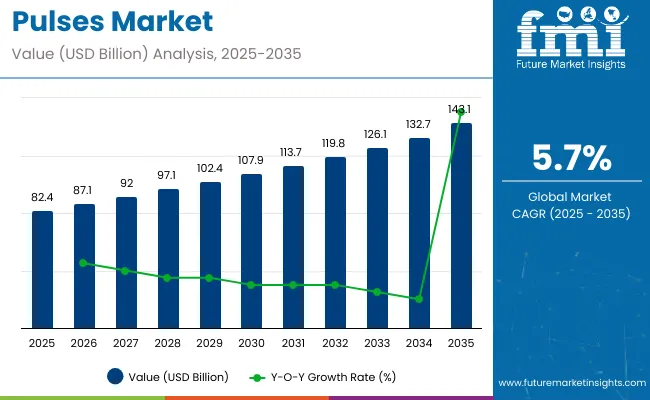

The global pulses market is expected to grow significantly from an estimated USD 82.4 billion in 2025 to reach around USD 143.1 billion by 2035, exhibiting a stable CAGR of 5.7% over the forecast period. The increasing demand for plant-based proteins and functional food ingredients is driving this market expansion.

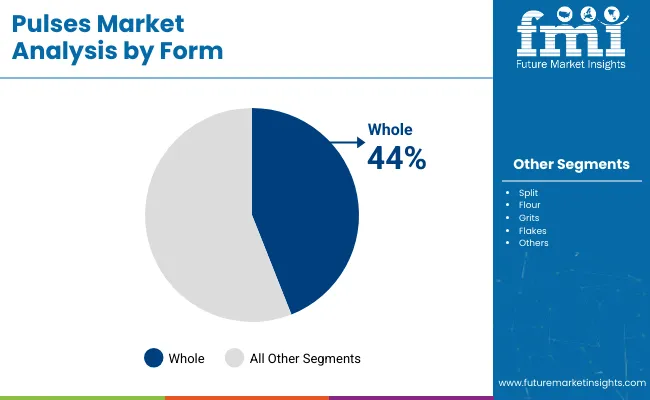

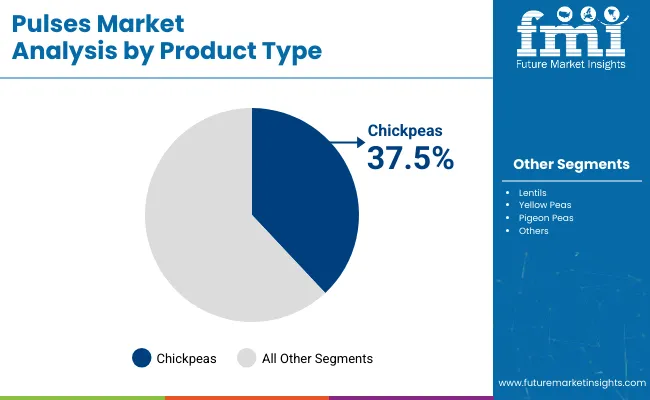

The Whole-form segment is projected to account for the largest share of 44.0% in 2025, as consumers prefer natural, unprocessed pulses for cooking and nutrition. In terms of product type, Chickpeas are estimated to capture a leading share of 37.5% in 2025, driven by their widespread application in various regional cuisines and health supplements.

In preparation for the 2025 kharif season, the Gumla district agriculture department will distribute high-yielding pulses seed varieties-Pant Arhar‑6 and Kota Urad‑6-across 1,260 hectares. Approximately 2,500 mini-kits of Arhar and 3,800 kits of Urad will be provided to farmers under this initiative, aiming to reduce India's dependency on pulse imports, improve soil fertility through nitrogen fixation, and enhance farmer income.

This development was officially reported by The Times of India on June 8, 2025, citing statements from Gumla district agriculture officials confirming the scheme's implementation and objectives. The initiative aligns with India’s broader goal to boost domestic pulse production, ensuring food security and sustainable agricultural growth.

The market is further supported by the rise in health-conscious consumers seeking high-protein, fiber-rich food options as part of balanced diets. The adoption of pulses as primary ingredients in meat substitutes and protein-enriched snack products is accelerating in Europe and North America. Governments in developing regions are also introducing favorable policies to promote pulse cultivation for both export potential and domestic nutritional needs.

Asia Pacific dominates the pulses market, particularly India, Myanmar, and China, owing to their massive production capacity and export orientation. Conversely, Middle Eastern and African countries are witnessing rising pulse imports to meet growing dietary demand. Moreover, Western nations are expanding pulse-based product portfolios to cater to vegan and vegetarian consumers, further propelling market expansion.

Major industry participants such as Archer Daniels Midland Company, AGT Food and Ingredients Inc., Bunge Limited, The Scoular Company, and Cargill Incorporated are focusing on strengthening supply chains, improving pulse quality, and investing in advanced processing technologies to capitalize on evolving market opportunities.

| Attribute | Detail |

|---|---|

| Industry Size (2025E) | USD 82.4 billion |

| Industry Size (2035F) | USD 143.1 billion |

| CAGR (2025-2035) | 5.7% |

Per capita spending on pulses is experiencing steady growth worldwide due to increasing consumer focus on healthy, sustainable, and plant-based diets. Pulses are valued for their high protein content, affordability, and environmental benefits, making them a popular choice across diverse populations. While developed countries show moderate but rising expenditure driven by wellness trends and specialty products, emerging markets maintain relatively higher spending due to pulses’ status as a dietary staple and ongoing improvements in supply and accessibility.

Developed Countries: In regions such as North America and Europe, per capita spending on pulses is moderate but growing. Consumers are incorporating pulses into their diets as part of vegetarian, vegan, and health-focused lifestyles. Specialty and organic pulses command higher price points, supported by retail availability and nutrition education.

Emerging Markets: In countries like India, Brazil, and parts of Africa and Southeast Asia, per capita spending on pulses is relatively higher given their role as a dietary staple. Growing populations and rising incomes in urban areas are increasing demand for diverse pulse varieties and processed pulse products. Price sensitivity remains a factor, but improved supply chains and government initiatives help sustain consumption.

The global trade of pulses is shaped by growing demand for plant-based proteins and the need to ensure food security across regions. Pulses are widely traded commodities, with international markets responding to supply fluctuations caused by climatic conditions, crop yields, and changing consumer preferences.

Major Exporting Countries: Key exporters include Canada, India, Australia, Myanmar, and Russia. Canada is one of the world’s largest exporter of pulses, particularly lentils and peas, supplying major markets in Asia, the Middle East, and Europe. India exports chickpeas and pigeon peas to various countries, while Australia and Myanmar focus on chickpeas and other pulses. Russia is an emerging player with growing production and export volumes.

Major Importing Countries: Leading importers include India, Bangladesh, Egypt, United Arab Emirates, and Nepal. These countries import pulses to meet domestic demand, often supplementing local production to stabilize prices and ensure availability. Import patterns reflect population size, dietary habits, and processing industry needs, with many importers relying on international suppliers for diverse pulse varieties.

The pulses market is driven by rising demand for whole-form pulses and chickpeas. In 2025, the whole-form segment is projected to account for 44.0% of the market share. Chickpeas are estimated to be the leading product type, capturing nearly 37.5% market share. These segments are benefiting from health trends and growing plant protein consumption globally.

The whole-form pulses segment is forecasted to dominate the global pulses market with a 44.0% share by 2025. Demand for whole pulses remains strong due to their nutritional superiority and minimal processing requirements. Consumers in Asia-Pacific and the Middle East prefer whole pulses like lentils, chickpeas, and pigeon peas for traditional cooking.

In India, whole-form pulses are integral to daily diets and government nutrition schemes, boosting local demand. North American health-conscious consumers are also adopting whole pulses in soups and ready-to-eat meals. Minimal processing ensures better fiber, protein, and micronutrient retention, aligning with clean-label food trends.

The ease of storage and long shelf life further encourages large-scale adoption by food processors and households. As global awareness about plant-based protein sources rises, whole-form pulses are expected to sustain their leadership in the market.

Chickpeas are projected to capture nearly 37.5% share of the global pulses market by 2025, making them the leading product type. Rising global demand for hummus, falafel, and plant-based protein products drives chickpea consumption. Countries like India, Australia, and Turkey are leading producers, ensuring abundant supply for global markets.

In Europe and North America, chickpeas are increasingly used in protein snacks, gluten-free flours, and meat substitutes. Their high protein, fiber, and mineral content enhances their appeal among vegan and health-focused consumers. Chickpeas also meet the growing demand for sustainable and affordable protein alternatives in developing economies.

Agro-processing industries are expanding chickpea-based product portfolios, from pasta to bakery goods. With widespread culinary versatility and nutritional benefits, chickpeas are set to retain the highest market share among pulse types, ensuring sustained segment growth.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global pulses market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 4.7% (2024 to 2034) |

| H2 | 5.1% (2024 to 2034) |

| H1 | 5.4% (2025 to 2035) |

| H2 | 5.9% (2025 to 2035) |

The above table presents the expected CAGR for the global pulses demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 4.7%, followed by a slightly higher growth rate of 5.1% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 5.4% in the first half and remain relatively moderate at 5.9% in the second half. In the first half (H1 2025) the market witnessed a decrease of 17 BPS while in the second half (H2 2025), the market witnessed an increase of 28 BPS.

Inclusion of Pulses in Global Cuisines

Culinary trends are making pulses more popular as consumers are exploring different global cuisines. Dishes from places like the Middle East and India usually use pulses, such as chickpeas and lentils, in their recipes. This growing interest in diverse foods motivates more individuals to cook with pulses at home and order them in restaurants.

As chefs are making new meals including pulses, they are attracting consumers who want to try healthy and tasty options, further boosting demand in both households and food services.

Rising Inclusion of Pulses in Functional Foods

Functional foods are becoming more popular as they provide health benefits beyond basic nutrition. Pulses, like lentils and chickpeas, are known for their ability to support health, such as improving digestion and lowering cholesterol.

This has led to their increased use in the pharmaceutical and nutraceutical industries, where they are included in supplements and health products. As more consumers are looking for ways to improve their health through diet, the demand for pulse-based functional foods continues to rise.

Expansion in Pulse-Based Product Offering

New products made from pulses are becoming more popular and attracting different types of consumers. Companies are manufacturing new products like pulse-based pasta, snacks, and protein powders. These products offer tasty and healthy options for individuals looking for alternatives to traditional foods.

For instance, pasta made from lentils is high in protein and gluten-free. Snacks made from chickpeas are crunchy and nutritious. This variation helps pulses to reach more customers in the food and beverage industry, as well as in health and wellness domain.

Banza makes pasta from chickpeas and offers a high-protein, gluten-free substitute to traditional wheat pasta.

Consumers Shifting to Plant-Based Diets

Plant-based diets are becoming more popular as individuals are looking for healthier and more sustainable food alternatives. Many consumers are choosing to reduce or cut down on meat from their diets, which further increases the demand for pulses like beans, lentils, and chickpeas as a main source of protein.

These foods are not only nutritious but also versatile, which makes it easy to include them in various meals. Due to this, sales of pulse products are rising in grocery stores and restaurants.

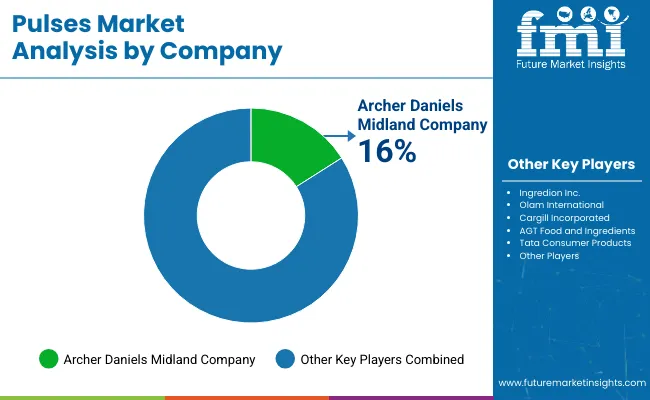

Tier 1 companies comprise market leaders with market revenue of above USD 10 million capturing sales domain share of 30% to 40% in the global sphere.

These companies are defined by high production capacity and a wide product offerings, they are known for their broad expertise in manufacturing and reforming across multiple packaging formats and a broad geographical reach, supported by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Ingredion Inc., Archer Daniels Midland Company, Cargill Incorporated, AGT Food and Ingredients, Tata Consumer Products, and Adani Wilmar Private Limited.

Tier 2 companies include mid-size players with revenue of USD 2 to 10 million having a presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge.

These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Olam International, BroadGrain Commodities Inc., B&G Foods, Inc., and Goya Foods, Inc.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche demand space having revenue below USD 1 million. These companies are notably oriented towards fulfilling local marketplace demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized field, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

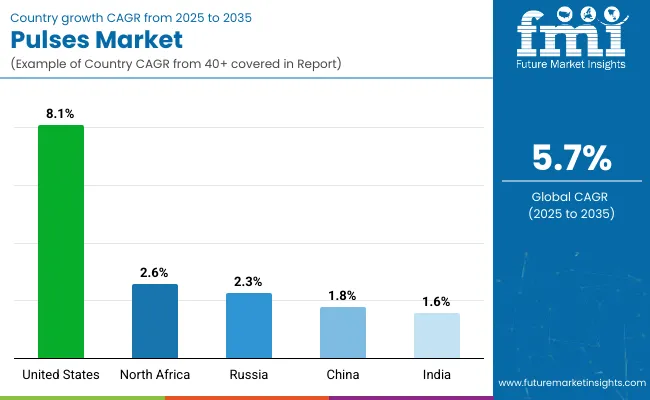

The following table shows the estimated growth rates of the top sales domains. Russia and United States are set to exhibit high Pulses consumption, recording CAGRs of 2.3% and 8.1%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 1.6% |

| China | 1.8% |

| North Africa | 2.6% |

| Russia | 2.3% |

| United States | 8.1% |

The ecosystem for Pulses in India is projected to exhibit a CAGR of 1.6% during the assessment period. By 2035, revenue from the sales of Pulses in the country is expected to reach USD 8.0 billion.

The Indian government strongly supports pulse cultivation to ensure food security and self-sufficiency. It has introduced various schemes, such as subsidies for farmers, training programs, and financial assistance for growing pulses.

These initiatives help farmers to increase their production and improve the quality of their crops. By promoting pulses, the government is planning to make them more available and affordable for consumers. This support is not only boosting the income of farmers but also promoting consumers to include more pulses in their diets for better nutrition.

Pulses demand in China is calculated to rise at a value CAGR of 1.8% during the forecast period (2025 to 2035). By 2035, Germany is expected to account for 41.7% of Pulses sales in China.

China is becoming a major importer of pulses to meet its growing domestic demand. By importing pulses from countries like Canada, Australia, and the United States, China makes sure a constant supply of these nutritious foods.

This increased availability makes it easier for consumers to have access to variety of pulses, such as lentils, chickpeas, and beans. As more pulse products are entering the market, they are becoming more popular among consumers, leading to higher consumption.

Consumption of Pulses in North Africa is projected to increase at a value CAGR of 2.6% over the next ten years. By 2035, the segment size is forecasted to reach USD 2.9 billion, with North Africa expected to account for a demand space share of 24.2% in MEA.

North African countries are gradually exporting pulses like chickpeas and lentils, in the international markets. This makes local market stable and promotes farmers to grow more pulses to meet both domestic and global demand. As exportation rises, farmers are earning better incomes, which helps in boosting the local economy.

Moreover, pulses are well-suited to the climate conditions in North Africa, where water scarcity and dry soil are a challenge. As pulses require less water than many other crops, it has become a reliable option for farmers over there.

The Pulses market encompasses a diverse and dynamic competitive landscape. Leading pulses manufacturing companies are focusing on research and development, sustainable sourcing, and new product formulations.

They are also emphasizing environment-friendly practices and product certifications to satisfy the increasing demand for natural and sustainable ingredients. With numerous companies vying for a share of the market. These companies compete on various factors, including the quality of their products, pricing, distribution channels, and their ability to innovate.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 82.4 billion |

| Projected Market Size (2035) | USD 143.1 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tons for volume |

| Product Type Analyzed (Segment 1) | Chickpea, Lentils, Yellow Peas, Pigeon Peas |

| Form Analyzed (Segment 2) | Whole, Split, Flour, Grits, Flakes |

| End Use Application Analyzed (Segment 3) | Business to Business (Food & Beverage Industry, Pharmaceutical Industry, Cosmetic Industry, Nutraceutical Industry, Animal Feed Industry), Household Retail (Store-Based Retail, Hypermarkets/Supermarkets, Convenience Stores, Mass Grocery Retailers, Wholesale Stores, Departmental Stores, Food & Drink Specialty Stores, Other Retail Forums including Online (E-commerce)), Food Service (HoReCa), Institutional (Schools, Universities, etc.), Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Mexico, South Africa, GCC Countries |

| Key Players influencing the Pulses Market | Ingredion Inc., Archer Daniels Midland Company, Olam International, Cargill Incorporated, AGT Food and Ingredients, Tata Consumer Products, BroadGrain Commodities Inc., Adani Wilmar Private Limited, B&G Foods, Inc., Goya Foods, Inc., Others |

| Additional Attributes | Dollar sales by pulse type and form, Demand shifts in processed and convenience pulse-based foods, Influence of plant-based protein trends, Supply chain dynamics in pulse-producing nations, E-commerce platform growth for retail pulse sales, Functional food applications in nutraceuticals and pharmaceuticals |

As per Pulses type, the ecosystem has been categorized into chickpea, lentils, yellow peas, and pigeon peas.

This segment is further categorized into whole, split, flour, grits, and flakes.

This segment is further categorized into business to business (food & beverage industry, pharmaceutical industry, cosmetic industry, nutraceutical industry, animal feed industry), household retail (store-based retail), hypermarkets or supermarkets, convenience stores, mass grocery retailers, wholesale stores, departmental stores, food & drink specialty stores, other retail forums (online (e-commerce)), food service (HoReCa), institutional (schools, universities, etc.), and others.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global Pulses industry is estimated at a value of USD 82.4 billion in 2025.

Ingredion Inc., Archer Daniels Midland Company, Cargill Incorporated, AGT Food and Ingredients, Tata Consumer Products, and Adani Wilmar Private Limited are some of the leading players in this industry.

The South Asia sales domain is projected to hold a revenue share of 24.1% over the forecast period.

MEA holds 15.6% share of the global demand space for Pulses.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Pulses Market Share & Industry Trends

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

USA Pulses Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Europe Pulses Market Outlook – Share, Growth & Forecast 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA