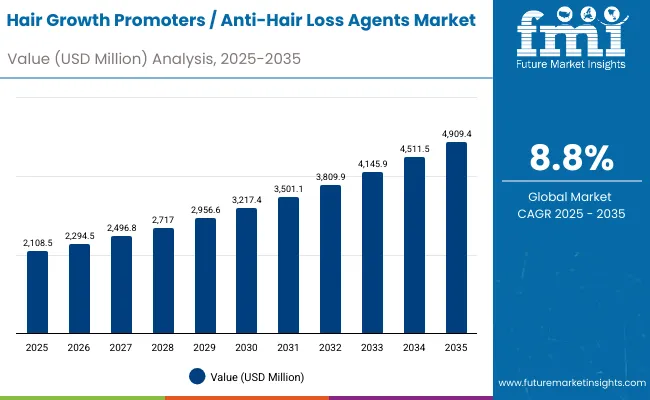

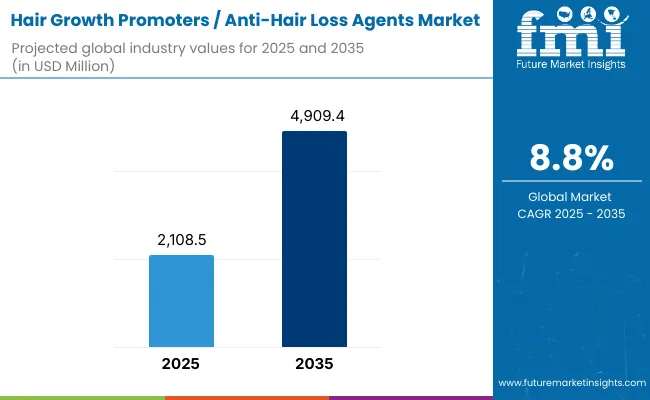

A valuation of USD 2,108.5 Million is projected for the Hair Growth Promoters / Anti-Hair Loss Agents Market in 2025, which is expected to rise to USD 4,909.4 Million by 2035. Over the decade, an expansion of nearly USD 2,800 Million is anticipated, reflecting a doubling of market size and a CAGR of 8.8%. This trajectory is being shaped by stronger clinical validation of actives, sustained demand from haircare and dermocosmetic brands, and rising formulation sophistication.

Hair Growth Promoters / Anti-Hair Loss Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Hair Growth Promoters / Anti-Hair Loss Agents Market Estimated Value in (2025E) | USD 2,108.5 million |

| Hair Growth Promoters / Anti-Hair Loss Agents Market Forecast Value in (2035F) | USD 4,909.4 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

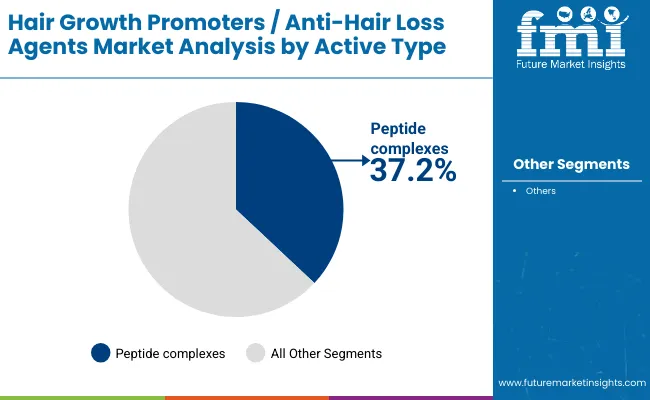

During the first phase between 2025 and 2030, the market is expected to expand from USD 2,108.5 Million to USD 3,217.4 Million, contributing USD 1,108.9 Million in additional value. This period is likely to account for almost 40% of decade growth. Growth is expected to be anchored by peptide complexes, which are forecast to command a 37.2% share in 2025 (USD 784.36 Million). Uptake of encapsulated delivery systems, accounting for 65.3% share in 2025 (USD 1,376.85 Million), is also anticipated to reinforce value realization during this stage.

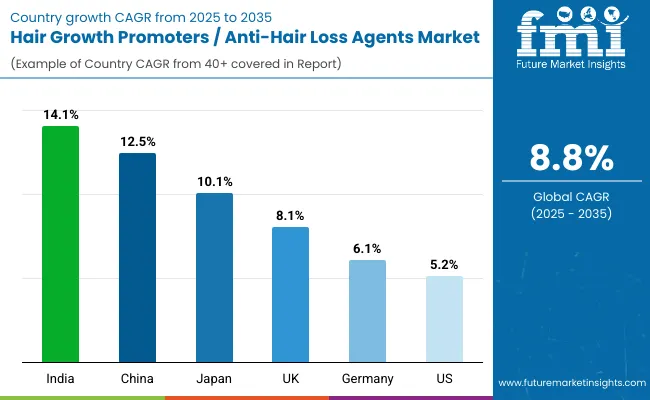

From 2030 to 2035, the market is expected to accelerate further, increasing by USD 1,692 Million as sales grow from USD 3,217.4 Million to USD 4,909.4 Million. This period will represent nearly 60% of total decade growth. Expansion is projected to be driven by high-growth Asian markets, particularly China and India, where double-digit CAGRs of 12.5% and 14.1% respectively are expected. Such regional momentum is anticipated to reshape global sourcing and competitive positioning.

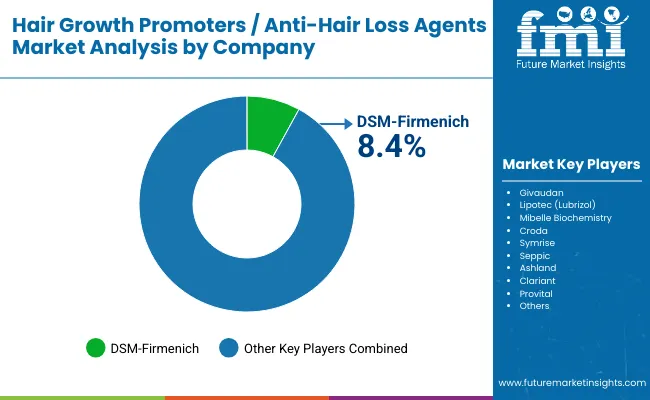

From 2020 to 2024, the foundations for future expansion were laid through enhanced R&D investment and stronger claims validation. By 2025, the market is expected to cross USD 2,108.5 Million, with encapsulated formats already capturing dominant share as stability and bioavailability were prioritized by formulators. Competitive dynamics are anticipated to remain highly fragmented, with DSM-Firmenich positioned as the leading supplier at 8.4% global value share, while the long tail of specialty ingredient providers will collectively hold over 90%.

Looking ahead, growth is expected to be fueled by double-digit CAGRs in China (12.5%) and India (14.1%), supported by clinic-adjacent adoption, rising consumer awareness, and channel digitization. The United States and Europe will contribute steady volume demand, guided by dermocosmetic and trichology-led innovation pipelines. Competitive advantage is expected to shift toward suppliers that combine mechanism-driven dossiers, encapsulation engineering, and regulatory-ready substantiation. As a result, ecosystem capability, data-backed efficacy, and alignment with region-specific compliance are expected to define market leadership through 2035.

Market expansion is being fueled by rising incidence of stress-induced hair loss, increased consumer focus on personal appearance, and greater willingness to invest in clinically validated scalp health solutions. The shift from cosmetic claims toward mechanism-driven efficacy has been reinforced by demand for peptide complexes and biotech-derived actives that demonstrate measurable follicular benefits. Encapsulated delivery systems have been adopted widely, as stability and targeted release are valued by formulators seeking consistent performance across leave-on and rinse-off formats.

Rapid growth in Asia, particularly in China and India, is being driven by higher disposable incomes and expanding clinic-adjacent channels, while North America and Europe continue to sustain demand through dermocosmetic and trichology-led innovation. Competitive differentiation is being established through credible efficacy dossiers, regulatory alignment, and scalable supply chains. With rising awareness and evidence-based formulations, adoption is expected to accelerate further, ensuring sustained double-digit growth in key markets.

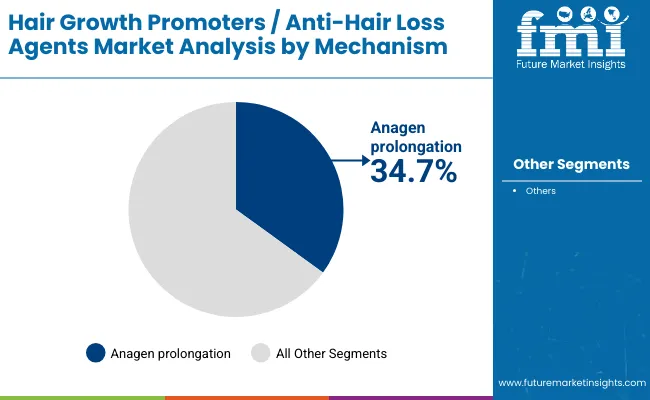

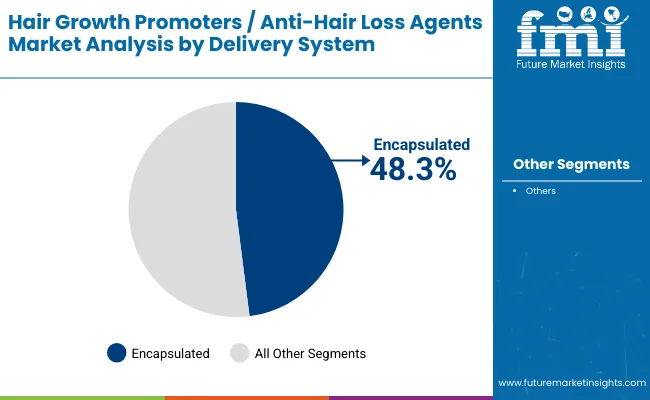

The Hair Growth Promoters / Anti-Hair Loss Agents Market demonstrates clear leadership patterns across its key segments, reflecting evolving formulation priorities and consumer-driven adoption trends. Within the Active Type category, peptide complexes are projected to dominate with a 37.2% share in 2025 (USD 784.36 Mn), supported by strong clinical validation and proven follicular efficacy. In terms of mechanism, anagen prolongation is expected to lead with 34.7% share (USD 731.65 Mn), highlighting growing demand for actives that extend the hair growth cycle. Delivery System segmentation shows encapsulated formats taking the forefront with a 48.3% share (USD 1,018.41 Mn), driven by the need for stability, targeted release, and enhanced bioavailability. These dominant categories are anticipated to anchor innovation pipelines and define competitive differentiation over the coming decade.

| Active Type | Market Value Share, 2025 |

|---|---|

| Peptide complexes | 37.2% |

| Others | 62.8% |

Peptide complexes hold 37.2% share in 2025, valued at USD 784.36 Mn, establishing them as the leading active type in the Hair Growth Promoters / Anti-Hair Loss Agents Market. This dominance is being reinforced by strong clinical validation, which has elevated peptides as preferred solutions for follicular stimulation and scalp vitality. Their compatibility with advanced formulations such as leave-on serums and dermocosmetic concentrates has positioned them as premium ingredients within brand pipelines. Peptides are also being prioritized for their reproducibility, scalability, and regulatory compliance, enabling reliable adoption in global markets. Although alternative actives continue to expand, peptides are expected to remain central to innovation, as sustained demand for clinically supported, efficacy-driven solutions continues to guide product development and differentiation.

| Mechanism | Market Value Share, 2025 |

|---|---|

| Anagen prolongation | 34.7% |

| Others | 65.3% |

Anagen prolongation accounts for 34.7% share in 2025, valued at USD 731.65 Mn, marking it as the leading mechanism in the Hair Growth Promoters / Anti-Hair Loss Agents Market. This share reflects a strong emphasis on extending the active growth phase of hair follicles, which remains the most clinically validated pathway for promoting visible hair density. Formulators are increasingly adopting this mechanism due to its proven outcomes, while research pipelines continue to support its relevance with enhanced delivery technologies. Its application across premium dermocosmetic lines and professional trichology treatments has strengthened its commercial importance. Over the forecast horizon, anagen-focused innovation is expected to remain critical, with growing integration into multi-mechanism blends designed to deliver comprehensive scalp-health solutions.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 48.3% |

| Others | 51.7% |

Encapsulated systems dominate with 48.3% share in 2025, valued at USD 1,018.41 Mn, underscoring their role as the preferred delivery method in the Hair Growth Promoters / Anti-Hair Loss Agents Market. Their leadership reflects the growing requirement for stability, controlled release, and improved bioavailability in high-value formulations. Encapsulation technologies enable enhanced protection of sensitive actives, ensuring consistent efficacy even in complex formulations such as leave-on serums and foams. This system is being adopted widely by dermocosmetic brands and professional clinics seeking measurable performance and compliance with stringent regulatory standards. With consumer expectations shifting toward clinically validated results, encapsulated systems are projected to sustain their lead, as further advancements in nano-encapsulation and micro-delivery platforms broaden application opportunities across product categories.

High clinical scrutiny and evolving consumer expectations are reshaping the Hair Growth Promoters / Anti-Hair Loss Agents Market, where scientific validation, delivery optimization, and region-specific compliance pressures are converging, defining a decade of innovation-driven growth and portfolio differentiation.

Mechanism-Level Evidence Integration

Market advancement is being propelled by the integration of mechanism-level evidence into ingredient dossiers, which has transformed procurement criteria across brand and clinic buyers. Rather than generic claims, suppliers are being evaluated on their ability to demonstrate follicular activity through validated biomarkers, in-vitro studies, and controlled in-vivo outcomes. This shift is expected to elevate suppliers capable of linking anagen support, DHT modulation, and scalp-barrier restoration to measurable endpoints, thus enabling differentiation in increasingly competitive brand portfolios. Value capture is anticipated to concentrate among ingredient vendors that align evidence strategies with regulatory frameworks across Asia, North America, and Europe, where scientific substantiation is becoming a prerequisite for claims approval.

Hybridization of Encapsulation Platforms

A key trend is emerging through the hybridization of encapsulation platforms, where lipid-based carriers are being integrated with polymeric shells or nano-gels to enhance both stability and targeted scalp delivery. This convergence is expected to reduce active degradation while tailoring release profiles to residence time in leave-on applications. Adoption of these advanced carriers is anticipated to accelerate as premium brands and professional trichology clinics demand actives that combine long shelf stability with precision bioavailability. Over the forecast period, hybrid encapsulation is expected to transform procurement decisions, rewarding suppliers who can scale innovative systems without compromising cost efficiency or regulatory compliance.

| Country | CAGR |

|---|---|

| China | 12.5% |

| USA | 5.2% |

| India | 14.1% |

| UK | 8.1% |

| Germany | 6.1% |

| Japan | 10.1% |

The global Hair Growth Promoters / Anti-Hair Loss Agents Market exhibits differentiated growth trajectories across leading economies, reflecting demographic shifts, lifestyle pressures, and evolving regulatory frameworks. India is projected to lead with a CAGR of 14.1% through 2035, as a youthful population, stress-linked hair concerns, and digital-first retail adoption accelerate penetration of advanced scalp-health formulations. China follows closely with a 12.5% CAGR, where clinic-adjacent channels, social commerce, and a rising middle class are expected to amplify demand for biotech-driven actives and encapsulated formats. Japan is anticipated to deliver robust growth at 10.1% CAGR, guided by dermocosmetic sophistication and a strong preference for clinical-grade efficacy.

Europe is projected to grow steadily at 7.5%, supported by dermocosmetic alignment and regulatory clarity, with the UK (8.1%) and Germany (6.1%) anchoring market expansion through established trichology practices and premium brand adoption. The United States is expected to record moderate growth at 5.2%, reflecting market maturity but reinforced by strong demand for peptide-rich portfolios and clinical substantiation required by retailers. These country-level dynamics suggest that while Western markets sustain steady value realization, Asian markets are expected to drive the next wave of expansion, reshaping sourcing priorities and competitive strategies over the forecast period.

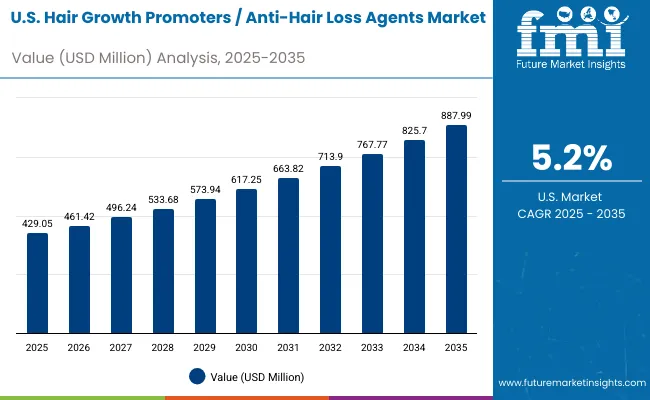

| Year | USA Hair Growth Promoters / Anti-Hair Loss Agents Market (USD Million) |

|---|---|

| 2025 | 429.05 |

| 2026 | 461.42 |

| 2027 | 496.24 |

| 2028 | 533.68 |

| 2029 | 573.94 |

| 2030 | 617.25 |

| 2031 | 663.82 |

| 2032 | 713.90 |

| 2033 | 767.77 |

| 2034 | 825.70 |

| 2035 | 887.99 |

The USA Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to grow at a CAGR of 5.2% from 2025 to 2035, supported by rising adoption of clinically validated actives and advanced delivery technologies. Demand is expected to be reinforced by strong alignment with dermocosmetic positioning and expanding trichology-based clinic networks. Encapsulated delivery systems are anticipated to gain further traction in premium leave-on products, while peptides are projected to retain preference in evidence-driven formulations. Regulatory oversight is expected to encourage suppliers to emphasize mechanism-level substantiation. Competitive positioning is anticipated to rely on cost-in-use efficiency, robust safety profiles, and scalable encapsulation platforms.

The UK Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to grow at a CAGR of 8.1% from 2025 to 2035.Steady expansion is expected as dermocosmetic positioning, pharmacist-led recommendation, and retailer compliance frameworks shape specification. Premium leave-on serums are anticipated to anchor value creation, with encapsulated systems prioritized for stability and sensory elegance. Clinical substantiation will be required to secure shelf space, while private-label programs are expected to widen ingredient access for mid-tier brands. Digital dermatology and tele-trichology are anticipated to increase conversion from advice to purchase, improving velocity for evidence-backed actives.

The India Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to grow at a CAGR of 14.1% from 2025 to 2035.Outperformance is expected as youthful demographics, stress-linked hair fall, and rapid e-commerce adoption converge. Clinic-adjacent protocols and dermatologist co-brands are anticipated to accelerate uptake, while sachet and mini-serum formats are expected to balance affordability with premium efficacy. Encapsulated systems are projected to scale through climate-resilient stability and improved bioavailability. Regional regulatory alignment and localized claims language are anticipated to unlock distribution depth beyond metros.

The China Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to grow at a CAGR of 12.5% from 2025 to 2035.Expansion is expected to be led by social-commerce discovery, clinic-linked ecosystems, and fast iteration cycles. Anagen-support mechanisms are anticipated to remain central in briefs, while multi-mechanism stacks are projected to gain share for visible density outcomes. Encapsulated formats are expected to be favored in tonic and light-emulsion leave-ons to meet residue and stability expectations. Cross-border compliance and local filing strategies are anticipated to shape time-to-market.

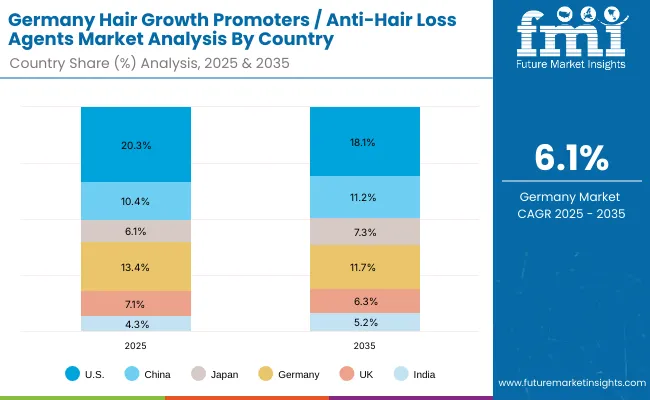

| Country | 2025 |

|---|---|

| USA | 20.3% |

| China | 10.4% |

| Japan | 6.1% |

| Germany | 13.4% |

| UK | 7.1% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 18.1% |

| China | 11.2% |

| Japan | 7.3% |

| Germany | 11.7% |

| UK | 6.3% |

| India | 5.2% |

The Germany Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to grow at a CAGR of 6.1% from 2025 to 2035.Growth is expected to be steady, driven by pharmacist trust, stringent safety expectations, and preference for clinically documented actives. Dermocosmetic brands are anticipated to prioritize peptides and scalp-barrier-supportive systems, with encapsulation favored for controlled release and stability. Sustainability requirements and INCI transparency are expected to influence procurement, rewarding suppliers with traceable inputs and robust QC.

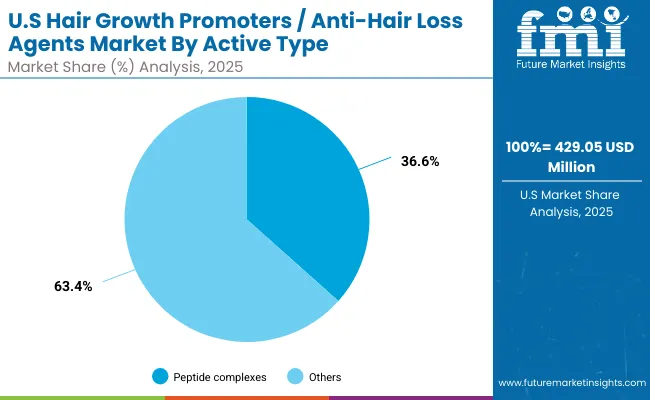

| USA By Active Type | Market Value Share, 2025 |

|---|---|

| Peptide complexes | 36.6% |

| Others | 63.4% |

The Hair Growth Promoters / Anti-Hair Loss Agents Market in the USA is projected at USD 429.05 million in 2025. Others contribute 63.4% (USD 272.02 million), while peptide complexes account for 36.6% (USD 157.03 million), which highlights the strength of diversified active portfolios in meeting varied consumer and clinical requirements. This clear dominance of broader actives stems from the preference for botanical, nutraceutical, and biotech-derived ingredients that align with wellness narratives and regulatory flexibility. Peptides, though smaller in share, are positioned as premium solutions, valued for their clinical validation, reproducibility, and compatibility with encapsulated systems favored in leave-on dermocosmetic applications. The balance between cost-effective multifunctional actives and high-value peptides is expected to shape procurement strategies in the USA market. Over the forecast horizon, dual adoption of multi-active formulations and peptide-led innovation is projected to sustain category growth and reinforce supplier competitiveness.

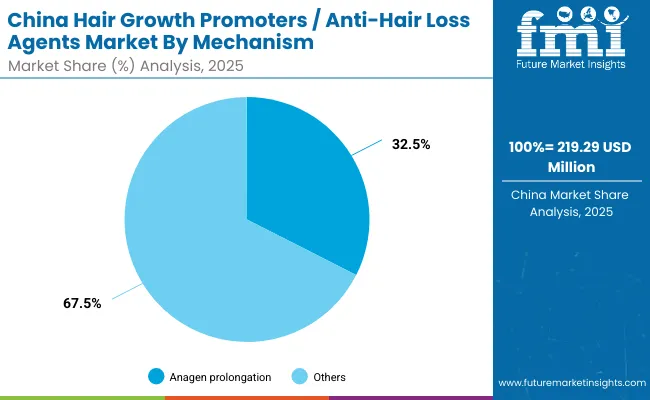

| China By Mechanism | Market Value Share, 2025 |

|---|---|

| Anagen prolongation | 32.5% |

| Others | 67.5% |

The Hair Growth Promoters / Anti-Hair Loss Agents Market in China is projected at USD 219.29 million in 2025. Others contribute 67.5% (USD 148.02 million), while anagen prolongation mechanisms account for 32.5% (USD 71.27 million), showing a preference for multi-pathway solutions that deliver broad-spectrum efficacy. This dominance of diversified mechanisms reflects reliance on DHT modulation, follicle nourishment, microcirculation enhancement, and anti-inflammatory pathways, which together address the complexity of hair loss triggers in a large and diverse consumer base. Anagen prolongation remains an important driver, particularly in clinical and professional settings, where visible improvements in hair density are prioritized. In China, rapid adoption is expected to be supported by clinic-adjacent distribution and strong demand for formulations that balance traditional herbal narratives with modern biotechnology. Over the forecast horizon, mechanism diversity is projected to remain the foundation of competitive advantage, while targeted anagen-focused innovation continues to secure share in premium ranges.

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.4% |

| Others | 91.6% |

The Hair Growth Promoters / Anti-Hair Loss Agents Market is moderately fragmented, with global leaders, regional innovators, and niche-focused specialists competing across ingredient platforms. Global suppliers such as DSM-Firmenich are holding notable influence, accounting for 8.4% of global value share in 2025. Their leadership has been reinforced by extensive peptide portfolios, regulatory-ready dossiers, and strong partnerships with multinational dermocosmetic and haircare brands. Strategies are increasingly centered on encapsulation-ready formats, mechanism-specific substantiation, and alignment with evolving safety frameworks.

Established mid-sized players such as Givaudan, Croda, Symrise, and Ashland are expanding relevance by leveraging multifunctional botanical and nutraceutical actives. Their emphasis on sensory innovation, sustainability, and rapid adaptation to regional trends is expected to capture incremental share in premium consumer-facing applications.

Specialist providers including Mibelle Biochemistry, Seppic, and Provital remain focused on niche innovations, offering highly differentiated biotechnology actives and hybrid botanical complexes. Their ability to customize portfolios for trichology clinics, dermocosmetic ranges, and nutricosmetic applications ensures competitive agility despite smaller scale.

Competitive differentiation is expected to shift further from ingredient novelty alone toward integrated ecosystem advantages, including hybrid encapsulation platforms, regulatory support, and clinical partnerships. Over the forecast period, consolidation through alliances and acquisitions is anticipated to strengthen global reach and optimize supply resilience.

Key Developments in Hair Growth Promoters / Anti-Hair Loss Agents Market

| Item | Value |

|---|---|

| Market size (2025) | USD 2,108.5 million |

| Market size (2035, forecast) | USD 4,909.4 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

| Dominant active type (2025) | Peptide complexes: 37.2% share; USD 784.36 million |

| Dominant mechanism (2025) | Anagen prolongation: 34.7% share; USD 731.65 million |

| Dominant delivery system (2025) | Encapsulated: 48.3% share; USD 1,018.41 million |

| Additional active types | Others: 62.8% share; USD 1,324.14 million |

| Additional mechanisms | Others: 65.3% share; USD 1,376.85 million |

| Additional delivery systems | Others: 51.7% share; USD 1,090.09 million |

| End-use industries | Haircare brands; Dermocosmetic brands; Professional trichology/clinic; Nutricosmetic premix (B2B) |

| Applications | Leave-on scalp treatments; Shampoos & rinse-offs; Professional clinic/meso adjuncts; Nutricosmetic premix (B2B) |

| Regions covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries covered (key) | United States; China; India; United Kingdom; Germany; Japan |

| Key companies profiled | DSM-Firmenich; Givaudan; Lipotec (Lubrizol); Mibelle Biochemistry; Croda; Symrise; Seppic; Ashland; Clariant; Provital |

| Competitive snapshot (2025) | DSM-Firmenich: 8.4% global value share; Others: 91.6% |

| Notable country CAGRs (2025-2035) | India: 14.1%; China: 12.5%; Japan: 10.1%; UK: 8.1%; Europe: 7.5%; Germany: 6.1%; USA: 5.2% |

| Additional attributes | Evidence-led dossiers; hybrid encapsulation platforms; cost-in-use modeling; clinic-adjacent channels; regulatory readiness across USA/EU/Asia; premiumization of leave-on serums; scalability for global rollouts |

The global Hair Growth Promoters / Anti-Hair Loss Agents Market is estimated to be valued at USD 2,108.5 million in 2025.

The market size for the Hair Growth Promoters / Anti-Hair Loss Agents Market is projected to reach USD 4,909.4 million by 2035.

The Hair Growth Promoters / Anti-Hair Loss Agents Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Hair Growth Promoters / Anti-Hair Loss Agents Market include peptide complexes and other actives such as botanical, nutraceutical, and biotechnology-derived ingredients.

In terms of delivery systems, encapsulated formats are projected to command 48.3% share of the Hair Growth Promoters / Anti-Hair Loss Agents Market in 2025, driven by stability and enhanced bioavailability.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Hair Styling Products Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Industry Share & Competitive Positioning in the Hair Dryer Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA