feature-rich consolidation efforts shaping the competitive landscape.

Cvent (20-25%)

Cvent tops the event management software industry with its strong event planning, AI-based analytics, and automation features, providing an integrated experience for event planners.

Bizzabo (15-20%)

Bizzabo's cloud-based event experience solutions provide comprehensive support for hybrid and virtual event production at advanced levels of engagement.

Eventbrite (10-15%)

Eventbrite has built an online ticketing and marketing automation platform, allowing organizers to maximize attendance and revenue for their events.

Aventri (8-12%)

Aventri provides end-to-end event management solutions, together with integrated attendee engagement and data-informed insights.

Hopin (5-10%)

Hopin is a foremost virtual event platform, offering great networking, live streaming, and interactive engagement features.

RainFocus (4-8%)

RainFocus provides AI-powered personalization for events, centralized event data management, and attendee analytics with true depth.

Other Key Players (30-38% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 17 billion |

| Projected Market Size (2035) | USD 82.3 billion |

| CAGR (2025 to 2035) | 17.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| By Deployment | Clouds and On-premise |

| By Enterprise Size | Small & Medium Enterprises (SMEs) and Large Enterprises |

| By End User | Event Management Companies, Travel & Hospitality Companies, Corporates, Government, Academic Institutions |

| Regions Covered | North America, Latin America, Asia Pacific, the Middle East & Africa (MEA), and Europe |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Cvent, Eventbrite, Bizzabo, Whova, EventMobi, vFairs, Eventzilla, Aventri, Eventdex, and Sched |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

By deployment, the industry is segmented into clouds and on-premises.

By enterprise size, the industry is segmented into small & medium enterprises (SMEs) and large enterprises.

By end user, the industry is segmented into event management companies, travel & hospitality companies, corporates, government, academic institutions, and others.

By region, the industry is segmented into North America, Latin America, Asia Pacific, the Middle East & Africa (MEA), and Europe.

The market is projected to reach USD 82.3 billion by 2035, growing from USD 17 billion in 2025, at a CAGR of 17.1%.

The cloud-based segment is growing the fastest, with a CAGR of 17.8%.

India is expected to grow at the fastest rate, registering a CAGR of 18.3%.

Key drivers include rising demand for hybrid and virtual events, AI-driven automation, real-time analytics, and seamless CRM integrations.

Top players include Cvent, Eventbrite, Bizzabo, Whova, EventMobi, and vFairs.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End User , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 18: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 38: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End User , 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Deployment, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End User , 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Deployment, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End User , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Japan Event Management Software Market Growth - Trends & Forecast 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Security Information and Event Management Software Market

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Apps Market Analysis – Size, Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Video Event Data Recorder Market Report – Trends & Forecast 2016-2026

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Virtual Event Platforms Market Share

Corporate Event Planner Market Size and Share Forecast Outlook 2025 to 2035

On-site Preventive Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Embolic Prevention Systems Market

Blowout Preventers Market

Backflow Preventers Market Size and Share Forecast Outlook 2025 to 2035

Automotive Event Data Recorder Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Backflow Preventers Companies

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA