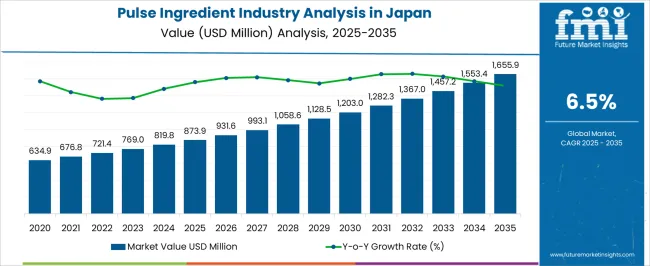

The Pulse Ingredient Industry Analysis in Japan is estimated to be valued at USD 873.9 million in 2025 and is projected to reach USD 1655.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Pulse Ingredient Industry Analysis in Japan Estimated Value in (2025 E) | USD 873.9 million |

| Pulse Ingredient Industry Analysis in Japan Forecast Value in (2035 F) | USD 1655.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The pulse ingredient industry in Japan is showing strong growth potential, supported by rising consumer awareness of plant-based proteins and the incorporation of sustainable ingredients in food formulations. Shifts in dietary preferences toward healthier and high-protein alternatives have positioned pulse-derived ingredients as a core component of functional and fortified foods.

The market is further reinforced by technological advancements in ingredient processing, which have improved texture, taste, and nutritional delivery in finished products. Demand is being driven by increasing utilization in bakery, snack, and convenience food categories, reflecting evolving consumer lifestyles.

Moreover, the alignment of pulse ingredients with clean-label and allergen-free trends has strengthened their role as a reliable substitute in various formulations. With ongoing innovation and a supportive regulatory environment encouraging plant-based consumption, the pulse ingredient industry in Japan is expected to continue expanding at a steady pace.

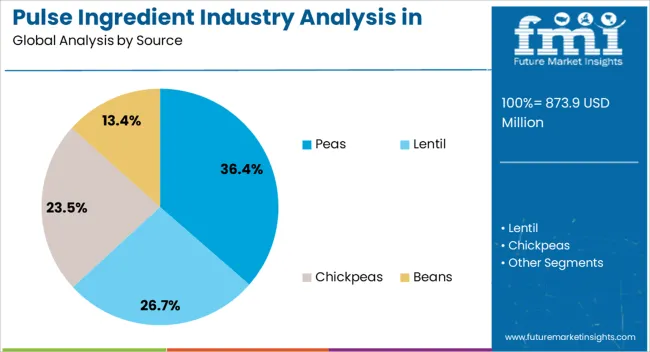

The peas segment leads the source category in Japan’s pulse ingredient industry, representing approximately 36.40% share. Its dominance is attributed to the high protein concentration, versatile functionality, and cost-efficiency of peas in food processing.

Peas are widely utilized as a base for protein isolates, concentrates, and flours, enhancing their role in both mainstream and specialty food products. The segment benefits from stable supply chains and consistent quality, which support adoption in large-scale production.

Growing application in meat alternatives and dairy substitutes has further accelerated demand. With favorable perception as a sustainable crop and broad applicability across industries, the peas segment is expected to maintain its leadership position.

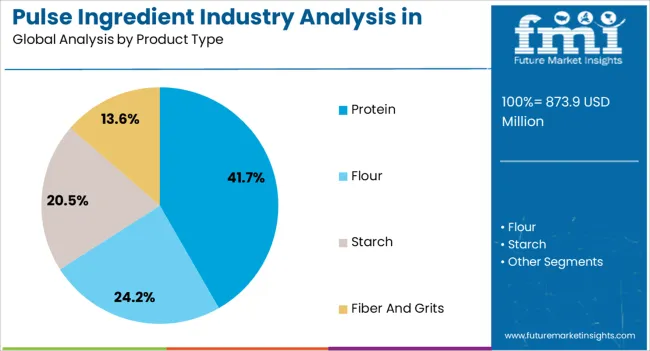

The protein segment dominates the product type category, accounting for approximately 41.70% share. Pulse-based proteins are increasingly used to fortify bakery products, beverages, and functional snacks, aligning with the demand for high-protein, plant-derived nutrition.

The segment’s growth is supported by its nutritional density, allergen-free nature, and ability to deliver essential amino acids without compromising product quality. Improved processing techniques have enhanced solubility and sensory profiles, increasing their adoption in mainstream foods.

Rising consumer interest in fitness and wellness products further reinforces demand for protein-based pulse ingredients. This segment is anticipated to maintain its lead as Japan’s health-conscious population drives consumption.

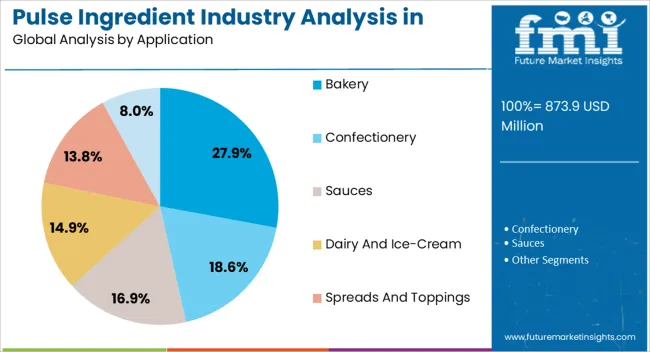

The bakery segment holds approximately 27.90% share in the application category, reflecting strong integration of pulse ingredients in bread, cakes, and pastry formulations. Their inclusion improves nutritional value by increasing protein and fiber content, while also offering gluten-free alternatives for specialized consumer groups.

Adoption is reinforced by consumer demand for healthier bakery options and industry efforts to differentiate product portfolios with functional attributes. The segment benefits from widespread consumption of baked goods in Japan, supported by innovation in ready-to-eat and packaged formats.

With bakery products serving as a major vehicle for fortification, the bakery segment is projected to remain a critical driver of market growth.

Japan is a developed country with an expanding population, an urbanizing populace, a growing working class, and a rising desire for foods that are good for their health. Pulses are viewed as the main source of protein in Japanese diets, and this is a crucial factor that is facilitating the growth of the pulse ingredient industry in Japan.

The rise in demand for natural ingredients and clean-labeled food products is driving the pulse ingredient market in Japan. Due to pulse components' high vitamin and mineral content, people are incorporating more natural and organic foods into their diets.

As the demand for cruelty-free products rises, people are shifting from animal-based proteins to plant-based supplement items. Moreover, the body digests and absorbs vitamins and proteins from plants far more efficiently than from synthetic sources.

Increasing taste for high protein-based foods, such as those manufactured with the help of pulse ingredients, is favoring the growth of the Japanese pulse ingredient market.

Since foods derived from pulses, like pea protein, pea flour, and pea starch, contain a high amount of protein, they have become more in demand due to associated health benefits. Consequently, Japan's pulse ingredient industry is anticipated to expand throughout the forecast period.

| Attributes | Details |

|---|---|

| Product Type | Flour |

| Industry Share in 2025 | 52.3% |

Japan has the most significant sales share in pulse flour market due to its high fiber, protein, and vitamin content. The demand for pulse flour is extremely high in Japan due to its extensive shelf life, superiority in flavor to wheat flour, and gluten-free nature.

The pulse flour is easy to expand as well as retains moisture and softness after cooking. These factors are increasing its use in end-use applications. Further, pulse flour is widely used to prepare bread, cakes, snacks, cereals, and meat products, and it is projected to observe increased demand over the projection period.

| Attributes | Details |

|---|---|

| Pulses Type | Peas |

| Industry Share in 2025 | 51.6% |

The peas segment is anticipated to comprise the highest percentage of pulse components in Japan over the projected period. The product demand is expected to be driven by factors such as rising obesity, blood sugar levels, various health issues, and a consumer shift toward a healthier diet.

Some health benefits of peas include weight management, improved digestion, and increased muscle strength. This is increasing the demand for peas and products containing pea protein. Further, pea starch is a by-product of pea processing, and its use in ethanol production is creating additional value for the industry's expansion.

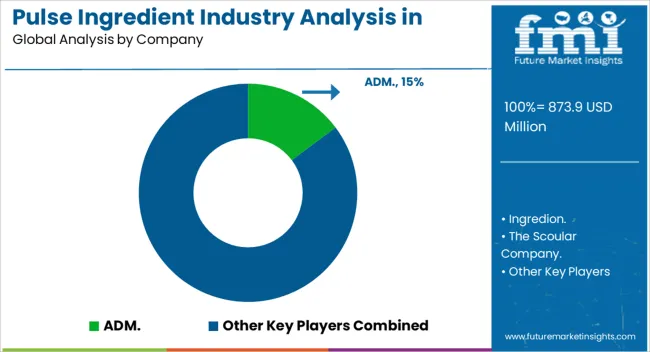

With an aging population, further heightened health consciousness, and a fast-rising demand for self-care, the competitive environment in Japan's pulse ingredient industry is changing rapidly. The top companies in the Japan pulse ingredient sector include ADM, Ingredion, The Scoular Company, Ajinomoto Co., Inc., Nisshin Oillio Group Co., Ltd., Toei Foods Co., Ltd., Nihon Shokuhin Kako Co., Ltd., and Tanaka Shoji Co., Ltd.

These companies supply their pulses variety to a wide range of markets in the food and beverage domain. The development of new products, like nutrient-added or functional component-added pulse supplements, is expected to continue influencing the industry.

Recent Developments in the Pulse Ingredient Industry in Japan

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 873.9 million |

| Projected Valuation (2035) | USD 1655.9 million |

| Anticipated CAGR (2025 to 2035) | 6.5% CAGR |

| Historical Analysis of Pulse Ingredient in Japan | 2020 to 2025 |

| Demand Forecast for Pulse Ingredient in Japan | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Pulse Ingredient Adoption in Japan, Insights on Global Players and Leading Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Industry. |

| Key Companies Profiled | ADM.; Ingredion.; The Scoular Company.; Ajinomoto Co., Inc.; Nisshin Oillio Group Co., Ltd.; Toei Foods Co., Ltd.; Nihon Shokuhin Kako Co., Ltd.; Tanaka Shoji Co., Ltd. |

The global pulse ingredient industry analysis in Japan is estimated to be valued at USD 873.9 million in 2025.

The market size for the pulse ingredient industry analysis in Japan is projected to reach USD 1,655.9 million by 2035.

The pulse ingredient industry analysis in Japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in pulse ingredient industry analysis in Japan are peas, lentil, chickpeas and beans.

In terms of product type, protein segment to command 41.7% share in the pulse ingredient industry analysis in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Resveratrol Industry Analysis in Japan Growth, Trends and Forecast from 2025 to 2035

Smart Space Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA