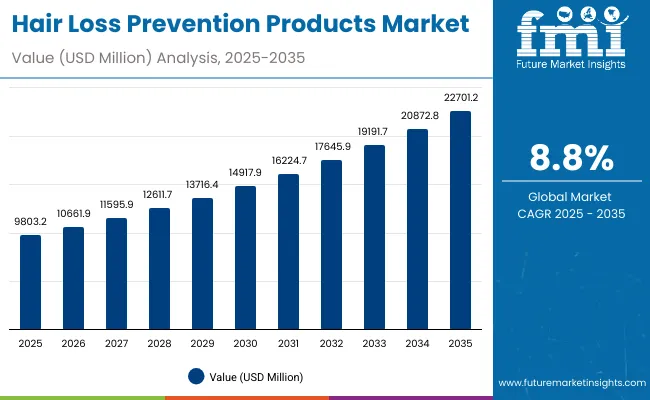

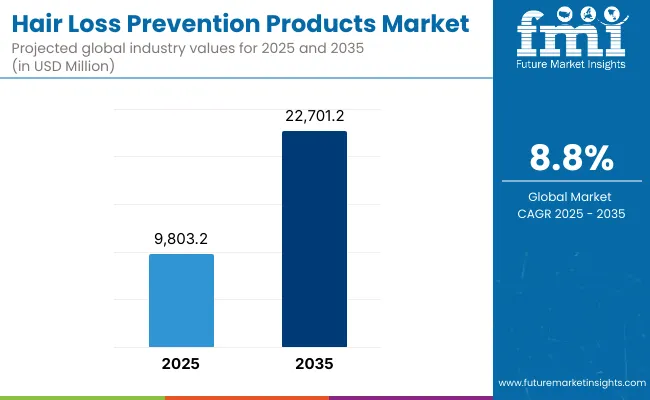

In 2025, the hair loss prevention products market is anticipated to be valued at USD 9,803.2 million, with growth projected to reach USD 22,701.2 million by 2035. This represents an addition of nearly USD 12,898 million across the decade, translating into an expansion of 193% in absolute value. The trajectory reflects a CAGR of 8.8% over the period, signifying a consistent surge in demand for advanced, preventive, and restorative solutions in personal care. Rising awareness of hair health, coupled with lifestyle-related hair loss concerns, is expected to sustain momentum and reinforce steady adoption.

Quick Stats for Hair Loss Prevention Products Market

Hair Loss Prevention Products Market Key Takeaways

| Metric | Value |

|---|---|

| Hair Loss Prevention Products Market Estimated Value in (2025E) | USD 9,803.2 million |

| Hair Loss Prevention Products Market Forecast Value in (2035F) | USD 22,701.2 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

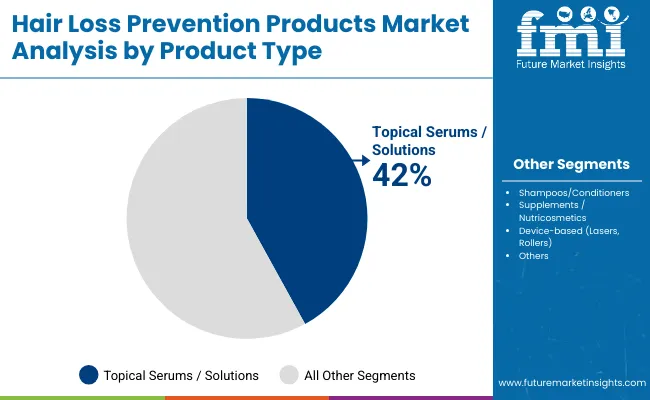

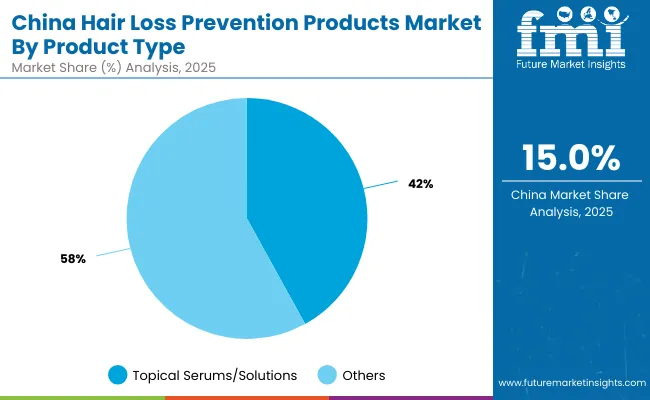

Between 2025 and 2030, the market is forecast to grow from USD 9,803.2 million to USD 14,917.9 million, adding over USD 5,114 million, which equals almost 40% of the total decade growth. This stage is expected to be characterized by strong uptake of topical serums and solutions, which are projected to command 42.0% of the market in 2025, supported by clinically validated ingredients like minoxidil.

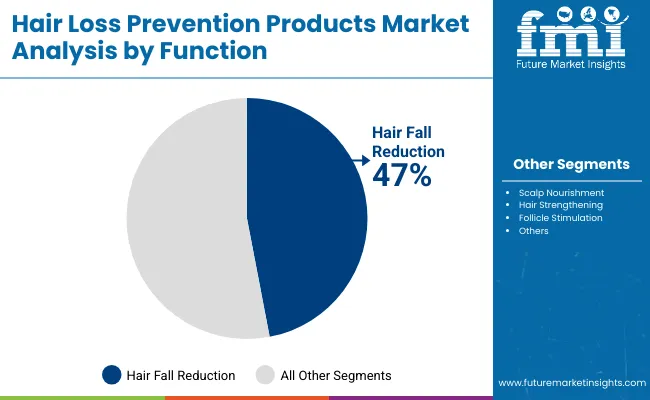

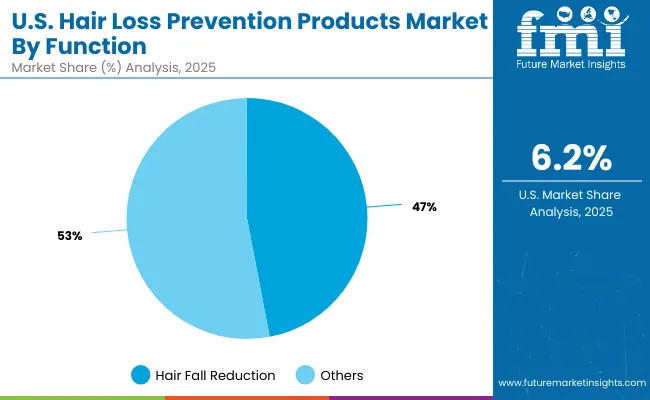

Hair fall reduction is also foreseen to dominate the functional category, capturing 47.0% share in 2025, as early treatment measures are increasingly preferred over corrective procedures.

From 2030 to 2035, the market is set to rise further from USD 14,917.9 million to USD 22,701.2 million, delivering USD 7,783 million in incremental gains, equivalent to nearly 60% of total growth. E-commerce is expected to reinforce its position as the leading distribution channel, supported by personalization, accessibility, and discreet purchase behavior.

The competitive outlook is projected to be shaped by innovation in bioactive formulations, greater penetration in emerging economies, and digital-first brand strategies that will sustain acceleration into the next decade.

The market outlook is expected to be shaped by rising adoption of topical serums, strong preference for preventive solutions, and accelerated growth in e-commerce channels. Regional expansion is projected to be most dynamic across Asia-Pacific, led by double-digit growth in India and China, while North America and Europe are anticipated to sustain steady gains.

The competitive landscape is expected to be influenced by innovation in active ingredients, digital-first business models, and increasing consumer trust in clinically validated solutions.

Growth in the hair loss prevention products market is being stimulated by rising consumer awareness of early intervention in hair health and increasing prevalence of lifestyle-related hair concerns. The demand has been further elevated as aging populations actively seek preventive care solutions supported by clinically validated ingredients.

Digital-first purchasing behavior has expanded rapidly, with e-commerce emerging as the preferred channel due to accessibility and discretion. Functional formulations targeting hair fall reduction are being prioritized, reflecting consumer preference for long-term preventive measures over corrective treatments. Innovations in bioactive ingredients such as minoxidil, biotin, and peptides have enhanced product efficacy, reinforcing trust and repeat adoption.

Regional momentum is being amplified by double-digit growth in emerging economies like India and China, where rising disposable incomes and urbanization are driving uptake. Competitive differentiation is expected to rely on subscription-led models, personalization, and integration of AI-driven diagnostics that will transform consumer engagement in the next decade.

The hair loss prevention products market has been segmented across product type, function, and active ingredient, enabling a clear understanding of demand dynamics and consumer adoption patterns. Each category highlights evolving preferences shaped by scientific validation, lifestyle needs, and clinical effectiveness.

By product type, the emphasis is shifting toward solutions that deliver visible results and ease of application. Functional classification underscores how prevention and restoration needs are being addressed simultaneously, with strong traction in hair fall reduction.

Active ingredient analysis demonstrates how both clinically tested pharmaceuticals and naturally derived complexes are sustaining trust and long-term consumption. The interplay of these segments illustrates how innovation, accessibility, and targeted efficacy are reinforcing the broader growth momentum in this evolving industry.

| Product Type | Market Value Share, 2025 |

|---|---|

| Topical serums/solutions | 42% |

| Others | 58.0% |

Product type segmentation reveals topical serums and solutions as a dominant category, capturing 42.0% of the market in 2025, equivalent to USD 4117.34 million. This strong share reflects increasing adoption of targeted topical therapies, which are being prioritized for their proven ability to address hair loss with minimal invasiveness.

Other product categories, representing 58.0% or USD 5685.86 million, are also contributing significantly, with expansion expected through supplements, conditioners, and device-based offerings. Growth in this segment is anticipated to be driven by consumers seeking holistic regimens that integrate both treatment and maintenance. As awareness rises, innovations in formulation and delivery mechanisms are expected to reinforce long-term trust in product efficacy. The trajectory highlights diversification as a defining trend in product adoption.

| Function | Market Value Share, 2025 |

|---|---|

| Hair fall reduction | 47% |

| Others | 53.0% |

By function, hair fall reduction emerges as the leading segment, accounting for 47.0% of the market in 2025, valued at USD 4607.50 million. This dominance reflects consumer urgency to address the most immediate and visible concerns associated with hair loss. The remaining 53.0% share, worth USD 5195.70 million, is distributed across functions such as scalp nourishment, strengthening, and follicle stimulation.

These categories are anticipated to gain traction as preventive care and long-term maintenance become integral to consumer routines. Growth in this segment is expected to be supported by clinical research linking multi-functional benefits with higher efficacy. Sustained preference for solutions that combine treatment with restoration is projected to reinforce innovation and premiumization within this segment over the forecast period.

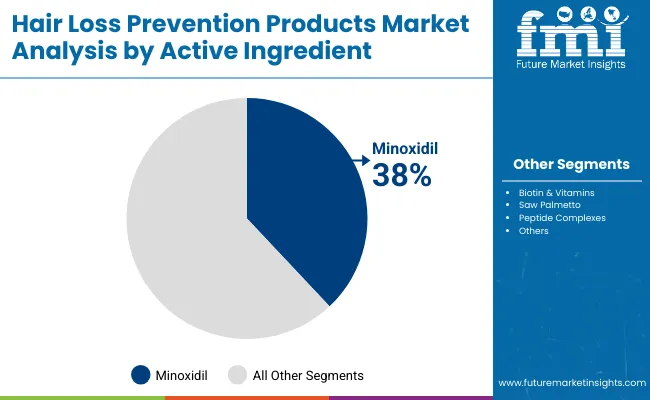

| Active Ingredient | Market Value Share, 2025 |

|---|---|

| Minoxidil | 38% |

| Others | 62.0% |

Segmentation by active ingredient highlights minoxidil as a leading component, holding 38.0% of the market in 2025 with a valuation of USD 3725.22 million. Its clinically proven effectiveness has ensured strong adoption across global consumer groups, particularly for early intervention in hair thinning. Other active ingredients, together representing 62.0% or USD 6077.98 million, include biotin, vitamins, peptides, and natural complexes, which are increasingly being adopted by health-conscious consumers seeking gentler and holistic alternatives.

The balance between pharmaceutical and natural solutions is expected to define long-term segment expansion. Continuous R&D aimed at improving bioavailability and reducing side effects is likely to reinforce trust. The category outlook suggests that broader ingredient diversification will sustain adoption across diverse consumer demographics.

The hair loss prevention products market faces structural shifts as consumer priorities evolve, with clinical validation and digital accessibility reshaping engagement, even as affordability concerns, fragmented regulation, and long adoption cycles influence growth trajectories across established and emerging geographies.

Clinical Innovation and Ingredient Diversification

Growth in the hair loss prevention products market is being strengthened by advancements in clinical research and diversified ingredient development. Minoxidil continues to anchor trust, but bioactive complexes such as peptides, vitamins, and botanicals are being positioned as science-backed alternatives appealing to health-conscious consumers.

Formulations are increasingly designed to provide multifunctional benefits, combining hair fall reduction with scalp nourishment and follicle stimulation. This convergence of pharmaceutical efficacy with holistic wellness has expanded consumer choice and sustained long-term adoption. Regulatory bodies are expected to support such diversification through clearer labeling and safety standards, reinforcing credibility. As R&D pipelines expand, new launches are anticipated to drive differentiation and premiumization, particularly in competitive digital marketplaces.

Price Sensitivity and Unequal Access

Despite strong demand momentum, expansion is being restricted by high product costs and uneven accessibility across regions. Premium topical solutions and nutraceutical-based products remain concentrated in urban markets, limiting penetration in price-sensitive segments. Consumers in emerging economies often face limited availability of clinically validated brands due to distribution inefficiencies and fragmented retail ecosystems.

Parallel challenges include the proliferation of counterfeit products, which undermine trust and create regulatory complexity. Unless affordability models and broader distribution channels are developed, significant consumer bases may remain underserved. The industry’s ability to balance pricing with efficacy while ensuring safe, authentic product delivery will be decisive for sustainable scale.

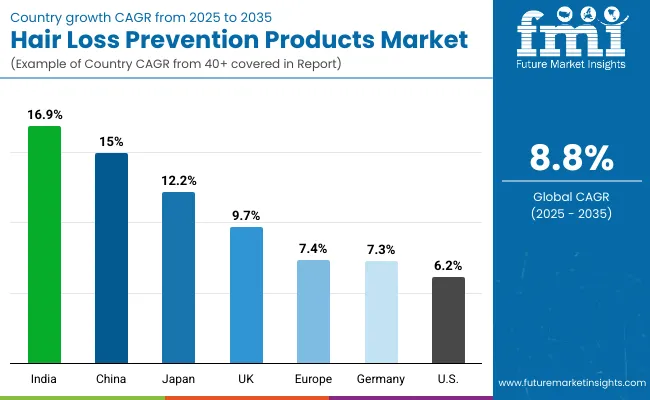

| Country | CAGR |

|---|---|

| China | 15.0% |

| USA | 6.2% |

| India | 16.9% |

| UK | 9.7% |

| Germany | 7.3% |

| Japan | 12.2% |

The hair loss prevention products market is projected to expand unevenly across geographies, with emerging economies expected to post significantly higher growth than mature markets. India is anticipated to lead with a CAGR of 16.9% from 2025 to 2035, reflecting rapid urbanization, increasing disposable incomes, and rising awareness of preventive personal care.

China is forecast to follow with 15.0% CAGR, supported by strong digital adoption, extensive e-commerce penetration, and a growing preference for clinically validated formulations among younger consumers. Japan is also projected to record robust growth at 12.2%, fueled by an aging demographic actively seeking advanced solutions for long-term hair health.

By contrast, the USA is expected to see slower expansion at 6.2%, reflecting maturity in product penetration and cautious adoption beyond premium consumer clusters. Europe as a whole is estimated to advance at 7.4%, though individual markets like the UK at 9.7% indicate higher-than-average growth driven by demand for multifunctional hair care solutions.

Germany is forecast at 7.3%, highlighting steady but moderate expansion aligned with clinical validation and regulated retail channels. Regional dynamics collectively suggest that Asia-Pacific will dominate future growth momentum, with innovations in affordability, digital outreach, and ingredient diversification reshaping competitive positioning.

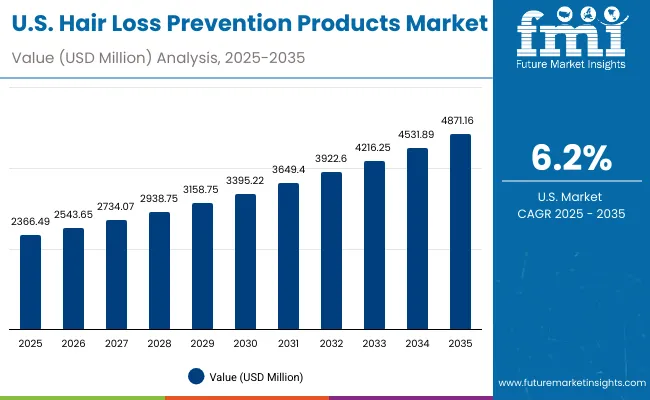

| Year | USA Hair Loss Prevention Products Market (USD Million) |

|---|---|

| 2025 | 2366.49 |

| 2026 | 2543.65 |

| 2027 | 2734.07 |

| 2028 | 2938.75 |

| 2029 | 3158.75 |

| 2030 | 3395.22 |

| 2031 | 3649.40 |

| 2032 | 3922.60 |

| 2033 | 4216.25 |

| 2034 | 4531.89 |

| 2035 | 4871.16 |

The hair loss prevention products market in the United States is expected to grow at a CAGR of nearly 7% from 2025 to 2035, expanding from USD 2366.49 million to USD 4871.16 million. Adoption is being reinforced by strong demand for clinically validated topical serums, alongside a rising inclination toward multi-functional hair care products that integrate strengthening, scalp nourishment, and follicle stimulation.

E-commerce penetration is accelerating accessibility, with subscription-based models reshaping recurring purchase patterns. Clinical dermatology practices and wellness-oriented channels are increasingly integrated into product adoption cycles, creating synergies between healthcare and consumer markets.

The hair loss prevention products market in the UK is projected to grow at a CAGR of 9.7% between 2025 and 2035, reflecting robust consumer engagement with both therapeutic and cosmetic hair care solutions. Market expansion is expected to be influenced by high awareness of early prevention, a strong wellness culture, and widespread access to premium brands.

Retail pharmacies remain essential in driving trust, while e-commerce platforms are accelerating adoption through personalization and direct delivery models. The interplay of clinical dermatology and consumer hair care is projected to create new opportunities for hybrid product formats.

The hair loss prevention products market in India is forecast to register the highest CAGR globally at 16.9% from 2025 to 2035, underscoring rapid adoption in both urban and semi-urban regions. Market expansion is expected to be driven by rising disposable incomes, lifestyle-induced hair loss, and increasing awareness of preventive health.

E-commerce platforms and digital-first brands are making advanced formulations accessible to younger demographics, while herbal and natural formulations continue to sustain trust among traditional users. The long-term outlook suggests that India will become a central hub for product innovation and mass-market scalability.

The hair loss prevention products market in China is anticipated to grow at a CAGR of 15.0% from 2025 to 2035, supported by strong e-commerce ecosystems and growing consumer focus on personal wellness. Demand is being reinforced by a younger demographic adopting preventive care earlier, coupled with urban professionals seeking clinically proven solutions for stress-related hair loss.

Social commerce platforms are playing a pivotal role in awareness-building, while premiumization is occurring rapidly as consumers increasingly prioritize efficacy and brand credibility. Local and international players are expected to compete aggressively by leveraging AI-driven personalization.

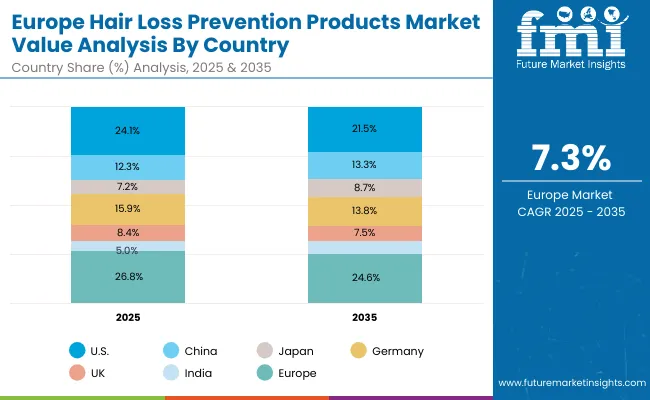

| Country | 2025 |

|---|---|

| USA | 24.1% |

| China | 12.3% |

| Japan | 7.2% |

| Germany | 15.9% |

| UK | 8.4% |

| India | 5.0% |

| Country | 2035 |

|---|---|

| USA | 21.5% |

| China | 13.3% |

| Japan | 8.7% |

| Germany | 13.8% |

| UK | 7.5% |

| India | 6.1% |

The hair loss prevention products market in Germany is projected to grow at a CAGR of 7.3% between 2025 and 2035, supported by strong demand for clinically validated, dermatology-backed products. Consumer trust is expected to remain high due to strict regulatory frameworks and pharmacy-led distribution channels.

Preventive care is being integrated into everyday routines as awareness of scalp health and early intervention becomes more widespread. E-commerce adoption is expanding, although pharmacy retail remains the primary channel for building consumer confidence. Germany is anticipated to remain a mature but steadily expanding market with premiumization and clinical validation as core drivers.

| USA By FUNCTION | Market Value Share, 2025 |

|---|---|

| Hair fall reduction | 47% |

| Others | 53.0% |

The USA hair loss prevention products market is projected at USD 2366.49 million in 2025. Hair fall reduction contributes 47%, valued at USD 1112.25 million, while other functional categories command 53%, equivalent to USD 1254.24 million. This slight dominance of broader functions underscores the rising preference for holistic hair care that integrates scalp nourishment, follicle stimulation, and strengthening benefits alongside traditional anti-hair fall solutions. Demand is being reinforced by preventive care adoption, where multifunctional products are sought for sustained outcomes.

Premium formulations are increasingly aligned with wellness trends, highlighting the convergence of dermatology and personal care. As consumer expectations evolve, clinically validated multi-benefit products are expected to gain momentum.

| China By product type | Market Value Share, 2025 |

|---|---|

| Topical serums/solutions | 42% |

| Others | 58.0% |

The China hair loss prevention products market is projected at USD 1209.54 million in 2025. Topical serums and solutions contribute 42%, valued at USD 508.01 million, while other categories command 58%, equivalent to USD 701.53 million.

The larger share held by diversified products underscores consumer openness to supplements, conditioners, and holistic formulations, which align with traditional wellness preferences. At the same time, clinically validated topical therapies are gaining strong traction among urban populations, particularly younger consumers seeking preventive care.

Digital-first retail ecosystems are expected to amplify accessibility, with personalization and AI-driven diagnostics reinforcing long-term adoption. Rising awareness, premiumization, and cross-border product flows are projected to further shape the trajectory of China’s product type landscape.

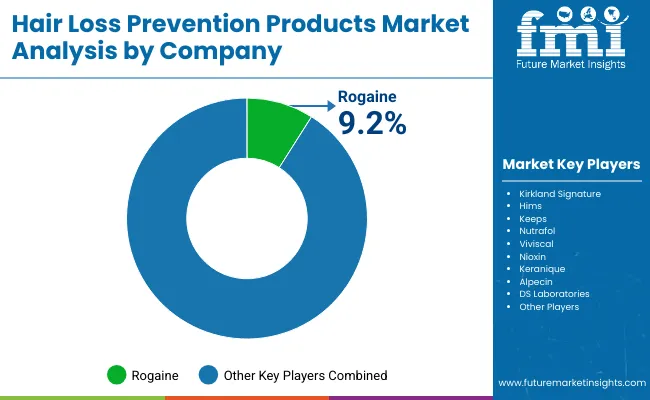

| Company | Global Value Share 2025 |

|---|---|

| Rogaine | 9.2% |

| Others | 90.8% |

The hair loss prevention products market is moderately fragmented, with global leaders, emerging innovators, and niche-focused brands competing across multiple product categories. Rogaine remains the most recognized global player, holding a 9.2% share in 2025, supported by its established position as a clinically validated solution based on minoxidil. Its brand strength, clinical credibility, and wide retail presence have ensured dominance, although significant competition is being mounted by newer entrants.

Mid-sized players such as Hims, Keeps, Nutrafol, and Viviscal are increasingly targeting younger demographics through digital-first business models, subscription-based services, and e-commerce platforms. Their strategies emphasize accessibility, convenience, and brand engagement, which are accelerating adoption among millennials and Gen Z consumers.

Niche brands including DS Laboratories, Alpecin, and Keranique are differentiating through premium positioning, natural formulations, and targeted functionality such as strengthening or scalp nourishment. These companies are leveraging dermatology-backed claims and influencer-led marketing to deepen penetration in specific regional markets.

Competitive differentiation is expected to shift toward personalization, AI-driven scalp diagnostics, and subscription ecosystems that ensure recurring revenues. Partnerships with dermatology networks and expansion into emerging economies are also projected to shape the competitive balance in the coming decade.

Key Developments in Hair Loss Prevention Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 9,803.2 million in 2025; USD 22,701.2 million by 2035 |

| Product Type | Topical serums/solutions, Shampoos/conditioners, Supplements/nutricosmetics, Device-based (lasers, rollers), and Others |

| Function | Hair fall reduction, Scalp nourishment, Hair strengthening, Follicle stimulation, and Others |

| Active Ingredient | Minoxidil, Biotin & vitamins, Saw palmetto, Peptide complexes, and Others |

| Distribution Channel | Pharmacies/drugstores, E-commerce, Salons & clinics, Mass retail |

| End User | Men, Women, Aging population |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rogaine, Kirkland Signature, Hims, Keeps, Nutrafol, Viviscal, Nioxin, Keranique, Alpecin, DS Laboratories |

| Additional Attributes | Market growth supported by preventive care adoption, digital-first sales channels, clinical validation of active ingredients, premiumization trends, rising awareness among younger consumers, high growth in Asia-Pacific, subscription-based business models, and innovation in multifunctional formulations that blend cosmetic and therapeutic benefits |

The global Hair Loss Prevention Products Market is estimated to be valued at USD 9,803.2 million in 2025.

The market size for the Hair Loss Prevention Products Market is projected to reach USD 22,701.2 million by 2035.

The Hair Loss Prevention Products Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Hair Loss Prevention Products Market are topical serums/solutions, shampoos/conditioners, supplements/nutricosmetics, device-based solutions, and others.

In terms of function, hair fall reduction is expected to command 47% share in the Hair Loss Prevention Products Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Industry Share & Competitive Positioning in the Hair Dryer Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA