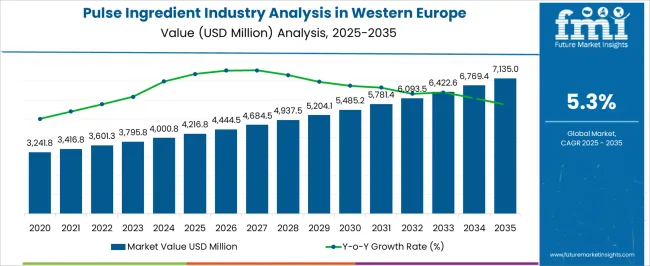

The Pulse Ingredient Industry Analysis in Western Europe is estimated to be valued at USD 4216.8 million in 2025 and is projected to reach USD 7135.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Pulse Ingredient Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 4216.8 million |

| Pulse Ingredient Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 7135.0 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The pulse ingredient industry in Western Europe is advancing steadily, propelled by growing consumer preference for plant-based proteins, clean-label ingredients, and sustainable food sources. Pulses are recognized for their nutritional benefits, including high protein and fiber content, making them an ideal component in health-driven food innovation.

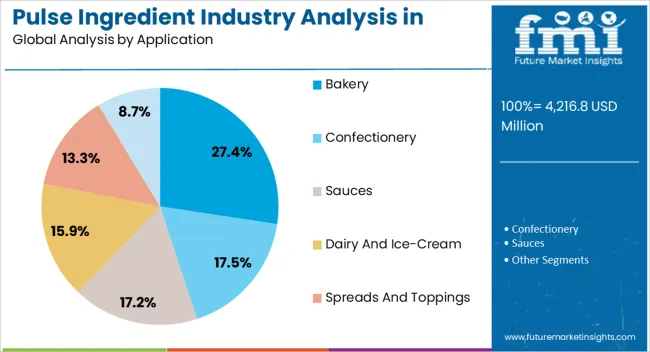

The market is currently supported by strong demand from the bakery, snacks, and meat alternatives sectors, where pulse-based ingredients enhance functionality and nutritional value. Rising health awareness and regulatory encouragement for sustainable diets have further expanded market opportunities.

With investment in processing technologies and diversification into functional food applications, the industry is expected to continue its upward trajectory.

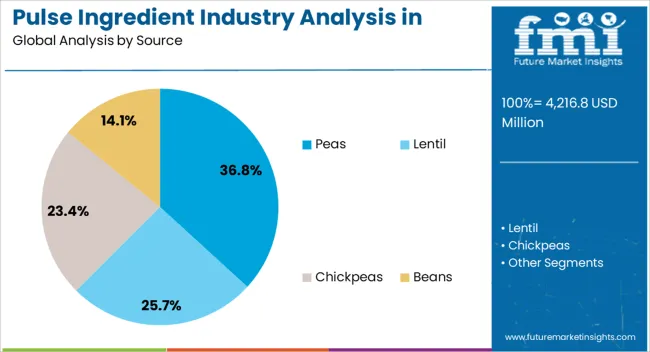

The peas segment holds approximately 36.80% share in the source category of the Western Europe pulse ingredient industry. Its leadership is supported by high protein concentration, neutral flavor, and versatility across a broad range of applications.

Pea-based ingredients align with clean-label and allergen-free trends, positioning them as a preferred alternative to soy and wheat derivatives. Strong supply chains within Europe and growing processing capabilities have reinforced its availability and competitiveness.

With increasing consumer demand for sustainable and plant-based food sources, the peas segment is projected to maintain its strong position.

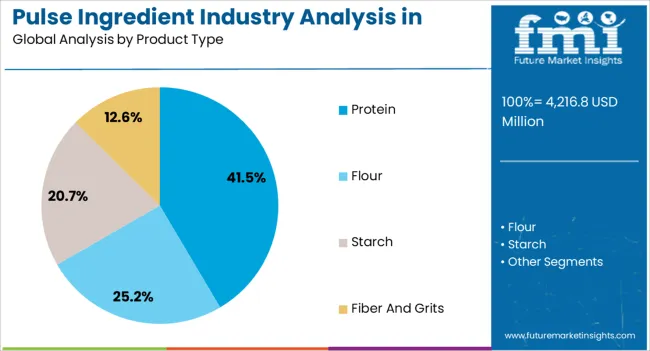

The protein segment leads the product type category with approximately 41.50% share, reflecting its critical role in driving the overall industry. Pulse-derived proteins are widely utilized in meat substitutes, dairy alternatives, and functional nutrition, supported by rising demand for high-protein diets.

The segment benefits from technological innovations that enhance solubility, texture, and taste, enabling broader use in mainstream food formulations. Consumer preference for plant-based proteins over animal-based sources due to sustainability and health considerations further drives growth.

With growing adoption in both retail and foodservice channels, the protein segment is expected to sustain its leading position.

The bakery segment accounts for approximately 27.40% share in the application category, driven by rising demand for healthier bread, snacks, and confectionery products fortified with pulse ingredients. The use of pulse flours and proteins enhances nutritional content while meeting consumer demand for high-fiber and gluten-free formulations.

Western Europe’s strong bakery culture has provided a consistent demand base, with manufacturers increasingly incorporating pulse ingredients into mainstream and specialty products.

With health-driven reformulation gaining traction across bakery lines, the segment is expected to maintain its relevance and steady growth.

Due to the growing production of pulses, which are an excellent source of protein, iron, and vitamins and have a high appeal among health-conscious consumers to lead to rising per capita consumption. As a result, the demand for pulse ingredient is poised to be stimulated.

The pulse ingredient industry in Western Europe is evolving with the product being combined with food like energy bars, chips, and biscuits.

Growing demand for clean-label and gluten-free products, urbanization, and shifting lifestyles contribute to the industry expansion for pulse ingredient in Western Europe. Technological advancements in food processing further support the industry growth.

A thorough segmentation analysis pulse ingredient in Western Europe is included in this section. With close monitoring of the trends going on in the industry and growing demand from the flour segment, manufacturers of pulse ingredients are on high alert in Western Europe. Similarly, the performance of the peas segment is outclassing other types of pulses.

| Segment | Flour |

|---|---|

| Industry Share in 2025 | 54.0% |

| Segment | Peas |

|---|---|

| Industry Share in 2025 | 55.5% |

The table below depicts the expected pulse ingredient demand in Western Europe, with an emphasis on the region's key economies, the United Kingdom, France, Italy, Germany, and the Netherlands. According to the qualitative and quantitative investigation, the Netherlands has lucrative potential with influential pulse ingredient manufacturers.

| Country | Netherlands |

|---|---|

| CAGR from 2025 to 2035 | 8.4% |

Food manufacturers are encouraged to investigate pulse-derived ingredient for various product formulations. This encouragement stems from the growing pulse ingredient industry in the Netherlands, where sustainability and nutritional value are becoming more important considerations.

| Country | United Kingdom |

|---|---|

| CAGR from 2025 to 2035 | 5.1% |

The demand for various pulse-derived products in the food industry has driven the United Kingdom's demand for pulse ingredient. The increase in demand is also a consequence of consumers’ preference for plant-based proteins.

| Country | France |

|---|---|

| CAGR from 2025 to 2035 | 4.2% |

Demand for pulse ingredients in France is on the rise due to health-conscious consumers moving towards plant-based alternatives. There is also growing usage of pulse ingredient in in a large number of culinary applications.

| Country | Italy |

|---|---|

| CAGR from 2025 to 2035 | 3.5% |

The Italian pulse ingredient industry is growing at a stable pace. This growth can be attributed to the fact that Italy is one of the major consumers of the Mediterranean diet, and pulses happen to form an integral part of the traditional diet. Thus, the adoption of pulse ingredients is highly encouraged here.

| Country | Germany |

|---|---|

| CAGR from 2025 to 2035 | 2.8% |

With consumer demand for more sustainable and more protein-rich food increasing, the German pulse ingredient industry is shifting accordingly. Pulse ingredient is being used more widely in the food and beverage industry as a result.

There is a fierce competition among the various Western European pulse ingredient industry players contending for market share. Significant pulse ingredient manufacturers in Western Europe are extending their reach geographically, collaborating strategically, and developing new products.

Industry expansion is driven by rising consumer awareness of the nutritional advantages linked to pulse ingredient. Leading pulse ingredient producers in Western Europe concentrate on environmentally friendly production and sourcing practices to meet changing consumer demands for green products.

Latest Advancements in Pulse Ingredient Industry in Western Europe

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 4216.8 million |

| Projected Valuation (2035) | USD 7135.0 million |

| Anticipated CAGR (2025 to 2035) | 5.3% |

| Historical Analysis of Pulse Ingredient in Western Europe | 2020 to 2025 |

| Demand Forecast for Pulse Ingredient in Western Europe | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Countries Analyzed while Studying Opportunities in Pulse Ingredient in Western Europe | United Kingdom, Germany, France, Italy, Spain |

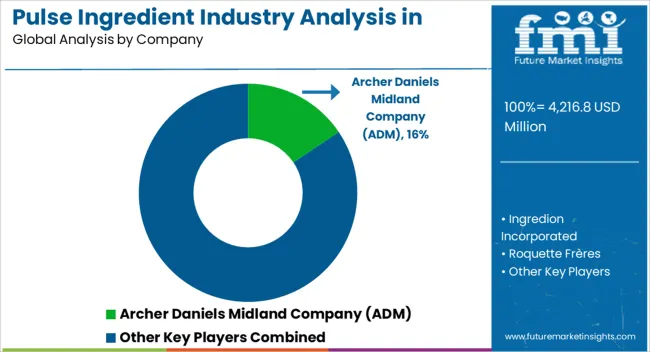

| Key Companies Profiled | Archer Daniels Midland Company (ADM); Ingredion Incorporated; Roquette Frères; AGT Food and Ingredient Inc.; Emsland Group; Vestkorn Milling AS; Batory Foods; Dakota Ingredient; Axiom Foods; Sotexpro |

The global pulse ingredient industry analysis in Western Europe is estimated to be valued at USD 4,216.8 million in 2025.

The market size for the pulse ingredient industry analysis in Western Europe is projected to reach USD 7,135.0 million by 2035.

The pulse ingredient industry analysis in Western Europe is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in pulse ingredient industry analysis in Western Europe are peas, lentil, chickpeas and beans.

In terms of product type, protein segment to command 41.5% share in the pulse ingredient industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulse Safety Resistor Market Size and Share Forecast Outlook 2025 to 2035

Pulses Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Pulse Lavage Market Size and Share Forecast Outlook 2025 to 2035

Pulse Electromagnetic Field Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Pulse Oximeter Market Size and Share Forecast Outlook 2025 to 2035

Pulse Width Modulation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulsed Field Ablation Market Analysis by Product, End User, and Region - Forecast for 2025 to 2035

Pulse Generator Market

Analyzing Pulses Market Share & Industry Trends

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

MRI Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

USA Pulses Market Insights – Demand, Size & Industry Trends 2025–2035

Smart Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Europe Pulses Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA