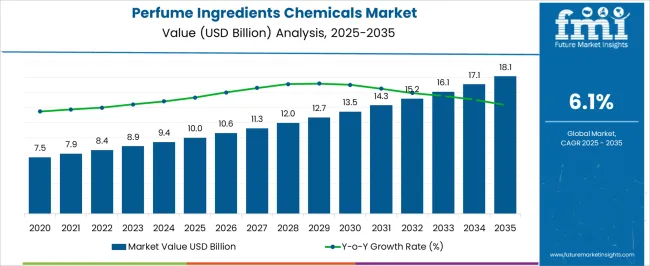

The perfume ingredients chemicals market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. A rolling CAGR analysis highlights steady growth, with variations in growth rates across different periods, reflecting changes in consumer demand, industry trends, and market dynamics. Between 2025 and 2030, the market grows from USD 10.0 billion to USD 13.5 billion, contributing USD 3.5 billion in growth, with a CAGR of 6.4%. This early-phase growth is driven by the continued demand for high-quality fragrance ingredients in the perfume and cosmetics industries, as consumer interest in premium, personalized fragrances rises. Innovations in sustainable and natural ingredients also contribute to this growth.

From 2030 to 2035, the market expands from USD 13.5 billion to USD 18.1 billion, adding USD 4.6 billion in growth, with a slightly lower CAGR of 5.9%. The deceleration reflects a more mature market as the industry reaches a higher saturation level, and growth becomes more incremental. Despite the slowdown, the demand for luxury fragrances, the adoption of eco-friendly and cruelty-free ingredients, and the expansion of fragrance applications across industries such as wellness and home care sustain continued growth. The rolling CAGR analysis shows a strong early-phase expansion, followed by steady growth as the market matures.

| Metric | Value |

|---|---|

| Perfume Ingredients Chemicals Market Estimated Value in (2025 E) | USD 10.0 billion |

| Perfume Ingredients Chemicals Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

Growth is being influenced by the continuous development of novel aromatic molecules and the expanding reach of global cosmetic and personal care brands. The current market dynamics are shaped by the increasing integration of sustainable and cruelty-free ingredients, alongside heightened investment by manufacturers in R&D to produce high-performing, long-lasting scents.

Press releases from fragrance houses and chemical manufacturers have emphasized the growing adoption of biotechnology and green chemistry, which is enhancing the appeal of both synthetic and naturally derived components. Additionally, the role of global branding, social media, and consumer lifestyle shifts is contributing to stronger market penetration.

Industry news and corporate presentations suggest that innovation in molecular distillation and encapsulation technologies will further redefine product performance and customer experience.

The perfume ingredients chemicals market is segmented by type, application, and geographic regions. By type, the perfume ingredients chemicals market is divided into Synthetic ingredients and Natural ingredients. In terms of application, the perfume ingredients chemicals market is classified into Fine fragrance, Personal care products, and Household products. Regionally, the perfume ingredients chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

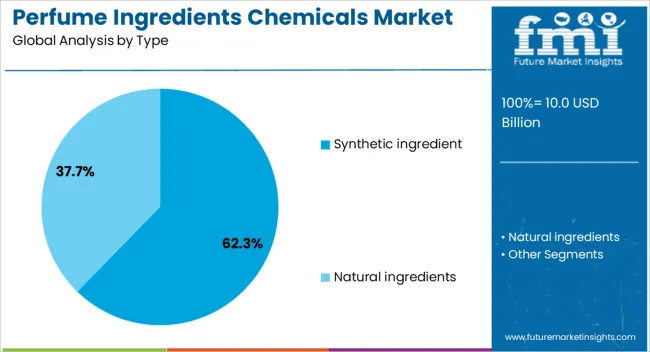

The synthetic ingredient segment is projected to hold 62.3% of the market revenue share in 2025, positioning it as the dominant type segment. This leadership is being attributed to the ability of synthetic ingredients to offer greater consistency, cost efficiency, and scalability compared to natural alternatives. Industry insights from product manufacturers have highlighted that synthetic ingredients allow for precise replication of complex scents without dependence on seasonal or regional supply chains.

Additionally, synthetic compounds are often used to mimic rare or restricted natural ingredients, ensuring regulatory compliance and safety in mass production. Fragrance developers have also favored synthetic formulations for their enhanced stability and extended shelf life.

These ingredients have supported widespread usage in both high-end perfumes and everyday personal care products. Corporate disclosures and R&D updates further emphasize that ongoing innovation in molecule synthesis is enabling brands to create unique olfactory profiles, driving the sustained demand for synthetic inputs in perfume production.

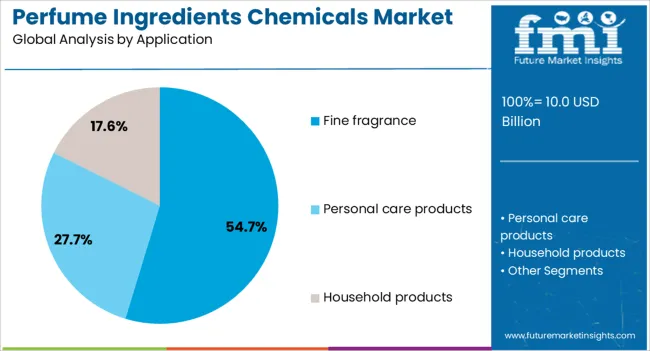

The fine fragrance segment is expected to contribute 54.7% of the perfume ingredients chemicals market revenue share in 2025, establishing itself as the leading application area. The growing consumer demand for premium, long-lasting scents and brand-specific signature fragrances has reinforced this segment’s prominence. Annual reports and investor briefings from luxury fragrance brands have noted that consumer inclination toward personal expression and identity through fragrance has significantly increased product uptake.

The segment has also benefited from the expansion of global retail channels, both online and offline, which has broadened access to fine fragrances. Technological advancements in scent formulation and encapsulation are improving fragrance longevity and skin adherence, which is enhancing consumer satisfaction.

Additionally, strategic marketing initiatives and celebrity-driven endorsements have boosted the visibility and desirability of fine fragrances. These combined factors have resulted in strong market demand and are expected to support the segment’s continued leadership in the overall market.

The perfume ingredients chemicals market is expanding due to the growing demand for fragrances across various industries, including personal care, cosmetics, and home care. Key ingredients such as essential oils, aroma chemicals, and floral extracts are crucial to creating a wide range of perfumes. The increasing consumer interest in premium and personalized fragrances, along with the rising trend of wellness and self-care, is driving market growth. However, challenges related to raw material sourcing and regulatory compliance remain. Innovations in natural and synthetic ingredients continue to shape the future of the market.

The primary driver of growth in the perfume ingredients chemicals market is the rising demand for custom and high-quality fragrances. With consumers becoming more conscious of the fragrances they wear, there is an increasing shift towards premium, unique, and personalized perfumes. Fragrance manufacturers are responding to this by investing in high-quality raw materials, including rare floral extracts, exotic oils, and innovative aroma chemicals. The growing popularity of niche and luxury perfumes, along with the increasing emphasis on wellness and self-care, has further accelerated the demand for sophisticated perfume ingredients. The expansion of online perfume sales also allows consumers to explore a broader range of fragrance options, boosting market growth.

A key challenge in the perfume ingredients chemicals market is the fluctuation in raw material costs. The prices of essential oils and natural extracts are highly volatile due to factors such as weather conditions, crop yields, and global supply chain disruptions. This can lead to increased production costs for fragrance manufacturers. Additionally, the industry faces regulatory challenges, with strict guidelines on ingredient sourcing, production, and labeling to ensure product safety and compliance. Manufacturers must navigate these regulations, which vary across regions, adding complexity to their operations. As natural ingredients are highly sensitive to contamination, ensuring consistent quality and supply is another hurdle the market faces.

The perfume ingredients chemicals market presents several opportunities, particularly in the innovation of natural and synthetic ingredients. With growing consumer preference for eco-friendly and allergen-free fragrances, manufacturers are investing in the development of biodegradable, and skin-safe ingredients. Innovations in synthetic biology are enabling the creation of new, sustainable aroma chemicals that mimic natural scents while minimizing environmental impact. Moreover, there is an increasing trend towards personalization in the fragrance industry, with consumers looking for unique, tailored scents. This opens opportunities for ingredient suppliers to develop custom formulations that meet individual consumer preferences, providing a competitive edge in the market.

A significant trend in the perfume ingredients chemicals market is the growing demand for natural fragrances. Consumers are becoming more mindful of the ingredients in the products they use, pushing for more organic, plant-based, and chemical-free perfumes. This trend is driving innovation in natural and organic extracts, such as floral, citrus, and herbal fragrances, to cater to a more eco-conscious consumer base. Alongside this, there is a rise in eco-friendly packaging solutions, with manufacturers shifting toward recyclable and biodegradable materials. These trends are influencing the perfume industry to embrace cleaner, greener, and more sustainable practices, with brands offering fragrances that align with consumer values on environmental and health consciousness.

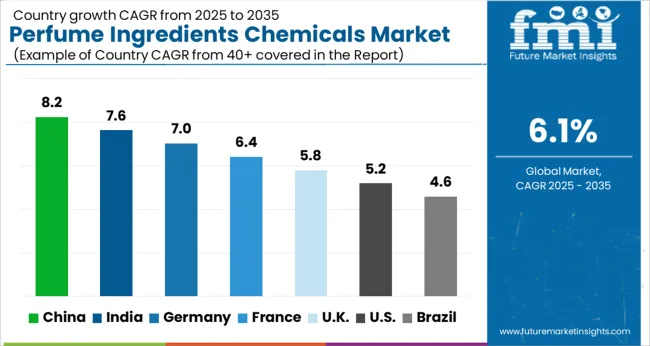

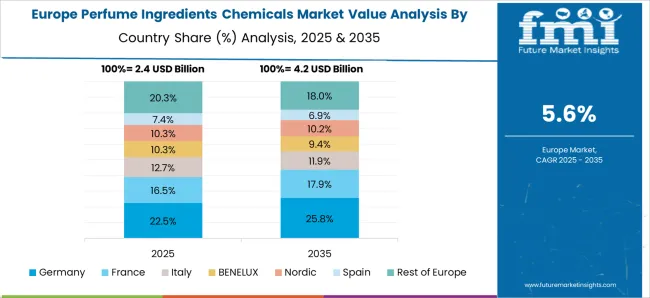

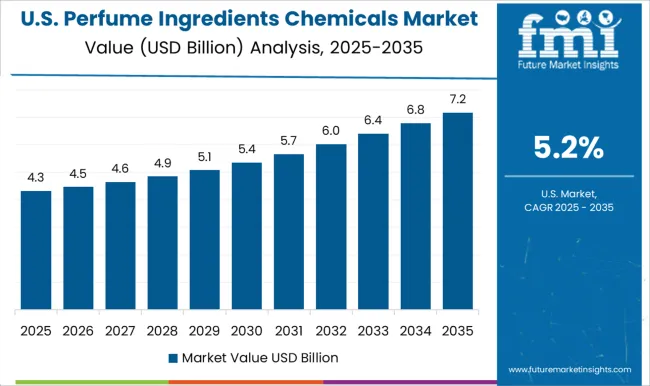

The perfume ingredients chemicals market is projected to grow at a global CAGR of 6.1% from 2025 to 2035. China leads with 8.2%, followed by India at 7.6%, and France at 6.4%. The UK is expected to grow at 5.8%, and the USA at 5.2%. The rising demand for fragrance products across personal care, cosmetics, and household goods is driving this growth, particularly in emerging economies like China and India. Established markets in Europe and North America are also seeing steady growth, supported by consumer preferences for high-quality, natural ingredients in perfumes. The market is further driven by innovations in fragrance formulation and an increasing shift toward eco-friendly and sustainable production processes. The analysis spans over 40 countries, with the leading markets shown below.

China is expected to lead the market with a growth rate of 8.2% CAGR through 2035. The country's strong position in the fragrance sector is driven by growing consumer spending and an increasing middle-class population. With rising disposable incomes, Chinese consumers are becoming more inclined toward high-quality personal care products, which include perfumes and fragrances. The growing demand for premium fragrance ingredients, including natural and exotic scents, is further boosting the market. As the fragrance industry expands, the adoption of advanced ingredients in the production of perfumes is on the rise. Chinese manufacturers are also focusing on innovation, using more sustainable ingredients to meet the evolving preferences of consumers.

India is projected to grow at 7.6% CAGR through 2035, fueled by the increasing demand for personal care products, particularly in the fragrance sector. The rise in disposable income and changing lifestyles in urban areas are contributing to a growing preference for luxury and premium perfumes. India’s booming cosmetics market is further supporting this growth, with the fragrance industry playing an integral role in personal care routines. As consumers become more conscious of the ingredients in the products they use, there is also a noticeable shift toward natural and sustainably sourced perfume ingredients. Indian manufacturers are increasingly focusing on catering to these evolving consumer preferences while expanding their market presence in both domestic and international markets.

France is expected to see a 6.4% CAGR through 2035. The country, known for its rich perfume heritage, continues to be a leader in the global fragrance market. France's long-standing reputation for producing high-quality perfumes drives steady demand for premium perfume ingredients. The fragrance industry in France is heavily influenced by both traditional luxury brands and emerging players focused on eco-friendly ingredients. With increasing global demand for French perfumes, the country continues to dominate the market. The French fragrance sector is focusing on innovative formulations and the use of natural ingredients to meet consumer demands for sustainability and authenticity.

The United States is projected to grow at 5.2% CAGR through 2035. The USA fragrance market continues to expand, with a growing emphasis on premium and natural ingredients. As consumers become more focused on the ingredients in their beauty and personal care products, there is a noticeable shift toward fragrances that feature sustainable and natural components. The demand for organic, cruelty-free, and eco-friendly perfumes is on the rise, contributing to the growth of the perfume ingredients chemicals market in the USA The country’s strong presence in the cosmetics and personal care industry supports a steady increase in the demand for quality fragrance ingredients.

The United Kingdom is projected to grow at 5.8% CAGR through 2035, driven by the increasing adoption of high-quality perfumes and fragrance products. The UK fragrance market is experiencing steady growth, particularly in the luxury segment, where demand for premium ingredients is rising. British consumers are becoming more discerning about the fragrances they choose, with a growing preference for natural and sustainably sourced ingredients. This trend is being driven by consumer interest in the ethical sourcing of ingredients and the increasing awareness of sustainability issues. As the demand for natural and organic perfumes rises, manufacturers in the UK are focusing on meeting these needs by offering innovative solutions.

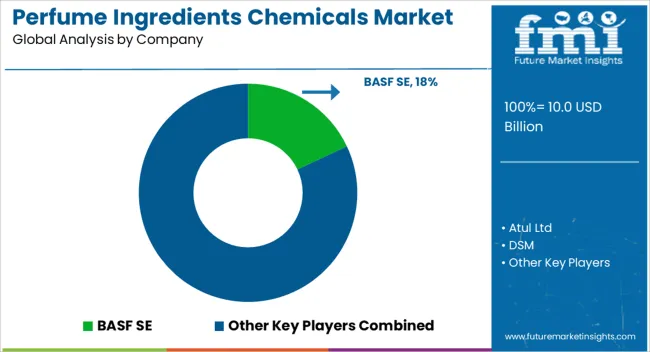

BASF SE is a market leader, offering a wide range of chemical ingredients, including essential oils, aroma chemicals, and other fragrance components, known for their high purity and performance in creating diverse scent profiles. Atul Ltd provides a comprehensive portfolio of chemicals, including both natural and synthetic ingredients used in perfumes, catering to both the luxury and mass-market segments. DSM offers high-quality chemicals and fragrance ingredients, specializing in the development of sustainable and eco-friendly solutions for the fragrance industry, meeting the growing consumer demand for natural and bio-based ingredients. Eternis Fine Chemicals is a significant player, known for offering high-performance perfume ingredients that focus on the balance of longevity, intensity, and complexity in fragrance formulation.

Firmenich and Givaudan are two of the largest players in the fragrance chemicals market, both leading the industry with cutting-edge innovations in perfume ingredient formulations. These companies focus on natural ingredient sourcing, sustainability, and the creation of unique fragrance experiences, supported by extensive R&D capabilities. Godavari Biorefineries Ltd. and Harmony Organics Pvt. Ltd. focus on offering eco-friendly, sustainable chemicals sourced from natural and renewable materials, targeting the growing demand for green and natural perfumes. International Flavors and Fragrances Inc. (IFF) provides a wide array of chemicals for fragrance and flavor production, with a strong emphasis on innovative solutions for the perfume industry. KDAC CHEM Pvt. Ltd. and MANE specialize in fragrance chemicals that support both traditional and modern perfume formulations, focusing on creating harmonious and long-lasting scents. Sensient Technologies Corporation and Symrise are prominent players, offering fragrance ingredients with a focus on innovation, quality, and sustainability, leading to a growing share in the global perfume market. Shiseido has become an important player by offering a broad range of fragrance chemicals, with a strong emphasis on integrating technology into perfume ingredient development. The company focuses on blending tradition with innovation to develop captivating and unique scent profiles for global consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Type | Synthetic ingredient and Natural ingredients |

| Application | Fine fragrance, Personal care products, and Household products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Atul Ltd, DSM, Eternis Fine Chemicals, Firmenich, Givuadan, Godavari Biorefineries Ltd., Harmony Organics Pvt. Ltd., International Flavors and Fragrances Inc, KDAC CHEM Pvt. Ltd., MANE, Sensient Technologies Corporation, Shiseido, and Symrise |

| Additional Attributes | Dollar sales by product type (essential oils, synthetic fragrances, aroma chemicals, fixatives, natural extracts) and end-use segments (luxury perfumes, mass-market perfumes, personal care products, household fragrances). Demand dynamics are influenced by the increasing consumer preference for natural and eco-friendly ingredients, growing popularity of niche perfumes, and rising awareness of sustainability in cosmetics. Regional trends show strong growth in North America and Europe, driven by the presence of established perfume manufacturers and high demand for luxury and personalized fragrances. |

The global perfume ingredients chemicals market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the perfume ingredients chemicals market is projected to reach USD 18.1 billion by 2035.

The perfume ingredients chemicals market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in perfume ingredients chemicals market are synthetic ingredient and natural ingredients.

In terms of application, fine fragrance segment to command 54.7% share in the perfume ingredients chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Analyzing Perfume Packs Market Share & Industry Leaders

Perfume Market Analysis by Product Type, Nature, End-use, Sales Channel, and Region through 2035

Perfume Bottle Market Growth & Trends Forecast 2024-2034

Perfume Ingredient Chemicals Market Analysis - Size & Industry Trends 2025 to 2035

Market Share Distribution Among Pet Perfume Providers

Pet Perfume Market Trends & Insights 2024 to 2034

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Luxury Perfume Market

Mini Refillable Perfume Bottles Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA