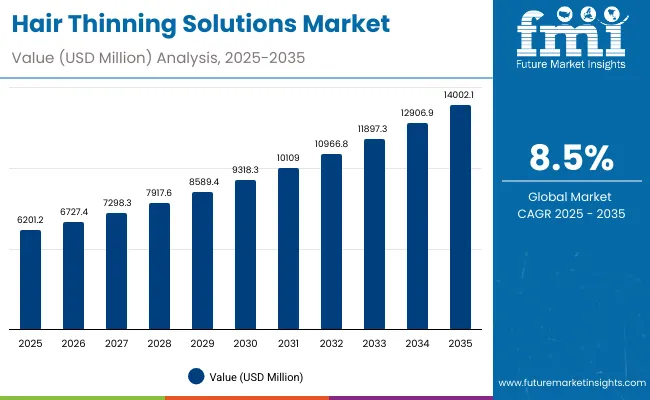

The Hair Thinning Solutions Market is projected at USD 6,201.2 million in 2025 and is forecast to achieve USD 14,002.1 million by 2035. An increase of USD 7,800.9 million over the decade represents a 2.3X growth, equal to a CAGR of 8.5%. Expansion is expected to be supported by rising awareness of hair thinning concerns, greater ingredient transparency, and growing digital channel penetration.

Hair Thinning Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Hair Thinning Solutions Market Estimated Value in (2025E) | USD 6,201.2 million |

| Hair Thinning Solutions Market Forecast Value in (2035F) | USD 14,002.1 million |

| Forecast CAGR (2025 to 2035) | 8.50% |

Between 2025 and 2030, the market is estimated to expand from USD 6,201.2 million to USD 9,318.3 million, adding USD 3,117.1 million. This period is projected to account for about 40 percent of the total incremental growth, reflecting strong adoption of advanced formulations featuring keratin and biotin, together with early adoption of subscription-based regimens in mature economies.

The second half of the forecast horizon from 2030 to 2035 is anticipated to contribute USD 4,683.8 million, equaling almost 60 percent of total expansion. Market size is expected to increase from USD 9,318.3 million to USD 14,002.1 million during this phase. Growth will be shaped by wider acceptance of e-commerce, integration of digital diagnostics for personalized solutions, and consumer preference for clinically proven outcomes. Keratin-driven formulations are likely to dominate active ingredient positioning, while volume enhancement remains a key function area. Strong momentum is projected to emerge in Asia, where China and India are forecast to outpace global averages and reinforce the long-term growth trajectory of the sector.

From 2020 to 2024, steady momentum was observed as consumers increasingly adopted ingredient-driven solutions, supported by rising awareness and expanding product accessibility through both online and offline channels. By 2025, demand is anticipated to accelerate to USD 6,201.2 million, underpinned by strong uptake of volume enhancement and keratin-enriched products. Competitive dynamics are projected to remain fragmented, with niche innovators and premium brands competing alongside mass retail players.

Growth through 2035, reaching USD 14,002.1 million, is expected to be fueled by digital commerce penetration, subscription-led replenishment, and expansion into Asia, where China and India are anticipated to lead global growth rates. Traditional leaders are expected to be challenged by new entrants offering science-backed claims and tailored regimens, shifting the basis of competition toward clinical validation, ecosystem strength, and consumer loyalty.

Growth in the Hair Thinning Solutions Market is being propelled by rising consumer awareness of hair density concerns, reinforced by greater exposure to dermatologist-led education and social media advocacy. Demand is being supported by advances in ingredient formulations, where keratin, biotin, and caffeine-based blends are being positioned with clinical validation to deliver measurable outcomes. Expansion of e-commerce platforms has provided seamless access and improved replenishment cycles, accelerating adoption across both mature and emerging economies.

Subscription-based models are being leveraged to enhance long-term regimen adherence, while digital diagnostics and AI-enabled scalp analysis are expected to increase personalization and improve efficacy perceptions. Aging demographics and lifestyle-driven hair loss incidence are further contributing to demand momentum. As consumers seek transparency and proof of results, companies with evidence-backed claims and holistic solutions that combine volume enhancement, strand strengthening, and scalp nutrition are anticipated to capture stronger brand loyalty and accelerate global market penetration.

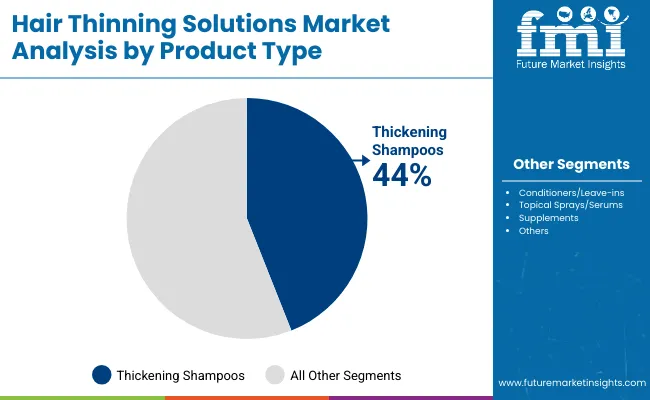

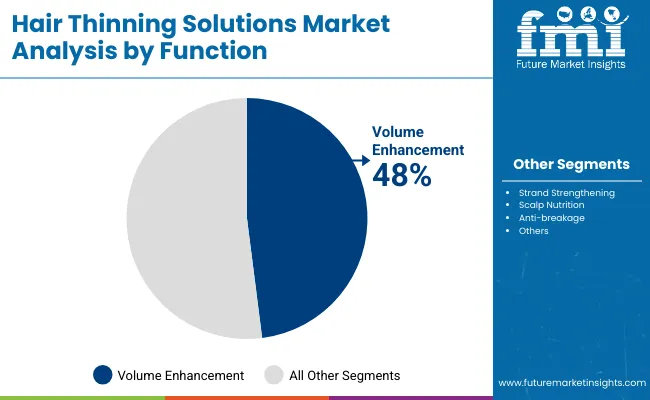

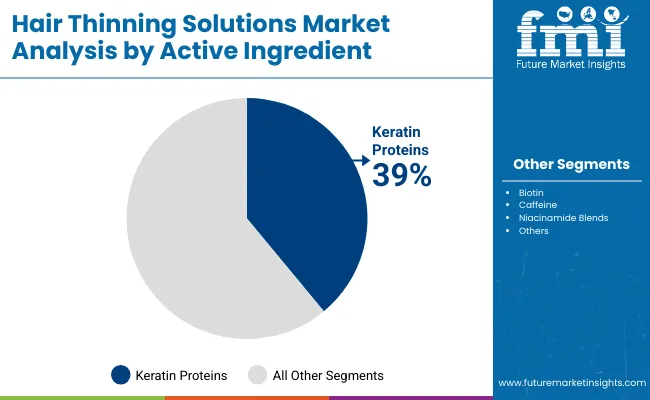

The Hair Thinning Solutions Market has been segmented across multiple dimensions to capture the diverse factors shaping demand and adoption. Key segmentation areas include product type, function, and active ingredients, each offering a distinct view of consumer priorities and industry strategies. By analyzing these segments, the structural growth drivers of the market can be better understood.

Product type segmentation highlights consumer inclination toward accessible and daily-use formulations, while functional categorization reveals the performance outcomes most valued by buyers. Active ingredient segmentation emphasizes the scientific basis of efficacy claims, which play a central role in consumer trust. Together, these segments provide clarity on the pathways through which innovation, marketing, and consumption trends are expected to influence market expansion.

| Product Type | Market Value Share, 2025 |

|---|---|

| Thickening shampoos | 44% |

| Others | 56.0% |

The product type segment is expected to be led by thickening shampoos, which accounted for 44% of the market in 2025 with sales of USD 2728.53 million. Growth in this segment is anticipated to be supported by consumer preference for convenient, daily-use solutions that deliver visible improvements in hair density. The rising influence of dermatologist endorsements and digital marketing campaigns is projected to further enhance product trust and repeat purchase rates. Although other product formats collectively hold a higher share at 56%, thickening shampoos are likely to remain the entry point for many first-time consumers. This positioning ensures sustained dominance, as consistent usage patterns strengthen brand loyalty and reinforce their role as the foundation of hair thinning solutions.

| Function | Market Value Share, 2025 |

|---|---|

| Volume enhancement | 48% |

| Others | 52.0% |

The function segment is projected to be driven by demand for volume enhancement, which held a 48% share in 2025, equivalent to USD 2976.58 million. Preference for fuller hair profiles and visible thickness has been reinforced by consumer awareness of self-image and social influence, making this function the most recognized category. As marketing narratives shift toward instant but lasting results, volume enhancement solutions are being positioned as essential components of personal care regimens. The segment’s outlook is further strengthened by innovation in product claims that balance efficacy with safety. While other functions collectively dominate with 52% share, volume enhancement is expected to maintain leadership through its universal appeal and consistent ability to address the most visible symptoms of thinning.

| Active Ingredient | Market Value Share, 2025 |

|---|---|

| Keratin proteins | 39% |

| Others | 61.0% |

The active ingredient segment is expected to remain anchored by keratin proteins, which accounted for 39% of the market in 2025 with USD 2418.47 million in sales. Keratin-based formulations have been positioned as credible due to their proven role in hair strengthening and density improvement, reinforcing their preference among consumers and professionals. Growing emphasis on clinically validated outcomes and visible repair benefits is expected to support their continued relevance. Although other active ingredients collectively represented 61% of the market, keratin proteins are anticipated to retain dominance as the foundation of premium and mid-range solutions. Sustained consumer trust and compatibility with multi-functional regimens are likely to reinforce keratin’s prominence in the hair thinning solutions category.

The Hair Thinning Solutions Market is being reshaped by scientific validation, consumer behavior shifts, and digital distribution models, even as regulatory scrutiny and competitive fragmentation intensify, making strategic alignment essential for sustaining long-term growth and category leadership.

Clinical Validation and Evidence-Led Adoption

Market expansion is being accelerated by the increasing emphasis on evidence-backed product claims, as clinical validation is now demanded by both regulators and consumers. Formulations featuring keratin, biotin, and caffeine are being subjected to measurable outcome studies, establishing credibility that fosters consumer trust and professional endorsement. This shift is anticipated to redefine brand hierarchies, as companies with strong trial data and dermatology-led credibility secure premium positioning. As ingredient transparency becomes standardized, the competitive advantage will lie in real-world efficacy metrics, reinforcing long-term adoption and market penetration.

Digital Diagnostics and Personalized Regimens

A major trend shaping the industry is the integration of digital diagnostics, where AI-enabled scalp analysis and strand imaging tools are being embedded into purchase journeys. These diagnostics allow for personalized regimens, improving treatment adherence and lifetime customer value. This evolution is projected to blur the lines between product manufacturers and digital health platforms, as consumers increasingly expect holistic solutions that combine analysis, recommendation, and replenishment. The move toward personalization is not only expected to enhance efficacy perceptions but also to lock consumers into long-term subscription models, creating predictable revenue streams.

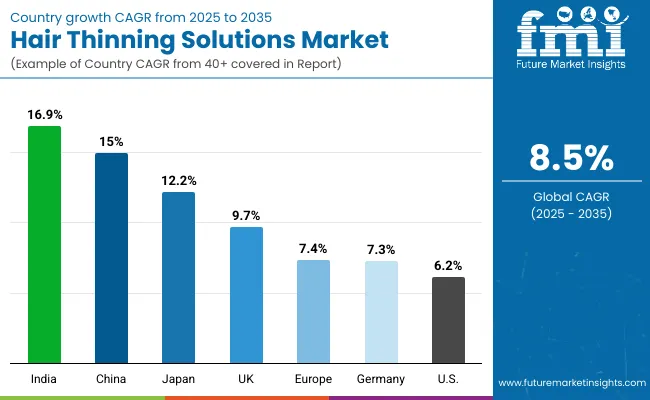

| Countries | CAGR |

|---|---|

| China | 15.0% |

| USA | 6.2% |

| India | 16.9% |

| UK | 9.7% |

| Germany | 7.3% |

| Japan | 12.2% |

The Hair Thinning Solutions Market is projected to demonstrate distinct growth trajectories across major economies, shaped by demographic pressures, digital adoption, and healthcare engagement levels. Asia is anticipated to emerge as the most dynamic growth hub, with India recording the highest CAGR of 16.9 percent and China following at 15.0 percent. Expansion in these markets is expected to be underpinned by rising middle-class incomes, increased willingness to invest in personal care, and rapid scaling of e-commerce ecosystems that enhance accessibility.

Japan, with a CAGR of 12.2 percent, is anticipated to achieve strong traction through premium-led demand, supported by consumers who prioritize efficacy and innovation in routine care. The UK, projected at 9.7 percent, is likely to maintain steady adoption, aided by lifestyle shifts and broad acceptance of dermatologist-endorsed regimens. Germany, at 7.3 percent, is expected to rely on pharmacy-driven trust and high compliance with safety and quality standards. In contrast, the USA is forecast to expand at a relatively moderate CAGR of 6.2 percent, reflecting maturity in adoption patterns but still benefiting from growing acceptance among men and aging consumers. Overall, geographic diversification of growth is projected to define the next decade for the market.

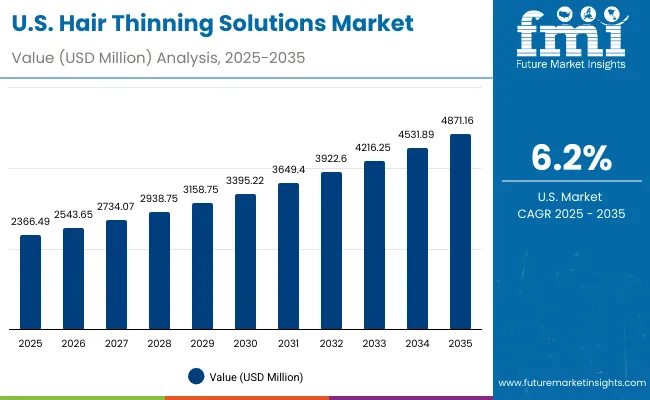

| Year | USA Hair Thinning Solutions Market (USD Million) |

|---|---|

| 2025 | 2366.49 |

| 2026 | 2543.65 |

| 2027 | 2734.07 |

| 2028 | 2938.75 |

| 2029 | 3158.75 |

| 2030 | 3395.22 |

| 2031 | 3649.40 |

| 2032 | 3922.60 |

| 2033 | 4216.25 |

| 2034 | 4531.89 |

| 2035 | 4871.16 |

The Hair Thinning Solutions Market in the United States is projected to grow at a CAGR of 6.2 percent between 2025 and 2035. This trajectory represents a near doubling of value across the decade, supported by consistent demand among women, increasing acceptance among men, and strong adoption within aging demographics. Steady year-on-year growth reflects the integration of keratin-based regimens and the expansion of volume enhancement solutions that align with consumer expectations of visible results. E-commerce penetration is anticipated to accelerate market access, while professional salons and pharmacies are projected to remain pivotal for discovery and credibility.

The Hair Thinning Solutions Market in the United Kingdom is projected to expand at a CAGR of 9.7 percent from 2025 to 2035. Growth is expected to be reinforced by lifestyle-driven adoption, strong visibility of hair health in media, and broad access through professional salons and pharmacies. Expansion of dermatologist-endorsed solutions is anticipated to create premium demand, while online subscription models are projected to increase retention rates. Rising awareness among male consumers and younger demographics is likely to broaden adoption beyond traditional segments.

The Hair Thinning Solutions Market in India is forecast to grow at a CAGR of 16.9 percent through 2035, positioning it as the fastest-growing market globally. Expansion is expected to be driven by rapid digital adoption, rising disposable incomes, and cultural acceptance of grooming across genders. Increasing penetration of e-commerce marketplaces and quick-commerce platforms is projected to transform accessibility, while urban middle-class consumers are anticipated to favor premium, clinically validated products. Adoption is also expected to rise in tier-two cities, supported by influencer-driven marketing and affordable regimen bundling.

The Hair Thinning Solutions Market in China is anticipated to register a CAGR of 15.0 percent between 2025 and 2035. Expansion is expected to be shaped by strong e-commerce infrastructure, aggressive adoption of personalized regimens, and growing emphasis on clinical validation. Partnerships with dermatology clinics and digital health platforms are projected to increase credibility and accelerate long-term adherence. Demand is also anticipated to rise across younger demographics, where self-care and appearance are becoming critical lifestyle priorities.

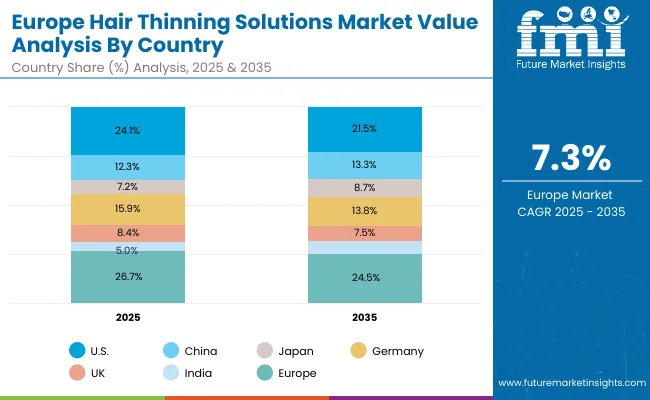

| Countries | 2025 |

|---|---|

| USA | 24.1% |

| China | 12.3% |

| Japan | 7.2% |

| Germany | 15.9% |

| UK | 8.4% |

| India | 5.0% |

| Countries | 2035 |

|---|---|

| USA | 21.5% |

| China | 13.3% |

| Japan | 8.7% |

| Germany | 13.8% |

| UK | 7.5% |

| India | 6.1% |

The Hair Thinning Solutions Market in Germany is projected to grow at a CAGR of 7.3 percent during the forecast period. Expansion is expected to be supported by strong pharmacy-led trust, adherence to strict quality standards, and consumer preference for clinically proven formulations. Increased acceptance of hair health as part of preventive care is anticipated to reinforce adoption among aging consumers, while digital channels are projected to extend reach to younger cohorts. Professional salon recommendations are likely to sustain premium positioning.

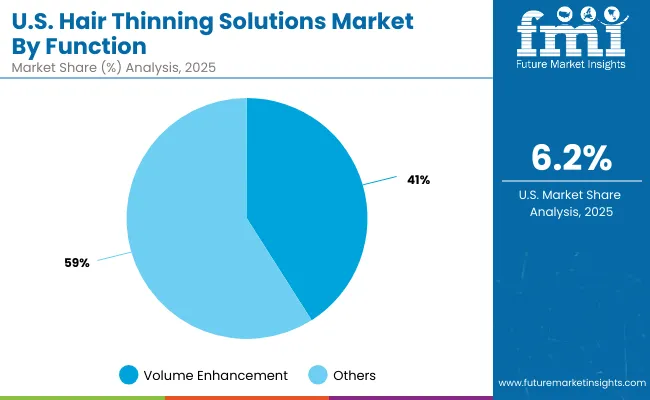

| USA By FUNCTION | Market Value Share, 2025 |

|---|---|

| Volume enhancement | 41% |

| Others | 59.0% |

The Hair Thinning Solutions Market in the United States is projected at USD 2366.49 million in 2025. Within this, volume enhancement accounts for 41 percent with USD 970.26 million, while other functional outcomes collectively contribute 59 percent with USD 1396.23 million. The greater share of non-volume categories highlights the widening consumer focus on strand strengthening, scalp nourishment, and anti-breakage solutions that extend beyond cosmetic thickening. This shift reflects evolving expectations where effectiveness is judged not only by immediate fullness but also by long-term strand resilience and scalp health. Dermatology-led endorsements and ingredient transparency are reinforcing credibility, particularly in categories that emphasize repair and prevention.

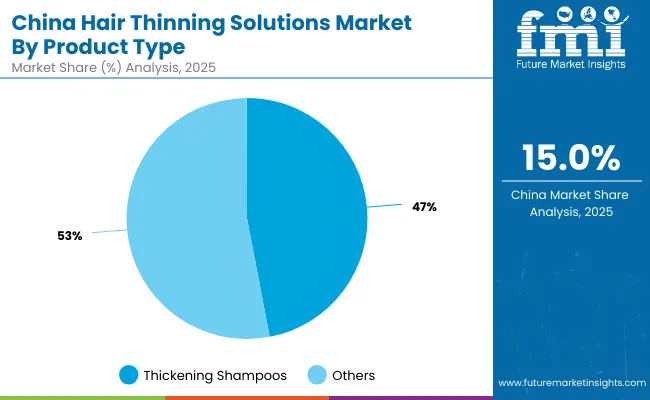

| China By product type | Market Value Share, 2025 |

|---|---|

| Thickening shampoos | 47% |

| Others | 53.0% |

The Hair Thinning Solutions Market in China is projected at USD 765.12 million in 2025. Thickening shampoos represent 47 percent of the value at USD 359.60 million, while other product types collectively hold a 53 percent share at USD 405.51 million. The prominence of thickening shampoos demonstrates their role as an accessible entry point for new consumers, providing immediate visual results that align with growing urban grooming habits. However, the slightly higher share of other product types reflects a transition toward multi-functional regimens, including conditioners, serums, and nutritional supplements, which offer more comprehensive care. E-commerce ecosystems and quick-commerce platforms are expected to accelerate adoption by improving convenience and reinforcing product discovery.

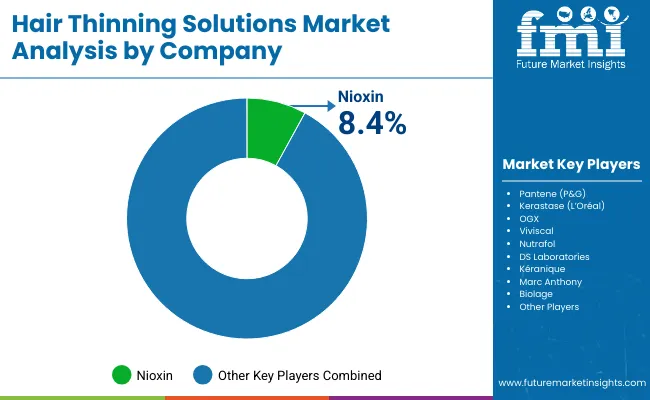

The Hair Thinning Solutions Market is moderately fragmented, with global consumer health brands, specialist innovators, and niche-focused formulators competing across diverse distribution channels. Global leaders such as Nioxin and Pantene (P&G) maintain significant visibility, supported by strong retail penetration, salon endorsements, and continuous innovation in thickening shampoos. Their strategies are increasingly aligned with clinically validated claims, ingredient transparency, and omnichannel integration, particularly through e-commerce subscriptions and dermatology-linked partnerships.

Established mid-sized players, including Nutrafol, Viviscal, and DS Laboratories, are catering to the demand for supplement-based and multi-functional regimens. These companies are accelerating adoption through nutraceutical blends, scalp health formulations, and personalized routines that appeal to both men and women.

Niche brands such as Marc Anthony, OGX, and Kéranique focus on cost-effective, consumer-friendly solutions that emphasize affordability, accessibility, and stylist-driven trust. Their strength lies in customization, influencer-led marketing, and regional adaptability rather than global scale.

Competitive differentiation is shifting away from simple thickening promises toward integrated regimens that combine topical care, supplements, and diagnostics. Digital-first approaches, including AI-based scalp analysis, subscription replenishment, and holistic care ecosystems, are expected to define future leadership.

Key Developments in Hair Thinning Solutions Market

| Item | Value |

|---|---|

| Market Value & Units | USD 6,201.2 million (2025); USD 14,002.1 million (2035); CAGR 8.5% (2025-2035) |

| Core Segments (Scope) | Product Type; Function; Active Ingredient; Channel; End User; Region/Country |

| Product Type | Thickening shampoos; Others (conditioners/leave-ins, topical sprays/serums, supplements) |

| Function | Volume enhancement; Others (strand strengthening, scalp nutrition, anti-breakage) |

| Active Ingredient | Keratin proteins; Others (biotin, caffeine, niacinamide blends) |

| Channel | E-commerce; Pharmacies/drugstores; Salons & professional; Mass retail |

| End User | Women; Men; Aging consumers |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Leading Country Growth (CAGR) | India 16.9%; China 15.0%; Japan 12.2%; UK 9.7%; Germany 7.3%; USA 6.2% (2025-2035) |

| 2025 Segment Benchmarks | Product Type: Thickening shampoos 44% (USD 2,728.53 million); Function: Volume enhancement 48% (USD 2,976.58 million); Active Ingredient: Keratin proteins 39% (USD 2,418.47 million); E-commerce channel 39% (USD 2,418.47 million, global) |

| Competitive Snapshot (2025) | Nioxin 8.4% global value share; Others 91.6% |

| Key Companies Profiled | Nioxin; Pantene (P&G); Kérastase (L’Oréal); OGX; Viviscal; Nutrafol; DS Laboratories; Kéranique; Marc Anthony; Biolage |

| USA Market Trajectory | USD 2,366.49 million (2025) → USD 4,871.16 million (2035) |

| China Marker (2025) | USD 765.12 million total; Thickening shampoos 47% (USD 359.60 million) |

| Scope Notes (Method) | All values and shares reflect the Hair Thinning Solutions Market; figures synthesized from provided dataset; outlook expressed in passive, evidence-based terms |

| Additional Attributes | Value splits by function, product type, active ingredient, and channel; subscription and e-commerce penetration; dermatologist-endorsed claims; personalization via digital diagnostics; aging-cohort adoption; Asia-led acceleration; fragmentation with long-tail challengers |

The global Hair Thinning Solutions Market is estimated to be valued at USD 6,201.2 million in 2025.

The market size for the Hair Thinning Solutions Market is projected to reach USD 14,002.1 million by 2035.

The Hair Thinning Solutions Market is expected to grow at a CAGR of 8.5 percent between 2025 and 2035.

The key product types in the Hair Thinning Solutions Market are thickening shampoos, conditioners/leave-ins, topical sprays/serums, and supplements.

In terms of product type, thickening shampoos are anticipated to command a 44 percent share, valued at USD 2,728.53 million, in the Hair Thinning Solutions Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA