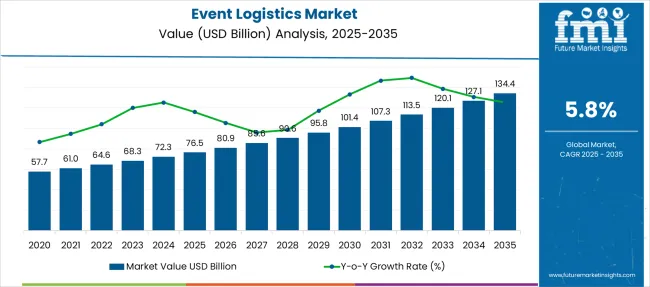

The Event Logistics Market is estimated to be valued at USD 76.5 billion in 2025 and is projected to reach USD 134.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Unlike traditional linear growth, the upcoming decade shows a structural shift toward integrated service ecosystems, where logistics providers are transforming into solution orchestrators rather than asset-heavy operators. Historical growth from USD 57.7 billion in 2020 to USD 72.3 billion in 2024 (25% rise) was largely volume-driven, relying on physical transport and storage services.

The future trajectory differs significantly, with more than 40% of incremental revenues between 2025 and 2035. Demand will rise from tech-enabled services, including real-time inventory tracking, IoT-driven coordination, and AI-based route optimization. Event complexity and cross-border mobility of equipment will fuel demand for agile warehousing and just-in-time delivery. Regional mega-events, sustainability compliance, and experiential marketing formats further amplify logistics sophistication. Competitive advantage will increasingly depend on digital orchestration, capacity planning, and risk mitigation strategies rather than fleet size alone, signaling a transition from logistics as a cost center to a strategic enabler of event experience.

The growth trajectory of the event logistics market demonstrates a smooth, upward-sloping exponential pattern, aligning closely with an elongated S-curve rather than a sharp recovery or stagnation cycle. From 2020 to 2024, the industry advanced from USD 57.7 billion to USD 72.3 billion, adding USD 14.6 billion in value, which represents a moderate incline of approximately 25%. This stage reflects gradual stabilization, driven by the resumption of physical events and early adoption of hybrid formats.

The second phase, spanning 2025 to 2030, marks a more pronounced escalation, with the market increasing from USD 76.5 billion to USD 101.4 billion, generating an additional USD 24.9 billion, equal to 32.6% growth. Large-scale international exhibitions, digital orchestration requirements, and expansion into multi-venue event formats fuel this acceleration. The final phase, from 2030 to 2035, delivers the strongest absolute dollar gains, with an increase of USD 33 billion, pushing the market to USD 134.4 billion. Despite CAGR stabilization, the size of value addition intensifies as technology-driven services, AI-enabled planning, and sustainability compliance emerge as critical differentiators.

| Metric | Value |

|---|---|

| Event Logistics Market Estimated Value in (2025E) | USD 76.5 billion |

| Event Logistics Market Forecast Value in (2035F) | USD 134.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The event logistics market is expanding steadily as global demand for professional event execution and streamlined supply chain coordination continues to rise. As events grow in scale and complexity, organizers increasingly rely on specialized logistics providers to manage time-sensitive operations such as transportation, setup, storage, and on-site support.

The market is further driven by corporate globalization, the rise of experiential marketing, and the resurgence of in-person gatherings across business, entertainment, and cultural domains. Technological advancements, including real-time tracking, RFID-enabled inventory systems, and automation, are enhancing operational precision and transparency.

In the coming years, the sector is expected to benefit from rising event frequency, increased outsourcing of logistical functions, and the continued recovery of the global meetings, incentives, conferences, and exhibitions (MICE) industry. As organizers prioritize efficiency, safety, and sustainability, logistics service providers are increasingly viewed as strategic partners essential to event success.

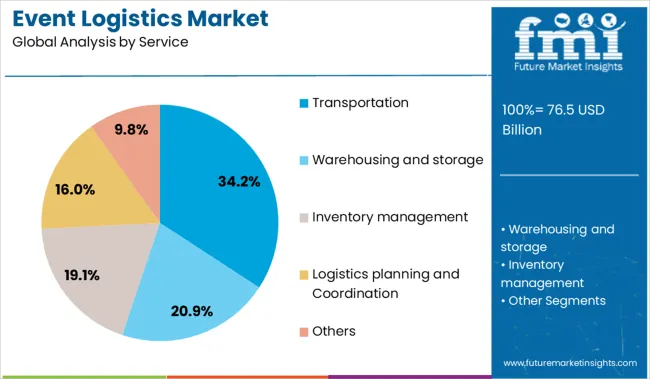

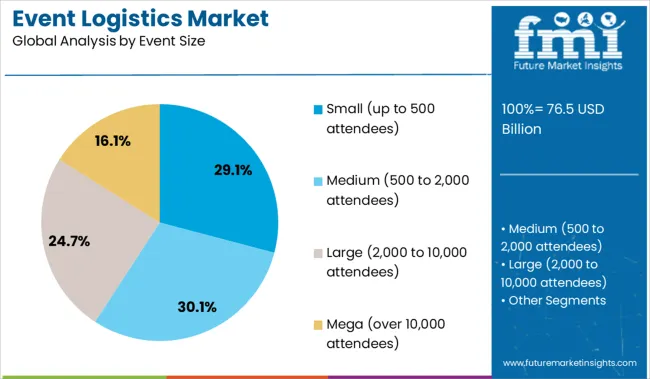

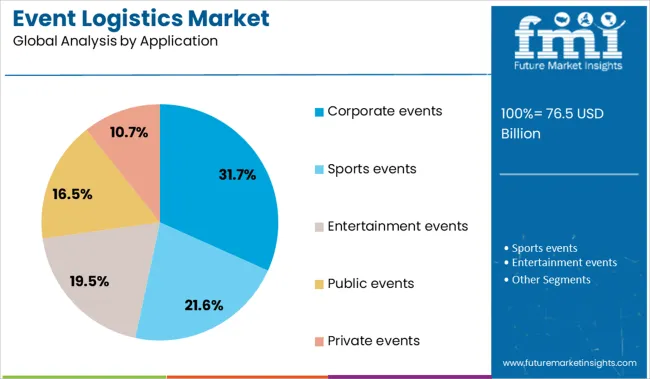

The event logistics market is segmented by service, event size, application, end use, and region. By service, it includes transportation, warehousing and storage, inventory management, logistics planning and coordination, and others. Event size categories comprise small events with up to 500 attendees, medium events with 500 to 2,000 attendees, large events with 2,000 to 10,000 attendees, and mega events with over 10,000 attendees. Applications encompass corporate events, sports events, entertainment events, public events, and private events. End-use segments cover corporate and commercial, entertainment and media, sports, government and public sector, educational institutions, and others. Geographically, the market spans North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The transportation segment leads the service category with a 34.2% share, driven by its critical role in ensuring the timely and secure movement of equipment, personnel, and materials across venues. The complexity of modern events demands highly coordinated transport logistics, including fleet management, cargo handling, and last-mile delivery, all tailored to the unique timelines and sensitivities of each event.

Growth in international and large-scale events has further increased reliance on multimodal transport solutions that guarantee precision and reliability. Providers are enhancing service offerings by integrating GPS tracking, route optimization, and temperature-controlled units to manage high-value or sensitive cargo.

The segment continues to evolve with a growing emphasis on sustainable transport practices, such as electric fleets and fuel-efficient routing. As events expand into remote or temporary venues, the need for flexible and dependable transportation services is expected to sustain this segment's prominence within the event logistics landscape.

The small event segment, comprising up to 500 attendees, holds a 29.1% share and remains a foundational element of the event logistics market. These events, often involving corporate meetings, community gatherings, and private celebrations, require tailored logistical planning that balances efficiency and cost-effectiveness.

The frequency and diversity of small-scale events across urban centers contribute to steady demand for modular logistics solutions that can be rapidly deployed and scaled. Service providers catering to this segment emphasize agility, localized coordination, and streamlined inventory management to support quicker turnaround times and reduced lead cycles.

Growth in this segment is supported by the increasing adoption of hybrid event formats and pop-up event models, which prioritize flexibility and low overhead. As organizations and individuals continue to host smaller, high-impact experiences, demand for cost-sensitive yet professional logistics solutions is expected to sustain this segment’s relevance.

The corporate events segment leads the application category with a 31.7% share, reflecting the consistent investment by enterprises in conferences, product launches, exhibitions, and internal gatherings. These events typically involve detailed logistical coordination across multiple functions, including branding, equipment transport, audiovisual setup, and delegate management.

The growth of business travel and brand engagement strategies has fueled demand for logistics providers that can ensure punctual, seamless execution aligned with corporate standards. The segment benefits from the return of in-person engagements, with companies increasingly blending physical and digital formats to maximize outreach.

Providers are responding by offering integrated logistics platforms that support real-time visibility and collaborative planning. Additionally, growing emphasis on sustainability and ROI measurement is shaping logistics practices within this segment. As enterprises continue to prioritize immersive and efficient event delivery, the corporate events segment is expected to maintain its leading role in driving overall market demand.

Demand for event logistics services is rising sharply with the return of large-scale gatherings, trade shows, and hybrid conferences. In 2024, service demand grew 17% year-on-year across corporate, entertainment, and exhibition segments. Temporary warehousing and modular staging rentals expanded by 22% in metropolitan hubs. Logistics providers added RFID tracking and temperature monitoring to asset flows in 58% of high-value event setups. Integrated transport-prep suites now include last-mile micro-hubs for same-day delivery and display setup. Collaboration between venue operators and third-party logistics reduces on-site handling time and speeds teardown by 13%, boosting operational throughput and response flexibility.

Event organizers increasingly require end‑to‑end logistics that support both in-person and hybrid formats. Integrated workflows now include digital load tracking, interactive asset tagging, and mobile setup teams. Between 2022 and 2025, logistics using RFID pallet tracking rose 35%, and drone-based inventory audits were used in 18% of large trade shows. Cold-chain PPE handling and modular cooling units are now standard in health sector events. Providers bundle equipment staging, storage, and connectivity rigs to support broadcast and virtual streaming pods. These modernized workflows deliver 12 % faster load-ins and reduce staff overspend by 20 % compared to traditional methods.

Scaling event logistics remains difficult due to capacity gaps, compliance requirements, and the complexity of post-event returns. Major hubs report warehouse fill rates above 85% during peak months, pushing spot rental costs up by 14-17%. Local regulations on road closures, night loading, and restricted access zones are delaying truck turnaround by 6-9 hours in city center locations. Equipment depreciation and return logistics contribute to up to 18% of the overall job cost. Tracking losses, mostly portable AV and display gear, average 6-7% across events in dynamic sites. Small operators claim average return-to-inventory timelines of 14-16 days, which limits reuse cadence and fleet efficiency.

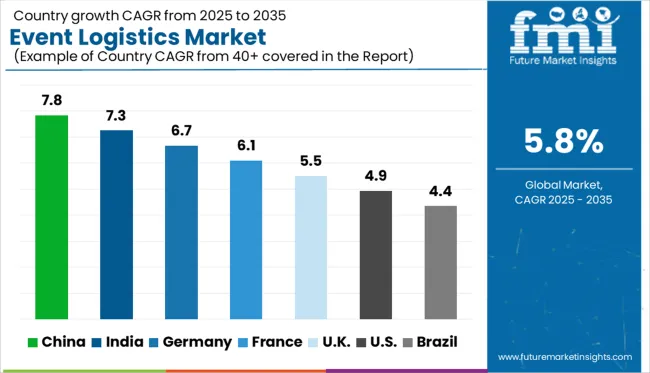

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

Global event logistics market demand is projected to rise at a 5.8% value-based CAGR from 2025 to 2035. Of the profiled markets out of 40 covered, China leads at 7.8%, followed by India at 7.3%, and Germany at 6.7%, while France posts 6.1% and the UK records 5.5%. These rates translate to a growth premium of +34% for China, +26% for India, and +16% for Germany versus the baseline, while the UK shows slower growth. Divergence reflects national differences with stronger momentum from mega-events in China and India, Germany’s established exhibition economy, steady logistics demand tied to cultural events in France, and a more saturated logistics network in the UK.The report features insights from 40+ countries, with the top countries shown below.

China’s event logistics market is expected to grow at a CAGR of 7.8% from 2025 to 2035, outperforming the global average by 2.0%. High-volume exhibitions in Beijing, Guangzhou, and Chengdu continue to drive containerized transport, temperature-sensitive shipments, and just-in-time delivery. Organizers are selecting logistics partners with in-house customs clearance and bonded storage capabilities. The live concert segment, fueled by multi-city artist tours, has boosted vehicle tracking demand across provincial routes. Large-scale sports events like esports tournaments and marathons are triggering advance procurement of rigging, LED systems, and high-voltage power equipment. Market concentration is shifting toward third-party providers offering end-to-end solutions, including last-mile handling and reverse logistics.

India’s event logistics market is forecast to grow at a CAGR of 7.3% between 2025 and 2035, surpassing the global rate by 1.5%. Cultural fairs, spiritual gatherings, and political rallies are the key contributors to volume. Bengaluru, Hyderabad, and Kolkata have emerged as regional transit hubs for high-value AV transport. Cold-chain solutions are expanding for weddings and catered events in rural districts. 3PL providers are integrating RFID asset tracking and app-based crew scheduling to manage remote locations. The film industry has also boosted intra-state logistics needs for lighting rigs, sets, and generators. Transport coordination for simultaneous installations across multiple cities is becoming more frequent, requiring container pooling and pre-booked intermodal corridors.

The event logistics market in Germany is likely to expand at a CAGR of 6.7% from 2025 to 2035, exceeding the global benchmark by 0.9%. Messe Frankfurt and Koelnmesse remain the core nodes for time-sensitive logistics across B2B expos, fashion shows, and sporting events. High precision is demanded for delivery timing, especially during narrow venue access windows. Third-party vendors are investing in fleet GPS calibration, modular transport racks, and night-time unloading capabilities. Customs-cleared corridors with Austria, Poland, and the Netherlands have supported regional flows for live performances. Demand for hybrid logistics-supporting in-person and streamed content simultaneously-has increased van fleet deployments for video production units and broadcast uplinks.

France’s event logistics market is forecast to grow at a CAGR of 6.1% through 2035. Paris remains the central hub for international conferences and brand launches, followed by Lyon and Marseille for regional events. Logistics providers have expanded express clearance services and EU road pass integrations. On-demand logistics models have gained traction among entertainment organizers and trade fair planners. Transport of high-sensitivity items-like digital walls, 4K projectors, and pyrotechnics-is being handled with calibrated shock-absorbing containers. Summer music festivals and sports tournaments have also widened logistics windows, requiring overnight deliveries and quick disassembly frameworks.

The UK’s event logistics market is projected to grow at a CAGR of 5.5% between 2025 and 2035, just below the global average. Growth is supported by recurring sports events, academic conferences, and touring exhibitions across England and Scotland. London and Manchester dominate freight activity, with Birmingham rising as a secondary node. Brexit-related delays have led logistics firms to maintain temporary warehousing for EU-bound returns. Mobile broadcast and stage freight make up a growing share of demand. Booking systems for weekend and night-time delivery slots have expanded due to congestion and toll zones. Fleet modifications for zero-emission event logistics are also underway in city centers.

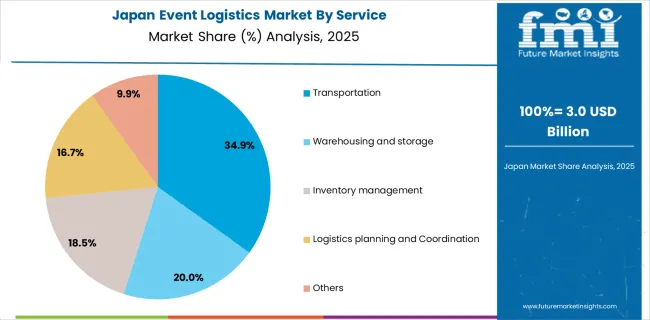

Japan accounts for USD 3.0 billion in 2025, translating to approximately 3.9% of the global market value. Service distribution reflects a strong preference for physical mobility and support. Transportation claims the largest portion at 34.9% or around USD 1.05 billion, owing to stringent performance expectations for major corporate and exhibition events. Warehousing and storage represent 20%, followed closely by inventory management at 18.5%, a segment increasingly driven by automation tools for stock accuracy. Logistics planning and coordination holds 16.7%, signaling the rising relevance of integrated control systems. Smaller service categories grouped under others form 9.9%, including packaging and documentation.

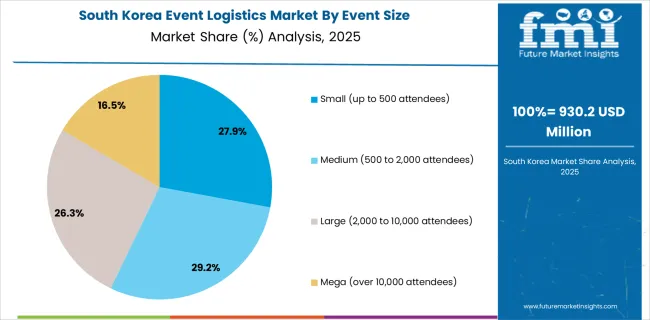

South Korea contributes USD 930.2 million in 2025, roughly 1.2% of the global share. Medium-sized events between 500 and 2,000 attendees form the largest category at 29.2% or nearly USD 272 million, reflecting strong corporate activity. Smaller gatherings account for 27.9%, emphasizing demand for quick-deployment logistics. Large events (2,000-10,000 attendees) add 26.3%, while mega-events above 10,000 attendees capture 16.5%, showing a smaller but high-value base linked to global conferences and sports formats.

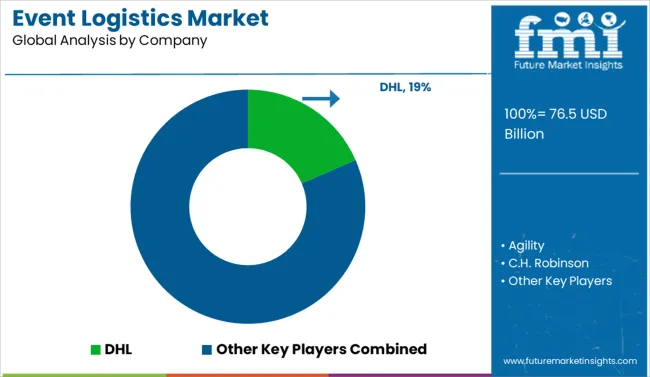

The event logistics market exhibits moderate concentration with high operational complexity, where differentiation relies on speed, reliability, and integrated service capability rather than cost alone. DHL commands an 18.5% share, leveraging global infrastructure to manage time-critical freight, on-site handling, and coordination for mega-events, positioning itself as the dominant integrated player. Agility and DB Schenker secure strongholds in government and defense exhibitions, offering specialized services like permit management and customs clearance, which raise switching costs for clients with compliance-heavy needs. CEVA Logistics and Kuehne + Nagel capture volume-driven trade shows and touring productions by exploiting economies of scale in multimodal freight and warehousing.

C.H. Robinson, Expeditors, and XPO compete in high-frequency, short-lead deployments, focusing on scheduling precision for large venues. FedEx and UPS emphasize smaller activations and mobile brand campaigns with last-mile efficiency rather than end-to-end orchestration. Entry barriers remain high due to route planning accuracy, venue-specific compliance, and the ability to manage cargo variability under strict timelines. These capabilities require both infrastructure and deep process expertise. The market tilts toward firms with global reach, digital orchestration platforms, and localized event knowledge.

Key Developments in the Event Logistics Market

Key players in the event logistics market adopt strategies focused on integrated service offerings, combining transportation, warehousing, and inventory management for efficiency. Investments in digital platforms, including real-time tracking, IoT, and AI-based route optimization, are prioritized to enhance visibility and speed. Many companies pursue strategic partnerships and alliances with event organizers for exclusive service contracts. Expansion into emerging regions and offering customized solutions for mega-events are common approaches.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.5 Billion |

| Service | Transportation, Warehousing and storage, Inventory management, Logistics planning and Coordination, and Others |

| Event Size | Small (up to 500 attendees), Medium (500 to 2,000 attendees), Large (2,000 to 10,000 attendees), and Mega (over 10,000 attendees) |

| Application | Corporate events, Sports events, Entertainment events, Public events, and Private events |

| End Use | Corporate and commercial, Entertainment & media, Sports, Government & public sector, Educational institutions, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL, Agility, C.H. Robinson, CEVA Logistics, DB Schenker, Expeditors, FedEx, Kuehne Nagel, UPS, and XPO |

| Additional Attributes | Dollar sales by service type and event category, growing demand in international exhibitions and large-scale sports events, stable activity across corporate meetings and entertainment tours, advancements in time-critical freight solutions and digital tracking systems support coordination and delivery precision |

The global event logistics market is estimated to be valued at USD 76.5 billion in 2025.

The market size for the event logistics market is projected to reach USD 134.4 billion by 2035.

The event logistics market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in event logistics market are transportation, warehousing and storage, inventory management, logistics planning and coordination and others.

In terms of event size, small (up to 500 attendees) segment to command 29.1% share in the event logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Event Apps Market Analysis – Size, Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Japan Event Management Software Market Growth - Trends & Forecast 2025 to 2035

Video Event Data Recorder Market Report – Trends & Forecast 2016-2026

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Virtual Event Platforms Market Share

Corporate Event Planner Market Size and Share Forecast Outlook 2025 to 2035

On-site Preventive Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Embolic Prevention Systems Market

Blowout Preventers Market

Backflow Preventers Market Size and Share Forecast Outlook 2025 to 2035

Automotive Event Data Recorder Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Backflow Preventers Companies

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Bio-Fouling Prevention Coatings Market

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA