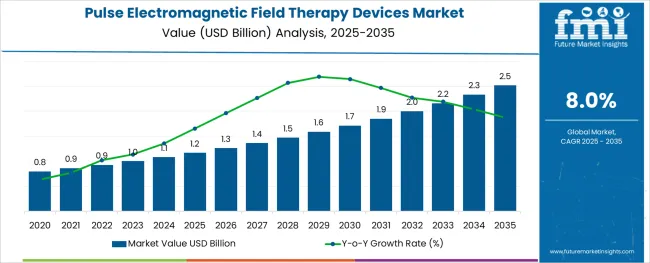

The Pulse Electromagnetic Field Therapy Devices Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The pulse electromagnetic field therapy devices market is gaining momentum as awareness of non-invasive therapeutic solutions and alternative medicine grows among patients and healthcare providers.

Rising prevalence of musculoskeletal disorders, increasing focus on pain management without pharmacological intervention, and growing acceptance of home-based therapies are driving adoption. Advancements in portable and user-friendly device designs have made these solutions more accessible to individual consumers, while healthcare professionals continue to integrate them as adjunct therapies.

Future growth is expected to be shaped by continued innovation in device technology, increasing evidence supporting efficacy, and higher demand for cost-effective, drug-free treatment options. Regulatory approvals and consumer trust in non-invasive solutions are paving the way for deeper penetration into emerging markets and wider acceptance across age groups and healthcare settings.

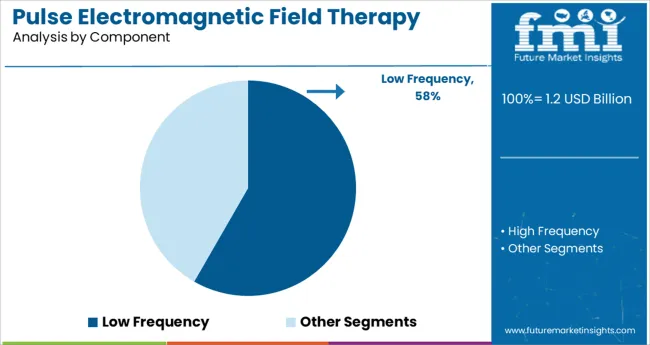

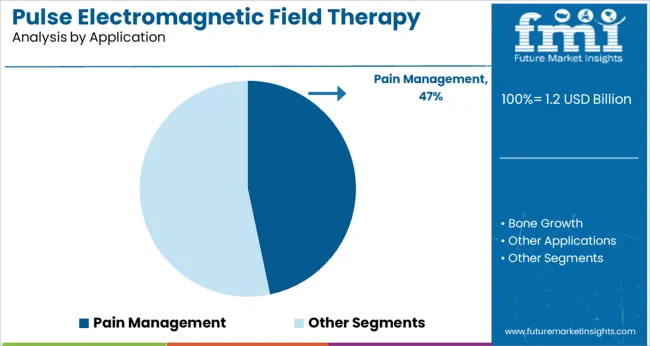

The market is segmented by Component, Application, and End-use and region. By Component, the market is divided into Low Frequency and High Frequency. In terms of Application, the market is classified into Pain Management, Bone Growth, and Other Applications.

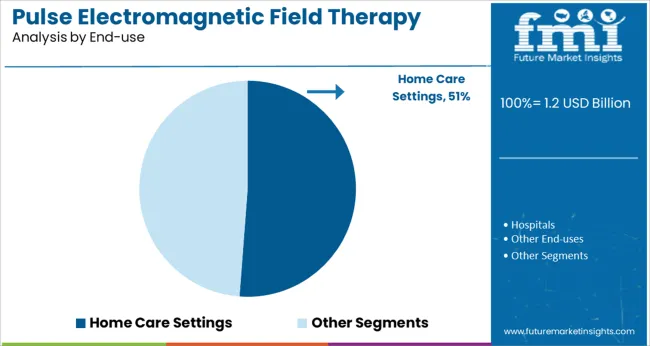

Based on End-use, the market is segmented into Home Care Settings, Hospitals, and Other End-uses. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

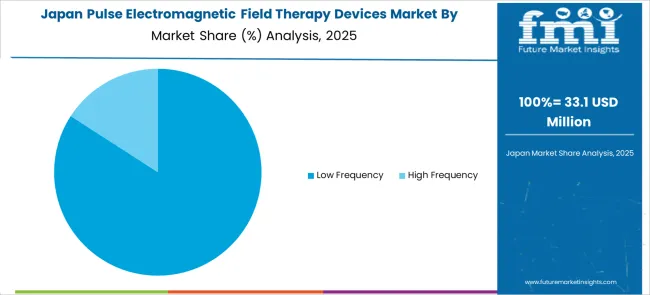

When segmented by component, the low frequency segment is projected to hold 58.3% of the total market revenue in 2025, establishing itself as the leading component. This leadership has been attributed to its recognized effectiveness in penetrating deeper tissues while maintaining safety and comfort for users.

Clinical observations have highlighted that low frequency devices achieve superior therapeutic outcomes in managing chronic pain, inflammation, and tissue recovery compared to higher frequencies. Manufacturers have focused on enhancing the efficiency and affordability of these devices, aligning with consumer expectations and clinical protocols.

Ease of regulatory clearance and proven user tolerance have further strengthened the adoption of low frequency devices, positioning this segment as the preferred choice for both home users and professionals.

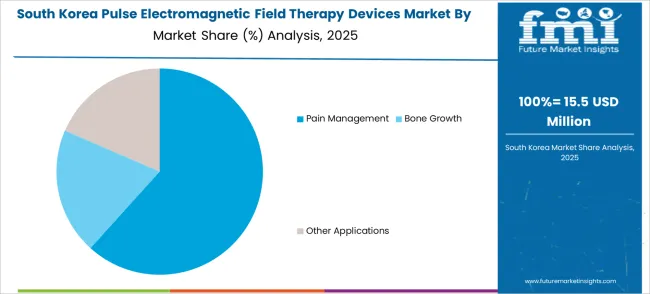

In terms of application, pain management is expected to account for 46.7% of the market revenue share in 2025, marking it as the dominant application segment. This prominence has been reinforced by growing demand for drug-free and non-invasive approaches to treat acute and chronic pain conditions.

Patients and clinicians have increasingly favored pulse electromagnetic field therapy as an adjunct or alternative to traditional analgesics, driven by concerns about long-term medication side effects. The ability to provide localized, repeatable, and customizable treatment has strengthened its role in pain clinics, rehabilitation centers, and home care.

Consumer education, rising incidence of arthritis and sports injuries, and preference for self-managed therapies have collectively supported the leadership of the pain management segment in the market.

Segmenting by end use, home care settings are forecast to contribute 51.2% of the market revenue in 2025, positioning them as the leading end use segment. This dominance has been underpinned by the increasing trend toward self-care and the preference for convenient, private, and cost-effective treatment options.

The growing availability of compact and easy-to-use devices has empowered patients to manage their conditions without frequent clinical visits. This shift has been further driven by an aging population, heightened awareness of preventive healthcare, and advancements in telehealth integration that support remote monitoring.

Manufacturers have responded by designing devices specifically tailored for layperson use, ensuring safety and efficacy while reducing the need for professional supervision. These factors have reinforced the position of home care settings as the preferred environment for pulse electromagnetic field therapy.

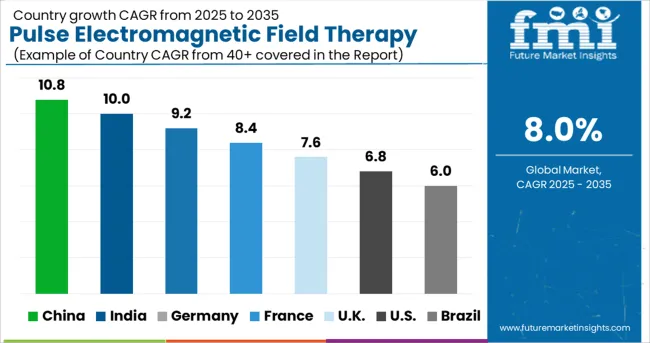

As per the Pulse Electromagnetic Field Therapy Devices Market industry research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Pulse Electromagnetic Field Therapy Devices Market industry increased at around 7.8% CAGR. Countries such as the USA, United Kingdom, China, Japan, and, South Korea held a significant share of the global market.

PEMF (pulsed electromagnetic field) therapy devices are non-invasive and have no known negative effects. PEMF therapy is a treatment option for a variety of musculoskeletal problems. The FDA has approved PEMF devices for the treatment of non-union fractures as well as post-operative osteoarthritis, plantar fasciitis, discomfort, and edema.

These devices also have a number of advantages, including the reduction of chronic and acute pain associated with a variety of connective tissues, such as bone, tendon, ligament, and cartilage injury, as well as the control of edema and inflammation. As a result, the advantages of these devices are expected to drive market expansion.

The market is expected to rise due to an increase in the global elderly population and increased awareness of pulse electromagnetic field (PEMF) therapy devices. The market position is projected to be secured by technological improvements including the development of narrow, downsized PEMF therapeutic devices employing sophisticated materials. The addition of telemedicine is likely to broaden the range of applications for these devices.

Severe spinal injuries, as well as delayed union and non-union fractures, are the most common outcomes of road accidents and trauma, necessitating surgical intervention. During the treatment of failed spinal fusions, delayed unions, fracture non-union, and new fractures, PEMF therapy devices stimulate bone repair.

The International Osteoporosis Foundation estimates that osteoporosis causes 8.9 million fractures per year. Furthermore, approximately 1.6 million hip fractures occur globally each year, with this figure expected to rise to between 4.5 and 6.3 million by 2050. As a result, the demand for PEMF therapy devices is likely to rise as the number of instances of osteoporosis rises.

The surge in the number of fractures due to falls, accidents, and sports injuries and Poor conditions of roads in various countries are some of the factors responsible for the growth of the market. Fractures caused by sports injuries, accidents, falls from a certain height, and symptoms such as arthritis, knee discomfort, and joint pain affect a major section of people around the world.

According to WHO figures, around 1.3 million people die each year as a result of traffic accidents. Furthermore, low- and middle-income countries account for the majority of worldwide traffic fatalities. Poorly maintained roads can result in a variety of injuries and pain in various body areas.

Potholes, uneven roads, broken surfaces, and road cracking can all cause injury to pedestrians, necessitating medical attention. Furthermore, governments' lack of focus on improving road infrastructure raises the risk of accidents and other injuries that can cause significant pain, raising healthcare expenses for individuals.

Interventional Orthopaedics of Atlanta is promoting PEMF therapy, an orthopedic clinic in Atlanta, Georgia, for the treatment of chronic tiredness symptoms, osteoporosis, and poor wound healing. The market for pulse electromagnetic field therapy devices in the United States is growing as a result of these discoveries.

PEMF technology is known for generating energy in the body's cells without requiring invasive surgery. For enterprises in the pulse electromagnetic field (PEMF) therapeutic equipment industry, such advantages translate into value-grab opportunities. PEMF therapy boosts the body's natural function by amplifying the body's natural energy. This therapy aids in the improvement of sports performance as well as the speedier recovery of injuries.

Because electromagnetic therapies cause a wide range of interactions within the body, some patients have reported discomfort during their first sessions. As a result, these occurrences occur seldom during the initial stages of treatment. Mild side effects are more common with whole-body treatments and, in rare situations, local therapies.

PEMF side effects are small and transitory, and they normally go away after the therapy is continued. Furthermore, people with electromagnetic hypersensitivity are more likely to have these side effects. Patients may experience overreactions because PEMF therapy has the power to modify biological systems and excite cells or tissues.

The market in the United Kingdom is projected to reach a valuation of USD 48 million by 2035. With a CAGR of 9.8% from 2025 to 2035, the market is expected to gross an absolute dollar opportunity of USD 29 million during the forecast period.

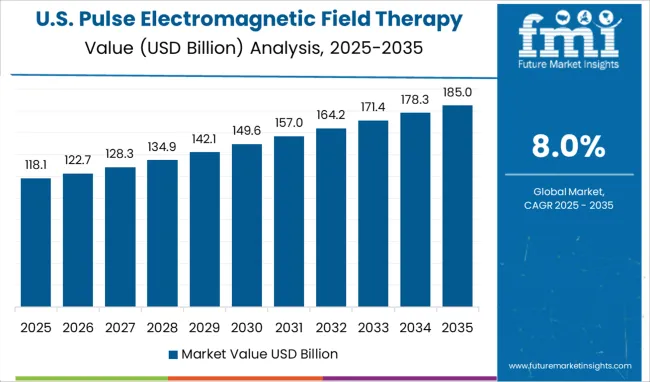

United States remains the most dominant country in the Pulse Electromagnetic Field Therapy Market having the expected largest market share of USD 2.5 million by 2035. The demand for PEMF therapy devices in the United States is expected to rise as the number of individuals suffering from osteoporosis and osteoarthritis rises. Furthermore, the growing shift to minimally invasive procedures is expected to boost regional growth. In addition, the presence of a well-developed healthcare system in the United States is expected to stimulate the demand.

In Japan, the market is expected to reach USD 46 million by 2035. The market in the country is projected to gross an absolute dollar opportunity of USD 31 million during the forecast period, growing at a CAGR of 11.6%.

The market in South Korea is projected to witness an absolute dollar opportunity of USD 9.6 million during the forecast period. By 2035, the market in the country is likely to reach USD 17 million by 2035, growing at a CAGR of 8.5%.

The Low-Frequency pulsed electromagnetic field therapy devices market is expected to account for the highest CAGR of 8.8%. Low-frequency PEMF devices generate magnetic fields with frequencies that are medium-high but low in intensity. These devices may also be used to address hard tissues and delayed bone growth. Low-frequency PEMF devices are used to treat rheumatoid arthritis inflammation, pain, and impairments in a quick, non-invasive, and simple way. As a result, the use of low-frequency PEMF therapy devices for arthritis treatment is likely to drive growth.

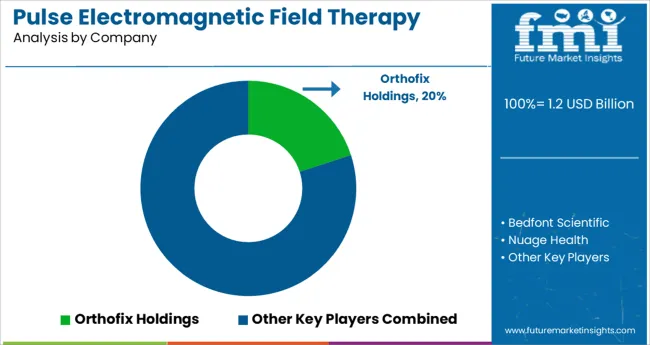

Some of the players operating in the pulse electromagnetic field therapy devices market include Bedfont Scientific, Orthofix Holdings, Nuage Health, Bemer, Oxford Medical Instruments Health, OSKA, Medithera, NiuDeSai, and I-Tech Medical Division.

Some of the recent developments of key players in the Pulse Electromagnetic Field Therapy Devices Market are as follows:

Similarly, recent developments related to companies offering Pulse Electromagnetic Field Therapy Devices Market have been tracked by the team at Future Market Insights, which is available in the full report.

The global pulse electromagnetic field therapy devices market is estimated to be valued at USD 1.2 billion in 2025.

It is projected to reach USD 2.5 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are low frequency and high frequency.

pain management segment is expected to dominate with a 46.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Pulse Safety Resistor Market Size and Share Forecast Outlook 2025 to 2035

Pulses Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Pulse Lavage Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Pulse Oximeter Market Size and Share Forecast Outlook 2025 to 2035

Pulse Width Modulation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Pulses Market Share & Industry Trends

Pulse Generator Market

Pulsed Field Ablation Market Analysis by Product, End User, and Region - Forecast for 2025 to 2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

MRI Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

USA Pulses Market Insights – Demand, Size & Industry Trends 2025–2035

Smart Pulse Oximeters Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Europe Pulses Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA