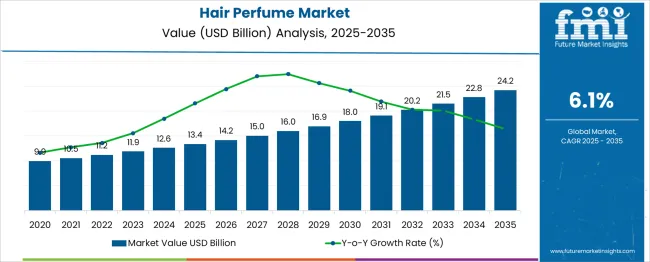

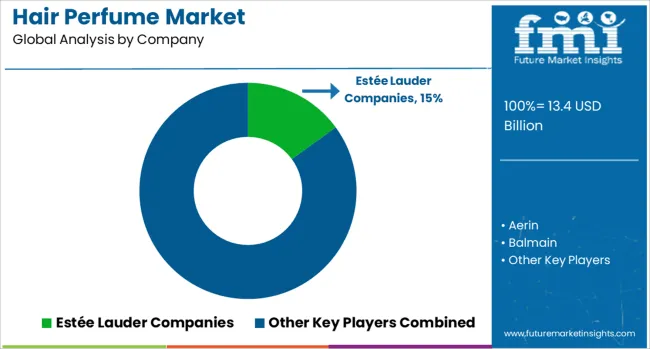

The Hair Perfume Market is estimated to be valued at USD 13.4 billion in 2025 and is projected to reach USD 24.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. A closer examination of the CAGR over the forecast period reveals steady growth, with some acceleration in the early years. Between 2025 and 2030, the market grows from USD 13.4 billion to USD 18.0 billion, contributing USD 4.6 billion in growth, reflecting a CAGR of 6.7%.

This early-phase acceleration is driven by increasing consumer demand for hair care products that offer both fragrance and treatment benefits, particularly in emerging markets. Hair perfumes are gaining popularity as consumers seek multi-functional products that provide long-lasting fragrance and nourishment. From 2030 to 2035, the market continues its upward trajectory, growing from USD 18.0 billion to USD 24.2 billion, contributing USD 6.2 billion in growth, with a slightly slower CAGR of 5.8%.

This deceleration can be attributed to the market maturing, as the initial surge in demand stabilizes, and growth becomes more incremental. The growth rate remains positive, driven by continued innovation in fragrance formulations, rising disposable incomes, and growing awareness of personal care products' benefits. The overall CAGR of 6.1% reflects strong, consistent growth across the period, underpinned by rising consumer interest in premium hair fragrance products.

| Metric | Value |

|---|---|

| Hair Perfume Market Estimated Value in (2025 E) | USD 13.4 billion |

| Hair Perfume Market Forecast Value in (2035 F) | USD 24.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Hair Perfume market is witnessing significant growth, driven by increasing consumer preference for specialized hair care products that combine fragrance with hair conditioning benefits. Rising awareness about personal grooming and the growing influence of social media trends have encouraged the adoption of hair perfumes as an essential part of beauty routines.

According to corporate press releases and investor briefings from leading cosmetics companies, innovations in formulations that avoid alcohol damage while providing long-lasting scents have further supported demand. Sustainability-focused packaging and the rise of niche, natural fragrances have also contributed to market momentum, as highlighted in industry news and company announcements.

The future outlook remains positive as premiumization in the personal care segment, coupled with growing disposable incomes, enables wider accessibility to hair perfumes. Additionally, evolving consumer expectations around multi-functional products and heightened demand for personalized fragrance experiences are expected to continue shaping the market’s expansion in both established and emerging regions.

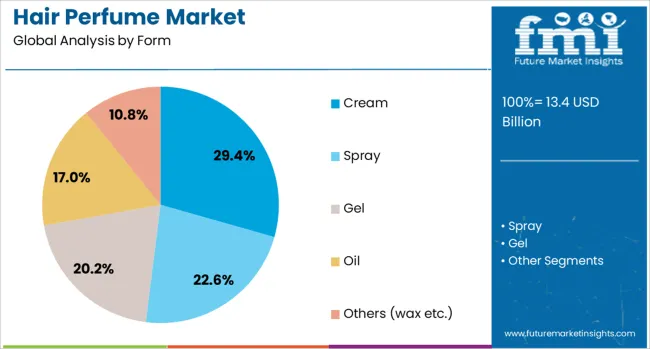

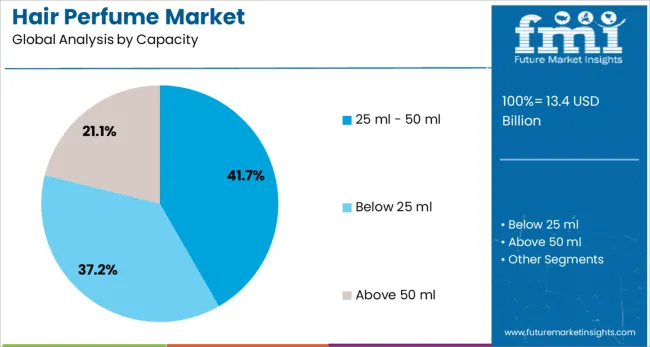

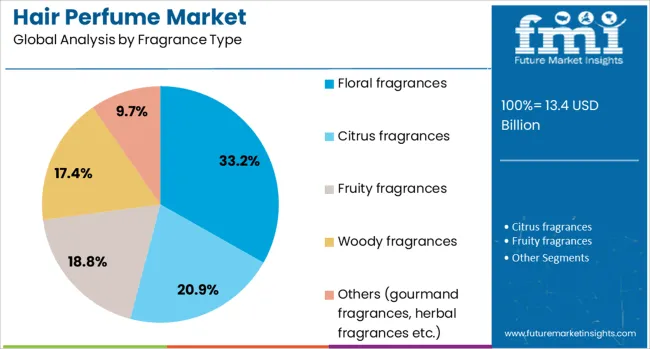

The hair perfume market is segmented by form, capacity, fragrance type, price range, consumer group, distribution channel, and geographic regions. The hair perfume market is divided into Cream, Spray, Gel, Oil, and others (such as wax). In terms of capacity, the hair perfume market is classified into 25 ml - 50 ml, below 25 ml, and above 50 ml. Based on fragrance type, the hair perfume market is segmented into Floral fragrances, Citrus fragrances, Fruity fragrances, Woody fragrances, and Others (gourmand fragrances, herbal fragrances, etc.).

The price range of the hair perfume market is segmented into Medium, Low, and High. The hair perfume market is segmented into Women, Men, and Unisex. The distribution channel of the hair perfume market is segmented into offline and online. Regionally, the hair perfume industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cream form segment is expected to hold 29.4% of the Hair Perfume market revenue share in 2025, making it the leading form segment. This dominance has been attributed to its ability to provide both fragrance and nourishment, addressing consumer concerns about hair health while delivering long-lasting scent. According to product announcements and beauty industry journals, cream-based hair perfumes have been favored for their alcohol-free formulation that minimizes dryness and breakage.

Additionally, press statements from manufacturers have noted that creams allow for better control during application, ensuring even distribution and improved scent retention. The versatility of cream formats, which cater to various hair types and styles, has further reinforced their popularity.

Retail updates have highlighted that consumers appreciate the dual benefits of fragrance and conditioning in one product, aligning with preferences for simplified beauty routines. These factors have supported the segment’s continued leadership within the market in 2025.

The 25 ml to 50 ml capacity segment is projected to account for 41.7% of the Hair Perfume market revenue share in 2025, positioning it as the dominant capacity segment. This prominence has been driven by its convenience, portability, and affordability, as cited in corporate product briefs and packaging design updates. The segment has gained traction among consumers seeking travel-friendly options that fit easily into handbags or carry-on luggage without sacrificing quantity.

Beauty retailers have reported that mid-sized packaging appeals to price-conscious buyers while still offering sufficient product for regular use. According to company presentations, this capacity also aligns with regulatory requirements for liquid products during air travel, enhancing its attractiveness to frequent travelers.

The segment’s sustained growth has been further supported by its popularity in gift sets and limited-edition launches, as highlighted in seasonal product announcements. These drivers have ensured its dominant share in the market landscape.

The floral fragrances segment is anticipated to capture 33.2% of the Hair Perfume market revenue share in 2025, maintaining its lead among fragrance types. This leadership has been underpinned by strong consumer preference for classic, versatile, and universally appealing floral notes, as observed in brand campaigns and fragrance trend analyses.

Floral scents have been associated with freshness, femininity, and elegance, which resonate strongly with the target demographic, according to statements from beauty brand executives. Press releases and industry publications have noted that floral variants are widely adopted across age groups and regions due to their timeless appeal and ability to complement different occasions.

Additionally, corporate presentations have highlighted the continued innovation in creating layered floral compositions that offer unique sensorial experiences while maintaining familiarity. These factors combined have reinforced the floral fragrances segment’s position at the forefront of the market in 2025.

Demand for hair perfumes is increasing as consumers seek longer-lasting fragrance solutions for their hair. These products, which offer a blend of fragrance and hair care benefits, have become increasingly popular in the beauty and personal care industry. Hair perfumes are valued for their ability to add scent, enhance hair health, and provide added protection against environmental factors. With growing consumer interest in hair care and beauty products, opportunities continue to expand in the market for innovative, long-lasting, and multi-functional hair perfumes.

The growing demand for hair fragrances is a key driver in the rise of hair perfumes. Consumers are increasingly looking for ways to enhance their personal care routine, and hair perfumes provide an easy solution for adding scent and refreshing the hair throughout the day. These products are becoming increasingly popular in the beauty industry, particularly among those who desire long-lasting fragrances or are sensitive to traditional perfumes. Consumers are seeking multi-functional beauty products, and hair perfumes that combine fragrance with hair care benefits like conditioning, UV protection, and nourishment are seeing greater adoption. The growing trend of self-care and wellness is also driving demand for high-quality, premium hair perfumes.

A major challenge for the hair perfume industry is the high production cost of premium ingredients and fragrance formulations. High-quality, long-lasting fragrances require costly raw materials and intricate production processes, which can increase the price of the final product. This can limit the widespread adoption of hair perfumes, particularly among price-sensitive consumers. Furthermore, consumer awareness is another challenge, as hair perfumes are a relatively new concept compared to traditional hair care products. Educating consumers on the benefits of hair perfumes, such as scent longevity and added hair protection, remains critical for increasing market penetration and ensuring broader adoption.

There are significant growth opportunities in the hair perfume sector, driven by product innovation and the expanding consumer base. With an increasing number of consumers looking for luxury, multi-functional beauty products, there is potential for brands to innovate by offering hair perfumes with added benefits, such as moisturization, shine, and heat protection. Additionally, the growing demand for natural and organic beauty products presents opportunities for hair perfumes made with eco-friendly ingredients. As the product category expands, targeting niche consumer segments, such as men’s grooming products or specific age groups, can also lead to growth. The rise of online beauty shopping is another opportunity to reach a broader audience.

A notable trend in the hair perfume market is the increasing use of natural and organic ingredients in formulations. As consumers become more conscious of the ingredients used in beauty products, there is a growing preference for hair perfumes made with botanical extracts, essential oils, and eco-friendly formulations. Another trend is the move towards customization, with brands offering personalized fragrances tailored to individual preferences. Customizable scent profiles, along with hair care benefits, are gaining popularity. Furthermore, the rise of social media and influencer culture is driving the trend for unique, high-quality hair care and fragrance products, contributing to the growing demand for hair perfumes.

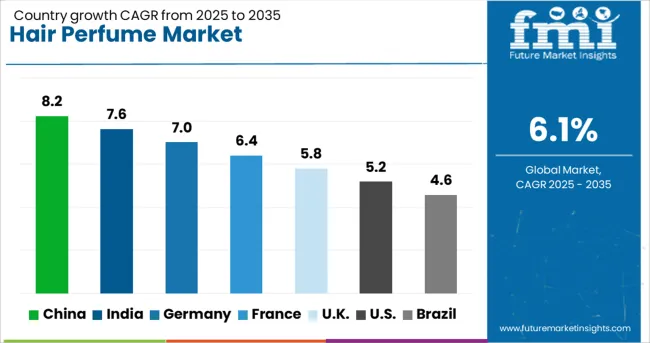

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global hair perfume market is projected to grow at a CAGR of 6.1%, with notable contributions from China, India, France, the UK, and the USA China leads with a growth rate of 8.2%, followed by India at 7.6%. France records a growth rate of 6.4%, while the UK and USA show growth rates of 5.8% and 5.2%, respectively. The increasing demand for hair care and fragrance products, particularly in emerging markets like China and India, is fueling growth. Developed markets like France, the UK, and the USA benefit from growing consumer interest in premium and personalized hair care experiences. The market’s evolution is driven by changing consumer preferences, evolving beauty standards, and advancements in product formulations. The analysis includes over 40 countries, with the top five detailed below.

China is expected to lead the hair perfume market with a projected CAGR of 8.2%. The country’s growing beauty and personal care sector, combined with rising disposable incomes, contributes to the increasing demand for premium hair care products. Consumers in China are increasingly seeking luxury and personalized experiences, driving the adoption of high-quality hair perfumes. With the growing influence of social media and beauty influencers, hair perfumes have become an essential part of Chinese beauty routines. The expanding retail networks and e-commerce platforms make these products more accessible to a broader consumer base.

India is projected to grow at a CAGR of 7.6% in the hair perfume market. The demand for hair care and fragrance products is increasing as more consumers seek to enhance their grooming routines. The growth of the middle class, combined with rising disposable incomes, is encouraging the consumption of premium personal care products. India’s evolving beauty standards and the increasing focus on self-care are key factors driving the growth of hair perfumes. The increasing popularity of natural and organic hair care products also influences the demand for hair perfumes that offer gentle, long-lasting fragrances.

France is projected to grow at a CAGR of 6.4% in the hair perfume market, benefiting from its established position as a leader in the global beauty industry. French consumers have long prioritized luxury and high-quality beauty products, and hair perfumes are increasingly becoming a staple in personal care routines. With a deep-rooted tradition of fragrance, France continues to drive innovation in the sector, focusing on offering premium, long-lasting products. The growing preference for personalized beauty experiences, along with France’s status as a key exporter of cosmetics and perfumes, supports continued market expansion.

The UK is expected to grow at a CAGR of 5.8% in the hair perfume market. The demand for high-quality, long-lasting hair perfumes is being driven by changing consumer preferences for luxury beauty products. With the rise in self-care trends and increasing attention to personal grooming, the UK has seen a surge in the popularity of premium and natural hair care products. Additionally, the growing trend of e-commerce and online shopping platforms provides wider access to a diverse range of hair perfumes, contributing to market growth.

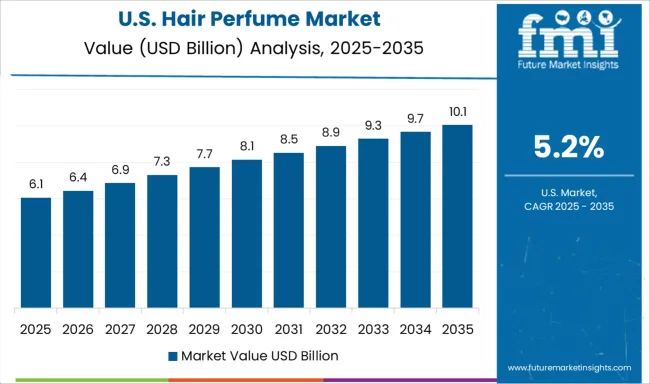

The USA hair perfume market is projected to grow at a CAGR of 5.2%. The country’s strong consumer base for luxury and personal care products continues to drive the demand for hair perfumes. USA consumers are increasingly seeking personalized and unique fragrance experiences, with a focus on high-quality, long-lasting products. The growing popularity of premium beauty products and organic ingredients also boosts the adoption of hair perfumes. Retail innovations, especially the rise of online shopping and direct-to-consumer models, enhance product accessibility, further supporting market growth in the USA

The hair perfume market is driven by leading beauty and fragrance companies that specialize in creating luxurious, high-quality scents specifically designed for hair care. Estée Lauder Companies is a prominent player, offering a wide range of premium hair perfumes under its established fragrance brands like Aerin, focusing on delivering sophisticated scents that provide both fragrance and hair nourishment.

Balmain and Byredo are also key players, offering exclusive and high-end hair fragrances aimed at enhancing the luxury beauty experience. Chanel and Dior are iconic brands known for their fragrances, with products such as Chanel No. 5 extending to hair perfumes, providing consumers with premium, signature scents. Diptyque and Gucci cater to consumers seeking distinctive, high-quality hair fragrances with a blend of natural ingredients, creating a unique sensory experience.

Kao and Maison Francis Kurkdjian offer luxurious hair perfumes that blend fashion and fragrance, with an emphasis on rich, long-lasting scents that complement personal style. Oribe and Shiseido specialize in hair care products, with Oribe in particular being renowned for its hair perfumes that focus on delivering a sensorial experience while providing added hair nourishment and protection.

Unilever offers hair fragrances under its diverse beauty product portfolio, emphasizing affordability and accessibility, while still maintaining quality. Viktor&Rolf and Yves Saint Laurent provide cutting-edge, fashionable hair perfumes that cater to the modern consumer's desire for both luxury and practicality.

Competitive differentiation in this market is driven by factors such as fragrance uniqueness, brand reputation, product performance, and the ability to cater to niche luxury or mass-market segments. Barriers to entry include the high cost of fragrance development, strong brand loyalty, and significant investment in marketing. Strategic priorities include expanding fragrance offerings, enhancing packaging aesthetics, and creating personalized, bespoke scents for consumers seeking unique, tailored hair experiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.4 Billion |

| Form | Cream, Spray, Gel, Oil, and Others (wax etc.) |

| Capacity | 25 ml - 50 ml, Below 25 ml, and Above 50 ml |

| Fragrance Type | Floral fragrances, Citrus fragrances, Fruity fragrances, Woody fragrances, and Others (gourmand fragrances, herbal fragrances etc.) |

| Price Range | Medium, Low, and High |

| Consumer Group | Women, Men, and Unisex |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder Companies, Aerin, Balmain, Byredo, Chanel, Dior, Diptyque, Gucci, Kao, Maison Francis Kurkdjian, Oribe, Shiseido, Unilever, Viktor&Rolf, and Yves Saint Laurent |

| Additional Attributes | Dollar sales by product type (luxury hair perfumes, mass-market hair perfumes) and end-use segments (luxury, premium, mass-market). Demand dynamics are driven by the increasing desire for multi-sensory beauty products, the growth of the luxury fragrance market, and the rising awareness of hair care as a holistic beauty category. Regional trends show strong growth in North America and Europe, where luxury and premium hair care products are highly sought after, while Asia-Pacific is seeing an increasing interest in high-end beauty products. |

The global hair perfume market is estimated to be valued at USD 13.4 billion in 2025.

The market size for the hair perfume market is projected to reach USD 24.2 billion by 2035.

The hair perfume market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in hair perfume market are cream, spray, gel, oil and others (wax etc.).

In terms of capacity, 25 ml - 50 ml segment to command 41.7% share in the hair perfume market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA