The global pulses market is characterized by a combination of regional dominance and international trade leadership, with multinational corporations occupying 40% of the market share. Companies like AGT Foods (Canada), Olam International (Singapore), and Cargill (USA) are key players due to their integrated supply chains, advanced processing capabilities, and global distribution networks.

Amul (India), Meiji (Japan), and Lotte Confectionery (South Korea) enjoy a 35% market share in the regional segment by catering to local tastes and preferences. Pulse-based innovative product offerings from the startup and niche brands Banza (USA) and Simply 7 Snacks (USA) occupy 15%.

Private labels, of which Tesco (UK) and Walmart (USA) are leaders, occupy 10% through cost-effective value offerings to the budget conscious. The market is segmented, but only to a moderate degree at the global level due to the existence of numerous producers and processors in regions.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (AGT Foods, Cargill, Olam International) | 40% |

| Regional Leaders (Amul, Meiji, Lotte, ETG, SunOpta) | 35% |

| Startups & Niche Brands (Banza) | 15% |

| Private Labels (Tesco, Walmart) | 10% |

The global market for pulses is fragmented in nature. The leaders from regional levels along with multinationals make substantial contributions.

The largest market share is captured by chickpeas in the global pulses market, holding 40% of the market share. Chickpeas are the legume commonly known for use in a broad number of culinary disciplines, popular within the Mediterranean regions of the Middle East, South Asia, and within the European subcontinent.

There are good reasons why they enjoy such immense popularity in terms of having excessive amounts of protein content along with much-needed fiber content. Lentils contribute around 30% to the total market within pulses. Lentils are one of the staple foods in many cultures around the world, and they are prepared easily, are cheap, and have health benefits.

Yellow peas are another variety that captures 20% of the market share as they are versatile for both industrial and culinary uses. Pigeon peas represent 10% of the market and are mainly used in the Indian and African continents, where they are well-entrenched in some types of traditional diets.

The global pulses market provides a wide variety of product forms to meet the unique needs of consumers and industries. The largest segment is split pulses, which account for 35% of the market. Split pulses are popular because they are convenient, easy to cook, and suitable for a wide range of dishes.

Whole pulses, 25% of the market, are preferred by consumers who enjoy the authentic taste and texture of the legumes. Pulse flour, 20% of the market, is gaining popularity in the food processing industry for use in baked goods, snacks, and other food products.

Pulse grits, 10% of the market, are used in specific applications such as porridge and breakfast cereals. Pulse flakes, at 10% of the market, are used in different food formulations such as vegetarian meat alternatives and breakfast cereals.

The year saw considerable progress in the pulses market with companies focusing on sustainability, innovation, and regional expansions. AGT Foods expanded protein extraction facilities in North America, addressing the demand for isolates, plant-based protein.

Olam International strengthened its traceable supply chains across Asia and Africa and ensured sustainable sourcing. Cargill launched pulse-based ingredients for plant-based foods in Europe to respond to veganism. Amul expanded its rural India distribution network further, making packaged pulses more accessible in the region.

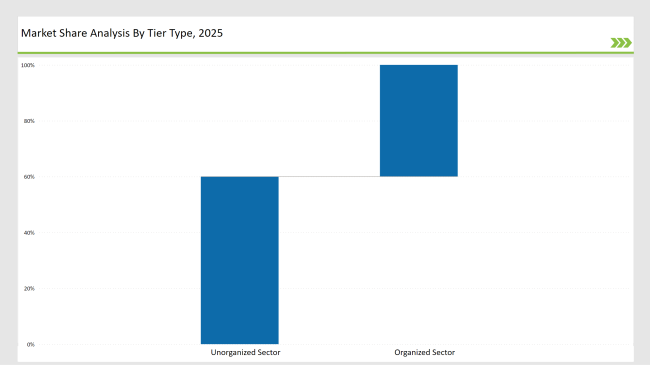

| Market Structure | Organized Sector |

|---|---|

| Market Share (%) | 40% |

| Key Companies | AGT Foods, Olam International, Cargill |

| Market Structure | Unorganized Sector |

|---|---|

| Market Share (%) | 60% |

| Key Companies | Small regional producers and processors |

| Brand | Key Focus |

|---|---|

| AGT Foods | Scaling protein extraction for plant-based alternatives globally. |

| Olam International | Implementing blockchain for transparent supply chains in Asia and Africa. |

| Cargill | Expanding processing facilities to include pulse-based protein concentrates. |

| ADM | Co-developing pulse-based snacks with leading food innovators. |

| Amul | Launching affordable pulse-based ready-to-eat meals for rural markets. |

| Meiji | Innovating with lentil and chickpea snacks for younger demographics. |

| Lotte Confectionery | Introducing mung bean-based desserts tailored for Southeast Asian consumers. |

| Banza | Launching pulse-based frozen meal kits in USA retail markets. |

| Simply 7 Snacks | Promoting lentil crisps in Asia with health-focused marketing campaigns. |

| Tesco | Expanding organic pulse offerings under its private label to capture eco-conscious consumers. |

The next decade will see an increase in the demand for plant-based proteins around the world. Companies should be investing in developing pulse protein extraction technology. Focus should be given to the production of high-quality pulse protein isolates and concentrates to respond to the rising demand from alternative meat and dairy industries.

The pulse-based protein ingredients can be formulated into a broad range of plant-based products, catering to the evolving preferences of consumers regarding clean-label and environmentally friendly products.

The global pulses market is shifting towards direct-to-consumer sales and the expansion of e-commerce platforms, which is prominent in the urban markets.

Manufacturers can reap benefits by building strong online sales channels, entering contracts with leading e-commerce platforms, and implementing subscription-based models that create customer loyalty and recurring revenue. By using digital platforms and innovative sales strategies, manufacturers can easily meet the changing purchasing habits of modern consumers.

Beyond traditional food and beverage applications, pulses are increasingly being used in non-food industries, such as bioplastics, cosmetics, and nutraceuticals. Investments in R&D in these emerging applications can help manufacturers diversify their revenue streams and capitalize on the growing demand for sustainable, plant-based alternatives across various sectors.

By exploring and investing in these innovative applications, pulse manufacturers can position themselves at the forefront of the evolving global pulses market and unlock new growth opportunities.

AGT Foods, Cargill, and Olam International lead the market with a combined share of approximately 30%, highlighting their dominance in trade and processing.

Regional players contribute 35% of the market share by catering to local tastes and preferences, ensuring accessibility and affordability.

Eco-friendly and traceable sourcing practices are becoming crucial, with companies investing in blockchain and sustainable farming methods.

Private labels hold a 10% share, offering budget-friendly options through retailers like Walmart and Tesco, catering to cost-conscious consumers.

The organic segment, driven by premium demand, is expanding at a high CAGR, particularly in North America and Europe.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulses Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

USA Pulses Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Europe Pulses Market Outlook – Share, Growth & Forecast 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Examining Shrimp Market Share Trends & Industry Leaders

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA