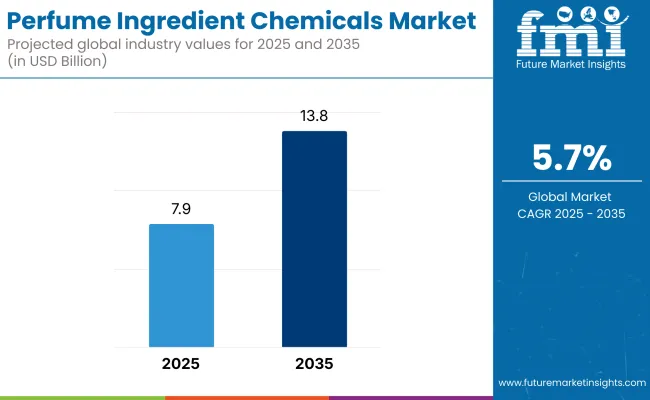

The perfume ingredient chemicals market is expected to grow at USD 7.92 billion in 2025, with a potential valuation of around USD 13.86 billion by 2035, at a CAGR of about 5.7%. Growth is driven by increasing demand from consumers for customized, high-end, and long-lasting scents.

One of the most important drivers of growth is the increasing global demand for niche and premium fragrances. Consumers are increasingly attracted to distinctive, long-lasting perfumes with personalized profiles. This trend is encouraging manufacturers to invest in new molecules, natural extracts, and sustainable ingredients with unique sensory effects.

Natural ingredients like sandalwood, rose, lavender and citrus oils are finding favor in premium and organic categories. Clean beauty trends and the demand for openness by consumers are driving the adoption of plant-based, responsibly sourced ingredients-despite supply uncertainty and greater cost being continuous issues.

The growth of personal grooming and care among men as well as women is further widening the industry. Perfume ingredient chemicals not only find their way into perfumes but also into deodorants, shampoos, lotions, and soaps. Multifunctionality and brand signature of fragrance are increasingly becoming major marketing tools for cosmetic products.

Technological innovation is creating new horizons. AI-assisted fragrance creation, biotechnology-facilitated synthesis, and micro-encapsulation for controlled release are revolutionizing new product creation for perfumers and suppliers of ingredients.

These technologies maximize consumer experience and provide maximum performance and cost.Geographically, Europe is still the powerhouse of production and consumption, led by heritage fragrance players and regulatory harmonization. Asia Pacific is growing most rapidly, driven by an emerging middle class, rising demand for Western beauty standards, and increasing e-commerce in China, India, and South Korea.

Market Metrics - Perfume Ingredient Chemicals Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 7.92 billion |

| Industry Value (2035F) | USD 13.86 billion |

| CAGR (2025 to 2035) | 5.7% |

The valuation of the perfume ingredient chemicals industry is expanding robustly, with increasing demand for natural and sustainable fragrances for personal care, cosmetics, and fine fragrances. Consumers are increasingly seeking natural ingredients, and this has led to a boom in the utilization of essential oils and natural aroma chemicals.

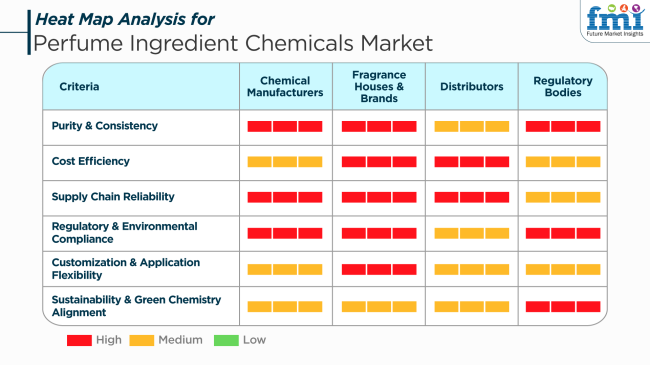

Fragrance houses and brands prefer cost-effective and reproducible ingredient solutions that provide the best performance in a range of applications. They choose materials that possess high efficacy, are environmentally compliant, and can be formulated to fit specific fragrance profiles. Distributors highlight the need to have a stable supply chain to serve the needs of fragrance houses and brands. They focus on offering a large range of products for different applications while ensuring timely delivery and competitive prices.

Regulatory authorities ensure adherence to green and safe environmental norms, enabling the implementation of sustainable and environment-friendly perfume raw material solutions. Regulatory authorities provide crucial leadership through market direction to influence industry patterns by enforcing legislation that instills green chemistry utilization and brings down the environmentally induced impacts on fragrance businesses.

From 2020 to 2024, the industry grew steadily, supported by increasing demand for personal grooming and wellness products. Consumer interest in niche and personalized fragrances expanded, encouraging manufacturers to diversify their product lines. While synthetic ingredients continued to dominate due to economics and consistency, companies began marketing perfumes based on natural ingredients as luxury scents in an attempt to cash in on changing consumer trends.

In 2025 to 2035, innovation and sustainability will lead the industry. Biotechnology will be at the center of making high-quality aromatic compounds from renewable sources. Consumers' demand for cruelty-free, vegan, and clean-label fragrances will drive new product launches. Fragrance houses will collaborate with biotechnology firms to develop responsibly sourced and traceable ingredients. Apart from this, a rise in the use of AI in the fragrance formulation and trend forecasting process is likely to lead to improved R&D cycles and tailored scent products, which would revolutionize consumer engagement in the fragrance industry.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| A steady expansion fueled by rising demand for personal care and fragrance products. | Accelerated growth is driven by innovation and expansion into new consumer segments. |

| Personal grooming trends, urban lifestyle changes, and interest in unique scents. | Adoption of biotechnology, ethically sourced, and clean-label demand. |

| Prioritization of substituting chemical constituents with natural substitutes. | Prioritization of biotechnological manufacture, AI-based formulation, and environmental sustainability. |

| Brisk presence in established markets with growing interest in Asia-Pacific markets. | Aggressive growth in emerging markets with rising demand for premium fragrances. |

| Pressure from regulations on synthetic materials prompted early green ingredients. | Tighter regulations are likely to enforce sustainability and sourcing transparency. |

| Formulation development of hybrid products with natural and synthetic ingredients. | Launch of completely sustainable, AI-personalized, and biotechnology-based fragrances. |

In 2025, the global valuation of this industry accounted for around USD 14.42 billion. Price fluctuations of raw materials, especially essential oils and synthetic aroma chemicals, could greatly affect manufacturers' production costs and profit margins.

Stringent safety and environmental regulations present significant threats to the industry. Consistency across varied regional standards demands constant monitoring and responsiveness. Non-compliance with such standards can attract legal action and damage the brand's reputation, affecting industry position and customer trust.

Supply chain disruptions such as logistics delays or geopolitical tensions can postpone the delivery of raw materials and finished goods, resulting in delays. Disruptions can lead to production stoppage and unfulfilled customer demands that negatively impact sales and long-term business relationships.

The sector is vulnerable to growing competition and technology transformation. Firms need to invest capital in research and development to keep innovating and improving product lines. Otherwise, they risk becoming obsolete and losing industry share to intense competitors.

Reindependence on strategic industries like fine fragrances, personal care, and cosmetics means that declines in these industries can directly affect the chemical demand for perfume ingredients. Diversifying the customer base across a range of sectors can reduce this risk.

Briefly, the industry is susceptible to raw material price volatility, regulatory risk, supply chain disruption, changes in technology, and sector economic downturns. Active measures are needed to cope with these concerns to ensure ongoing growth and competitiveness in this fluid industry.

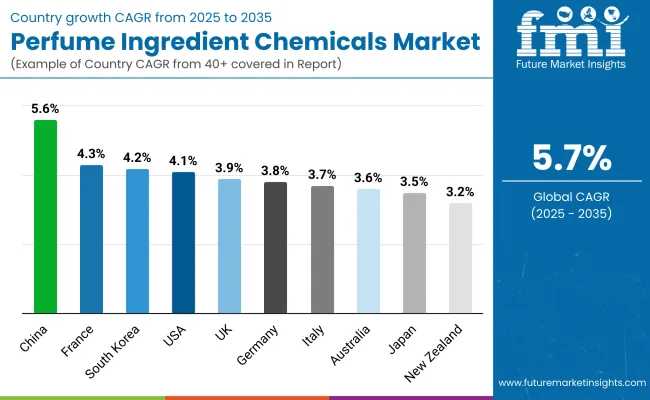

| Countries | CAGR (%) |

|---|---|

| USA | 4.1% |

| UK | 3.9% |

| France | 4.3% |

| Germany | 3.8% |

| Italy | 3.7% |

| South Korea | 4.2% |

| Japan | 3.5% |

| China | 5.6% |

| Australia | 3.6% |

| New Zealand | 3.2% |

The USA is expected to grow at a CAGR of 4.1% during 2025 to 2035. It is spurred by the robust domestic presence of the cosmetic and personal care industries, coupled with the growing consumer trend toward high-end and niche perfumes. Demand for natural and sustainable fragrance materials is also fueling innovation in this area.

Large chemical manufacturers are developing bio-derived and hypoallergenic fragrance materials to conform to changing consumer demands and regulatory requirements. Technological developments in molecular distillation and green chemistry processes are facilitating the manufacture of high-purity aroma chemicals. Fragrance houses' strategic partnerships with raw material producers continue to shape the trends favorably.

The UK is anticipated to develop at a CAGR of 3.9% during the 2025 to 2035 forecast period. Growing demand for organic and artisan perfumes, along with consumer choice for regionally derived fragrances, is driving demand for both synthetic and natural ingredients. Regulatory control dictates superior levels of ingredient traceability and safety.

Manufacturers are prioritizing transparency in formulation and the creation of sustainable supply chains. The trend toward clean labeling and low-allergen fragrance ingredients is impacting raw material selection. Collaborations between local perfumers and international chemical companies are enabling the use of innovative aroma profiles in British fragrance brands.

France is expected to register a CAGR of 4.3% over the forecast period. Being the global center of luxury perfumery, France leads the demand for an extensive range of aroma molecules, natural extracts, and specialty synthetic ingredients. Its well-established fragrance industry facilitates extended R&D in smell compounds.

Dominant players are improving capabilities in green chemistry, synthetic biology, and sustainable sourcing to address changing environmental aspirations. Demand is complemented by export-driven production and heritage strength in haute perfumery. The application of AI in perfume development also impacts ingredient choices and production steps.

Germany is projected to grow at a CAGR of 3.8% from 2025 to 2035. The nation's highly developed chemical industry provides extensive production of synthetic and natural aroma chemicals for both mass-market and premium fragrance uses. Increased demand for multifunctional and durable fragrances is driving innovation.

German producers are focusing on biocompatibility and biodegradability in ingredient formulation, meeting regulatory and environmental requirements. The application of new extraction technologies and encapsulation techniques is enhancing the performance and durability of fragrances. Local demand is also being supported by household and personal care product manufacturers.

Italy is poised to record a CAGR of 3.7% during the forecast period. Italy boasts a robust fashion and lifestyle economy, which accommodates rising demand for complex and emotionally engaging fragrance compositions. As consumers increasingly value artisanal and niche perfumery, they are fueling the diversification of ingredient sourcing.

Italian chemical manufacturers are making investments in botanical extraction, fermentation-derived molecules, and aromatic aldehydes to address changing olfactory tastes. The focus on olfactory narrative and product differentiation is driving demand for exotic and rare raw materials. Compliant regulation with EU safety standards guarantees product integrity and industry trust.

South Korea is predicted to expand at a CAGR of 4.2% from 2025 to 2035. The nation's dynamic beauty and skincare markets are driving heavy demand for fragrance ingredients. Simple formulas, coupled with the trend towards layering scents, are influencing ingredient development.

Local manufacturers are seeking out sustainable ingredient substitutes and applying biotechnology to develop innovative scent molecules. Increased demand for gender-neutral and wellness-based fragrances is spurring diversification in chemical content. The use of AI and data analytics to establish fragrances is further driving personalization in product lines.

Japan is expected to expand at a CAGR of 3.5% between 2025 and 2035. Japanese consumers have cultural tastes for delicate and subtle fragrances, which are fueling demand for low-intensity aroma compounds and skin-friendly ingredients. Applications range across personal care, wellness, and home care segments.

Japanese producers are emphasizing olfactory longevity and harmony and adhering to strict purity and safety standards. Investments in slow-release and microencapsulation technologies are adding performance to products. Botanically derived and natural fragrances continue to impact minimalist and low-irritant formulation development.

China is expected to lead with a CAGR of 5.6% between 2025 and 2035. Rising disposable incomes, urbanization, and increased awareness of personal grooming are driving the consumption of fragranced products. Local brands are investing in fragrance differentiation to enhance competition in the industry.

Chinese manufacturers are strongly increasing production capacity and improving formulation capability through alliances with international fragrance companies. Government incentives for local manufacturing and clean beauty are complementing the demand for natural and sustainable ingredients. Innovation in fragrance personalization and local scent profiles is also helping insales growth.

Australia is forecast to grow at a CAGR of 3.6% over the 2025 to 2035 forecast period. There is a growing interest in clean beauty and natural scents. Consumer concern over ingredient safety and sustainability is revolutionizing demands for plant-based aroma chemicals.

Suppliers are emphasizing transparency and traceability in sourcing natural extracts and essential oils. Integration with wellness and lifestyle branding is driving product development in home fragrance and personal care segments. Expansion is fueled by the demand for distinctively Australian botanicals in fragrance formulation, which supports the niche segment's growth.

New Zealand is also projected to develop at a CAGR of 3.2% during the forecast period. There is a growing demand for clean-label and natural products, as well as a high demand for botanical and environmentally friendly scent ingredients. Niche and artisan perfumery is becoming more popular with local consumers.

Local manufacturers are making use of the nation's rich biodiversity to design distinctive raw ingredients for perfume applications. Increased overseas demand for scent originating from New Zealand is stimulating the development of endemic ingredient sets. Regulation to ensure safety and eco-compatibility protects consumers and the market's credibility.

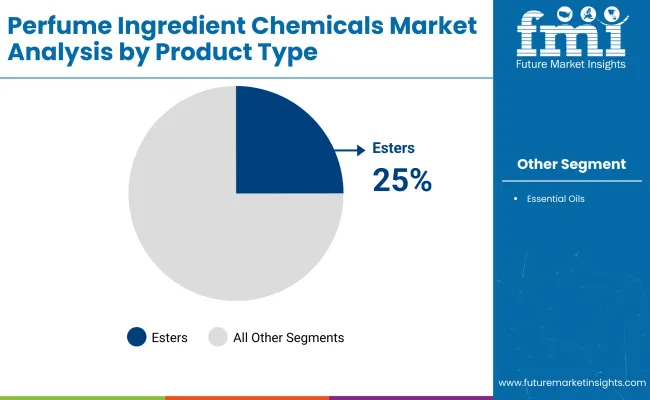

In 2025, the Esters segment is projected to dominate the industry, capturing 25% of the share, followed by alcohol, which is expected to account for 22% of the industry share. Eucalyptus and Orange Essential Oils are expected to contribute 8% and 7%, respectively.

Owing to versatility and high demand in the fragrance industry, this segment occupies the leading share. Esters are widely employed for their fruity, floral, and sweet notes, thereby making them popular in perfumery and personal care. This functionality, coupled with commercial value, affords esters with leading advantages.

These perfumes or fragrances are nothing but mixtures of some of the other fragrance chemicals. Besides, esters are also good for cleaning and air-freshening applications. Major players in this sector are Givaudan, Firmenich, and IFF (International Flavors & Fragrances). Companies manufacture esters in different solvents to meet growing requirements for fragrance profiles.

The second-largest segment, comprising 22% of the market share, consists of alcohol. Alcohol is used as a solvent in the formulation of perfumes to dissolve essential oils and other fragrance chemicals and to help deliver the required fragrance profile. It also contributes to the longevity and diffusion of perfume. The universal use of alcohol in commercial and luxury perfumes contributes massively to the industry share. Prominent suppliers of alcohol-based perfume ingredients include Symrise and Kraton Polymers.

The essential Oil segment on oranges and eucalyptus is forecasted to account for around 8% of the overall industry. These oils are preferred for their fresh and natural smell and are often used in natural- and organic-based fragrances. The demand is driven by consumer preference for natural ingredients being used in perfumes and personal care products. Other companies that produce these essential oils are doTERRA and Young Living, with much of their use in luxury perfumes and aromatherapy products.

These segments reflect the growing consumer preference for synthetic versus natural ingredients in fragrance formulation, with esters propelling forward due to their versatility. Meanwhile, essential oils are riding higher on the wave toward the global demand for natural and organic products.

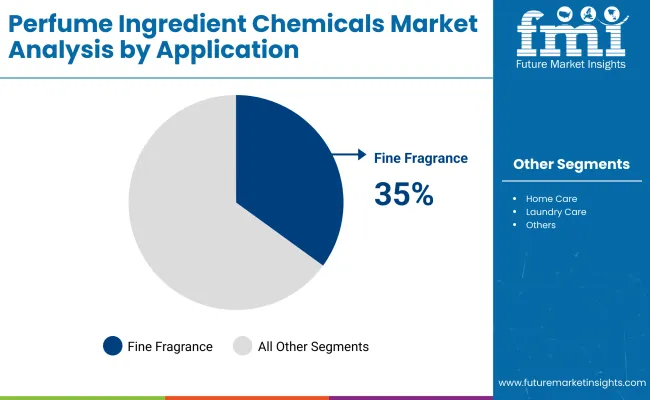

In 2025, the Fine Fragrance segment accounted for 35% of the projection for the Perfume Ingredients Chemicals Market, while Home Care followed behind with 20%.

The Fine Fragrance segment is burgeoning because of the increasing demand for high-end perfumes and luxury fragrances, which are catalysts in the fragrance industry. Fine fragrances are typically manufactured using blends of expensive aroma chemicals, essential oils, and esters to give the perfumes their complex and long-lasting qualities.

The rise in the consumer culture of personalized and unique fragrances, along with the assurance of growth through the expansion of the luxury perfume market, is thus creating a further push for the Fine Fragrance segment. Established perfume houses like Chanel, Dior, and Gucci are continually launching premium fragrances that make a trend and further drive demand for fine fragrance ingredients.

The Home Care segment stands in second place with a 20% revenue share. This segment deals with the use of perfume ingredient chemicals that go into detergents, air fresheners, and other household items. Since hygiene became increasingly in focus and the desire for fresh-smelling homes emerged, demand for home care products with long-lasting, pleasant scents has increased.

Fragrance chemicals are formulated into home care products by companies like Procter & Gamble, Reckitt Benckiser, and SC Johnson to create value for the user experience. An additional boost to demand comes from the ever-increasing demand for premium products in home care, defined by sophisticated fragrances.

Both segments are expected to show steady growth as consumers continue to seek high-quality fragrances for personal use and home environments, with fine fragrances leading due to their premium nature; in contrast, home care products benefit from overall consumer demand for products that are scented yet functional.

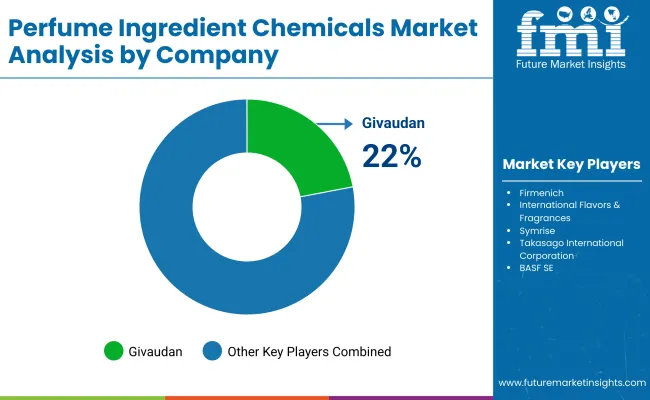

The perfume ingredient chemicals industry is highly competitive, where the key players innovate upon synthetic and natural fragrance ingredients for differentiation purposes. Givaudan, Firmenich, and International Flavors & Fragrances (IFF) enjoy strong positioning in the industry with the leverage of advanced R&D, an extensive portfolio of products and their acquisition strategies. They are working on biodegradable fragrance compounds, sustainable sourcing of ingredients, and AI-based formulation approaches to follow the shifts in consumer preferences.

Symrise, Takasago International Corporation, and Robertet are increasingly gaining industry share with the expansion of their natural fragrance segment along with investments in biotechnological aroma compounds. With increased regulatory scrutiny on synthetic ingredients, these entities are also strengthening their green chemistry innovations as well as partnering with organic farming communities to ensure the uninterrupted supply of botanical extracts.

Further, local manufacturers and niche players such as Eternis Fine Chemicals, Harmony Organics, and Atul Ltd. are effective competition, as they provide cheaper alternatives and custom-designed perfume ingredient solutions. Their business model centers around efficient production methodologies and optimized supply chains for price competitiveness while adhering to industry standards.

The merger and acquisition battleground includes licensing agreements, wherein the major fragrance houses are acquiring specialty ingredient firms to augment their capabilities. Companies such as BASF SE and Sensient Technologies Corporation are incorporating green solvent technology, encapsulated fragrance delivery systems, and AI-assisted scent creation, keeping ahead of the technology curve.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Givaudan | 22-27% |

| Firmenich | 18-22% |

| International Flavors & Fragrances (IFF) | 12-17% |

| Symrise | 8-12% |

| Takasago International Corporation | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Givaudan | A global leader in fragrance ingredient innovation with sustainable and AI-driven scent formulation capabilities. |

| Firmenich | Specializes in natural and synthetic aroma chemicals, leveraging biotechnology for unique fragrance compositions. |

| International Flavors & Fragrances (IFF) | Develops sustainable and eco-friendly fragrance solutions, incorporating encapsulation technology. |

| Symrise | Expands its natural fragrance segment, focusing on biodegradable and renewable ingredient sourcing. |

| Takasago International Corporation | Strengthens its Asian market presence with advanced extraction techniques for botanical-based fragrance compounds. |

Key Company Insights

Givaudan (22-27%)

Givaudan is at the forefront of AI-driven fragrance creation, sustainable sourcing practices, and high-end exclusive partnerships with global luxury brands.

Firmenich (18-22%)

Firmenich is developing biotechnology-inspired aroma solutions and growing its natural fragrance portfolio with strategic acquisitions.

International Flavors & Fragrances (IFF) (12-17%)

IFF is at the forefront of green chemistry innovations that develop biodegradable fragrances, and next-generation encapsulated delivery systems for fragrance.

Symrise (8-12%)

Symrise builds sustainable fragrance ingredient production and invests in biotech-based fragrance formulations.

Takasago International Corporation (5-9%)

Takasago is expanding in Asia with an emphasis on optimal raw material extracting methods and natural ingredient growth.

Other Key Players

The segmentation is into synthetic aroma chemicals (alcohol, esters, ethers, ketone, others) and essential oils (orange, citronella, peppermint, eucalyptus, others).

The segmentation is into fine fragrance, home care, laundry care, personal care, cosmetics, and others.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry valuation is estimated to reach USD 7.92 billion by 2025.

The perfume ingredient chemicals market is projected to grow to USD 13.86 billion by 2035, driven by rising consumer demand for premium and personalized fragrances, as well as innovation in natural and sustainable ingredients.

China is expected to exhibit a CAGR of 5.6%, reflecting the country’s expanding cosmetics and personal care industry.

The esters segment is leading due to their widespread application in fine fragrances, deodorants, and luxury personal care products.

Key players include Givaudan, Firmenich, International Flavors & Fragrances (IFF), Symrise, Takasago International Corporation, BASF SE, Sensient Technologies Corporation, Eternis Fine Chemicals, Robertet SA, Atul Ltd., Henkel AG & Co KGaA, Charkit Chemical Company LLC, and Huabao International Holdings Limited.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Analyzing Perfume Packs Market Share & Industry Leaders

Perfume Market Analysis by Product Type, Nature, End-use, Sales Channel, and Region through 2035

Perfume Bottle Market Growth & Trends Forecast 2024-2034

Market Share Distribution Among Pet Perfume Providers

Pet Perfume Market Trends & Insights 2024 to 2034

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Luxury Perfume Market

Mini Refillable Perfume Bottles Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Fig Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA